Global Green Steel Market 2026–2032 Low-Carbon Steel Transition Driven by EAF Adoption, Hydrogen-Based DRI, and Sustainable Infrastructure Demand

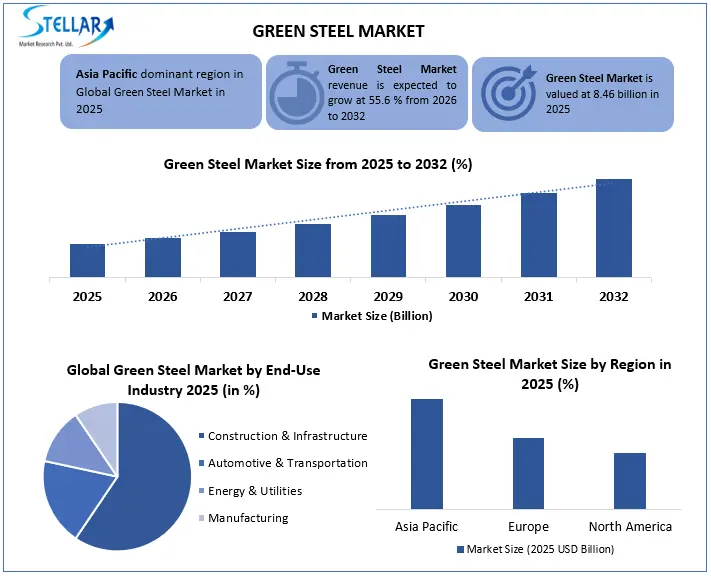

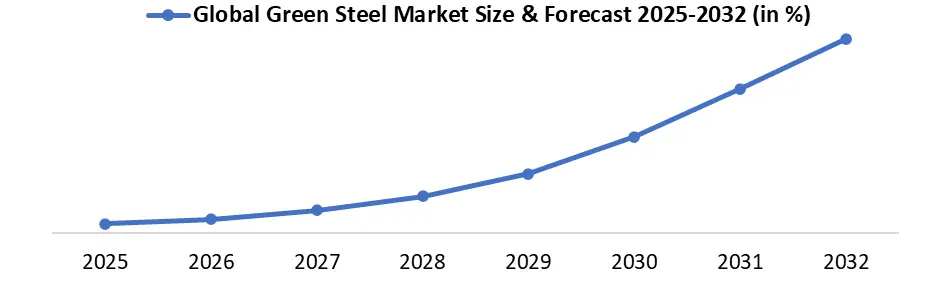

Green Steel Market was valued at USD 8.46 billion in 2025 and is expected to grow at a remarkable CAGR of 55.6%, reaching nearly USD 186.82 billion in 2032, driven by low-carbon steel production, hydrogen-based DRI adoption, and sustainable infrastructure demand.

Format : PDF | Report ID : SMR_2124

The exceptionally high CAGR of 55.6% reflects the Green Steel market’s early-stage base effect, where limited commercial capacity in 2025 is followed by large-scale commissioning of hydrogen-based DRI plants, EAF expansions, and policy-mandated decarbonization investments across Europe, Asia Pacific, and North America. Market growth is further amplified by long-term offtake agreements, green public procurement mandates, and accelerated capital deployment toward low-carbon steel capacity rather than incremental efficiency upgrades.

Green Steel Market: Low-Carbon Shift, Hydrogen Innovation, and Global Growth

Green Steel refers to steel produced with significantly reduced or near-zero carbon emissions through Electric Arc Furnace (EAF) routes using recycled scrap, hydrogen-based direct reduced iron (H?-DRI), biomass-assisted blast furnace processes, or advanced carbon capture technologies. It is positioned as a critical material for decarbonizing construction, automotive, energy, and industrial value chains under net-zero and ESG compliance frameworks.

Global Green Steel Market is rapidly shifting toward low-carbon production through Electric Arc Furnace (EAF) technology and Hydrogen-Based Steel Production (H2 DRI), driven by carbon regulations, energy efficiency gains, and hydrogen policy support. Key opportunities lie in Sustainable Steel for Building and Construction Sector and Low-Carbon Steel for Green Infrastructure Projects, despite high electrolyser costs and limited hydrogen infrastructure. Asia Pacific leads growth with volume-driven growth, while Europe sets policy-driven benchmarks. Adoption of EAF, H2 DRI, and carbon capture technologies is central to competitiveness, investment, and long-term market transformation.

Green Steel Market Key Highlights -

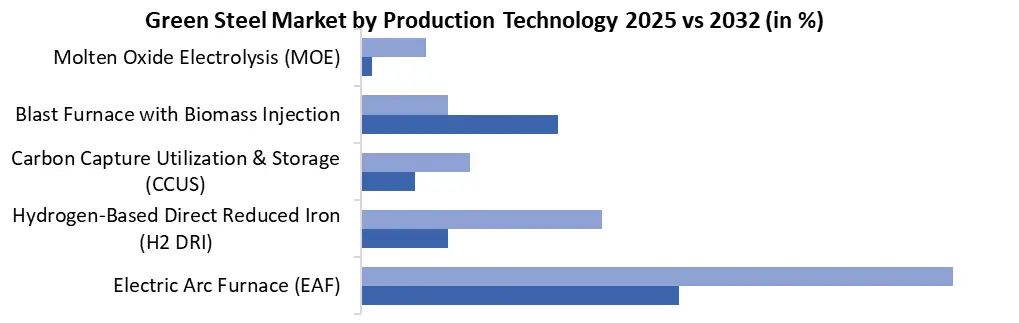

- Structural Technology Shift: By 2032, approximately 54% of new global steelmaking capacity is expected to adopt Electric Arc Furnace (EAF) routes, marking a decisive shift away from BF-BOF dominance.

- Regulatory-Driven Demand: Carbon pricing, CBAM mechanisms, and national decarbonization mandates are accelerating hydrogen-based steel adoption, enabling an estimated reduction of over 20.5 million tonnes of CO? emissions.

- Capital Reallocation Opportunity: Hydrogen-based DRI and low-carbon steel for green infrastructure represent the fastest-scaling investment segments.

- Adoption Constraints: High electrolyser costs (USD 1,400–2,500/kW) and limited green hydrogen infrastructure remain key barriers to rapid commercialization.

- Regional Divergence: Asia Pacific leads in volume-driven growth, while Europe establishes policy-driven and technology-led benchmarks.

To get more Insights: Request Free Sample Report

Green Steel Trends: Rapid Shift Toward EAF and Hydrogen Steel

- As of 2025, nearly 62% of global crude steel production capacity remains based on blast furnace–basic oxygen furnace (BF-BOF) routes, while Electric Arc Furnace (EAF) steelmaking accounts for approximately 29%. By 2032, more than half of all newly commissioned steelmaking capacity is expected to adopt EAF-based routes, driven by recycled steel availability, renewable electricity integration, and tightening emissions regulations.

- By 2032, nearly 54% of new global steelmaking capacity is expected to be developed using Electric Arc Furnace (EAF) Technology in Steel Manufacturing, signalling a rapid transition toward low?carbon steel production aligned with Net?Zero Steel Manufacturing and climate policies.

- Hydrogen-based direct reduced iron (H2-DRI) combined with EAF is emerging as a critical alternative pathway in decarbonized steelmaking, expected to contribute substantially to primary steel production by mid-century. This enables Green Steel Production Using Hydrogen DRI.

Policy Pressure and Hydrogen Investment Boost Green Steel Growth

The steel industry contributes nearly 7% of global CO2 emissions, prompting stringent carbon regulations to incentivize Sustainable Steel Production and enforce compliance through GHG monitoring and reporting.

Energy efficiency initiatives across major steel-producing economies have achieved 5.583 million tonnes of oil equivalent (MTOE) in energy savings, translating into nearly 20.52 million tonnes of CO2 reduction in 2024-2025.

India’s National Green Hydrogen Mission, active through FY 2029-30, has a total budget of nearly USD 2.4 billion, including nearly USD 55 million specifically for pilot hydrogen projects in steel production. This policy support accelerates Hydrogen-Based Steel Production scaling.

Hydrogen Steel Scaling Unlocks Next-Generation Investment Opportunities

Scaling hydrogen-based steelmaking presents a significant investment pathway to decarbonize both the Steel Recycling Industry and primary steel production.

Pilot plants producing 100% hydrogen-based DRI are validating technical feasibility, paving the way for commercial adoption of hydrogen-based processes.

Investment focus includes hydrogen supply chains, electrolyser capacity growth, and integrated facilities targeting Sustainable Steel for Building and Construction Sector markets.

High Hydrogen Costs and Infrastructure Gaps Restrain Green Steel Growth

- High capital expenditure for green hydrogen production remains key constraint electrolyser costs range from USD 1,400 to USD 2,500 per kW, limiting rapid deployment of hydrogen-based green steel plants.

- Limited green hydrogen infrastructure constrains supply chain integration, increasing project complexity and extending payback periods for investors in 2025.

EAF Technology and Green Infrastructure Drive Green Steel Demand

Production Technology Segment

- Electric Arc Furnace (EAF) steelmaking has become a core low-carbon production route by 2025, driven by its compatibility with recycled steel feedstock, renewable electricity integration, and flexible operations. Its increasing deployment reflects industry-wide alignment with Low-Carbon Steel Market objectives and Electric Arc Furnace Technology in Steel Manufacturing as a foundation for decarbonized steel manufacturing.

- EAF routes enable the use of Recycled Steel and renewable energy inputs, reinforcing its role in the Low-Carbon Steel Market.

End-Use Industry Segment

- Demand for green steel in building, construction, and infrastructure is projected to reach 4.49 million tonnes by 2030, with construction contributing 2.52 million tonnes and infrastructure 1.5 million tonnes.

- By 2040, total demand across these sectors is expected to grow to 73.44 million tonnes, reaching 179.17 million tonnes by 2050.

- Construction and infrastructure together account for approximately 78% of finished steel demand, highlighting their key role in green steel adoption.

Green Steel Market Regional Insights

Asia Pacific: It remains the dominant Global Steel Production and consumption hub, supported by large domestic markets, industrial growth, and active policy support for Sustainable Steel Manufacturing. Strategic investments in Hydrogen-Based Steel Production, renewable-powered steelmaking, and modernization of legacy assets position the region as the primary growth engine of the Global Sustainable Steel Market in 2025.

Europe: Advanced regulatory frameworks under the European Green Deal support accelerated adoption of Hydrogen-Based Steel Production and EAF technologies. Europe provides policy and technological benchmarks that guide global decarbonization initiatives.

Breakthrough Technologies and ESG Investments Redefine Green Steel Leadership

- ArcelorMittal: In its 2025 Sustainability Report, the company highlighted production sites achieving low-carbon steel output with low CO2 intensity. It growthed Responsible Steel certification to 42 facilities and invested over USD 1 billion in decarbonization projects, aligning with ESG-Driven Steel Investments.

- Boston Metal: Commissioned Molten Oxide Electrolysis (MOE) industrial cells for near-zero carbon steel, with commercial demonstration plant deployment planned in 2026. MOE represents a breakthrough hydrogen-free electrification approach.

Recent Developments

|

Company |

Year |

Recent Development |

|

ArcelorMittal |

2024 |

Launched HyMatch steel for hydrogen infrastructure and expanded XCarb low-carbon steel certificates; advanced low-carbon projects across hydrogen, biomass, EAF, and carbon capture technologies |

|

HYBRIT |

2024 |

Produced over 5,000 tonnes of hydrogen-reduced iron in pilot operations, demonstrating near-zero CO? emissions and validating industrial feasibility |

|

Boston Metal |

2025 |

Raised funding via convertible note to accelerate Molten Oxide Electrolysis (MOE) commercial deployment and industrial-scale MOE commissioning |

|

H2 Green Steel (Stegra) |

2025 |

Advanced construction and installation of electrolysers and steel production facilities; over 50% of electrolysis modules installed, key structural milestones completed |

Global Green Steel Market Scope:

|

Global Green Steel Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 8.46 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

55.6% |

Market Size in 2032: |

USD 186.82 Billion |

|

Global Green Steel Market Segment Analysis |

By Product Type |

Flat Steel Long Steel Tubes and Pipes |

|

|

By Production Technology |

Electric Arc Furnace (EAF) Hydrogen-Based Direct Reduced Iron (H-DRI) Carbon Capture Utilization and Storage (CCUS) Blast Furnace with Biomass Injection Molten Oxide Electrolysis |

||

|

By End User Industry |

Construction and Infrastructure Automotive and Transportation Energy and Utilities Manufacturing Others |

||

Green Steel Key Players

- Arcelor Mittal

- Boston Metal

- Carbon Re

- Electra

- Emirates Steel Arkan

- GravitHy

- Green Steel Group Inc.

- H2 Green Steel

- Helios

- HYBRIT

- JFE Steel Corporation

- Nippon Steel Corporation

- Nucor Corporation

- POSCO International

- Shougang Group

- Salzgitter AG

- Smart Steel Technologies

- SSAB

- Steel Corporation

- Tata Steel

- Thyssenkrupp Steel

- U.S. Steel Corporation

- Voestalpine AG

- Arvedi

- Outokumpu Oy

- Swiss Steel Group

- Essar Steel

- Riva Group

- Feralpi Group

- Sidenor

Frequently Asked Questions

Asia Pacific leads with volume-driven growth and modernization of legacy steel assets, while Europe sets policy-driven benchmarks and regulatory frameworks.

Key opportunities include hydrogen-based steel production, low-carbon steel for infrastructure, and sustainable steel for the building and construction sector.

High electrolyser costs (USD 1,400–2,500/kW) and limited green hydrogen infrastructure constrain rapid adoption and increase investment payback periods.

1. Green Steel Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Green Steel Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product

2.3.3. End-user

2.3.4. Revenue (2025)

2.3.5. Profit Margin

2.3.6. Revenue Growth

2.3.7. Geographical Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Green Steel Market: Dynamics

3.1. Green Steel Market Trends

3.2. Green Steel Market Dynamics

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Middle East and Africa

3.2.5. South America

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

4. Comparative Analysis of Green Steel and Traditional Steel

4.1. Environmental Impact of Production

4.1.1. CO? emissions per tonne for Green Steel vs. Traditional Steel

4.1.2. Lifecycle emissions assessment of hydrogen-based vs. blast furnace production

4.1.3. Carbon intensity reduction achieved through Recycled Steel Market adoption

4.1.4. Sustainable Inputs vs. Traditional Inputs

4.2. Use of green hydrogen, renewable electricity, and recycled steel in Green Steel

4.2.1. Use of iron ore, coking coal, and fossil boosts in traditional steel

4.2.2. Efficiency improvements and resource optimization in sustainable steel production

4.2.3. Comparative energy consumption per tonne of steel produced

5. Investment Analysis for Green Steel

5.1. Country-wise capital expenditure on Green Steel production technologies

5.2. Funding programs, subsidies, and policy incentives for low-carbon steel

5.3. ROI analysis and payback periods for EAF and hydrogen-based projects

5.4. Strategic investment opportunities in infrastructure, production, and supply chain

5.5. Risk assessment: technology adoption, raw material availability, and regulatory compliance

6. Investment Analysis for Green Steel

6.1. Country-wise capital expenditure on Green Steel production technologies

6.2. Funding programs, subsidies, and policy incentives for low-carbon steel

6.3. ROI analysis and payback periods for EAF and hydrogen-based projects

6.4. Strategic investment opportunities in infrastructure, production, and supply chain

6.5. Risk assessment: technology adoption, raw material availability, and regulatory compliance

7. Green Steel Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

7.1. Green Steel Market Size and Forecast, by Product Type (2025-2032)

7.1.1. Flat Steel

7.1.2. Long Steel

7.1.3. Tubes and Pipes

7.2. Green Steel Market Size and Forecast, by Production Technology (2025-2032)

7.2.1. Electric Arc Furnace (EAF)

7.2.2. Hydrogen-Based Direct Reduced Iron (H-DRI)

7.2.3. Carbon Capture Utilization and Storage (CCUS)

7.2.4. Blast Furnace with Biomass Injection

7.2.5. Molten Oxide Electrolysis

7.3. Green Steel Market Size and Forecast, by End User (2025-2032)

7.3.1. Construction and Infrastructure

7.3.2. Automotive and Transportation

7.3.3. Energy and Utilities

7.3.4. Manufacturing

7.3.5. Others

7.4. Green Steel Market Size and Forecast, by Region (2025-2032)

7.4.1. North America

7.4.2. Europe

7.4.3. Asia Pacific

7.4.4. Middle East and Africa

7.4.5. South America

8. North America Green Steel Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

8.1. North America Green Steel Market Size and Forecast, by Product Type (2025-2032)

8.1.1. Flat Steel

8.1.2. Long Steel

8.1.3. Tubes and Pipes

8.2. North America Green Steel Market Size and Forecast, by Production Technology (2025-2032)

8.2.1. Electric Arc Furnace (EAF)

8.2.2. Hydrogen-Based Direct Reduced Iron (H-DRI)

8.2.3. Carbon Capture Utilization and Storage (CCUS)

8.2.4. Blast Furnace with Biomass Injection

8.2.5. Molten Oxide Electrolysis

8.3. North America Green Steel Market Size and Forecast, by End User (2025-2032)

8.3.1. Construction and Infrastructure

8.3.2. Automotive and Transportation

8.3.3. Energy and Utilities

8.3.4. Manufacturing

8.3.5. Others

8.4. North America Green Steel Market Size and Forecast, by Country (2025-2032)

8.4.1. United States

8.4.2. Canada

8.4.3. Mexico

9. Europe Green Steel Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

9.1. Europe Green Steel Market Size and Forecast, by Product Type (2025-2032)

9.2. Europe Green Steel Market Size and Forecast, by Production Technology (2025-2032)

9.3. Europe Green Steel Market Size and Forecast, by End User (2025-2032)

9.4. Europe Green Steel Market Size and Forecast, by Country (2025-2032)

9.4.1. United Kingdom

9.4.2. France

9.4.3. Germany

9.4.4. Italy

9.4.5. Spain

9.4.6. Sweden

9.4.7. Austria

9.4.8. Rest of Europe

10. Asia Pacific Green Steel Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

10.1. Asia Pacific Green Steel Market Size and Forecast, by Product Type (2025-2032)

10.2. Asia Pacific Green Steel Market Size and Forecast, by Production Technology (2025-2032)

10.3. Asia Pacific Green Steel Market Size and Forecast, by End User (2025-2032)

10.4. Asia Pacific Green Steel Market Size and Forecast, by Country (2025-2032)

10.4.1. China

10.4.2. S Korea

10.4.3. Japan

10.4.4. India

10.4.5. Australia

10.4.6. Indonesia

10.4.7. Malaysia

10.4.8. Vietnam

10.4.9. Taiwan

10.4.10. Rest of Asia Pacific

11. Middle East and Africa Green Steel Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

11.1. Middle East and Africa Green Steel Market Size and Forecast, by Product Type (2025-2032)

11.2. Middle East and Africa Green Steel Market Size and Forecast, by Production Technology (2025-2032)

11.3. Middle East and Africa Green Steel Market Size and Forecast, by End User (2025-2032)

11.4. Middle East and Africa Green Steel Market Size and Forecast, by Country (2025-2032)

11.4.1. South Africa

11.4.2. GCC

11.4.3. Egypt

11.4.4. Nigeria

11.4.5. Rest of ME&A

12. South America Green Steel Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

12.1. South America Green Steel Market Size and Forecast, by Product Type (2025-2032)

12.2. South America Green Steel Market Size and Forecast, by Production Technology (2025-2032)

12.3. South America Green Steel Market Size and Forecast, by End User (2025-2032)

12.4. South America Green Steel Market Size and Forecast, by Country (2025-2032)

12.4.1. Brazil

12.4.2. Argentina

12.4.3. Chile

12.4.4. Colombia

12.4.5. Rest Of South America

13. Company Profile: Key Players

13.1. Arcelor Mittal

13.1.1. Company Overview

13.1.2. Business Portfolio

13.1.3. Financial Overview

13.1.4. SWOT Analysis

13.1.5. Strategic Analysis

13.1.6. Recent Developments

13.2. Boston Metal

13.3. Carbon Re

13.4. Electra

13.5. Emirates Steel Arkan

13.6. GravitHy

13.7. Green Steel Group Inc.

13.8. H2 Green Steel

13.9. Helios

13.10. HYBRIT

13.11. JFE Steel Corporation

13.12. Nippon Steel Corporation

13.13. Nucor Corporation

13.14. POSCO International

13.15. Shougang Group

13.16. Salzgitter AG

13.17. Smart Steel Technologies

13.18. SSAB

13.19. Steel Corporation

13.20. Tata Steel

13.21. Thyssenkrupp Steel

13.22. U.S. Steel Corporation

13.23. Voestalpine AG

13.24. Arvedi

13.25. Outokumpu Oy

13.26. Swiss Steel Group

13.27. Essar Steel

13.28. Riva Group

13.29. Feralpi Group

13.30. Sidenor

14. Key Findings

15. Industry Recommendations

16. Green Steel Market: Research Methodology