Pizza Market Industry Analysis and Forecast (2026-2032)

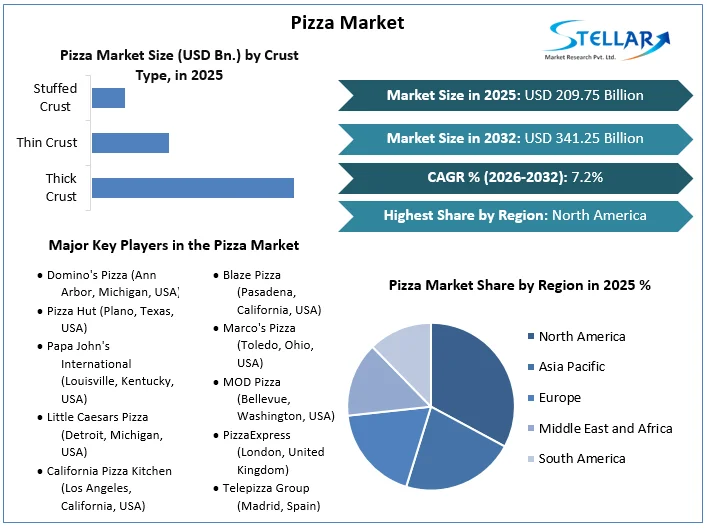

The Pizza Market size was valued at USD 209.75 Bn. in 2025 and the total Global Pizza revenue is expected to grow at a CAGR of 7.2% from 2026 to 2032, reaching nearly USD 341.25 Bn. by 2032.

Format : PDF | Report ID : SMR_1966

Pizza Market Overview

Pizza is a popular dish that typically consists of a flat, round base of leavened wheat dough topped with tomatoes, cheese, and various other ingredients, which is then baked at a high temperature, traditionally in a wood-fired oven. Originating from Italy, the classic pizza has a thin crust and is often topped with tomato sauce, mozzarella cheese, and a variety of toppings such as pepperoni, vegetables, and herbs. Over time, pizza has evolved and adapted to local tastes around the world, resulting in a wide variety of styles, including thick-crust, stuffed-crust, deep-dish, and more. The research methodology for analyzing the Pizza Market typically integrates qualitative and quantitative approaches. Qualitative research encompasses extensive literature reviews, interviews with industry experts, and analyses of industry reports and publications to gain insights into market trends, dynamics, and challenges.

Quantitative research, on the other hand, involves collecting and analyzing numerical data on market size, growth rates, revenue, and other pertinent metrics. This includes conducting surveys, data mining, and performing statistical analysis on market data sourced from reputable entities like industry associations, government agencies, and market research firms. By merging these methodologies, researchers gain a comprehensive understanding of the Pizza Market's size, growth drivers, competitive landscape, and future outlook. This integrated approach enables stakeholders to make well-informed decisions about investments, product development, marketing strategies, and other aspects of the Pizza industry.

To get more Insights: Request Free Sample Report

Pizza Market Dynamics

The pizza market is propelled by rising disposable income, changing lifestyles favoring convenient meals, and the global influence of Western food culture.

Increasing consumer demand for convenient and quick meal options, especially among busy urban populations has raised the pizza market. The proliferation of online food delivery services and mobile apps has made it easier for consumers to order pizza from the comfort of their homes. Additionally, the continuous innovation in pizza recipes, including the introduction of gourmet and artisanal pizzas, has attracted a broader audience. Marketing strategies such as promotional offers, loyalty programs, and effective advertising have also played a significant role in boosting sales.

The global expansion of pizza chains and the growing popularity of Western-style fast food in emerging markets further contribute to the pizza market's growth. The rapid expansion of quick-service restaurants and continuous innovation in flavors and toppings keep consumer interest high. Aggressive marketing campaigns and the availability of frozen and ready-to-bake pizzas make pizza more accessible, while customization options cater to individual preferences. Additionally, health-conscious innovations, efficient delivery systems, and loyalty programs enhance customer satisfaction and retention. These drivers collectively fuel the growth and dynamic evolution of the pizza market.

The pizza market's current trends include a focus on healthier options, such as gluten-free, vegan, and organic pizzas, catering to the increasing health consciousness among consumers. There is also a rise in the popularity of personalized and customizable pizzas, allowing customers to choose their preferred toppings and crust types. Technology integration, such as automated ordering systems, AI-driven customer recommendations, and drone deliveries, is reshaping the customer experience. Furthermore, the trend of incorporating local and seasonal ingredients into pizza recipes is gaining traction, enhancing the appeal of pizzas with fresh and unique flavors.

The intense competition among numerous local, regional, and international pizza brands, can lead to pizza market saturation. Health concerns associated with high-calorie, high-fat, and high-sodium pizza offerings also deter health-conscious consumers. Also, fluctuations in the prices of key ingredients like cheese, wheat, and tomatoes can impact profitability. The increasing costs of labor and delivery logistics, especially with the rising demand for quick delivery services, present further operational challenges for pizza businesses.

Pizza Market Regional Analysis

In North America, the pizza market is highly mature and dominated by major players such as Domino's, Pizza Hut, and Papa John's, along with a robust presence of local pizzerias and frozen pizza brands like DiGiorno and Red Baron. The US market is particularly significant, with high consumer demand for both restaurant-delivered and store-bought pizzas. Innovations in delivery services, such as drone and automated vehicle deliveries, are enhancing customer convenience. Health-conscious trends are also influencing the market, with increased offerings of gluten-free, vegan, and organic pizzas. The Canadian market mirrors the US in terms of high consumption and the popularity of both dine-in and takeout pizza options. In the United States, the pizza market is divided into in-store deli food offerings and the frozen food department, with pizza being an extremely popular choice among consumers, often regarded as America's number one dinner option. It is estimated that over 200 million Americans consume frozen pizza, representing more than half of the US population.

The global frozen pizza market, currently valued at approximately 16.2 billion US dollars, is projected to grow to over 23 billion dollars by 2027. The US pizza retail sector includes products such as refrigerated pizza, pizza kits, frozen pizza crust/dough, and frozen pizza. Leading vendors in the US pizza market are Nestlé USA and Schwan’s Company. DiGiorno (Nestlé) is currently the most popular frozen pizza brand in the US, followed by Red Baron (Schwan’s Company) and various private-label products. Private label manufacturers play a significant role in the US frozen pizza retail market, with private label sales through supermarkets, mass merchants, military commissaries, and select club and dollar stores accounting for about 158.8 million US dollars per quarter. Nearly 63 million Americans consume one or two DiGiorno pizzas in a given month, although DiGiorno's market share is currently shrinking, while Freschetta (Schwan’s Company) and Red Baron are experiencing double-digit sales growth.

The European pizza market is diverse, with Italy being the birthplace of pizza, driving a strong cultural influence on pizza consumption across the continent. Traditional pizzerias are prevalent, but there is also a significant presence of international pizza chains and a growing market for frozen pizzas. Countries like the UK, Germany, and France have substantial markets for both fresh and frozen pizzas. The trend towards artisanal and gourmet pizzas, with a focus on high-quality ingredients and authentic preparation methods, is strong in Europe. Additionally, health and sustainability trends are prominent, with increasing demand for organic ingredients and eco-friendly packaging.

The Asia Pacific pizza market is rapidly growing, driven by urbanization, rising disposable incomes, and the Westernization of food habits. Major international pizza chains such as Domino's and Pizza Hut are expanding aggressively in countries like China, India, and Japan. These markets are characterized by a preference for localized pizza flavors and toppings that cater to regional tastes. The frozen pizza segment is also expanding as busy lifestyles drive demand for convenient meal options. In addition, the growing middle class and the increasing influence of digital food delivery platforms are significantly boosting the market. Innovations tailored to local preferences, such as seafood toppings in Japan and spicier flavors in India, are key to capturing market share in this diverse region.

Pizza Market Segment Analysis

Crust-type segmentation includes thick crust, thin crust, and stuffed crust pizzas. Thick-crust pizzas appeal to consumers who prefer a hearty, substantial base, often associated with deep-dish or pan-style pizzas. Thin crust pizzas cater to those seeking a lighter, crispier option, while stuffed crust pizzas offer a unique twist with cheese or other fillings inside the crust, appealing to cheese lovers and those looking for added indulgence. In 2025, the thin crust sub-segment emerges as the dominating segment in the pizza market. Thin crust pizzas have gained widespread popularity due to their versatility, appealing to health-conscious consumers seeking a lighter option as well as those valuing the crispy texture and enhanced toppings-to-crust ratio.

The thin crust sub-segment aligns with the growing demand for healthier alternatives and customizable toppings, reflecting evolving consumer preferences towards lighter, fresher, and more diverse pizza options. Additionally, the convenience of online ordering platforms has further propelled the popularity of thin-crust pizzas, enabling consumers to customize their orders and enjoy quick delivery to their doorstep. As a result, the thin crust sub-segment captures a significant market share in 2025, driving growth and innovation in the pizza industry.

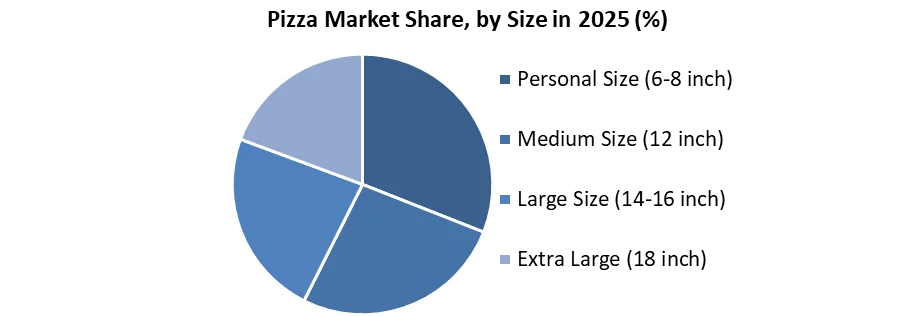

Size segmentation ranges from personal size (6-8 inch) to extra-large (18 inch) pizzas. Personal-sized pizzas are convenient for individual consumption or small gatherings, offering portion control and variety. Medium and large-sized pizzas are popular choices for families and larger groups, providing ample servings for sharing. Extra-large pizzas cater to gatherings and parties, offering generous portions to satisfy larger appetites.

Distribution channel segmentation includes online and offline channels. Online channels encompass pizza delivery services through websites and mobile apps, offering convenience and ease of ordering. Online distribution channels in the pizza market are predominantly trending nowadays as they tend to be the most convenient and reliable option for consumers. Offline channels comprise traditional brick-and-mortar pizzerias, restaurants, and supermarkets, providing a physical dining experience and in-store purchase options.

|

Pizza Market Scope |

|

|

Market Size in 2025 |

USD 209.75 Bn. |

|

Market Size in 2032 |

USD 341.25 Bn. |

|

CAGR (2026-2032) |

7.2% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Crust Type Thick Crust Thin Crust Stuffed Crust |

|

By Size Personal Size (6-8 inch) Medium Size (12 inch) Large Size (14-16 inch) Extra Large (18 inch) |

|

|

By Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Pizza Market

- Domino's Pizza (Ann Arbor, Michigan, USA)

- Pizza Hut (Plano, Texas, USA)

- Papa John's International (Louisville, Kentucky, USA)

- Little Caesars Pizza (Detroit, Michigan, USA)

- California Pizza Kitchen (Los Angeles, California, USA)

- Papa Murphy's Holdings Inc. (Vancouver, Washington, USA)

- Sbarro (Columbus, Ohio, USA)

- Blaze Pizza (Pasadena, California, USA)

- Marco's Pizza (Toledo, Ohio, USA)

- MOD Pizza (Bellevue, Washington, USA)

- PizzaExpress (London, United Kingdom)

- Telepizza Group (Madrid, Spain)

- Pizza Inn (The Colony, Texas, USA)

- Round Table Pizza (Concord, California, USA)

- Uno Pizzeria & Grill (Boston, Massachusetts, USA)

- Donatos Pizza (Columbus, Ohio, USA)

- Godfather's Pizza (Omaha, Nebraska, USA)

- Jet's Pizza (Sterling Heights, Michigan, USA)

- Hungry Howie's Pizza (Madison Heights, Michigan, USA)

- Giordano's (Chicago, Illinois, USA)

Frequently Asked Questions

In Pizza Market, Popular pizza toppings vary by region, but some common ones include cheese, pepperoni, mushrooms, onions, peppers, sausage, and bacon.

Major pizza chains compete through pricing strategies, promotional offers, product innovation, delivery services, and the expansion of their store networks in the pizza market.

the Pizza Market, challenges include increasing competition, fluctuating ingredient prices, health concerns related to high-calorie and high-fat offerings, and the need to adapt to changing consumer preferences.

the Pizza Market significant growth is observed in North America, particularly in countries like the US and Canada, as well as in Europe.

1. Pizza Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Pizza Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Business Segment

2.3.3. End-user Segment

2.3.4. Revenue (2025)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Pizza Market: Dynamics

3.1. Pizza Market Trends by Region

3.2. Pizza Market Dynamics

3.2.1. Global Pizza Market Drivers

3.2.2. Global Pizza Market Restraints

3.2.3. Global Pizza Market Opportunities

3.2.4. Global Pizza Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technology Roadmap

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East and Africa

3.6.5. South America

3.7. Key Opinion Leader Analysis for Pizza Industry

4. Pizza Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

4.1. Pizza Market Size and Forecast, By Crust Type (2025-2032)

4.1.1. Thick Crust

4.1.2. Thin Crust

4.1.3. Stuffed Crust

4.2. Pizza Market Size and Forecast, By Size (2025-2032)

4.2.1. Personal Size (6-8 inch)

4.2.2. Medium Size (12 inch)

4.2.3. Large Size (14-16 inch)

4.2.4. Extra Large (18 inch)

4.3. Pizza Market Size and Forecast, By Distribution Channel (2025-2032)

4.3.1. Online

4.3.2. Offline

4.4. Pizza Market Size and Forecast, by Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Pizza Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. North America Pizza Market Size and Forecast, By Crust Type (2025-2032)

5.1.1. Thick Crust

5.1.2. Thin Crust

5.1.3. Stuffed Crust

5.2. North America Pizza Market Size and Forecast, By Size (2025-2032)

5.2.1. Personal Size (6-8 inch)

5.2.2. Medium Size (12 inch)

5.2.3. Large Size (14-16 inch)

5.2.4. Extra Large (18 inch)

5.3. North America Pizza Market Size and Forecast, By Distribution Channel (2025-2032)

5.3.1. Online

5.3.2. Offline

5.4. North America Pizza Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Pizza Market Size and Forecast, By Crust Type (2025-2032)

5.4.1.1.1. Thick Crust

5.4.1.1.2. Thin Crust

5.4.1.1.3. Stuffed Crust

5.4.1.2. United States Pizza Market Size and Forecast, By Size (2025-2032)

5.4.1.2.1. Personal Size (6-8 inch)

5.4.1.2.2. Medium Size (12 inch)

5.4.1.2.3. Large Size (14-16 inch)

5.4.1.2.4. Extra Large (18 inch)

5.4.1.3. United States Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

5.4.1.3.1. Online

5.4.1.3.2. Offline

5.4.1.4. Canada Pizza Market Size and Forecast, By Crust Type (2025-2032)

5.4.1.4.1. Thick Crust

5.4.1.4.2. Thin Crust

5.4.1.4.3. Stuffed Crust

5.4.1.5. Canada Pizza Market Size and Forecast, By Size(2025-2032)

5.4.1.5.1. Personal Size (6-8 inch)

5.4.1.5.2. Medium Size (12 inch)

5.4.1.5.3. Large Size (14-16 inch)

5.4.1.5.4. Extra Large (18 inch)

5.4.2. Canada Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

5.4.2.1.1. Online

5.4.2.1.2. Offline

5.4.3. Mexico

5.4.3.1. Mexico Pizza Market Size and Forecast, By Crust Type (2025-2032)

5.4.3.1.1. Thick Crust

5.4.3.1.2. Thin Crust

5.4.3.1.3. Stuffed Crust

5.4.3.2. Mexico Pizza Market Size and Forecast, By Size(2025-2032)

5.4.3.2.1. Personal Size (6-8 inch)

5.4.3.2.2. Medium Size (12 inch)

5.4.3.2.3. Large Size (14-16 inch)

5.4.3.2.4. Extra Large (18 inch)

5.4.3.3. Mexico Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

5.4.3.3.1. Online

5.4.3.3.2. Offline

6. Europe Pizza Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. Europe Pizza Market Size and Forecast, By Crust Type (2025-2032)

6.2. Europe Pizza Market Size and Forecast, By Size(2025-2032)

6.3. Europe Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

6.4. Europe Pizza Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Pizza Market Size and Forecast, By Crust Type (2025-2032)

6.4.1.2. United Kingdom Pizza Market Size and Forecast, By Size(2025-2032)

6.4.1.3. United Kingdom Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

6.4.2. France

6.4.2.1. France Pizza Market Size and Forecast, By Crust Type (2025-2032)

6.4.2.2. France Pizza Market Size and Forecast, By Size(2025-2032)

6.4.2.3. France Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

6.4.3. Germany

6.4.3.1. Germany Pizza Market Size and Forecast, By Crust Type (2025-2032)

6.4.3.2. Germany Pizza Market Size and Forecast, By Size(2025-2032)

6.4.3.3. Germany Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

6.4.4. Italy

6.4.4.1. Italy Pizza Market Size and Forecast, By Crust Type (2025-2032)

6.4.4.2. Italy Pizza Market Size and Forecast, By Size(2025-2032)

6.4.4.3. Italy Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

6.4.5. Spain

6.4.5.1. Spain Pizza Market Size and Forecast, By Crust Type (2025-2032)

6.4.5.2. Spain Pizza Market Size and Forecast, By Size(2025-2032)

6.4.5.3. Spain Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Pizza Market Size and Forecast, By Crust Type (2025-2032)

6.4.6.2. Sweden Pizza Market Size and Forecast, By Size(2025-2032)

6.4.6.3. Sweden Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

6.4.7. Austria

6.4.7.1. Austria Pizza Market Size and Forecast, By Crust Type (2025-2032)

6.4.7.2. Austria Pizza Market Size and Forecast, By Size(2025-2032)

6.4.7.3. Austria Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Pizza Market Size and Forecast, By Crust Type (2025-2032)

6.4.8.2. Rest of Europe Pizza Market Size and Forecast, By Size(2025-2032)

6.4.8.3. Rest of Europe Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7. Asia Pacific Pizza Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Asia Pacific Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.2. Asia Pacific Pizza Market Size and Forecast, By Size(2025-2032)

7.3. Asia Pacific Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4. Asia Pacific Pizza Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.1.2. China Pizza Market Size and Forecast, By Size(2025-2032)

7.4.1.3. China Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.2.2. S Korea Pizza Market Size and Forecast, By Size(2025-2032)

7.4.2.3. S Korea Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4.3. Japan

7.4.3.1. Japan Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.3.2. Japan Pizza Market Size and Forecast, By Size(2025-2032)

7.4.3.3. Japan Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4.4. India

7.4.4.1. India Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.4.2. India Pizza Market Size and Forecast, By Size(2025-2032)

7.4.4.3. India Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4.5. Australia

7.4.5.1. Australia Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.5.2. Australia Pizza Market Size and Forecast, By Size(2025-2032)

7.4.5.3. Australia Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.6.2. Indonesia Pizza Market Size and Forecast, By Size(2025-2032)

7.4.6.3. Indonesia Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.7.2. Malaysia Pizza Market Size and Forecast, By Size(2025-2032)

7.4.7.3. Malaysia Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4.8. Vietnam

7.4.8.1. Vietnam Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.8.2. Vietnam Pizza Market Size and Forecast, By Size(2025-2032)

7.4.8.3. Vietnam Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4.9. Taiwan

7.4.9.1. Taiwan Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.9.2. Taiwan Pizza Market Size and Forecast, By Size(2025-2032)

7.4.9.3. Taiwan Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

7.4.10. Rest of Asia Pacific

7.4.10.1. Rest of Asia Pacific Pizza Market Size and Forecast, By Crust Type (2025-2032)

7.4.10.2. Rest of Asia Pacific Pizza Market Size and Forecast, By Size(2025-2032)

7.4.10.3. Rest of Asia Pacific Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

8. Middle East and Africa Pizza Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Middle East and Africa Pizza Market Size and Forecast, By Crust Type (2025-2032)

8.2. Middle East and Africa Pizza Market Size and Forecast, By Size(2025-2032)

8.3. Middle East and Africa Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

8.4. Middle East and Africa Pizza Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Pizza Market Size and Forecast, By Crust Type (2025-2032)

8.4.1.2. South Africa Pizza Market Size and Forecast, By Size(2025-2032)

8.4.1.3. South Africa Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

8.4.2. GCC

8.4.2.1. GCC Pizza Market Size and Forecast, By Crust Type (2025-2032)

8.4.2.2. GCC Pizza Market Size and Forecast, By Size(2025-2032)

8.4.2.3. GCC Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Pizza Market Size and Forecast, By Crust Type (2025-2032)

8.4.3.2. Nigeria Pizza Market Size and Forecast, By Size(2025-2032)

8.4.3.3. Nigeria Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Pizza Market Size and Forecast, By Crust Type (2025-2032)

8.4.4.2. Rest of ME&A Pizza Market Size and Forecast, By Size(2025-2032)

8.4.4.3. Rest of ME&A Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

9. South America Pizza Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. South America Pizza Market Size and Forecast, By Crust Type (2025-2032)

9.2. South America Pizza Market Size and Forecast, By Size(2025-2032)

9.3. South America Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

9.4. South America Pizza Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Pizza Market Size and Forecast, By Crust Type (2025-2032)

9.4.1.2. Brazil Pizza Market Size and Forecast, By Size(2025-2032)

9.4.1.3. Brazil Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Pizza Market Size and Forecast, By Crust Type (2025-2032)

9.4.2.2. Argentina Pizza Market Size and Forecast, By Size(2025-2032)

9.4.2.3. Argentina Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Pizza Market Size and Forecast, By Crust Type (2025-2032)

9.4.3.2. Rest Of South America Pizza Market Size and Forecast, By Size(2025-2032)

9.4.3.3. Rest Of South America Pizza Market Size and Forecast, By Distribution Channel(2025-2032)

10. Company Profile: Key Players

10.1. Domino's Pizza (Ann Arbor, Michigan, USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Pizza Hut (Plano, Texas, USA)

10.3. Papa John's International (Louisville, Kentucky, USA)

10.4. Little Caesars Pizza (Detroit, Michigan, USA)

10.5. California Pizza Kitchen (Los Angeles, California, USA)

10.6. Papa Murphy's Holdings Inc. (Vancouver, Washington, USA)

10.7. Sbarro (Columbus, Ohio, USA)

10.8. Blaze Pizza (Pasadena, California, USA)

10.9. Marco's Pizza (Toledo, Ohio, USA)

10.10. MOD Pizza (Bellevue, Washington, USA)

10.11. PizzaExpress (London, United Kingdom)

10.12. Telepizza Group (Madrid, Spain)

10.13. Pizza Inn (The Colony, Texas, USA)

10.14. Round Table Pizza (Concord, California, USA)

10.15. Uno Pizzeria & Grill (Boston, Massachusetts, USA)

10.16. Donatos Pizza (Columbus, Ohio, USA)

10.17. Godfather's Pizza (Omaha, Nebraska, USA)

10.18. Jet's Pizza (Sterling Heights, Michigan, USA)

10.19. Hungry Howie's Pizza (Madison Heights, Michigan, USA)

10.20. Giordano's (Chicago, Illinois, USA)

11. Key Findings

12. Analyst Recommendations

13. Pizza Market: Research Methodology