Global OLED Market Size Technology Advancements, Display Applications, Growth Opportunities and Forecast (2026–2032)

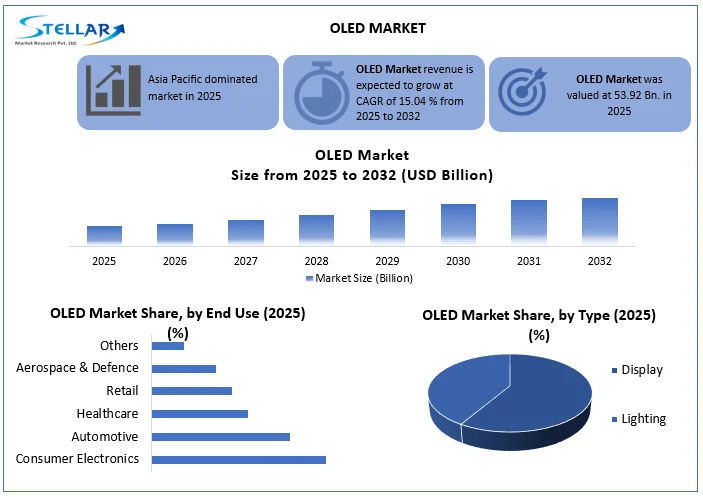

OLED Market was valued at USD 53.92 Billion in 2025, and the total revenue is expected to grow at a CAGR of 15.04 % from 2025 to 2032, reaching USD 143.78 Billion by 2032.

Format : PDF | Report ID : SMR_2216

Organic Light Emitting Diode (OLED) technology represents the pinnacle of current display evolution. Unlike traditional LCDs that require a backlight, OLEDs are self-emissive, meaning each individual pixel produces its own light. This results in "perfect blacks," infinite contrast ratios, and significantly lower power consumption. In 2025, the market has transitioned from being a "premium niche" to the standard for high-performance electronics, driven by the mass adoption of AMOLED (Active-Matrix) panels in smartphones and the rapid rise of Tandem OLED structures in tablets and laptops.

Key Market Insights (2025):

- Tablet Market Surge: OLED tablet shipments are expected to rise by 39% this year, reaching 15 million units. This is almost entirely driven by the expansion of OLED into the iPad Mini and iPad Air lines.

- U.S. Consumer Strength: According to SMR analysis, a steady rise in disposable personal income (USD 79.7B increase) has correlated with a 58% adoption rate of OLED panels in new premium smartphones sold in the U.S.

- South Korea's Global Lead: The South Korean government (Ministry of Trade, Industry and Energy) continues to treat OLED as a "National Strategic Tech," providing billions in subsidies. Currently, Samsung and LG combined hold 70%+ of the high-end OLED market.

- India’s Manufacturing Boom: The electronics sector is on track for USD 300B by the end of FY26. Local assembly of OLED smartphones is a key driver, as domestic demand for 5G OLED devices has grown by 72% year-on-year.

To get more Insights: Request Free Sample Report

Top Market Trend:

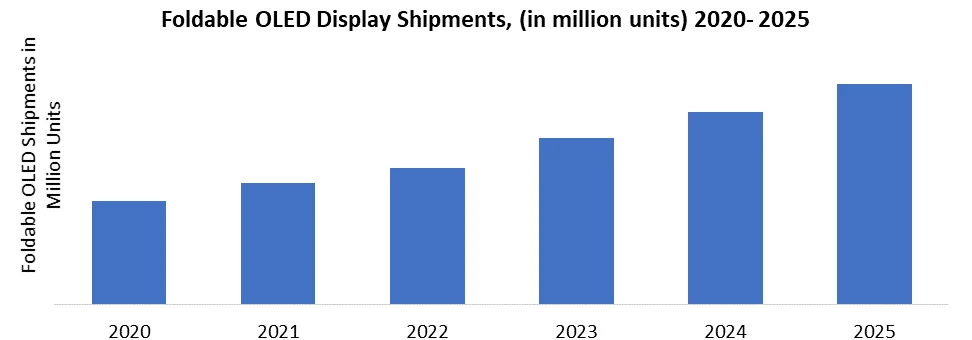

Accelerated Adoption of Flexible and Foldable OLED Displays with Strong Export Growth

The global OLED market is experiencing accelerated adoption of flexible and foldable OLED displays, reflecting robust demand for next-generation consumer electronics and premium form factors. It was supported by strong export performance from South Korea, a global OLED hub: in the first half of 2024, South Korea’s display exports recorded approximately USD 8.9 billion, with OLED panels accounting for around 70% (about USD 6.3 billion) of the total display export value, demonstrating how OLED technology drives trade performance. According to SMR analysis, monthly OLED panel exports reached over USD 1.1 billion in March 2025, a record-level indicator of sustained global demand for high-quality OLED displays used in smartphones, foldable devices, wearables, and televisions. These flexible and foldable technologies are becoming key revenue drivers in the OLED market, enabling dramatic form factors and enhanced performance that support premium pricing and broader adoption across consumer electronics, automotive displays, and emerging smart devices.

Worldwide Foldable OLED Display Shipments (2020–2025)

OLED Market Dynamics:

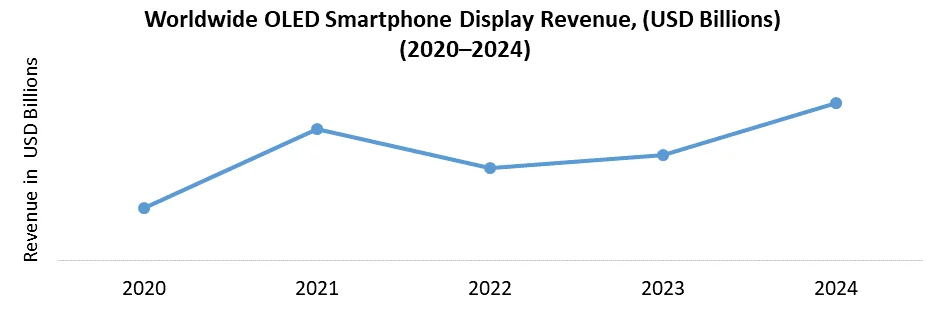

Rising OLED Adoption in Consumer Electronics to drive the Market Growth

A key driver fueling OLED market expansion is the accelerated integration of AMOLED and flexible OLED display technology across a wide range of consumer electronics, supported by rapid global smartphone penetration. By 2024, flexible AMOLED shipments reached approximately 631 million units, capturing around 42% of the smartphone display market, up sharply from prior years as manufacturers replace LCD panels with OLED for premium devices. This shift is reinforced by widespread smartphone usage, with nearly 90% global smartphone penetration expected by 2025, underscoring the strong demand for high-performance displays. These trends reinforce the adoption of OLED panels not only in smartphones but also in wearables, tablets, and other consumer devices, driving OLED market growth, expanding revenue potential, and accelerating replacement cycles for high-quality display technologies worldwide.

High Production and Manufacturing Costs

One major restraint constraining the OLED market was high production cost and manufacturing complexity, which are cited as limiting factors for wider adoption. Production defects and energy-intensive fabrication processes contribute to increased unit prices, slowing uptake in more price-sensitive segments and delaying volume penetration in some applications despite technology advantages.

Increase in Government Initiatives Supporting OLED Adoption to create Opportunity in the OLED Market

In global OLED market the growing number of government initiatives, tax incentives, and strategic funding programs that support OLED technology innovation and commercialization. For example, the South Korean Ministry of Trade, Industry and Energy (MTIE) has designated OLED as a national strategic technology, providing significant tax credits for R&D and production investments up to 50% credit coverage for core technology development and up to 75% for small enterprises to strengthen domestic OLED competitiveness against global rivals. In addition, the South Korean government allocated USD 26.5 million to fund OLED and microLED display R&D projects in 2025, covering 40 strategic innovation programs across displays and AR/VR technologies. These policies not only reduce financial barriers for OLED manufacturers and startups but also encourage higher private and foreign investments in next-generation displays, positioning OLED technology as a priority in national industrial strategies.

OLED Market: Segment Analysis

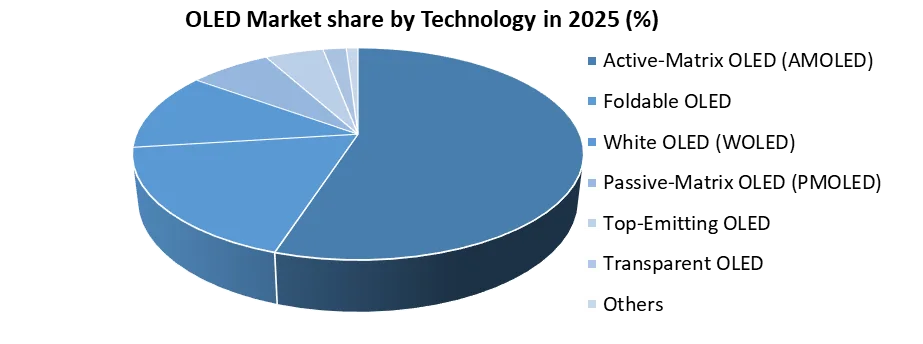

By Technology: Active-Matrix OLED (AMOLED) dominated the OLED market in 2025 due to its superior resolution, faster refresh rates, and low power consumption, making it the preferred choice for smartphones, televisions, laptops, and wearable devices. Foldable OLED is the fastest-growing segment, driven by rising adoption in foldable smartphones and next-generation consumer electronics, particularly in Asia-Pacific markets. Passive-Matrix OLED (PMOLED) maintains a niche presence in small-sized displays such as fitness trackers and industrial panels due to its lower cost and simple structure. White OLED (WOLED) continues to see strong demand in large-screen televisions and lighting applications, supported by its uniform brightness and color accuracy. Transparent OLED and Top-Emitting OLED technologies are gaining traction in automotive displays, retail digital signage, and aerospace applications, where design flexibility and visibility are critical. The Others category, including Micro-OLED and emerging hybrid technologies, is witnessing growing R&D investments, especially for AR/VR and head-mounted display applications, reinforcing long-term OLED market growth.

Regional Analysis:

Asia Pacific dominated the global OLED market in 2025, accounting for the largest revenue and volume share, driven by its strong electronics manufacturing ecosystem and technological leadership. Countries such as South Korea, China, and Japan are the backbone of global OLED supply. South Korea OLED market remains the global benchmark, with Samsung Display and LG Display collectively controlling over 70% of global OLED panel production and approximately XX% of OLED market revenue in 2024 (around USD 36.3 billion). OLED panel shipments were XX million units in 2025, supported by rising demand for smartphones, foldable devices, IT displays, and automotive applications. China continued to be the fastest-growing OLED manufacturing hub, supported by large-scale consumer electronics production and domestic display investments, while India contributes through rising electronics assembly and smartphone demand.

North America and Europe witnessed strong growth in the OLED market, driven by different end-use strengths. North America is expected to register the fastest growth over the forecast period, supported by high adoption of premium consumer electronics, OLED TVs, wearables, AR/VR devices, and automotive digital cockpits, aided by high disposable income and rapid uptake of advanced display technologies. Europe was experiencing steady and sustainable growth, primarily driven by the automotive sector, where OLED displays are increasingly used in instrument clusters, heads-up displays, infotainment systems, and interior lighting, especially across Germany, France, and the UK, as vehicle electrification and demand for premium in-car experiences continue to rise.

The geopolitical landscape of the OLED market has shifted into a high-stakes "asynchronous war" as South Korea’s historical dominance faces a structural challenge from China’s state-subsidized expansion. While South Korea, led by Samsung Display (SDC), maintains a qualitative edge in premium segments (supplying 220 million iPhones), China has effectively utilized a "Capex-heavy" strategy, with the government subsidizing up to 75% of capital expenditures for local firms. Consequently, South Korea’s total OLED market share has recently slipped below the 50% threshold, signaling a transition from a monopoly to a duopoly. Strategic data indicates that China is currently outspending South Korea in new OLED fabrication plant construction by a ratio of 3:1, leveraging its USD 80 billion LCD stronghold to fund the leap into next-generation AMOLED and flexible displays. This regional rivalry is increasingly being fought in intellectual property (IP) courts, with SDC acquiring over 100 LCD and OLED patents from LG and AUO specifically to restrict the import of lower-cost Chinese panels into the U.S. and European markets.

Competitive Landscape:

The OLED market in 2025 was characterized by high industry concentration, capital intensity, and technology-led competition, dominated by a small group of vertically integrated Asian players. Samsung Display and LG Display together account for over XX% of global OLED panel revenue, reflecting strong entry barriers driven by high R&D costs, proprietary materials, and advanced manufacturing know-how. South Korea continued to lead the premium OLED segment, while China was aggressively expanding capacity through state-backed investments exceeding USD 30–40 billion across multiple OLED fabs, intensifying long-term competitive pressure.

Leading players are pursuing a “scale-plus-innovation” strategy, focusing on 8.6-generation OLED lines, foldable and IT OLEDs, automotive displays, and yield optimization to protect margins. Strategic priorities include capacity expansion, long-term supply agreements with Tier-1 OEMs (Apple, Samsung Electronics, global auto OEMs), and sustained R&D spending, which for top players averages 7–10% of annual display revenues. Competitive dynamics are further shaped by selective partnerships, equipment localization, and technology differentiation (AMOLED, WOLED, transparent and automotive OLEDs), positioning the market as a high-stakes, winner-takes-most ecosystem rather than a fragmented competitive field.

Value Chain Analysis: Global OLED Industry

The OLED value chain is highly consolidated and technically complex, spanning from specialized chemical synthesis to high-precision semiconductor fabrication. In 2025, the value chain was characterized by a "Midstream Squeeze," where panel manufacturers face rising raw material costs while being pressured by downstream OEMs to lower ASPs (Average Selling Prices

The Silicon-to-Organic Integration": A major bottleneck in the current value chain is the supply of Display Driver ICs (DDICs). In 2025, top-tier panel makers like Samsung are vertically integrating their DDIC production to avoid the supply-side shocks that hampered the market in previous years.

|

Value Chain Stage |

Key Cost/Value Components |

Margin Profile |

Regional Leader |

|

Upstream |

PHOLED Materials, Canon Tokki VTE, FMM |

High (35-45%) |

USA / Japan |

|

Midstream |

AMOLED Fabrication, Tandem Stacking, TFE |

Moderate (15-22%) |

S. Korea / China |

|

Downstream |

Product Assembly, Branding, Retail |

Low-High (Varies) |

Global |

OLED Market Scope

|

OLED Market |

|||

|

This Report Covers |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 53.92 Bn |

|

Forecast Period 2026 to 2032 CAGR: |

15.04 % |

Market Size in 2032: |

USD 143.78 Bn |

|

OLED Market Segments Covered: |

By Type |

Display Lighting |

|

|

By Technology |

Active-Matrix OLED (AMOLED) Passive-Matrix OLED (PMOLED) Foldable OLED White OLED Transparent OLED Top-Emitting OLED Others |

||

|

By Display Panel Type |

Rigid Flexible Others |

||

|

By End Use |

Consumer Electronics Automotive Retail Aerospace & Defence Healthcare Others |

||

OLED Market, by region

North America (United States, Canada and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, and Rest of APAC)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)

OLED industry key Players

- Samsung Electronics Co., Ltd.

- LG Display

- BOE Technology Group

- Acuity Brands

- OLEDWorks LLC

- China Star Optoelectronics Technology (CSOT)

- Tianma Microelectronics

- Visionox

- AU Optronics

- Innolux Corporation

- Sony Corporation

- Panasonic Holdings Corporation

- Universal Display Corporation

- OSRAM GmbH

- Konica Minolta

- JOLED

- eMagin Corporation

- Kopin Corporation

- Royole Corporation

- Truly International

- Wisechip Semiconductor

- Raystar Optronics

- Winstar Display

- RiTdisplay Corporation

- Lumiotec

- Seiko Epson Corporation

- Futaba Corporation

- Sharp Corporation

Frequently Asked Questions

Asia Pacific is expected to dominate the OLED market during the forecast period.

The OLED market size is expected to reach USD 143.78 Bn by 2032.

The major top players in the Global OLED Market are FUTABA CORPORATION (Japan), Samsung Electronics Co., Ltd. (South Korea) and others.

The growth of the global OLED market is driven by increasing consumer adoption of electronic devices, smartphone penetration and wearable devices growth.

1. OLED Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global OLED Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Product Portfolio

2.2.3. Distribution Channel Reach

2.2.4. Technology and Innovations

2.2.5. New Product Launch Frequency

2.2.6. Market Share (%)

2.2.7. Revenue (2025)

2.2.8. Profit Margin (%)

2.2.9. R&D Investment (%)

2.2.10. Revenue Growth Rate (%)

2.2.11. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. OLED Market: Dynamics

3.1. OLED Market Trends

3.2. OLED Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. OLED Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in 000’Units) (2025-2032)

4.1. OLED Market Size and Forecast, By Type (2025-2032)

4.1.1. Display

4.1.2. Lighting

4.2. OLED Market Size and Forecast, By Technology (2025-2032)

4.2.1. Active-Matrix OLED (AMOLED)

4.2.2. Passive-Matrix OLED (PMOLED)

4.2.3. Foldable OLED

4.2.4. White OLED

4.2.5. Transparent OLED

4.2.6. Top-Emitting OLED

4.2.7. Others

4.3. OLED Market Size and Forecast, By Display Panel Type (2025-2032)

4.3.1. Rigid

4.3.2. Flexible

4.3.3. Others

4.4. OLED Market Size and Forecast, By End Use (2025-2032)

4.4.1. Consumer Electronics

4.4.2. Automotive

4.4.3. Retail

4.4.4. Aerospace & Defence

4.4.5. Healthcare

4.4.6. Others

4.5. OLED Market Size and Forecast, By Region (2025-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America OLED Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in 000’Units) (2025-2032)

5.1. North America OLED Market Size and Forecast, By Type (2025-2032)

5.2. North America OLED Market Size and Forecast, By Technology (2025-2032)

5.3. North America OLED Market Size and Forecast, By Display Panel Type (2025-2032)

5.4. North America OLED Market Size and Forecast, By End Use (2025-2032)

5.5. North America OLED Market Size and Forecast, by Country (2025-2032)

5.5.1. United States

5.5.2. Canada

5.5.3. Mexico

6. Europe OLED Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in 000’Units) (2025-2032)

6.1. Europe OLED Market Size and Forecast, By Type (2025-2032)

6.2. Europe OLED Market Size and Forecast, By Technology (2025-2032)

6.3. Europe OLED Market Size and Forecast, By Display Panel Type (2025-2032)

6.4. Europe OLED Market Size and Forecast, By End Use (2025-2032)

6.5. Europe OLED Market Size and Forecast, by Country (2025-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom OLED Market Size and Forecast, By Type (2025-2032)

6.5.1.2. United Kingdom OLED Market Size and Forecast, By Technology (2025-2032)

6.5.1.3. United Kingdom OLED Market Size and Forecast, By Display Panel Type (2025-2032)

6.5.1.4. United Kingdom OLED Market Size and Forecast, By End Use (2025-2032)

6.5.2. France

6.5.3. Germany

6.5.4. Italy

6.5.5. Spain

6.5.6. Sweden

6.5.7. Russia

6.5.8. Rest of Europe

7. Asia Pacific OLED Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in 000’Units) (2025-2032)

7.1. Asia Pacific OLED Market Size and Forecast, By Type (2025-2032)

7.2. Asia Pacific OLED Market Size and Forecast, By Technology (2025-2032)

7.3. Asia Pacific OLED Market Size and Forecast, By Display Panel Type (2025-2032)

7.4. Asia Pacific OLED Market Size and Forecast, By End Use (2025-2032)

7.5. Asia Pacific OLED Market Size and Forecast, by Country (2025-2032)

7.5.1. China

7.5.2. S Korea

7.5.3. Japan

7.5.4. India

7.5.5. Australia

7.5.6. Indonesia

7.5.7. Malaysia

7.5.8. Philippines

7.5.9. Thailand

7.5.10. Vietnam

7.5.11. Rest of Asia Pacific

8. Middle East and Africa OLED Market Size and Forecast (by Value in USD Billion, Volume in 000’Units) (2025-2032)

8.1. Middle East and Africa OLED Market Size and Forecast, By Type (2025-2032)

8.2. Middle East and Africa OLED Market Size and Forecast, By Technology (2025-2032)

8.3. Middle East and Africa OLED Market Size and Forecast, By Display Panel Type (2025-2032)

8.4. Middle East and Africa OLED Market Size and Forecast, By End Use (2025-2032)

8.5. Middle East and Africa OLED Market Size and Forecast, by Country (2025-2032)

8.5.1. South Africa

8.5.2. GCC

8.5.3. Egypt

8.5.4. Nigeria

8.5.5. Rest of ME&A

9. South America OLED Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in 000’Units) (2025-2032)

9.1. South America OLED Market Size and Forecast, By Type (2025-2032)

9.2. South America OLED Market Size and Forecast, By Technology (2025-2032)

9.3. South America OLED Market Size and Forecast, By Display Panel Type (2025-2032)

9.4. South America OLED Market Size and Forecast, By End Use (2025-2032)

9.5. South America OLED Market Size and Forecast, by Country (2025-2032)

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Chile

9.5.5. Rest Of South America

10. Company Profile: Key Players

10.1. Samsung Electronics Co., Ltd.

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. LG Display

10.3. BOE Technology Group

10.4. Acuity Brands

10.5. OLEDWorks LLC

10.6. China Star Optoelectronics Technology (CSOT)

10.7. Tianma Microelectronics

10.8. Visionox

10.9. AU Optronics

10.10. Innolux Corporation

10.11. Sony Corporation

10.12. Panasonic Holdings Corporation

10.13. Universal Display Corporation

10.14. OSRAM GmbH

10.15. Konica Minolta

10.16. JOLED

10.17. eMagin Corporation

10.18. Kopin Corporation

10.19. Royole Corporation

10.20. Truly International

10.21. Wisechip Semiconductor

10.22. Raystar Optronics

10.23. Winstar Display

10.24. RiTdisplay Corporation

10.25. Lumiotec

10.26. Seiko Epson Corporation

10.27. Futaba Corporation

10.28. Sharp Corporation

10.29. Others

11. Key Findings

12. Analyst Recommendations

13. OLED Market: Research Methodology