Australia Coffee Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

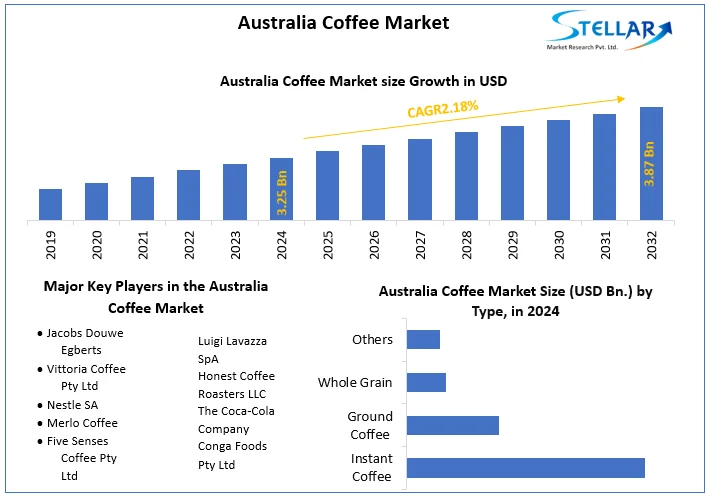

Australia Coffee Market size was valued at US $ 3.25 Bn. in 2024. Coffee will encourage a great deal of transformation in Beverage Sector in Australia.

Format : PDF | Report ID : SMR_85

Australia Coffee Market Definition:

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product. Australia Coffee Market report is studied and analysed using the segment analysis on the basis of source, type, process and geography.

To get more Insights: Request Free Sample Report

Australia Coffee Market Dynamics:

The vast majority of coffee consumers buy different types of coffee through online distribution channels. Many consumers order coffee online and increase their consumption of coffee at home. Home coffee growth rose to 37% of Australia coffee market in March 2020.

Coffee is popular with Australians. Consumers have different tastes in the coffee they consume. Companies are expanding their market presence by launching new and innovative products to enhance their presence in the region.

Australian consumers want to see the entire food and beverage supply chain, including coffee. Consumers prefer to look for certified coffee products to ensure the reliability of their coffee purchases. Authentication provides consumers with a variety of third-party guarantees. The Australia coffee market players can switch to environmentally friendly farming practices, including organic certification.

Certified coffee products guarantee the sustainability and quality of coffee production. In addition to importers, several manufacturers and retailers across the country are focused on responding to their growing preference for sustainable coffee. Numerous coffee certification bodies control the coffee production process and supply chain of leading coffee producers supplying Australia with a variety of coffee products.

Convenience and Instant Coffee is the most important factor driving the Australia coffee market, as it is easier to prepare than freshly brewed coffee. The busy lifestyle of consumers is revitalizing the convenience food market. The instant coffee market is extremely competitive due to a large number of players in the market. Companies compete with others and stay in the market through joint ventures, partnerships, and product launches.

A beverage capsule refers to a single-serve container within a filter that contains the material. These capsules commonly contain coffee, which is widely used in vending machines in both commercial and home environments. As the cafe culture grows in Australia and the demand for ready-to-drink hot drinks is growing, consumers are increasingly leaning towards coffee capsules to make these drinks.

Australia coffee market is showing strong growth among millennial and Gen Z consumers. Due to its British origin, tea is also an important part of modern Australian culture. For this reason, various Australian cafes and restaurants use tea and coffee capsules to provide a consistent taste and minimize the breakdown of functional ingredients such as flavonoids, vitamins, minerals, and antioxidants. These capsules also prevent contamination of tea leaves and coffee grounds and prevent the filter from breaking. Due to the busy lifestyle, consumers also prefer beverage capsules that help make coffee or tea without mixing additional ingredients. Increasing income is leading consumers to spend more on premium products.

Recent Developments:

In February 2020, Lavazza Australia launched a barista-inspired premium whole coffee bean collection, known as Espresso Barista. The product is available on the company’s new e-commerce site, lavazza.Com.

In March 2019, Nespresso launched a new coffee pod. The limited-edition Master Origin Costa Rica is available across Australia and comes in a sleeve of ten pods.

The objective of the report is to present a comprehensive analysis of the Australia Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Australia Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Australia Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Australia Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Australia Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Australia market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Australia Coffee market. The report also analyses if the Australia Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Australia Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Australia Coffee market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Australia market is aided by legal factors.

Australia Coffee Market Scope:

|

Australia Coffee Market |

|

|

Market Size in 2024 |

USD 3.25 Bn. |

|

Market Size in 2032 |

USD 3.87 Bn. |

|

CAGR (2025-2032) |

2.18% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

KEY PLAYERS:

-

Vittoria Coffee Pty Ltd

-

Merlo Coffee

-

Five Senses Coffee Pty Ltd

-

Global Beverage Solutions

-

Luigi Lavazza SpA

-

Honest Coffee Roasters LLC

-

The Coca-Cola Company

-

Conga Foods Pty Ltd

Frequently Asked Questions

Australia Coffee Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

Australia Coffee Market size was USD 3.25 Billion in 2024.

1. Australia Coffee Market: Research Methodology

2. Australia Coffee Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Australia Coffee Market: Dynamics

3.1. Australia Coffee Market Trends

3.2. Australia Coffee Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. Australia Coffee Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2032)

4.1. Australia Coffee Market Size and Forecast, by Source (2024-2032)

4.1.1. Arabica

4.1.2. Robusta

4.2. Australia Coffee Market Size and Forecast, by Type (2024-2032)

4.2.1. Instant Coffee

4.2.2. Ground Coffee

4.2.3. Whole Grain

4.2.4. Others

4.3. Australia Coffee Market Size and Forecast, by Process (2024-2032)

4.3.1. Caffeinated

4.3.2. Decaffeinated

5. Australia Coffee Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Jacobs Douwe Egberts

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Vittoria Coffee Pty Ltd

6.3. Nestle SA

6.4. Merlo Coffee

6.5. Five Senses Coffee Pty Ltd

6.6. Global Beverage Solutions

6.7. Luigi Lavazza SpA

6.8. Honest Coffee Roasters LLC

6.9. The Coca-Cola Company

6.10. Conga Foods Pty Ltd

7. Key Findings

8. Industry Recommendations