Foldable Smartphone Market - Global Industry Analysis and Forecast (2025-2032) by Material, Product and Application

The Foldable Smartphone Market size was valued at USD 34.59 Bn. in 2024 and the total Global Foldable Smartphone revenue is expected to grow at a CAGR of 24.9% from 2025 to 2032, reaching nearly USD 204.89 Bn.

Format : PDF | Report ID : SMR_1632

Foldable Smartphone Market Overview

Foldable smartphones are innovative mobile devices having a flexible display that bends or folds, giving users the option to neatly fold the device for small storage or increase the screen size when needed. With a more compact form factor for portability and a larger display for improved entertainment and productivity, this design offers a flexible user experience. Thanks to the introduction of models with both inward and outward folding mechanisms by multiple manufacturers, the market for foldable smartphones has experienced substantial growth. Prominent firms in this field, such as Huawei, are influencing the growing global acceptance of foldable cell phones.

The Foldable Smartphone Market is influenced by several factors such as Addressing pricing and durability concerns, the increase in the need for robust engineering and durable materials, the desire for a unique blend of portability and expanded screen real estate, and many more. The Foldable Smartphone Market is primarily driven by certain factors like the Development of Flexible display technology, the Increase in screen real estate compared to traditional smartphones, and continuous technological advancements. Though the Foldable Smartphone Market is experiencing significant growth with a CAGR of 24.9%, it still faces some restraints because of its high manufacturing cost, app ecosystem Optimization, and tough competition from traditional smartphones. The Foldable Smartphone Market is segmented based on Type and Application.

North America is dominating the Foldable Smartphone Market with a substantial market share of about 36%, due to its consumer base that is tech-savvy and that has a strong desire for cutting-edge mobile technologies. With an emphasis on the US, there is a sizable market for foldable cell phones in that country. With users eager to embrace smartphones that combine portability and increased screen real estate, the region's developed smartphone market offers an optimal setting for the spread of foldable smartphones. Europe is a major player in the foldable smartphone market, with a consumer base that values high-end features and design. The region is a lucrative market for foldable smartphones because of its developed smartphone market and propensity for high-tech devices. When it comes to the APAC region, the major contributor to the growth of the foldable smartphone market, are China and Indonesia offering enormous market potential due to their tech-savvy populations' active search for handsets with cutting-edge features and experiences. Some of the major key players in the Foldable Smartphone Market are Samsung, Huawei, BOE, Apple Inc., and Google.

To get more Insights: Request Free Sample Report

Foldable Smartphone Market Dynamics

Development of flexible display technology- One key element fuelling the market for foldable smartphones is the advancement of flexible display technology. The performance of flexible displays, which are usually made with flexible OLED (Organic Light-Emitting Diode) technology, is preserved even when the screens bend and fold. The Global flexible OLED market size reached USD 4.48 billion in 2021 with a CAGR of 41.2%. A new age of design possibilities has been brought about by this discovery, which allows smartphones to change from their conventional slab-like forms into foldable, compact gadgets. The flexible display technology offers versatility by offering consumers a unique and adaptable experience. Also, when the gadget is folded, the foldable displays give a more compact design, improving portability. The technology improves user experience by enabling multitasking and innovative use cases.

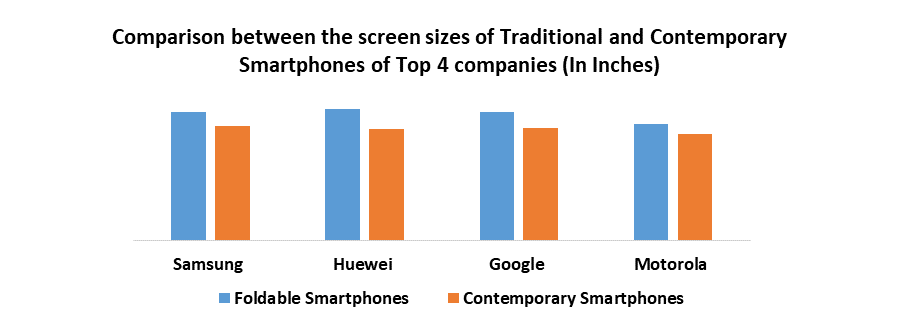

Increase in Screen real estate compared to traditional smartphones- One of the main factors propelling the foldable smartphone market is the increased screen real estate when compared to regular smartphones. Larger screens on foldable smartphones offer greater space for consuming content, improving the enjoyment of activities like gaming, watching videos, and web browsing. Over time, there has been a discernible rise in the size of cell phone screens; the average size of the screen of a foldable smartphone ranges from 6.5-7.5 inches whereas, the average screen size of a contemporary phone ranges around 6.2 inches. Because of the larger screens on foldable smartphones, users experience a range of content with greater clarity and detail thanks to a unique blend of portability and enlarged screen real estate.

Manufacturing Cost- the complications in design and the need for highly developed engineering solutions lead to potential manufacturing issues that ultimately impact the market's stability. Building a smartphone requires complex processes and specialized constituents like flexible displays such as the use of flexible OLED technology. The OLED technology is estimated to cost 1.4 times higher than the corresponding combination of displays. Also, the R&D required for these devices further contributes to the total inclusive expenses. The average cost required to make the Galaxy Z Fold 4 a high-end product in the segment, is 670 US Dollars to manufacture for each unit.

|

Company |

Model Name |

Cost of manufacturing one Unit (In Dollars) |

|

Samsung |

Galaxy Z Fold 4 |

670 USD |

|

Motorola |

Motorola Razr 40 |

XX USD |

|

Huawei |

Mate Xs 2 |

XX USD |

|

|

Pixel Fold |

XX USD |

App Ecosystem Optimization- The market for foldable smartphones is largely constrained by the optimization of the app ecosystem. The seamless user experience and overall functioning and appeal of foldable smartphones are negatively impacted by the fact that not all applications are built to make use of the unique form factor of these devices. The user experience suffer as a result of incompatibility problems, subpar performance, and restricted usefulness caused by a dearth of apps tailored for foldable devices. When consumers see no benefit in buying a foldable smartphone since their apps are not suited for the device, this also diminish their interest in the product.

Competition from Traditional Smartphones- One of the main factors holding back the market for foldable smartphones is competition from Traditional smartphones. Foldable smartphones face competition from traditional smartphones, as they still hold a dominant market share. Customers prefer well-known designs over cutting-edge but comparatively unproven foldable versions. The more well-known and established form factor of traditional smartphones functions as a barrier to the adoption of foldable devices. Conventional smartphones are frequently less expensive than foldable smartphones, which is a big deal for budget-conscious customers. For instance, the average cost of a traditional smartphone ranges around 364 USD, whereas the average cost of a Foldable Smartphone ranges between 700 USD to 1800 USD.

Foldable Market Segmentation

Display Panel Type, The flip and foldable smartphone markets are divided into two segments based on the type of display panel. The fold category, which is expected to develop at the fastest rate throughout the projected time frame, is expected to trail the most popular flip category in terms of popularity. Because flip smartphones are less expensive than foldable smartphones, they have the largest market share. Because of the quickly rising demand for contemporary consumer electronics and the widespread use of mobile devices in the entertainment and gaming industries, the fold category is predicted to develop at the fastest rate.

Sales Channel, the Foldable Smartphone segment is divided into online and offline segments with Online sales dominating the market share due to consumers growing preference towards Online shopping. Offline sales continue to play a pivotal role in the Foldable Smartphone market with it promising potential over the year. For instance, in India, the online channel holds a significant share of 58% of the total smartphone sales which reached its peak in the year 2024. Also, With a projected CAGR of 24% between 2025 and 2032, the global foldable smartphone market, including online sales, reached about USD 25.34 billion in 2023.

Type, the Foldable Smartphone Market is segmented by type in two components Inward fold and Outard fold. The Inward Fold is currently dominating the market share and is expected to reach a market share of 53% by the year 2032, showing a substantial preference from consumers for the folding mechanism. The flip category is considered to be the leading display type for Foldable Smartphones.

Competitive Landscape of the Foldable Smartphone Market

The Foldable Smartphone market is highly competitive, with several key players operating in the industry. Some of the Key players dominating the market include Samsung, Huawei, Google, LG Electronics, Microsoft, Motorola, Royole, SONY, TCL, Lenovo, and Asus. By making R&D investments, and introducing new technologies and innovative solutions, these corporations are concentrating on growing their market share. For instance,

Samsung- Samsung has witnessed significant adoption of its Galaxy foldable smartphones, especially in the enterprise sector, reflecting a strong market presence with over 60% of the total market share and a constant increase in demand. With devices like the Galaxy Fold and Galaxy Flip, Samsung hopes to take 50% of the super-premium smartphone market in India, demonstrating a deliberate investment emphasis in a vital market.

Huawei- Huawei has been making investments in the creation and introduction of new kinds of foldable smartphones. With a self-developed 5G Kirin chip, the company debuted a new flip-foldable smartphone in February, highlighting its commitment to innovation and cutting-edge technology. Huawei is still the market leader for smartphones in China having a market share of 57%, a sign of its strength and ongoing commitment to making investments to retain its competitiveness at home. Huawei has demonstrated its dedication to improving technology and exploring new form factors by unveiling a 10-inch tri-folding smartphone that pushes the boundaries of innovation.

Motorola- A revamped Razr model will be part of Motorola's 2024 product lineup, demonstrating the company's dedication to design and innovation in the foldable smartphone market. The company's study into incorporating artificial intelligence (AI) capabilities into its smartphones is a calculated step in the direction of improving user experience and technological innovation. Motorola has demonstrated its commitment to offering a competitive and wide range of foldable smartphones by releasing a detailed roadmap for 2024 that includes plans for the flagship X series and the Moto Razr 2024.

|

Foldable Smartphone Market Scope |

|

|

Market Size in 2024 |

USD 34.59 Bn |

|

Market Size in 2032 |

USD 204.89 bn |

|

CAGR (2025-2032) |

24.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Display Panel type

|

|

By Sales Channel

|

|

|

By End-User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Foldable Smartphone Key Players

Frequently Asked Questions

There are 2 major types of Foldable Smartphone Market, namely; Inward Fold and Outward Fold.

Include Samsung, Huawei, Google, LG Electronics, Microsoft, Motorola, Royole, SONY, TCL, Lenovo, and Asus.

North America holds the largest market share in Foldable Smartphone Market.

24.9% CAGR is the growth rate of the Foldable Smartphone Market.

1. Foldable Smartphone Market: Research Methodology

2. Foldable Smartphone Market: Executive Summary

3. Foldable Smartphone Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Foldable Smartphone Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Foldable Smartphone Market Size and Forecast by Segments (by Value)

5.1. Foldable Smartphone Market Size and Forecast, by By Display Panel type (2024-2032)

5.1.1. Flip

5.1.2. Fold

5.2. Foldable Smartphone Market Size and Forecast, by By Sales Channel (2024-2032)

5.2.1. Online

5.2.2. Offline

5.3. Foldable Smartphone Market Size and Forecast, by By Type(2024-2032)

5.3.1. Inward Fold

5.3.2. Outward Fold

5.4. Foldable Smartphone Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Foldable Smartphone Market Size and Forecast (by Value)

6.1. North America Foldable Smartphone Market Size and Forecast, by By Display Panel type (2024-2032)

6.1.1. Flip

6.1.2. Fold

6.2. North America Foldable Smartphone Market Size and Forecast, by By Sales Channel (2024-2032)

6.2.1. Online

6.2.2. Offline

6.3. North America Foldable Smartphone Market Size and Forecast, by By Type(2024-2032)

6.3.1. Inward Fold

6.3.2.Outward Fold

6.4. North America Foldable Smartphone Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Foldable Smartphone Market Size and Forecast (by Value)

7.1. Europe Foldable Smartphone Market Size and Forecast, by By Display Panel type (2024-2032)

7.1.1. Flip

7.1.2. Fold

7.2. Europe Foldable Smartphone Market Size and Forecast, by By Sales Channel (2024-2032)

7.2.1. Online

7.2.2. Offline

7.3. Europe Foldable Smartphone Market Size and Forecast, by By Type(2024-2032)

7.3.1. Inward Fold

7.3.2. Outward Fold

7.4. Europe Foldable Smartphone Market Size and Forecast, by Country (2024-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Foldable Smartphone Market Size and Forecast (by Value)

8.1. Asia Pacific Foldable Smartphone Market Size and Forecast, by By Display Panel type (2024-2032)

8.1.1. Flip

8.1.2. Fold

8.2. Asia Pacific Foldable Smartphone Market Size and Forecast, by By Sales Channel (2024-2032)

8.2.1. Online

8.2.2. Offline

8.3. Asia Pacific Foldable Smartphone Market Size and Forecast, by By Type(2024-2032)

8.3.1. Inward Fold

8.3.2. Outward Fold

8.4. Asia Pacific Foldable Smartphone Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. South Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Foldable Smartphone Market Size and Forecast (by Value)

9.1. Middle East and Africa Foldable Smartphone Market Size and Forecast, by By Display Panel type (2024-2032)

9.1.1. Flip

9.1.2. Fold

9.2. Middle East and Africa Foldable Smartphone Market Size and Forecast, by By Sales Channel (2024-2032)

9.2.1. Online

9.2.2. Offline

9.3. Middle East and Africa Foldable Smartphone Market Size and Forecast, by By Type(2024-2032)

9.3.1. Inward Fold

9.3.2. Outward Fold

9.4. Middle East and Africa Foldable Smartphone Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Foldable Smartphone Market Size and Forecast (by Value)

10.1. South America Foldable Smartphone Market Size and Forecast, by By Display Panel type (2024-2032)

10.1.1. Flip

10.1.2. Fold

10.2. South America Foldable Smartphone Market Size and Forecast, by By Sales Channel (2024-2032)

10.2.1. Online

10.2.2. Offline

10.3. South America Foldable Smartphone Market Size and Forecast, by By Type(2024-2032)

10.3.1. Inward Fold

10.3.2. Outward Fold

10.4. South America Foldable Smartphone Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Samsung

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Motorola

11.3. Royole

11.4. Apple

11.5. Xiaomi

11.6. Oppo

11.7. Google

11.8. Sony

11.9. TCL

11.10. Lenovo

11.11. ZTE

11.12. Asus

11.13. Nokia

11.14. Sharp

11.15. OnePlus

11.16. Vivo

11.17. Alcatel

12. Key Findings

13. Industry Recommendation