Infant Nutrition Market Industry Analysis and Forecast (2025-2032)

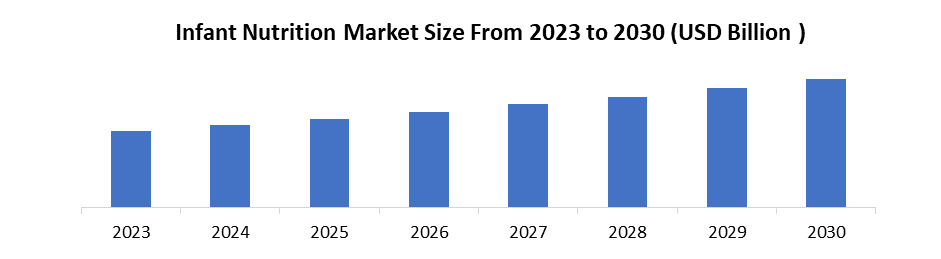

Infant Nutrition Market size was valued at USD 70.04 Bn. in 2024 and the Infant Nutrition revenue is expected to grow at a CAGR of 8 % from 2025 to 2032, reaching nearly USD 129.65 Bn. by 2032.

Format : PDF | Report ID : SMR_1897

Infant Nutrition Market Overview:

Children between the ages of birth and one year are considered infants. Infants grow very rapidly and have special nutritional requirements that are different from other age groups. Infant nutrition is designed to meet the special needs of very young children and give them a healthy start in life. Children under one-year-old do not have fully mature organ systems. They need nutrition that is easy to digest and contains enough calories, vitamins, minerals, and other nutrients to grow and develop normally. Infants also need the proper number of fluids for their immature kidneys to process. In addition, infant nutrition involves avoiding exposing infants to substances that are harmful to their growth and development.

The Infant Nutrition market provides market size, share, scope, growth, and potential of the industry. It offers valuable information to help businesses identify opportunities and potential risks within the market. In addition, the global Infant Nutrition market research reports provide detailed analysis of market conditions, trends, challenges, and recommendations for stakeholders in the industry. The reports highlight the increasing demand for infant nutrition products thanks to rising awareness about the importance of early childhood nutrition. Key findings include the growing popularity of organic and natural baby food products, as well as the impact of e-commerce on distribution channels.

To get more Insights: Request Free Sample Report

Infant Nutrition Market Dynamics:

Health Consciousness, Urbanization, and Changing Parental Priorities to Drive the Infant Nutrition Market

A significant driver of the Infant nutrition market is the growing consumer awareness of health and wellness. The heightened consciousness has resulted in a surge in demand for Infant nutrition products that are perceived as healthier and more natural alternatives. The growing prevalence of malnutrition among children and newborns has increased the need for Infant Nutrition. Because newborns lack the necessary muscles and teeth to chew properly, baby food and baby formula serve as their major sources of nutrition. Parents are becoming more conscious of the importance of proper nutrition in their child’s general growth and development.

The growing urban population and changing lifestyles of individuals as a result of significant increases in disposable incomes, are driving the overall growth of the Infant Nutrition market. Parents from different regions have slightly different top concerns for their children. Despite the differences, there is a clear trend that parents are increasingly seeking out products that use prebiotics and probiotics.

Challenges Facing the Infant Nutrition Market

Competition from Breast Milk Banks the proliferation of breast milk banks, which are places where moms give and collect breast milk, is hampering the market for infant nutrition. Donated breast milk is preferred by certain parents over commercial formula, which affects the demand in the market.

Rising concerns regarding the health implications of certain ingredients in baby formula and negative public perception significantly impact market demand. Instances of product recalls or controversies related to formula safety erode consumer trust and lead to a decline in sales. Additionally, Stringent regulations and increased scrutiny from regulatory bodies pose a significant threat to the baby infant formula market. Any changes in regulatory standards or compliance issues impact manufacturing processes, leading to potential disruptions and additional costs for companies.

Infant Nutrition Market Segment Analysis:

By Product, Infant Milk is the dominant segment in the Infant Nutrition Market. Infant milk, the initial feeding option for newborns, dominates the Infant Nutrition Market. Trends include a focus on probiotics, and the popularity of organic variants, reflecting parents’ desire for high-quality and wholesome options. Chinese parents are increasingly spending more on infant milk powder, with sales of premium and super-premium products rising faster than regular products. In 2024, Bobbie, a maker of clean-label infant formula, acquired Nature's One, an Ohio-based pediatric nutrition company.

- The top 3 exporters of Baby formula are China with 1,147 shipments followed by the United Kingdom with 818 and Netherlands at the 3rd spot with 466 shipments.

Infant Nutrition Market Regional Insight:

Asia Pacific held the largest share of the Infant Nutrition Market. The Asia-Pacific region's high birth rates and growing purchasing power have boosted demand for infant food and milk formula-based goods. China is the largest market in the region. Additionally, growing economies such as India and Indonesia are expected to fuel the region's market growth. In China, only 21% of babies are exclusively breastfed. Whenever babies are not exclusively breastfed during the first 6 months or when they start with complementary feeding at the age of 6 months, the most preferred second food is cow or buffalo milk.

The nutrient composition of cow or buffalo milk is not suitable for babies less than 1 year old and leads to certain deficiencies, for example, iron deficiency anemia. formula feeding is mainly used due to lack of breastmilk and with the perception that the child isn’t getting enough food, differences have been spotted in each market. While breast milk is the gold standard for infant feeding, moms in Indonesia, Vietnam, and China use formula milk to provide the right number of vitamins and growth. In Australia, the UK, and the US, the usage of formula is dominated by shared feeding responsibility between parents or caregivers.

Danone launched a new milk-formulated Infant Nutrition product, Nutrilon Yunhui Stage 3, in China in April 2022, containing a high level of essential vitamins. Additionally, Jennewein Biotechnologie and Yili Group signed a Memorandum of Understanding to develop innovative infant formula and Nutrition products tailored to the Chinese market through research and development of infant microbiomes and human milk oligosaccharides.

- In December 2023, the Codex Alimentarius, a document published jointly by the Food and Agriculture Organization of the United States (US FAO) and the World Health Organization (WHO) detailing guidelines and codes of practice for follow-up formula and other related products intended for children aged between one and three years, was released.

Infant Nutrition Market Competitive Landscape:

- In 2023, Danone Early Life Nutrition introduced a new infant formula containing milk droplets that closely mimic the structure found in mother's milk in China.

- In 2023, Gerber, a subsidiary of Nestle and the frontrunner in early childhood nutrition received clean-label certifications from a renowned non-profit clean-label project.

- November 2023, ELSE NUTRITION HOLDINGS INC. announced its multi-stage partnership with Danone S.A., wherein the first stage of their partnership involves providing Danone access to Else Nutrition's plant-based baby food portfolio. The signing of the definitive agreement was scheduled for the end of the first quarter of 2024, allowing Danone to negotiate opportunities beyond product commercialization.

- October 2023 (Launch), Nestlé S.A. launched its new infant nutrition product, 'Sinergity', a proprietary blend comprising a specific probiotic combined with six different human milk oligosaccharides (HMOs). Probiotics play a key role in the development of the gut microbiome and infant immunity. Meanwhile, HMOs, a crucial component of breastmilk, support the development of intestinal microbiota and the fortification of the immune system during early childhood.

Infant Nutrition Market Scope:

|

Infant Nutrition Market |

|

|

Market Size in 2024 |

USD 70.04 Bn. |

|

Market Size in 2032 |

USD 129.65 Bn. |

|

CAGR (2025-2032) |

8 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Follow-on Milk Specialty baby milk Infant Milk Prepared baby food Dried baby food |

|

By Form Solid baby food Liquid baby food |

|

|

By Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Infant Nutrition Market Key Players:

- Abbott Laboratories

- Danone S.A.

- Nestlé

- Mead Johnson Nutrition Company

- Reckitt Benckiser Group plc

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- The Honest Company

- HiPP GmbH & Co. Vertrieb KG

- Ausnutria Dairy Corporation Ltd.

- Beingmate Baby & Child Food Co., Ltd.

- FrieslandCampina

- Feihe International Inc.

- Hero Group

- Arla Foods amba

- Pinnacle Foods Inc.

- Plum, PBC

- Meiji Holdings Co. Ltd.

- Pfizer Inc.

- Morinaga Milk

- Perrigo

- Sun-Maid Growers of California, Inc.

- XXX Inc.

Frequently Asked Questions

Competition from breastfeeding milk bank is the challenge in the Infant Nutrition Market.

The Market size was valued at USD 70.04 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 8 % from 2025 to 2032, reaching nearly USD 129.65 Billion.

The segments covered in the market report are by Product, form and Distribution Channel.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Infant Nutrition Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Infant Nutrition Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. New Product Launches

4. Infant Nutrition Market: Dynamics

4.1. Infant Nutrition Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Infant Nutrition Market Drivers

4.3. Infant Nutrition Market Restraints

4.4. Infant Nutrition Market Opportunities

4.5. Infant Nutrition Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Infant Nutrition Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Infant Nutrition Market Size and Forecast, by Product (2024-2032)

5.1.1. Follow-on Milk

5.1.2. Specialty baby milk

5.1.3. Infant Milk

5.1.4. Prepared baby food

5.1.5. Dried baby food

5.2. Infant Nutrition Market Size and Forecast, by Form (2024-2032)

5.2.1. Solid baby food

5.2.2. Liquid baby food

5.3. Infant Nutrition Market Size and Forecast, by Distribution Channel (2024-2032)

5.3.1. Online

5.3.2. Offline

5.4. Infant Nutrition Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Infant Nutrition Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Infant Nutrition Market Size and Forecast, by Product (2024-2032)

6.1.1. Follow-on Milk

6.1.2. Specialty baby milk

6.1.3. Infant Milk

6.1.4. Prepared baby food

6.1.5. Dried baby food

6.2. North America Infant Nutrition Market Size and Forecast, by Form (2024-2032)

6.2.1. Solid baby food

6.2.2. Liquid baby food

6.3. North America Infant Nutrition Market Size and Forecast, by Distribution Channel (2024-2032)

6.3.1. Online

6.3.2. Offline

6.4. North America Infant Nutrition Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Infant Nutrition Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Infant Nutrition Market Size and Forecast, by Product (2024-2032)

7.2. Europe Infant Nutrition Market Size and Forecast, by Form (2024-2032)

7.3. Europe Infant Nutrition Market Size and Forecast, by Distribution Channel (2024-2032)

7.4. Europe Infant Nutrition Market Size and Forecast, by Country (2024-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Infant Nutrition Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Infant Nutrition Market Size and Forecast, by Product (2024-2032)

8.2. Asia Pacific Infant Nutrition Market Size and Forecast, by Form (2024-2032)

8.3. Asia Pacific Infant Nutrition Market Size and Forecast, by Distribution Channel (2024-2032)

8.4. Asia Pacific Infant Nutrition Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Infant Nutrition Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Infant Nutrition Market Size and Forecast, by Product (2024-2032)

9.2. Middle East and Africa Infant Nutrition Market Size and Forecast, by Form (2024-2032)

9.3. Middle East and Africa Infant Nutrition Market Size and Forecast, by Distribution Channel (2024-2032)

9.4. Middle East and Africa Infant Nutrition Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Infant Nutrition Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Infant Nutrition Market Size and Forecast, by Product (2024-2032)

10.2. South America Infant Nutrition Market Size and Forecast, by Form (2024-2032)

10.3. South America Infant Nutrition Market Size and Forecast, by Distribution Channel (2024-2032)

10.4. South America Infant Nutrition Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Abbott Laboratories

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Danone S.A.

11.3. Nestlé

11.4. Mead Johnson Nutrition Company

11.5. Reckitt Benckiser Group plc

11.6. The Kraft Heinz Company

11.7. The Hain Celestial Group, Inc.

11.8. The Honest Company

11.9. HiPP GmbH & Co. Vertrieb KG

11.10. Ausnutria Dairy Corporation Ltd.

11.11. Beingmate Baby & Child Food Co., Ltd.

11.12. FrieslandCampina

11.13. Feihe International Inc.

11.14. Hero Group

11.15. Arla Foods amba

11.16. Pinnacle Foods Inc.

11.17. Plum, PBC

11.18. Meiji Holdings Co. Ltd.

11.19. Pfizer Inc.

11.20. Morinaga Milk

11.21. Perrigo

11.22. Sun-Maid Growers of California, Inc.

11.23. XXX Inc.

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook