Prompt Engineering Market Size, Share, Dynamics, and Segmentation By Component, Technology, Application, Industry Vertical and End-User

The Prompt Engineering Market Size was estimated at USD 271.38 Mn in 2024, and it is expected to grow USD 2471.16 Mn in 2032. The Market CAGR is expected to be around 31.8% during the forecast period (2025-2032)

Format : PDF | Report ID : SMR_2801

Prompt Engineering Market Overview

Prompt engineering is a relatively new discipline to develops and customizes prompts to efficiently use language models (LMS) for various types of applications and research subjects. Prompt engineering skills help to better understand the abilities and limitations of a large language model. They identify scripts and templates that users can customize and complete to get the best results from the language models. A prompt engineer can develop prompts with domain-independent instructions emphasizing logical connections and general patterns. Organizations can quickly reuse the prompts across the corporation to leverage their AI investments.

The prompt engineering market is growing due to the rising adoption of AI tools and the need for scalable, cost-efficient solutions. The prompt engineering market is segmented by components, with tools and platforms dominating due to automation needs, while services are rapidly growing, especially in BFSI lacking in-house AI expertise. Techniques like RAG lead in real-time applications, while auto-prompt optimization is gaining momentum for efficiency. IT & Tech is the largest application area, while code development sees rapid growth due to tools like GitHub Copilot. IT and Tech sectors lead the market, with healthcare growing fastest due to precision needs. Regionally, North America dominates the market, Asia-Pacific is the fastest-growing, and Europe focuses on ethical AI. OpenAI leads the competitive landscape, with Anthropic, Cohere, and Baidu emerging as strong players.

The Prompt Engineering Market is segmented by components, which dominate the needs of equipment and platform automation, while services are rapidly growing, especially in BFSI in-house AI lacks in-house AI expertise. In real-time applications, techniques such as RAG lead, while auto-prompt optimization are gaining momentum for efficiency. Material production is the largest application area, while code development sees rapid growth due to devices such as GitHub copilot. IT and Tech sector lead the market, with the fastest growing healthcare due to accurate needs. Regional, North America dominates, Asia-Pacific grows fastest, and Europe focuses on moral AI. OpenAI leads a competitive landscape, in which anthropic, cohere and Baidu emerge as strong players.

To get more Insights: Request Free Sample Report

Prompt Engineering Market Dynamics

Rising Adoption of Code Development and Demand for Scalability to Boost the Prompt Engineering Market

Rapid adoption of Code Development in industries, marketing, customer service, to software development is promoting explosive demand for Scalable prompt engineering solutions rapidly. Since businesses integrate AI tools such as ChatGPT and Claude into operations, they face challenges in maintaining stability, controlling costs, and optimizing performance at scale. This has led to growing dependence on automatic early adaptation platforms such as LangChain and Vellam, which help enterprises to generate high-quality outputs efficiently while reducing API expenses. AI-assisted system shifts from manual prompting, reflects the market requirement for solutions that can handle thousands of queries simultaneously without compromising quality-making scalability in prompt engineering innovation.

Lack of Standardization and AI Development Restraints the Prompt Engineering Market

The absence of universal prompting standards forces businesses to use trial-and-error approaches, increasing costs and disabilities. Meanwhile, Rapid AI progress (eg, GPT-4 → GPT-5) constantly disrupts the best practices, as new models require different prompting techniques. This dual challenge forces companies to repeatedly adapt strategies, slow down enterprise adoption, and create dependence on top experts. Emerging solutions such as fine-tuning and RAG (Retrieval-Augmented Generation) aim to mitigate these issues by reducing prompt dependency.

Automated Prompt Engineering Tools to Produce Opportunities in the Prompt Engineering Market

Automated Prompt engineering tools address the scalability boundaries of the manual approach using AI-operated adaptation to refine the prompts through techniques such as A/B testing and reinforcement learning. These solutions enable enterprises to maintain high-quality output by reducing cost and development time in large deployments. As AI adoption increases, such tools are becoming essential infrastructure for businesses running Code Development at scale.

Prompt Engineering Market Segment Analysis

Based on Component, the Prompt engineering market is segmented by Software and Services. The tools and platforms segments are currently inspired by adopting broad enterprises of solutions such as Langchen and Wellam, which dominate the Prompt Engineering Market. These technologies enable organizations to automate and scale their AI interactions, reducing dependence on manual prompt crafting. This dominance stems from the significant requirement of standardized, repeatable prompt workflows across large deployments. However, services are emerging as the fastest growing segment, especially among BFSI that lack in-house AI expertise, but require optimized prompts for business applications like customer service chatbots and marketing IT & Tech.

Based on application, IT & Tech maintains the dominance of the market, accounting for about 40% of prompt engineering applications, as the sector businesses give priority to automated marketing copy, SEO content, and social media generation. The lead of the segment refers to the direct ROI of AI-based materials in reducing creative production costs. The code development application is growing at an unprecedented pace, which is fueled by developer tools such as GitHub Copilot, which shows how well the structured prompt can dramatically improve coding efficiency and accuracy.

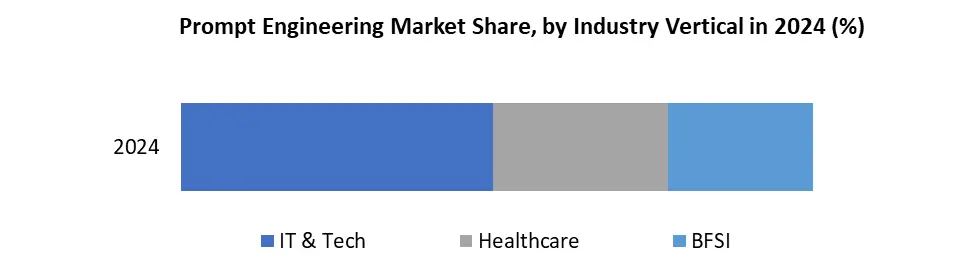

Based on Industry Vertical, the IT & Tech sector dominates more than 50% of the market, as both technology companies are early adopters and primary developers of Prompt Engineering Solutions. This dominance reflects a symbiotic relationship between AI progress and technical industry needs. Healthcare is emerging rapidly as the fastest growing vertical, where engineered prompts are changing diagnostic support, patient communication, and medical documentation procedures, driven by the sector’s urgent need for precision and compliance.

Prompt Engineering Market Regional Analysis

The prompt engineering market exhibits distinct regional dynamics driven by technological infrastructure, AI adoption rates, regulatory environments, and industry-specific demands. North America currently dominates the Prompt Engineering Market, fueled by the adoption of the advanced technical ecosystem, major AI innovators, and BFSI and Healthcare. The Asia-Pacific is the fastest-growing sector, which is inspired by large-scale government investment (especially China), a rapidly growing digital economy, and rapid AI integration in e-commerce and industry. Europe takes advantage of its strong regulatory structures (European Union AI Act) and industrial base, focusing on moral AI and automation. Asia-Pacific's explosive development trajectory suggests a possible change in the projection dominance.

Prompt Engineering Market Competitive Landscape

OpenAI (USA) currently dominates the prompt engineering competitive landscape with the highest market share, driven by the industry-standard GPT models and the ChatGPT platform. Their dominance stems from adopting broad enterprises through the first-mover advantage, continuous model improvement (GPT-3.5 from GPT-4 turbo), and API integration. Recent developments include the launch of customizable GPTs for specific use cases, enhanced prompt understanding capabilities, and JSON mode for structured outputs. Close Competitor Anthropic (USA) follows with its constitutional AI approach, emphasizing security-aligned prompt engineering, recently releasing Cloude 3 with superior context window management. In Asia, Baidu (China) leads with its Wenxin large models and industry-specific prompt templates, recently an autonomous vehicle expanding in prompt systems. The landscape shows increasing expertise, with the players like Scale AI focusing on military/government Prompt Engineering.

|

Prompt Engineering Market Scope |

|

|

Market Size in 2024 |

USD 271.38 Mn |

|

Market Size in 2032 |

USD 2471.16 Mn |

|

CAGR (2024-2032) |

31.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Component Software Services |

|

By Technique Retrieval-Augmented Generation Auto-Prompt Optimization Few-shot Prompting Others |

|

|

By Application IT & Tech Code Development Customer Support Data Analysis Healthcare/Legal |

|

|

By Industry Vertical IT & Tech BFSI Healthcare Retail/E-commerce Education |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Prompt Engineering Market

North America

- OpenAI – USA

- Amazon – USA

- IBM – USA

- Google – USA

- Microsoft – USA

- Replit – USA

- CXR.Agency – USA

- Software Pro – USA

- VTC Tech – USA

- Webisoft – Canada

- Napollo – USA

Europe

- DeepMind – UK

- Diffblue – UK

- Ponicode – France

- Linnify – Romania

- Huboxt – UK

- NEKLO – Czech Republic

- Future Forward – Netherlands

- Web Optic – UK

Asia

- Tabnine – Israel

- Vedlogic – India

- Commoditech – India

- Pandalatec – India

- Tricky Mind Solution – India

- SMV Experts – India

- Thespian – India

- SmithySoft – India

South America

- CI&T (Brazil)

- Globant (Argentina)

MEA

- Beyond Limits (UAE)

Frequently Asked Questions

Growing adoption of AI and ML technologies by industries and high investments in the R&D of generative AI drive the market.

Lack of Standardization, Rapid Model Evolution, Data Privacy & Security Risks

North America leads in regional adoption, while the IT & Tech sector is the dominant industry driving Prompt Engineering implementation.

OpenAI, Microsoft, Google, AWS, and Anthropic are top players. They compete via cloud integration, vertical solutions, and AI innovations.

1. Prompt Engineering Market: Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Prompt Engineering Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Prompt Engineering Market: Dynamics

3.1. Prompt Engineering Market Trends by Region

3.1.1. North America Prompt Engineering Market Trends

3.1.2. Europe Prompt Engineering Market Trends

3.1.3. Asia Pacific Prompt Engineering Market Trends

3.1.4. Middle East and Africa Prompt Engineering Market Trends

3.1.5. South America Prompt Engineering Market Trends

3.2. Prompt Engineering Market Dynamics

3.2.1. Prompt Engineering Market Drivers

3.2.2. Prompt Engineering Market Restraints

3.2.3. Prompt Engineering Market Opportunities

3.2.4. Prompt Engineering Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Prompt Engineering Industry

4. Prompt Engineering Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. Prompt Engineering Market Size and Forecast, By Component (2024-2032)

4.1.1. Software

4.1.2. Services

4.2. Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

4.2.1. Retrieval-Augmented Generation

4.2.2. Auto-Prompt Optimization

4.2.3. Few-shot Prompting

4.2.4. Others

4.3. Prompt Engineering Market Size and Forecast, By Application (2024-2032)

4.3.1. IT & Tech

4.3.2. Code Development

4.3.3. Customer Support

4.3.4. Data Analysis

4.3.5. Healthcare/Legal

4.4. Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

4.4.1. IT & Tech

4.4.2. BFSI

4.4.3. Healthcare

4.4.4. Retail/E-commerce

4.4.5. Education

4.5. Prompt Engineering Market Size and Forecast, by Region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Prompt Engineering Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Prompt Engineering Market Size and Forecast, By Component (2024-2032)

5.1.1. Software

5.1.2. Services

5.2. North America Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

5.2.1. Retrieval-Augmented Generation

5.2.2. Auto-Prompt Optimization

5.2.3. Few-shot Prompting

5.2.4. Others

5.3. North America Prompt Engineering Market Size and Forecast, By Application (2024-2032)

5.3.1. IT & Tech

5.3.2. Code Development

5.3.3. Customer Support

5.3.4. Data Analysis

5.3.5. Healthcare/Legal

5.4. North America Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

5.4.1. IT & Tech

5.4.2. BFSI

5.4.3. Healthcare

5.4.4. Retail/E-commerce

5.4.5. Education

5.5. North America Prompt Engineering Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Prompt Engineering Market Size and Forecast, By Component (2024-2032)

5.5.1.1.1. Software

5.5.1.1.2. Services

5.5.1.2. United States Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

5.5.1.2.1. Retrieval-Augmented Generation

5.5.1.2.2. Auto-Prompt Optimization

5.5.1.2.3. Few-shot Prompting

5.5.1.2.4. Others

5.5.1.3. United States Prompt Engineering Market Size and Forecast, By Application (2024-2032)

5.5.1.3.1. IT & Tech

5.5.1.3.2. Code Development

5.5.1.3.3. Customer Support

5.5.1.3.4. Data Analysis

5.5.1.3.5. Healthcare/Legal

5.5.1.4. United States Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

5.5.1.4.1. IT & Tech

5.5.1.4.2. BFSI

5.5.1.4.3. Healthcare

5.5.1.4.4. Retail/E-commerce

5.5.1.4.5. Education

5.5.2. Canada

5.5.2.1. Canada Prompt Engineering Market Size and Forecast, By Component (2024-2032)

5.5.2.1.1. Software

5.5.2.1.2. Services

5.5.2.2. Canada Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

5.5.2.2.1. Retrieval-Augmented Generation

5.5.2.2.2. Auto-Prompt Optimization

5.5.2.2.3. Few-shot Prompting

5.5.2.2.4. Others

5.5.2.3. Canada Prompt Engineering Market Size and Forecast, By Application (2024-2032)

5.5.2.3.1. IT & Tech

5.5.2.3.2. Code Development

5.5.2.3.3. Customer Support

5.5.2.3.4. Data Analysis

5.5.2.3.5. Healthcare/Legal

5.5.2.4. Canada Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

5.5.2.4.1. IT & Tech

5.5.2.4.2. BFSI

5.5.2.4.3. Healthcare

5.5.2.4.4. Retail/E-commerce

5.5.2.4.5. Education

5.5.3. Mexico

5.5.3.1. Mexico Prompt Engineering Market Size and Forecast, By Component (2024-2032)

5.5.3.1.1. Software

5.5.3.1.2. Services

5.5.3.2. Mexico Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

5.5.3.2.1. Retrieval-Augmented Generation

5.5.3.2.2. Auto-Prompt Optimization

5.5.3.2.3. Few-shot Prompting

5.5.3.2.4. Others

5.5.3.3. Mexico Prompt Engineering Market Size and Forecast, By Application (2024-2032)

5.5.3.3.1. IT & Tech

5.5.3.3.2. Code Development

5.5.3.3.3. Customer Support

5.5.3.3.4. Data Analysis

5.5.3.3.5. Healthcare/Legal

5.5.3.4. Mexico Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

5.5.3.4.1. IT & Tech

5.5.3.4.2. BFSI

5.5.3.4.3. Healthcare

5.5.3.4.4. Retail/E-commerce

5.5.3.4.5. Education

6. Europe Prompt Engineering Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. Europe Prompt Engineering Market Size and Forecast, By Component (2024-2032)

6.2. Europe Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

6.3. Europe Prompt Engineering Market Size and Forecast, By Application (2024-2032)

6.4. Europe Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

6.5. Europe Prompt Engineering Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Prompt Engineering Market Size and Forecast, By Component (2024-2032)

6.5.1.2. United Kingdom Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

6.5.1.3. United Kingdom Prompt Engineering Market Size and Forecast, By Application (2024-2032)

6.5.1.4. United Kingdom Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.2. France

6.5.2.1. France Prompt Engineering Market Size and Forecast, By Component (2024-2032)

6.5.2.2. France Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

6.5.2.3. France Prompt Engineering Market Size and Forecast, By Application (2024-2032)

6.5.2.4. France Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Prompt Engineering Market Size and Forecast, By Component (2024-2032)

6.5.3.2. Germany Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

6.5.3.3. Germany Prompt Engineering Market Size and Forecast, By Application (2024-2032)

6.5.3.4. Germany Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Prompt Engineering Market Size and Forecast, By Component (2024-2032)

6.5.4.2. Italy Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

6.5.4.3. Italy Prompt Engineering Market Size and Forecast, By Application (2024-2032)

6.5.4.4. Italy Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Prompt Engineering Market Size and Forecast, By Component (2024-2032)

6.5.5.2. Spain Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

6.5.5.3. Spain Prompt Engineering Market Size and Forecast, By Application (2024-2032)

6.5.5.4. Spain Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Prompt Engineering Market Size and Forecast, By Component (2024-2032)

6.5.6.2. Sweden Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

6.5.6.3. Sweden Prompt Engineering Market Size and Forecast, By Application (2024-2032)

6.5.6.4. Sweden Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.7. Austria

6.5.7.1. Austria Prompt Engineering Market Size and Forecast, By Component (2024-2032)

6.5.7.2. Austria Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

6.5.7.3. Austria Prompt Engineering Market Size and Forecast, By Application (2024-2032)

6.5.7.4. Austria Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Prompt Engineering Market Size and Forecast, By Component (2024-2032)

6.5.8.2. Rest of Europe Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

6.5.8.3. Rest of Europe Prompt Engineering Market Size and Forecast, By Application (2024-2032)

6.5.8.4. Rest of Europe Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7. Asia Pacific Prompt Engineering Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Asia Pacific Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.2. Asia Pacific Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.3. Asia Pacific Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5. Asia Pacific Prompt Engineering Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.1.2. China Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.1.3. China Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.1.4. China Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.2.2. S Korea Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.2.3. S Korea Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.2.4. S Korea Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.3.2. Japan Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.3.3. Japan Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.3.4. Japan Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.4. India

7.5.4.1. India Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.4.2. India Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.4.3. India Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.4.4. India Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.5.2. Australia Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.5.3. Australia Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.5.4. Australia Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.6.2. Indonesia Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.6.3. Indonesia Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.6.4. Indonesia Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.7. Philippines

7.5.7.1. Philippines Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.7.2. Philippines Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.7.3. Philippines Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.7.4. Philippines Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.8. Malaysia

7.5.8.1. Malaysia Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.8.2. Malaysia Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.8.3. Malaysia Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.8.4. Malaysia Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.9. Vietnam

7.5.9.1. Vietnam Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.9.2. Vietnam Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.9.3. Vietnam Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.9.4. Vietnam Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.10. Thailand

7.5.10.1. Thailand Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.10.2. Thailand Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.10.3. Thailand Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.10.4. Thailand Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Prompt Engineering Market Size and Forecast, By Component (2024-2032)

7.5.11.2. Rest of Asia Pacific Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

7.5.11.3. Rest of Asia Pacific Prompt Engineering Market Size and Forecast, By Application (2024-2032)

7.5.11.4. Rest of Asia Pacific Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

8. Middle East and Africa Prompt Engineering Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Middle East and Africa Prompt Engineering Market Size and Forecast, By Component (2024-2032)

8.2. Middle East and Africa Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

8.3. Middle East and Africa Prompt Engineering Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

8.5. Middle East and Africa Prompt Engineering Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Prompt Engineering Market Size and Forecast, By Component (2024-2032)

8.5.1.2. South Africa Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

8.5.1.3. South Africa Prompt Engineering Market Size and Forecast, By Application (2024-2032)

8.5.1.4. South Africa Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Prompt Engineering Market Size and Forecast, By Component (2024-2032)

8.5.2.2. GCC Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

8.5.2.3. GCC Prompt Engineering Market Size and Forecast, By Application (2024-2032)

8.5.2.4. GCC Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

8.5.3. Nigeria

8.5.3.1. Nigeria Prompt Engineering Market Size and Forecast, By Component (2024-2032)

8.5.3.2. Nigeria Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

8.5.3.3. Nigeria Prompt Engineering Market Size and Forecast, By Application (2024-2032)

8.5.3.4. Nigeria Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

8.5.4. Rest of ME&A

8.5.4.1. Rest of ME&A Prompt Engineering Market Size and Forecast, By Component (2024-2032)

8.5.4.2. Rest of ME&A Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

8.5.4.3. Rest of ME&A Prompt Engineering Market Size and Forecast, By Application (2024-2032)

8.5.4.4. Rest of ME&A Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

9. South America Prompt Engineering Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. South America Prompt Engineering Market Size and Forecast, By Component (2024-2032)

9.2. South America Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

9.3. South America Prompt Engineering Market Size and Forecast, By Application (2024-2032)

9.4. South America Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

9.5. South America Prompt Engineering Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Prompt Engineering Market Size and Forecast, By Component (2024-2032)

9.5.1.2. Brazil Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

9.5.1.3. Brazil Prompt Engineering Market Size and Forecast, By Application (2024-2032)

9.5.1.4. Brazil Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Prompt Engineering Market Size and Forecast, By Component (2024-2032)

9.5.2.2. Argentina Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

9.5.2.3. Argentina Prompt Engineering Market Size and Forecast, By Application (2024-2032)

9.5.2.4. Argentina Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

9.5.3. Rest Of South America

9.5.3.1. Rest Of South America Prompt Engineering Market Size and Forecast, By Component (2024-2032)

9.5.3.2. Rest Of South America Prompt Engineering Market Size and Forecast, By Technique Type (2024-2032)

9.5.3.3. Rest Of South America Prompt Engineering Market Size and Forecast, By Application (2024-2032)

9.5.3.4. Rest Of South America Prompt Engineering Market Size and Forecast, By Industry Vertical (2024-2032)

10. Company Profile: Key Players

10.1. OpenAI

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Amazon

10.3. IBM

10.4. Google

10.5. Microsoft

10.6. Replit

10.7. CXR.Agency

10.8. Software Pro

10.9. VTC Tech

10.10. Webisoft

10.11. Napollo

10.12. DeepMind

10.13. Diffblue

10.14. Ponicode

10.15. Linnify

10.16. Huboxt

10.17. NEKLO

10.18. Future Forward

10.19. Web Optic

10.20. Tabnine

10.21. Vedlogic

10.22. Commoditech

10.23. Pandalatec

10.24. Tricky Mind Solution

10.25. SMV Experts

10.26. Thespian

10.27. SmithySoft

10.28. CI&T

10.29. Globant

10.30. Beyond Limits

11. Key Findings

12. Analyst Recommendations

13. Prompt Engineering Market: Research Methodology