Mexico Esports Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

The Mexico Esports Market size was valued at USD 114.19 Mn. in 2024 and the total Mexico Esports revenue is expected to grow at a CAGR of 20.2% from 2025 to 2032, reaching nearly USD 497.58 Mn.

Format : PDF | Report ID : SMR_1585

Mexico Esports Market Overview

The Mexico Esports industry continues to boom with increasing markets and revenue growth. New game genres gain popularity, driving investment in tournaments and infrastructure. The sector sees robust mobile gaming growth, attracting sponsors and advertisers, signalling the potential for increased international exposure and partnerships. Live events drive revenue through ticket sales and merchandise. The Mexico Esports industry growth drives the increase in advertising as well and lucrative broadcasting deals with platforms such as Twitch and YouTube are part of media rights. Popular live events generate revenue through ticket and merchandise sales.

- 18 million Mexicans tuned into professional esports tournaments online, with 8.4 million actively participating as competitors.

- The user penetration rate stood at 12.4% in 2024.

The comprehensive report serves as a detailed analysis of the Mexico Esports Market. STELLAR has precisely examined the industry's evolution, spotlighting significant trends, groundbreaking innovations, and the driving forces that mold its trajectory. Delving deep into the present landscape, the report dissects the Mexico Esports Market. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence. Additionally, it keenly identifies the pivotal factors driving market growth and sheds light on growing opportunities.

To get more Insights: Request Free Sample Report

Growing Popularity and Viewership Drives the Mexico Esports Market

In 2024, The Mexico Esports industry boomed with 12.7 million viewers, a 36% surge. Mobile gaming takes the lead, making up 70% of esports revenue, driven by Mexico's widespread mobile usage. The surge fuels job growth in event management, streaming, content creation, and game development, boosting economic expansion. Additionally, the rising popularity of esports drives investments in infrastructure, improving the gaming experience with dedicated gaming centers and high-speed internet access.

The Mexico Esports industry's rapid growth exacerbates the digital divide, fostering social and economic inequalities, as not everyone has access to the required technology. Excessive screen time contributes to health issues like obesity and eye strain. Responsible gaming practices and parental controls are essential to address addiction, particularly among young people. The male-dominated Mexico esports industry demands increased efforts to attract and retain female players for inclusivity. Additionally, the adoption of sustainable practices and energy-efficient technologies is necessary to mitigate the environmental impact of energy-intensive gaming hardware and streaming.

Mexico Esports Market Segment Analysis

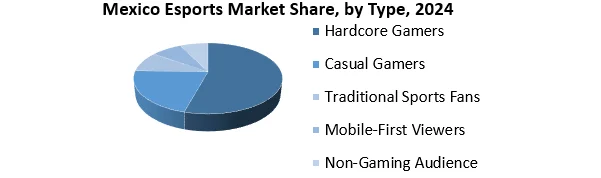

Based on Type, the Casual Gamers segment held the largest market share of about 40% in the Mexico Esports Market in 2024. According to the STELLAR analysis, the segment is expected to grow at a CAGR of 20.6% during the forecast period. It stands out as the dominant segment within the Esports Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

The rise of the Mexico esports industry is making gaming more accessible, attracting casual players to explore diverse genres. Streaming by pro players and commentators sparks interest, urging casual viewers to try the games. Local tournaments and viewing parties provide chances for casual gamers to compete and connect. Esports' growth fosters community, improves game development, and inspires improvement among casual gamers.

In Mexico esports Market, the competitive focus intimidates casual gamers, discouraging them with perceived skill gaps and performance pressure. Some communities exhibit toxicity and elitism, creating unpleasant environments for casual players. Growing commercialization and microtransactions financially burden them. High-level esports involvement demands a time commitment, conflicting with other responsibilities for casual gamers.

Additionally, the Mexico esports market brings positive impacts like increased exposure and community but poses challenges such as competitiveness, toxicity, and financial pressure. Addressing these issues is crucial for an inclusive and enjoyable gaming environment.

|

Mexico Esports Market Scope |

|

|

Market Size in 2024 |

USD 114.19 Million |

|

Market Size in 2032 |

USD 497.58 Million |

|

CAGR (2025-2032) |

20.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Gender

|

|

By Type

|

|

|

By Revenue Model

|

|

Leading Key Players in the Mexico Esports Market

- Team Liquid

- Fnatic

- Cloud9

- G2 Esports

- Evil Geniuses (EG)

- FaZe Clan

- OG (OG Esports)

Frequently Asked Questions

Player Well-being and Sustainability Infrastructure Accessibility and Inclusivity are expected to be the major restraining factors for the Mexico Esports market growth.

The Mexico Esports Market size was valued at USD 114.19 Million in 2024 and the total Mexico Esports revenue is expected to grow at a CAGR of 20.2% from 2025 to 2032, reaching nearly USD 497.58 Million By 2032.

1. Mexico Esports Market Executive Summary

1.1 Study Assumption and Market Definition

1.2 Scope of the Study

1.3 Emerging Technologies

1.4 Market Projections

1.5 Strategic Recommendations

2. Mexico Esports Market Events and Tournaments

2.1 ESL (Electronic Sports League)

2.2 DreamHack

2.3 US-Based Esports Tournaments and Leagues

3. Mexico Esports Market: Dynamics

3.1.1 Market Driver

3.1.2 Market Restraints

3.1.3 Market Opportunities

3.1.4 Market Challenges

3.2 PORTER’s Five Forces Analysis

3.3 PESTLE Analysis

3.4 Regulatory Landscape

3.5 Analysis of Government Schemes and Initiatives for the Mexico Esports Industry

3.6 The Pandemic and Redefining of The Mexico Esports Industry Landscape

4. Mexico Esports Market: Market Size and Forecast by Segmentation (Value) (2024-2032)

4.1 Mexico Esports Market Size and Forecast, by Gender (2024-2032)

4.1.1 Male

4.1.2 Female

4.2 Mexico Esports Market Size and Forecast, by Type (2024-2032)

4.2.1 Hardcore Gamers

4.2.2 Casual Gamers

4.2.3 Traditional Sports Fans

4.2.4 Mobile-First Viewers

4.2.5 Non-Gaming Audience

4.3 Mexico Esports Market Size and Forecast, by Revenue Model (2024-2032)

4.3.1 Sponsorship & advertising

4.3.2 Esports betting & fantasy site

4.3.3 Prize pool

4.3.4 Amateur & micro tournament

4.3.5 Merchandising

4.3.6 Ticket sale

5. Mexico Esports Market: Competitive Landscape

5.1 STELLAR Competition Matrix

5.2 Competitive Landscape

5.3 Key Players Benchmarking

5.3.1 Company Name

5.3.2 Service Segment

5.3.3 End-user Segment

5.3.4 Revenue (2024)

5.3.5 Company Locations

5.4 Leading Mexico Esports Companies, by market capitalization

5.5 Market Structure

5.5.1 Market Leaders

5.5.2 Market Followers

5.5.3 Emerging Players

5.6 Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1 Team Liquid

6.1.1 Company Overview

6.1.2 Business Portfolio

6.1.3 Financial Overview

6.1.4 SWOT Analysis

6.1.5 Strategic Analysis

6.1.6 Scale of Operation (small, medium, and large)

6.1.7 Details on Partnership

6.1.8 Regulatory Accreditations and Certifications Received by Them

6.1.9 Awards Received by the Firm

6.1.10 Recent Developments

6.2 Fnatic

6.3 Cloud9

6.4 G2 Esports

6.5 Evil Geniuses (EG)

6.6 FaZe Clan

6.7 OG (OG Esports)

7. Key Findings

8. Industry Recommendations

9. Terms and Glossary

10. Mexico Esports Market: Research Methodology