Laptop Market Global Industry Analysis and Forecast (2026-2032)

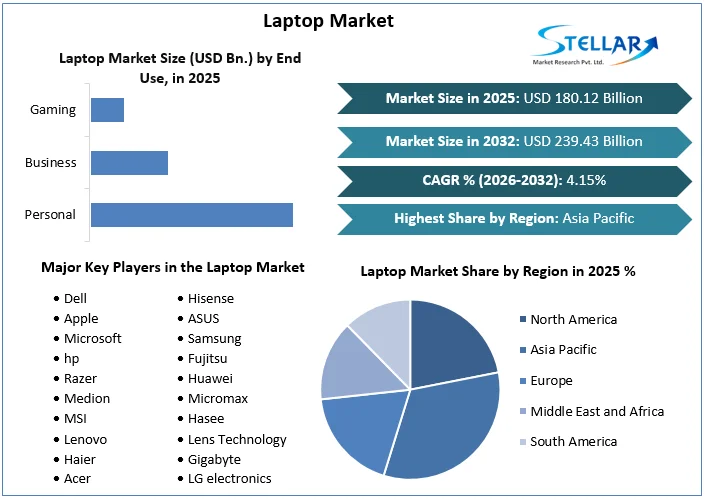

Laptop Market size was valued at USD 180.12 Bn. in 2025 and the total Laptop Market size is expected to grow at a CAGR of 4.15% from 2026 to 2032, reaching nearly USD 239.43 Bn. by 2032.

Format : PDF | Report ID : SMR_2107

Laptop Market Overview

A laptop is a personal computer that is easily moved and used in a variety of locations. Most laptops are designed to have all of the functionality of a desktop computer, which means it generally run the same software and open the same types of files. Laptops also tend to be more expensive than comparable desktop computers.

The Laptop Market Report has covered factors influencing market growth for electronics. To guarantee accuracy and dependability, primary and secondary research methods were carefully combined to create the Laptop Market report. Primary research methods included sending out questionnaires, surveying people, and conducting phone interviews with a wide range of professionals, business leaders, marketers, and entrepreneurs in the Laptop industry.

The study estimated the sizes of the global and regional markets using a bottom-up methodology. Furthermore, a SWOT analysis was employed to highlight the advantages and disadvantages of major companies operating in the Laptop sector. Along with covering several factors driving market growth, the report also discussed how rising health consciousness has propelled the market for laptops.

- Laptops worth USD 5,917,354,337 have been imported

- The average import price for the laptop was USD 122.38.

- China was the largest exporter of laptops accounting for 95.13% of the total imports of laptops and Singapore was the second largest exporter of laptops accounting for 2.85% of the total imports of laptops.

- The most frequently used laptop HS Code is 84713010.

- There are 8,161 exporters of laptops and there are 7,541 importers of laptops.

- In 2023, the total number of laptops sold globally is expected to reach 188.1 million, a 3% increase from the previous year.

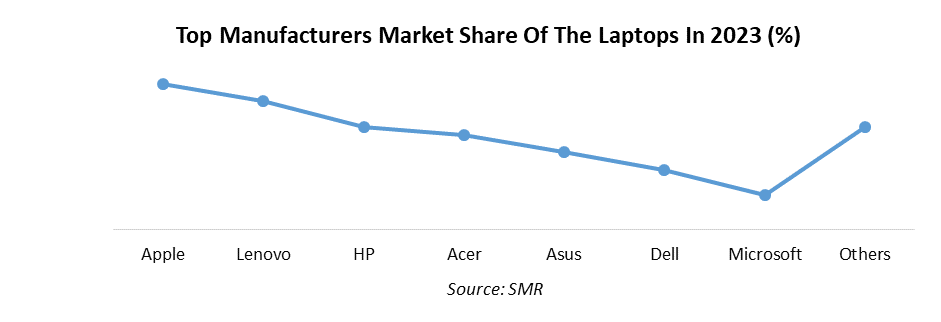

- In 2023, Lenovo, Dell, and HP, the most popular laptop brands, are dominating the market with a combined share of 60%.

To get more Insights: Request Free Sample Report

Laptop Market Dynamics

Adaptable Gadgets Driving Growth in the Laptop Market

The market has grown as a result of the adaptable gadgets that have been used in a variety of ways to suit different needs and preferences. These modes include laptop, tent, tablet, and stand mode. Thanks to their ability to switch between productivity and entertainment with ease, touchscreens, and detachable keyboards are popular options for people who multitask. The market has grown faster because laptop manufacturers still prioritize portability, emphasizing thin designs and long battery lives. This trend has led to technological advancements in the fields of large-capacity batteries, fast charging, and energy-efficient processors.

Users have taken advantage of extremely fast internet speeds and constant connectivity while on the go as 5G connectivity integration into laptops gains momentum. There is a strong demand for laptops as it has eliminated the need to use Wi-Fi hotspots or tether to a smartphone to provide quick access to cloud services, streaming, and collaboration tools. The purpose of laptops is to enable users to be more productive and stay connected virtually anywhere. The demand for notebooks has increased significantly, according to consumer electronics majors like HP, Apple, Lenovo, and Asus.

Challenges and Shifts in the Evolving Laptop Market

As consumer purchasing power has been undermined by inflation, there has been a recent decline in the number of PC and laptop owners as a result it has hindered market growth. The rise in mobile phones, which are without a doubt the most popular internet-using device across all generations, are overtaking PCs and laptops in the race for usage. The restricted availability of USB Type-C and Thunderbolt ports hinders the ability to directly connect external video devices, like projectors or monitors, as well as USB peripherals like storage devices, keyboards, and mice.

It has been difficult to guarantee compatibility with current peripherals that depend on different connection types because different laptops offer different configurations of Thunderbolt and USB Type-C ports. It is necessary to purchase laptop components from specific businesses, which has affected the total cost. Because these components are so important, the purchasing power of the makers of personal computers is limited compared to those of microprocessors (Intel and AMD) and graphics cards (NVidia and ATI). E. As oligopolies, the markets for CPUs and graphics cards have substantial negotiating power.

AI Integration and Innovation Driving the Future of the Laptop Market

Artificial intelligence (AI) integrated laptops are increasingly prevalent, enhancing user satisfaction and efficiency. Laptops equipped with AI features can enhance performance by analyzing usage patterns, enhance security with facial recognition, and extend battery life with smart power management. These clever characteristics offer ease and productivity, enhancing the user-friendliness and intuitiveness of laptops. The laptop sector has been constantly changing and adjusting to meet various preferences and needs.

Users have a variety of options available to help them find the ideal laptop, including gaming PCs, hybrid laptops, ultrabooks, and always-connected devices. The latest trends in manufacturing focus on creating devices that are smarter and more efficient, with a priority on sustainability, portability, and performance. Foreseeing progress in 5G connectivity, AI integration, and environmentally friendly design is prudent.

Laptop Market Segment Analysis

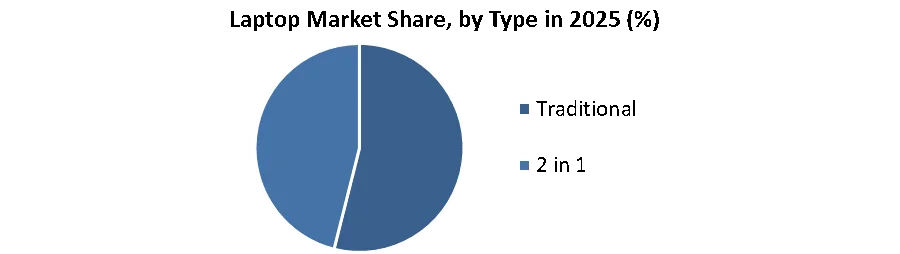

Based on type, the Traditional Laptop segment dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. As traditional laptops handle everything from basic computing to more demanding applications like video editing, software development, and gaming, traditional laptops offer an unmatched combination of performance and versatility, which has led to the growth of the market.

The market has extended as a result of business professionals who frequently travel depending on laptops like the Lenovo ThinkPad and HP Elite Book because they are so powerful and portable and have been worked from airports, hotels, or client locations. The popular laptop operating systems Linux, macOS, and Windows are meant for to Users access and use essential programs without any problems thanks to this compatibility, which increases demand for traditional laptops. Because of their cost-effectiveness, software compatibility, portability, customization potential, and customizable interfaces, traditional laptops continue to be in high demand and have contributed to the growth of the laptop market.

Laptop Market Regional Analysis

Asia Pacific dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. Consumer expenditure on digital products, particularly laptops, is also being driven by rising urbanization and the middle class in the region. The rise in the popularity of esports and game streaming has fueled demand for high-performance gaming laptops in the Asia Pacific. Gamers and streamers require powerful machines to handle live streaming and competitive gaming simultaneously. Consumers in China’s central region are more cautious and strategic than those in the mainland’s fiercely competitive first?tier markets. They tend to be more concerned with product quality than brand image and are highly price?sensitive, favoring value-for-money items.

- The world imports most of its Use laptops from China, Vietnam, and the United States

- The top 3 importers of Use laptops are Vietnam with 46,265 shipments followed by India with 29,127 and Pakistan at the 3rd spot with 10,216 shipments.

- India exports most of its Laptops to Bhutan, China, and the United States.

- The top 3 exporters of laptops are China with 2,074,165 shipments followed by Vietnam with 226,424 and the United States at the 3rd spot with 161,853 shipments.

Laptop Market Competitive Landscape

- In May 2023, ASUS announced the exciting new Zenbook S 13 OLED (UX5304), the world's slimmest 13.3-inch OLED laptop. It's also the most eco-friendly Zenbook ever and takes the brand's signature qualities of ultraportable design, sustainability, and on-the-go performance to a new level.

- In March 2023, Toshiba Corp opened a new tab board has accepted a USD 15.2 billion buyout offer from a group led by private equity firm Japan Industrial Partners, the company, potentially drawing a line under years of upheaval at the conglomerate. A successful deal, which has valued Toshiba at 4,620 yen per share or 2 trillion yen in total, saw the scandal-ridden company taken private and firmly in domestic hands after much tension with overseas activist shareholders.

- In June 2023, Fujitsu unveiled its latest range of LIFEBOOK business notebooks capturing the performance and technologies of the 13th generation Intel Core processors. The made-in-Japan LIFEBOOK U9 Series is an ultra-mobile premium commercial notebook designed for business professionals. The new devices promise best-in-class mobility, powerful performance, and advanced security options for modern executives.

|

Laptop Market Scope |

|

|

Market Size in 2025 |

USD 180.12 Bn. |

|

Market Size in 2032 |

USD 239.43 Bn. |

|

CAGR (2026-2032) |

4.15 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type

|

|

By Screen Size

|

|

|

By End Use

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Laptop Market Key Players

Frequently Asked Questions

Laptop substitute has restrained market growth.

The Market size was valued at USD 180.12 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 4.15 % from 2026 to 2032, reaching nearly USD 239.43 Billion.

The segments covered in the market report are by type, Screen Size and End Use.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Laptop Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Laptop Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Laptop Market: Dynamics

4.1. Laptop Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Laptop Market Drivers

4.3. Laptop Market Restraints

4.4. Laptop Market Opportunities

4.5. Laptop Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Innovations in Laptop Design and Functionality

4.8.2. Automation and Smart Laptop

4.8.3. Impact of IoT and AI on Laptop Operations

4.8.4. Technological Roadmap

4.9. Value Chain Analysis

4.10. Trade Analysis

4.10.1. Import Scenario

4.10.2. Export Scenario

4.11. Regulatory Landscape

4.11.1. Market Regulation by Region

4.11.1.1. North America

4.11.1.2. Europe

4.11.1.3. Asia Pacific

4.11.1.4. Middle East and Africa

4.11.1.5. South America

4.11.2. Impact of Regulations on Market Dynamics

4.11.3. Government Schemes and Initiatives

5. Laptop Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

5.1. Laptop Market Size and Forecast, by Type (2025-2032)

5.1.1. Traditional

5.1.2. 2 in 1

5.2. Laptop Market Size and Forecast, by Screen Size (2025-2032)

5.2.1. Upto 10.9"

5.2.2. 11" to 12.9"

5.2.3. 13" to 14.9"

5.2.4. 15.0" to 16.9"

5.2.5. More than 17"

5.3. Laptop Market Size and Forecast, by End Use (2025-2032)

5.3.1. Personal

5.3.2. Business

5.3.3. Gaming

5.4. Laptop Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Laptop Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

6.1. North America Laptop Market Size and Forecast, by Type (2025-2032)

6.1.1. Traditional

6.1.2. 2 in 1

6.2. North America Laptop Market Size and Forecast, by Screen Size (2025-2032)

6.2.1. Upto 10.9"

6.2.2. 11" to 12.9"

6.2.3. 13" to 14.9"

6.2.4. 15.0" to 16.9"

6.2.5. More than 17"

6.3. North America Laptop Market Size and Forecast, by End Use (2025-2032)

6.3.1. Personal

6.3.2. Business

6.3.3. Gaming

6.4. North America Laptop Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Laptop Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

7.1. Europe Laptop Market Size and Forecast, by Type (2025-2032)

7.2. Europe Laptop Market Size and Forecast, by Screen Size (2025-2032)

7.3. Europe Laptop Market Size and Forecast, by End Use (2025-2032)

7.4. Europe Laptop Market Size and Forecast, by Country (2025-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific Laptop Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

8.1. Asia Pacific Laptop Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific Laptop Market Size and Forecast, by Screen Size (2025-2032)

8.3. Asia Pacific Laptop Market Size and Forecast, by End Use (2025-2032)

8.4. Asia Pacific Laptop Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. India

8.4.3. Japan

8.4.4. South Korea

8.4.5. Australia

8.4.6. ASEAN

8.4.7. Rest of Asia Pacific

9. Middle East and Africa Laptop Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

9.1. Middle East and Africa Laptop Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa Laptop Market Size and Forecast, by Screen Size (2025-2032)

9.3. Middle East and Africa Laptop Market Size and Forecast, by End Use (2025-2032)

9.4. Middle East and Africa Laptop Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Rest of the Middle East and Africa

10. South America Laptop Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2025-2032)

10.1. South America Laptop Market Size and Forecast, by Type (2025-2032)

10.2. South America Laptop Market Size and Forecast, by Screen Size (2025-2032)

10.3. South America Laptop Market Size and Forecast, by End Use (2025-2032)

10.4. South America Laptop Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Dell

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Apple

11.3. Microsoft

11.4. hp

11.5. Razer

11.6. Medion

11.7. MSI

11.8. Lenovo

11.9. Haier

11.10. Acer

11.11. Hisense

11.12. ASUS

11.13. Samsung

11.14. Fujitsu

11.15. Huawei

11.16. Micromax

11.17. Hasee

11.18. Lens Technology

11.19. Gigabyte

11.20. LG electronics

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook