Cassava Market Global Industry Analysis and Forecast (2026-2032)

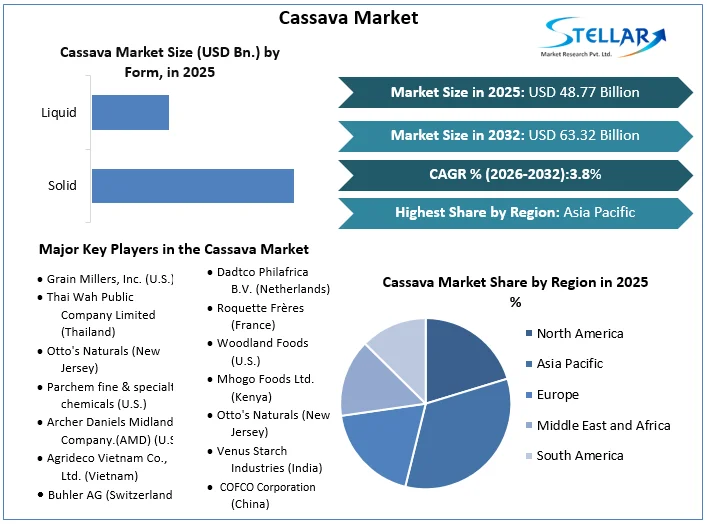

The Cassava Market size was valued at USD 48.77 Bn. in 2025 and the total Global Cassava revenue is expected to grow at a CAGR of 3.8 % from 2026 to 2032, reaching nearly USD 63.32 Bn. by 2032.

Format : PDF | Report ID : SMR_1917

Cassava Market Overview

The cassava root is the edible, starchy tuberous root of the Manihot esculenta plant. It is a staple food crop in many tropical regions, where it is consumed fresh, processed into flour, chips, or starch, and used in various traditional dishes. Also, it is utilized in industrial applications such as animal feed and biofuel production. Cassava is a good source of resistant starch, which supports gut health and blood sugar management. It also contains vitamin C, a key micronutrient that can enhance immune function, collagen production, and enhances immunity.

The Global Cassava Market research report contains historical data, current market trends, product consumption, environmental factors, technological innovation forecasts, upcoming technologies, and technical progress in the related industry. It categorizes the global data by manufacturer, region, type, and application. Additionally, the report analyzes market status, market share, growth rate, future trends, drivers, opportunities, challenges, risks, entry barriers, sales channels, and distributors. The report also outlines the potential of the Cassava market. It combines extensive quantitative analysis and exhaustive qualitative analysis, providing a deep insight into the Cassava market, covering all its essential aspects, from macro overview to micro details of segment markets by type, application, and region.

- Nigeria is the world's largest manufacturer of cassava, while Thailand is the largest exporter of cassava starch.

- Indonesia, Thailand, China, and Vietnam are also the key cassava producers in the region. They also produce lightweight cassava bags, which they export globally.

- In March 2022, the total value of domestic and export sales of cassava starch produced in Thailand amounted to approximately 7.52 billion Thai baht.

To get more Insights: Request Free Sample Report

Cassava Market Dynamics

Rising urbanization with increasing demand for cassava-based products

A growing global population creates an ongoing demand for reliable and affordable food sources, leading to increased need for cassava as a high-calorie crop. As individuals migrate to urban areas, their dietary preferences shift towards convenient food options. Cassava is used in various industries, including food, animal feed, and biofuels. The growing demand for sustainable and renewable energy sources drives the use of cassava-derived ethanol as an industrial feedstock. Changing consumer preferences and the growing middle class in emerging economies have increased the demand for Cassava Market with products such as cakes, balls, pizza, and pancakes. Sweeteners produced from cassava starch are gaining popularity owing to their natural properties and low-calorie content.

Cassava flour can be a gluten-free alternative in various food products. The rise of functional foods with added nutritional or health-promoting properties creates a demand for cassava derivatives like cassava starch, which can be used as a thickener or bulking agent. The rising food demand is driving the cultivation and production of cassava. The rising importance of sustainability for businesses lies in their desire to appeal to environmentally conscious consumers and stand out in the market. This change in focus signifies a growing awareness of the need to conserve natural resources and minimize carbon emissions.

Cassava Market Restraints:

Short shelf life and Threats from pests and diseases are challenges hindering the cassava market growth.

The cassava market faces several challenges that hinder its growth and development. Cassava crops are vulnerable to diseases and pests, such as viral diseases like cassava mosaic disease and cassava brown streak disease, as well as pests like whiteflies and mealy bugs. These pathogens and pests can cause significant yield losses, affecting the overall supply and quality of cassava roots. Another major restraint is the perishable nature of fresh cassava roots. Cassava roots have a short shelf life and must be processed or consumed within a few days after harvesting to prevent spoilage. This perishability poses challenges in transportation and storage, limiting the geographical reach of the cassava market and increasing post-harvest losses.

Limited availability of improved varieties and advanced cultivation techniques. Many farmers, particularly in developing countries, depend on traditional cassava varieties and farming practices, resulting in lower yields and productivity. he access to superior cassava strains, fertilizers, and contemporary agricultural methods is frequently restricted, which hampers the potential for increased cassava production.

Opportunities:

Cassava Market Segment Analysis

Based on the Form, the Solid form segment held the largest market share of about 49.1% in the Cassava Market in 2025. According to the SMR analysis, the segment is expected to grow at a CAGR of 3.8 % during the forecast period and maintain its dominance till 2032. The solid form segment which includes products like dried cassava chips, pellets, and flour has a significantly longer shelf life compared to fresh cassava roots or liquid products. The extended shelf life of solid forms of cassava, such as flour and starch, makes them easier to store, transport, and distribute over longer distances, increasing their commercial viability. Solid forms of cassava, particularly flour and starch, have a wide range of applications across various industries, including food and beverages, animal feed, pharmaceuticals, and industrial uses. This versatility drives a higher demand for solid cassava products.

- A 3.5-ounce (100-gram) serving of cooked cassava root contains 191 calories. About 84% of the calories come from carbohydrates, while the remainder comes from protein and fat.

Cassava Market Regional Analysis

Asia Pacific region has dominated the Cassava Market, which held the largest market share accounting for 56.40% in 2025, the region is expected to grow during the forecast period and maintain its dominance by 2032. The Asia-Pacific region has a large population that depends on cassava as a staple food crop and an important source of carbohydrates. Cassava is widely consumed in various forms, such as fresh roots, processed products (chips, flour, starch), and traditional dishes, Rising populations in the region create a constant demand for cassava as a food source, driving significant domestic demand within the region.

Many countries have suitable land for large-scale cassava production. Some countries in the Asia-Pacific region, especially Thailand and Vietnam, are significant exporters of cassava products, including dried chips, pellets, and starch. These exports are fueled by the demand from international markets, particularly in China, the European Union, and other regions where cassava is utilized in various industries such as animal feed, food processing, and biofuel production.

- China is a major producer of cassava, with increasing domestic consumption and industrial applications.

- Thailand is the world's largest exporter of cassava starch, promoting its robust processing industry and well-established export channels.

South America represents a mature market for the Cassava industry, holding a market share of XX% and experiencing significant growth during its forecast period. The cultivation of cassava is an integral part of traditional agricultural practices and culinary traditions in many South American countries, including Brazil, Colombia, Peru, and Venezuela. The warm temperatures, abundant rainfall, and fertile soils provide an ideal environment for cassava growth, allowing for widespread cultivation across the continent.In South America, many research institutions and universities are dedicated to improving cassava cultivation techniques, developing disease-resistant varieties, and finding new uses for cassava products. This research is crucial for promoting the sustainability and growth of the cassava industry in the region.

Cassava Market Competitive Landscape

The competitive landscape of the Cassava Market is constantly evolving, with leading players emerging and established players adapting their strategies. A key Company's strategy is its constant commitment to research and development (R&D) to maintain a leading position in technological development. The competitive landscape of the Cassava market includes a mix of established companies focusing on research and development to enhance efficiency and performance. Product launches have been an important strategic step for the major players in the Cassava market to remain competitive in the global market.

The key players in the Cassava market are Grain Millers, Inc., Woodland Foods, Mhogo Foods Ltd., Otto's Naturals, Venus Starch Industries, Psaltry International Company Limited, COFCO Corporation, Cargill, and Tereos Group. These companies employ strategies like product/service launches, acquisitions, partnerships, and collaborations to strengthen their market presence. The market is characterized by technological advancements, government regulations, and consumer demand for healthy and natural food products, driving the Cassava industry's growth.

- In 2023, Roquette Frères, known for its innovation in starches and bio-ingredients, might have launched new cassava-based products and it have announced advancements in sustainable cassava processing methods or introduced eco-friendly cassava derivatives.

- In February 2024, Cargill made an undisclosed investment in the Glasgow-based alternative protein startup ENOUGH as an additional contribution to its new series C funding round. Additionally, Cargill signed business agreements to use and promote ENOUGH's 'ABUNDA' mycoprotein.

|

Cassava Market Scope |

|

|

Market Size in 2025 |

USD 48.77 Bn. |

|

Market Size in 2032 |

USD 63.32 Bn. |

|

CAGR (2026-2032) |

3.8 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

|

by Category Organic Conventional

|

|

|

by Form Solid Liquid

|

|

|

by End Used Industries Food & Beverages Animal Feed Industry Pharmaceuticals Paper and Textile Manufacturing Others

|

|

|

by Distribution Channels Hypermarket & Supermarket Specialty Stores Modern Retail Online Stores

|

|

Regional Scope |

North America(United States), Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Cassava Market

- Grain Millers, Inc. (U.S.)

- Thai Wah Public Company Limited (Thailand)

- Otto's Naturals (New Jersey)

- Parchem fine & specialty chemicals (U.S.)

- Archer Daniels Midland Company.(AMD) (U.S.)

- Agrideco Vietnam Co., Ltd. (Vietnam)

- Buhler AG (Switzerland)

- Ingredion Incorporated (U.S.)

- American Key Food Products Inc. (U.S.)

- Psaltry International Limited (Nigeria)

- Dadtco Philafrica B.V. (Netherlands)

- Roquette Frères (France)

- Woodland Foods (U.S.)

- Mhogo Foods Ltd. (Kenya)

- Otto's Naturals (New Jersey)

- Venus Starch Industries (India)

- Psaltry International Company Limited (Nigeria)

- COFCO Corporation (China)

- Cargill, Incorporated (U.S.)

- Avebe U.A. (Netherlands)

- Penford Corporation (U.S.)

- Tereos Group (France)

- AGRANA Beteiligungs-AG (Austria)

- KMC (Kartoffelmelcentralen) (Denmark)

- Emsland Group (Germany)

- Nihon Shokuhin Kako Co., Ltd. (Japan)

- Anhui AAA Agricultural Technology Co., Ltd. (China)

Frequently Asked Questions

Asia Pacific is expected to hold the highest share of the Cassava Market.

The Cassava Market size was valued at USD 48.77 Billion in 2025 reaching nearly USD 63.32 Billion in 2032.

The growing demand for cassava-based products, especially in developing economies, and Advances in cassava processing technologies are improving efficiency and product quality, is a key driver of market growth.

The segments covered in the Cassava Market report are based on Category, form, End used industries, and Distribution Channels.

1. Cassava Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Cassava Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Cassava Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Cassava Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Trade Analysis

4.10.1. Import Scenario

4.10.2. Export Scenario

4.11. Regulatory Landscape

4.11.1. Market Regulation by Region

4.11.1.1. North America

4.11.1.2. Europe

4.11.1.3. Asia Pacific

4.11.1.4. Middle East and Africa

4.11.1.5. South America

4.11.2. Impact of Regulations on Market Dynamics

4.11.3. Government Schemes and Initiatives

5. Cassava Market Size and Forecast by Segments (by Value USD Million)

5.1. Cassava Market Size and Forecast, By Category (2025-2032)

5.1.1. Organic

5.1.2. Conventional

5.2. Cassava Market Size and Forecast, By Form (2025-2032)

5.2.1. Solid

5.2.2. Liquid

5.3. Cassava Market Size and Forecast, By End Use Industries (2025-2032)

5.3.1. Food & Beverages

5.3.2. Animal Feed Industry

5.3.3. Pharmaceuticals

5.3.4. Paper and Textile Manufacturing

5.3.5. Others

5.4. Cassava Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.1. Hypermarket & Supermarket

5.4.2. Specialty Stores

5.4.3. Modern Retail

5.4.4. Online Stores

5.5. Cassava Market Size and Forecast, by Region (2025-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Cassava Market Size and Forecast (by Value USD Million)

6.1. North America Cassava Market Size and Forecast, By Category (2025-2032)

6.1.1. Organic

6.1.2. Conventional

6.2. North America Cassava Market Size and Forecast, By Form (2025-2032)

6.2.1. Solid

6.2.2. Liquid

6.3. North America Cassava Market Size and Forecast, By End Use Industries (2025-2032)

6.3.1. Food & Beverages

6.3.2. Animal Feed Industry

6.3.3. Pharmaceuticals

6.3.4. Paper and Textile Manufacturing

6.3.5. Others

6.4. North America Cassava Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.1. Hypermarket & Supermarket

6.4.2. Specialty Stores

6.4.3. Modern Retail

6.4.4. Online Stores

6.5. North America Cassava Market Size and Forecast, by Country (2025-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Cassava Market Size and Forecast (by Value USD Million)

7.1. Europe Cassava Market Size and Forecast, By Category (2025-2032)

7.2. Europe Cassava Market Size and Forecast, By Form (2025-2032)

7.3. Europe Cassava Market Size and Forecast, By End Use Industries (2025-2032)

7.4. Europe Cassava Market Size and Forecast, By Distribution Channel (2025-2032)

7.5. Europe Cassava Market Size and Forecast, by Country (2025-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Cassava Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Cassava Market Size and Forecast, By Category (2025-2032)

8.2. Asia Pacific Cassava Market Size and Forecast, By Form (2025-2032)

8.3. Asia Pacific Cassava Market Size and Forecast, By End Use Industries (2025-2032)

8.4. Asia Pacific Cassava Market Size and Forecast, By Distribution Channel (2025-2032)

8.5. Asia Pacific Cassava Market Size and Forecast, by Country (2025-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Cassava Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Cassava Market Size and Forecast, By Category (2025-2032)

9.2. Middle East and Africa Cassava Market Size and Forecast, By Form (2025-2032)

9.3. Middle East and Africa Cassava Market Size and Forecast, By End Use Industries (2025-2032)

9.4. Middle East and Africa Cassava Market Size and Forecast, By Distribution Channel (2025-2032)

9.5. Middle East and Africa Cassava Market Size and Forecast, by Country (2025-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Cassava Market Size and Forecast (by Value USD Million)

10.1. South America Cassava Market Size and Forecast, By Category (2025-2032)

10.2. South America Cassava Market Size and Forecast, By Form (2025-2032)

10.3. South America Cassava Market Size and Forecast, By End Use Industries (2025-2032)

10.4. South America Cassava Market Size and Forecast, By Distribution Channel (2025-2032)

10.5. South America Cassava Market Size and Forecast, by Country (2025-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. Grain Millers, Inc. (U.S.)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Thai Wah Public Company Limited (Thailand)

11.3. Otto's Naturals (New Jersey)

11.4. Parchem fine & specialty chemicals (U.S.)

11.5. Archer Daniels Midland Company.(AMD) (U.S.)

11.6. Agrideco Vietnam Co., Ltd. (Vietnam)

11.7. Buhler AG (Switzerland)

11.8. Ingredion Incorporated (U.S.)

11.9. American Key Food Products Inc. (U.S.)

11.10. Psaltry International Limited (Nigeria)

11.11. Dadtco Philafrica B.V. (Netherlands)

11.12. Roquette Frères (France)

11.13. Woodland Foods (U.S.)

11.14. Mhogo Foods Ltd. (Kenya)

11.15. Otto's Naturals (New Jersey)

11.16. Venus Starch Industries (India)

11.17. Psaltry International Company Limited (Nigeria)

11.18. COFCO Corporation (China)

11.19. Cargill, Incorporated (U.S.)

11.20. Avebe U.A. (Netherlands)

11.21. Penford Corporation (U.S.)

11.22. Tereos Group (France)

11.23. AGRANA Beteiligungs-AG (Austria)

11.24. KMC (Kartoffelmelcentralen) (Denmark)

11.25. Emsland Group (Germany)

11.26. Nihon Shokuhin Kako Co., Ltd. (Japan)

11.27. Anhui AAA Agricultural Technology Co., Ltd. (China)

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook