North America Ceramic Tile Market- Regional Industry Overview and Forecast (2025-2032)

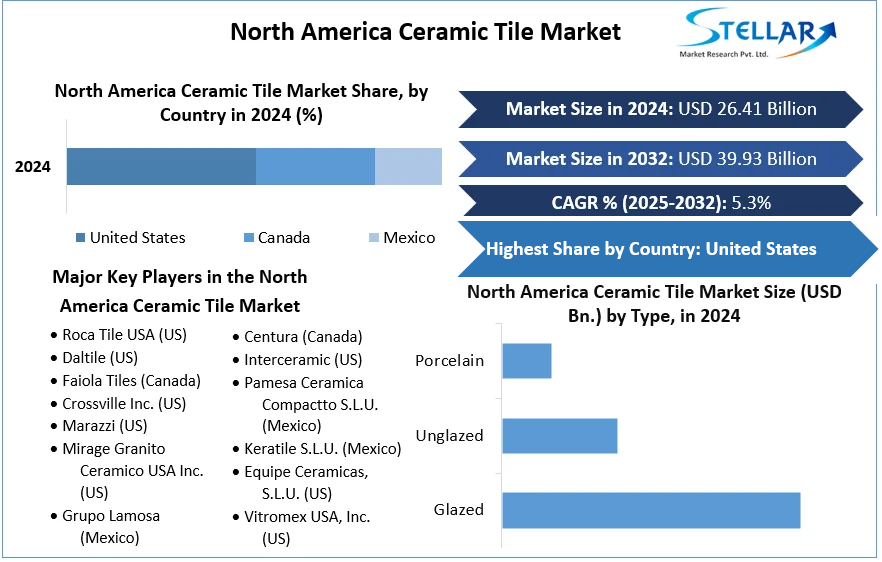

North America Ceramic Tile Market size was valued at US$ 26.41 Bn. in 2024, and the total revenue is expected to grow at 5.3% from 2025 to 2032, reaching nearly US$ 39.93 Bn. by 2032.

Format : PDF | Report ID : SMR_907

North America Ceramic Tile Market Overview:

Demand for ceramic tiles in North America is expected to grow in the forecast period due to their properties, such as durability, durability, and ease of maintenance. In addition, easy installation, coupled with the availability of ceramic tiles in a variety of colors, textures, and sizes, is expected to increase its popularity in wall and floor applications.

North America Ceramic Tile Market report examines the market's growth drivers and segments (Conductive Material, Application, End-User, and Region). Data has been provided by market participants and regions (North America, APAC, Europe, MEA, and South America). This market study takes an in-depth look at all of the significant advancements occurring across all industry sectors. To provide key data analysis for the historical period (2019-2024), statistics, infographics, and presentations are used. The report examines the North America Ceramic Tile markets, Drivers, Restraints, Opportunities, and Challenges. This SMR report includes North America Ceramic Tile investor recommendations based on a detailed analysis of the current competitive landscape of the North America Ceramic Tile market.

To get more Insights: Request Free Sample Report

COVID-19 pandemic on the North America Ceramic Tile Market:

Ceramic Tile Market growth in North America stems from the COVID-19 epidemic, which has led to declining growth in all countries, including the US, Canada, and Mexico. According to a survey from the U.S. Chamber of commercial Construction index, the overall construction index has dropped from 74 in Q1'20 to 56 in Q2'20 due to the size of the closure limits. However, the break from closure from Q3'20 onwards gradually improved, leading to the stabilization of the supply chain across the construction industry.

The US construction industry in the country saw a sharp decline in 2020 due to the outbreak of COVID-19. The construction industry in the U.S. faces challenges such as the closure of construction sites, staff shortages, and disruption of supply. In addition, the supply of raw materials from China, a major supplier of building products in the U.S., was disrupted due to lockdown closures, which had a negative impact on the supply chain, thus hampering growth in 2020.

North America Ceramic Tile Market Dynamics:

Key ceramic tile manufacturers of North America are partnering with a number of service companies, including state-of-the-art studios that help to create new images for the production of more attractive products. In addition, it includes end-of-line processing providers to complete the final product by cutting, grinding, and rusting.

In the past, the production of ceramic tiles has proven the growing trend of digital inkjet printing technology for product decoration. In addition, significant improvements in the design of print heads and ink design are expected to improve the penetration of the above-mentioned technologies in the ceramic tile industry during the forecast period. The North American ceramic tile market sees an increase in the portfolio of a commercial print systems for both online and offline use.

Manufacturers have their own network of corporate vendors that provide directly to end-users. These authorized retailers are involved in the distribution of all kinds of products, which, in turn, help to provide you with customized services with detailed information about each product.

Demand from the construction industry, coupled with a series of service delivery needs, is expected to grow further. In addition, high renovation costs have created a market for products that have a very long lifespan and require minimal adjustment, thus encouraging the use of ceramic tiles compared to their counterparts.

North America Ceramic Tile Market Segment Analysis:

North America Ceramic Tile Market, by Product

Porcelain tiles dominated the market with a budget of 50.7% by 2032 in the North American ceramic tile market. Porcelain tiles offer excellent durability, as well as resistance to chemicals, stains, molds, and bacteria, making them a popular choice among their counterparts. The properties listed above facilitate the use of the product in both residential and commercial areas.

Porcelain tiles are made of clay and are durable compared to ceramic tiles, providing a water absorption rate of less than 0.5%. However, the product is more expensive compared to its counterparts, thus limiting its use to low-cost systems.

Non-glazed ceramic tiles gain popularity due to their strength as these tiles are able to provide protection from severe damage and aging. This encourages the use of these products in outdoor applications, including areas, paths, parking spaces, store floors, and exterior wall coverings.

Other types of ceramic tiles include terracotta and other digital and non-digital tiles, including tiles used in public places to help the visually impaired. Highly compacted terracotta tile is more resistant to cracking compared to low-grade terracotta tiles, thus making them suitable for use in heavy work.

North America Ceramic Tile Market, by Application

Ceramic floor tiles held the largest revenue share of 59.4% in 2024. Clay tiles are widely used in floors, walls, assemblies, and counters. Ceramic floor tiles are gaining popularity due to their high durability and amazing strength. In addition, these products are resistant to corrosion and scratching, thus furthering their demand in outdoor environments.

Buyers are quickly moving from marble and stone to cheaper and more durable ceramic tiles. In addition, ceramic tiles are resistant to stains and retain their appearance for a long time. Technological advances such as the development of digital printing processes also help speed up the demand for ceramic floor tiles.

Ceramic wall tiles are widely used in residential areas, such as halls, recreation areas, and bedrooms. Product manufacturers or contractors / installers recommend wall-sized tiles by inspecting the installation site. Large-sized wall tiles are becoming increasingly popular these days. In addition, wood is gaining popularity for bathroom walls.

Advances in manufacturing technology have made it possible to produce tiles that are larger, smaller, and lighter than other tiles. Large-sized tiles are widely used in commercial areas, including airports, corporate offices, and health centers. However, the difficulty of installing tiles in a straight line and their heavyweight are some of the factors that limit growth.

North America Ceramic Tile Market by End User

The commercial sector held the maximum revenue share of 54.8% by 2024 in the North America ceramic tile market. The growing demand for durable and inexpensive ceramic flooring for use in commercial and automotive sectors is expected to further the market in the forecast period.

Part of the settlement is expected to witness significant growth during the forecast period. Ceramic tiles are used in the construction of residential areas due to their strong durability and high resistance to shock, stains, dirt, and scratches, which are the main requirements for indoor installation.

Growth in the residential and commercial sectors is growing due to the development of existing infrastructure. This is especially true in the commercial construction industry, which includes offices, hotels, and lodges, which are major applications that enhance the growth of the industry.

North America Ceramic Tile Market Country Insights:

The U.S. will held the largest revenue share of 45.8% by 2024. The growing number of single-family homes and strengthening residential transformation in the country have supported market growth in the U.S. In addition, well-established manufacturing industry in the country, as well as the presence of MNCs operating in all manufacturing industries, has played a major role in advancing the demand for ceramic tile market in commercial applications in the U.S.

Domestic and foreign producers are increasingly investing in the U.S. ceramic tile market to meet the growing demand from various application industries. However, the increase in imports of flooring, especially for competing manufacturers and prices around the world, is expected to disrupt the domestic producer market nationwide.

The market in North America is expected to see significant growth in the coming years due to the increase in residential and commercial construction in the region. The market is seeing a rapid change toward domestic production of ceramic tiles, supported by the growing demand for floor and wall insulation.

Increased commercial construction activities in Mexico and Canada are expected to increase productivity over the forecast period. In addition, the increase in government spending on public and private building infrastructure is expected to further boost the demand for ceramic tiles for wall and floor installation, which is expected to boost the market from 2025 to 2032.

Objective:

The objective of this report is to present an in-depth analysis of the North America Ceramic Tile Market to industry stakeholders. The report provides the recent trends in the North America Ceramic Tile Market and how these factors will impact new business investment and market enhancement during the forecast period. The report also provides an understanding of the potential of the North America Ceramic Tile Market and the competitive structure of the market by analyzing market leaders, market fans, and regional players.

The quality and quantity data provided in the North America Ceramic Tile Market report assist the readers in understanding which market Conductive Materials, regions are expected to grow in value, market factors, and key opportunity areas, which will impact industry growth and predictable market growth with respect to time. The report includes the competitive status of key competitors in the industry and their recent developments in the North America Ceramic Tile Market. The report also provides a comprehensive set of factors such as company size, market share, market growth, revenue, production capacity, and profits of key players in the North America Ceramic Tile Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Market. The report also analyses if the North America Ceramic Tile Market is easy for a new player to gain an edge in the market, do they come and go in the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political factors help in analyzing how much a government can impact the Market. Economic variables assist in calculating economic performance drivers that can affect the Market. Analyzing the impact of the overall environment and the impact of environmental concerns on the North America Ceramic Tile Market is aided by legal factors.

North America Ceramic Tile Market Scope:

|

North America Ceramic Tile Market |

|

|

Market Size in 2024 |

USD 26.41 Bn. |

|

Market Size in 2032 |

USD 39.93 Bn. |

|

CAGR (2025-2032) |

5.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By End-User

|

|

By Type

|

|

|

|

By Application

|

|

Country Scope |

United States Canada Mexico |

North America Ceramic Tile Market Key Players

- Roca Tile USA (US)

- Daltile (US)

- Faiola Tiles (Canada)

- Crossville Inc. (US)

- Marazzi (US)

- Mirage Granito Ceramico USA Inc. (US)

- Grupo Lamosa (Mexico)

- Mohawk Industries Inc. (US)

- Centura (Canada)

- Interceramic (US)

- Pamesa Ceramica Compactto S.L.U. (Mexico)

- Keratile S.L.U. (Mexico)

- Equipe Ceramicas, S.L.U. (US)

- Vitromex USA, Inc. (US)

- Quarry Direct Inc (Canada)

Frequently Asked Questions

Porcelain tiles is the leading type segment of North America Ceramic Tile market

The market size of the North America Ceramic Tile is expected to reach by USD 39.93 Bn. in North America Ceramic Tile Market.

The forecast period of North America Ceramic Tile market is 2025-2032

Commercial is the leading application segment of North America Ceramic Tile market.

- Scope of the Report

- Research Methodology

- Research Process

- North America Ceramic Tile Market: Target Audience

- North America Ceramic Tile Market: Primary Research (As per Client Requirement)

- North America Ceramic Tile Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Country in 2024(%)

- US

- Canada

- Mexico

- Others

- North America Stellar Competition matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - M&A by Region, Value, and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Country in 2024(%)

- North America North America Ceramic Tile Market Segmentation

- North America North America Ceramic Tile Market, by Type (2024-2032)

- Porcelain

- Glazed

- Unglazed

- North America North America Ceramic Tile Market, by Application (2024-2032)

- Floor Tiles

- Wall Tiles

- Others

- North America North America Ceramic Tile Market, by End-User (2024-2032)

- Commercial

- Residential

- North America North America Ceramic Tile Market, by Type (2024-2032)

- Company Profiles

- Key Players

- Roca Tile USA (US)

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Daltile (US)

- Faiola Tiles (Canada)

- Crossville Inc. (US)

- Marazzi (US)

- Mirage Granito Ceramico USA Inc. (US)

- Grupo Lamosa (Mexico)

- Mohawk Industries Inc. (US)

- Centura (Canada)

- Interceramic (US)

- Pamesa Ceramica Compactto S.L.U. (Mexico)

- Keratile S.L.U. (Mexico)

- Equipe Ceramicas, S.L.U. (US)

- Vitromex USA, Inc. (US)

- Quarry Direct Inc (Canada)

- Roca Tile USA (US)

- Key Players

Key Findings Recommendations