Electric Tractor Market- Global Industry Analysis and Forecast (2025 -2032)

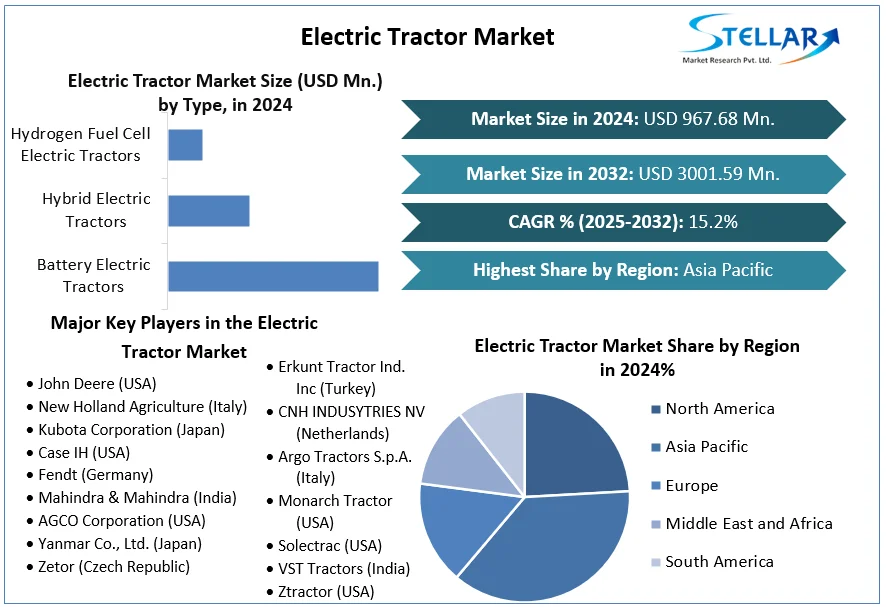

Electric Tractor Market size was valued at USD 967.68 Mn. in 2024. The total Electric Tractor Market revenue is expected to grow by 15.2% from 2025 to 2032, reaching nearly USD 3001.59 Mn.

Format : PDF | Report ID : SMR_2173

Electric Tractor Market Overview

Electric tractors, or EV tractors, represent a pivotal advancement in agricultural technology, offering numerous benefits that address both economic and environmental challenges faced by farmers. Powered by electric vehicle batteries, EV tractors eliminate emissions and reduce fuel costs, contributing to cleaner air and improved crop health. Their efficient electric motors convert energy with up to 80% efficiency, surpassing the 35% efficiency of diesel engines, while requiring minimal maintenance due to fewer moving parts. Despite initial cost concerns, EV tractors demonstrate significant long-term savings and potential financial incentives for adoption.

As agriculture embraces electrification and autonomous capabilities, EV tractors are poised to not only streamline farm operations but also lead the industry towards sustainable and profitable farming practices for years to come. Thus, the electric tractor market is expected to grow as technological advancements continue to improve battery performance, and regulatory pressures drive adoption. The integration of digital agriculture solutions and smart farming practices to further enhance the efficiency and sustainability of electric tractors.

To get more Insights: Request Free Sample Report

Electric Tractor Market Competitive Landscape

As per the study, the market is highly competitive. The competitive landscape is characterized by a mix of established players focusing on global presence and product innovation, innovative startups driving technological innovation and collaborative efforts to overcome challenges in battery technology and Electric Tractor Market acceptance.

- New Holland, in collaboration with Türk Traktör, unveiled the T3 Electric Power at the Konya agricultural fair, marking a significant advancement in agricultural technology. Featuring a 75 kWh battery pack and two electric motors, this compact electric tractor offers robust performance with up to 100 horsepower equivalent. Its 'robotic' transmission allows for seamless gear shifts and immediate torque availability from 1 km/h, enhancing operational efficiency. Initially launching in Turkey and potentially expanding to Europe, the T3 Electric Power represents New Holland's commitment to sustainable farming solutions, addressing challenges in concealing the battery pack while maintaining operational versatility and performance standards.

- AutoNxt Automation, a Mumbai-based startup, secured $3 million in a Pre-Series A funding round led by Saama Capital, with participation from industry leaders like Amit Singhal and Suveer Sinha. Founded by Kaustubh Dhonde, the startup aims to launch India’s first electric, self-driving tractor for commercial use by the end of 2024. Their technology promises significant cost savings compared to diesel tractors, with an operational break-even in under two years. AutoNxt plans to leverage the funding to accelerate engineering efforts and expand into diverse sectors beyond agriculture, highlighting their commitment to advancing India’s automation and mobility landscape.

- In 2021, CNH Industrial N.V. has entered an exclusive multi-year licensing agreement with Monarch Tractor, a US-based AgTech firm specializing in fully electric autonomous tractors. This partnership aims to co-develop scalable electrification platforms for low horsepower tractors. CNH Industrial seeks to leverage Monarch's expertise in EV technology and Silicon Valley R&D to enhance its agricultural offerings. The agreement underscores CNH Industrial's commitment to advancing sustainable precision farming and accelerating innovation in alternative propulsion systems for global agriculture.

Electric Tractor Market Dynamics

Global Shift towards Sustainability Driving the Global Electric Tractor Market

Electric tractors produce zero tailpipe emissions, reducing greenhouse gases and local air pollutants compared to diesel counterparts. The rise of electric tractors marks a transformative shift in agriculture towards sustainability and efficiency. By eliminating emissions and offering superior performance over diesel counterparts, electric tractors not only reduce environmental impact but also enhance operational productivity.

Their lower maintenance costs and compatibility with renewable energy sources further bolster their appeal, promising long-term savings for farmers. With advancements in battery technology and precision agriculture integration, electric tractors are becoming increasingly versatile and effective across diverse farming applications. Despite challenges like limited battery range, ongoing developments and government support are driving their adoption. Overall, electric tractors represent a pivotal advancement in farming technology, poised to redefine agricultural practices and contribute significantly to environmental conservation.

Technological Advancements to Drive the Global Electric Tractor Market

Technological advancements are increasingly accelerating the adoption of electric tractors worldwide, driven by regulatory support, environmental awareness, and technological innovation. Electric Tractor Manufacturers and agricultural stakeholders are investing in research and development to further enhance the performance, efficiency, and affordability of electric tractors, paving the way for a sustainable and technologically advanced future in agriculture. The convergence of battery technology advancements, electric motor efficiency, precision agriculture integration and smart farming solutions are reshaping the global electric tractor market. These advancements highly address current challenges and unlock new opportunities for enhancing agricultural productivity while reducing environmental impact.

For Example - John Deere is driving innovation in agriculture with a focus on electrification, automation to autonomy, and artificial intelligence. Their advancements include electric compact tractors with high PTO power and low maintenance costs, and eAutoPowr transmissions for efficient, wear-free operation. Collaborations like the large spraying drone with Volocopter showcase electric flight technology for crop protection. Automation enhances productivity with features like hands-free AutoTrac guidance and Integrated Combine Adjust for real-time adjustments.

Meanwhile, autonomous concepts like the compact electric tractor and semi-autonomous sprayer offer emission-free operation and precision in crop management. Artificial intelligence powers innovations such as See & Spray technology, enabling targeted weed control and reduced pesticide use through high-resolution cameras and AI recognition. These technologies aim to optimize farming efficiency, reduce environmental impact, and meet evolving agricultural challenges globally.

Operational Adaptation and Training to the Farmers is a major Challenge for the Electric Tractor Market

Transitioning from diesel to electric tractors necessitates a comprehensive overhaul in operational practices and skill sets among farmers and operators. Central to this adaptation is the need for thorough training on battery management and charging protocols. Farmers must grasp the knowledge of battery maintenance, including optimal charging schedules and storage practices to maximize battery life and performance. Unlike the refueling simplicity of diesel, the reliance on electric charging infrastructure demands a strategic approach to planning daily operations and optimizing downtime for recharging. This is a major challenge for the growth of the Electric Tractor Market.

Moreover, integrating precision agriculture technologies, such as GPS-guided navigation and sensor-based monitoring systems, adds another layer of complexity and opportunity. Training programs are required to encompass not only the technical aspects of electric tractor operation but also the strategic utilization of data-driven insights to enhance farming efficiency and productivity. Ultimately, fostering a culture of continuous learning and support to be pivotal in empowering farmers to embrace electric tractors effectively and capitalize on their sustainable and operational benefits.

For Example – in 2023, Chatham University considered transitioning to a smaller, more sustainable tractor for its Eden Hall Farm, aiming to better serve student learning and operational needs. They are exploring options like a 30-40 hp four-wheel-drive tractor with hydrostatic transmission, weighing the benefits of biodiesel versus electric models. Despite concerns over power and support, the university is intrigued by Solectrac's 25 hp electric model and plans to test its capabilities through a rental, potentially pioneering new technology in their educational setting and sharing results with fellow farmers.

Electric Tractor Market Segment Analysis

Based on Type: The market is segmented into Battery Electric Tractors, Hybrid Electric Tractors and Hydrogen Fuel Cell Electric Tractors. The Battery Electric Tractors dominated the global market with the largest Electric Tractor Market share in 2024 and expected to retain its dominance during the forecast period. This is attributed to the increasing advancements in the battery technology, which are making battery electric tractors more attractive. They offer lower operating costs and zero emissions. The Hybrid Electric Tractors segment is expected to lose the market share during the forecast period because of the improving battery technology.

Based on End-Use: The market is segmented into Farming, Construction, Landscaping, Municipalities and Others. The Farming segment held the largest Electric Tractor Market share in 2024. Electric tractors represent a transformative shift towards sustainable and efficient farming practices. By eliminating emissions and noise pollution, these tractors significantly reduce environmental impact while offering cost-effectiveness through lower fuel and maintenance expenses. Their superior efficiency, with up to 80% energy conversion compared to 35% for diesel counterparts, ensures optimal performance and precision in agricultural operations. As agriculture embraces technological advancements, electric tractors emerge as pivotal tools for future farming, combining ecological responsibility with economic viability.

Electric Tractor Market Regional Insights

Asia Pacific Electric Tractor Market held the largest share of the global market in 2024 with India holding the major market for Electric Tractors. The electric tractors offer a sustainable solution to mitigate greenhouse gas emissions and reduce operational costs in the India’s agricultural sector. With diesel-powered tractors contributing significantly to both air pollution and agricultural expenses, the shift to electric alternatives could lead to substantial savings and environmental benefits. Electric tractors produce zero tailpipe emissions, addressing public health concerns and aligning with global sustainability goals. However, their adoption faces challenges such as high initial costs and the need for supportive infrastructure and regulatory frameworks.

Initiatives like Punjab's subsidy inclusion in EV policies and investment in charging infrastructure are pivotal for widespread adoption. Moreover, developing standardized testing and quality assurance protocols will instill confidence among manufacturers and consumers alike. By fostering R&D collaborations and promoting skill development, India to accelerate innovation in electric tractor technology, potentially positioning itself as a global hub for sustainable agricultural machinery. This strategic shift not only supports economic growth but also reinforces India's commitment to environmental stewardship and agricultural modernization.

Europe Electric Tractor Market is expected to grow rapidly during the forecast period. In the region, the key players in the agricultural machinery sector are investing heavily in research and development to enhance the performance, efficiency, and affordability of electric tractors. Seederal, a French startup, has secured €7.1 million in funding, bolstered by a €3.7 million grant from France 2030, to advance its electric tractor development. Specializing in medium-sized tractors (100 to 200 hp), Seederal aims to significantly reduce agricultural emissions, targeting a market segment accounting for over €9 billion in annual sales across Europe.

Their innovative chassis-battery system, akin to Tesla's approach, promises enhanced energy density and operational efficiency. With initial success in field trials, this funding round will support further R&D efforts, patent portfolio expansion, and prototype launches, leading to series production by 2026. The investment underscores confidence in Seederal’s technological approach and its potential to revolutionize sustainability in agriculture, aligning with global efforts to mitigate carbon footprints and reshape the agricultural machinery landscape.

Electric Tractor Market Scope

|

Electric Tractor Market |

|

|

Market Size in 2024 |

USD 967.68 Mn. |

|

Market Size in 2032 |

USD 3001.59 Mn. |

|

CAGR (2025-2032) |

15.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Battery Electric Tractors Hybrid Electric Tractors Hydrogen Fuel Cell Electric Tractors |

|

By Power Range Low-Power(Less than 50 HP) Medium-Power(50-150 HP) High-Power(More than 150 HP) |

|

|

By End-Use Farming Construction Landscaping Municipalities Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Top Electric Tractor Market Players

- John Deere (USA)

- New Holland Agriculture (Italy)

- Kubota Corporation (Japan)

- Case IH (USA)

- Fendt (Germany)

- Mahindra & Mahindra (India)

- AGCO Corporation (USA)

- Yanmar Co., Ltd. (Japan)

- Zetor (Czech Republic)

- Erkunt Tractor Ind. Inc (Turkey)

- CNH INDUSYTRIES NV (Netherlands)

- Argo Tractors S.p.A. (Italy)

- Monarch Tractor (USA)

- Solectrac (USA)

- VST Tractors (India)

- Ztractor (USA)

Frequently Asked Questions

The segments covered in the Electric Tractor Market report are based on Type, Power Range, End-Use and Region.

The North America region is expected to hold the largest Electric Tractor Market share.

The Electric Tractor Market size by 2032 is expected to reach US$ 3001.59 Mn.

The availability of charging infrastructure in rural areas is a major challenge for Global Electric Tractor Market.

1. Electric Tractor Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Electric Tractor Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Electric Tractor Market: Dynamics

3.1. Electric Tractor Market Trends

3.2. Electric Tractor Market Dynamics

3.2.1. Electric Tractor Market Drivers

3.2.2. Electric Tractor Market Restraints

3.2.3. Electric Tractor Market Opportunities

3.2.4. Electric Tractor Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape

4. Electric Tractor Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032)

4.1. Electric Tractor Market Size and Forecast, by Type (2024-2032)

4.1.1. Battery Electric Tractors

4.1.2. Hybrid Electric Tractors

4.1.3. Hydrogen Fuel Cell Electric Tractors

4.2. Electric Tractor Market Size and Forecast, by Power Range (2024-2032)

4.2.1. Low-Power(Less than 50 HP)

4.2.2. Medium-Power(50-150 HP)

4.2.3. High-Power(More than 150 HP)

4.3. Electric Tractor Market Size and Forecast, by End-Use (2024-2032)

4.3.1. Farming

4.3.2. Construction

4.3.3. Landscaping

4.3.4. Municipalities

4.3.5. Others

4.4. Electric Tractor Market Size and Forecast, by Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Electric Tractor Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Electric Tractor Market Size and Forecast, by Type (2024-2032)

5.1.1. Battery Electric Tractors

5.1.2. Hybrid Electric Tractors

5.1.3. Hydrogen Fuel Cell Electric Tractors

5.2. North America Electric Tractor Market Size and Forecast, by Power Range (2024-2032)

5.2.1. Low-Power(Less than 50 HP)

5.2.2. Medium-Power(50-150 HP)

5.2.3. High-Power(More than 150 HP)

5.3. North America Electric Tractor Market Size and Forecast, by End-Use (2024-2032)

5.3.1. Farming

5.3.2. Construction

5.3.3. Landscaping

5.3.4. Municipalities

5.3.5. Others

5.4. North America Electric Tractor Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Electric Tractor Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. Europe Electric Tractor Market Size and Forecast, by Type (2024-2032)

6.2. Europe Electric Tractor Market Size and Forecast, by Power Range (2024-2032)

6.3. Europe Electric Tractor Market Size and Forecast, by End-Use (2024-2032)

6.4. Europe Electric Tractor Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Austria

6.4.8. Rest of Europe

7. Asia Pacific Electric Tractor Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Asia Pacific Electric Tractor Market Size and Forecast, by Type (2024-2032)

7.2. Asia Pacific Electric Tractor Market Size and Forecast, by Power Range (2024-2032)

7.3. Asia Pacific Electric Tractor Market Size and Forecast, by End-Use (2024-2032)

7.4. Asia Pacific Electric Tractor Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Malaysia

7.4.8. Vietnam

7.4.9. Taiwan

7.4.10. Rest of Asia Pacific

8. Middle East and Africa Electric Tractor Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Middle East and Africa Electric Tractor Market Size and Forecast, by Type (2024-2032)

8.2. Middle East and Africa Electric Tractor Market Size and Forecast, by Power Range (2024-2032)

8.3. Middle East and Africa Electric Tractor Market Size and Forecast, by End-Use (2024-2032)

8.4. Middle East and Africa Electric Tractor Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Nigeria

8.4.4. Rest of ME&A

9. South America Electric Tractor Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. South America Electric Tractor Market Size and Forecast, by Type (2024-2032)

9.2. South America Electric Tractor Market Size and Forecast, by Power Range (2024-2032)

9.3. South America Electric Tractor Market Size and Forecast, by End-Use (2024-2032)

9.4. South America Electric Tractor Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest Of South America

10. Company Profile: Key Players

10.1. John Deere

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. New Holland Agriculture

10.3. Kubota Corporation

10.4. Case IH

10.5. Fendt

10.6. Mahindra & Mahindra

10.7. AGCO Corporation

10.8. Yanmar Co., Ltd.

10.9. Zetor

10.10. Erkunt Tractor Ind. Inc

10.11. CNH INDUSYTRIES NV

10.12. Argo Tractors S.p.A.

10.13. Monarch Tractor

10.14. Solectrac

10.15. VST Tractors

10.16. Ztractor

11. Key Findings

12. Industry Recommendations

13. Electric Tractor Market: Research Methodology