Maritime Sector Market Global Industry Analysis and Forecast (2026-2032)

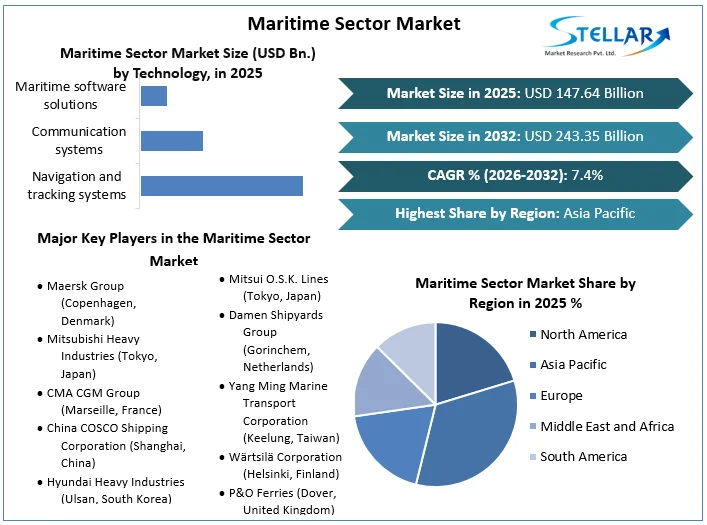

The Maritime Sector Market size was valued at USD 147.64 Bn. in 2025 and the total Global Maritime Sector revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 243.35 Bn. by 2032.

Format : PDF | Report ID : SMR_1855

Maritime Sector Market Overview

The maritime industry is crucial for global trade, responsible for transporting over 95% of global trade by volume, totaling around 11 billion tons annually. The industry, consisting of approximately 50,000 merchant vessels, forms the backbone of international commerce, ensuring the smooth movement of goods, products, and people worldwide. The maritime sector is not only essential for global trade but also serves as a major source of employment. With over 1.8 million seafarers and an estimated 20+ million workers supporting the maritime sector, it significantly contributes to job creation and economic growth globally. As per the study, the Maritime Sector Market is expected to grow during the forecast period.

Moreover, the maritime sector is increasingly focusing on environmental protection. Despite transporting the majority of global trade, it is responsible for just 1.7% of global greenhouse gas emissions. Efforts to further reduce environmental impact include the International Maritime Organization's target to cut GHG emissions by at least 50% by 2050 compared to 2008 levels. Overall, the maritime industry's role in global trade, job creation, and environmental protection makes it an indispensable component of the modern world.

To get more Insights: Request Free Sample Report

Maritime Sector Market Dynamics

Sustainable Development in Shipping and Ports

Maritime transport is essential for global trade and development, with over 80 percent of goods transported by sea. Developing countries rely heavily on shipping, accounting for 55 percent of seaborne exports and 61 percent of imports. Ports serve as gateways for economic growth, enabling countries to participate in trade and fostering development. To build resilience in supply chains and combat climate change, the maritime sector is pivotal.

The World Bank is actively working to promote sustainable development in shipping and ports, which is expected to drive the Maritime Sector Market growth. It is focusing on three core areas:

- Greening Ships and Ports: Maritime transport contributes around three percent of global greenhouse gas emissions, making it crucial for climate mitigation efforts. The World Bank supports client countries, especially Least Developed Countries (LDCs) and Small Island Developing States (SIDS), in developing policies to reduce the sector's carbon footprint. This includes promoting the use of hydrogen-based fuels like green ammonia and methanol.

- Digitalizing Operations: Digital solutions are key to optimizing port operations, reducing costs, and lowering emissions. However, as ports digitize operations, the risk of cyberattacks increases. The World Bank works to protect critical maritime infrastructure from digital threats, ensuring efficient and secure trade.

- Improving Efficiency: Operational efficiency is vital for low-cost maritime transport. Ports play a crucial role in reducing shipping costs and building supply chain resilience, particularly for food security. The World Bank focuses on improving existing infrastructure and optimizing vessel operations to achieve positive cost and climate impacts.

Through these initiatives, the World Bank aims to promote sustainable development, enhance global trade, and combat climate change in the maritime sector.

Impact of E-Commerce on the Maritime Industry

E-commerce and the maritime industry are increasingly collaborating to streamline logistics and enhance the flow of goods. This is majorly contributing to the maritime sector market growth. Platforms like Alibaba's OneTouch allow merchants to book container ship spots directly online, bypassing traditional freight forwarders. This benefits SMEs by simplifying the shipping process and provides shipping companies access to a new client base. Locally, e-commerce giants like RedMart heavily rely on sea freight to transport goods to Singapore. RedMart ships products at least twice a week, with 90% of imports arriving by sea.

The upcoming Tuas Mega Port, set to be completed by 2040, aims to double Singapore's port capacity to 65 million TEUs. This expansion is expected to accommodate increasing demand and provide efficient services to major shipping alliances. Initiatives like MPA's support for technology start-ups, such as XjeraLabs, will enhance port operations, benefiting e-commerce businesses by improving transportation networks and facilitating a smoother flow of goods.

Cyber Risks in Marine Industry

The maritime sector is on the brink of a digital revolution, but with this transformation comes the risk of cyber threats. This is the major challenging factor for Maritime Sector Market. KPMG and KONGSBERG have partnered to help navigate these challenges and capitalize on the immense business potential digitalization offers. With around 90 percent of world trade being carried by the international shipping industry, the sector's increasing interconnectivity exposes it to more cyber vulnerabilities than ever before. Failure to comply with upcoming regulatory requirements, such as those set by the International Maritime Organization (IMO), could result in significant financial losses and reputational damage.

Maritime Sector Market Segment Analysis

Based on Service, the market is segmented into Water Transport Services, Vessel Leasing and Rental Services, Cargo Handling, Supporting Service Activities to Water Transport and Others. The Water Transport Services held the largest Maritime Sector Market share in 2025. Water transportation has been essential for moving commodities and people for centuries. In 2020, around 80 percent of global goods were transported by sea, with vital commodities such as coal, oil, and gas making up a significant portion. Ships offer a vast capacity, making them economical for transporting large, heavy, and bulky items. Despite their efficiency, shipping accounted for only 11 percent of global transportation emissions in 2020, less than road freight transport.

Maritime Sector Market Regional Insight

Asia Pacific Maritime Sector Market dominated the global market in 2025. As per the study Indian market is expected to grow at a high rate during the forecast period. TK Ramachandran, Secretary of the Ministry of Ports, Shipping, and Waterways, emphasized the substantial growth potential in India's maritime sector and advocated for enhanced collaboration with Europe. Addressing the 2nd CII India Europe Business and Sustainability Conclave, he underscored the opportunities within the India-Middle-East-Europe Connectivity Corridor and highlighted the potential for collaboration in shipbuilding and the development of green ports. Asia Pacific Maritime (APM) returns for its 18th installment in Singapore from 13 to 15 March 2024 at the Marina Bay Sands, serving as the largest meeting place in Southeast Asia for the global maritime value chain.

The premier exhibition and conference are expected to attract over 14,000 industry professionals, including shipowners, shipyards, ship management, and technical procurers, to meet with over 1,400 solutions providers. With the theme "Future of Vessels, Solutions for Tomorrow," APM 2024 aims to facilitate knowledge exchange and information sharing, focusing on smarter solutions to achieve net-zero objectives, drive cybersecurity, improve satellite communication mobility, and embrace digitalization.

Europe Maritime Sector Market is also a major market, which is expected to grow rapidly in the future. Maritime shipping has long been a crucial mode of transportation for European countries. In 2021, ships transported over half the value of goods imports to the EU, totaling about 1.1 trillion euros, and over 40% of EU exports, valued at around 956 billion euros. On 1 January 2024, the European Union (EU) expanded its Emissions Trading System (ETS) to include the maritime sector, as part of the broader EU ETS reform enacted in June 2023.

Accounting for 3 to 4% of the EU’s total CO2 emissions, the sector now encompasses emissions from large ships departing from or arriving in EU ports, regardless of their flag. Initially targeting vessels with a gross tonnage of 5000 or more, the system will extend to offshore activities from 2027. Companies are required to monitor emissions, acquire and surrender EU allowances (EUAs), with revenues directed to the Innovation Fund to drive maritime sector innovation and support decarbonization efforts.

|

Maritime Sector Market Scope |

|

|

Market Size in 2025 |

USD 147.64 Bn. |

|

Market Size in 2032 |

USD 243.35 Bn. |

|

CAGR (2026-2032) |

7.4% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Service Water Transport Services Vessel Leasing and Rental Services Cargo Handling Supporting Service Activities to Water Transport Others |

|

By Technology Navigation and tracking systems Communication systems Maritime software solutions |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key players in Maritime Sector Market

- Maersk Group (Copenhagen, Denmark)

- Mitsubishi Heavy Industries (Tokyo, Japan)

- CMA CGM Group (Marseille, France)

- China COSCO Shipping Corporation (Shanghai, China)

- Hyundai Heavy Industries (Ulsan, South Korea)

- Evergreen Marine Corp. Ltd. (Taipei, Taiwan)

- Samsung Heavy Industries (Seoul, South Korea)

- Mitsui O.S.K. Lines (Tokyo, Japan)

- Damen Shipyards Group (Gorinchem, Netherlands)

- Yang Ming Marine Transport Corporation (Keelung, Taiwan)

- Wärtsilä Corporation (Helsinki, Finland)

- P&O Ferries (Dover, United Kingdom)

- Marco Polo Shipping Co Pte Ltd (Singapore)

Frequently Asked Questions

China held the largest Maritime Sector Market share in 2025.

The Global Maritime Sector Market size was valued at US$ 147.64 Bn in 2025.

Maersk, Mitsubishi Heavy Industries, CMA CGM Group, Samsung Heavy Industries, Yang Ming Marine Transport Corporation, CHINA COSCO SHIPPING, Hyundai Heavy Industries, Evergreen Marine Corp. Ltd., Mitsui O.S.K. Lines, Damen Shipyards Group, Wärtsilä, P&O Ferries and Marco Polo Shipping Co Pte Ltd.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Maritime Sector Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Maritime Sector Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. Maritime Sector Market: Dynamics

4.1. Maritime Sector Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Maritime Sector Market Drivers

4.3. Maritime Sector Market Restraints

4.4. Maritime Sector Market Opportunities

4.5. Maritime Sector Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Trade Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Maritime Sector Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Maritime Sector Market Size and Forecast, by Service (2025-2032)

5.1.1. Water Transport Services

5.1.2. Vessel Leasing and Rental Services

5.1.3. Cargo Handling

5.1.4. Supporting Service Activities to Water Transport

5.1.5. Others

5.2. Maritime Sector Market Size and Forecast, by Technology (2025-2032)

5.2.1. Navigation and tracking systems

5.2.2. Communication systems

5.2.3. Maritime software solutions

5.3. Maritime Sector Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Maritime Sector Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Maritime Sector Market Size and Forecast, by Service (2025-2032)

6.1.1. Water Transport Services

6.1.2. Vessel Leasing and Rental Services

6.1.3. Cargo Handling

6.1.4. Supporting Service Activities to Water Transport

6.1.5. Others

6.2. North America Maritime Sector Market Size and Forecast, by Technology (2025-2032)

6.2.1. Navigation and tracking systems

6.2.2. Communication systems

6.2.3. Maritime software solutions

6.3. North America Maritime Sector Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Maritime Sector Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Maritime Sector Market Size and Forecast, by Service (2025-2032)

7.2. Europe Maritime Sector Market Size and Forecast, by Technology (2025-2032)

7.3. Europe Maritime Sector Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Maritime Sector Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Maritime Sector Market Size and Forecast, by Service (2025-2032)

8.2. Asia Pacific Maritime Sector Market Size and Forecast, by Technology (2025-2032)

8.3. Asia Pacific Maritime Sector Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Rest of Asia Pacific

9. Middle East and Africa Maritime Sector Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Maritime Sector Market Size and Forecast, by Service (2025-2032)

9.2. Middle East and Africa Maritime Sector Market Size and Forecast, by Technology (2025-2032)

9.3. Middle East and Africa Maritime Sector Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Maritime Sector Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Maritime Sector Market Size and Forecast, by Service (2025-2032)

10.2. South America Maritime Sector Market Size and Forecast, by Technology (2025-2032)

10.3. South America Maritime Sector Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. Maersk Group (Copenhagen, Denmark)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Mitsubishi Heavy Industries (Tokyo, Japan)

11.3. CMA CGM Group (Marseille, France)

11.4. China COSCO Shipping Corporation (Shanghai, China)

11.5. Hyundai Heavy Industries (Ulsan, South Korea)

11.6. Evergreen Marine Corp. Ltd. (Taipei, Taiwan)

11.7. Samsung Heavy Industries (Seoul, South Korea)

11.8. Mitsui O.S.K. Lines (Tokyo, Japan)

11.9. Damen Shipyards Group (Gorinchem, Netherlands)

11.10. Yang Ming Marine Transport Corporation (Keelung, Taiwan)

11.11. Wärtsilä Corporation (Helsinki, Finland)

11.12. P&O Ferries (Dover, United Kingdom)

11.13. Marco Polo Shipping Co Pte Ltd (Singapore)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook