Residential Gateway Market: Size, Market Dynamics and Segment Analysis By Type, Connectivity and Component

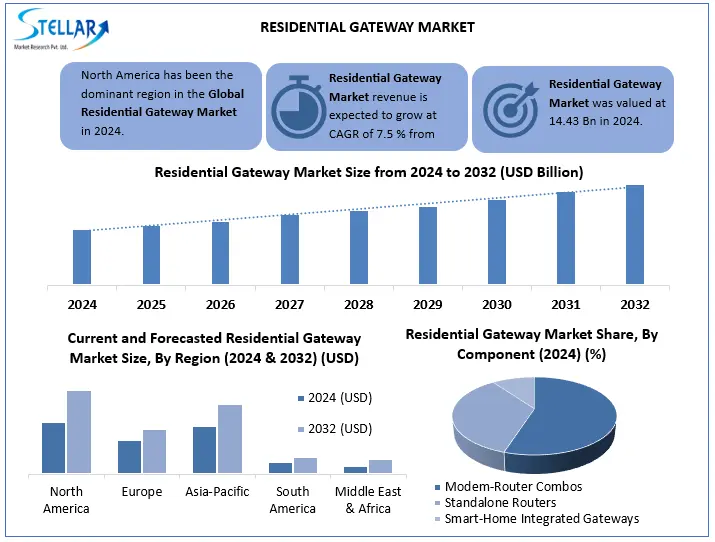

Global Residential Gateway Market Size was estimated at USD 14.43 Bn in 2024, and it is expected to reach USD 25.74 Bn in 2032. The Market CAGR is expected to be around 7.5% during the forecast period (2025-2032)

Format : PDF | Report ID : SMR_2787

Residential Gateway Market Overview

A residential gateway is a multifunctional device which connects home networks with broadband services like fiber, DSL, or cable, integrating routing, modem, firewall, and smart-home hub capabilities. The residential gateway market consists of hardware solutions that enables access to internet, voice, video, IoT, home security, and automation services, with the demand that is driven by increasing smart-home adoption, high-speed internet availability, and the expansion of multi-device households.

North America was the region that dominated the residential gateway market with an expected valuation of approximately USD?8?billion in 2024, that was supported by large-scale fiber rollouts and high smart-home adoption, while Asia-Pacific is observing rapid growth that would be driven by rising urbanization and IoT surge. Key players in this market are large companies such as Cisco, TP-Link, Huawei, Netgear, Technicolor, and Nokia that are focusing on innovations in various parts of the industry such as Wi?Fi?6E/7, AI-driven mesh networking, and cloud-managed security. Over 80% of total market revenue results from residential households installing these gateways for various reasons such as uninterrupted internet, automation, and IPTV/VoIP service incorporation.

Residential Gateway Market Recent Developments

|

Date |

Recent Development |

Region |

|

June 13, 2025 |

Amazon released eeroOS v7.9.1 firmware — enhancing PoE management, device steering, and Zigbee/Matter stability. |

Global |

|

June 18, 2025 |

Dell’Oro Group published its vBNG Advanced Research Report, forecasting 31?% CAGR for virtual broadband network gateways through 2030. |

Global |

|

April 30, 2025 |

Dell’Oro Group officially launched its vBNG Advanced Research Report, detailing the global shift to cloud-native broadband gateways. |

Global |

|

May 22, 2025 |

Amazon rolled out eeroOS v7.9.0, improving client steering and PoE support on the eero PoE Gateway. |

Global |

To get more Insights: Request Free Sample Report

Residential Gateway Market Dynamics

Smart Home & Multi-Device Households to Drive the Growth of Residential Gateway Market

By end of the year 2024, more than 307 million smart homes were active across the globe, in which North America region alone reported more than 60 Million households that had connected devices that were installed like smart thermostats, cameras, lights, and speakers. This rise in smart-home expansion has driven strong demand for high-performance residential gateways that can manage 20+ devices all at the same time, support automation protocols, and handle continuous data traffic through multiple streams. In the countries like U.S., the average household reported more than 22 connected devices, that highlighted the demand for robust, scalable, and intelligent gateway solutions.

Next-Gen Broadband & Wi-Fi Rollouts to Drive the Growth of Residential Gateway Market

In the years 2023–2024, subscriptions like Fiber-to-the-Home (FTTH) subscriptions crossed 180 million new connections across the globe. This was led by countries like China, India, and the United States. Simultaneously, more than 400 million Wi-Fi?6E-enabled devices were distributed globally, that marked a total of 38% Year-on-Year increase in the market. These developments enhanced the shift towards advanced gateways capable of supporting multi-gigabit speeds, tri-band wireless coverage, and low-latency performance, that is important for applications such as 8K streaming, online gaming, and hybrid work environments.

Cloud-Managed AI-Driven Gateways to Create Growth Opportunities in the Residential Gateway Market

Residential gateways such as Cloud-based and AI-integrated residential gateways are rapidly developing as a solution that is game-changing for both ISPs and end-users. Various platforms such as TP-Link HomeShield, Plume IQ, and Netgear Armor are offering advanced features recently such as intrusion detection, adaptive QoS, remote diagnostics, and automated firmware updates. As observed in early 2024, more than 42 million households across the globe were using gateways with cloud-managed capabilities. These solutions were reported to reduce technical involvement, improve cybersecurity, and provide real-time user behavior analytics. These solutions particularly appealed the telecom operators that were looking to lower the support costs and improve customer retention.

High Cost & Compatibility Challenges to Hinder Residential Gateway Market Growth

Despite progress in technology, their cost remains a major barrier, with Wi?Fi?6E/7 routers that are priced between medium to high range. This pricing makes them unaffordable in markets of countries like Brazil, South Africa, and Southeast Asia. Premium model such as the Netgear Nighthawk RAXE500 reported limited adoption. Compatibility issues also continue, as older IoT devices are still using out-of-date protocols, while newer gateways are supporting Matter and Wi?Fi?7, that leads to fragmentation and hindering smooth smart-home integration.

Residential Gateway Market Segment Analysis

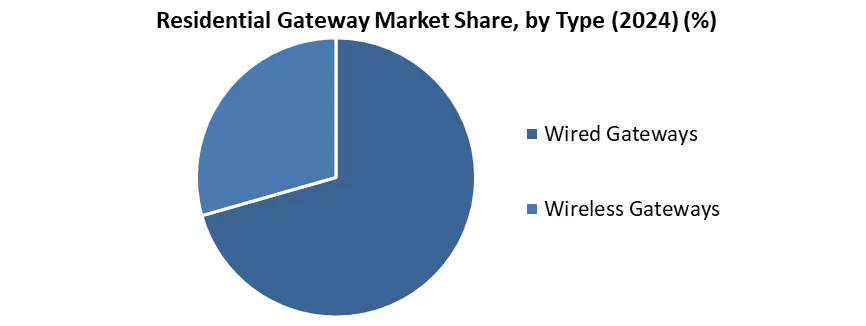

Based on Type, the residential gateway market is segmented into Wired Gateways and Wireless Gateways. Wireless Gateways segment, dominated the market in the year 2024, reporting over 72% of the total global revenue. This dominance resulted due to increasing consumer preference for cable-free, smart-home-ready devices. Adoption of this segment was highest in regions like North America and Western Europe, in which Wi-Fi 6/6E that is compatible with the mesh systems such as the TP-Link Deco X90 and Netgear Orbi RBKE963. This increased momentum for whole-home coverage, seamless device roaming, and tri-band support. In contrast, wired gateways remained relevant in commercial or legacy-use households but declined in residential installations due to lack of mobility and scalability.

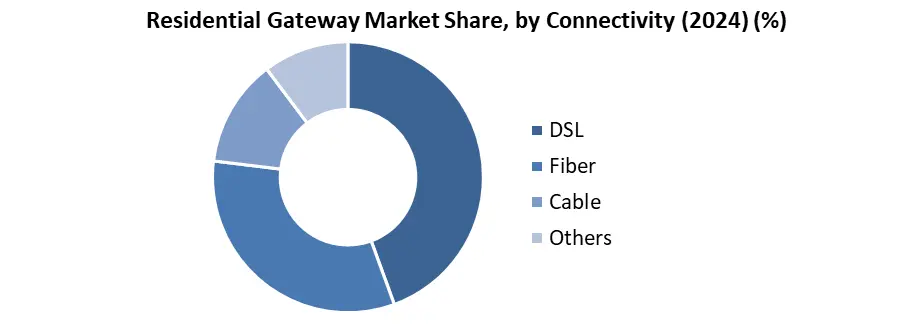

Based on Connectivity, the residential gateway market is segmented into DSL, Fiber, Cable, and Others. Fiber Connectivity is the segment that dominated in the year 2024 with a total of 46% of market share, as global FTTH rollouts extended quickly. The growth of gigabit fiber networks by the major ISPs like AT&T’s Fiber 5 Gbps plans in the countries like U.S. and China Mobile’s fiber extensions. This fueled installation of gateways that are compatible with multi-gig WAN ports and optical interfaces. DSL-based gateways, that were previously common in older infrastructure parts, observed a decline of below 20% because of their lower bandwidth support. Cable gateways remained significant in the region of North America and parts of Europe.

Residential Gateway Market Regional Analysis

North America is the region that dominated the global residential gateway market in the year 2024 with total market value of approximately USD?6 billion. This dominance is driven by the factors like extensive fiber broadband availability, advanced smart-home penetration, and high consumer spending on connected home setup. More than 70% of the U.S. households had high-speed internet plans that exceeded up to 500 Mbps by 2024, which demanded next-gen Wi-Fi 6E and Wi-Fi 7 compatible gateways. Major ISPs such as Comcast, Verizon, and AT&T led bundled installations with the smart mesh routers that are integrated into their home service packages. Additionally, increasing usage of streaming, gaming, and IoT applications among North American consumers amplified the average number of the connected devices which is more than 22 devices per household, that reinforced the demand for high-performance gateways.

Asia-Pacific is the region that appeared as the fastest-growing, with the residential gateway market that is rapidly growing. This growth of the market is led by countries such as China, India, Japan, and South Korea, where rapid urbanization and 5G-led fiber installations have increased the demand for the high-capacity residential networking equipment. Manufacturing companies from countries like China such as Huawei and Xiaomi were observed to hold a significant market share in the mid-tier markets, which offered affordable and AI-enhanced routers. Meanwhile, government-backed broadband initiatives in India (e.g., BharatNet) have also accelerated gateway penetration in semi-urban and rural regions.

Residential Gateway Market Competitive Landscape

Notable companies that are leading in the residential gateway market are Cisco, TP?Link, Huawei, Netgear, and Technicolor. These companies are strategically investing in advanced feature integration, including AI-powered mesh networking, cloud-based remote management, advanced parental controls, and multi-layered security functionalities. In 2024, these brands collectively reported for over 65% of the total global market share, that reflected strong partnerships with telecom providers and consumer preference for trusted and high-performance hardware.

- Internet Service Providers (ISPs) such as Comcast, Verizon, and AT&T have accelerated adoption by bundling high-end residential gateways—such as TP-Link Deco XE75 Pro and Netgear Nighthawk RAXE500—with their fiber and gigabit internet plans. These gateways often support tri-band Wi-Fi 6E or Wi-Fi 7 and deliver up to 10.8 Gbps speeds, catering to the growing demand for 4K streaming, remote work, and smart-home automation.

- Key differentiators among vendors include seamless ecosystem integration (with Matter, Zigbee, Alexa, etc.), frequency of firmware/security updates, cloud diagnostics capabilities, and customer support responsiveness. As of 2024, over 75 million households globally used ISP-provided gateways embedded with such smart capabilities, reinforcing the market’s shift toward fully managed, scalable, and interoperable networking solutions.

|

Residential Gateway Market Scope |

|

|

Market Size in 2024 |

USD 14.43 Bn. |

|

Market Size in 2032 |

USD 25.74 Bn. |

|

CAGR (2024-2032) |

7.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Wired gateways Wireless gateways |

|

By Connectivity DSL Fiber Cable Others |

|

|

By Component Modem-router combos Standalone routers Smart-home integrated gateways |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Residential Gateway Market Key Players

North America

- Cisco Systems, Inc. (USA)

- Netgear, Inc. (USA)

- ARRIS (CommScope) (USA)

- Motorola Networking (USA)

- Actiontec Electronics (USA)

- Zoom Telephonics (Minim Inc.) (USA)

- Linksys (Belkin) (USA)

Europe

- AVM GmbH (Germany)

- Technicolor Connected Home (France)

- Sagemcom Broadband SAS (France)

- Nokia Corporation (Finland)

- Devolo AG (Germany)

- Telsey S.p.A. (Italy)

- British Telecom (BT Smart Hub devices) (UK)

Asia Pacific

- Huawei Technologies Co., Ltd. (China)

- ZTE Corporation (China)

- TP-Link Technologies Co., Ltd. (China)

- ASUSTeK Computer Inc. (Taiwan)

- D-Link Corporation (Taiwan)

- Hitron Technologies Inc. (Taiwan)

- Sumitomo Electric Industries, Ltd. (Japan)

- NEC Corporation (Japan)

- iBall (Best IT World) (India)

South America

- Intelbras S.A. (Brazil)

- Positivo Tecnologia (Brazil)

- Oi S.A. (Brazil)

- Claro Brasil (Brazil)

MEA

- Etisalat Group (UAE)

- MTN Group (South Africa)

Frequently Asked Questions

Growth is driven by smart-home adoption, high-speed internet demand, and rising multi-device households. Advanced features like cloud management and AI-based mesh networking also boost market expansion.

North America led the market in 2024 with USD 8 billion due to fiber rollout and smart-home usage. Asia-Pacific is the fastest-growing, driven by urbanization and government broadband initiatives.

Wireless gateways dominated with over 72% share due to demand for cable-free, smart-ready devices. Fiber-based gateways led connectivity options with 46% market share from FTTH expansion.

Key players include Cisco, TP-Link, Huawei, Netgear, and Technicolor. They focus on Wi-Fi 6E/7, AI-powered mesh systems, cloud-based security, and ecosystem integration.

1. Residential Gateway Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Residential Gateway Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Residential Gateway Market: Dynamics

3.1. Residential Gateway Market Trends by Region

3.1.1. North America Residential Gateway Market Trends

3.1.2. Europe Residential Gateway Market Trends

3.1.3. Asia Pacific Residential Gateway Market Trends

3.1.4. Middle East and Africa Residential Gateway Market Trends

3.1.5. South America Residential Gateway Market Trends

3.2. Residential Gateway Market Dynamics

3.2.1. Residential Gateway Market Drivers

3.2.2. Residential Gateway Market Restraints

3.2.3. Residential Gateway Market Opportunities

3.2.4. Residential Gateway Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Residential Gateway Industry

4. Residential Gateway Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

4.1. Residential Gateway Market Size and Forecast, By Type (2024-2032)

4.1.1. Wired Gateways

4.1.2. Wireless Gateways

4.2. Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

4.2.1. DSL

4.2.2. Fiber

4.2.3. Cable

4.2.4. Others

4.3. Residential Gateway Market Size and Forecast, By Component (2024-2032)

4.3.1. Modem-router combos

4.3.2. Standalone routers

4.3.3. Smart-home integrated gateways

4.4. Residential Gateway Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Residential Gateway Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

5.1. North America Residential Gateway Market Size and Forecast, By Type (2024-2032)

5.1.1. Wired Gateways

5.1.2. Wireless Gateways

5.2. North America Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

5.2.1. DSL

5.2.2. Fiber

5.2.3. Cable

5.2.4. Others

5.3. North America Residential Gateway Market Size and Forecast, By Component (2024-2032)

5.3.1. Modem-router combos

5.3.2. Standalone routers

5.3.3. Smart-home integrated gateways

5.4. North America Residential Gateway Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Residential Gateway Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Wired Gateways

5.4.1.1.2. Wireless Gateways

5.4.1.2. United States Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

5.4.1.2.1. DSL

5.4.1.2.2. Fiber

5.4.1.2.3. Cable

5.4.1.2.4. Others

5.4.1.3. United States Residential Gateway Market Size and Forecast, By Component (2024-2032)

5.4.1.3.1. Modem-router combos

5.4.1.3.2. Standalone routers

5.4.1.3.3. Smart-home integrated gateways

5.4.2. Canada

5.4.2.1. Canada Residential Gateway Market Size and Forecast, By Type (2024-2032)

5.4.2.1.1. Wired Gateways

5.4.2.1.2. Wireless Gateways

5.4.2.2. Canada Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

5.4.2.2.1. DSL

5.4.2.2.2. Fiber

5.4.2.2.3. Cable

5.4.2.2.4. Others

5.4.3. Canada Residential Gateway Market Size and Forecast, By Component (2024-2032)

5.4.3.1.1. Modem-router combos

5.4.3.1.2. Standalone routers

5.4.3.1.3. Smart-home integrated gateways

5.4.4. Mexico

5.4.4.1. Mexico Residential Gateway Market Size and Forecast, By Type (2024-2032)

5.4.4.1.1. Wired Gateways

5.4.4.1.2. Wireless Gateways

5.4.4.2. Mexico Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

5.4.4.2.1. DSL

5.4.4.2.2. Fiber

5.4.4.2.3. Cable

5.4.4.2.4. Others

5.4.4.3. Mexico Residential Gateway Market Size and Forecast, By Component (2024-2032)

5.4.4.3.1. Modem-router combos

5.4.4.3.2. Standalone routers

5.4.4.3.3. Smart-home integrated gateways

6. Europe Residential Gateway Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

6.1. Europe Residential Gateway Market Size and Forecast, By Type (2024-2032)

6.2. Europe Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

6.3. Europe Residential Gateway Market Size and Forecast, By Component (2024-2032)

6.4. Europe Residential Gateway Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Residential Gateway Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

6.4.1.3. United Kingdom Residential Gateway Market Size and Forecast, By Component (2024-2032)

6.4.2. France

6.4.2.1. France Residential Gateway Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

6.4.2.3. France Residential Gateway Market Size and Forecast, By Component (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Residential Gateway Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

6.4.3.3. Germany Residential Gateway Market Size and Forecast, By Component (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Residential Gateway Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

6.4.4.3. Italy Residential Gateway Market Size and Forecast, By Component (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Residential Gateway Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

6.4.5.3. Spain Residential Gateway Market Size and Forecast, By Component (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Residential Gateway Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

6.4.6.3. Sweden Residential Gateway Market Size and Forecast, By Component (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Residential Gateway Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

6.4.7.3. Austria Residential Gateway Market Size and Forecast, By Component (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Residential Gateway Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

6.4.8.3. Rest of Europe Residential Gateway Market Size and Forecast, By Component (2024-2032)

7. Asia Pacific Residential Gateway Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

7.1. Asia Pacific Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.3. Asia Pacific Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4. Asia Pacific Residential Gateway Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.1.3. China Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.2.3. S Korea Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.3.3. Japan Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.4. India

7.4.4.1. India Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.4.3. India Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.5.3. Australia Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.6.3. Indonesia Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Philippines Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.7.3. Philippines Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Malaysia Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.8.3. Malaysia Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Vietnam Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.9.3. Vietnam Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Thailand Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.10.3. Thailand Residential Gateway Market Size and Forecast, By Component (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Residential Gateway Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

7.4.11.3. Rest of Asia Pacific Residential Gateway Market Size and Forecast, By Component (2024-2032)

8. Middle East and Africa Residential Gateway Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

8.1. Middle East and Africa Residential Gateway Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

8.3. Middle East and Africa Residential Gateway Market Size and Forecast, By Component (2024-2032)

8.4. Middle East and Africa Residential Gateway Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Residential Gateway Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

8.4.1.3. South Africa Residential Gateway Market Size and Forecast, By Component (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Residential Gateway Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

8.4.2.3. GCC Residential Gateway Market Size and Forecast, By Component (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Residential Gateway Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

8.4.3.3. Nigeria Residential Gateway Market Size and Forecast, By Component (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Residential Gateway Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

8.4.4.3. Rest of ME&A Residential Gateway Market Size and Forecast, By Component (2024-2032)

9. South America Residential Gateway Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

9.1. South America Residential Gateway Market Size and Forecast, By Type (2024-2032)

9.2. South America Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

9.3. South America Residential Gateway Market Size and Forecast, By Component (2024-2032)

9.4. South America Residential Gateway Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Residential Gateway Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

9.4.1.3. Brazil Residential Gateway Market Size and Forecast, By Component (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Residential Gateway Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

9.4.2.3. Argentina Residential Gateway Market Size and Forecast, By Component (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Residential Gateway Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest Of South America Residential Gateway Market Size and Forecast, By Connectivity (2024-2032)

9.4.3.3. Rest Of South America Residential Gateway Market Size and Forecast, By Component (2024-2032)

10. Company Profile: Key Players

10.1. Cisco Systems, Inc. (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Netgear, Inc. (USA)

10.3. ARRIS (CommScope) (USA)

10.4. Motorola Networking (USA)

10.5. Actiontec Electronics (USA)

10.6. Zoom Telephonics (Minim Inc.) (USA)

10.7. Linksys (Belkin) (USA)

10.8. AVM GmbH (Germany)

10.9. Technicolor Connected Home (France)

10.10. Sagemcom Broadband SAS (France)

10.11. Nokia Corporation (Finland)

10.12. Devolo AG (Germany)

10.13. Telsey S.p.A. (Italy)

10.14. British Telecom (BT Smart Hub devices) (UK)

10.15. Huawei Technologies Co., Ltd. (China)

10.16. ZTE Corporation (China)

10.17. TP-Link Technologies Co., Ltd. (China)

10.18. ASUSTeK Computer Inc. (Taiwan)

10.19. D-Link Corporation (Taiwan)

10.20. Hitron Technologies Inc. (Taiwan)

10.21. Sumitomo Electric Industries, Ltd. (Japan)

10.22. NEC Corporation (Japan)

10.23. iBall (Best IT World) (India)

10.24. Intelbras S.A. (Brazil)

10.25. Positivo Tecnologia (Brazil)

10.26. Oi S.A. (Brazil)

10.27. Claro Brasil (Brazil)

10.28. Etisalat Group (UAE)

10.29. MTN Group (South Africa)

11. Key Findings

12. Analyst Recommendations

13. Residential Gateway Market: Research Methodology