Electric Vehicle Traction Motor Market: Industry Analysis and Forecast (2025-2032)

The Electric Vehicle Traction Motor Market size was valued at USD 15.21 Bn. in 2024 and the total market is expected to grow at a CAGR of 15 % from 2025 to 2032, reaching nearly USD 46.54 Bn. by 2032.

Format : PDF | Report ID : SMR_1762

Electric Vehicle Traction Motor Market Overview

A traction motor is an electric motor used in vehicles such as trains, EVs, and HEVs to provide propulsion. It delivers torque to the wheels or axles, enabling movement, and is designed for high efficiency and power density, making it a crucial component in modern vehicle powertrains.

- The top three exporters of traction motors are the Netherlands, Germany & France.

The report from Stellar Market Research presents a thorough analysis of the Electric Vehicle Traction Motor Market, focusing on predicting market growth trends and offering valuable insights into the value chain and supply chain dynamics. The market scope includes opportunities in new product development and advancements in formulation technologies, which propel market growth and innovation. Through quantitative research methods, the report offers statistical data on the effectiveness of Electric Vehicle Traction motors in various applications and their impact on market trends. Competitive intelligence analysis aids in comprehending market dynamics, competitor strategies, and customer perceptions, empowering market players to gain a competitive advantage in the global Electric Vehicle Traction Motor Market.

The electric traction market is experiencing rapid expansion, fueled by increasing acceptance of e-mobility and heightened environmental concerns. This growth is particularly evident in the railway industry, where investments are on the rise. Factors such as subsidies, governmental policies favoring electric transportation, emission standards, and environmental regulations further drive market growth. The growing demand for energy-efficient motors, driven by the need for vehicles with lower maintenance and higher energy savings, is a significant driver.

Key players play a crucial role in driving innovation and improving product efficacy, underscoring the importance of targeted strategies to meet evolving consumer demands. The report highlights the significance of import and export activities in the Electric Vehicle Traction Motor Market, ensuring continuous transactions between suppliers and end-users. Additionally, the analysis evaluates the cost-profit ratio, assessing companies' financial capabilities for investing in research and development to introduce new products or enhance existing ones.

The report also offers an extensive evaluation of Porter's five forces analysis and SWOT analysis to furnish appropriate business insights. Porter's five forces model aids in understanding the competitive landscape, while the SWOT analysis identifies market attributes influencing company growth and sustainability in the long term.

To get more Insights: Request Free Sample Report

Electric Vehicle Traction Motor Market Dynamics

Increasing Adoption of Electric Vehicles

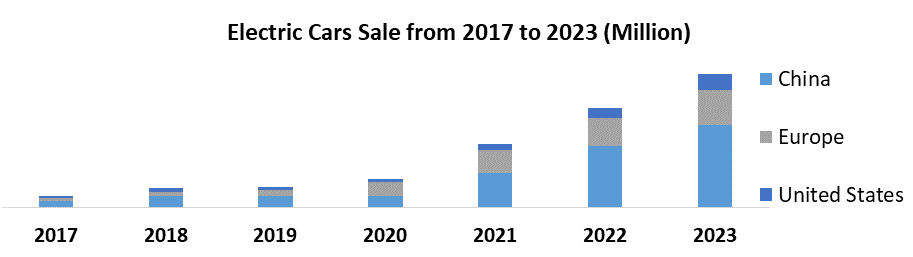

The significant growth of increasing adoption of electric vehicles (EVs) presents a beneficial market opportunity for EV traction motor manufacturers. As consumer awareness about environmental issues grows and governments implement stricter emission regulations, the demand for EVs is expected to soar, which creates a favorable environment for the growth of the EV traction motor market. EV traction motors are a crucial component of EVs, and their demand is directly linked to EV sales.

With a growing market, manufacturers of traction motors expect higher production volumes, which results in economies of scale and improved profit margins. The economic implications of a flourishing EV traction motor market are diverse. It has the potential to generate new employment opportunities in the manufacturing, R&D, and installation sectors. Additionally, the increased adoption of EVs results in decreased reliance on fossil fuels, which have a positive impact on energy security and environmental sustainability.

These favorable economic outcomes also encourage government backing through subsidies and tax incentives, establishing a beneficial cycle for the EV traction motor market. Investing in research and development is crucial for creating more efficient, powerful, and cost-effective EV traction motors. This innovation focuses not only on improving EV performance but also on increasing accessibility to a broader consumer base, ultimately driving market penetration and further fuelling the EV Traction Motor market.

- As per SMR analysis, the global electric car fleet reached 10 million in 2020, with battery electric vehicles (BEVs) representing two-thirds of the total. Europe witnessed the most rapid growth in 2020, with registrations doubling to 1.4 million, making it the world's top electric car industry for the first time.

Lack of Charging Infrastructure

The insufficient number of EV charging stations has a significant impact on market volatility and reimbursement efforts. It hinders the widespread adoption of electric vehicles, limits market growth, and perpetuates the dependence on traditional combustion engines. Trade policies and market consolidation worsen the situation by hindering investment in charging infrastructure development owing to the absence of standardized regulations. Cross-border infrastructure growth needs organized trade policies to meet the increasing demand for reliable charging points with the rising popularity of EVs.

However, market consolidation presents challenges as dominant players prioritize short-term profits over long-term infrastructure investments. The volatility of emerging markets further compounds these challenges, discouraging potential investors. Without adequate reimbursement mechanisms, stakeholders face financial uncertainties, which discourage them from committing to extensive charging network deployments. The EV traction motor market fully realizes its potential in the global transportation landscape by overcoming the challenge of inadequate charging infrastructure through collective action.

- China has over 8x more publicly available EVSE chargers than any other nation.

Electric Vehicle Traction Motor Market Segment Analysis

By Vehicle Type, According to SMR research, the Battery Electric Vehicle (BEV) segment is the largest in 2023 and dominates the Electric Vehicle Traction Motor Market. BEVs provide a distinct benefit in terms of zero-emission operation, which aligns seamlessly with the increasing consumer demand for sustainable transportation and strict government regulations aimed at reducing carbon footprints.

This emphasis on the environment is fueling substantial investments in BEV technology, resulting in a growth of the Electric Vehicle Traction Motor Market. As the production volume rises, economies of scale come into play, thereby reducing production costs. Consequently, this makes BEVs even more appealing to consumers, thereby further amplifying the production volume. Manufacturers are continuously focused on reducing costs, with a particular emphasis on the manufacturing expenses of Battery Electric Vehicles (BEVs).

Innovation plays a critical role in this aspect, as manufacturers are investing heavily in developing more efficient motors that require fewer materials which drives the demand for the Electric Vehicle Traction Moto Market. In addition to cost considerations, product positioning strategies are crucial for manufacturers as they highlight the long-term cost benefits of BEVs, including lower fuel and maintenance expenses. In addition, the superior performance and driving experience offered by BEVs are being emphasized to attract a broader consumer base. The Electric Vehicle Traction Motor market is largely dominated by BEVs, which brings both challenges and opportunities. Taking advantage of online retail trends and effective product positioning further accelerates the adoption of BEVs driving the demand for the Electric Vehicle Traction Motor Market.

Electric Vehicle Traction Motor Market Regional Analysis

In 2023, the Asia Pacific region is dominant in the global Electric Vehicle Traction Motor Market and experience significant growth to maintain its dominance during the forecast period. With a strong manufacturing ecosystem, the Asia Pacific region is home to renowned industry players who capitalize on their domestic brand loyalty and effectively expand their reach through international trade networks, catering to various regions across the globe.

China stands out as the top-selling region for EVs worldwide driven by government support, a growing EV market, and efforts to combat air pollution in key urban areas. Additionally, India, with its rising middle class and urban population, offers a beneficial market for affordable EVs, opening up new avenues for traction motor producers driving the dominance of the region in the Electric Vehicle Traction Motor Market. The region is experiencing a rise in new players, which encourages innovation and drives down production costs, making electric vehicles (EVs) more affordable for consumers.

- The Indian government has implemented the Faster Adoption and Manufacturing of Electric Vehicles (FAME) India scheme. It provides financial incentives to electric vehicle buyers and manufacturers, promoting the country's adoption and production of EVs.

Additionally, government policies that promote clean energy further incentivize the adoption of EVs, creating a positive cycle for the EV traction motor market. Given the dominance of the Asia Pacific region in this market, it presents a profitable opportunity for investors. To make the most of this growth, investors focus on companies that excel in high-efficiency Permanent Magnet Synchronous Motors (PMSMs) and those involved in producing crucial components like silicon carbide inverters. With a strong manufacturing foundation, favorable government policies, and a swiftly growing electric vehicle market, the Electric Vehicle Traction Motor Market presents a promising opportunity for investors aiming to benefit from the advancements in clean transportation.

Electric Vehicle Traction Motor Market Competitive Landscape

The competitive landscape of the Electric Vehicle Traction Motor Market includes key players such as Advanced Motors & Drives (US), BOSCH (Germany), BorgWarner Inc. (US), Continental AG (Germany), DENSO Corporation (Japan), Emerson Electric Co. (US), GKN Automotive Limited (UK), etc. These companies play a significant role in the production and distribution of Electric Vehicle Traction Motors globally, catering to various industries. The market is characterized by competitive dynamics, market share, and strategies employed by these key players to maintain their position and drive growth in the industry.

- In 2023, Siemens AG, a German multinational conglomerate, sold its stake in the electric-car components venture, Valeo Siemens eAutomotive, to Valeo SA. This acquisition allowed Valeo to strengthen its position in the rapidly expanding EV market and reach profitability in 2023 after years of losses.

- In October 2021, Nidec, the Japanese automaker, launched a third E-Axle traction motor system - the 200 kW Ni200Ex model, which has obtained a place in the innovative Zeekr 001, the first model, based on the new Sustainable Electric Architecture (SEA) platform of Geely. The new motor has a peak power output of 200 kW & 384 Nm of torque.

|

Electric Vehicle Traction Motor Market Scope |

|

|

Market Size in 2024 |

USD 15.21 Bn. |

|

Market Size in 2032 |

USD 46.54 Bn. |

|

CAGR (2025-2032) |

15% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

by Motor Type AC Induction Motors Permanent Magnet Synchronous Motors Switched Reluctance Motors Others |

|

by Vehicle Type Battery Electric Vehicles (BEV) Hybrid Electric Vehicles (HEV) Plug-In Hybrid Electric Vehicles (PHEV) Others |

|

|

by Power Output Less than 250 kW 251-500 kW More than 500 kW |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Electric Vehicle Traction Motor Market

- Robert Bosch GmbH (Germany)

- Siemens AG (Germany)

- Toshiba Corporation (Japan)

- BorgWarner Inc. (US)

- Continental AG (Germany)

- DENSO Corporation (Japan)

- Valeo SA (France)

- WEG S.A. (Brazil)

- YASA Limited (UK)

- ZF Friedrichshafen AG (Germany)

- Hino Motors, Ltd. (Japan)

- TM4 Inc. (Canada)

- ABB Ltd. (Switzerland)

- Advanced Motors & Drives (US)

- Emerson Electric Co.(US)

- GKN Automotive Limited (UK)

- Hitachi Automotive Systems, Ltd. (Japan)

- Hyundai Mobis Co., Ltd. (South Korea)

- Jing-Jin Electric Technologies (China)

- Magna International Inc. (Canada)

- Mahindra Electric Mobility Limited (India)

- Mitsubishi Electric Corporation (Japan)

- Nidec Corporation (Japan)

- Parker-Hannifin Corporation (US)

- Regal Beloit Corporation (US)

Frequently Asked Questions

Rising investments in electric vehicles and increasing demand for energy-efficient motors are the drivers of Electric Vehicle Traction Motor are the drivers of the Electric Vehicle Traction Motor Market.

Investors can capitalize on the Electric Vehicle Traction Motor Market by considering companies developing high-efficiency motors (PMSMs) and researching manufacturers supplying parts for them, like those producing silicon carbide inverters.

The Market size was valued at USD 15.21 billion in 2024 and the total Market revenue is expected to grow at a CAGR of 15% from 2025 to 2032, reaching nearly USD 46.54 billion.

The segments covered in the market report are type, vehicle type, power output, and region.

1. Electric Vehicle Traction Motor Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Electric Vehicle Traction Motor Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Electric Vehicle Traction Motor Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

3.5. Electric Vehicle Traction Motor Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. Electric Vehicle Traction Motor Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Electric Vehicle Traction Motor Market Size and Forecast by Segments (by Value USD Million and Volume in Units)

5.1. Electric Vehicle Traction Motor Market Size and Forecast, By Motor Type (2024-2032)

5.1.1. AC Induction Motors

5.1.2. Permanent Magnet Synchronous Motors

5.1.3. Switched Reluctance Motors

5.1.4. Others

5.2. Electric Vehicle Traction Motor Market Size and Forecast, By Vehicle Type (2024-2032)

5.2.1. Battery Electric Vehicles (BEV)

5.2.2. Hybrid Electric Vehicles (HEV)

5.2.3. Plug-In Hybrid Electric Vehicles (PHEV)

5.2.4. Others

5.3. Electric Vehicle Traction Motor Market Size and Forecast, By Power Output (2024-2032)

5.3.1. Less than 250 kW

5.3.2. 251-500 kW

5.3.3. More than 500 kW

5.4. Electric Vehicle Traction Motor Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Electric Vehicle Traction Motor Market Size and Forecast (by Value USD Million and Volume in Units)

6.1. North America Electric Vehicle Traction Motor Market Size and Forecast, By Motor Type (2024-2032)

6.1.1. AC Induction Motors

6.1.2. Permanent Magnet Synchronous Motors

6.1.3. Switched Reluctance Motors

6.1.4. Others

6.2. North America Electric Vehicle Traction Motor Market Size and Forecast, By Vehicle Type (2024-2032)

6.2.1. Battery Electric Vehicles (BEV)

6.2.2. Hybrid Electric Vehicles (HEV)

6.2.3. Plug-In Hybrid Electric Vehicles (PHEV)

6.2.4. Others

6.3. North America Electric Vehicle Traction Motor Market Size and Forecast, By Power Output (2024-2032)

6.3.1. Less than 250 kW

6.3.2. 251-500 kW

6.3.3. More than 500 kW

6.4. North America Electric Vehicle Traction Motor Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Electric Vehicle Traction Motor Market Size and Forecast (by Value USD Million and Volume in Units)

7.1. Europe Electric Vehicle Traction Motor Market Size and Forecast, By Motor Type (2024-2032)

7.2. Europe Electric Vehicle Traction Motor Market Size and Forecast, By Vehicle Type (2024-2032)

7.3. Europe Electric Vehicle Traction Motor Market Size and Forecast, By Power Output (2024-2032)

7.4. Europe Electric Vehicle Traction Motor Market Size and Forecast, by Country (2024-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Electric Vehicle Traction Motor Market Size and Forecast (by Value USD Million and Volume in Units)

8.1. Asia Pacific Electric Vehicle Traction Motor Market Size and Forecast, By Motor Type (2024-2032)

8.2. Asia Pacific Electric Vehicle Traction Motor Market Size and Forecast, By Vehicle Type (2024-2032)

8.3. Asia Pacific Electric Vehicle Traction Motor Market Size and Forecast, By Power Output (2024-2032)

8.4. Asia Pacific Electric Vehicle Traction Motor Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Electric Vehicle Traction Motor Market Size and Forecast (by Value USD Million and Volume in Units)

9.1. Middle East and Africa Electric Vehicle Traction Motor Market Size and Forecast, By Motor Type (2024-2032)

9.2. Middle East and Africa Electric Vehicle Traction Motor Market Size and Forecast, By Vehicle Type (2024-2032)

9.3. Middle East and Africa Electric Vehicle Traction Motor Market Size and Forecast, By Power Output (2024-2032)

9.4. Middle East and Africa Electric Vehicle Traction Motor Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Electric Vehicle Traction Motor Market Size and Forecast (by Value USD Million and Volume in Units)

10.1. South America Electric Vehicle Traction Motor Market Size and Forecast, By Motor Type (2024-2032)

10.2. South America Electric Vehicle Traction Motor Market Size and Forecast, By Vehicle Type (2024-2032)

10.3. South America Electric Vehicle Traction Motor Market Size and Forecast, By Power Output (2024-2032)

10.4. South America Electric Vehicle Traction Motor Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Robert Bosch GmbH (Germany)

11.1.1. Company Overview

11.1.2. Product Segment

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Siemens AG (Germany)

11.3. Toshiba Corporation (Japan)

11.4. BorgWarner Inc. (US)

11.5. Continental AG (Germany)

11.6. DENSO Corporation (Japan)

11.7. Valeo SA (France)

11.8. WEG S.A. (Brazil)

11.9. YASA Limited (UK)

11.10. ZF Friedrichshafen AG (Germany)

11.11. Hino Motors, Ltd. (Japan)

11.12. TM4 Inc. (Canada)

11.13. ABB Ltd. (Switzerland)

11.14. Advanced Motors & Drives (US)

11.15. Emerson Electric Co.(US)

11.16. GKN Automotive Limited (UK)

11.17. Hitachi Automotive Systems, Ltd. (Japan)

11.18. Hyundai Mobis Co., Ltd. (South Korea)

11.19. Jing-Jin Electric Technologies (China)

11.20. Magna International Inc. (Canada)

11.21. Mahindra Electric Mobility Limited (India)

11.22. Mitsubishi Electric Corporation (Japan)

11.23. Nidec Corporation (Japan)

11.24. Parker-Hannifin Corporation (US)

11.25. Regal Beloit Corporation (US)

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook