Oleic Acid Market Industry Analysis & Forecast (2026-2032) Trends, Statistics, Dynamics, and Segmentation

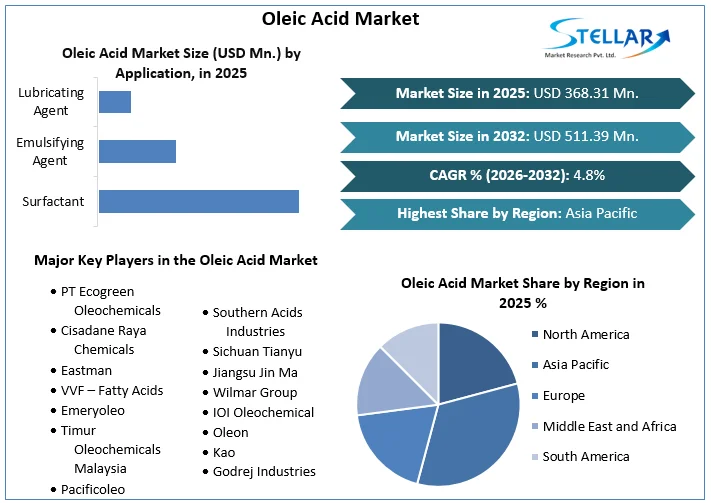

The Oleic Acid Market size was valued at USD 368.31 Million in 2025. The Global Oleic Acid Market is expected to reach USD 511.39 Million by 2032 with a CAGR of 4.8% from 2026 to 2032.

Format : PDF | Report ID : SMR_1454

Oleic Acid Market Overview:

Oleic Acid, a type of fatty acid can be found in fats and oils derived from plants and animals. It is a slightly yellow liquid, without any odor. In the body oleic acid is the prevalent fatty acid and is known to have beneficial effects, on health.

Oleic Acid Market expansion may be influenced by factors such as rising consumer awareness of natural and plant-based components, increased demand for health and wellness products, and continuous research into the possible health advantages of Oleic acid

This Oleic Acid Market report is an in-depth analysis of the most important market variables in the study of the global Oleic Acid Market. Along with competitive environment and market structure analysis, this also contains market drivers, trends, and challenges. Additionally, this report offers a thorough review of the market's size and growth, product type segmentation, regional country breakdowns, and major competitors in the Oleic Acid Market.

To get more Insights: Request Free Sample Report

Oleic Acid Market Dynamics:

Consumption of products containing monounsaturated fats, such as oleic acid, has increased due to consumer knowledge of the health benefits of these fats. This is evident in dietary trends favoring healthier cooking oils and food goods. Natural and organic ingredients are growing popular in food, skincare, and cosmetic products.

Oleic acid, which is obtained from natural oils like olive oil, falls into this trend as a naturally occurring and better alternative to some manufactured compounds. Oleic acid is employed in many industrial applications, such as lubricants, detergents, and chemical processes. As many sectors expand, so does the demand for oleic acid as a raw material or ingredient.

Oleic Acid Market Restraints:

The oleic acid market is fragmented, with several small and medium-sized competitors. This fragmentation can result in fierce rivalry, price wars, and lower profit margins for market participants. Technological and manufacturing process advancements have the potential to disrupt traditional oleic acid production methods. Companies that do not keep up with technological advancements may find it difficult to remain competitive.

Oleic acid is typically obtained from vegetable oils such as soybean, palm, and sunflower oil. The pricing of various basic commodities can fluctuate due to factors such as weather, crop production, and geopolitical events. Fluctuations in raw material costs can have a direct impact on the cost of producing oleic acid and, consequently, its market price. The manufacturing of oleic acid frequently includes the processing of vast quantities of vegetable oils, which can have environmental consequences. Concerns about deforestation, habitat loss, and the use of toxic chemicals in agriculture can lead to regulatory limits and public reaction, affecting the oleic acid industry.

Oleic Acid Market Opportunities:

Companies that use environmentally friendly and sustainable production practices can obtain a competitive advantage. Green chemical methods are less harmful to the environment and appeal to environmentally aware customers and enterprises. The advent of e-commerce platforms and digital marketing allows oleic acid manufacturers to reach a larger client base and better promote their products.

Oleic acid has a significant possibility in the food business, particularly in the manufacture of healthier food products. Oleic acid-rich oils, such as olive oil, are thought to be heart-healthy, and there is a growing market for them. Oleic acid can also be utilized as a food additive in a variety of applications. Oleic acid is used in lubricants, detergents, and biofuels. With improvements in biotechnology and sustainable manufacturing techniques, there is a chance to extend the usage of oleic acid in these industries.

Oleic Acid Market Trends:

Consumers were increasingly looking for natural and plant-based ingredients in a variety of products, including food, cosmetics, and personal care items. Oleic acid, obtained from vegetable oils, is in line with this trend and is in high demand for usage in natural and organic products. There was a greater emphasis on health and wellness, which led to an increase in demand for items containing beneficial fats like oleic acid. Oils high in oleic acid, such as olive oil, have been pushed for their possible cardiovascular and health advantages.

Oleic acid has remained a popular ingredient in cosmetics and skin care products due to its moisturizing and emollient characteristics. It was employed in the formulation of creams, lotions, and serums. The use of oleic acid in functional meals and nutraceuticals for potential health benefits has increased. These items attempted to address specific health conditions while also improving overall well-being.

The sustainable and responsible sourcing of raw materials for oleic acid manufacturing was a developing concern. Companies were increasingly seeking strategies to ensure that the procurement of vegetable oils for oleic acid was environmentally and socially appropriate.

Oleic Acid Market Segment Analysis:

By Source:

Plant: Olive oil, palm oil, sunflower oil, soybean oil, and macadamia nut oil are the main plant sources of Oleic acid. It is the largest segment by source due to increasing demand for plant-based products.

Animal: Tallow, lard, and fish oil are the main animal sources of Oleic Acid.

By Grade:

Regular: It is the most common type of oleic acid used in a wide range of applications such as industrial lubricants, surfactants, and chemical intermediaries. The food-grade oleic acid segment is the largest segment by grade. It is used as an emulsifier and flavoring agent in the food and beverages industry. Pharmaceutical: It is used in ointments and creams.

By Application: Surfactant is the largest segment of the Oleic acid market by application. It is used in the production of soaps, detergents, and shampoos. Second-largest segment of the Oleic acid market by application. It is used in the food and beverages industry to make products such as mayonnaise, margarine, and salad dressings. Third-largest segment of the Oleic acid market by application. It is used in a variety of industrial applications such as metalworking and metal processing.

Oleic Acid Market Regional Analysis:

Asia Pacific is the largest and fastest-growing regional market for oleic acid, accounting for over 50% of global demand in 2025. The demand for Oleic Acid in the Asia-Pacific region is driven by a growing population, increasing disposable income, and rising awareness of healthy living. China is the largest Oleic Acid Market. In the global market, China is the major producer of Oleic Acid. India is another major Oleic Acid Market with a growing demand for food and beverages, cosmetics and personal care, and pharmaceutical industries.

North America is the second-largest regional market for Oleic Acid, accounting for over 25% of global demand. The United States is the largest Oleic Acid Market in North America followed by Canada. Europe is the third largest regional market for Oleic Acid, accounting for over 15% of global demand. Germany is the largest Oleic Acid Market in Europe.

Middle East and Africa are smaller regional market for oleic acid which combined accounts for less than 10% of global demand in 2024. However, these markets are expected to grow at a faster pace than the global market in the coming years, driven by the growing population.

|

Oleic Acid Market |

|

|

Market Size in 2025 |

USD 368.31 Mn. |

|

Market Size in 2032 |

USD 511.39 Mn |

|

CAGR (2025-2032) |

4.8% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Source

|

|

By Grade

|

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Oleic Acid Market Key Players:

- PT Ecogreen Oleochemicals

- Cisadane Raya Chemicals

- Eastman

- VVF – Fatty Acids

- Emeryoleo

- Timur Oleochemicals Malaysia

- Pacificoleo

- KLK OLEO

- Southern Acids Industries

- Sichuan Tianyu

- Jiangsu Jin Ma

- Wilmar Group

- IOI Oleochemical

- Oleon

- Kao

- Godrej Industries

Frequently Asked Questions

The Asia-Pacific region holds the maximum share of the Oleic Acid Market.

The forecasted period for the Oleic Acid Market research report is 2026-2032.

The expected market size of the Oleic Acid Market in 2032 is US$ 511.39 Million.

The Oleic Acid Market is segmented on the basis of source, grade, and application.

1. Oleic Acid Market: Research Methodology

2. Oleic Acid Market: Executive Summary

3. Oleic Acid Market: Competitive Landscape

3.1. STELLAR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Oleic Acid Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Oleic Acid Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Oleic Acid Market Size and Forecast, by Source (2025-2032)

5.1.1. Plant

5.1.2. Animal

5.2. Oleic Acid Market Size and Forecast, by Grade (2025-2032)

5.2.1. Regular

5.2.2. Food

5.2.3. Pharmaceutical

5.3. Oleic Acid Market Size and Forecast, by Application (2025-2032)

5.3.1. Surfactant

5.3.2. Emulsifying Agent

5.3.3. Lubricating Agent

5.4. Oleic Acid Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Oleic Acid Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Oleic Acid Market Size and Forecast, by Source (2025-2032)

6.1.1. Plant

6.1.2. Animal

6.2. North America Oleic Acid Market Size and Forecast, by Grade (2025-2032)

6.2.1. Regular

6.2.2. Food

6.2.3. Pharmaceutical

6.3. North America Oleic Acid Market Size and Forecast, by Application (2025-2032)

6.3.1. Surfactant

6.3.2. Emulsifying Agent

6.3.3. Lubricating Agent

6.4. North America Oleic Acid Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Oleic Acid Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Oleic Acid Market Size and Forecast, by Source (2025-2032)

7.1.1. Plant

7.1.2. Animal

7.2. Europe Oleic Acid Market Size and Forecast, by Grade (2025-2032)

7.2.1. Regular

7.2.2. Food

7.2.3. Pharmaceutical

7.3. Europe Oleic Acid Market Size and Forecast, by Application (2025-2032)

7.3.1. Surfactant

7.3.2. Emulsifying Agent

7.3.3. Lubricating Agent

7.4. Europe Oleic Acid Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Oleic Acid Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Oleic Acid Market Size and Forecast, by Source (2025-2032)

8.1.1. Plant

8.1.2. Animal

8.2. Asia Pacific Oleic Acid Market Size and Forecast, by Grade (2025-2032)

8.2.1. Regular

8.2.2. Food

8.2.3. Pharmaceutical

8.3. Asia Pacific Oleic Acid Market Size and Forecast, by Application (2025-2032)

8.3.1. Surfactant

8.3.2. Emulsifying Agent

8.3.3. Lubricating Agent

8.4. Asia Pacific Oleic Acid Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Oleic Acid Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Oleic Acid Market Size and Forecast, by Source (2025-2032)

9.1.1. Plant

9.1.2. Animal

9.2. Middle East and Africa Oleic Acid Market Size and Forecast, by Grade (2025-2032)

9.2.1. Regular

9.2.2. Food

9.2.3. Pharmaceutical

9.3. Middle East and Africa Oleic Acid Market Size and Forecast, by Application (2025-2032)

9.3.1. Surfactant

9.3.2. Emulsifying Agent

9.3.3. Lubricating Agent

9.4. Middle East and Africa Oleic Acid Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Oleic Acid Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Oleic Acid Market Size and Forecast, by Source (2025-2032)

10.1.1. Plant

10.1.2. Animal

10.2. South America Oleic Acid Market Size and Forecast, by Grade (2025-2032)

10.2.1. Regular

10.2.2. Food

10.2.3. Pharmaceutical

10.3. South America Oleic Acid Market Size and Forecast, by Application (2025-2032)

10.3.1. Surfactant

10.3.2. Emulsifying Agent

10.3.3. Lubricating Agent

10.4. South America Oleic Acid Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. PT Ecogreen Oleochemicals

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Cisadane Raya Chemicals

11.3. Eastman

11.4. VVF – Fatty Acids

11.5. Emeryoleo

11.6. Timur Oleochemicals Malaysia

11.7. Pacificoleo

11.8. KLK OLEO

11.9. Southern Acids Industries

11.10. Sichuan Tianyu

11.11. Jiangsu Jin Ma

11.12. Wilmar Group

11.13. IOI Oleochemical

11.14. Oleon

11.15. Kao

11.16. Godrej Industries

12. Key Findings

13. Industry Recommendation