Remote Asset Management Market: Global Industry Analysis and Forecast (2025-2032)

The Remote Asset Management Market size was valued at USD 26.45 Billion in 2024 and the total Remote Asset Management revenue is expected to grow at a CAGR of 15 % from 2025 to 2032, reaching nearly USD 80.91 Billion by 2032.

Format : PDF | Report ID : SMR_1568

Remote Asset Management Market Overview

Remote Asset Management (RAM) is an operational approach consisting of monitoring, tracking, and administration of assets situated in remote locations through the integration of technologies like the Internet of Things (IoT), sensors, and software solutions. The assets consists of physical entities, ranging from machinery, equipment, and vehicles to infrastructure such as buildings and utilities. The objective of remote asset management is to enhance the performance, efficiency, and lifespan of assets, mitigating downtime and optimizing operational costs.

The remote asset management market is growing due to various factors, including a demand for inventive solutions that drive cost reduction, efficiency, and operational convenience. The adoption of cloud computing services, with improvements in internet connectivity has been instrumental in catering to the rising demand of remote asset management. Automation capabilities of Remote asset management software has further fueled the growth. The remote asset management market has experienced an increase in demand due to acceptance of technologies like Internet of Things (IoT) and cloud based asset management. Cloud-based asset management plays an important role in the remote asset management market's evolution, offering advantages such as cost efficiency, rapid processing speeds, and exceptional accessibility.

North America dominates the remote asset management market with 35% global market share, driven by the robust presence of sectors like transport, logistics, and manufacturing. Companies such as Cisco Systems, IBM, and General Electric cater to the growing demand for remote asset management. In Europe, the market is experiencing growth, driven by structural trends marked by minimal government intervention and a pronounced emphasis on Environmental, Social, and Governance (ESG) performances, which are actively shaping the remote asset management market. When it comes to APAC, the region is expected to emerge as the fastest growing market of remote asset management, fueled by the rapid pace of technological advancements and heightened acceptance across nations, collectively propelling overall market expansion. China stands as the frontrunner, commanding a substantial market share in the APAC remote asset management market.

Remote Asset Management market Dynamics

Adoption of Cloud Computing Services

The key reason behind growth of remote asset management market is the adoption of cloud computing services. Cloud-based enable businesses with advantages like increase in security, scalability, user-friendly interfaces, and substantial time savings. The rising demand for connected devices, coupled with the cost-effectiveness of cloud computing services, opens up abundant growth opportunities for the remote asset management market.

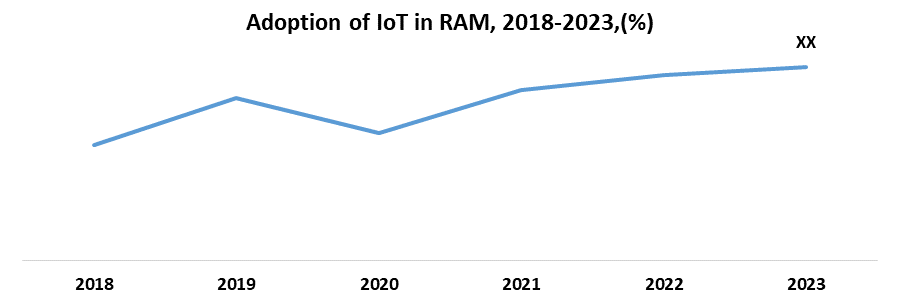

Rise in IoT-Enabled Solutions

The dominance of IoT-enabled solutions within the remote asset management sector is proving to be a key factor of substantial growth and innovation. The surge is fueled by a widespread embrace of IoT-enabled remote asset management solutions, strategically deployed to enhance asset efficiency, institute predictive maintenance practices, and optimize asset lifecycles through remote monitoring.

The integration of IoT in asset management is leading in a transformative era for the market, facilitating real-time monitoring, predictive maintenance, and streamlined automation.

Companies like Maersk participating in this trend by using IoT sensors to globally track shipping containers, providing real-time data on location and conditions. In the wind energy sector, Vestas uses Remote Asset Management for maintenance, strategically reducing costs and increasing operational efficiency.

Regulation impact on Remote Asset Management

The General Data Protection Regulation (GDPR) stands as the European Union's comprehensive data protection law, mandates robust measures like data encryption and pseudonymization to enhance data security in concern to remote asset management.

In the United States, the Health Insurance Portability and Accountability Act (HIPAA) has implications for Remote Asset Management (RAM) in healthcare, influencing practices related to patient monitoring and equipment data protection. As businesses navigate the intersection of GDPR and HIPAA, compliance with these regulations becomes important, shaping data management practices and ensuring the highest standards of security and confidentiality.

Remote Asset Management Market Segment Analysis:

By application, in 2024, the Remote Asset Management (RAM) Market has dominance of Predictive Maintenance as the leading application, a trend expected to persist throughout the forecast period. This dominance is due to its broad adoption across industries, using the power of data analytics and the Internet of Things (IoT) to forecast asset failures and optimize maintenance schedules. Companies like General Electric utilizes Remote Asset Management to anticipate turbine failures in wind energy Industries such as manufacturing and aviation rely significantly on Predictive Maintenance.

Real-time Location Systems (RTLS) play an important role, enabling precise asset tracking particularly in logistics and healthcare sectors. Condition Monitoring is an aspect for assessing asset health, finds extensive application in sectors like oil and gas, where continuous monitoring ensures operational efficiency. Automotive companies like Tesla leverage Remote Asset Management for remote diagnostics to ensure prompt resolution of vehicle issues.

By components, the Hardware segment emerged as the dominant force, serving as the foundational infrastructure that includes pivotal components like IoT sensors, devices, and connectivity tools essential for comprehensive data collection. Industries like manufacturing heavily depend on these hardware components for asset monitoring, utilizing sensor-equipped machinery to enable predictive maintenance strategies.

Software serves as the backbone of Remote Asset Management, facilitating important functions such as data analysis, visualization, and decision-making. Companies specializing in Remote Asset Management services provide expertise in integration and management, particularly beneficial for sectors like utilities navigating infrastructure integrations.

Remote asset management Competitive Landscape

Cisco acquired Socio Labs, an event technology platform based in the U.S. This platform equips event organizers with comprehensive tools to successfully manage events, whether in-person, virtual, or hybrid, regardless of size or format.

McLaren Racing entered into a new multi-year partnership with Cisco WebEx, designating it as the Official Collaboration Partner for the McLaren Formula 1 team. The integration of the Cisco WebEx platform into McLaren Racing's daily operations aims to enhance collaboration across all team areas, irrespective of global locations.

AT&T has collaborated with Nokia to establish an innovation studio in Munich. The primary objective of this partnership is to support the increasing global adoption of current and next-generation Internet of Things (IoT) solutions.

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Global Remote Asset Management. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as anticipated market size and trends. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers.

The research includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favourable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry.

The research also aids in comprehending the Global Remote Asset Management dynamics and structure by studying market segments and forecasting market size.

The research is an investor's guide since it clearly depicts competitive analysis of major competitors in the Global Remote Asset Management by product, price, financial situation, product portfolio, growth plans, and geographical presence.

|

Remote Asset Management Market Scope |

|

|

Market Size in 2024 |

USD 26.45 Bn. |

|

Market Size in 2032 |

USD 80.91 Bn. |

|

CAGR (2025-2032) |

15% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Deployment Mode

|

|

By Components

|

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Remote Asset Management Market Key Players:

- Cisco Systems

- IBM

- General Electric (GE)

- Verizon

- Meridium

- Honeywell International

- Oracle

- Rockwell Automation

- PTC

- Emerson Electric

- Trimble

- Zebra Technologies

- Fleet Complete

- Digi International

- Siemens

- Bosch

- Schneider Electric

- SAP

- ABB

- Accenture

Frequently Asked Questions

North America region is expected to hold the highest share in the Remote Asset Management Market.

The market size of the Remote Asset Management Market by 2023 is expected to reach US$ 80.91 BN.

The forecast period for the Remote Asset Management Market is 2025-2032.

The market size of the Remote Asset Management Market in 2024 was valued at US$ 26.45 BN.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Remote Asset Management Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025-2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Remote Asset Management Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2023)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. Remote Asset Management Market: Dynamics

4.1. Remote Asset Management Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Remote Asset Management Market Drivers

4.3. Remote Asset Management Market Restraints

4.4. Remote Asset Management Market Opportunities

4.5. Remote Asset Management Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Remote Asset Management Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. Remote Asset Management Market Size and Forecast, by Deployment Mode (2023-2030)

5.1.1. Cloud-based

5.1.2. On-premises

5.2. Remote Asset Management Market Size and Forecast, by Components (2023-2030)

5.2.1. Hardware

5.2.2. Software

5.2.3. Services

5.3. Remote Asset Management Market Size and Forecast, by Application (2023-2030)

5.3.1. Predictive Maintenance

5.3.2. Real-time Location System (RTLS)

5.3.3. Condition Monitoring

5.3.4. Remote Diagnostics

5.4. Remote Asset Management Market Size and Forecast, by Region (2023-2030)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. North America Remote Asset Management Market Size and Forecast, by Deployment Mode (2023-2030)

6.1.1. Cloud-based

6.1.2. On-premises

6.2. North America Remote Asset Management Market Size and Forecast, by Components (2023-2030)

6.2.1. Hardware

6.2.2. Software

6.2.3. Services

6.3. North America Remote Asset Management Market Size and Forecast, by Application (2023-2030)

6.3.1. Predictive Maintenance

6.3.2. Real-time Location System (RTLS)

6.3.3. Condition Monitoring

6.3.4. Remote Diagnostics

6.4. North America Remote Asset Management Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Europe Remote Asset Management Market Size and Forecast, by Deployment Mode (2023-2030)

7.2. Europe Remote Asset Management Market Size and Forecast, by Components (2023-2030)

7.3. Europe Remote Asset Management Market Size and Forecast, by Application (2023-2030)

7.4. Europe Remote Asset Management Market Size and Forecast, by Country (2023-2030)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Asia Pacific Remote Asset Management Market Size and Forecast, by Deployment Mode (2023-2030)

8.2. Asia Pacific Remote Asset Management Market Size and Forecast, by Components (2023-2030)

8.3. Asia Pacific Remote Asset Management Market Size and Forecast, by Application (2023-2030)

8.4. Asia Pacific Remote Asset Management Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. Middle East and Africa Remote Asset Management Market Size and Forecast, by Deployment Mode (2023-2030)

9.2. Middle East and Africa Remote Asset Management Market Size and Forecast, by Components (2023-2030)

9.3. Middle East and Africa Remote Asset Management Market Size and Forecast, by Application (2023-2030)

9.4. Middle East and Africa Remote Asset Management Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

10.1. South America Remote Asset Management Market Size and Forecast, by Deployment Mode (2023-2030)

10.2. South America Remote Asset Management Market Size and Forecast, by Components (2023-2030)

10.3. South America Remote Asset Management Market Size and Forecast, by Application (2023-2030)

10.4. South America Remote Asset Management Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Cisco Systems

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. IBM

11.3. General Electric (GE)

11.4. Verizon

11.5. Meridium

11.6. Honeywell International

11.7. Oracle

11.8. Rockwell Automation

11.9. PTC

11.10. Emerson Electric

11.11. Trimble

11.12. Zebra Technologies

11.13. Fleet Complete

11.14. Digi International

11.15. Siemens

11.16. Bosch

11.17. Schneider Electric

11.18. SAP

11.19. ABB

11.20. Accenture

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook