India Coffee Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

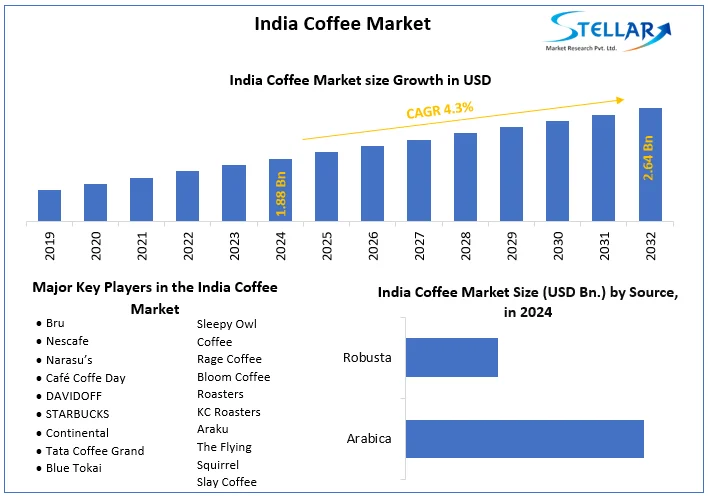

India Coffee Market size was valued at 1.88 Bn. US$ in 2024. Coffee will encourage a great deal of transformation in Beverage Sector in India.

Format : PDF | Report ID : SMR_65

India Coffee Market Definition:

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product. India coffee market report's segment analysis is studied by considering segments, by source, type, process and geography.

India Coffee Market Dynamics:

Over the past two decades, India has seen an unprecedented increase in the number of coffee lovers. Increase in disposable income, global exposure, digital and media penetration, urbanization, lifestyle changes, are responsible for India Coffee Market growth. These changes have led to what we call coffee culture and are driving the growth of coffee in the market. Factors driving demand for coffee in India include rising incomes, growing demand from the institutional sector, changing eating habits, health benefits, increased coffee cultivation in India, etc.

The growing obese population, unhealthy eating habits among children and adults, hectic lifestyles, and hectic work schedules are factors driving consumers towards healthy alternatives. Coffee is also one of the functional drinks available with proven health benefits. Various coffees are introduced to the market, to serve a wide range of consumers as calorie-conscious consumers and diabetic populations are looking for alternatives to sugar in their drinks. This increases the rate of preference for antioxidant-fortified drinks among them. India coffee market is also driven by strong demand from young consumers amid a thriving coffee culture.

To get more Insights: Request Free Sample Report

The major challenge for India Coffee Market that nation has being traditionally a tea-drinking nation and still doesn't have the appeal for coffee in the commons. As models evolve, brands must move beyond product innovation and connect with consumers to create a habit of it. There should be brand resonance for a larger segment of consumers. The new generation is more inclined towards coffee than tea as a preference for a morning beverage.

In India, Coffee was an Out of home thing, which then aroused the Café culture in the country, giving rise to branded service stores such as CCD, Starbucks, etc. The love for coffee has encouraged major domestic and international companies to launch a wide variety of coffees. Many retail stores have begun to offer a wider range of coffees. The Indian Consumers are different than other regions as they mostly prefer to have coffee sitting in cafes, enjoying with friends, etc. rather than go to coffee.

Most of today's India Coffee Market growth is due to out-of-home consumption, this category is likely to increase consumption at home. But penetration appears to be a major obstacle, coffee's geographical penetration is largely confined to urban populations in tier I and tier II cities, putting South India aside. 70% of the Indian population lives in the rural belt, and coffee is an acquired taste. Brands that offer packaged products are trying to enter with CPGs like sachets, helping to differentiate themselves in these markets.

Rural India is gradually changing in all aspects. Consumers don't hesitate to try new things, whether it's online shopping or digital banking. Brands can link up with rural India, the market will see exponential growth in overall coffee consumption in the country.

Globally, the coffee market has grown steadily by 2.5 to 3% year on year, but the growth rate is much faster in India. The India coffee market is growing 10.15% year on year. India's strong growth is due to weak fundamentals as the Indian coffee market is smaller than the rest of the world. During the Covid period, internal coffee consumption increased significantly around the world with the closure of cafes and hotels. Before Covid, household consumption accounted for 70%. This number has increased to about 90% during the Covid crisis.

Women coffee entrepreneurs are roasting an aroma of change in a predominantly tea-drinking nation. Fueled by India's coffee revolution, the women who lead the country's "bean business" have taken interesting routes to discover the diversity of local coffee. Coffee consumers in India no longer see coffee as a bittersweet drink that effectively wakes you up in the morning. These factors are driving the demand in the India coffee market.

The first-generation drinkers in North India started with instant coffee, while in the South, where coffee was grown, filter coffee is popular. With the second generation, cafes like Cafe Coffee Day came in. These were more than the coffee but about the culture of meeting friends, hanging out, going for dates – a melting pot of young people which is driving the demand of the product in the market.

The coffee shop is always positioned as the last place where food and culture meet in this region. With the energy of revolution and wisdom, the cafe has become an important space for the exchange of ideas over the years. Wi-Fi replaced books, today's coffee shops are crowded with young people who are hard at work using laptops or trendy monitors. Consumers' knowledge of coffee here is much greater, thanks to the support of internationally renowned Indian shops such as Blue Tokai and Araku Coffee placing handcrafted cups on the table. Metros have more access to cafes and brands. Though tier 2 and 3 cities don't have that access, there is a consumer base there. Brands are delivering cold brew sachets, micro cans, or coffee beans through orders placed online. This factor is driving the growth of the India coffee market.

In recent years, the industry has witnessed a rising demand for disruptive and premium products, and a dozen or so coffee start-ups/direct-to-consumer brands are catering to the evolving consumer taste and requirements. The rise in disposable income and a subsequent change in lifestyle have certainly driven India's young demography towards delectable foods and beverages. But it peaked when the food craze born out of lockdown isolation peaked, and the ubiquitous digital infrastructure made it easy to buy and taste at a tap or a click.

India Coffee Market Trends:

Coffee Beer: Coffee mixes well with almost everything, and there are some breweries that have already begun experimenting with this concept. Therefore, the choice of such sour coffee-infused beer is trending. Coffee-injected beer is quickly becoming the best-selling cocktail on the India Coffee Markett.

Nitrogen-rich coffee: India has seen continual growth in the adoption of fizzed or rather nitro coffees. This process of nitrogenization gives the coffee a silky mouthfeel. Most importantly, the inclusion of nitrogen will discourage the requirement for dairy and cream as coffee whiteners and thickening agents.

Gen-Z cafes and coffee shops: By 2023, the number of smart cafeterias increased, allowing individuals to engage in professional activities over a hot coffee. The perfect fusion of IoT in the world of potent drinks, with a focus on providing professional rooms that are more reminiscent of the GenZ Cafeteria. This will certainly shift towards a more cohesive workspace that accommodates the modern workforce and aspiring entrepreneurs.

|

Competitive Landscape: Indian Coffee Start-ups |

||

|

Company |

Revenue 2020 |

Product Categories |

|

Blue Tokai |

$ 5.6 Mn |

Roasted and Ground Coffee, Cold Brew Bags, Starter Kits, Coffee Mugs, Brewing Equipment |

|

Sleepy Owl Coffee |

$ 0.7 Mn |

Cold Brew, Hot Brew, Filter Coffee, RTD Coffee, Latte, Merchandise |

|

Rage Coffee |

$ 0.2 Mn |

Instant Coffee, Cold Brew Bags, Flavored Coffee |

|

Slay Coffee |

$ 0.3 Mn |

Coffee Ground and Beans, Coffee Pour Over, Coffee Concentrate, DIY Coffee Brewing Kit |

|

The Flying Squirrel |

$ 0.2 Mn |

Coffee Ground and beans, Cold Brew, Brewing Equipment and Accessories |

The objective of the report is to present a comprehensive analysis of the India Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the India Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the India Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the India Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Indian market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the India Coffee market. The report also analyses if the India Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the India Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the India Coffee market. Understanding the impact of the surrounding environment and the influence of ecological concerns on the Indian market is aided by legal factors.

India Coffee Market Scope:

|

India Coffee Market |

|

|

Market Size in 2024 |

USD 1.88 Bn. |

|

Market Size in 2032 |

USD 2.64 Bn. |

|

CAGR (2025-2032) |

4.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

India Coffee Market KEY PLAYERS

• Bru

• Nescafe

• Narasu’s

• Café Coffe Day

• DAVIDOFF

• STARBUCKS

• Continental

• Blue Tokai

• Sleepy Owl Coffee

• Rage Coffee

• Bloom Coffee Roasters

• KC Roasters

• Araku

• The Flying Squirrel

• Slay Coffee

Frequently Asked Questions

India Coffee Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

India Coffee Market size was USD 1.88 Billion in 2024.

1. India Coffee Market: Research Methodology

2. India Coffee Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. India Coffee Market: Dynamics

3.1. India Coffee Market Trends

3.2. India Coffee Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. India Coffee Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2032)

4.1. India Coffee Market Size and Forecast, by Source (2024-2032)

4.1.1. Arabica

4.1.2. Robusta

4.2. India Coffee Market Size and Forecast, by Type (2024-2032)

4.2.1. Instant Coffee

4.2.2. Ground Coffee

4.2.3. Whole Grain

4.2.4. Others

4.3. India Coffee Market Size and Forecast, by Process (2024-2032)

4.3.1. Caffeinated

4.3.2. Decaffeinated

5. India Coffee Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Bru

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Nescafe

6.3. Narasu’s

6.4. Café Coffe Day

6.5. DAVIDOFF

6.6. STARBUCKS

6.7. Continental

6.8. Tata Coffee Grand

6.9. Blue Tokai

6.10. Sleepy Owl Coffee

6.11. Rage Coffee

6.12. Bloom Coffee Roasters

6.13. KC Roasters

6.14. Araku

6.15. The Flying Squirrel

6.16. Slay Coffee

7. Key Findings

8. Industry Recommendations