Oxygenator Market: Size, Share & Competitive Landscape Report, By Product, By Age Group, By Application, By Geography, And Global Forecasts, (2025-2032)

The Oxygenator Market was valued at USD 378 million in 2024. Total Oxygenator Market revenue is expected to grow at a CAGR of 5.9% from 2025 to 2032, reaching nearly USD 485 million.

Format : PDF | Report ID : SMR_2618

Oxygenator Market Overview:

An oxygenator is a medical device that facilitates gas exchange by adding oxygen to the blood and removing carbon dioxide. It is commonly used in extracorporeal circulation, such as during cardiopulmonary bypass (CPB), extracorporeal membrane oxygenation (ECMO), and life-support systems for patients with severe respiratory or cardiac failure. It functions as an artificial lung, temporarily taking over the respiratory function. With ongoing advancements in medical technology, innovative services are making oxygenation products more accessible. In October 2024, Kids ECMO Referral Service (Kers) launch is a prime example by The Australian government. Powered by Sydney Children's Hospitals Network, cars are designed to offer important ECMO care to children during transportation.

According to the 2024 Global Asthma Report, over 450,000 deaths each year are due to Asthma, and about 260 million people worldwide live with Asthma. The prevalence of Asthma is on the rise, with the most severe cases occurring in low- and middle-income countries. Additionally, the British Heart Foundation's January 2024 report states that around 620 million people worldwide, mainly in Asia, suffer from heart and circulation-related diseases. This outlines the need for oxidation to a growing patient demographic, which increases the demand for cutting-edge technologies and advanced cardiac surgery devices.

To get more Insights: Request Free Sample Report

Oxygenator Market Dynamics:

Rising Demand for Oxygenators with Growing Prevalence of Heart Disease to boost the Oxygenator Market growth

The rising prevalence of heart disease is the primary driver of the growing global demand for oxygenators. According to the 2024 World Heart Report, ischemic heart disease remains the leading cause of global cardiovascular mortality, with an age-standardized rate of 108.8 deaths per 100,000 people. Additionally, the Global Burden of Disease study published in the Journal of the American College of Cardiology indicates that global cardiovascular deaths have risen from 12.4 million in 1990 to 19.8 million in 2022. With the increase in the incidence of heart disease, along with advances in medical technologies, there's a demand for innovative solutions in surgeries that require the oxygenation process, resulting in overall growth in this market.

Global Oxygenator Market Grows with Rising Demand and Innovation

The global demand for oxygenators is increasing due to significant growth opportunities in the Oxygenator industry. The rising burden of cardiopulmonary disorders has led to a higher adoption of oxygenators. In July 2022, OMRON Healthcare launched a portable oxygen concentrator that provides a continuous supply of oxygen (5L per minute) with over 90% concentration. This device is designed to support home care providers and individuals with COPD and respiratory conditions. The COVID-19 pandemic has further boosted the oxygenator market. In June 2021, the Government of India launched 'Project O2 for India' to increase medical oxygen production and meet rising demand. This initiative aimed to support stakeholders in strengthening the country’s oxygen supply. Membrane oxygenators were widely used in severe COVID-19 cases during the first two waves of the pandemic.

Oxygenator Market Segmentation:

Based on Product Type, the market is segmented into Membrane Oxygenator and Bubble Oxygenator. Membrane Oxygenator segment dominated the market in 2024 and is expected to hold the largest Oxygenator Market share over the forecast. In 2024, the global membrane oxygenator market held a revenue share of approximately USD 187 million, making it the leading segment within the USD 378 million oxygenator industry. This dominance was driven by the rising prevalence of respiratory and cardiac disorders, such as acute respiratory distress syndrome (ARDS) and cardiogenic shock, which required advanced oxygenation systems. Membrane oxygenators offered superior performance and safety features compared to bubble oxygenators, including more efficient gas exchange and reduced complications during surgeries. The growing geriatric population, more susceptible to these conditions, further fuelled the demand for membrane oxygenators, which significantly boost the Oxygenator Market growth.

By Age Group The adult segment dominates the oxygenator market in 2024, driven by the high prevalence of cardiovascular diseases, respiratory failures, and the increasing number of surgeries requiring oxygenation support. With aging populations and lifestyle-related factors such as obesity and smoking contributing to heart and lung conditions, the demand for advanced oxygenators continues to rise. Technological advancements have improved the efficiency and safety of oxygenators in adult surgeries, while the expanding use of extracorporeal membrane oxygenation (ECMO) for critical care has further fuelled Oxygenator Market growth. The growing burden of chronic diseases and the rising adoption of oxygenation therapies in intensive care settings make the adult segment the leading contributor to the market.

By Application The cardiac application segment dominated the Oxygenator Market, primarily due to the increasing prevalence of cardiovascular diseases (CVDs). According to the World Health Organization, ischemic heart disease accounted for 16% of global deaths in 2020, with an estimated 8.9 million deaths attributed to the condition in 2019. This rising burden of CVDs has led to a higher number of cardiopulmonary surgeries, such as coronary artery bypass grafting (CABG), thereby escalating the demand for oxygenators. Furthermore, advancements in medical technology and the growing adoption of extracorporeal membrane oxygenation (ECMO) therapy have reinforced the prominence of the cardiac segment within the oxygenator market.

Oxygenator Market Regional Analysis:

?In 2024, North America dominated the market, accounting for over 45.3% of the total Oxygenator Market share. This dominance is primarily due to the region's advanced healthcare infrastructure, substantial healthcare expenditure, and a high prevalence of cardiovascular and respiratory diseases necessitating oxygenation support. The United States, in particular, plays a significant role, with a market share of 83.2% within North America, driven by a large aging population and a high number of surgical procedures requiring oxygenators. Additionally, continuous technological advancements and the rapid adoption of innovative medical devices have further solidified North America's leading position in the oxygenator market.?

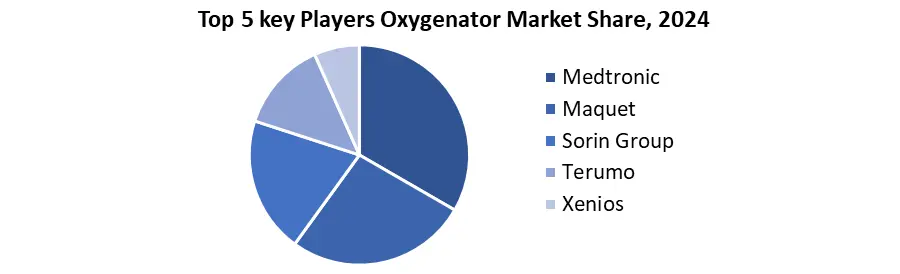

Oxygenator Market Competitive Landscape:

Leading Oxygenator companies such as Medtronic, Terumo Corporation, and Getinge AB maintained their competitive edge through continuous product development and strategic acquisitions.

- For instance, in September 2024, Medtronic introduced the VitalFlow ECMO System, enhancing extracorporeal life support with improved performance and user interface. Similarly, in February 2022, Getinge acquired Talis Clinical, expanding its portfolio in high-acuity IT solutions for critical care. These developments underscore the dynamic nature of the oxygenator market, with key players focusing on technological advancements and strategic partnerships to meet the evolving demands of healthcare providers worldwide.?

|

Oxygenator Market Scope |

|

|

Market Size in 2024 |

USD 378 Mn. |

|

Market Size in 2032 |

USD 485 Mn. |

|

CAGR (2025-2032) |

5.9% |

|

Historic Data |

2018-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Membrane Oxygenator |

|

By Age Group Neonates (0-28 days) |

|

|

By Application Respiratory |

|

Oxygenator Market Key Players includes:

- Medtronic (USA)

- Terumo Cardiovascular Systems Corporation (USA)

- LivaNova PLC (USA)

- Edwards Lifesciences Corporation (USA)

- Nipro Medical Corporation (USA)

- Getinge AB (Sweden)

- Drägerwerk AG & Co. KGaA (Germany)

- Xenios AG (Fresenius Medical Care Group) (Germany)

- Chalice Medical Ltd (UK)

- Eurosets Srl (Italy)

- Terumo Corporation (Japan)

- Senko Medical Instrument Mfg. Co., Ltd. (Japan)

- Beijing Aeonmed Co., Ltd. (China)

- Kejin Bio (China)

- Skanray Technologies (India)

- Braile Biomédica (Brazil)

- Silmag SA (Argentina)

- Vitalmex (Mexico)

- Haemotec (South Africa)

- Alvimedica (Turkey)

Frequently Asked Questions

The membrane oxygenator segment leads the market, due to its superior efficiency, reduced complications, and high demand for cardiac and respiratory treatments.

North America holds the largest market share (45.3% in 2024), driven by advanced healthcare infrastructure, high healthcare spending.

The market is driven by the rising prevalence of cardiovascular diseases, medical technology advancements, and increased ECMO adoption.

1. Oxygenator Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Oxygenator Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.4. Leading Oxygenator Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Oxygenator Market: Dynamics

3.1. Oxygenator Market Trends by Region

3.1.1. North America Oxygenator Market Trends

3.1.2. Europe Oxygenator Market Trends

3.1.3. Asia Pacific Oxygenator Market Trends

3.1.4. Middle East & Africa Oxygenator Market Trends

3.1.5. South America Oxygenator Market Trends

3.2. Oxygenator Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

3.7. Analysis of Government Schemes and Initiatives for the Oxygenator Industry

4. Oxygenator Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

4.1. Oxygenator Market Size and Forecast, By Product Type (2025-2032)

4.1.1. Membrane Oxygenator

4.1.2. Bubble Oxygenator

4.2. Oxygenator Market Size and Forecast, By Age Group (2025-2032)

4.2.1. Neonates (0-28 days)

4.2.2. Paediatrics (29 days - 18 years)

4.2.3. Adults (18+ years)

4.3. Oxygenator Market Size and Forecast, By Application (2025-2032)

4.3.1. Respiratory

4.3.2. Cardiac

4.3.3. Extracorporeal Cardiopulmonary

4.3.4. Resuscitation (ECPR)

4.4. Oxygenator Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Oxygenator Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn) (2025-2032)

5.1. North America Oxygenator Market Size and Forecast, By Product (2025-2032)

5.1.1. Membrane Oxygenator

5.1.2. Bubble Oxygenator

5.2. North America Oxygenator Market Size and Forecast, By Age Group (2025-2032)

5.2.1. Neonates (0-28 days)

5.2.2. Paediatrics (29 days - 18 years)

5.2.3. Adults (18+ years)

5.3. North America Oxygenator Market Size and Forecast, By Application (2025-2032)

5.3.1. Respiratory

5.3.2. Cardiac

5.3.3. Extracorporeal Cardiopulmonary

5.3.4. Resuscitation (ECPR)

5.4. North America Oxygenator Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Oxygenator Market Size and Forecast, By Product Type (2025-2032)

5.4.1.1.1. Wall-Mounted Oxygenators

5.4.1.1.2. Floor-Standing Oxygenators

5.4.1.1.3. Automatic Sensor-Activated Oxygenators

5.4.1.1.4. Manual-Activated Oxygenators

5.4.1.2. United States Oxygenator Market Size and Forecast, By Age Group (2025-2032)

5.4.1.2.1. Neonates (0-28 days)

5.4.1.2.2. Paediatrics (29 days - 18 years)

5.4.1.2.3. Adults (18+ years)

5.4.1.3. United States Oxygenator Market Size and Forecast, By Application (2025-2032)

5.4.1.3.1. Respiratory

5.4.1.3.2. Cardiac

5.4.1.3.3. Extracorporeal Cardiopulmonary

5.4.1.3.4. Resuscitation (ECPR)

5.4.2. Canada

5.4.2.1. Canada Oxygenator Market Size and Forecast, By Product (2025-2032)

5.4.2.1.1. Membrane Oxygenator

5.4.2.1.2. Bubble Oxygenator

5.4.2.2. Canada Oxygenator Market Size and Forecast, By Age Group (2025-2032)

5.4.2.2.1. Neonates (0-28 days)

5.4.2.2.2. Paediatrics (29 days - 18 years)

5.4.2.2.3. Adults (18+ years)

5.4.2.3. Canada Oxygenator Market Size and Forecast, By Application (2025-2032)

5.4.2.3.1. Respiratory

5.4.2.3.2. Cardiac

5.4.2.3.3. Extracorporeal Cardiopulmonary

5.4.2.3.4. Resuscitation (ECPR)

5.4.3. Mexico

5.4.3.1. Mexico Oxygenator Market Size and Forecast, By Product (2025-2032)

5.4.3.1.1. Membrane Oxygenator

5.4.3.1.2. Bubble Oxygenator

5.4.3.2. Mexico Oxygenator Market Size and Forecast, By Age Group (2025-2032)

5.4.3.2.1. Neonates (0-28 days)

5.4.3.2.2. Paediatrics (29 days - 18 years)

5.4.3.2.3. Adults (18+ years)

5.4.3.3. Mexico Oxygenator Market Size and Forecast, By Application (2025-2032)

5.4.3.3.1. Respiratory

5.4.3.3.2. Cardiac

5.4.3.3.3. Extracorporeal Cardiopulmonary

5.4.3.3.4. Resuscitation (ECPR)

6. Europe Oxygenator Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

6.1. Europe Oxygenator Market Size and Forecast, By Product (2025-2032)

6.2. Europe Oxygenator Market Size and Forecast, By Age Group (2025-2032)

6.3. Europe Oxygenator Market Size and Forecast, By Application (2025-2032)

6.4. Europe Oxygenator Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Oxygenator Market Size and Forecast, By Product (2025-2032)

6.4.1.2. United Kingdom Oxygenator Market Size and Forecast, By Age Group (2025-2032)

6.4.1.3. United Kingdom Oxygenator Market Size and Forecast, By Application (2025-2032)

6.4.2. France

6.4.2.1. France Oxygenator Market Size and Forecast, By Product Type (2025-2032)

6.4.2.2. France Oxygenator Market Size and Forecast, By Age Group (2025-2032)

6.4.2.3. France Oxygenator Market Size and Forecast, By Application (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Oxygenator Market Size and Forecast, By Product Type (2025-2032)

6.4.3.2. Germany Oxygenator Market Size and Forecast, By Age Group (2025-2032)

6.4.3.3. Germany Oxygenator Market Size and Forecast, By Application (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Oxygenator Market Size and Forecast, By Product Type (2025-2032)

6.4.4.2. Italy Oxygenator Market Size and Forecast, By Age Group (2025-2032)

6.4.4.3. Italy Oxygenator Market Size and Forecast, By Application (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Oxygenator Market Size and Forecast, By Product Type (2025-2032)

6.4.5.2. Spain Oxygenator Market Size and Forecast, By Age Group (2025-2032)

6.4.5.3. Spain Oxygenator Market Size and Forecast, By Application (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Oxygenator Market Size and Forecast, By Product Type (2025-2032)

6.4.6.2. Sweden Oxygenator Market Size and Forecast, By Age Group (2025-2032)

6.4.6.3. Sweden Oxygenator Market Size and Forecast, By Application (2025-2032)

6.4.7. Austria

6.4.7.1. Austria Oxygenator Market Size and Forecast, By Product Type (2025-2032)

6.4.7.2. Austria Oxygenator Market Size and Forecast, By Age Group (2025-2032)

6.4.7.3. Austria Oxygenator Market Size and Forecast, By Application (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Oxygenator Market Size and Forecast, By Product Type (2025-2032)

6.4.8.2. Rest of Europe Oxygenator Market Size and Forecast, By Age Group (2025-2032)

6.4.8.3. Rest of Europe Oxygenator Market Size and Forecast, By Application (2025-2032)

7. Asia Pacific Oxygenator Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn) (2025-2032)

7.1. Asia Pacific Oxygenator Market Size and Forecast, By Product Type (2025-2032)

7.2. Asia Pacific Oxygenator Market Size and Forecast, By Age Group (2025-2032)

7.3. Asia Pacific Oxygenator Market Size and Forecast, By Application (2025-2032)

7.4. Asia Pacific Oxygenator Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Oxygenator Market Size and Forecast, By Product Type (2025-2032)

7.4.1.2. China Oxygenator Market Size and Forecast, By Age Group (2025-2032)

7.4.1.3. China Oxygenator Market Size and Forecast, By Application (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Oxygenator Market Size and Forecast, By Product Type (2025-2032)

7.4.2.2. S Korea Oxygenator Market Size and Forecast, By Age Group (2025-2032)

7.4.2.3. S Korea Oxygenator Market Size and Forecast, By Application (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Oxygenator Market Size and Forecast, By Product Type (2025-2032)

7.4.3.2. Japan Oxygenator Market Size and Forecast, By Age Group (2025-2032)

7.4.3.3. Japan Oxygenator Market Size and Forecast, By Application (2025-2032)

7.4.4. India

7.4.4.1. India Oxygenator Market Size and Forecast, By Product Type (2025-2032)

7.4.4.2. India Oxygenator Market Size and Forecast, By Age Group (2025-2032)

7.4.4.3. India Oxygenator Market Size and Forecast, By Application (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Oxygenator Market Size and Forecast, By Product Type (2025-2032)

7.4.5.2. Australia Oxygenator Market Size and Forecast, By Age Group (2025-2032)

7.4.5.3. Australia Oxygenator Market Size and Forecast, By Application (2025-2032)

7.4.6. ASEAN

7.4.6.1. ASEAN Oxygenator Market Size and Forecast, By Product Type (2025-2032)

7.4.6.2. ASEAN Oxygenator Market Size and Forecast, By Age Group (2025-2032)

7.4.6.3. ASEAN Oxygenator Market Size and Forecast, By Application (2025-2032)

7.4.7. Rest of Asia Pacific

7.4.7.1. Rest of Asia Pacific Oxygenator Market Size and Forecast, By Product Type (2025-2032)

7.4.7.2. Rest of Asia Pacific Oxygenator Market Size and Forecast, By Age Group (2025-2032)

7.4.7.3. Rest of Asia Pacific Oxygenator Market Size and Forecast, By Application (2025-2032)

8. Middle East and Africa Oxygenator Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

8.1. Middle East and Africa Oxygenator Market Size and Forecast, By Product Type (2025-2032)

8.2. Middle East and Africa Oxygenator Market Size and Forecast, By Age Group (2025-2032)

8.3. Middle East and Africa Oxygenator Market Size and Forecast, By Application (2025-2032)

8.4. Middle East and Africa Oxygenator Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Oxygenator Market Size and Forecast, By Product Type (2025-2032)

8.4.1.2. South Africa Oxygenator Market Size and Forecast, By Age Group Model (2025-2032)

8.4.1.3. South Africa Oxygenator Market Size and Forecast, By Application (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Oxygenator Market Size and Forecast, By Product Type (2025-2032)

8.4.2.2. GCC Oxygenator Market Size and Forecast, By Age Group Model (2025-2032)

8.4.2.3. GCC Oxygenator Market Size and Forecast, By Application (2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Oxygenator Market Size and Forecast, By Product Type (2025-2032)

8.4.3.2. Nigeria Oxygenator Market Size and Forecast, By Age Group Model (2025-2032)

8.4.3.3. Nigeria Oxygenator Market Size and Forecast, By Application (2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Oxygenator Market Size and Forecast, By Product Type (2025-2032)

8.4.4.2. Rest of ME&A Oxygenator Market Size and Forecast, By Age Group Model (2025-2032)

8.4.4.3. Rest of ME&A Oxygenator Market Size and Forecast, By Application (2025-2032)

9. South America Oxygenator Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn.) (2025-2032)

9.1. South America Oxygenator Market Size and Forecast, By Product Type (2025-2032)

9.2. South America Oxygenator Market Size and Forecast, By Age Group (2025-2032)

9.3. South America Oxygenator Market Size and Forecast, By Application (2025-2032)

9.4. South America Oxygenator Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Oxygenator Market Size and Forecast, By Product (2025-2032)

9.4.1.2. Brazil Oxygenator Market Size and Forecast, By Age Group (2025-2032)

9.4.1.3. Brazil Oxygenator Market Size and Forecast, By Application (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Oxygenator Market Size and Forecast, By Product Type (2025-2032)

9.4.2.2. Argentina Oxygenator Market Size and Forecast, By Age Group (2025-2032)

9.4.2.3. Argentina Oxygenator Market Size and Forecast, By Application (2025-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Oxygenator Market Size and Forecast, By Product Type (2025-2032)

9.4.3.2. Rest Of South America Oxygenator Market Size and Forecast, By Age Group (2025-2032)

9.4.3.3. Rest Of South America Oxygenator Market Size and Forecast, By Application (2025-2032)

10. Company Profile: Key Players

11. Medtronic (USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Terumo Cardiovascular Systems Corporation (USA)

11.3. LivaNova PLC (USA)

11.4. Edwards Lifesciences Corporation (USA)

11.5. Nipro Medical Corporation (USA)

11.6. Getinge AB (Sweden)

11.7. Drägerwerk AG & Co. KGaA (Germany)

11.8. Xenios AG (Fresenius Medical Care Group) (Germany)

11.9. Chalice Medical Ltd (UK)

11.10. Eurosets Srl (Italy)

11.11. Terumo Corporation (Japan)

11.12. Senko Medical Instrument Mfg. Co., Ltd. (Japan)

11.13. Beijing Aeonmed Co., Ltd. (China)

11.14. Kejin Bio (China)

11.15. Skanray Technologies (India)

11.16. Braile Biomédica (Brazil)

11.17. Silmag SA (Argentina)

11.18. Vitalmex (Mexico)

11.19. Haemotec (South Africa)

11.20. Alvimedica (Turkey)

12. Key Findings & Analyst Recommendations

13. Oxygenator Market: Research Methodology