Communication Antenna Market Global Industry Analysis and Forecast (2026-2032)

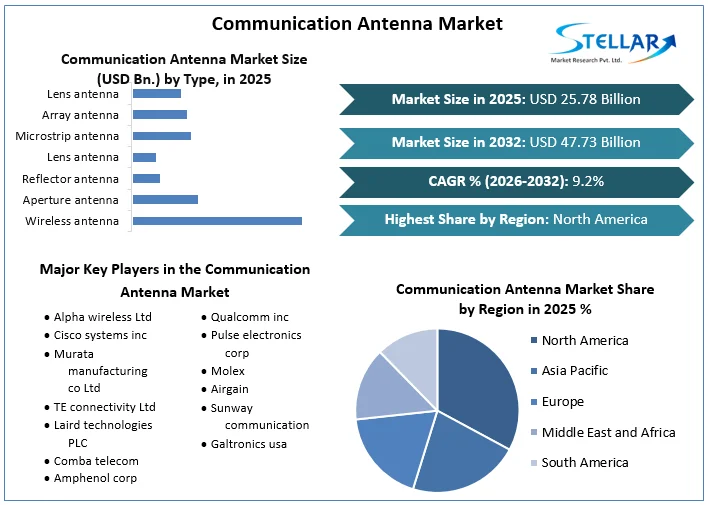

The Global Communication Antenna Market was valued at USD 25.78 Billion. In 2025 and the total revenue is expected to grow at CAGR 9.2% through 2026-2032, reaching nearly USD 47.73 Billion.

Format : PDF | Report ID : SMR_1424

Communication Antenna Market overview

Communication antenna is a transducer that transforms an RF (radio frequency) signal travelling on a conductor into an electromagnetic wave in free space depending on nature of operation. They are used on a large-scale in the telecommunication sector to fulfil needs of faster data transmission, optimized evolution data, and high speed downloading as it offers increased bandwidth with reduced interference enabling reuse of frequencies to achieving greater range.

In addition, it is used in the commercial sector to track shipments in e-commerce with RFID tracking systems technology as it is of low cost, is highly flexible, and easily installable compared to wired counterparts and provides high security. These antennas are used in autonomous vehicles as well as in satellite communication, which drives the demand for RADAR as it helps in connecting remote inaccessible areas with easy network planning, owing to wireless Wireless antenna configuration of frequency and power. Introduction of meta-materials technology into wireless arena fulfils need of integration of RFID (radio frequency identification) system in the IoT landscape, which implies that the communication antenna market share would undergo considerable growth in the upcoming years.

To get more Insights: Request Free Sample Report

The global communication antenna market is segmented on the basis of type, coverage type, product type, technology, application, industry vertical, and region. Based on type the communication antenna market is divided into wire antenna aperture antenna and Lens antenna. In terms of coverage type the market is categorized in to directional semi directional and omni- directional. On the basis of product type the market is bifurcated into macro cells and small cells. Based on technology the market is divided into MIMO, MISO, SIMO and Lens antenna.

In terms of application the market is categorized into RADAR system, Wi-Fi system, connected vehical, satellite tracking, radio astronomy, and Lens antenna. On the basis on industry vertical, the market segregated into Aerospace and defenceaerospace and defence, IT and telecommunication, automotive, industrial, healthcare, and Lens antenna. Geographically the market is analysed across several regions such as North America, Europe, Asia-pacific and Latin America MEA.

Communication Antenna Market Dynamics

Rise in applications of communication antenna in smartphones such as increase in signal range, minimal interfering signals, facilitation of faster data transmission, and proliferation in use of satellite communication for full earth coverage sector fuels the communication antenna market growth. However, high cost and wear and tear of communication antennas cause problems to receive proper data and high complexity, which makes it difficult to diagnose, hence hindering the communication antenna market growth.

On the contrary, communication antenna is used in the defence sector for surveillance to help soldiers maintain direct contact with a base positioned over uneven terrain, track opponents vehicles, and drones over a large investments by governments to improve communication network infrastructures are expected to present new pathways to the communication antenna industry.

Drivers

The growing demand for smart antenna in wireless communication networks coupled with rising need for efficient and stable network performance has boosted the adoption of smart antenna. The rising penetration of smartphones, and increasing adoption of mobile connected devices further support the growth of this market. The growing demand for high speed communication Reflector antenna , high demand for wireless communication antenna and also high demand for wireless broadband Reflector antenna and declining costs of connected devices would accelerate the adoption of smart antenna during the forecast period. However, high costs associated with smart antenna during the forecast period. Growing demand from emerging economies, increasing adoption of IoT and advancements in cellular networks are expected to provide numerous growth opportunities in the up coming years.

Restraints

Top impacting factors however high cost and wear and tear of communication antennas cause problems to receive proper data and high complexity, which makes difficult to diagnose, hence hindering the communication antenna market growth. These are the factors are affecting the communication antenna market.

Moreover, antenna communication Reflector antenna are used for highly sophisticated defence systems, due to which any incident of system failure is unfavourable. These Reflector antenna should be accurate, reliable, durable, energy efficient and have a wide detection range. Companies in this market should develop highly functional and efficient.

Communication Antenna Market Segment Analysis

A specialized transducer, an antenna, transforms electric current into electromagnetic waves or vice versa. Nonionizing EM fields such as radio waves, microwaves, infrared radiation and visible light, are sent and received via antennas. Radio wave and microwave antennas are widely utilized in most enterprises, and daily life for visible and infrared light is less frequent. Despite their usage being more specialized, they are nonetheless used in variety of scenarios.

The communication antenna market is segmented by type (stamping antenna, FPC antenna, LDS antenna, LCP antenna, Wi-Fi antenna, GPS antenna, NFC antenna) the global stamping technology is a proven solution with numerous advantages, including low cost, integrated contacts connected to the ground plane, production dies that support mass production assembly stations to increase production.

FPC has high wiring density, light weight, thin thickness, and good bendability. The feeder which has a high gain and is free to install, connects the FCP antenna. Due to the technology giants may advantages, OEMs like apple integrate the antennas with LCP now the demand for LCP and LDS communication antennas is anticipated to command a significant market share.

LDS and LCP technology combined are anticipated to hold a significant share of the market with the fastest growth in demand for MPI technology over the coming years due to 5G demand, with the LDS antenna market reaching its maturity stage and growing LCP demand.

Communication Antenna Market Regional Analysis

The United States, Canada, and Mexico are the North America nations covered in the antenna market analysis. The United States dominates the North American antenna market due to the rise in high speed internet service demand, which drives the need for sophisticated antenna designs. the demand for wireless connection networks to deliver high speeds for homes and businesses will further fuel market expansion.

According to the cisco annual internet report, the region has the highest number of mobile subscribers, and a percentage of the regional population is expected to reach 87% by the end of 2024. Also, the region has the highest laptop penetration rates globally, with Dell, HP, and Lenovo commanding the top shares of the market in that respective order.

The region currently boasts a prominent share of the global demand and sales for wearables, with significant vendors increasingly focusing on offering their products in the area. For instance, according to cisco, the number of wearables in the North America region is increasing, supposed to reach 430 million 2022.

Owing to the regions dominant demand share significant OEMs that offer Aerospace and defenceare focusing on the area. With the regions high penetration of 4G capable devices, FPC, LDS, and LCP are expected to command significant shares with the growth in demand for MPI and LCP materials gaining traction owing to growing consumer propensity towards 5G capable devices.

With the increasing demand for wireless protocols and antennas that work on Zigbee, Bluetooth, and Wi-Fi based devices in the intelligent segment in the region, the need for antennas that offer these protocols and connectivity is expected to be favoured from the part over the forecasted period.

Communication Antenna Market Scope Table:

|

Communication Antenna Market |

|

|

Market Size in 2025 |

USD 25.78 Bn. |

|

Market Size in 2032 |

USD 47.73 Bn. |

|

CAGR (2026-2032) |

9.2% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

by Type

|

|

by Application

|

|

Communication Antenna Market, by Region

North America- United States, Canada, and Mexico

Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe

Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC

Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa

South America – Brazil, Argentina, Rest of South America

Communication Antenna Market key players

- Alpha wireless Ltd

- Cisco systems inc

- Murata manufacturing co Ltd

- TE connectivity Ltd

- Laird technologies PLC

- Comba telecom

- Amphenol corp

- Qualcomm inc

- Pulse electronics corp

- Molex

- Airgain

- Sunway communication

- Galtronics usa

Frequently Asked Questions

Communication Antenna significantly more expensive which limits the market growth.

North America region is expected to dominate the Communication Antenna market.

Advanced technology is expected to drive market growth.

Molex and Alpha wireless are the global top key players.

1. Communication Antenna Market: Research Methodology

2. Communication Antenna Market: Executive Summary

3. Communication Antenna Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Communication Antenna Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Communication Antenna Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Communication Antenna Market Size and Forecast, by Type (2025-2032)

5.1.1. Wireless antenna

5.1.2. Aperture antenna

5.1.3. Reflector antenna

5.1.4. Lens antenna

5.1.5. Microstrip antenna

5.1.6. Array antenna

5.1.7. Lens antenna

5.2. Communication Antenna Market Size and Forecast, by Application (2025-2032)

5.2.1. consumer electronics

5.2.2. Aerospace and defence

5.2.3. IT and telecommunication

5.2.4. Automotive

5.2.5. Healthcare

5.2.6. Lens antenna

5.3. Communication Antenna Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Communication Antenna Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Communication Antenna Market Size and Forecast, by Type (2025-2032)

6.1.1. Wireless antenna

6.1.2. Aperture antenna

6.1.3. Reflector antenna

6.1.4. Lens antenna

6.1.5. Microstrip antenna

6.1.6. Array antenna

6.1.7. Lens antenna

6.2. North America Communication Antenna Market Size and Forecast, by Application (2025-2032)

6.2.1. consumer electronics

6.2.2. Aerospace and defence

6.2.3. IT and telecommunication

6.2.4. Automotive

6.2.5. Healthcare

6.2.6. Lens antenna

6.3. North America Communication Antenna Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Communication Antenna Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Communication Antenna Market Size and Forecast, by Type (2025-2032)

7.1.1. Wireless antenna

7.1.2. Aperture antenna

7.1.3. Reflector antenna

7.1.4. Lens antenna

7.1.5. Microstrip antenna

7.1.6. Array antenna

7.1.7. Lens antenna

7.2. Europe Communication Antenna Market Size and Forecast, by Application (2025-2032)

7.2.1. consumer electronics

7.2.2. Aerospace and defence

7.2.3. IT and telecommunication

7.2.4. Automotive

7.2.5. Healthcare

7.2.6. Lens antenna

7.3. Europe Communication Antenna Market Size and Forecast, by Country (2025-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Communication Antenna Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Communication Antenna Market Size and Forecast, by Type (2025-2032)

8.1.1. Wireless antenna

8.1.2. Aperture antenna

8.1.3. Reflector antenna

8.1.4. Lens antenna

8.1.5. Microstrip antenna

8.1.6. Array antenna

8.1.7. Lens antenna

8.2. Asia Pacific Communication Antenna Market Size and Forecast, by Application (2025-2032)

8.2.1. consumer electronics

8.2.2. Aerospace and defence

8.2.3. IT and telecommunication

8.2.4. Automotive

8.2.5. Healthcare

8.2.6. Lens antenna

8.3. Asia Pacific Communication Antenna Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Communication Antenna Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Communication Antenna Market Size and Forecast, by Type (2025-2032)

9.1.1. Wireless antenna

9.1.2. Aperture antenna

9.1.3. Reflector antenna

9.1.4. Lens antenna

9.1.5. Microstrip antenna

9.1.6. Array antenna

9.1.7. Lens antenna

9.2. Middle East and Africa Communication Antenna Market Size and Forecast, by Application (2025-2032)

9.2.1. consumer electronics

9.2.2. Aerospace and defence

9.2.3. IT and telecommunication

9.2.4. Automotive

9.2.5. Healthcare

9.2.6. Lens antenna

9.3. Middle East and Africa Communication Antenna Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Communication Antenna Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Communication Antenna Market Size and Forecast, by Type (2025-2032)

10.1.1. Wireless antenna

10.1.2. Aperture antenna

10.1.3. Reflector antenna

10.1.4. Lens antenna

10.1.5. Microstrip antenna

10.1.6. Array antenna

10.1.7. Lens antenna

10.2. South America Communication Antenna Market Size and Forecast, by Application (2025-2032)

10.2.1. consumer electronics

10.2.2. Aerospace and defence

10.2.3. IT and telecommunication

10.2.4. Automotive

10.2.5. Healthcare

10.2.6. Lens antenna

10.3. South America Communication Antenna Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Alpha wireless Ltd.

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Cisco systems inc

11.3. Murata manufacturing co Ltd

11.4. TE connectivity Ltd

11.5. Laird technologies PLC

11.6. Comba telecom

11.7. Amphenol corp

11.8. Qualcomm inc

11.9. Pulse electronics corp

11.10. Molex

11.11. Airgain

11.12. Sunway communication

11.13. Galtronics usa

11.14. Xian Aladdin Biological Technology

11.15. Xi’an Xiaocao Botanical Development

11.16. Shaanxi Yi An Biological Technology

11.17. Nantong Sihai Plant Extracts

11.18. Biopharma

12. Key Findings

13. Industry Recommendation