Luxury Wines and Spirits Market- Industry Analysis and Forecast (2026-2032)

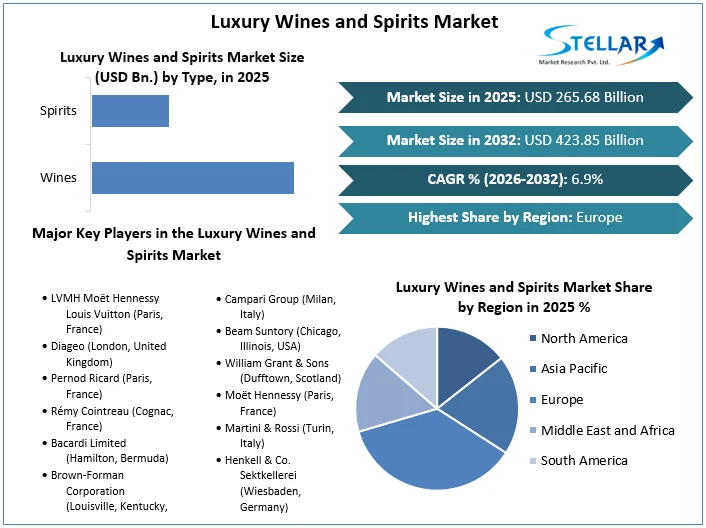

The Luxury Wines and Spirits Market size was valued at USD 265.68 Bn. in 2025 and the total Global Luxury Wines and Spirits revenue is expected to grow at a CAGR of 6.9% from 2026 to 2032, reaching nearly USD 423.85 Bn. by 2032.

Format : PDF | Report ID : SMR_1989

Luxury Wines and Spirits Market Overview

Luxury wines and spirits are high-end alcoholic beverages with superior quality, exclusivity, and often high prices. They use the finest ingredients and traditional production methods, usually involving meticulous craftsmanship and extended aging periods. These products are typically produced in limited quantities, making them rare and highly sought after. Prestigious brands with rich histories and compelling narratives enhance their appeal, while luxurious packaging and unique presentations further elevate their status. Examples include Château Margaux, Louis XIII Cognac, and Macallan Fine & Rare Collection, coveted by connoisseurs and collectors alike. The research methodology for analyzing the Luxury Wines and Spirits Market typically integrates qualitative and quantitative approaches. Qualitative research encompasses extensive literature reviews, interviews with industry experts, and analyses of industry reports and publications to gain insights into market trends, dynamics, and challenges.

Quantitative research, on the other hand, involves collecting and analyzing numerical data on market size, growth rates, revenue, and other pertinent metrics. This includes conducting surveys, data mining, and performing statistical analysis on market data sourced from reputable entities like industry associations, government agencies, and market research firms. By merging these methodologies, researchers comprehensively understand the Luxury Wines and Spirits Market's size, growth drivers, competitive landscape, and future outlook. This integrated approach enables stakeholders to make well-informed decisions about investments, product development, marketing strategies, and other Luxury Wines and Spirits industry aspects.

To get more Insights: Request Free Sample Report

Luxury Wines and Spirits Market Dynamics

Increasing luxury lifestyle culture and multiple income sources have boosted the Luxury Wines and Spirits Market

The luxury wines and spirits market are driven by the increasing luxury lifestyle culture and the rise of multiple income sources among consumers, which have collectively boosted demand. Affluent consumers are willing to spend more on premium products that offer exclusivity, superior quality, and prestige. Additionally, the growing appreciation for fine wines and spirits, often viewed as status symbols and investment assets, further propels market growth. The expansion of high-net-worth individuals and their inclination towards premium consumption experiences significantly contribute to this sector's dynamism.

The luxury wines and spirits market are driven by a combination of rising disposable incomes, urbanization, globalization, and changing lifestyles that foster a demand for sophisticated and premium products. Brand heritage and compelling storytelling enhance the perceived value and desirability of these products, while social media and influencer marketing amplify their visibility and appeal, particularly among younger consumers. The growth of international travel and tourism exposes more people to global luxury brands, and experiential luxury offerings, such as tasting events and winery tours, deepen consumer engagement. Additionally, health-conscious trends favor high-quality, organic, and biodynamic options, and the strong gifting culture associated with luxury wines and spirits further propels market growth.

The luxury wines and spirits market face several challenges as the stringent regulations and high taxes imposed on alcoholic beverages in various regions, which can hinder market expansion and accessibility. Additionally, the market is highly competitive, with numerous established brands vying for consumer attention and loyalty. Counterfeiting and the prevalence of fake products also pose significant risks, undermining consumer trust and brand integrity. Furthermore, economic downturns and fluctuations in disposable income can adversely affect luxury spending, potentially impacting market stability.

The luxury wines and spirits market present substantial opportunities, particularly in emerging markets where economic growth and increasing affluence are creating new consumer bases. Digital transformation and e-commerce platforms are revolutionizing the way luxury beverages are marketed and sold, offering wider reach and personalized experiences. There is also growing interest in sustainable and ethically produced wines and spirits, opening avenues for brands that emphasize environmental responsibility and social impact. Moreover, the trend of experiential luxury, including wine tourism and exclusive tasting events, offers brands the chance to engage directly with consumers and enhance brand loyalty.

Several key trends are shaping the luxury wines and spirits market such as, collection preferences for fine luxury wines and spirits are on the rise, with consumers increasingly viewing these products as valuable collectibles and investments. Personalization and bespoke services are becoming more popular, with brands offering tailored experiences and customized products to cater to individual tastes. Additionally, the influence of technology is evident in the adoption of blockchain for product authentication and the use of AI in enhancing consumer experiences. The market is also witnessing a surge in premiumization, where consumers seek higher quality and exclusivity, driving demand for ultra-premium and rare editions.

Luxury Wines and Spirits Market Regional Analysis

Europe has a long-standing tradition and heritage in wine and spirit production and European luxury wines, especially fine wines and vintage collections, are considered valuable investment assets these drive the Luxury Wines and Spirits Market in Europe.

Europe holds a substantial portion of the luxury wines and spirits market, with a market share of around 40%, making it the most dominant region. France had the highest wine-consuming population among European countries, with wine consumption standing at around 25.3 million hectolitres in 2022. This is largely due to the region's rich heritage in wine and spirit production, with countries like France, Italy, and Scotland being home to some of the world's most renowned brands. The European market is driven by a strong tradition of wine consumption, particularly in countries like France, Italy, and Spain. Additionally, the preference for high-quality spirits such as Scotch whisky, cognac, and champagne further cements Europe’s leading position in the global market.

North America, particularly the United States, is a major market for luxury wines and spirits, accounting for approximately 35% of the global market share. This dominance is driven by a strong culture of premium consumption, high disposable incomes, and a robust gifting culture. The U.S. market is characterized by a high demand for premium wines from Napa Valley and top-tier spirits such as bourbon and whiskey. Canada also contributes significantly to the market, with a growing interest in premium and craft spirits. In 2023, the average American consumed 2.86 gallons of wine per person, which is a 9% decrease from 2022's high of 3.18 gallons. Table wine is the most popular type of wine in the United States, with sales that are 12 times higher than champagne and sparkling wine.

The Asia Pacific region is rapidly emerging as a key player in the luxury wines and spirits market, accounting for about 20% of the global market share. This growth is fueled by increasing disposable incomes, urbanization, and a growing affinity for luxury lifestyles in countries like China, Japan, and India. China, in particular, has seen a surge in demand for high-end wines and spirits, driven by a burgeoning middle class and a strong culture of gifting premium products. Japan's market is characterized by a preference for high-quality whisky, while India's expanding affluent population shows increasing interest in both luxury wines and spirits.

Luxury Wines and Spirits Market Segment Analysis

Based on Type:

The wine segment in the luxury wines and spirits market encompasses high-end products such as fine wines, vintage wines, and limited-edition releases from renowned vineyards. This segment is characterized by a high level of craftsmanship, with many wines coming from prestigious regions like Bordeaux, Burgundy, and Napa Valley. The demand for luxury wines is driven by their status as collectibles and investment items, as well as their association with sophisticated dining and social events. Despite the growing interest in spirits, the wine segment remains a cornerstone of the luxury market, especially in Europe and North America.

The spirits segment includes premium offerings such as aged whiskies, cognacs, premium vodkas, and artisanal gins. This segment has seen significant growth, driven by a rising appreciation for craft and high-quality spirits, as well as the influence of cocktail culture. The luxury wines and spirits market is dominated by products from well-established brands with rich histories and reputations for excellence. The demand for luxury spirits is particularly strong in North America and the Asia Pacific region, where consumers are increasingly willing to pay a premium for exclusive, high-end spirits. Among the two segments, spirits are currently dominating the luxury market due to their broader appeal and higher price points.

Based on Sales Channel:

The offline Sales Channel for luxury wines and spirits includes physical retail locations such as specialty liquor stores, high-end supermarkets, wine shops, and duty-free stores. This segment is dominant in the luxury wines and spirits market due to the experiential aspect of purchasing high-end alcoholic beverages, where consumers prefer to see, touch, and often sample products before making a purchase. Additionally, offline channels offer personalized services and expert advice, enhancing the shopping experience. Luxury hotels, bars, and restaurants also play a significant role in this segment by offering exclusive and premium selections.

The online Sales Channel is rapidly gaining traction in the luxury wines and spirits market, driven by the convenience of shopping from home and the ability to access a wide range of products. E-commerce platforms, dedicated online liquor stores, and direct-to-consumer brand websites are key players in this segment. The online channel also benefits from digital marketing strategies and the growing trend of online gifting. While still smaller than the offline segment, the online Sales Channel is expanding quickly, especially in regions with high internet penetration and tech-savvy consumers. Despite its growth, the offline channel remains the dominant distribution method, particularly for luxury purchases where the tactile experience is highly valued.

|

Luxury Wines and Spirits Market Scope |

|

|

Market Size in 2025 |

USD 265.68 Bn. |

|

Market Size in 2032 |

USD 423.85 Bn. |

|

CAGR (2026-2032) |

6.9% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type Wines Spirits |

|

By Sales Channel Offline Online |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Luxury Wines and Spirits Market

- LVMH Moët Hennessy Louis Vuitton (Paris, France)

- Diageo (London, United Kingdom)

- Pernod Ricard (Paris, France)

- Rémy Cointreau (Cognac, France)

- Bacardi Limited (Hamilton, Bermuda)

- Brown-Forman Corporation (Louisville, Kentucky, USA)

- The Edrington Group (Glasgow, Scotland)

- Constellation Brands (Victor, New York, USA)

- Campari Group (Milan, Italy)

- Beam Suntory (Chicago, Illinois, USA)

- William Grant & Sons (Dufftown, Scotland)

- Moët Hennessy (Paris, France)

- Martini & Rossi (Turin, Italy)

- Henkell & Co. Sektkellerei (Wiesbaden, Germany)

- Davide Campari-Milano (Milan, Italy)

- Château Margaux (Margaux, France)

- Domaine de la Romanée-Conti (Vosne-Romanée, France)

- Treasury Wine Estates (Melbourne, Australia)

- SABMiller (London, United Kingdom)

- Asahi Group Holdings (Tokyo, Japan)

- Gruppo Italiano Vini (Milan, Italy)

- Laurent-Perrier Group (Tours-sur-Marne, France)

- Louis Roederer (Reims, France)

- Maisons Marques & Domaines USA Inc. (Oakland, California, USA)

- The Macallan (Craigellachie, Scotland)

Frequently Asked Questions

Europe is the dominant region, holding about 40% of the market share, followed by North America at 35%, and the Asia Pacific region at 20%.

Challenges include stringent regulations, high taxes, market competition, counterfeiting, and economic fluctuations affecting consumer spending on luxury items.

In the Luxury Wines and Spirits Market, challenges include increasing competition, fluctuating ingredient prices, health concerns related to high-calorie and high-fat offerings, and the need to adapt to changing consumer preferences.

Major players include LVMH Moët Hennessy Louis Vuitton, Diageo, Pernod Ricard, Rémy Cointreau, and Bacardi Limited, among others.

1. Luxury Wines and Spirits Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Luxury Wines and Spirits Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2025)

2.3.5. Headquarter

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Luxury Wines and Spirits Market: Dynamics

3.1. Market Trends - Global

3.2. Market Dynamics – By Region

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Luxury Wines and Spirits Industry

4. Luxury Wines and Spirits Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

4.1. Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

4.1.1. Wines

4.1.2. Spirits

4.2. Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

4.2.1. Offline

4.2.2. Online

4.3. Luxury Wines and Spirits Market Size and Forecast, by Region (2025-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Luxury Wines and Spirits Market Size and Forecast (by Value in USD Million) (2025-2032)

5.1. North America Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

5.1.1. Wines

5.1.2. Spirits

5.2. North America Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

5.2.1. Offline

5.2.2. Online

5.3. North America Luxury Wines and Spirits Market Size and Forecast, by Country (2025-2032)

5.3.1. United States

5.3.1.1. United States Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

5.3.1.1.1. Wines

5.3.1.1.2. Spirits

5.3.1.2. United States Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

5.3.1.2.1. Offline

5.3.1.2.2. Online

5.3.2. Canada

5.3.2.1. Canada Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

5.3.2.1.1. Wines

5.3.2.1.2. Spirits

5.3.2.2. Canada Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

5.3.2.2.1. Offline

5.3.2.2.2. Online

5.3.3. Mexico

5.3.3.1. Mexico Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

5.3.3.1.1. Wines

5.3.3.1.2. Spirits

5.3.3.2. Mexico Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

5.3.3.2.1. Offline

5.3.3.2.2. Online

6. Europe Luxury Wines and Spirits Market Size and Forecast (by Value in USD Million) (2025-2032)

6.1. Europe Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

6.2. Europe Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

6.3. Europe Luxury Wines and Spirits Market Size and Forecast, by Country (2025-2032)

6.3.1. United Kingdom

6.3.1.1. United Kingdom Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

6.3.1.2. United Kingdom Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

6.3.2. France

6.3.2.1. France Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

6.3.2.2. France Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

6.3.3. Germany

6.3.3.1. Germany Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

6.3.3.2. Germany Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

6.3.4. Italy

6.3.4.1. Italy Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

6.3.4.2. Italy Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

6.3.5. Spain

6.3.5.1. Spain Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

6.3.5.2. Spain Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

6.3.6. Sweden

6.3.6.1. Sweden Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

6.3.6.2. Sweden Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

6.3.7. Austria

6.3.7.1. Austria Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

6.3.7.2. Austria Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

6.3.8.2. Rest of Europe Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7. Asia Pacific Luxury Wines and Spirits Market Size and Forecast (by Value in USD Million) (2025-2032)

7.1. Asia Pacific Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.2. Asia Pacific Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3. Asia Pacific Luxury Wines and Spirits Market Size and Forecast, by Country (2025-2032)

7.3.1. China

7.3.1.1. China Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.1.2. China Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3.2. S Korea

7.3.2.1. S Korea Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.2.2. S Korea Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3.3. Japan

7.3.3.1. Japan Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.3.2. Japan Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3.4. India

7.3.4.1. India Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.4.2. India Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3.5. Australia

7.3.5.1. Australia Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.5.2. Australia Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3.6. Indonesia

7.3.6.1. Indonesia Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.6.2. Indonesia Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3.7. Malaysia

7.3.7.1. Malaysia Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.7.2. Malaysia Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3.8. Vietnam

7.3.8.1. Vietnam Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.8.2. Vietnam Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3.9. Taiwan

7.3.9.1. Taiwan Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.9.2. Taiwan Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

7.3.10. Rest of Asia Pacific

7.3.10.1. Rest of Asia Pacific Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

7.3.10.2. Rest of Asia Pacific Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

8. Middle East and Africa Luxury Wines and Spirits Market Size and Forecast (by Value in USD Million) (2025-2032)

8.1. Middle East and Africa Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

8.2. Middle East and Africa Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

8.3. Middle East and Africa Luxury Wines and Spirits Market Size and Forecast, by Country (2025-2032)

8.3.1. South Africa

8.3.1.1. South Africa Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

8.3.1.2. South Africa Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

8.3.2. GCC

8.3.2.1. GCC Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

8.3.2.2. GCC Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

8.3.3. Nigeria

8.3.3.1. Nigeria Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

8.3.3.2. Nigeria Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

8.3.4. Rest of ME&A

8.3.4.1. Rest of ME&A Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

8.3.4.2. Rest of ME&A Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

9. South America Luxury Wines and Spirits Market Size and Forecast (by Value in USD Million) (2025-2032)

9.1. South America Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

9.2. South America Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

9.3. South America Luxury Wines and Spirits Market Size and Forecast, by Country (2025-2032)

9.3.1. Brazil

9.3.1.1. Brazil Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

9.3.1.2. Brazil Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

9.3.2. Argentina

9.3.2.1. Argentina Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

9.3.2.2. Argentina Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

9.3.3. Rest Of South America

9.3.3.1. Rest Of South America Luxury Wines and Spirits Market Size and Forecast, By Type (2025-2032)

9.3.3.2. Rest Of South America Luxury Wines and Spirits Market Size and Forecast, By Sales Channel (2025-2032)

10. Company Profile: Key Players

10.1. LVMH Moët Hennessy Louis Vuitton (Paris, France)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Diageo (London, United Kingdom)

10.3. Pernod Ricard (Paris, France)

10.4. Rémy Cointreau (Cognac, France)

10.5. Bacardi Limited (Hamilton, Bermuda)

10.6. Brown-Forman Corporation (Louisville, Kentucky, USA)

10.7. The Edrington Group (Glasgow, Scotland)

10.8. Constellation Brands (Victor, New York, USA)

10.9. Campari Group (Milan, Italy)

10.10. Beam Suntory (Chicago, Illinois, USA)

10.11. William Grant & Sons (Dufftown, Scotland)

10.12. Moët Hennessy (Paris, France)

10.13. Martini & Rossi (Turin, Italy)

10.14. Henkell & Co. Sektkellerei (Wiesbaden, Germany)

10.15. Davide Campari-Milano (Milan, Italy)

10.16. Château Margaux (Margaux, France)

10.17. Domaine de la Romanée-Conti (Vosne-Romanée, France)

10.18. Treasury Wine Estates (Melbourne, Australia)

10.19. SABMiller (London, United Kingdom)

10.20. Asahi Group Holdings (Tokyo, Japan)

10.21. Gruppo Italiano Vini (Milan, Italy)

10.22. Laurent-Perrier Group (Tours-sur-Marne, France)

10.23. Louis Roederer (Reims, France)

10.24. Maisons Marques & Domaines USA Inc. (Oakland, California, USA)

10.25. The Macallan (Craigellachie, Scotland)

11. Key Findings

12. Industry Recommendations

13. Luxury Wines and Spirits Market: Research Methodology