Convertible Bond Market Size, Tech-Driven Growth and Arbitrage Trends

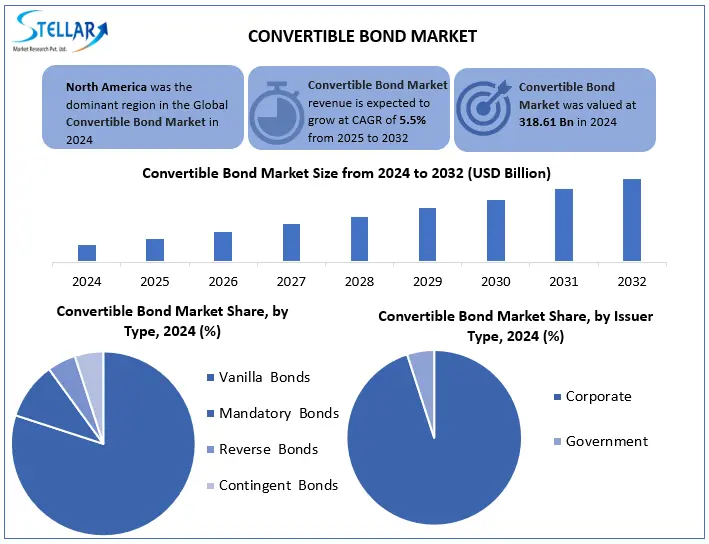

Convertible Bond Market size was valued at USD 318.61 Bn in 2024, and is expected to grow at a CAGR of 5.5% from 2025 to 2032, reaching nearly USD 488.97 Bn by 2032.

Format : PDF | Report ID : SMR_2793

Convertible Bond Market Overview

Convertible bond is a fixed-income corporate debt security that yields interest payments and is converted into a predetermined number of common stock or equity shares. The conversion from the bond to stock is done at certain time during the bond's life and is usually at the discretion of the bondholder. As a hybrid security, the price of a convertible bond is especially sensitive to changes in interest rates, the price of the underlying stock, and the issuer's credit rating.

Convertible bond market is driven by demand from high growth companies seeking flexible financing and investors attracted to hybrid instruments offering equity upside with downside protection. In 2024, issuance surged over 60%, led by tech and biotech firms leveraging low rates while avoiding immediate dilution. Hedge funds contribute significantly, with arbitrage strategies fueling 30% of market liquidity. North America leads due to deep capital markets and investor sophistication. Key players like Goldman Sachs, BlackRock, and Citadel shape the competitive landscape.

To get more Insights: Request Free Sample Report

Convertible Bond Market Dynamics

High-Growth Issuers, and Hedge Fund Demand Combine to Boost Convertible Bond Market Growth

Convertible bond market is primarily driven by demand from growth stage companies seeking flexible financing and investors looking for hybrid instruments that offer equity upside with downside protection. Convertible bond issuance surged by over 60% in 2023, as tech and biotech firms capitalized on low interest rates to raise cheap capital without immediate equity dilution. In 2023, 40% of convertible issuers from the US were in pre profit companies, highlighting the appeal of convertibles for high growth sectors.

Hedge funds also play a critical role; arbitrage strategies account for 30% of convertible market liquidity. Bank of America notes that convertibles offer average yields 2–3% lower than traditional corporate bonds, making them attractive for issuers, while 25% of convertibles eventually convert to equity, benefiting investors in bullish markets.

Complex Pricing and Dilution Risks Continue to restrain Convertible Bond Market Growth

Convertible bond market faces several structural challenges that impact both issuers and investors. Pricing these instruments remains notoriously tricky as their dual nature demands analysis of credit risk, equity volatility, and conversion math, resulting in wider trading spreads that reach 75 basis points versus conventional bonds. Liquidity remains constrained, with secondary market activity covering barely a fifth of outstanding volume as most buyers adopt buy-and-hold strategies. Recent macroeconomic shifts compounded these issues.

The Fed’s aggressive rate hikes pushed convertible yields to 5.7% in 2023 as nearly doubling from 2021, undermining issuers long-standing cost advantage. Meanwhile, equity market swings have squeezed conversion premiums to 22%, down from 35% pre-pandemic, exposing companies to greater dilution risks. Regulatory changes, like stricter hedge fund reporting rules, have further dampened the arbitrage activity that once provided crucial market liquidity.

Convertible Bond Market Segment Analysis

Based on Type, the Convertible Bond Market is segmented into vanilla convertible bonds, mandatory convertible bonds, reverse convertible bonds, and contingent convertible bonds, with vanilla convertible bonds dominated type in 2024 and is expected to hold largest market share during forecast period. Vanilla bond accounts for roughly 65-70% of total issuance volume. Their popularity stems from greater flexibility compared to other types of issuers benefit from lower coupon payments (typically 1-3%) while retaining control over conversion timing, unlike mandatory convertibles which force equity conversion at maturity. Investors favor vanilla structures as they offer unlimited equity upside through standard conversion options while maintaining bond like protection when stock underperforms.

Based on Issuer Type, the Convertible Bond Market is segmented into corporate, and government, with corporate dominated issuer type in 2024 and is expected to hold largest market share during forecast period. Corporate convertible bond represents 90% to 95% of total issuance volume compared to minimal government participation. This lopsided distribution stems from fundamental differences in financing needs and risk profiles. Corporations in the technology (40% of issuance), healthcare (20-25%), and in consumer discretionary sectors (15-20%), favor convertible bond as strategic tool to raise growth capital while managing dilution. The hybrid nature aligns perfectly with their need for lower cost financing (average 2-3% coupons vs. 5-7% for straight corporate bonds) coupled with equity upside potential.

Convertible Bond Market Regional Analysis

North America dominated the Convertible Bond Market in 2024 and is expected to dominate during forecast period (2025-2032)

Convertible Bond Market is dominated by the North America, accounting for 45-50% of total issuance. Dominance is due to three key factors: First, the region's deep capital markets and robust ecosystem for growth companies especially in technology (40% of U.S. convertibles) and biotech (25%) creates ideal conditions for hybrid financing. Second, the presence of sophisticated institutional investors and active hedge funds specializing in convertible arbitrage provides unparalleled liquidity, with secondary market trading volumes 2-3 times higher than other regions. Third, the U.S. market's flexibility accommodates diverse structures, from traditional vanilla convertibles to innovative SPAC-linked instruments, attracting both blue-chip firms and pre-revenue startups. North America's combination of issuer demand, investor depth, and market infrastructure solidifies its position as the convertible bond hub.

Convertible Bond Market Competitive Landscape

Convertible bond market features fierce competition among major players, each fighting for dominance in their niche. Goldman Sachs continues to dominate the tech and biotech convertible space, leveraging its strong ECM franchise to win lead roles on 60% of large-cap US convertible deals. Morgan Stanley is aggressively challenging this position by offering more innovative structures and competitive pricing, particularly for healthcare issuers. On the buy side, BlackRock maintains its position as the largest convertible bond investor globally, using its scale to negotiate better terms. PIMCO focuses on value opportunities in distressed and crossover situations. Among trading firms, Citadel remains the market maker of choice for complex convertible arbitrage strategies, controlling an estimated 25% of secondary market liquidity.

Convertible Bond Market Recent Development

|

Date |

Company |

Development |

Details |

|

03-May-25 |

Goldman Sachs |

Led $500M convertible bond for AI startup Anthropic |

Coupon: 2.5%; Conversion premium: 25%. Funds to expand cloud infrastructure. |

|

12-February-25 |

Morgan Stanley |

Structured biotech CoCo bond for Moderna |

Contingent convertible (CoCo) with 3% yield, linked to FDA approval milestones. |

|

Convertible Bond Market Scope |

|

|

Market Size in 2024 |

USD 318.61 Bn. |

|

Market Size in 2032 |

USD 488.97 Bn. |

|

CAGR (2025-2032) |

5.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Vanilla Convertible Bonds Mandatory Convertible Bonds Reverse Convertible Bonds Contingent Convertible Bonds |

|

By Issuer Type Corporate Government |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Convertible Bond Market Key Players

North America

- Goldman Sachs (USA)

- Morgan Stanley (USA)

- J.P. Morgan (USA)

- Bank of America (USA)

- Citigroup (USA)

- BlackRock (USA)

- PIMCO (USA)

- Fidelity (USA)

- T. Rowe Price (USA)

- Citadel (USA)

- Millennium (USA)

- Point72 (USA)

- Jane Street (USA)

- Susquehanna SIG (USA)

Europe

- Barclays (UK)

- Deutsche Bank (Germany)

- UBS (Switzerland)

- BNP Paribas (France)

- Allianz GI (Germany)

- Amundi (France)

- BlueCrest (UK)

- Marshall Wace (UK)

Asia-Pacific

- Nomura (Japan)

- CICC (China)

- HSBC Asia (Hong Kong SAR)

- Ping An AM (China)

- Macquarie (Australia)

Middle East & Africa

- EFG Hermes (Egypt)

- First Abu Dhabi Bank (UAE)

South America

- Itaú BBA (Brazil)

Frequently Asked Questions

Hedge funds contribute 30% of market liquidity through arbitrage strategies, which help price efficiency and boost secondary trading.

North America led with a 45–50% share in 2024, due to deep capital markets, high-tech issuers, and strong hedge fund participation.

Their hybrid nature requires analyzing credit risk, stock volatility, and conversion math, leading to wider spreads and complex valuation.

The Fed’s hikes pushed yields to 5.7% in 2023, eroding cost advantages for issuers and increasing dilution risks from lower conversion premiums.

1. Convertible Bond Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Convertible Bond Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Convertible Bond Market: Dynamics

3.1. Convertible Bond Market Trends by Region

3.1.1. North America Convertible Bond Market Trends

3.1.2. Europe Convertible Bond Market Trends

3.1.3. Asia Pacific Convertible Bond Market Trends

3.1.4. Middle East and Africa Convertible Bond Market Trends

3.1.5. South America Convertible Bond Market Trends

3.2. Convertible Bond Market Dynamics

3.2.1. Global Convertible Bond Market Drivers

3.2.2. Global Convertible Bond Market Restraints

3.2.3. Global Convertible Bond Market Opportunities

3.2.4. Global Convertible Bond Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Micromotor Industry

4. Convertible Bond Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Convertible Bond Market Size and Forecast, By Type (2024-2032)

4.1.1. Vanilla Convertible Bonds

4.1.2. Mandatory Convertible Bonds

4.1.3. Reverse Convertible Bonds

4.1.4. Contingent Convertible Bonds

4.2. Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

4.2.1. Corporate

4.2.2. Government

4.3. Convertible Bond Market Size and Forecast, By Region (2024-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Convertible Bond Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Convertible Bond Market Size and Forecast, By Type (2024-2032)

5.1.1. Vanilla Convertible Bonds

5.1.2. Mandatory Convertible Bonds

5.1.3. Reverse Convertible Bonds

5.1.4. Contingent Convertible Bonds

5.2. North America Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

5.2.1. Corporate

5.2.2. Government

5.3. North America Convertible Bond Market Size and Forecast, by Country (2024-2032)

5.3.1. United States

5.3.1.1. United States Convertible Bond Market Size and Forecast, By Type (2024-2032)

5.3.1.1.1. Vanilla Convertible Bonds

5.3.1.1.2. Mandatory Convertible Bonds

5.3.1.1.3. Reverse Convertible Bonds

5.3.1.1.4. Contingent Convertible Bonds

5.3.1.2. United States Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

5.3.1.2.1. Corporate

5.3.1.2.2. Government

5.3.1.3. Canada Convertible Bond Market Size and Forecast, By Type (2024-2032)

5.3.1.3.1. Vanilla Convertible Bonds

5.3.1.3.2. Mandatory Convertible Bonds

5.3.1.3.3. Reverse Convertible Bonds

5.3.1.3.4. Contingent Convertible Bonds

5.3.1.4. Canada Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

5.3.1.4.1. Corporate

5.3.1.4.2. Government

5.3.2. Mexico

5.3.2.1. Mexico Convertible Bond Market Size and Forecast, By Type (2024-2032)

5.3.2.1.1. Vanilla Convertible Bonds

5.3.2.1.2. Mandatory Convertible Bonds

5.3.2.1.3. Reverse Convertible Bonds

5.3.2.1.4. Contingent Convertible Bonds

5.3.2.2. Mexico Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

5.3.2.2.1. Corporate

5.3.2.2.2. Government

6. Europe Convertible Bond Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Convertible Bond Market Size and Forecast, By Type (2024-2032)

6.2. Europe Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

6.3. Europe Convertible Bond Market Size and Forecast, by Country (2024-2032)

6.3.1. United Kingdom

6.3.1.1. United Kingdom Convertible Bond Market Size and Forecast, By Type (2024-2032)

6.3.1.2. United Kingdom Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

6.3.2. France

6.3.2.1. France Convertible Bond Market Size and Forecast, By Type (2024-2032)

6.3.2.2. France Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

6.3.3. Germany

6.3.3.1. Germany Convertible Bond Market Size and Forecast, By Type (2024-2032)

6.3.3.2. Germany Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

6.3.4. Italy

6.3.4.1. Italy Convertible Bond Market Size and Forecast, By Type (2024-2032)

6.3.4.2. Italy Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

6.3.5. Spain

6.3.5.1. Spain Convertible Bond Market Size and Forecast, By Type (2024-2032)

6.3.5.2. Spain Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

6.3.6. Sweden

6.3.6.1. Sweden Convertible Bond Market Size and Forecast, By Type (2024-2032)

6.3.6.2. Sweden Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

6.3.7. Austria

6.3.7.1. Austria Convertible Bond Market Size and Forecast, By Type (2024-2032)

6.3.7.2. Austria Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe Convertible Bond Market Size and Forecast, By Type (2024-2032)

6.3.8.2. Rest of Europe Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7. Asia Pacific Convertible Bond Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3. Asia Pacific Convertible Bond Market Size and Forecast, by Country (2024-2032)

7.3.1. China

7.3.1.1. China Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.1.2. China Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.2. S Korea

7.3.2.1. S Korea Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.2.2. S Korea Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.3. Japan

7.3.3.1. Japan Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.3.2. Japan Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.4. India

7.3.4.1. India Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.4.2. India Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.5. Australia

7.3.5.1. Australia Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.5.2. Australia Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.6. Indonesia

7.3.6.1. Indonesia Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.6.2. Indonesia Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.7. Philippines

7.3.7.1. Philippines Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.7.2. Philippines Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.8. Malaysia

7.3.8.1. Malaysia Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.8.2. Malaysia Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.9. Vietnam

7.3.9.1. Vietnam Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.9.2. Vietnam Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.10. Thailand

7.3.10.1. Thailand Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.10.2. Thailand Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

7.3.11. Rest of Asia Pacific

7.3.11.1. Rest of Asia Pacific Convertible Bond Market Size and Forecast, By Type (2024-2032)

7.3.11.2. Rest of Asia Pacific Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

8. Middle East and Africa Convertible Bond Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Convertible Bond Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

8.3. Middle East and Africa Convertible Bond Market Size and Forecast, by Country (2024-2032)

8.3.1. South Africa

8.3.1.1. South Africa Convertible Bond Market Size and Forecast, By Type (2024-2032)

8.3.1.2. South Africa Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

8.3.2. GCC

8.3.2.1. GCC Convertible Bond Market Size and Forecast, By Type (2024-2032)

8.3.2.2. GCC Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

8.3.3. Nigeria

8.3.3.1. Nigeria Convertible Bond Market Size and Forecast, By Type (2024-2032)

8.3.3.2. Nigeria Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

8.3.4. Rest of ME&A

8.3.4.1. Rest of ME&A Convertible Bond Market Size and Forecast, By Type (2024-2032)

8.3.4.2. Rest of ME&A Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

9. South America Convertible Bond Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Convertible Bond Market Size and Forecast, By Type (2024-2032)

9.2. South America Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

9.3. South America Convertible Bond Market Size and Forecast, by Country (2024-2032)

9.3.1. Brazil

9.3.1.1. Brazil Convertible Bond Market Size and Forecast, By Type (2024-2032)

9.3.1.2. Brazil Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

9.3.2. Argentina

9.3.2.1. Argentina Convertible Bond Market Size and Forecast, By Type (2024-2032)

9.3.2.2. Argentina Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

9.3.3. Rest Of South America

9.3.3.1. Rest Of South America Convertible Bond Market Size and Forecast, By Type (2024-2032)

9.3.3.2. Rest Of South America Convertible Bond Market Size and Forecast, By Issuer Type (2024-2032)

10. Company Profile: Key Players

10.1. Goldman Sachs (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Steelcase Morgan Stanley (USA)

10.3. J.P. Morgan (USA)

10.4. Bank of America (USA)

10.5. Citigroup (USA)

10.6. BlackRock (USA)

10.7. PIMCO (USA)

10.8. Fidelity (USA)

10.9. T. Rowe Price (USA)

10.10. Citadel (USA)

10.11. Millennium (USA)

10.12. Point72 (USA)

10.13. Jane Street (USA)

10.14. Susquehanna SIG (USA)

10.15. Barclays (UK)

10.16. Deutsche Bank (Germany)

10.17. UBS (Switzerland)

10.18. BNP Paribas (France)

10.19. Allianz GI (Germany)

10.20. Amundi (France)

10.21. BlueCrest (UK)

10.22. Marshall Wace (UK)

10.23. Nomura (Japan)

10.24. CICC (China)

10.25. HSBC Asia (Hong Kong SAR)

10.26. Ping An AM (China)

10.27. Macquarie (Australia)

10.28. EFG Hermes (Egypt)

10.29. First Abu Dhabi Bank (UAE)

10.30. Itaú BBA (Brazil)

11. Key Findings

12. Analyst Recommendations

13. Convertible Bond Market: Research Methodology