Non-Alcoholic Beer Market Global Industry Analysis and Forecast (2026-2032)

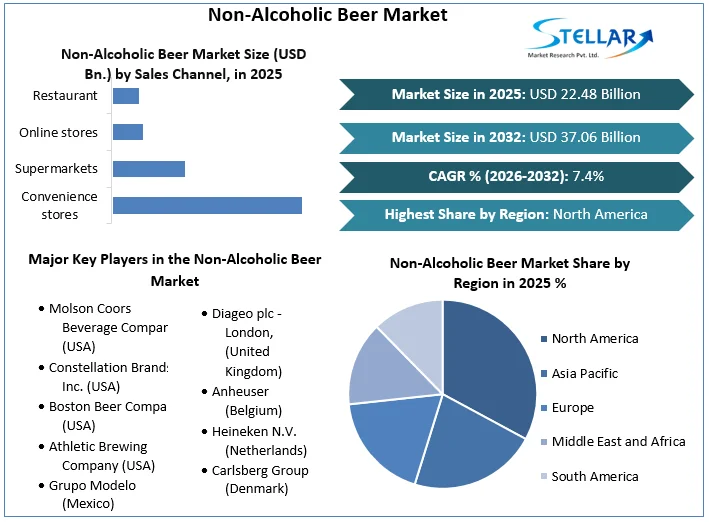

The Non-Alcoholic Beer Market size was valued at USD 22.48 Bn. in 2025 and the total Global Non-Alcoholic Beer Market revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 37.06 Bn. by 2032.

Format : PDF | Report ID : SMR_1970

Non-Alcoholic Beer Market Overview

The non-alcoholic beer market is undergoing a significant transformation, Due to societal trends and market forces. Once overshadowed by the overwhelming variety of craft beers—ranging from Double Chunky Cheeky Stouts to Guava Java Smoothie Sours and Gothic Baltic Barleywines—non-alcoholic options are now emerging as a significant category in their own right. This soft revolution in the beer industry reflects a growing consumer preference for healthier choices and moderation. The non-alcoholic beer market is growing rapidly, offering a diverse range of flavourful alternatives that provide to those seeking to reduce their alcohol intake while still enjoying the craft beer experience.

The non-alcoholic beer market experienced significant growth, Due to increasing consumer demand for alcohol-free options. According to the SMR, the percentage of people reporting at least one alcoholic drink in the past year dropped from 70.7% in 2019 to 68.2% in 2024. This shift has spurred local and national breweries to introduce non-alcoholic (NA) beer lines. Deschutes Brewery, for instance, invested $5 million over five years in R&D for their Fresh-Squeezed Non-Alcoholic IPA. A study revealed that 75% of Gen Z and Millennials are interested in non-alcoholic options, prioritizing taste and flavor.

Non-alcoholic beer sales have more than doubled in recent years, now constituting over 1% of the beer market with sales reaching $400 million in the last 52 weeks and likely exceeding $1 billion annually. Significantly, sales of NA beer at Deschutes Brewery surged 163% between 2019 and 2024. Interestingly, over 80% of NA beer consumers also drink alcoholic beverages, seeking moderation on specific occasions. The Non-Alcoholic Beer market's growth underscores a broader trend toward health-conscious consumption and the desire for flavorful, alcohol-free alternatives.

Non-Alcoholic Beer Market: Methodology

Stellar Market Research has recently published an extensive report delving into the Non-Alcoholic Beer Industry's trends, aiming to forecast its growth trajectory. This comprehensive analysis covers crucial aspects including industry size, market share, scope, growth potential, and more, offering valuable insights for businesses to navigate opportunities and risks effectively. The report meticulously examines various facets such as market overview, segmentation, current and future growth projections, competitive landscape, and beyond.

With a research objective focused on providing an in-depth understanding of the Non-Alcoholic Beer market across parameters such as Product, Material, Technology, and Sales Channel region, the report furnishes rich data on factors shaping the market dynamics. It evaluates competitive strategies encompassing mergers, expansions, product launches, and technological advancements, spotlighting key players driving innovation in diagnostics technology. Through quantitative research methodologies, the report presents statistical analyses highlighting the efficacy of Non-Alcoholic Beer and its influence on market trends. Furthermore, the inclusion of competitive intelligence analysis aids in deciphering market dynamics, competitor strategies, and customer perceptions. Such insights empower market participants to formulate targeted strategies, thereby gaining a competitive edge in the global Non-Alcoholic Beer Market landscape.

To get more Insights: Request Free Sample Report

Non-Alcoholic Beer Market: Dynamics

Increasing Health Consciousness Drives Non-Alcoholic Beer Market Growth

The growing health consciousness among consumers is a major driving factor behind the rapid growth of the non-alcoholic beer market. As people become more aware of the potential health risks associated with alcohol consumption, they are increasingly seeking out healthier alternatives such as non-alcoholic beer.

- For instance, this trend is the rising popularity of non-alcoholic beer among young people, particularly in Europe and the United States. A lifestyle known as "sober curious," which involves abstaining from alcohol despite being of legal drinking age, has gained traction in these regions. According to the SMR study Report, over 55% of do not drink or rarely drink alcohol.

To this growing demand, major beer manufacturers are investing heavily in the Non-Alcoholic Beer Market, launching new products and improving existing ones provided to health-conscious consumers. These efforts, combined with effective marketing strategies highlighting the health benefits and taste of non-alcoholic beer, are further driving market growth.

Limited Flavors and Taste restrains Non-Alcoholic Beer Market Growth

The non-alcoholic beer market faces significant growth constraints due to the limited range of flavors and taste profiles available. Consumers seek variety and complexity in their beverages, and the current offerings in the non-alcoholic beer segment tend to lack the depth and diversity found in traditional alcoholic beers. This led to a perception that non-alcoholic beers are less enjoyable, discouraging potential customers from making the switch.

The process of removing and reducing alcohol sometimes impacts the overall flavor, resulting in a taste that is perceived as inferior and less satisfying. Traditional beer drinkers, in particular, find non-alcoholic options lacking in the strong and rich flavors they are accustomed to, making them less likely to adopt these alternatives. The limited flavor options do not cater well to the diverse palates of global consumers, reducing the market’s appeal across different regions and cultures. Without a broader and more appealing range of flavors, the non-alcoholic beer market struggles to attract a wider audience, ultimately restraining its growth potential. Increasing flavor innovation and improving taste profiles are crucial steps needed to overcome these barriers and foster Non-Alcoholic Beer Market growth.

Technological Advancements in Brewing Technology create lucrative growth opportunities for Non-Alcoholic Beer Market Growth.

Technological advancements in brewing technology are creating lucrative growth opportunities for the non-alcoholic beer market. Modern techniques such as vacuum distillation, reverse osmosis, and advanced fermentation processes are significantly improving the quality and flavor of non-alcoholic beers. These methods allow brewers to remove and reduce alcohol content without compromising the taste and aroma that consumers expect from traditional beers.

Vacuum distillation, for instance, enables alcohol removal at lower temperatures, preserving the beer's delicate flavors. Reverse osmosis filters out alcohol molecules while retaining essential flavor compounds, resulting in a more authentic beer taste Innovative fermentation methods, such as controlled yeast strains that produce minimal alcohol, help maintain the desired flavor profile. These technological improvements address the primary consumer concern about non-alcoholic beer taste. By offering a product that closely mimics the experience of drinking alcoholic beer, brewers attract a broader audience, including traditional beer enthusiasts and health-conscious consumers. Also, the ability to produce a wider variety of flavors and styles through these advanced techniques helps differentiate products in a competitive market, enhancing brand appeal and market penetration. These technological advancements are important in driving the growth and acceptance of non-alcoholic beers globally.

Non-Alcoholic Beer Market: Segment Analysis

Based On Product Type

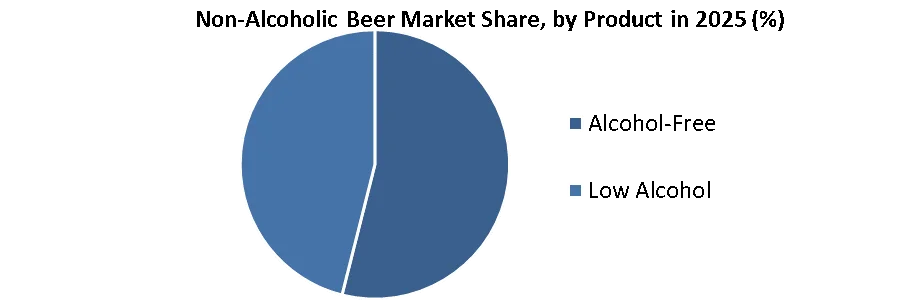

The alcohol-free segment dominated the Product Type segment of the Non-Alcoholic Beer Market in the year 2025. The alcohol-free segment (0.0% ABV) dominated the product type segment of the non-alcoholic beer market. The increasing health consciousness among consumers has led to a significant shift towards healthier beverage options. Alcohol-free beers, which contain no alcohol, align perfectly with this trend, offering the traditional beer experience without the adverse health effects associated with alcohol consumption. Also, stricter regulations and social norms regarding alcohol consumption, especially in certain regions and among specific demographics, have bolstered the appeal of alcohol-free beers.

This includes minors, pregnant women, and designated drivers who prefer to avoid alcohol entirely. Advancements in brewing technology have greatly improved the taste and quality of alcohol-free beers, making them more appealing to a broader audience. Major breweries have invested in this segment, launching premium and varied alcohol-free options that attract traditional beer drinkers and newcomers alike. The widespread availability in supermarkets, specialty stores, and online platforms has made it easier for consumers to access and try alcohol-free beers, driving market dominance in this segment.

Non-Alcoholic Beer Market: Regional Analysis

North America Dominated the Non-Alcoholic Beer Market in the year 2025. North America's dominance in the non-alcoholic beer market. Rising health consciousness and a shift towards wellness have led consumers to seek healthier alternatives to alcoholic beverages. Advances in brewing technology have significantly improved the taste and variety of non-alcoholic beers, making them more appealing to a broader audience.

The "sober curious" movement and changing social norms have also contributed, with more people choosing moderate drinking and abstinence. Strategic marketing, including targeted campaigns and celebrity endorsements, has boosted visibility and appeal. Economically, non-alcoholic beers command premium pricing, contributing to profitability. Investments in research and development have enabled North American breweries to produce high-quality products. Strategic partnerships with health brands and distributors have ensured wide availability. Supportive regulatory environments and effective consumer education campaigns have bolstered the Non-Alcoholic Beer Market growth. Cultural acceptance and mainstream inclusion in the hospitality industry have solidified non-alcoholic beer's position in North America. Together, these factors have cemented North America's leadership in the Non-Alcoholic Beer Market.

Non-Alcoholic Beer Market: Competitive Analysis

The Non-Alcoholic Beer Market is highly competitive such as the various key players dominating the Non-Alcoholic Beer Industry. The competitiveness of the Non-Alcoholic Beer Market is attributed to factors such as the increasing consumer demand for healthier beverage options, the presence of a wide range of product offerings from different brands, and the continuous innovation and development of new flavors and brewing techniques by key players in the industry. The Key players majorly focus on mergers, acquisitions, and the invention of new flavors in Non-Alcoholic Beer.

Some successful mergers in the non-alcoholic beer market include the partnership between Heineken and United Breweries, which resulted in the creation of Kingfisher Zero, and the collaboration between Anheuser-Busch InBev and Tilray, leading to the development of a line of cannabis-infused non-alcoholic beers. These mergers have allowed companies to expand their product offerings and attract a wider consumer base.

Top Non-Alcohol Beers

|

Non-Alcohol Beer |

Dollar Sales |

|

Heineken |

$79,307,590 |

|

Athletic |

$59,423,729 |

|

Bud |

$56,159,740 |

|

Busch |

$33,988,544 |

|

O'Douls |

$27,412,939 |

|

Total sales |

$368,683,318 |

|

Non-Alcoholic Beer Market Scope |

|

|

Market Size in 2025 |

USD 22.48 Bn. |

|

Market Size in 2032 |

USD 37.06 Bn. |

|

CAGR (2026-2032) |

7.4 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Product Alcohol-Free Low Alcohol |

|

By Material Malted Grains Hops Yeasts Enzymes Others |

|

|

By Technology Restricted fermentation/ fermentation-free Dealcoholization Reverse osmosis Heat treatment Vacuum distillation Others |

|

|

By Sales Channel Convenience stores Supermarkets Online stores Restaurant |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Non-Alcoholic Beer Market

North America Non-Alcoholic Beer Market Giants

- Molson Coors Beverage Company (USA)

- Constellation Brands, Inc. (USA)

- Boston Beer Company (USA)

- Athletic Brewing Company (USA)

- Grupo Modelo (Mexico)

Europe Non-Alcoholic Beer Market Key Players

- Diageo plc - London, (United Kingdom)

- Anheuser (Belgium)

- Heineken N.V. (Netherlands)

- Carlsberg Group (Denmark)

- Brauerei C. & A. Veltins (Germany)

- Clausthaler (Germany)

- Holsten Brewery (Germany)

- Bitburger Braugruppe GmbH (Germany)

- AB InBev (Budweiser Zero) (Belgium)

- Mikkeller (Denmark)

- Beavertown Brewery (United Kingdom)

Asia Pacific Non-Alcoholic Beer Industry Leaders

- Kirin Holdings Company, Limited (Japan)

- Asahi Group Holdings, Ltd. (Japan)

- Suntory Holdings Limited (Japan)

Frequently Asked Questions

The rising popularity of flavored non-alcoholic beer drives the Non-Alcoholic Beer market.

Investors can capitalize on opportunities in the Non-Alcoholic Beer market by focusing on companies that are leading in innovation trends such as advanced technology adoption. Additionally, investing in companies with strong distribution channels and a growing online retail presence can offer the potential for growth as the market growth globally.

The Market size was valued at USD 22.48 Billion in 2025 and the R of 7.4 % from 2026 to 2032, reaching total Market revenue is expected to grow at a USD 37.06 Billion.

The segments covered in the market report are Product, Material, Technology, and Sales Channel region

1. Non-Alcoholic Beer Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Non-Alcoholic Beer Market: Dynamics

2.1. Market Trends

2.2. Market Dynamics

2.2.1.1. Drivers

2.2.1.2. Restraints

2.2.1.3. Opportunities

2.2.1.4. Challenges

2.3. PORTER’s Five Forces Analysis

2.4. PESTLE Analysis

2.5. Value Chain Analysis

2.6. Technological Roadmap

2.7. Regulatory Landscape by Region

2.7.1. North America

2.7.2. Europe

2.7.3. Asia Pacific

2.7.4. Middle East and Africa

2.7.5. South America

2.8. Analysis of Government Schemes and Initiatives for Non-Alcoholic Beer Industry

2.9. Key Opinion Leader Analysis

3. Non-Alcoholic Beer Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

3.1. Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

3.1.1. Alcohol-Free

3.1.2. Low Alcohol

3.2. Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

3.2.1. Malted Grains

3.2.2. Hops

3.2.3. Yeasts

3.2.4. Enzymes

3.2.5. Others

3.3. Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

3.3.1. Restricted fermentation/ fermentation-free

3.3.2. Dealcoholization

3.3.3. Reverse osmosis

3.3.4. Heat treatment

3.3.5. Vacuum distillation

3.3.6. Others

3.4. Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

3.4.1. Convenience stores

3.4.2. Supermarkets

3.4.3. Online stores

3.4.4. Restaurant

3.5. Non-Alcoholic Beer Market Size and Forecast, By Region (2025-2032)

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

4. North America Non-Alcoholic Beer Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

4.1. North America Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

4.1.1. Alcohol-Free

4.1.2. Low Alcohol

4.2. North America Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

4.2.1. Malted Grains

4.2.2. Hops

4.2.3. Yeasts

4.2.4. Enzymes

4.2.5. Others

4.3. North America Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

4.3.1. Restricted fermentation/ fermentation-free

4.3.2. Dealcoholization

4.3.3. Reverse osmosis

4.3.4. Heat treatment

4.3.5. Vacuum distillation

4.3.6. Others

4.4. North America Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

4.4.1. Convenience stores

4.4.2. Supermarkets

4.4.3. Online stores

4.4.4. Restaurant

4.5. North America Non-Alcoholic Beer Market Size and Forecast, by Country (2025-2032)

4.5.1. United States

4.5.1.1. United States Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

4.5.1.1.1. Alcohol-Free

4.5.1.1.2. Low Alcohol

4.5.1.2. United States Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

4.5.1.2.1. Malted Grains

4.5.1.2.2. Hops

4.5.1.2.3. Yeasts

4.5.1.2.4. Enzymes

4.5.1.2.5. Others

4.5.1.3. United States Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

4.5.1.3.1. Restricted fermentation/ fermentation-free

4.5.1.3.2. Dealcoholization

4.5.1.3.3. Reverse osmosis

4.5.1.3.4. Heat treatment

4.5.1.3.5. Vacuum distillation

4.5.1.3.6. Others

4.5.1.4. United States Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

4.5.1.4.1. Convenience stores

4.5.1.4.2. Supermarkets

4.5.1.4.3. Online stores

4.5.1.4.4. Restaurant

4.5.2. Canada

4.5.2.1. Canada Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

4.5.2.1.1. Alcohol-Free

4.5.2.1.2. Low Alcohol

4.5.2.2. Canada Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

4.5.2.2.1. Malted Grains

4.5.2.2.2. Hops

4.5.2.2.3. Yeasts

4.5.2.2.4. Enzymes

4.5.2.2.5. Others

4.5.2.3. Canada Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

4.5.2.3.1. Restricted fermentation/ fermentation-free

4.5.2.3.2. Dealcoholization

4.5.2.3.3. Reverse osmosis

4.5.2.3.4. Heat treatment

4.5.2.3.5. Vacuum distillation

4.5.2.3.6. Others

4.5.2.4. Canada Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

4.5.2.4.1. Convenience stores

4.5.2.4.2. Supermarkets

4.5.2.4.3. Online stores

4.5.2.4.4. Restaurant

4.5.3. Mexico

4.5.3.1. Mexico Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

4.5.3.1.1. Alcohol-Free

4.5.3.1.2. Low Alcohol

4.5.3.2. Mexico Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

4.5.3.2.1. Malted Grains

4.5.3.2.2. Hops

4.5.3.2.3. Yeasts

4.5.3.2.4. Enzymes

4.5.3.2.5. Others

4.5.3.3. Mexico Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

4.5.3.3.1. Restricted fermentation/ fermentation-free

4.5.3.3.2. Dealcoholization

4.5.3.3.3. Reverse osmosis

4.5.3.3.4. Heat treatment

4.5.3.3.5. Vacuum distillation

4.5.3.3.6. Others

4.5.3.4. Mexico Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

4.5.3.4.1. Convenience stores

4.5.3.4.2. Supermarkets

4.5.3.4.3. Online stores

4.5.3.4.4. Restaurant

5. Europe Non-Alcoholic Beer Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Europe Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

5.2. Europe Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

5.3. Europe Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

5.4. Europe Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

5.5. Europe Non-Alcoholic Beer Market Size and Forecast, by Country (2025-2032)

5.5.1. United Kingdom

5.5.1.1. United Kingdom Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

5.5.1.2. United Kingdom Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

5.5.1.3. United Kingdom Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

5.5.1.4. United Kingdom Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

5.5.2. France

5.5.2.1. France Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

5.5.2.2. France Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

5.5.2.3. France Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

5.5.2.4. France Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

5.5.3. Germany

5.5.3.1. Germany Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

5.5.3.2. Germany Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

5.5.3.3. Germany Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

5.5.3.4. Germany Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

5.5.4. Italy

5.5.4.1. Italy Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

5.5.4.2. Italy Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

5.5.4.3. Italy Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

5.5.4.4. Italy Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

5.5.5. Spain

5.5.5.1. Spain Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

5.5.5.2. Spain Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

5.5.5.3. Spain Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

5.5.5.4. Spain Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

5.5.6. Russia

5.5.6.1. Russia Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

5.5.6.2. Russia Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

5.5.6.3. Russia Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

5.5.6.4. Russia Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

5.5.7. Austria

5.5.7.1. Austria Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

5.5.7.2. Austria Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

5.5.7.3. Austria Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

5.5.7.4. Austria Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

5.5.8. Rest of Europe

5.5.8.1. Rest of Europe Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

5.5.8.2. Rest of Europe Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

5.5.8.3. Rest of Europe Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

5.5.8.4. Rest of Europe Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

6. Asia Pacific Non-Alcoholic Beer Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. Asia Pacific Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

6.2. Asia Pacific Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

6.3. Asia Pacific Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

6.4. Asia Pacific Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

6.5. Asia Pacific Non-Alcoholic Beer Market Size and Forecast, by Country (2025-2032)

6.5.1. China

6.5.1.1. China Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

6.5.1.2. China Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

6.5.1.3. China Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

6.5.1.4. China Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

6.5.2. S Korea

6.5.2.1. S Korea Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

6.5.2.2. S Korea Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

6.5.2.3. S Korea Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

6.5.2.4. S Korea Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

6.5.3. Japan

6.5.3.1. Japan Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

6.5.3.2. Japan Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

6.5.3.3. Japan Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

6.5.3.4. Japan Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

6.5.4. India

6.5.4.1. India Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

6.5.4.2. India Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

6.5.4.3. India Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

6.5.4.4. India Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

6.5.5. Australia

6.5.5.1. Australia Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

6.5.5.2. Australia Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

6.5.5.3. Australia Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

6.5.5.4. Australia Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

6.5.6. ASEAN

6.5.6.1. ASEAN Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

6.5.6.2. ASEAN Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

6.5.6.3. ASEAN Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

6.5.6.4. ASEAN Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

6.5.7. Rest of Asia Pacific

6.5.7.1. Rest of Asia Pacific Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

6.5.7.2. Rest of Asia Pacific Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

6.5.7.3. Rest of Asia Pacific Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

6.5.7.4. Rest of Asia Pacific Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

7. Middle East and Africa Non-Alcoholic Beer Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Middle East and Africa Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

7.2. Middle East and Africa Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

7.3. Middle East and Africa Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

7.4. Middle East and Africa Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

7.5. Middle East and Africa Non-Alcoholic Beer Market Size and Forecast, by Country (2025-2032)

7.5.1. South Africa

7.5.1.1. South Africa Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

7.5.1.2. South Africa Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

7.5.1.3. South Africa Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

7.5.1.4. South Africa Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

7.5.2. GCC

7.5.2.1. GCC Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

7.5.2.2. GCC Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

7.5.2.3. GCC Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

7.5.2.4. GCC Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

7.5.3. Nigeria

7.5.3.1. Nigeria Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

7.5.3.2. Nigeria Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

7.5.3.3. Nigeria Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

7.5.3.4. Nigeria Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

7.5.4. Rest of ME&A

7.5.4.1. Rest of ME&A Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

7.5.4.2. Rest of ME&A Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

7.5.4.3. Rest of ME&A Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

7.5.4.4. Rest of ME&A Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

8. South America Non-Alcoholic Beer Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. South America Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

8.2. South America Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

8.3. South America Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

8.4. South America Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

8.5. South America Non-Alcoholic Beer Market Size and Forecast, by Country (2025-2032)

8.5.1. Brazil

8.5.1.1. Brazil Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

8.5.1.2. Brazil Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

8.5.1.3. Brazil Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

8.5.1.4. Brazil Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

8.5.2. Argentina

8.5.2.1. Argentina Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

8.5.2.2. Argentina Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

8.5.2.3. Argentina Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

8.5.2.4. Argentina Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

8.5.3. Rest Of South America

8.5.3.1. Rest Of South America Non-Alcoholic Beer Market Size and Forecast, By Product (2025-2032)

8.5.3.2. Rest Of South America Non-Alcoholic Beer Market Size and Forecast, By Material (2025-2032)

8.5.3.3. Rest Of South America Non-Alcoholic Beer Market Size and Forecast, By Technology (2025-2032)

8.5.3.4. Rest Of South America Non-Alcoholic Beer Market Size and Forecast, By Sales Channel (2025-2032)

9. Global Non-Alcoholic Beer Market: Competitive Landscape

9.1. SMR Competition Matrix

9.2. Competitive Landscape

9.3. Key Players Benchmarking

9.3.1. Company Name

9.3.2. Product Segment

9.3.3. End-Use Segment

9.3.4. Revenue (2023)

9.3.5. Headquarter

9.4. Market Structure

9.4.1. Market Leaders

9.4.2. Market Followers

9.4.3. Emerging Players

9.5. Mergers and Acquisitions Details

10. Company Profile: Key Players

10.1. Anheuser (Belgium)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Heineken N.V. (Netherlands)

10.3. Carlsberg Group (Denmark)

10.4. Diageo plc - London, United Kingdom

10.5. Kirin Holdings Company, Limited (Japan)

10.6. Asahi Group Holdings, Ltd. (Japan)

10.7. Molson Coors Beverage Company (USA)

10.8. Constellation Brands, Inc. (USA)

10.9. Suntory Holdings Limited (Japan)

10.10. Boston Beer Company (USA)

10.11. Athletic Brewing Company (USA)

10.12. AB InBev (Budweiser Zero) (Belgium)

10.13. Brauerei C. & A. Veltins(Germany)

10.14. Clausthaler (Germany)

10.15. Holsten Brewery (Germany)

10.16. Bitburger Braugruppe GmbH (Germany)

10.17. Grupo Modelo (Mexico)

10.18. Mikkeller (Denmark)

10.19. Beavertown Brewery (United Kingdom)

11. Key Findings

12. Industry Recommendations

13. Non-Alcoholic Beer Market: Research Methodology.