Baobab Market Global Industry Analysis and Forecast (2026-2032)

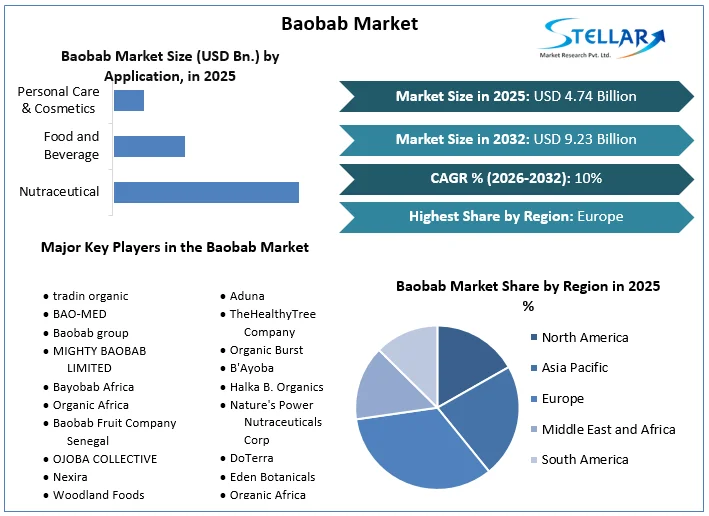

Baobab Market size was valued at USD 4.74 Bn. in 2025 and the Baobab revenue is expected to grow at a CAGR of 10% from 2026 to 2032, reaching nearly USD 9.23 Bn. by 2032.

Format : PDF | Report ID : SMR_1921

Baobab Market Overview:

The baobab, also called the baobab tree, is found in the savannah and drier regions of Africa. The tree reaches a height of 20 meters and bears very healthy fruits. The baobab fruit is a natural source of fibre, vitamin C, magnesium, and calcium. e baobab fruit is harvested with minimal impact on the environment. After harvesting, the hard outer shell is cracked open and the contents are extracted and processed into baobab powder.

The report focuses on the Baobab market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Additionally, the report provides a detailed cost analysis, and supply chain and also provides a holistic overview of market dynamics, a robust SWOT analysis, and a strategic roadmap to empower companies in the market. The report serves as a valuable resource for strategic planning, helping the company develop future strategies and plan its path forward in the industry. Make data-driven decisions and stay ahead of the competition.

To get more Insights: Request Free Sample Report

Baobab Market Dynamics:

Driving Forces and Growth Prospects in the Booming Baobab Market

Increasing consumer demand for organic products is driving the Baobab Market. Buyers are demanding certified organic baobab as a sign of quality and reliability. In developing countries, baobab powder is traditionally obtained by breaking the baobab fruit, after which its pulp is scooped out. The pulp is then pounded by a pestle in a mortar to separate the powder. Then, the baobab powder is sieved and packed. In addition, through the production process, baobab powder is contaminated by dirt, stones, nuts, and other foreign matter.

Baobab oil is a highly moisturizing ingredient and light on the skin, which makes it oil for all seasons. Resultantly, the baobab market witnesses steady demand. Additionally, factors such as the increasing geriatric populace and growing uptake of baobab extracts in nutraceuticals provide a push to market growth.

Overcoming Quality Control and Pricing Hurdles in the Baobab Powder Market

Another major challenge is the quality of baobab, particularly poor-quality damage to trust among buyers. One baobab trader stated that quality issues in baobab mainly stem from a lack of quality control, as processing is not centralized and there is a lack of food safety experts involved in processing. Also, side effects related to the surplus consumption of baobab powder act as a major hindrance to the advancement of the Baobab Powder Market through the forecast period. Additionally, the high price associated with baobab is hampering the Baobab Market.

Baobab Market Segment Analysis:

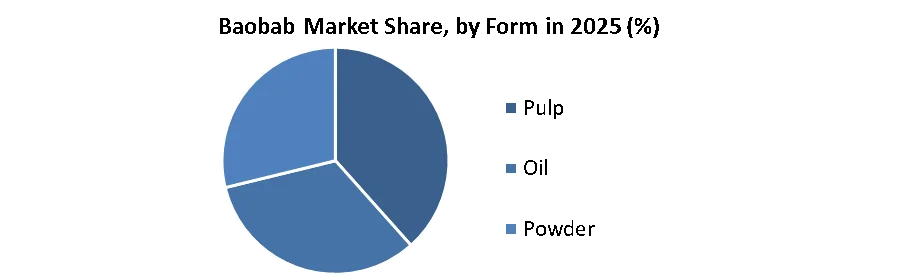

By form, the Baobab oil segment held the largest share in 2025 for the Baobab Market. Baobab oil is cold-pressed from seeds for various uses, from cooking to hair care to skin care. Baobab oil is rich in omega-3 fatty acids and other fats, including palmitic acid, oleic acid, linolenic acid, and linoleic acid. Baobab Oil is obtained from the kernel of the baobab seed. The production of baobab oil begins by cracking the fruit open and separating the seeds from the dry powdery pulp. The seeds are first hammer-milled to remove the hard outer coat from the kernel. They are then placed in a screw expeller and cold-pressed from the kernel. The oil is then filtered for purity. Europe is an attractive market for baobab oil because of the growing demand for natural ingredients from cosmetics companies.

They are moving to safer ingredients as consumers look to avoid synthetic ingredients in cosmetic and personal care products. The growing use of baobab oil in anti-aging and sun care products also presents an opportunity for exporters of baobab oil in developing countries. The most prospective countries for baobab oil are the Western European countries. These include Germany, the UK, France, the Netherlands, Italy and Spain. These countries have the most important markets for cosmetic products in Europe and they also have substantial manufacturing sectors. In countries such as Germany, France, and the UK, consumers are also familiar with baobab products.

Baobab Market Regional Insight:

Europe dominated the region in 2025 for the Baobab Market. Europe has an attractive market for baobab since there is a growing demand for supplements as well as ingredients with high nutrient content and antioxidant properties. Consumers are increasingly looking for products that boost their overall health. The presence of notable baobab providers and the nutraceuticals industry in the region drives a huge market share. Besides, the sports nutrition sector influences the size of the Baobab market in the region.

In addition, Western Europe, and particularly the UK, Germany, France, the Netherlands, Italy, and Spain, offers the most opportunities to baobab exporters in developing countries. These countries have a strong and growing natural health product industry, well-developed organic markets, as well as some of the largest consumer markets in Europe. The UK and Germany are home to several producers of baobab products, most of which are organic-certified.

The UK is one of the most attractive country markets for exporters of baobab. In the UK, many new products have been introduced with baobab. The product introductions and growing sales indicate that the UK is an important market for baobab products with higher awareness of baobab than other European countries. Additionally, the Netherlands is a leading importer as well re-exporter of natural ingredients to Europe. Most baobab powder imported to the Netherlands is imported by traders. The Netherlands also re-exports baobab and other natural ingredients to other European countries. One of the leading traders of organic ingredients, Tradin Organic, imports organic baobab. BAO-MED, Spiruella, and Pit-Pit are other Dutch companies supplying baobab powder and supplements.

Baobab Market Competitive Landscape:

- In November 2023, Evonik Industries AG, a Germany-based chemical company, launched a sustainable product called ECOHANCE Soft Baobab oil.

- In May 2023, AAIC Holdings Pte. Ltd. (hereinafter referred to as “AAIC Holdings”) is pleased to announce that it has invested in The Baobab Network Ltd. (hereinafter referred to as “Baobab”), an accelerator investing in African tech startups on 30th March 2023.

Baobab Market Scope:

|

Baobab Market |

|

|

Market Size in 2025 |

USD 4.74 Bn. |

|

Market Size in 2032 |

USD 9.23 Bn. |

|

CAGR (2026-2032) |

10 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Category Organic Conventional |

|

By Application Nutraceutical Food and Beverage Personal Care & Cosmetics |

|

|

|

By Form Pulp Oil Powder |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Top 20 key players in the Baobab Market key Players:

- tradin organic

- BAO-MED

- Baobab group

- MIGHTY BAOBAB LIMITED

- Bayobab Africa

- Organic Africa

- Baobab Fruit Company Senegal

- OJOBA COLLECTIVE

- Nexira

- Woodland Foods

- Aduna

- TheHealthyTree Company

- Organic Burst

- B'Ayoba

- Halka B. Organics

- Nature's Power Nutraceuticals Corp

- DoTerra

- Eden Botanicals

- Organic Africa

- Indigenous Baobab Products

- Others

Frequently Asked Questions

High price of and poor quality are challenge for the Baobab Market.

The Market size was valued at USD 4.74 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 10 %from 2026 to 2032, reaching nearly USD 9.23 Billion.

The segments covered in the market report are by Category, Applications and Form.

1. Baobab Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Baobab Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Baobab Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Baobab Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Trade Analysis

4.10.1. Import Scenario

4.10.2. Export Scenario

4.11. Regulatory Landscape

4.11.1. Market Regulation by Region

4.11.1.1. North America

4.11.1.2. Europe

4.11.1.3. Asia Pacific

4.11.1.4. Middle East and Africa

4.11.1.5. South America

4.11.2. Impact of Regulations on Market Dynamics

4.11.3. Government Schemes and Initiatives

5. Baobab Market Size and Forecast by Segments (by Value USD Million)

5.1. Baobab Market Size and Forecast, By Category (2025-2032)

5.1.1. Organic

5.1.2. Conventional

5.2. Baobab Market Size and Forecast, By Application (2025-2032)

5.2.1. Nutraceutical

5.2.2. Food and Beverage

5.2.3. Personal Care & Cosmetics

5.3. Baobab Market Size and Forecast, By Form (2025-2032)

5.3.1. Pulp

5.3.2. Oil

5.3.3. Powder

5.4. Baobab Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Baobab Market Size and Forecast (by Value USD Million)

6.1. North America Baobab Market Size and Forecast, By Category (2025-2032)

6.1.1. Organic

6.1.2. Conventional

6.2. North America Baobab Market Size and Forecast, By Application (2025-2032)

6.2.1. Nutraceutical

6.2.2. Food and Beverage

6.2.3. Personal Care & Cosmetics

6.3. North America Baobab Market Size and Forecast, By Form (2025-2032)

6.3.1. Pulp

6.3.2. Oil

6.3.3. Powder

6.4. North America Baobab Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Baobab Market Size and Forecast (by Value USD Million)

7.1. Europe Baobab Market Size and Forecast, By Category (2025-2032)

7.2. Europe Baobab Market Size and Forecast, By Application (2025-2032)

7.3. Europe Baobab Market Size and Forecast, By Form (2025-2032)

7.4. Europe Baobab Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Baobab Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Baobab Market Size and Forecast, By Category (2025-2032)

8.2. Asia Pacific Baobab Market Size and Forecast, By Application (2025-2032)

8.3. Asia Pacific Baobab Market Size and Forecast, By Form (2025-2032)

8.4. Asia Pacific Baobab Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Baobab Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Baobab Market Size and Forecast, By Category (2025-2032)

9.2. Middle East and Africa Baobab Market Size and Forecast, By Application (2025-2032)

9.3. Middle East and Africa Baobab Market Size and Forecast, By Form (2025-2032)

9.4. Middle East and Africa Baobab Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Baobab Market Size and Forecast (by Value USD Million)

10.1. South America Baobab Market Size and Forecast, By Category (2025-2032)

10.2. South America Baobab Market Size and Forecast, By Application (2025-2032)

10.3. South America Baobab Market Size and Forecast, By Form (2025-2032)

10.4. South America Baobab Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. tradin organic

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. BAO-MED

11.3. Baobab group

11.4. MIGHTY BAOBAB LIMITED

11.5. Bayobab Africa

11.6. Organic Africa

11.7. Baobab Fruit Company Senegal

11.8. OJOBA COLLECTIVE

11.9. Nexira

11.10. Woodland Foods

11.11. Aduna

11.12. TheHealthyTree Company

11.13. Organic Burst

11.14. B'Ayoba

11.15. Halka B. Organics

11.16. Nature's Power Nutraceuticals Corp

11.17. DoTerra

11.18. Eden Botanicals

11.19. Organic Africa

11.20. Indigenous Baobab Products

11.21. Others

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook