Digital Twin Market- Global Industry Analysis and Forecast (2025-2032) by Business Model, Product Type, Platform/Sales Channel and, Device Type.

Digital Twin Market size was valued at USD 16.8 Billion in 2024 and the Cable Connector revenue is expected to grow at 40% through 2025 to 2032, reaching nearly USD 247.93 Billion.

Format : PDF | Report ID : SMR_1606

Research Objective

Stellar Market Research conducted brief analysis on Global Digital Twin Market. The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Global Digital Twin Market. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers. The research is an investor's guide since it clearly depicts competitive analysis of major competitors in the Global Digital Twin Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

Digital Twin Market Overview

A digital twin is a sophisticated digital representation of a tangible entity, be it an object, person, or process. It exists within a digital environment that mirrors its real-world context. Organizations leverage digital twins to simulate actual scenarios, enabling them to analyse potential outcomes and, ultimately, make more informed and strategic decisions.

Using historical data, digital twins excel in predicting equipment failures and maintenance requirements, offering an approach that helps businesses in avoiding costly downtimes. The application of digital twins extends beyond manufacturing processes to optimize the entire supply chain. Virtual replicas of supply chain elements contribute to heightened visibility, identification of bottlenecks, and streamlined logistics, thereby improving overall performance. The key driving factors for Digital Twin market such as adoption of industry 4.0, rapid adoption of IoT and Demand for Remote Monitoring and Maintenance, and many others are analysed in the report. Recent technologies, like Artificial Intelligence (AI) for enhancing customer experience, Machine Learning (ML) algorithms for analysing customer data and Augmented Reality (AR) to create dynamic experience, are applied to cater the rising demand for Digital Twin Market.

Increasing focus on predictive maintenance in industries has created huge opportunity for Digital Twin market players to enhance their sales. Recent trends in Digital Twin market, such as, Integration of AI and Machine Learning, to learn from past data and forecast future actions, Blockchain, for Data Security and Extended Reality (XR), for Enhanced Visualization, and many others are analysed thoroughly in the report.

Stellar market research conducted the analysis of Digital Twin market over past 5 years and by using the data, came to a conclusion that North America dominated the Global Digital Twin market with around 36% market share and is expected to continue its dominance during the forecast period. The dominance is majorly supported by US, Canada, and Mexico. US, with a CAGR of nearly 40%, has dominated the Digital Twin market in North America. Companies like Microsoft, Rockwell Automation, Ansys, IBM, Siemens, Dassault Systems, and others are few major companies operating in North America region analysed in the report. Europe and APAC are also contributing significantly to the Global Digital Twin Market.

To get more Insights: Request Free Sample Report

Digital Twin Market Dynamics

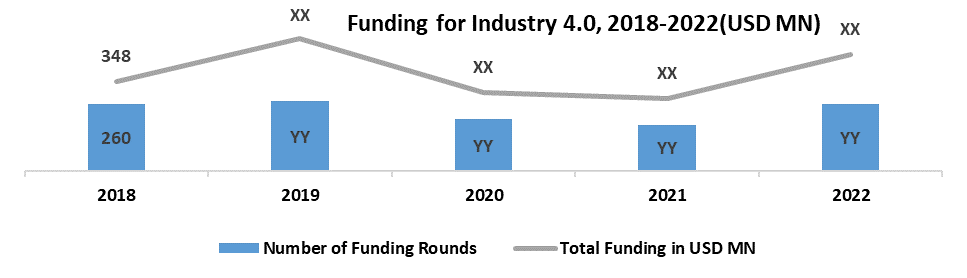

Industry 4.0 Adoption

The increase in the adoption of digital twins is propelled by the widespread use of Industry 4.0, signifying the integration of digital technologies in manufacturing. This shift is due to intelligent manufacturing practices, wherein digital twins serve as important tools for crafting virtual replicas of physical assets. These digital counterparts facilitate real-time monitoring, analysis, and optimization of manufacturing processes. In the connected environment promoted by Industry 4.0, digital twins utilizes the Internet of Things (IoT) to seamlessly connect physical objects with their virtual equivalents, thereby increasing control and coordination in manufacturing environments. Driving force behind this transformation is the Industry 4.0 framework's emphasis on data-driven decision-making role, in generating and analysing substantial data derived from physical assets. Adoption of Industry 4.0 also provides better connections, smart decisions using data, and a constant push for operational efficiency.

The growing dominance of APAC in industry 4.0 market, with the help of China, Japan, South Korea, and Taiwan being the major contributor, caters to the growing demand of Digital Twin market. Meanwhile in North America, companies like Tesla, which is a leading player in the automotive industry has implemented Industry 4.0 by combining physical production and digital technologies and uses digital twin technology to simulate and optimize its manufacturing processes. Siemens is a global leader in Industry 4.0 and has developed a range of digital twin solutions for various industries, including manufacturing, energy, and healthcare in 2023.

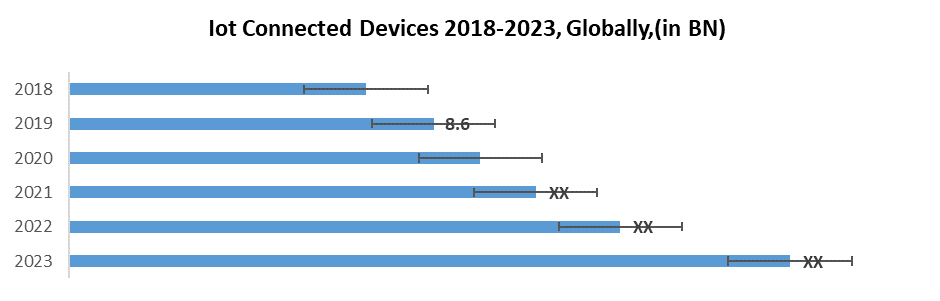

The Role of IoT (Internet of Things)

The surge in Internet of Things (IoT) adoption stands as a catalyst propelling the exponential growth of the digital twin market. The prolific generation and connectivity of data facilitated by IoT devices, equipped with sensors, amass extensive data, laying the foundation for digital twins to craft intricate virtual replicas of physical assets. This empowers real-time monitoring and analysis. In the realm of operational efficacy, the integration of IoT into the digital twin landscape enables industries to achieve dynamic and interconnected ecosystems.

By using the vast network of interconnected devices, digital twins provide a comprehensive overview of entire systems, better coordination and optimization. The synergy of IoT-generated data and digital twin technology performs data-driven decision-making. Industries, especially manufacturing, benefit from optimizing production processes based on real-time information, resulting in informed and strategic decision-making. Over 700 USD BN is spent globally to adopt IoT in various technologies like Digital Twin, and this rising interest drives the digital twin market.

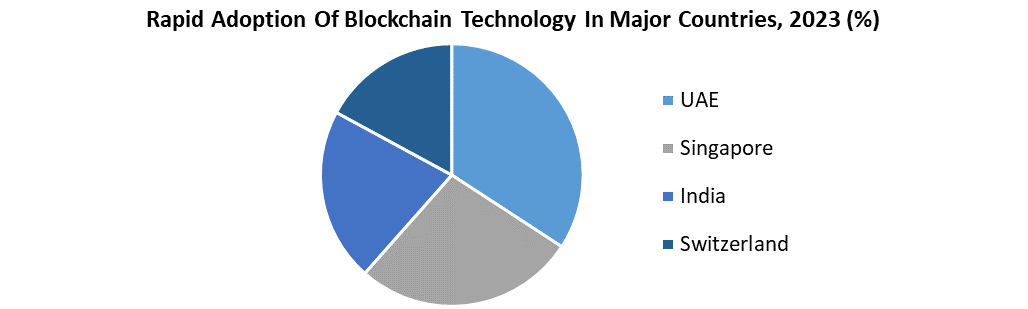

Blockchain for Data Security

Blockchain technology plays a crucial role in enhancing data security within digital twin applications. It offers a secure, cost-effective, and scalable solution, guarding against potential threats from hackers through robust encryption features. The use of blockchain ensures data traceability, a valuable feature that contributes to the security of digital twin technology. This secure environment enables the transmission of data for digital twins, ensuring confidentiality.

Companies use blockchain to validate the accuracy and security of the vast amounts of information generated by digital twins. This technology serves to automate processes and establish connections between digital twins. When coupled with machine learning, this combination has the potential to predict behaviours, conduct thorough and secure analyses, and a more comprehensive global connection. The integration of blockchain technology with digital twins brings benefits with data security standing out as a primary advantage.

Rise in adoption of blockchain indicates the growing demand for digital twin market. Companies like IBM, AWS, LeewayHertz, and others, are key drivers boosting the growth of the blockchain market in North America. The adoption of blockchain technology is growing at a rate of 30% indicating strong demand for digital twin market.

Digital Twin Market Segment Analysis

By type, the Product Digital Twin is like a virtual copy of physical products that helps monitor, analyse, and improve them throughout their lifecycle. It is widely used in manufacturing, automotive, and consumer goods. This part holds a big share in the market because It is used a lot to make products work better and to make developing products easier. It is popular in many places, with good growth potential because more people want to optimize products and predict when they need maintenance. The growth of Product Digital Twin applications is driven by the need for better product performance and more efficient product development.

The Process Digital Twin models and simulates workflows, operations, and business processes to make them work better. It is used in many industries to make processes more efficient and improve decision-making. This part is a big deal in the digital twin market, giving insights to improve how businesses run. It is popular in many places, showing its role in making digital twins work better in different regions.

The growth of Process Digital Twin applications comes from the focus on making operations smoother, cutting costs, and always finding better ways to do things. The System Digital Twin gives a complete view of whole systems or ecosystems, showing how different products and processes work together. It is getting more attention, especially in complex industries like aerospace, defence, and smart cities. This part is important and is growing in different regions, playing a big role in the growth of digital twins there. The demand for seeing how everything works together, making systems work better, and improving collaboration are the reasons why System Digital Twin applications are growing.

Digital Twin Market Competitive Analysis

Growing interest in digital twins, coupled with the rapid advancement of supporting technologies, is fuelling projections for substantial investments in digital-twin solutions, expected to exceed $50 billion by 2027.

- Emirates Team New Zealand: The sailing team utilizes a digital twin of their sailing environments, boats, and crew members to test boat designs without physical construction. This innovative approach has allowed them to assess thousands of hydrofoil designs, surpassing traditional testing limitations.

- RisingMax: As of November 2023, the combined funding efforts of RisingMax and its industry counterparts have amassed a substantial financial backing, exceeding $2.5 billion. This substantial capital injection has been sourced through a total of 497 funding rounds, attracting participation from 729 distinct investors.

- Anheuser-Busch InBev: Implementing a digital twin in brewing and supply chain operations enables brewers to adapt inputs based on real-time conditions. The system can automatically address production bottlenecks, such as full vats, enhancing operational efficiency.

- Microsoft: Microsoft strategically utilizes Azure Digital Twins to effectively oversee intelligent building technologies within its newly refurbished corporate facilities, illustrating the tangible implementation of this technology in practical business environments.

- SoFi Stadium: To optimize stadium management and operations, a digital twin integrates diverse data sources, including information on the stadium's structure and real-time football data, contributing to more efficient decision-making.

- ANSYS: L&T Technology Services and ANSYS have collaboratively inaugurated a Center of Excellence (CoE) dedicated to Digital Twins, underscoring their recognition of substantial market value and the promising growth prospects within the burgeoning digital twin industry.

- Space Force: The US Armed Forces' Space Force is actively creating a digital twin of space, encompassing replicas of extraterrestrial bodies and satellites, showcasing the versatile applications of digital twins.

- SpaceX utilizes a digital twin of their Dragon capsule spacecraft to monitor and adjust trajectories, loads, and propulsion systems. The primary goal is to enhance safety and reliability during transportation, showcasing the practical use of digital twins in aerospace.

- Dassault Systems: Dassault Systèmes, has expanded its capabilities through significant acquisitions. An instance is the acquisition of Medidata in late 2019, valued at $5.8 billion, marking the largest in Dassault Systèmes' history. This move aligns with the company's overarching goal of advancing healthcare virtualization through the implementation of digital twin technology. As of the latest available information, Dassault Systèmes continues to propel its digital twin capabilities, exemplified by the introduction of 'Emma,' a digital twin unveiled in September 2023.

- PTC: PTC has strategically expanded its portfolio through recent acquisitions, securing both Pure Systems and ServiceMax. The acquisition of ServiceMax, a prominent Software as a Service (SaaS) provider in Field Service Management (FSM), aligns with PTC's objective to reinforce its closed-loop product lifecycle management offerings. This strategic move is geared towards enhancing PTC's capabilities and ensuring a comprehensive approach to product lifecycle management within its business ecosystem.

The purpose of this research is to provide stakeholders in the industry with a thorough insight into the Digital Twin Market. The study includes an analysis of difficult data in simple language, as well as the industry's historical and current state, as well as expected market size and trends. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers.

The research includes a PORTER, PESTEL analysis as well as the possible influence of microeconomic market determinants. External and internal elements that are expected to have a favourable or negative impact on the firm have been examined, providing decision-makers with a clear future vision of the industry.

The research also aids in comprehending the Digital Twin Market dynamics and structure by studying market segments and forecasting market size.

The research is an investor's guide since it clearly depicts competitive analysis of major competitors in the Digital Twin Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.

|

Digital Twin Market Scope |

|

|

Market Size in 2024 |

USD 16.8 Bn. |

|

Market Size in 2032 |

USD 247.93 Bn. |

|

CAGR (2025-2032) |

40% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Type

|

|

By Technology

|

|

|

By End User Industry

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Digital Twin Market Players

- Siemens

- General Electric (GE)

- IBM

- Microsoft

- PTC

- ANSYS

- Dassault Systèmes

- Oracle

- SAP

- Altair

- Bentley Systems

- AVEVA

- Honeywell

- Cisco

- Schneider Electric

Frequently Asked Questions

The market benefits businesses by enhancing operational efficiency, predicting maintenance needs, and facilitating data-driven decision-making, leading to cost savings and improved productivity.

Various industries, including manufacturing, healthcare, automotive, and smart cities, are adopting digital twin technology to optimize processes, enhance product development, and improve overall performance.

Internet of Things (IoT) is integral to the digital twin market, enabling the connection of physical assets to their virtual counterparts. This connectivity enhances data collection and analysis for more accurate digital representations.

The market focuses on implementing robust cybersecurity measures to protect sensitive data associated with digital twins, ensuring the secure deployment and operation of virtual models.

Factors such as the increasing adoption of IoT, advancements in cloud computing, and the demand for predictive maintenance solutions are driving the growth of the digital twin market.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Digital Twin Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Digital Twin Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

3.5. Digital Twin Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. Digital Twin Market: Dynamics

4.1. Digital Twin Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Digital Twin Market Drivers

4.3. Digital Twin Market Restraints

4.4. Digital Twin Market Opportunities

4.5. Digital Twin Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Analysis

4.8.1. IoT And IIoT

4.8.2. AI and ML

4.8.3. Augmented Reality, Virtual Reality, and Mixed Reality

4.8.4. 5G

4.8.5. Cloud Computing and Edge Computing

4.8.6. Blockchain

4.8.7. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Global Digital Twin Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Global Digital Twin Market Size and Forecast, by Type (2024-2032)

5.1.1. Product Digital Twin

5.1.2. Process Digital Twin

5.1.3. System Digital Twin

5.2. Global Digital Twin Market Size and Forecast, by Technology (2024-2032)

5.2.1. IoT-based Digital Twins

5.2.2. Augmented Reality (AR) & Virtual Reality (VR) Digital Twins

5.2.3. Machine Learning-based Digital Twins

5.3. Global Digital Twin Market Size and Forecast, by End-User Industry (2024-2032)

5.3.1. Manufacturing

5.3.2. Healthcare

5.3.3. Aerospace and Defence

5.3.4. Automotive

5.3.5. Energy and Utilities

5.4. Global Digital Twin Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. North America Digital Twin Market Size and Forecast, by Type (2024-2032)

6.1.1. Product Digital Twin

6.1.2. Process Digital Twin

6.1.3. System Digital Twin

6.2. North America Digital Twin Market Size and Forecast, by Technology (2024-2032)

6.2.1. IoT-based Digital Twins

6.2.2. Augmented Reality (AR) & Virtual Reality (VR) Digital Twins

6.2.3. Machine Learning-based Digital Twins

6.3. North America Digital Twin Market Size and Forecast, by End-User Industry (2024-2032)

6.3.1. Manufacturing

6.3.2. Healthcare

6.3.3. Aerospace and Defence

6.3.4. Automotive

6.3.5. Energy and Utilities

6.4. North America Digital Twin Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Europe Digital Twin Market Size and Forecast, by Type (2024-2032)

7.2. Europe Digital Twin Market Size and Forecast, by Technology (2024-2032)

7.3. Europe Digital Twin Market Size and Forecast, by End-User Industry (2024-2032)

7.4. Europe Digital Twin Market Size and Forecast, by Country (2024-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Asia Pacific Digital Twin Market Size and Forecast, by Type (2024-2032)

8.2. Asia Pacific Digital Twin Market Size and Forecast, by Technology (2024-2032)

8.3. Asia Pacific Digital Twin Market Size and Forecast, by End-User Industry (2024-2032)

8.4. Asia Pacific Digital Twin Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. Middle East and Africa Digital Twin Market Size and Forecast, by Type (2024-2032)

9.2. Middle East and Africa Digital Twin Market Size and Forecast, by Technology (2024-2032)

9.3. Middle East and Africa Digital Twin Market Size and Forecast, by End-User Industry (2024-2032)

9.4. Middle East and Africa Digital Twin Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

10.1. South America Digital Twin Market Size and Forecast, by Type (2024-2032)

10.2. South America Digital Twin Market Size and Forecast, by Technology (2024-2032)

10.3. South America Digital Twin Market Size and Forecast, by End-User Industry (2024-2032)

10.4. South America Digital Twin Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Siemens

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. General Electric (GE)

11.3. IBM

11.4. Microsoft

11.5. PTC

11.6. ANSYS

11.7. Dassault Systèmes

11.8. Oracle

11.9. SAP

11.10. Altair

11.11. Bentley Systems

11.12. AVEVA

11.13. Honeywell

11.14. Cisco

11.15. Schneider Electric

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook