FMCG Logistic Market Global Industry Analysis and Forecast (2026-2032)

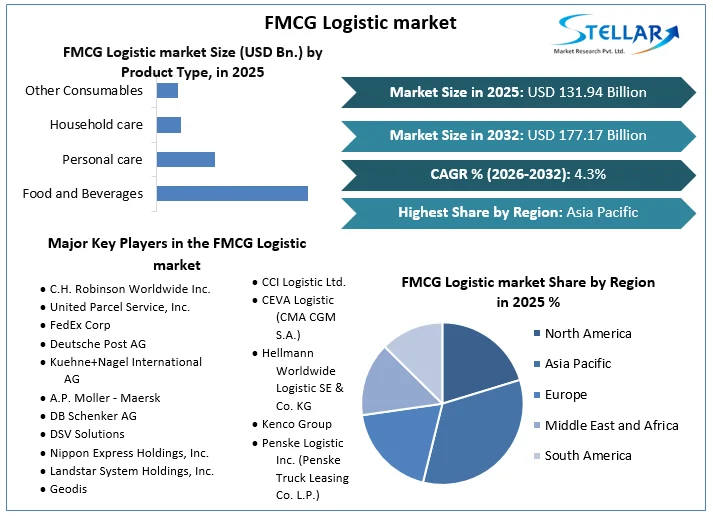

The global FMCG Logistic market size was valued at USD 131.94 Billion in 2025. The market is expected to grow at a CAGR of 4.3% during the forecast period from 2026-2032, reaching nearly USD 177.17 Billion by 2032.

Format : PDF | Report ID : SMR_2470

FMCG Logistic Market Overview

Fast moving consumer goods (FMCG) are the product that have low durability and fast revenue rate due to high customer demand. Logistic is the process of moving items like Food & beverages, goods, materials and other products from one location to another location or stores. The FMCG industry include various products like food & beverages, cosmetics, cleaning & personal hygiene care, medicines and household cares. Efficient logistics processes are crucial for the high turnover rate of FMCG products, which require flexible logistics process to meet the customer demand.

FMCG Logistic market is driven by the factors like rapid growth of E-commerce, transformation of consumer preferences and habits and rise in Retail industry. Poor infrastructure & higher Logistic costs and lack of control of manufacturers and retailers on Logistic service are obstacles to the growth of the market. Asia-Pacific is a dominating market for FMCG Logistic in 2024, driven by population growth, urbanization, and rising disposable incomes.

In North America, the FMCG Logistic market is mature and highly competitive, as the region benefits from advanced infrastructure like extensive roadways and railways. The major key players like FedEx, Deutsche Post AG, Kuehne + Nagel International AG, Bollore Logistic, and C.H. Robinson play important roles in FMCG Logistic, offering wide supply chain solutions worldwide C.H. Robinson have a wide customer base across various industries, including retail, automotive, food and beverage, and industrial manufacturing. Its reputation for reliability, flexibility, and personalized service supports strong customer relationships. In the FMCG Logistic market, factors like infrastructure development, regulatory compliance, technological adoption, and consumer behaviour trends significantly influence market dynamics.

To get more Insights: Request Free Sample Report

FMCG Logistic Market Dynamics

E-commerce transforms retail, offering inventory updates, delivery tracking, and direct-to-consumer sales.

In E-commerce the growing trend like D2C model, where FMCG companies sell products directly to customers through online platforms, driving the FMCG logistics market. Online grocery stores and retailers such as Big Basket, Flipkart, and Amazon offer FMCG (fast-moving consumer goods) products with big discounts, festive season sales, and same-day delivery. Additionally, platforms like Flipkart and Amazon have started offering FMCG items in their grocery sections. This collaboration between retail companies, e-commerce platforms, and Logistic providers helps speed up deliveries and cut costs, boosting market growth. As the E-commerce industry continues to expand, optimized logistics becomes an increasingly vital consideration for today’s retails leaders. By staying up to date with ecommerce logistics trends and continuously finding ways to optimize operations, retailers can keep their customers satisfied while setting themselves up for sustainable growth and success in the market.

Online shopping, rising disposable incomes, and urbanization boost demand for personal care and food products.

Consumers used to buy products by visiting stores, but now they prefer to order through online platforms. Additionally, the COVID-19 pandemic rise the adoption of online shopping, as more consumers avoid to visit the physical stores. The rising awareness of personal care, health and hygiene products, and cosmetics has raised consumer goods sales. Growing disposable incomes, changing lifestyles and preferences, and increased purchasing power also benefit the market. Additionally, urbanization and the expansion of modern retail drive food and beverage consumption. The growing awareness of digital payment methods and improved internet structure have made online shopping more accessible and convenient. Social media and influencer marketing play a significant role in making consumer selections and driving online sales. These trends are expected to increase up to 20-30% demand for consumer goods and create significant opportunities for the FMCG Logistic market.

FMCG Logistic Market Opportunities

The rise in home delivery offers Logistic companies growth opportunities through technology, innovation, and enhanced delivery services.

The trend towards home delivery is growing because it's convenient and allows people to shop and pay the prices from home, this shift offers big opportunities for Logistic companies. They need efficient systems to handle high order volumes and ensure fast, safe deliveries. Investments in such a technologies like automated warehouses and drones are helping manage this demand. Offering services such as same-day and contactless delivery improve the customer satisfaction and loyalty. As consumer expectations evolve, Logistic providers are embracing opportunities to innovate and expand their capabilities in the dynamic e-commerce landscape. Overall, the rise in home delivery is a major opportunity for Logistic providers to grow by meeting increasing consumer expectations.

FMCG Logistic Market challenges

Evolving consumer preferences and demand for faster delivery pose challenges for FMCG Logistics

The challenge faced by the FMCG Logistic market is the changing consumer preferences for delivery services, further complicates the FMCG distribution. Consumer preferences are constantly evolving due to various factors such as Urbanization, changing lifestyles and increased awareness of sustainability and health consciousness. Shareholders need to upgrade their related products, such as packaging and labeling, according to consumer demand. Additionally, creating innovative products could be beneficial in this condition. Consumers now expect quicker delivery times due to the convenience and efficiency offered by e-commerce platforms. They often prefer same-day or next-day delivery options, especially for perishable goods and daily essentials.

FMCG Logistic Market Segment analysis

By Product type

The segment of food and beverages is expected to hold the largest market share during the forecast period 2026-2032. The food and beverage segment of the market for fast-moving consumer goods is driven by the increasing disposable income, multicultural working, and population growth. The habit to eat healthily has been a significant factor in expanding the food and beverage industry. Consumers are becoming increasingly health-conscious, and a growing number of individuals have adopted special diets and wish to enjoy these healthier options at home and in restaurant as well. This increased demand for high-quality consumables expands the global FMCG Logistic market demand.

The personal care segment will hold the second-largest share. The importance of personal care and hygiene in the lives of men and women in various parts of the world has increased in popularity over the past decade. Rising disposable income, expanding middle-class aspirational spending, and a desire for higher-quality products have been the most influential factors in the global demand for personal care and hygiene products.

By Transportation Type

The segment of roadways will hold most of the share during the forecast period. Roadways involve the movement of goods from one location to another via roads. The most frequently utilized mode of Logistic transit is roadway transport. Compared to other transportation modes, such as rail and air, Logistic transportation by roadways requires a low capital investment. This results in the formation of new businesses and increases the segment's market presence. In addition, an increase in the import and export of goods and materials is expected to launch the FMCG Logistic market on the roadways.

The waterways segment will hold the second-largest share. Waterways refer to transporting goods or products by watercraft such as a boat, ship, or sailboat across sea, ocean, canal, or river. Water is the cheapest and oldest mode of transportation. The initiation of containerization has significantly change the waterways Logistic industry. The FMCG Logistic market growth has been influenced by the popularity of containerization and the expansion of new ports. In addition, new technological advancements, such as machine-to-machine communication, have radically altered waterway transport, which is anticipated to increase demand for waterways Logistic transport.

FMCG Logistic Market Regional Insights

Regionally market is divided into the North America, Europe, Asia pacific, Middle East and Africa and South America.

Asia Pacific dominated the FMCG Logistic market in 2025 and expected to grow during the forecast period 2026-2032.The fast-moving consumer goods (FMCG) industry in the Asia-Pacific region is a large market covers food, beverages, cosmetics, personal and home care, and other. FMCG Logistic market contain the storage, warehousing, and value-added services provide to FMCG companies by Logistic vendors. Changing lifestyle, consumer preferences and ease of access are the key growth drivers for the consumer goods industry. To accomplish the demand of customer, FMCG companies require highly efficient, flexible and sustainable global supply chains services from logistic service providers.

North America held the second largest share in the FMCG market in 2025, due to the growing e-commerce sector and online trend of shopping. FMCG logistic market is increasing in this region as a result of electrical vehicles use for the delivering orders in urban areas like private residence. Logistic and suppliers are upgrading their systems with the integration of AI, the Internet of Things, and block chains to improve supply visibility and reduce costs.

FMCG Logistic Market Competitive Landscape

Key players of the FMCG Logistic market such as, C.H. Robinson Worldwide Inc., United Parcel Service, Inc., FedEx Corp, and Deutsche Post AG, Kuehne + Nagel International AG, Bollore Logistic and others. FedEx Express is one of the world's largest express transportation companies, providing fast and well organised delivery services to more than 220 countries. FedEx is known for its reliable and speedy services and has a good brand image. FedEx uses the worldwide airways and the roadways for speedy shipment of delivery. FedEx faces challenges in maintaining competitive pricing while investing in technology and infrastructure upgrades. FedEx offers a wide range of services including express shipping, ground shipping, freight services, and Logistic solutions. Its service portfolio of transportation to both individual consumers and large Businesses. To improve the efficiency and customer experience FedEx has invested in technologies like advanced order tracking tools, route optimization, and Logistic management tools.

C.H. Robinson is a leading third-party Logistic provider known for its large network of transportation and Logistics services. It operates worldwide and offers a vast range of supply chain solutions, including freight transportation, Logistic outsourcing, and technology-based services. C.H. Robinson provides customised logistic solutions to meet the specific needs of its large customer base. Its services include truckload, less-than-truckload (LTL), intermodal, air, and ocean freight forwarding, as well as customs brokerage and supply chain consulting. C.H. Robinson leverages advanced technology platforms, such as its proprietary Navisphere system, for real-time visibility, shipment tracking, and supply chain optimization. This enhances operational efficiency and customer satisfaction.

|

FMCG Logistic Market Scope |

|

|

Market Size in 2025 |

USD 131.94 Billion |

|

Market Size in 2032 |

USD 177.17 Billion |

|

CAGR (2026-2032) |

4.3% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Product Type

|

|

By Service Type

|

|

|

By Mode Of transportation

|

|

Key Regions

North America- United States, Canada, and Mexico

Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe

Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC

Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa

South America – Brazil, Argentina, Rest of South America

FMCG Logistic market Key Players

- C.H. Robinson Worldwide Inc.

- United Parcel Service, Inc.

- FedEx Corp

- Deutsche Post AG

- Kuehne+Nagel International AG

- A.P. Moller - Maersk

- DB Schenker AG

- DSV Solutions

- Nippon Express Holdings, Inc.

- Landstar System Holdings, Inc.

- Geodis

- Xpo Logistic, Inc.,

- Geodis

- CCI Logistic Ltd.

- CEVA Logistic (CMA CGM S.A.)

- Hellmann Worldwide Logistic SE & Co. KG

- Kenco Group

- Penske Logistic Inc. (Penske Truck Leasing Co. L.P.)

- Rhenus Group, SIMARCo Worldwide Logistic Ltd

- Gefco S.A.

- Agility Goods

- Bollore Logistic

- FM Logistic

- Others

Frequently Asked Questions

Asia Pacific dominated the FMCG Logistic Market in 2025.

The FMCG market is divided by mode transportation, product type and regions.

DHL Group, Kuehne + Nagel, C.H. Robinson and FedEx Corporation are the major companies operating in the FMCG Logistic Market.

1. FMCG Logistic Market: Research Methodology

2. FMCG Logistic Market: Competitive Landscape

2.1. Stellar Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Consolidation of the Market

3. FMCG Logistic Market: Executive Summary

4. FMCG Logistic Market: Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Market Opportunities

4.4. Market Challenges

4.5. Regulatory Landscape by Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. FMCG Logistic Market Size and Forecast by Segments (by Value USD Billion)

5.1. FMCG Logistic Market Size and Forecast, by Product Type (2025-2032)

5.1.1. Food and Beverages

5.1.2. Personal care

5.1.3. Household care

5.1.4. Other Consumables

5.2. FMCG Logistic Market Size and Forecast, by Service Type (2025-2032)

5.2.1. Transportation

5.2.2. Warehousing

5.2.3. Value added services

5.3. FMCG Logistic Market Size and Forecast, by Mode of Transportation (2025-2032)

5.3.1. Railways

5.3.2. Airways

5.3.3. Roadways

5.4. FMCG Logistic Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America FMCG Logistic Market Size and Forecast (by Value USD Billion)

6.1. North America FMCG Logistic Market Size and Forecast, by Product Type (2025-2032)

6.1.1. Food and Beverages

6.1.2. Personal care

6.1.3. Household care

6.1.4. Other Consumables

6.2. North America FMCG Logistic Market Size and Forecast, by Service Type (2025-2032)

6.2.1. Transportation

6.2.2. Warehousing

6.2.3. Value added services

6.3. FMCG Logistic Market Size and Forecast, by Mode of Transportation (2025-2032)

6.3.1. Railways

6.3.2. Airways

6.3.3. Roadways

6.4. North America FMCG Logistic Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe FMCG Logistic Market Size and Forecast (by Value USD Billion)

7.1. Europe FMCG Logistic Market Size and Forecast, by Product Type (2025-2032)

7.1.1. Food and Beverages

7.1.2. Personal care

7.1.3. Household care

7.1.4. Other Consumables

7.2. Europe FMCG Logistic Market Size and Forecast, by Service Type (2025-2032)

7.2.1. Transportation

7.2.2. Warehousing

7.2.3. Value added services

7.3. Europe FMCG Logistic Market Size and Forecast, by Mode of Transportation (2025-2032)

7.3.1. Railways

7.3.2. Airways

7.3.3. Roadways

7.4. Europe FMCG Logistic Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific FMCG Logistic Market Size and Forecast (by Value USD Billion)

8.1. Asia Pacific FMCG Logistic Market Size and Forecast, by Product Type (2025-2032)

8.1.1. Food and Beverages

8.1.2. Personal care

8.1.3. Household care

8.1.4. Other Consumables

8.2. Asia Pacific FMCG Logistic Market Size and Forecast, by Service Type (2025-2032)

8.2.1. Transportation

8.2.2. Warehousing

8.2.3. Value added services

8.3. Asia Pacific FMCG Logistic Market Size and Forecast, by Mode of Transportation (2025-2032)

8.3.1. Railways

8.3.2. Airways

8.3.3. Roadways

8.4. Asia Pacific FMCG Logistic Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa FMCG Logistic Market Size and Forecast (by Value USD Billion)

9.1. Middle East and Africa FMCG Logistic Market Size and Forecast, by Product Type (2025-2032)

9.1.1. Food and Beverages

9.1.2. Personal care

9.1.3. Household care

9.1.4. Other Consumables

9.2. Middle East and Africa FMCG Logistic Market Size and Forecast, by Service Type (2025-2032)

9.2.1. Transportation

9.2.2. Warehousing

9.2.3. Value added services

9.3. Middle East and Africa FMCG Logistic Market Size and Forecast, by Mode of Transportation (2025-2032)

9.3.1. Railways

9.3.2. Airways

9.3.3. Roadways

9.4. Middle East and Africa FMCG Logistic market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of MEA

10. South America FMCG Logistic Market Size and Forecast (by Value USD Billion)

10.1. South America FMCG Logistic Market Size and Forecast, by Product Type (2025-2032)

10.1.1. Food and Beverages

10.1.2. Personal care

10.1.3. Household care

10.1.4. Other Consumables

10.2. South America FMCG Logistic Market Size and Forecast, by Service Type (2025-2032)

10.2.1. Transportation

10.2.2. Warehousing

10.2.3. Value added services

10.3. South America FMCG Logistic Market Size and Forecast, by Mode of Transportation (2025-2032)

10.3.1. Railways

10.3.2. Airways

10.3.3. Roadways

10.4. South America FMCG Logistic Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Mexico

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. C.H. Robinson Worldwide Inc.

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. United Parcel Service, Inc.

11.3. FedEx Corp

11.4. Deutsche Post AG

11.5. Kuehne+Nagel International AG

11.6. A.P. Moller - Maersk

11.7. DB Schenker AG

11.8. DSV Solutions

11.9. Nippon Express Holdings, Inc.

11.10. Landstar System Holdings, Inc.

11.11. Geodis

11.12. Xpo Logistic, Inc.,

11.13. Geodis

11.14. CCI Logistic Ltd.

11.15. CEVA Logistic (CMA CGM S.A.)

11.16. Hellmann Worldwide Logistic SE & Co. KG

11.17. Kenco Group

11.18. Penske Logistic Inc. (Penske Truck Leasing Co. L.P.)

11.19. Rhenus Group, SIMARCo Worldwide Logistic Ltd

11.20. Gefco S.A.

11.21. Agility Goods

11.22. Bollore Logistic

11.23. FM Logistic

12. Key Findings

13. Industry Recommendations