Buy Now Pay Later Market Industry Analysis and Forecast (2026-2032) Trends, Statistics, Dynamics

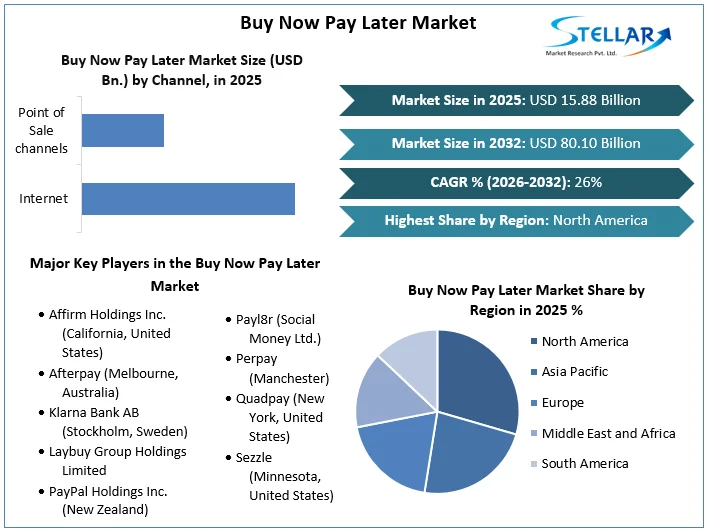

Buy Now Pay Later Market is expected to grow at a CAGR of 26.0% during the forecast period. Buy Now Pay Later Market is expected to reach US$ 80.10 Bn. in 2032 from US$ 15.88 Bn. in 2024

Format : PDF | Report ID : SMR_551

Buy Now Pay Later Market Overview:

The "Buy now, Pay Later” is a type of short-term financing that allows individuals to purchase essential things such as clothing, electrical equipment, and home improvement products. The point of sale (POS) installment loan mechanism will enable consumers to buy products and control reimbursement.

Retailers are offering buy now, pay later solutions that allow their consumers to purchase everyday necessities by selecting an inexpensive and flexible financing plan and paying in installments rather than the entire cost at once.

Globally, several business owners have been using the Buy Now, Pay Later payment platform to finance massive equipment, purchase raw materials, and pay staff salaries, which is driving the global growth of the Buy Now Pay Later Market. Furthermore, there is a rise in the adoption of Buy Now, Pay Later payment technology among the youth because it provides several benefits such as purchasing a high-priced smartphone and laptop, paying tuition fees and stationery products, and paying the canteen bill, which accelerates the Buy Now Pay Later Market growth.

To get more Insights: Request Free Sample Report

Buy Now Pay Later Market Dynamics:

The growing acceptance of online payment methods among consumers in developing countries such as China, India, the United States etc. has accelerated the rise of the Buy Now Pay Later Market.

The primary reasons driving the expansion of the global Buy Now Pay Later Market trends include economical and convenient payment services of Buy Now, Pay Later platforms, as well as growth in the global e-commerce industry. However, substantial late and returned payment costs stifle market expansion. On the contrary, an increase in demand for delayed payments for online purchases, as well as an increase in spending on luxury goods among adults, are likely to generate profitable chances for the Buy Now, Pay Later industry.

The retail goods segment held the most significant market share in 2024, owing to increased consumer spending on everyday essential products and services at retail outlets via the purchase now, pay later platform.

The healthcare & wellness category, on the other hand, is predicted to rise at the fastest rate throughout the forecast period, owing to a growth in the treatment costs of various severe conditions such as chronic heart disease, cancer, as well as cardiovascular disorders.

Furthermore, due to the rapid spread of COVID-19, patients around the world, and the increased need for treatment of these diseases, people all over the world are adopting Buy Now, Pay Later services, which is expected to provide a lucrative opportunity for Buy Now, Pay Later platforms in the healthcare industry.

However, the restraints related to the Buy Noe, Pay Later market are mainly around the existence of credit & debit cards, postdated cheques, and others which are available.

In many countries like South Africa, customers and merchants are unaware of the BNPL service.

Buy Now, Pay Later Markey- COVID-19 effect:

The impact of COVID-19 has resulted in staggering demand for services during the forecast period. There has been a more than average growth after the advent of COVID, and this can be attributed to the surge in online shopping as well as rising e-commerce Sale of consumer electronics and retail products. Several organisations entered the online market after 2020, and the leading players in market have adopted various business strategies and expansion product launches in order to cater to the changing market of Buy Now, Pay Later.

Buy Now Pay Later Market Segmentation:

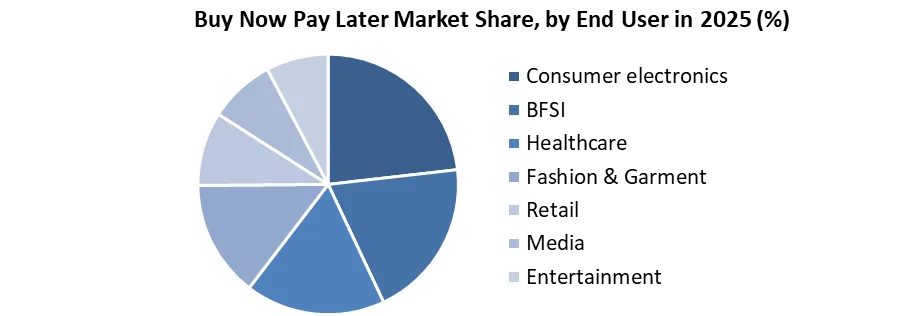

Buy Now Pay Later Market is segmented into Channel, Enterprise size, and End User.

Based on Channel, Buy Now Pay Later Market is segmented into the Online Channel and Point-of-Sale Channel (PoS). In 2025, the online channel segment led the market, accounting for more than 64.0 percent of global sales. As part of their post-pandemic revival plans, several firms throughout the world are forming alliances to focus on the adoption of the fastest-growing online payment options, such as Buy Now, Pay Later.

Over the projected period, the Point-of-Sale channel is expected to grow rapidly. Many firms are focusing on providing PoS-BNPL financing solutions to improve client experience and grow customer relationships. Furthermore, businesses provide clients with transparent loyalty-driven PoS installment financing plans.

With the growing spread of COVID-19, the online channel has been increasing its presence, thereby holding a significant portion of the market share in the channel of the "Buy Now, Pay Later" market.

Based on Enterprise Size, Buy Now Pay Later Market is segmented into Small and Medium Enterprises (SMEs) and large enterprises. In 2025, the large enterprise's segment led the market, accounting for more than 61.0% of global revenue. Large-scale firms are increasingly implementing BNPL payment solutions because they provide clients with a flexible and cheap payment method for acquiring high-value products. The simplicity of shopping also encourages people to buy more things, increasing sales. As a result, BNPL assists large-scale organizations in considerably improving their customer experience.

Small and medium-sized businesses worldwide are focusing on implementing BNPL solutions to assist merchants in increasing sales conversion rates. Small and medium-sized businesses concentrate on expanding their customer base and enhancing their market position. As a result, BNPL solutions among SMEs are likely to rise, supporting the segment's growth in the forecast period.

Based on End User, The Buy Now Pay Later Market is segmented into BFSI, Consumer Electronics, Fashion and garments, Healthcare, Retail, Media, and Entertainment. Consumer electronics is predicted to have the most significant market share in 2020, increasing online sales due to the lockdown imposed due to COVID-19 throughout various consumer electronics such as smart TVs, smartphones, gaming consoles and others. India's consumer goods industry is estimated at USD 537.50 billion, and a surge in the digital economy and payment flexibility are factors driving the market's growth in the coming years.

The sector is seeing an increase in BNPL payment systems, which provide a low-friction alternative to credit cards. Furthermore, users choose BNPL payment options over credit cards to avoid costly compounding interest and hidden costs. Increasing consumer electronic provider awareness of the flexible Buy Now, Pay Later payment method will likely fuel demand for BNPL services during the projection period.

BFSI is predicted to develop at the fastest CAGR in the Buy Now Pay Later Market, because of the increased adoption of services by the finance and banking sectors. The healthcare sector comes after the BFSI sector due to the surge in the adoption of life and health insurance services amidst a global pandemic. Several players are developing customized services for their customers, one of which is the Buy Now, Pay Later payment service.

Buy Now Pay Later Market Regional Insights:

The Buy Now Pay Later Market has been segmented into North America, Europe, Asia-Pacific, South America, Middle East, and Africa in terms of region.

North America dominated the market in 2025, accounting for around 30.0 percent of global sales. A significant number of prominent firms can be credited to the regional market's growth. Furthermore, various fintech companies in this region collaborate with entertainment organizations to provide BNPL services for hotel booking. For example, Uplift, Inc., a BNPL solution provider, collaborated with SeaWorld Parks & Entertainment, Inc., an American Theme Park, and entertainment company, in September 2021.

Followed by this region is the Asia-pacific region having 2nd highest amount in sales in the Buy Now, Save later Market. Major developing countries like China, India, and Australia in this region, having large populations, are increasingly moving to flexible and inexpensive financial plans for customers. This market is expected to dominate the market over the forecast period, and this is primarily attributed to the presence of GooglePay, PayPal, Amazon pay and others. These online channels have created a massive demand for these services.

The Middle East and Africa region is expected to witness steady growth in the coming years, owing to the rising shopping trends among customers and an increase in digital payment acceptance by the people in the country.

Europe, a rapidly growing region, home to customers with high spending and purchasing power, with online shopping surge. Buy Now, Pay Later fintech services like Afterpay, Affirm etc have become highly popular in their services.

The report aims to provide stakeholders in the Buy Now Pay Later Market with a detailed market outline. The research discusses the most critical Buy Now, Pay Later sector trends and how these trends will impact future business investments and marketing strategies throughout the forecast period. By studying market leaders, market followers, and regional players, the report also aids in the understanding of the Buy Now Pay Later Market dynamics, economic fundamentals, and competitive structure.

The qualitative and quantitative data in the Buy Now Pay Later Market research will help determine which market segments, regions, and influencing factors are expected to grow at faster rates and significant opportunity areas that will drive the market and market growth during the projected period.

The competitive landscape of essential players in the market and their recent advances in the Buy Now Pay Later Market is also included in the report. The study examines company size, market share, market growth, revenue, production volume, and profitability of the Buy Now Pay Later Market's major players.

This report aims to provide a comprehensive analysis of the Buy Now Pay Later Market and highlight the significant trends and growth opportunities. The report offers Porter's Five Force Model for analysis of the Buy Now Pay Later Market, which helps design the business strategies in the market. The study aids in determining the number of rivals, who they are, and the performance of the products in the industry.

The analysis also examines whether the Buy Now Pay Later Market is open to new entrants, whether they enter and exit the market regularly, and whether a few players dominate it.

The report also includes PESTEL Analysis, which aids in developing company strategies. Numerous elements affect growth and profitability. A PESTEL study can assist in determining the significance and strength of these elements.

It helps firms decide which characteristics are beneficial and which are not. PESTEL is a word that stands for Political, Economic, Socio-cultural, Technological, Environmental, and Legal. These variables take on added significance for organizations functioning in a global setting.

Buy Now Pay Later Market Scope:

|

Buy Now Pay Later Market |

|

|

Market Size in 2025 |

USD 15.88 Bn. |

|

Market Size in 2032 |

USD 80.10 Bn. |

|

CAGR (2026-2032) |

26% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Channel

|

|

By Environment

|

|

|

|

By End User

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Buy Now Pay Later Market: Key players and their Insights:

The Buy Now Pay Later Market has become competitive, with various players in the industry have adopted product launches and business expansion as their developmental strategies to expand their market share, increase profitability, and remain stable in the market.

To grow their product range and acquire a competitive edge in the industry, key players in the market are employing various business tactics such as business expansion.

To strengthen their market position, significant organizations in the industry are pursuing various business strategies such as mergers and acquisitions.

Some of the most prominent players in the Buy Now Pay Later Market are:

- Affirm Holdings Inc. (California, United States)

- Afterpay (Melbourne, Australia)

- Klarna Bank AB (Stockholm, Sweden)

- Laybuy Group Holdings Limited

- PayPal Holdings Inc. (New Zealand)

- Payl8r (Social Money Ltd.)

- Perpay (Manchester)

- Quadpay (New York, United States)

- Sezzle (Minnesota, United States)

- Splitit (New York, United States)

- Billie (Germany)

Frequently Asked Questions

Payl8r, Perpay, Quadpay, Sezzle, Splitit are among the key players in the Buy Now Pay Later Market.

The Consumer Electronics End Users is expected to grow in the Buy Now Pay Later Market at a higher rate during the next five years.

North America is expected to be the largest Buy Now Pay Later Market during the forecast period.

The rise in penetration of online payment across the globe and growth in the e-commerce industry in emerging countries etc. boost the Buy Now Pay Later Market growth.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Buy Now Pay Later Market Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Buy Now Pay Later Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. Buy Now Pay Later Market: Dynamics

4.1. Buy Now Pay Later Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Buy Now Pay Later Market Drivers

4.3. Buy Now Pay Later Market Restraints

4.4. Buy Now Pay Later Market Opportunities

4.5. Buy Now Pay Later Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Global Buy Now Pay Later Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Global Buy Now Pay Later Market Size and Forecast, by Channel (2025-2032)

5.1.1. Internet

5.1.2. Point of Sale channels

5.2. Global Buy Now Pay Later Market Size and Forecast, by Environment (2025-2032)

5.2.1. Small and Medium Enterprises (SMEs)

5.2.2. Large Enterprises

5.3. Global Buy Now Pay Later Market Size and Forecast, by End-User (2025-2032)

5.3.1. Consumer electronics

5.3.2. BFSI

5.3.3. Healthcare

5.3.4. Fashion & Garment

5.3.5. Retail

5.3.6. Media

5.3.7. Entertainment

5.4. Global Buy Now Pay Later Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Buy Now Pay Later Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Buy Now Pay Later Market Size and Forecast, by Channel (2025-2032)

6.1.1. Internet

6.1.2. Point of Sale channels

6.2. North America Buy Now Pay Later Market Size and Forecast, by Environment (2025-2032)

6.2.1. Small and Medium Enterprises (SMEs)

6.2.2. Large Enterprises

6.3. North America Buy Now Pay Later Market Size and Forecast, by End-User (2025-2032)

6.3.1. Consumer electronics

6.3.2. BFSI

6.3.3. Healthcare

6.3.4. Fashion & Garment

6.3.5. Retail

6.3.6. Media

6.3.7. Entertainment

6.4. North America Buy Now Pay Later Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Buy Now Pay Later Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Buy Now Pay Later Market Size and Forecast, by Channel (2025-2032)

7.2. Europe Buy Now Pay Later Market Size and Forecast, by Environment (2025-2032)

7.3. Europe Buy Now Pay Later Market Size and Forecast, by End-User (2025-2032)

7.4. Europe Buy Now Pay Later Market Size and Forecast, by Country (2025-2032)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Buy Now Pay Later Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Buy Now Pay Later Market Size and Forecast, by Channel (2025-2032)

8.2. Asia Pacific Buy Now Pay Later Market Size and Forecast, by Environment (2025-2032)

8.3. Asia Pacific Buy Now Pay Later Market Size and Forecast, by End-User (2025-2032)

8.4. Asia Pacific Buy Now Pay Later Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Rest of Asia Pacific

9. Middle East and Africa Buy Now Pay Later Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Buy Now Pay Later Market Size and Forecast, by Channel (2025-2032)

9.2. Middle East and Africa Buy Now Pay Later Market Size and Forecast, by Environment (2025-2032)

9.3. Middle East and Africa Buy Now Pay Later Market Size and Forecast, by End-User (2025-2032)

9.4. Middle East and Africa Buy Now Pay Later Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Nigeria

9.4.4. Rest of ME&A

10. South America Buy Now Pay Later Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Buy Now Pay Later Market Size and Forecast, by Channel (2025-2032)

10.2. South America Buy Now Pay Later Market Size and Forecast, by Environment (2025-2032)

10.3. South America Buy Now Pay Later Market Size and Forecast, by End-User (2025-2032)

10.4. South America Buy Now Pay Later Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Affirm Holdings Inc. (California, United States)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Afterpay (Melbourne, Australia)

11.3. Klarna Bank AB (Stockholm, Sweden)

11.4. Laybuy Group Holdings Limited

11.5. PayPal Holdings Inc. (New Zealand)

11.6. Payl8r (Social Money Ltd.)

11.7. Perpay (Manchester)

11.8. Quadpay (New York, United States)

11.9. Sezzle (Minnesota, United States)

11.10. Splitit (New York, United States)

11.11. Billie (Germany)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook