Capital Expenditure Market 2025–2032: Size, Share, Growth Trends, by Asset Type & Industry Vertical, Key Players Overview

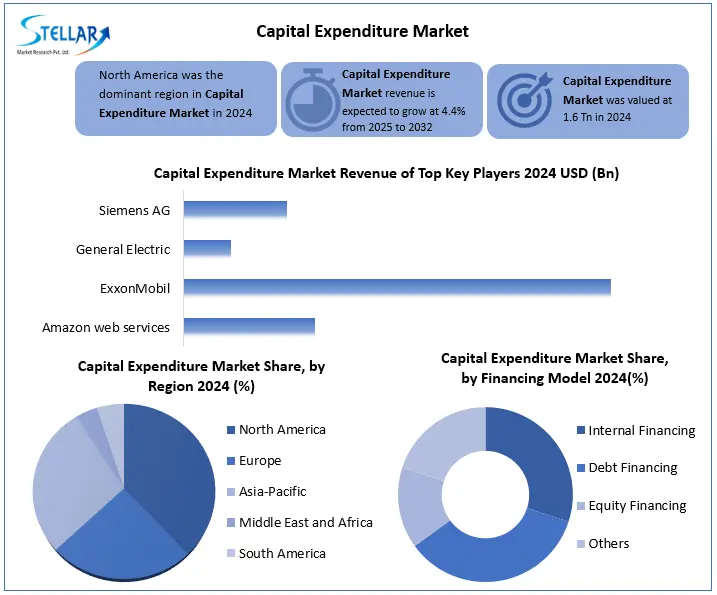

The Capital Expenditure Market was estimated at USD 1.6 Tn. in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2032, reaching nearly USD 2.26 Tn. by 2032

Format : PDF | Report ID : SMR_2797

Capital Expenditure Market Overview:

Capital Expenditure refers to money spent on acquiring, upgrading, or maintaining long-term assets like buildings, machinery, equipment, and infrastructure.

Capital Expenditure Market has been growing due to the drivers include global energy transition, growing 5G connectivity, smart city infrastructure, and increasing in digital transformation like AI, IoT, and blockchain technology. North America dominated the capital expenditure market in 2024, fuelled by large scale upgradation in clean energy and industrial automation. These dynamics present opportunities in software spending, healthcare automation and renewable energy investments. In the United States, grid overhaul initiatives backed by major federal programs unlocking over USD 11?billion for smart-grid upgrades and advanced transmission, have become driver for capital expenditure growth.

These developments open attractive opportunities in smart-grid technologies, EV charging networks and AI-operated data centres. ESG and Sustainability Integration are shaping further investment strategies, in which financing is directed towards rapid renewable, energy efficiency and green bonds. By these factors, capital expenditure market is set to grow during the forecasted period.

To get more Insights: Request Free Sample Report

Capital Expenditure Market Dynamics:

AI Infrastructure Expansion to Boost the Capital Expenditure Market Growth

The capital expenditure market is primarily fuelled by increasing demand for artificial intelligence infrastructure. In 2024, global data centre investments reached a record USD 455 billion, marking a 51% increase from the previous year, with an expected 30% growth in 2025. This growth is largely due to the hyperscale cloud providers like Amazon, Microsoft and Google. These companies make significant investments in AI-optimized data centres to meet the growing needs of AI applications. Recently, Amazon committed USD 10 billion to develop AI centres in North Carolina. By this development, the market is growing during the forecast period.

Capital Expenditure Market Faces Restraints Related to High Interest Rates and Inflation

In 2025, the Organisation for Economic Co-operation and Development (OECD) forecasts global GDP growth to decelerate to just 2.9%, the weakest since the COVID-19 pandemic, largely due to these financial pressures. U.S. has seen its average effective tariff rates more than 2.5% to 15%, the highest since World War II, increasing costs and reduces investment. This financial stress is particularly acute in capital-intensive fields such as utilities, technology and manufacturing. With the AI ??infrastructure and strong demand for clean energy, companies are rapidly cautious. By these factors, Global Ratings projects a slowdown in capital expenditure growth to 4.2% in 2025, down from 5.5% in 2024.

Clean Energy and AI infrastructure Shift to create Opportunity for Capital Expenditure Market

Governments and private sector are aligning efforts to from fossil fuels, running significant investment in renewable energy projects, battery storage and sustainable transport systems. At the same time, the rapid expansion of Artificial Intelligence and Cloud Technologies is inspiring large-scale investment in data centers, high-demonstration computing infrastructure and power grid modernization. These dual trends not only address climate imperative and digital change goals, but also unlock the long -term growth ability for industries ranging from utilities to semiconductors. By these sectors, Clean energy and AI infrastructure development offers the most transformative opportunities for capital expenditure market development in the forecast period.

Capital Expenditure Market Segment Analysis

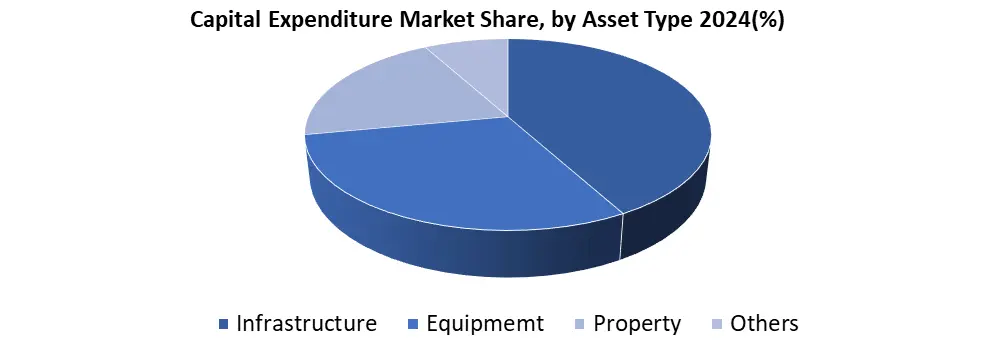

Based on Asset Type, the capital expenditure market is segmented into infrastructure, equipment, property and others. The infrastructure segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). It captures 42% of total capital expenditure spending in 2024. It is expected to continue as governments and enterprises with speed, which prefer long -term physical assets such as energy grids, roads, ports and digital networks. The U.S. federal initiatives, including the Inflation Reduction Act and Bipartisan Infrastructure Law, have significantly boosted funding for clean energy. Additionally, increasing integration of digital technologies in traditional infrastructure - such as smart grids, intelligent traffic systems and 5G towers - are accelerating the hybrid infrastructure development.

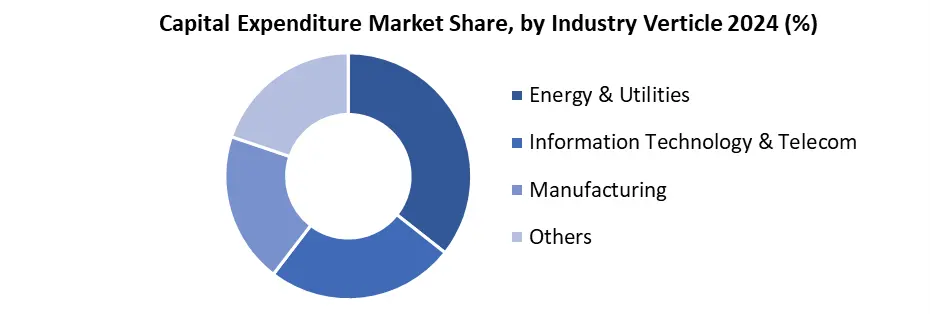

Based on Industry Vertical, the capital expenditure market is segmented into energy & utilities, information technology & telecom, manufacturing and others. The energy & utilities segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). This dominance is fueled by global change towards renewable energy, grid modernization and decarbonization efforts, as governments and private players accelerate investment in solar, wind, hydrogen and storage infrastructure. In addition, massive utility upgradation and electrification projects, especially in North America and Europe, are promoting continuous capital deployment. Also, increasing electrification of transport and industrial areas has accelerated the demand for flexible, high -capacity power infrastructure.

Capital Expenditure Market Regional Analysis

The North America region dominated the Market in 2024 and is expected to hold the largest Market share over the forecast period (2024-2032)

In North America United States leads the region, It contributed over 85% of North America’s total Capital expenditure, fueled by clean energy, digital infrastructure and strategic investment in advanced manufacturing. Decreased inflation Act (IRA) is expected to drive more than USD 500 billion in investments related to clean energy alone through 2032, Importantly promoting capital expenditure in areas such as solar, wind, hydrogen and EV infrastructure. Canada supports regional development with renewable energy, grid modernization and increased expenses on green transport. The Capital expenditure path of North America is expected to be strongly boosted by policy assistance, innovation and digital and energy transition goals.

Capital Expenditure Market Competitive Landscape

The global capital expenditure market is highly competitive and characterized by the presence of multinational corporations, state-backed enterprises, and sector-focused leaders with deep investment capabilities. The key players include General Electric, Siemens AG, ExxonMobil, Amazon Web Services all of all of which announced multi-billion-dollar capital investments in 2024. In addition, infrastructure firms such as Vinci and Bechtel are performing massive public and private projects during transportation, utilities and urban development.

Capital Expenditure Market Recent Developments

|

Date

|

Company |

Development |

|

June 4, 2025 |

Amazon |

Amazon announced a USD 10 billion investment to develop artificial intelligence (AI) and cloud computing data centers in Richmond County, North Carolina. This project is expected to generate at least 500 high-skilled jobs and support thousands more through construction and supply chains. |

|

May 27, 2025 |

CenterPoint Energy |

CenterPoint Energy announced an increase in its 10-year capital expenditure plan to USD 52.5 billion through 2030, up from the previously planned USD 48.5 billion. |

|

April 2025 |

GridFree AI |

GridFree AI secured $5 million in seed funding to develop modular, off-grid micro-data centers designed to reduce infrastructure costs and carbon emissions. |

|

Capital Expenditure Market Scope |

|

|

Market Size in 2024 |

USD 1.6 Tn |

|

Market Size in 2032 |

USD 2.26 Tn |

|

CAGR (2024-2032) |

4.4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Asset Type Infrastructure Equipment Property Others |

|

By Industry Vertical Energy & Utilities Information Technology & telecom Manufacturing Others |

|

|

By Financing Model Internal Financing Debt Financing Equity Financing Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Capital Expenditure Market

North America

- ExxonMobil (United States)

- Amazon Web Services – AWS (United States)

- Meta Platforms (United States)

- General Electric – GE (United States)

- Intel Corporation (United States)

- Tesla Inc. (United States)

- Chevron Corporation (United States)

- Microsoft Corporation (United States)

- CenterPoint Energy (United States)

- Bechtel Corporation (United States)

Europe

- Siemens AG (Germany)

- Royal Dutch Shell (Netherlands)

- TotalEnergies (France)

- BP plc (United Kingdom)

- Vinci SA (France)

- ABB Ltd. (Switzerland)

- Rolls-Royce Holdings plc (United Kingdom)

Asia-Pacific

- Taiwan Semiconductor Manufacturing Company – TSMC (Taiwan)

- Samsung Electronics (South Korea)

- Reliance Industries Limited (India)

- Toyota Motor Corporation (Japan)

- Adani Green Energy Ltd. (India)

- PetroChina Company Limited (China)

- SK Hynix (South Korea)

- BHP Group (Australia)

- Sumitomo Corporation (Japan)

- Keppel Corporation (Singapore)

Frequently Asked Questions

AI Infrastructure Expansion to Boost the Capital Expenditure Market.

General Electric, Siemens AG, ExxonMobil, Amazon Web Services Company are the key competitors in the Capital Expenditure Market.

Clean Energy and AI infrastructure Shift is an Opportunity for Capital Expenditure Market.

The Infrastructure Asset type segment dominated the Capital Expenditure Market.

1. Capital Expenditure Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Capital Expenditure Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. Distribution Channel Segment

2.3.4. Revenue (2024)

2.4. Leading Capital Expenditure Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Capital Expenditure Market: Dynamics

3.1. Capital Expenditure Market Trends by Region

3.1.1. North America Capital Expenditure Market Trends

3.1.2. Europe Capital Expenditure Market Trends

3.1.3. Asia Pacific Capital Expenditure Market Trends

3.1.4. Middle East & Africa Capital Expenditure Market Trends

3.1.5. South America Capital Expenditure Market Trends

3.2. Capital Expenditure Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

4. Capital Expenditure Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

4.1. Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

4.1.1. Infrastructure

4.1.2. Equipment

4.1.3. Property

4.1.4. Others

4.2. Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

4.2.1. Energy & Utilities

4.2.2. Information Technology & telecom

4.2.3. Manufacturing

4.2.4. Others

4.3. Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

4.3.1. Internal Financing

4.3.2. Debt Financing

4.3.3. Equity Financing

4.3.4. Others

4.4. Capital Expenditure Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Capital Expenditure Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

5.1. North America Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

5.1.1. Infrastructure

5.1.2. Equipment

5.1.3. Property

5.1.4. Others

5.2. North America Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

5.2.1. Energy & Utilities

5.2.2. Information Technology & telecom

5.2.3. Manufacturing

5.2.4. Others

5.3. North America Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

5.3.1. Internal Financing

5.3.2. Debt Financing

5.3.3. Equity Financing

5.3.4. Others

5.4. North America Capital Expenditure Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

5.4.1.1.1. Infrastructure

5.4.1.1.2. Equipment

5.4.1.1.3. Property

5.4.1.1.4. Others

5.4.1.2. United States Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

5.4.1.2.1. Energy & Utilities

5.4.1.2.2. Information Technology & telecom

5.4.1.2.3. Manufacturing

5.4.1.2.4. Others

5.4.1.3. United States Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

5.4.1.3.1.

5.4.1.3.2. Internal Financing

5.4.1.3.3. Debt Financing

5.4.1.3.4. Equity Financing

5.4.1.3.5. Others

5.4.2. Canada

5.4.2.1. Canada Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

5.4.2.1.1. Infrastructure

5.4.2.1.2. Equipment

5.4.2.1.3. Property

5.4.2.1.4. Others

5.4.2.2. Canada Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

5.4.2.2.1. Energy & Utilities

5.4.2.2.2. Information Technology & telecom

5.4.2.2.3. Manufacturing

5.4.2.2.4. Others

5.4.2.3. Canada Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

5.4.2.3.1. Internal Financing

5.4.2.3.2. Debt Financing

5.4.2.3.3. Equity Financing

5.4.2.3.4. Others

5.4.3. Mexico

5.4.3.1. Mexico Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

5.4.3.1.1. Infrastructure

5.4.3.1.2. Equipment

5.4.3.1.3. Property

5.4.3.1.4. Others

5.4.3.2. Mexico Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

5.4.3.2.1. Energy & Utilities

5.4.3.2.2. Information Technology & telecom

5.4.3.2.3. Manufacturing

5.4.3.2.4. Others

5.4.3.3. Mexico Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

5.4.3.3.1. Internal Financing

5.4.3.3.2. Debt Financing

5.4.3.3.3. Equity Financing

5.4.3.3.4. Others

6. Europe Capital Expenditure Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

6.1. Europe Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

6.2. Europe Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

6.3. Europe Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

6.4. Europe Capital Expenditure Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

6.4.1.2. United Kingdom Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

6.4.1.3. United Kingdom Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

6.4.2. France

6.4.2.1. France Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

6.4.2.2. France Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

6.4.2.3. France Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

6.4.3.2. Germany Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

6.4.3.3. Germany Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

6.4.4.2. Italy Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

6.4.4.3. Italy Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

6.4.5.2. Spain Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

6.4.5.3. Spain Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

6.4.6.2. Sweden Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

6.4.6.3. Sweden Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

6.4.7.2. Austria Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

6.4.7.3. Austria Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

6.4.8.2. Rest of Europe Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

6.4.8.3. Rest of Europe Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7. Asia Pacific Capital Expenditure Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

7.1. Asia Pacific Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.2. Asia Pacific Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.3. Asia Pacific Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4. Asia Pacific Capital Expenditure Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.1.2. China Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.1.3. China Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.2.2. S Korea Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.2.3. S Korea Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.3.2. Japan Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.3.3. Japan Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.4. India

7.4.4.1. India Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.4.2. India Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.4.3. India Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.5.2. Australia Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.5.3. Australia Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.6.2. Indonesia Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.6.3. Indonesia Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.7.2. Philippines Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.7.3. Philippines Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.8.2. Malaysia Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.8.3. Malaysia Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.9.2. Vietnam Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.9.3. Vietnam Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.10.2. Thailand Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.10.3. Thailand Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.11. ASEAN

7.4.11.1. ASEAN Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.11.2. ASEAN Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.11.3. ASEAN Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

7.4.12. Rest of Asia Pacific

7.4.12.1. Rest of Asia Pacific Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

7.4.12.2. Rest of Asia Pacific Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

7.4.12.3. Rest of Asia Pacific Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

8. Middle East and Africa Capital Expenditure Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

8.1. Middle East and Africa Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

8.2. Middle East and Africa Capital Expenditure Market Size and Forecast, By Industry Vertical Model (2024-2032)

8.3. Middle East and Africa Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

8.4. Middle East and Africa Capital Expenditure Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

8.4.1.2. South Africa Capital Expenditure Market Size and Forecast, By Industry Vertical Model (2024-2032)

8.4.1.3. South Africa Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

8.4.2.2. GCC Capital Expenditure Market Size and Forecast, By Industry Vertical Model (2024-2032)

8.4.2.3. GCC Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

8.4.3.2. Nigeria Capital Expenditure Market Size and Forecast, By Industry Vertical Model (2024-2032)

8.4.3.3. Nigeria Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

8.4.4.2. Rest of ME&A Capital Expenditure Market Size and Forecast, By Industry Vertical Model (2024-2032)

8.4.4.3. Rest of ME&A Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

9. South America Capital Expenditure Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

9.1. South America Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

9.2. South America Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

9.3. South America Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

9.4. South America Capital Expenditure Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

9.4.1.2. Brazil Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

9.4.1.3. Brazil Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

9.4.2.2. Argentina Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

9.4.2.3. Argentina Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Capital Expenditure Market Size and Forecast, By Asset Type (2024-2032)

9.4.3.2. Rest Of South America Capital Expenditure Market Size and Forecast, By Industry Vertical (2024-2032)

9.4.3.3. Rest Of South America Capital Expenditure Market Size and Forecast, By Financing Model (2024-2032)

10. Company Profile: Key Players

10.1 ExxonMobil (United States)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Development

10.2 Amazon Web Services – AWS (United States)

10.3 Meta Platforms (United States)

10.4 General Electric – GE (United States)

10.5 Intel Corporation (United States)

10.6 Tesla Inc. (United States)

10.7 Chevron Corporation (United States)

10.8 Microsoft Corporation (United States)

10.9 CenterPoint Energy (United States)

10.10 Bechtel Corporation (United States)

10.11 Siemens AG (Germany)

10.12 Royal Dutch Shell (Netherlands)

10.13 TotalEnergies (France)

10.14 BP plc (United Kingdom)

10.15 Vinci SA (France)

10.16 ABB Ltd. (Switzerland)

10.17 Rolls-Royce Holdings plc (United Kingdom)

10.18 Taiwan Semiconductor Manufacturing Company – TSMC (Taiwan)

10.19 Samsung Electronics (South Korea)

10.20 Reliance Industries Limited (India)

10.21 Toyota Motor Corporation (Japan)

10.22 Adani Green Energy Ltd. (India)

10.23 PetroChina Company Limited (China)

10.24 SK Hynix (South Korea)

10.25 BHP Group (Australia)

10.26 Sumitomo Corporation (Japan)

10.27 Keppel Corporation (Singapore)

11. Key Findings & Analyst Recommendations

12. Capital Expenditure Markets: Research Methodology