Electric Vehicle Charging Infrastructure Market- Global Industry Analysis and Forecast (2025-2032) by Business Model, Product Type, Platform/Sales Channel and, Device Type.

Electric Vehicle Charging Infrastructure Market size was valued at US$ 25.6 Billion in 2024 and the revenue is expected to grow at 28% through 2025 to 2032, reaching nearly US$ 184.46 Billion.

Format : PDF | Report ID : SMR_1591

Objective: Stellar Market Research

conducted brief analysis on Global Electric Vehicle Charging Infrastructure Market. The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Electric Vehicle Charging Infrastructure Market. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers. The research is an investor's guide since it clearly depicts competitive analysis of major competitors in the Global Electric Vehicle Charging Infrastructure Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Electric Vehicle Charging Infrastructure Market Overview

Electric vehicle charging infrastructure provides the necessary facilities for electric cars to charge the automotive battery. Electric vehicle charging infrastructure includes charging stations, typically equipped with electric outlets or charging cables, and vary in terms of charging speed.

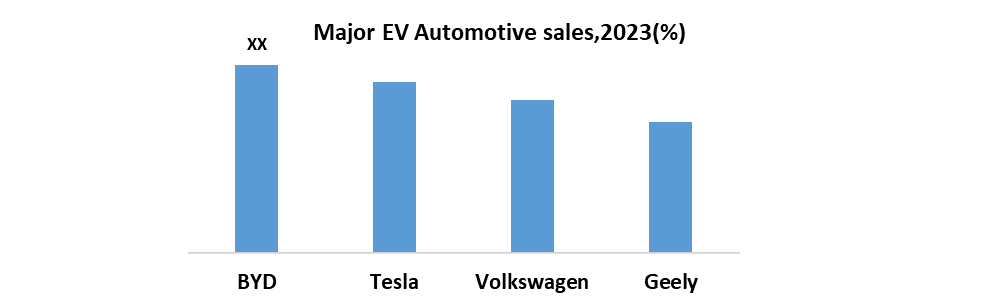

The key driving factors for Electric vehicle charging infrastructure market such as Increasing Adoption of Electric Vehicles, Government Initiatives and Regulations, Increased Investment, Environmental Sustainability, and many others are analysed in the report. Consumer preferences are shifting towards electric vehicles from tradition ICE vehicles and this change in sentiments in another key factor driving the Electric vehicle charging infrastructure market. Sales of around 13.5 million EV units globally in 2023, with an increase of 30% over 2022 indicates the change in consumer preferences. The charge point operators (CPO) are collaborating with Original equipment manufacturer (OEM), which caters to the growing demand for Electric vehicle charging infrastructure market. The charging infrastructure includes Level 1, Level 2, and Level 3 charging stations, complemented by essential supporting hardware and software components.

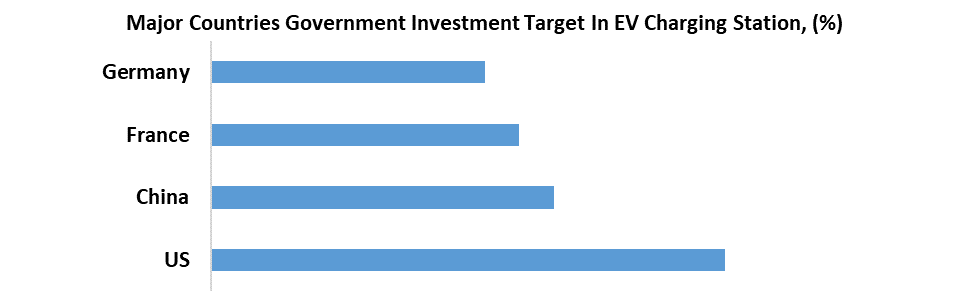

Stellar market research conducted the analysis of Electric vehicle charging infrastructure market over past 5 years and by using the data, came to a conclusion that APAC dominated the Global Electric vehicle charging infrastructure market with 48% market share and is expected to continue its dominance during the forecast period. China stands out as the leading force, boasting the highest concentration of public chargers at a rate of 1 charge point for every 7 EVs and a remarkable 17% penetration of electric four-wheelers (EV 4Ws), surpassing other major economies. Europe holds second largest market share with a target of deploying 1 public charger for every 10 electric vehicles. North America is also contributing significantly, especially in the United States, a goal has been set to install 500,000 public chargers by 2030, backed by a substantial financial commitment of USD 7.5 billion to support the achievement of this target. Key players in Electric vehicle charging infrastructure market such as TGood State Grid Corporation of China, Tesla, ChargePoint Holdings Inc, EVgo, Tata power and others are analysed in the report.

To get more Insights: Request Free Sample Report

Electric Vehicle Charging Infrastructure Market Dynamics

Rise in adoption of Electric Vehicles

The economic benefits that comes with electric vehicle is the main reason for the rising adoption of electric vehicles. The operational costs per mile for electric cars are around ½ that of traditional gasoline-powered vehicles. Charging an electric vehicle is more economical as with a full charge costing around $1-1.5, in contrast to around $30 required for a gas tank refill. The reduced maintenance needs of EVs contribute significantly to long-term cost savings. Electric cars boast fewer moving parts and eliminate the necessity for oil changes, resulting in an estimated lifetime maintenance and repair cost of around $4,000. In comparison, gasoline counterparts incur around $8,500 in lifetime maintenance and repair expenses. These benefits led to rise in demand for Electric Vehicle Charging Infrastructure market.

Government role in Electric vehicle charging Infrastructure

Global governments are expected to provide substantial financial support for the development of electric vehicle charging infrastructure, with setting ambitious targets for charger deployment by 2030. Leading nations, including France and Germany, have allocated special budgets for infrastructure construction, reflecting a collective effort to meet the rising demand. In Europe, an investment of nearly Euro 10 billion is estimated to accommodate the projected demand. United States has committed to the construction of approximately 0.5 million chargers by 2030.

Lack of uniformity exists globally, with different countries adopting distinct standards for fast charging—CHAdeMO in Japan, CCS in Europe, the U.S., and South Korea, and GB/T in China.

Electric Vehicle Charging Infrastructure Market Segment Analysis

By charger type, the market is divided into two main segments, slow chargers and fast chargers. The fast charger segment emerged as the dominant force, holding over 92% of global sales. This significant market share is driven by a demand for rapid chargers, mainly in commercial stations. In 2024, there was an increase in fast chargers by around 4,20,000; 85% of which was provided by China alone. Businesses, recognizing this trend, are installing Level 1 DC fast chargers and Level 2 AC charging stations, capable of fully charging electric vehicles within 3 to 6 hours. Automakers are strategically deploying electric vehicle (EV) charging stations to promote awareness of electric cars like installation of 100 Level 2 EV charging stations in the parking areas of General Motors Company's Detroit facility.

By connector type, the market is majorly segmented into CHAdeMO (Charge the move), Combined Charging System (CCS). In 2024, the CHAdeMO connector segment secured a significant market share exceeding 35%. CHAdeMO is installed around 96 countries globally. This is due to its broad compatibility with a diverse range of electric vehicles, including BMW, GM, and VW and its user-friendly design.

The CHAdeMO connector's advantage lies in its ability to offer design flexibility for electric vehicles, requiring only a single charging port, unlike CHAdeMO connectors, which necessitate two charging ports due to their limitation in enabling AC charging. The current CHAdeMO connectors are capable of delivering 62.5 kW of DC power and comply with the Japan Electric Vehicle Standard (JEVS). More than 300 certified CHADeMO charger models have been produced by around 60 companies.

Electric Vehicle Charging Infrastructure Market Competitive Landscapes

- ABB's latest innovation, the Terra 360, stands out as the world's fastest electric car charger. It boasts the capability to fully charge an electric vehicle in under 15 minutes, delivering an impressive 100 kilometres of range.

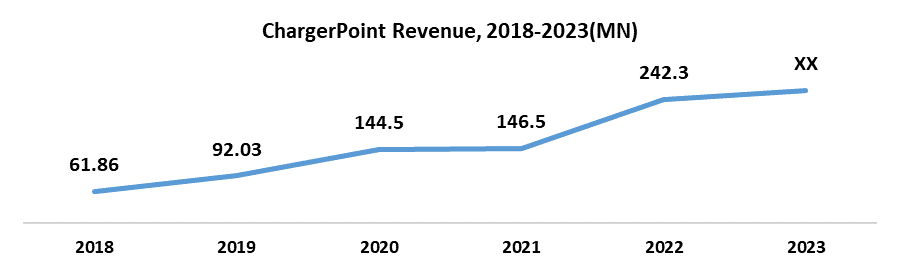

- ChargePoint Raised $232M in 2023.

- BP acquired UK’s largest EV charging company Chargemaster for USD 130 million. Eaton recently made a strategic investment as part of ChargeLab's expanded Series A funding round.

- EVCS has strategically partnered with ChargeHub to optimize and simplify public charging accessibility for electric vehicle drivers along the West Coast. This collaboration entails EVCS integrating with ChargeHub's Passport Hub platform as a Charge Point Operator (CPO), enabling an expanded network catering to a diverse group of EV drivers utilizing various e-mobility service providers (MSPs).

- BYD Europe B.V. and Shell EV Charging Solutions B.V. (Shell) have joined forces to deliver efficient Shell Recharge EV charging services to a minimum of 100,000 BYD batteries and plug-in Electric Vehicles (EV) customers across Europe. This partnership offers customers an exclusive Platinum membership to the Shell Recharge network, facilitating discounted charging access at Shell's fast and ultra-fast DC charging locations.

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Global Electric vehicle charging infrastructure Market. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as anticipated market size and trends. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers.

The research includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favourable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry.

The research also aids in comprehending the Global Electric vehicle charging infrastructure Market dynamics and structure by studying market segments and forecasting market size.

The research is an investor's guide since it clearly depicts competitive analysis of major competitors in the Global Electric vehicle charging infrastructure Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

|

Electric Vehicle Charging Infrastructure Market Scope |

|

|

Market Size in 2024 |

USD 25.6 Bn. |

|

Market Size in 2032 |

USD 184.46 Bn. |

|

CAGR (2025-2032) |

28% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Charger Type

|

|

By Connector type

|

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Electric Vehicle Charging Infrastructure Market key Players

• AeroVironment, Inc.

• ChargePoint, Inc.

• SemaConnect, Inc.

• ClipperCreek, Inc.

• Tesla Motors, Inc.

• General Electric Company

• Leviton Manufacturing Co., Inc.

• EVgo

• Blink Network

• Greenlots

• ABB Group

• Elektromotive Limited

• Schneider Electric SE

• Chargemaster Plc

• Delphi Automotive LLP

• Eaton Corporation

• Siemens AG

• Engie

• Pod Point Ltd.

• NewMotion

• BYD Company

• Efacec Electric Mobility

• Delta Electronics, Inc.

• TGOOD Global Ltd.

Frequently Asked Questions

In 2024, the Asia Pacific region dominated the Electric Vehicle Charging Infrastructure Market.

The market segments are based on Charging type, Connector Type, and Application.

The forecast period for Market is 2025 to 2032.

Electric Vehicle Charging Infrastructure Market is estimated as worth US$ 184.46 Bn.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Electric Vehicle Charging Infrastructure Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Electric Vehicle Charging Infrastructure Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

3.5. Electric Vehicle Charging Infrastructure Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. Electric Vehicle Charging Infrastructure Market: Dynamics

4.1. Electric Vehicle Charging Infrastructure Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Electric Vehicle Charging Infrastructure Market Drivers

4.3. Electric Vehicle Charging Infrastructure Market Restraints

4.4. Electric Vehicle Charging Infrastructure Market Opportunities

4.5. Electric Vehicle Charging Infrastructure Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. Turbo-Charging for EVS

4.8.2. Smart Charging Systems

4.8.3. Wireless Power Transfer

4.8.4. Bi-Directional Chargers

4.8.5. Integration of IoT in EV Charging Stations

4.8.6. Plug-And-Play Charging

4.8.7. Overhead Charging or Pantograph Charging

4.8.8. Megawatt Charging

4.8.9. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Global Electric Vehicle Charging Infrastructure Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Global Electric Vehicle Charging Infrastructure Market Size and Forecast, by Charger Type (2024-2032)

5.1.1. Slow Charger

5.1.2. Fast Charger

5.2. Global Electric Vehicle Charging Infrastructure Market Size and Forecast, by Connector Type (2024-2032)

5.2.1. CHAdeMO

5.2.2. Combined Charging System (CCS)

5.2.3. Others

5.3. Global Electric Vehicle Charging Infrastructure Market Size and Forecast, by Application (2024-2032)

5.3.1. Commercial

5.3.2. Residential

5.4. Global Electric Vehicle Charging Infrastructure Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Electric Vehicle Charging Infrastructure Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Electric Vehicle Charging Infrastructure Market Size and Forecast, by Charger Type (2024-2032)

6.1.1. Slow Charger

6.1.2. Fast Charger

6.2. North America Electric Vehicle Charging Infrastructure Market Size and Forecast, by Connector Type (2024-2032)

6.2.1. CHAdeMO

6.2.2. Combined Charging System (CCS)

6.2.3. Others

6.3. North America Electric Vehicle Charging Infrastructure Market Size and Forecast, by Application (2024-2032)

6.3.1. Commercial

6.3.2. Residential

6.4. North America Electric Vehicle Charging Infrastructure Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Electric Vehicle Charging Infrastructure Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Electric Vehicle Charging Infrastructure Market Size and Forecast, by Charger Type (2024-2032)

7.2. Europe Electric Vehicle Charging Infrastructure Market Size and Forecast, by Connector Type (2024-2032)

7.3. Europe Electric Vehicle Charging Infrastructure Market Size and Forecast, by Application (2024-2032)

7.4. Europe Electric Vehicle Charging Infrastructure Market Size and Forecast, by Country (2024-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Electric Vehicle Charging Infrastructure Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Electric Vehicle Charging Infrastructure Market Size and Forecast, by Charger Type (2024-2032)

8.2. Asia Pacific Electric Vehicle Charging Infrastructure Market Size and Forecast, by Connector Type (2024-2032)

8.3. Asia Pacific Electric Vehicle Charging Infrastructure Market Size and Forecast, by Application (2024-2032)

8.4. Asia Pacific Electric Vehicle Charging Infrastructure Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Electric Vehicle Charging Infrastructure Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Electric Vehicle Charging Infrastructure Market Size and Forecast, by Charger Type (2024-2032)

9.2. Middle East and Africa Electric Vehicle Charging Infrastructure Market Size and Forecast, by Connector Type (2024-2032)

9.3. Middle East and Africa Electric Vehicle Charging Infrastructure Market Size and Forecast, by Application (2024-2032)

9.4. Middle East and Africa Electric Vehicle Charging Infrastructure Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Electric Vehicle Charging Infrastructure Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Electric Vehicle Charging Infrastructure Market Size and Forecast, by Charger Type (2024-2032)

10.2. South America Electric Vehicle Charging Infrastructure Market Size and Forecast, by Connector Type (2024-2032)

10.3. South America Electric Vehicle Charging Infrastructure Market Size and Forecast, by Application (2024-2032)

10.4. South America Electric Vehicle Charging Infrastructure Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. AeroVironment, Inc.

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. ChargePoint, Inc.

11.3. SemaConnect, Inc.

11.4. ClipperCreek, Inc.

11.5. Tesla Motors, Inc.

11.6. General Electric Company

11.7. Leviton Manufacturing Co., Inc.

11.8. EVgo

11.9. Blink Network

11.10. Greenlots

11.11. ABB Group

11.12. Elektromotive Limited

11.13. Schneider Electric SE

11.14. Chargemaster Plc

11.15. Delphi Automotive LLP

11.16. Eaton Corporation

11.17. Siemens AG

11.18. Engie

11.19. Pod Point Ltd.

11.20. NewMotion

11.21. BYD Company

11.22. Efacec Electric Mobility

11.23. Delta Electronics, Inc.

11.24. TGOOD Global Ltd.

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook