LED Lighting Market The Rise of Smart Home and Building Automation Technologies to Increase the Demand for LED Lighting Products and Boost the Market Growth (2026-2032)

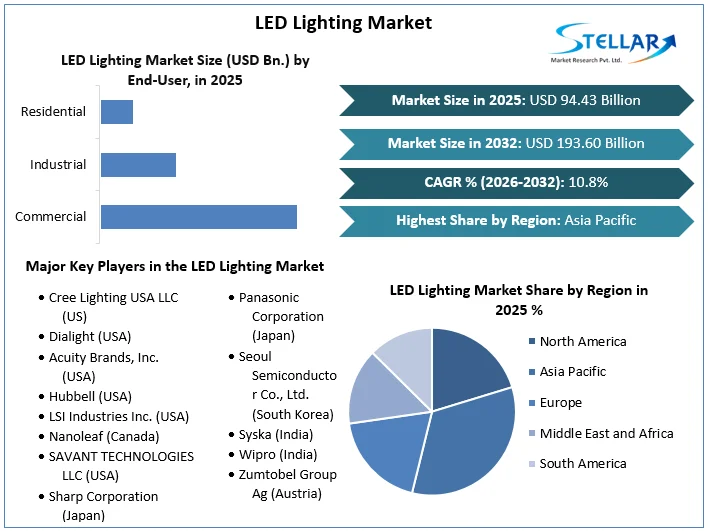

Global LED Lighting Market size was valued at USD 94.43 Bn in 2025 and is expected to reach USD 193.60 Bn by 2032, at a CAGR of 10.8 %.

Format : PDF | Report ID : SMR_2236

LED Lighting Market Overview

LED is a highly energy-efficient lighting technology and has the potential to fundamentally change the future of lighting in the United States. Residential LEDs especially ENERGY STAR-rated products use at least 75% less energy, and last up to 25 times longer, than incandescent lighting. The high efficiency and directional nature of LEDs make them ideal for many industrial uses. LEDs are increasingly common in street lights, parking garage lighting, walkway and other outdoor area lighting, refrigerated case lighting, modular lighting, and task lighting. Widespread use of LED lighting has a large potential impact on energy savings in the United States. By 2035, the majority of lighting installations are anticipated to use LED technology, and energy savings from LED lighting could top 569 TWh annually by 2035, equal to the annual energy output of more than 92 1,000 MW power plants.

The LED Lighting Market, as part of the broader industry landscape, is witnessing significant growth and transformative trends. LED, functioning as a solid-state light source with the ability to directly convert electrical energy into light, has emerged as one of the most energy-efficient technologies globally. This market overview reflects the growing adoption of LEDs, particularly in lamps as replacements for incandescent light sources. The industry trends indicate a rapid shift towards LEDs, driven by their longevity, operational efficiency, and superior light quality compared to traditional lighting technologies. LEDs pose a potential challenge to conventional lighting technologies such as Compact Fluorescent Lamp (CFL) and Cold Cathode Fluorescent Lamp (CCFL) due to their advanced features. The LED Lighting Market, part of the broader industry dynamics, showcases a cost-effective solution for various applications, including backlit widescreens and non-backlit Organic Light-Emitting Diode (OLED) displays. This market's size is growing as LEDs gain prominence, highlighting their market share and growth prospects.

To get more Insights: Request Free Sample Report

LED Lighting Market Dynamics

Cost per Lumen Efficiency has significantly boosted the LED Lighting Market Growth

According to a recent study by Research and Markets, LED lighting is set to dominate high-output stadium and arena lighting in the LED Lighting Market. The study predicts that the stadium lighting market is expected to grow by almost USD 200 million by 2023, reaching up to USD 622.2 million. Improvements in LED efficiency and reductions in the cost of luminaires (lighting fixtures) have significantly enhanced the cost per lumen, which measures light output relative to energy consumption. For instance, LEDs in large outdoor fixtures have improved from an average of 80 lumens per watt in 2013 to 130 lumens per watt in 2018. As the efficiency of LEDs continues to grow while their costs decline, LED lighting solutions have experienced unprecedented growth. Lower energy consumption translates to reduced operational costs, making LEDs a cost-effective solution for stadium lighting. Additionally, LED lights have a longer lifespan compared to traditional lighting solutions, reducing maintenance costs and the frequency of replacements, which is crucial for high-usage environments like sports stadiums.

Besides, LED lights have established a strong presence in the professional sporting market over the past few years, and their adoption continues to rise. The applications of LED stadiums and sports lighting extend beyond traditional sports to various venues such as rodeos and roping arenas, high school and college sports venues, racetracks, and concert arenas. This versatility ensures their demand continues to grow across different types of venues and events. The combination of improved cost-per-lumen efficiency, economic and environmental benefits, and the versatile applications of LED lighting are driving the substantial growth of the LED lighting market in sports stadiums and other large venues.

Latest LED Technology and Trends in the LED Industry

Many industries are making great strides when it comes to new technology and trends, the LED Lighting industry is certainly among the leaders. Over the last decade, the LED industry has experienced tremendous growth and change, with new applications, increasing efficiencies, and lower costs throughout. For multiple businesses and products, this creates a great opportunity for LED Lighting Market growth.

|

Category |

Description |

|

Elimination of External Drivers |

New DC LED chips handle power requirements directly, eliminating the need for external circuit board drivers. This allows for more compact packaging and new product applications, with increasing light output relative to cost. |

|

Dynamic Beam Spread |

Innovative LED systems with dynamic beam spread and no moving parts provide custom beam control, opening up new application possibilities. |

|

Flexible LED Foils |

A roll-to-roll process developed in Finland enables the production of flexible in-molded LED foils with printed electronics, reducing manufacturing costs for flexible LED displays. |

|

Li-Fi Technology |

Li-Fi uses modulated LED light for high-rate data transmission, ideal for electromagnetic-sensitive areas. This technology is moving from research to commercialization and is suited for home and architectural networks. |

|

Automotive LED Expansion |

LEDs are now widely used in the automotive industry across all car lines, enhancing both styling and functionality in rear, forward, and interior lighting. Benefits include improved ambiance, passenger safety, and long life without bulb changes. |

|

Adaptive Driving Beam Headlights |

Advanced headlights with arrays of LEDs and forward sensing technology reduce glare and optimize illumination. These systems, currently in use in Europe, await final industry standards in the US. |

|

Rapid Prototyping in Automotive LED Lighting |

Utilizing 3D printing and CAD, rapid prototyping allows for the creation of customized LED lighting solutions. This accelerates development cycles, reduces costs, and offers increased personalization, enhancing the overall driving experience. |

|

Global Technology Ventures |

Partners with clients to apply the latest LED technology to products. For more information, visit their website or contact a company representative. |

Smart LED lighting represents a significant trend, integrating advanced technology into lighting solutions. These smart-systems allow users to control lighting remotely via smartphones or voice-activated devices. They offer features such as adjustable brightness, color temperatures, and scheduling, providing enhanced flexibility and convenience. The smart lighting market, which includes connected LED solutions, is expected to reach $24 billion by 2025. This growth reflects a broader shift towards intelligent home and commercial environments, where lighting plays a critical role in energy management and personal comfort.

Development of Smart Cities to Create Lucrative Opportunity for the LED Lighting Market

The rise of smart cities presents a significant opportunity for the LED lighting market, as urban centers worldwide increasingly adopt intelligent infrastructure to enhance efficiency and livability. Smart cities integrate cutting-edge technologies to manage resources more effectively, and LED lighting is a key component of this transformation. Traditional lighting, LEDs are seamlessly integrated with smart systems, enabling features such as adaptive lighting, which adjusts based on ambient light levels, and motion sensors, which reduce energy waste by illuminating only when necessary. This capability not only cuts energy costs but also improves public safety and comfort. The Department of Energy (DOE) invest almost $10 million to expand efforts to support the emergence of smart, energy-efficient and low-emission cities that are leveraging Smart Cities technologies. Such investment is expected to boost the market growth. Technology spending on smart city initiatives worldwide is forecast to more than double between 2019 and 2024, increasing from 81 billion U.S. dollars in 2018 to 189.5 billion in 2023.

The smart LED streetlights equipped with IoT (Internet of Things) sensors collect and transmit data, providing valuable insights for urban planning and maintenance. These lights monitor air quality, and traffic flow, and even enhance security by detecting unusual activities. As governments and municipalities worldwide commit to creating more sustainable and connected urban environments, the demand for smart LED lighting solutions is set to soar. This burgeoning trend towards smart city development represents a golden opportunity for the LED lighting market to innovate and expand its reach.

Requirement of High Initial Costs for LED Lighting to Hinder the Market Growth

The long-term cost savings and energy efficiency benefits of LED lighting, the high initial costs remain a significant restraint on LED Lighting Market growth. LED lights, particularly those integrated with advanced technologies like smart controls and IoT capabilities, require a substantial upfront investment compared to traditional lighting options. This initial financial barrier deter both consumers and businesses, especially in price-sensitive markets or sectors with limited budgets. The cost of retrofitting existing infrastructure with LED lighting systems is particularly prohibitive, often necessitating additional expenses for new fixtures and compatible control systems.

The long lifespan and reduced energy consumption of LEDs translate into lower operational costs over time, the immediate financial outlay overshadows these long-term benefits for many potential users. This is especially true for small businesses, residential consumers, and public sector projects with constrained funding. Despite the availability of government incentives and rebates aimed at mitigating these costs, the perceived expense continues to hinder widespread adoption.

LED Lighting Market Import-Export Analysis

Import Analysis LED Lighting Market

LED Lighting Market import shipments from India stood at 97.3K, involving 13,948 world importers sourcing from 6,869 Indian suppliers. The global market sources most of its LED lights from China, Vietnam, and India. India's position as the largest importer of LED lights underscores its extensive domestic market demand, which is complemented by significant import volumes from leading suppliers like China and Vietnam. The high import figures also reflect the ongoing modernization and expansion of India's LED lighting infrastructure.

Export Analysis LED Lighting Market

LED Lighting Market export shipments from India also reached 97.3K, involving 6,869 Indian exporters and 13,948 buyers worldwide. India primarily exports its LED lights to the United Arab Emirates, the United States, and Nepal, establishing itself as the third-largest exporter of LED lights globally. This data highlights India's significant role in the global LED lighting market, with robust export activity contributing to its position as a major supplier. The strategic export relationships with key markets like the UAE and the USA further bolster India's export strength.

LED Lighting Market Segment Analysis

Based on the Application, the indoor segment held the largest LED Lighting Market share in 2025. This dominance is driven by the increasing demand for efficient lighting alternatives, particularly in places such as supermarkets, shopping centers, and retail establishments, as a shift away from traditional fluorescent and high-intensity discharge bulbs becomes evident. LED lighting in indoor spaces not only provides more effective illumination but also stands out for its energy efficiency, reduced heat generation, and cost-effectiveness. The segment is bolstered by significant demand from hospitals and educational institutions, projecting substantial growth during the forecast period.

The outdoor segment, although currently accounting for a comparatively smaller share, is poised for moderate growth in the upcoming forecast period. This growth is fueled by infrastructure-related projects such as motorways, airports, and public spaces. The government initiatives aiming to achieve net-zero emissions by reducing energy consumption are expected to drive increased demand for LED lights in outdoor applications.

Based on the End-User, the Commercial segment dominated the largest market share in 2025. This segment's supremacy is underscored by the heightened demand for cutting-edge lighting solutions, particularly among owners of museums, exhibitions, and galleries seeking improved lighting applications. The necessity for high-brightness LED lights in workplaces, driven by compliance with government norms and regulations, has further fueled the growth of the commercial LED lighting industry. In understanding the LED Lighting Market's target market analysis, it is evident that consumer demographics and product segmentation play crucial roles. High demand for LED lighting in both indoor and outdoor settings aligns with evolving consumer preferences for energy-efficient and cost-effective lighting solutions. This trend, coupled with the industry's focus on geographic segmentation and market subsegments, facilitates customer profiling for more targeted marketing strategies.

The market's resilience and competitive forces are reflected in the market share by segment, with commercial LED lighting holding a substantial position. A deeper dive into segment growth analysis reveals the ongoing evolution and potential of each market segment. The competitive segment landscape is dynamic, driven by emerging market segments and niche markets that present opportunities for innovation and market growth.

LED Lighting Market Regional Analysis

Asia Pacific emerged as the dominant player in the LED Lighting Market in the year 2025, securing the largest revenue share at 44%. A comprehensive geographic analysis underscores the region's pivotal role in the market, with consistent growth projected over the forecast period. This growth is intricately tied to the rapid development of infrastructure projects in emerging markets within the region, and the development of a heightened demand for LED lighting solutions. Also, the growth is fueled by the proactive energy-saving initiatives undertaken by regional governments, aligning with area-specific market dynamics. The construction industries in key economies such as China, Japan, and India contribute significantly to the rise of the regional market, complemented by the presence of numerous manufacturers focused on launching new products. These region-specific market trends underscore the resilience and potential of the LED Lighting Market in Asia Pacific.

Samsung Electronics Co. Ltd., operating from South Korea, asserts its dominance in the LED Lighting Market through a thorough competitor analysis. With a focus on competitive intelligence, Samsung's diverse portfolio of LED lighting solutions reflects its commitment to innovation across various sectors, from residential to industrial applications. Renowned for its commitment to technological innovation, Lite-On Technology positions itself strategically through a keen understanding of competitive positioning. Lowcled, a significant player based in China, employs a meticulous competitive landscape review to distinguish itself in the LED Lighting Market. Through competitor profiling and rivalry impact analysis, Lowcled strategically emphasizes its commitment to providing cost-effective and energy-efficient lighting solutions. India imports most of its LED, Lighting from China, India and is the largest importer of LED, Lighting in the World. The top 3 importers of LED Lighting are India with 7,323,950 shipments followed by the United States with 3,598,046 and Vietnam at the 3rd spot with 3,216,043 shipments.

Since LEDs use only a fifth of the electricity required by comparable incandescent bulbs, they are among the most energy-efficient light sources in the world. As countries increasingly phase out conventional bulbs, the market share of LEDs continues to grow. Between 2012 and 2019, the LED Lighting Market penetration rate of LEDs in the global LED lighting market steadily increased, and it is expected to reach around 76 percent by 2025. The global LED lighting market is also projected to expand, growing from approximately 70 million U.S. dollars in 2019 to nearly 100 million U.S. dollars by 2023. This growth has attracted both established and new players in the lighting industry. Leading light bulb manufacturers like Signify and Osram, along with specialized LED producers such as Cree and Nichia, are prominent in the global LED Lighting market, collectively generating up to 2 billion U.S. dollars annually from LED sales.

In Conclusion, The LED lighting market is poised for substantial growth driven by improvements in cost per lumen efficiency and technological advancements. LEDs have become the preferred choice for high-output applications like stadium lighting, with significant gains in efficiency and reductions in costs. Innovations such as DC LED chips, dynamic beam spread systems, flexible LED foils, Li-Fi technology, and smart LED lighting are reshaping the market. The smart lighting sector, expected to reach USD 24 billion by 2025, highlights a broader shift towards intelligent environments. To stay competitive, industry players should leverage these advancements and focus on integrating smart LED solutions, contributing to the development of smart cities and energy-efficient infrastructures.

|

LED Lighting Market Scope |

|

|

Market Size in 2025 |

USD 94.43 Bn. |

|

Market Size in 2032 |

USD 193.60 Bn. |

|

CAGR (2026-2032) |

10.8% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Product Lamps Luminaire |

|

By Installation Type New LED Retrofit LED |

|

|

By Application Indoor Outdoor |

|

|

By End-User Commercial Industrial Residential |

|

|

By Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Leading LED Lighting Manufacturers include:

North America LED Lighting Manufacturers

- Cree Lighting USA LLC (US)

- Dialight (USA)

- Acuity Brands, Inc. (USA)

- Hubbell (USA)

- LSI Industries Inc. (USA)

- Nanoleaf (Canada)

- SAVANT TECHNOLOGIES LLC (USA)

Asia Pacific LED Lighting Leading Players

- Sharp Corporation (Japan)

- Halonix Technologies Private Limited (India)

- Panasonic Corporation (Japan)

- Seoul Semiconductor Co., Ltd. (South Korea)

- Syska (India)

- Wipro (India)

- Zumtobel Group Ag (Austria)

- Samsung Electronics Co. Ltd (South Korea)

- Cooper Lighting Solutions (US)

Europe LED Lighting Companies

- Signify Holding (Netherlands)

- Siteco GmbH (Germany)

- Phillips Lighting Holding B.V.(Netherlands)

- Osram Licht AG (Germany)

- Virtual Extension Dialight PLC(UK)

- Eaton Corporation (Ireland)

Frequently Asked Questions

APAC is expected to dominate the LED Lighting Market during the forecast period.

The LED Lighting Market size is expected to reach USD 193.60 Bn by 2032.

The major top players in the Global LED Lighting Market are Cree Lighting USA LLC (US), Dialight (USA), Acuity Brands, Inc. (USA) and others.

The growth of huge construction activities and mining projects is expected to drive the LED Lighting Market growth.

China held the largest LED Lighting Market share in 2025.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. LED Lighting Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global LED Lighting Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

3.5. LED Lighting Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. LED Lighting Market: Dynamics

4.1. LED Lighting Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. LED Lighting Market Drivers

4.3. LED Lighting Market Restraints

4.4. LED Lighting Market Opportunities

4.5. LED Lighting Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Li-Fi

4.8.2. Human-Centric Lighting

4.8.3. IoT Lighting

4.8.4. Natural Lighting Robot

4.8.5. Quantum Dot-Enabled LED

4.8.6. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. LED Lighting Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. LED Lighting Market Size and Forecast, by Product (2025-2032)

5.1.1. Lamps

5.1.2. Luminaire

5.2. LED Lighting Market Size and Forecast, by Installation Type (2025-2032)

5.2.1. New LED

5.2.2. Retrofit LED

5.3. LED Lighting Market Size and Forecast, by Application (2025-2032)

5.3.1. Indoor

5.3.2. Outdoor

5.4. LED Lighting Market Size and Forecast, by End-User (2025-2032)

5.4.1. Commercial

5.4.2. Industrial

5.4.3. Residential

5.5. LED Lighting Market Size and Forecast, by Distribution Channel (2025-2032)

5.5.1. Online

5.5.2. Offline

5.6. LED Lighting Market Size and Forecast, by Region (2025-2032)

5.6.1. North America

5.6.2. Europe

5.6.3. Asia Pacific

5.6.4. Middle East and Africa

5.6.5. South America

6. North America LED Lighting Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America LED Lighting Market Size and Forecast, by Product (2025-2032)

6.1.1. Lamps

6.1.2. Luminaire

6.2. North America LED Lighting Market Size and Forecast, by Installation Type (2025-2032)

6.2.1. New LED

6.2.2. Retrofit LED

6.3. North America LED Lighting Market Size and Forecast, by Application (2025-2032)

6.3.1. Indoor

6.3.2. Outdoor

6.4. North America LED Lighting Market Size and Forecast, by End-User (2025-2032)

6.4.1. Commercial

6.4.2. Industrial

6.4.3. Residential

6.5. North America LED Lighting Market Size and Forecast, by Distribution Channel (2025-2032)

6.5.1. Online

6.5.2. Offline

6.6. North America LED Lighting Market Size and Forecast, by Country (2025-2032)

6.6.1. United States

6.6.2. Canada

6.6.3. Mexico

7. Europe LED Lighting Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe LED Lighting Market Size and Forecast, by Product (2025-2032)

7.2. Europe LED Lighting Market Size and Forecast, by Installation Type (2025-2032)

7.3. Europe LED Lighting Market Size and Forecast, by Application (2025-2032)

7.4. Europe LED Lighting Market Size and Forecast, by End-User (2025-2032)

7.5. Europe LED Lighting Market Size and Forecast, by Distribution Channel (2025-2032)

7.6. Europe LED Lighting Market Size and Forecast, by Country (2025-2032)

7.6.1. United Kingdom

7.6.2. France

7.6.3. Germany

7.6.4. Italy

7.6.5. Spain

7.6.6. Sweden

7.6.7. Russia

7.6.8. Rest of Europe

8. Asia Pacific LED Lighting Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific LED Lighting Market Size and Forecast, by Product (2025-2032)

8.2. Asia Pacific LED Lighting Market Size and Forecast, by Installation Type (2025-2032)

8.3. Asia Pacific LED Lighting Market Size and Forecast, by Application (2025-2032)

8.4. Asia Pacific LED Lighting Market Size and Forecast, by End-User (2025-2032)

8.5. Asia Pacific LED Lighting Market Size and Forecast, by Distribution Channel (2025-2032)

8.6. Asia Pacific LED Lighting Market Size and Forecast, by Country (2025-2032)

8.6.1. China

8.6.2. India

8.6.3. Japan

8.6.4. South Korea

8.6.5. Australia

8.6.6. ASEAN

8.6.7. Rest of Asia Pacific

9. Middle East and Africa LED Lighting Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa LED Lighting Market Size and Forecast, by Product (2025-2032)

9.2. Middle East and Africa LED Lighting Market Size and Forecast, by Installation Type (2025-2032)

9.3. Middle East and Africa LED Lighting Market Size and Forecast, by Application (2025-2032)

9.4. Middle East and Africa LED Lighting Market Size and Forecast, by End-User (2025-2032)

9.5. Middle East and Africa LED Lighting Market Size and Forecast, by Distribution Channel (2025-2032)

9.6. Middle East and Africa LED Lighting Market Size and Forecast, by Country (2025-2032)

9.6.1. South Africa

9.6.2. GCC

9.6.3. Egypt

9.6.4. Nigeria

9.6.5. Rest of the Middle East and Africa

10. South America LED Lighting Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America LED Lighting Market Size and Forecast, by Product (2025-2032)

10.2. South America LED Lighting Market Size and Forecast, by Installation Type (2025-2032)

10.3. South America LED Lighting Market Size and Forecast, by Application (2025-2032)

10.4. South America LED Lighting Market Size and Forecast, by End-User (2025-2032)

10.5. South America LED Lighting Market Size and Forecast, by Distribution Channel (2025-2032)

10.6. South America LED Lighting Market Size and Forecast, by Country (2025-2032)

10.6.1. Brazil

10.6.2. Argentina

10.6.3. Rest Of South America

11. Company Profile: Key Players

11.1. Cree Lighting USA LLC (US)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Dialight (USA)

11.3. Acuity Brands, Inc. (USA)

11.4. Hubbell (USA)

11.5. LSI Industries Inc. (USA)

11.6. Nanoleaf (Canada)

11.7. SAVANT TECHNOLOGIES LLC (USA)

11.8. Sharp Corporation (Japan)

11.9. Halonix Technologies Private Limited (India)

11.10. Panasonic Corporation (Japan)

11.11. Seoul Semiconductor Co., Ltd. (South Korea)

11.12. Syska (India)

11.13. Wipro (India)

11.14. Zumtobel Group Ag (Austria)

11.15. Samsung Electronics Co. Ltd (South Korea)

11.16. Cooper Lighting Solutions (US)

11.17. Signify Holding (Netherlands)

11.18. Siteco GmbH (Germany)

11.19. Phillips Lighting Holding B.V.(Netherlands)

11.20. Osram Licht AG (Germany)

11.21. Virtual Extension Dialight PLC(UK)

11.22. Eaton Corporation (Ireland)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook