High-Temperature Resistance Wire Market- Global Industry Analysis and Forecast (2025-2032)

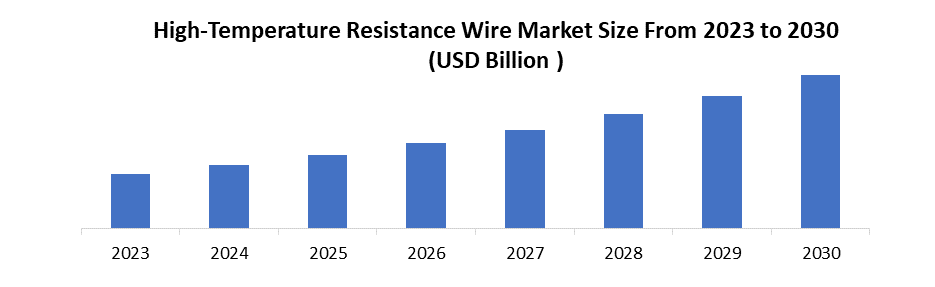

The High Temperature Resistance Wire Market size was valued at USD 3.13 Bn. in 2024 and the High Temperature Resistance Wire revenue is expected to grow at a CAGR of 16% from 2024 to 2032, reaching nearly USD 10.26 Bn. by 2032.

Format : PDF | Report ID : SMR_2028

High-Temperature Resistance Wire Market Overview:

Heat-resistant cables are specifically designed for use in extreme temperatures. Depending on the temperature range, special chain flex solutions are used in these extreme areas. Temperature-resistant cables are preferred for applications that continue to operate in very hot or very cold ambient temperatures. The cables are used in a wide variety of industries, where there are many demanding applications. For example, cables for low temperatures are often used in refrigeration and air conditioning technology or the offshore area, while high-temperature cables are often found in applications in metallurgical, steel, and rolling mill technology as well as in cement, glass, and ceramics processing

The High-Temperature Resistant Wire Market Report delivers an in-depth analysis of leading and emerging players in the market. The Report provides comprehensive lists of key companies that have been enlisted based on the type of products they are offering & other factors in the Market. Among company profiling market analysis, the analysts who worked on the report gave the year of market entry for each mentioned player can be considered for the research analysis.

To get more Insights: Request Free Sample Report

High-Temperature Resistance Wire Market Dynamics:

High-Temperature Resistance Wires in the Growing Electronics Industry

The High-Temperature Resistance Wire Market is being propelled by the growing Electronics Industry. The growing electronics sector, especially in areas like telecommunications, consumer electronics, and semiconductor production, needs wires that can withstand high temperatures for uses like circuitry and thermal control. With energy efficiency becoming increasingly important for both industries and consumers, there is a rising need for wires that withstand high temperatures to improve the efficiency of heating systems and electrical components. Strict safety and quality rules in different sectors, particularly in aerospace and automotive, boost the need for heat-resistant wires that adhere to industry norms and certifications.

Balancing Performance and Cost in High-Temperature Resistance Wire Production

Balancing cost and availability while achieving optimal performance at high temperatures is difficult when finding the right combination of materials. Certain high temperatures are not readily available or are expensive, which affects the feasibility of large-scale production. Wires with high-temperature resistance frequently endure mechanical strain and distortion, especially in situations prone to vibration or thermal changes. Creating a balance between mechanical strength and flexibility while maintaining temperature resistance poses a difficult engineering task. Additionally, as the demand for wires with high-temperature resistance increases, pricing flexibility is constrained by cost pressures from customers and competition. Maintaining competitiveness in the market requires balancing the use of high-performance materials with cost-effective manufacturing processes.

High-Temperature Resistance Wire Market Segment Analysis:

By Type, Polyurethane Material held the largest share in 2024 for the High-Temperature Resistance Wire Market. Polyurethane is a type of polymer known for its exceptional thermal properties, including resistance to high temperatures. The insulation material is frequently utilized to shield conductive parts from heat damage or to avoid electrical shorts at high temperatures. Industries like automotive, aerospace, electronics, and industrial manufacturing depend on these wires in high-temperature settings to guarantee the dependable operation and safety of their equipment and systems. Industries like automotive and aerospace fuel the need for specialized wires that endure high temperatures in the market for polyurethane high-temperature resistance wires. Continual progress in materials science and manufacturing technologies allows for the creation of wires with enhanced heat resistance and other favorable characteristics.

High-Temperature Resistance Wire Market Regional Insight:

Asia-Pacific is estimated to witness robust growth throughout the forecasted period for the High-Temperature Resistance Wire Market. Asia Pacific is known for its advancements in materials science, manufacturing processes, and research and development capabilities. Facilitates the production of high-quality, high-temperature resistant wires with improved performance characteristics, meeting the stringent requirements of diverse industries. China, Japan, and India are among the key countries driving the high-temperature resistance wire market in Asia Pacific.

China, in particular, is a major producer and consumer of high-temperature resistant wires, supported by its thriving manufacturing sector and industrial infrastructure. With the rapid development of China's economy, the demand for high-temperature wires in special industries has increased rapidly, and heat-resistant and high-temperature cables. High-temperature cables are an important part of special cables and have strong vitality. In short supply, China imports about 2 billion yuan from abroad for domestic construction.

China’s High-Temperature Resistant Wire market held the largest market share, and the Indian High-Temperature Resistant Wire market has been the fastest-growing market in the Asia-Pacific region.

- Heat-resistant wire export shipments stood from the World at 35.4K, exported by 2,812 World Exporters to 2,814 Buyers.

- The world exports most of its Heat-resistant wire to Vietnam, the United States, and India.

- The top 3 exporters of Heat-resistant wire are Vietnam with 14,619 shipments followed by China with 16,427 and Japan at the 3rd spot with 3,544 shipments.

High-Temperature Resistance Wire Market Competitive Landscape:

- In August 2023: Nexans, a leading global cable and wire manufacturer, announced the launch of a new high-temperature resistant wire specifically designed for use in electric vehicle (EV) charging stations. The development caters to the burgeoning EV market and highlights the growing demand for specialized high-temperature resistant wire solutions.

- In September 2023: Prysmian Group, another major player, unveiled a new range of fire-resistant cables with enhanced temperature resistance capabilities. This launch emphasizes the focus on safety and performance within the market.

- In October 2023, the acquisition of a leading high-temperature resistant wire manufacturer by a larger competitor sent ripples through the market. The consolidation move is indicative of the increasing competition and growing market potential.

High-Temperature Resistance Wire Market Scope:

|

Retail Logistics Market |

|

|

Market Size in 2024 |

USD 3.13 Bn. |

|

Market Size in 2032 |

USD 10.26 Bn. |

|

CAGR (2025-2032) |

16 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Polyurethane Material Polyvinylidene Fluoride Material Nylon Material Others |

|

By Application Communications Industry Automobile Industry Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

High Temperature Resistance Wire Market Key Players:

- LEONI

- American Wire Group

- Dacon Systems

- Totoku Electric

- SAB Cable

- Cole Wire

- Heatsense

- New England Wire Technologies Corp

- Zhejiang Wrlong High-Temperature Wire and Cable

- Omega Engineering, Inc.

- Heraeus Holding GmbH

- Zhejiang TTN Electric Co., Ltd.

- Calcutta Wire Craft

- Elmeridge Cables Limited

- Glenair, Inc.

- Axon Cable SAS

- Nexans

- Thermcraft, Inc.

- Thermax Inc.

- XXX Inc.

Frequently Asked Questions

Balancing Performance and Cost in High-Temperature Resistance Wire are major challenges for the High-Temperature Resistance Wire Market.

The Market size was valued at USD 3.13 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 16% from 2025 to 2032, reaching nearly USD 10.26 Billion.

segments covered in the market report are by Type and Applications.

1. High-Temperature Resistance Wire Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. High-Temperature Resistance Wire Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. High-Temperature Resistance Wire Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.5. End-user Segment

3.2.6. Y-O-Y%

3.2.7. Revenue (2024)

3.2.8. Profit Margin

3.2.9. Market Share

3.2.10. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. High-Temperature Resistance Wire Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. High-Temperature Resistance Wire Market Size and Forecast by Segments (by Value USD Million)

5.1. High-Temperature Resistance Wire Market Size and Forecast, By Type (2024-2032)

5.1.1. Polyurethane Material

5.1.2. Polyvinylidene Fluoride Material

5.1.3. Nylon Material

5.1.4. Others

5.2. High-Temperature Resistance Wire Market Size and Forecast, By Application (2024-2032)

5.2.1. Communications Industry

5.2.2. Automobile Industry

5.2.3. Others

5.3. High-Temperature Resistance Wire Market Size and Forecast, by Region (2024-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America High-Temperature Resistance Wire Market Size and Forecast (by Value USD Million)

6.1. North America High-Temperature Resistance Wire Market Size and Forecast, By Type (2024-2032)

6.1.1. Polyurethane Material

6.1.2. Polyvinylidene Fluoride Material

6.1.3. Nylon Material

6.1.4. Others

6.2. North America High-Temperature Resistance Wire Market Size and Forecast, By Application (2024-2032)

6.2.1. Communications Industry

6.2.2. Automobile Industry

6.2.3. Others

6.3. North America High-Temperature Resistance Wire Market Size and Forecast, by Country (2024-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe High-Temperature Resistance Wire Market Size and Forecast (by Value USD Million)

7.1. Europe High-Temperature Resistance Wire Market Size and Forecast, By Type (2024-2032)

7.2. Europe High-Temperature Resistance Wire Market Size and Forecast, By Application (2024-2032)

7.3. Europe High-Temperature Resistance Wire Market Size and Forecast, by Country (2024-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific High-Temperature Resistance Wire Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific High-Temperature Resistance Wire Market Size and Forecast, By Type (2024-2032)

8.2. Asia Pacific High-Temperature Resistance Wire Market Size and Forecast, By Application (2024-2032)

8.3. Asia Pacific High-Temperature Resistance Wire Market Size and Forecast, by Country (2024-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa High-Temperature Resistance Wire Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa High-Temperature Resistance Wire Market Size and Forecast, By Type (2024-2032)

9.2. Middle East and Africa High-Temperature Resistance Wire Market Size and Forecast, By Application (2024-2032)

9.3. Middle East and Africa High-Temperature Resistance Wire Market Size and Forecast, by Country (2024-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America High-Temperature Resistance Wire Market Size and Forecast (by Value USD Million)

10.1. South America High-Temperature Resistance Wire Market Size and Forecast, By Type (2024-2032)

10.2. South America High-Temperature Resistance Wire Market Size and Forecast, By Application (2024-2032)

10.3. South America High-Temperature Resistance Wire Market Size and Forecast, by Country (2024-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. LEONI

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. American Wire Group

11.3. Dacon Systems

11.4. Totoku Electric

11.5. SAB Cable

11.6. Cole Wire

11.7. Heatsense

11.8. New England Wire Technologies Corp

11.9. Zhejiang Wrlong High-Temperature Wire and Cable

11.10. Omega Engineering, Inc.

11.11. Heraeus Holding GmbH

11.12. Zhejiang TTN Electric Co., Ltd.

11.13. Calcutta Wire Craft

11.14. Elmeridge Cables Limited

11.15. Glenair, Inc.

11.16. Axon Cable SAS

11.17. Nexans

11.18. Thermcraft, Inc.

11.19. Thermax Inc.

11.20. XXX Inc.

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook