Asia Pacific Plant-based Beverages Market Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

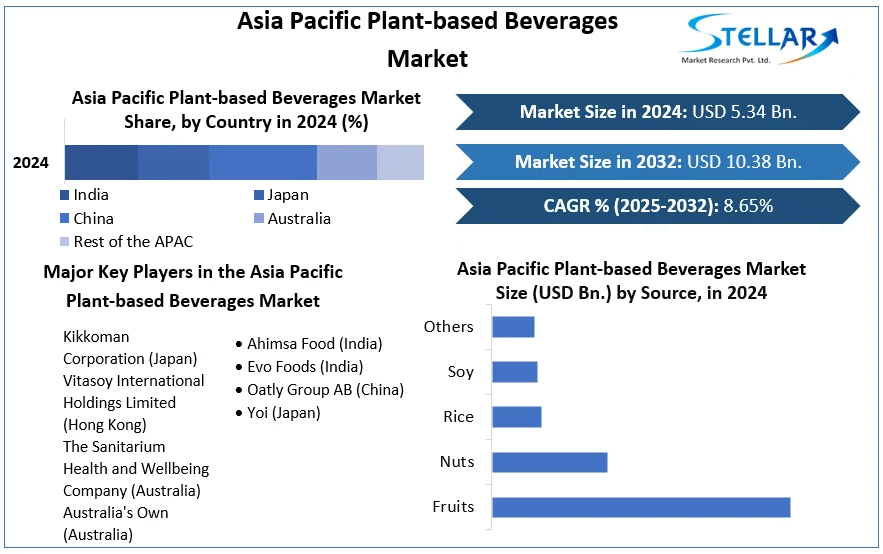

Asia Pacific Plant-based Beverages Market size was valued at US$ 5.34 Bn. in 2024. The Asia Pacific Plant-based Beverages Market is estimated to grow at a CAGR of 8.65% over the forecast period.

Format : PDF | Report ID : SMR_443

Asia Pacific Plant-based Beverages Market Overview:

Plant drinks are beverages that can be made without the use of dairy products. These drinks are made from plants and are a healthy alternative to dairy products. Plant-based beverages such as soy milk, rice milk, oat milk, cashew milk, coconut milk, flax milk, and almond milk are among the most popular alternatives around the world. Due to the presence of various essential vitamins and minerals, they are considered vigorous. They're fat-free, cholesterol-free, and lactose-free. Asia Pacific Plant-based Beverages Market's segment analysis is completed by studing the market on the basis of distribution channel, source and country.

To get more Insights: Request Free Sample Report

Asia Pacific Plant-based Beverages Market Dynamics:

Asia Is Getting Ready to Become a Center for Plant-Based Markets which is a major factor for driving the growth of the plant-based beverages market. Asia is quickly becoming the next regional hub for the plant-based food and beverage business, even though the region's diet is more meat-centric. There are various subcategories within this market, such as meat substitutes, dairy alternatives, and so on. As more people join the plant-based diet bandwagon, it is gaining acceptance across Asia. North America was the region with the largest portion of the pie in 2020, but this is expected to change dramatically in the next few years, as the Asia Pacific Plant-based Beverages Market is expected to grow by 200% by 2030.

The higher expense of plant-based beverages compared to dairy milk, on the other hand, is projected to stifle industry expansion. The plant-based beverages market is expected to face challenges due to a lack of consumer awareness. In China, vegetable consumption is high, whereas meat consumption is lower than in the United States. To reduce greenhouse gas emissions, the government also wants to cut total beef consumption by half by 2030. Plant-based brands are thought to be at the forefront of plant-based innovation around the world. Plant-based foods, beverages, and coffees are now part of the product lines of large global dairy firms that have invested in technology and expanded their product ranges. These companies are focusing on plant-based dairy substitutes by broadening the appeal of their products and utilising unique dairy replacements and techniques. These major factors are hampering the growth of the Asia Pacific Plant-based Beverages Market.

Asia's consistent expansion in this industry, combined with the region's technological advancements, has allowed it to establish itself as the finest location for plant-based firms to set up shop. As Asia's desire for plant-based foods and beverages continues to rise, this increasing trend is predicted to continue for many years and thus this factor is considered to give a huge opportunity for the Asia Pacific Plant-based Beverages Market.

Impact of Covid-19 on the Asia Pacific Plant-based Beverages Market:

The plant-based market in Asia has been steadily growing, with a value of $15.3 billion in 2019. When COVID-19 struck, this number jumped dramatically, as more people in Asia switched to a plant-based diet because of food safety worries. As a result, the region is expected to be valued at $17.1 billion in 2020, an increase of 11.6% over the previous year.

Asia Pacific Plant-based Beverages Market Segment Analysis:

By Distribution Channel, the market is segmented as Hypermarket and Supermarket, Convenience Stores, Speciality Stores and Online. Speciality Stores Segment dominated the market with a 42.2% share in 2024. The surge in the adoption of large retail formats such as supermarkets and hypermarkets in both mature and emerging markets can be described as the market's expansion. Furthermore, the convenience of these retail formats as a one-stop-shop makes them a popular shopping alternative for consumers.

However, The Online segment is expected to grow at a CAGR of 6.4% through the forecast period. Because of greater internet penetration, changing lifestyles, and increased use of smartphones, online stores have become one of the finest platforms for all consumers. These days, everyone is so busy with their own lives that they don't have enough time to go shopping and buy products. As a result, customers can order products online instead. Thus owing to these factors this segment is growing constantly in the Asia Pacific Plant-based Beverages Market.

Asia Pacific Plant-based Beverages Market Regional Insights:

The Asia Pacific's expanding vegan population, especially millennials' preference for plant-based, natural, and healthy foods and beverages, is predicted to boost demand for plant-based beverages. Countries such as China, India, and Thailand have promoted a healthy lifestyle by encouraging people to eat nutritious meals.

China is a major contributor to Asia Pacific Plant-based Beverages Market. The country accounts for 28% of worldwide meat consumption and has an $86 billion meat industry, yet it is making headlines throughout the world for its efforts to minimise meat consumption. China experienced a boom in demand for plant-based alternatives during the pandemic's peak. Meat substitutes are still being supplied at home and in popular restaurants a year after the pandemic began, indicating a possible shift in Chinese diet trends and consumer behaviour.

The objective of the report is to present a comprehensive analysis of the Asia Pacific Plant-based Beverages market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific Plant-based Beverages market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific Plant-based Beverages market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific Plant-based Beverages market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Asia Pacific Plant-based Beverages market. The report also analyses if the Asia Pacific Plant-based Beverages market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few Players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific Plant-based Beverages market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific Plant-based Beverages market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific Plant-based Beverages market is aided by legal factors.

Asia Pacific Plant-based Beverages Market Scope:

|

Asia Pacific Plant-based Beverages Market |

|

|

Market Size in 2024 |

USD 5.34 Bn. |

|

Market Size in 2032 |

USD 10.38 Bn. |

|

CAGR (2025-2032) |

8.65% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Distribution Channel

|

|

by Source

|

|

|

Country Scope |

China India Japan South Korea Australia ASEAN Rest of APAC |

Asia Pacific Plant-based Beverages Market Key Players:

- Kikkoman Corporation (Japan)

- Vitasoy International Holdings Limited (Hong Kong)

- The Sanitarium Health and Wellbeing Company (Australia)

- Australia's Own (Australia)

- Ahimsa Food (India)

- Evo Foods (India)

- Oatly Group AB (China)

- Yoi (Japan)

Frequently Asked Questions

China is expected to hold the highest share in the Asia Pacific Plant-based Beverage Market.

The market size of the Asia Pacific Plant-based Beverages Market is expected to be 10.38 Bn by 2032.

The forecast period for the Asia Pacific Plant-based Beverages Market is 2025-2032.

The market size of the Asia Pacific Plant-based Beverages Market in 2024 was US$ 5.34 Bn.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1.Research Process

2.2.Asia Pacific Plant-based Beverages Market: Target Audience

2.3.Asia Pacific Plant-based Beverages Market: Primary Research (As per Client Requirement)

2.4.Asia Pacific Plant-based Beverages Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1.Market Share Analysis, By Value, 2024-2032

4.1.1.Asia Pacific Market Share Analysis, By Distribution Channel, By Value, 2024-2032 (In %)

4.1.1.1.China Market Share Analysis, By Distribution Channel, By Value, 2024-2032 (In %)

4.1.1.2.India Market Share Analysis, By Distribution Channel, By Value, 2024-2032 (In %)

4.1.1.3.Japan Market Share Analysis, By Distribution Channel, By Value, 2024-2032 (In %)

4.1.1.4.South Korea Market Share Analysis, By Distribution Channel, By Value, 2024-2032 (In %)

4.1.1.5.Australia Market Share Analysis, By Distribution Channel, By Value, 2024-2032 (In %)

4.1.1.6.ASEAN Market Share Analysis, By Distribution Channel, By Value, 2024-2032 (In %)

4.1.1.7.Rest of APAC Market Share Analysis, By Distribution Channel, By Value, 2024-2032 (In %)

4.1.2.Asia Pacific Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.2.1.China Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.2.2.India Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.2.3.Japan Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.2.4.South Korea Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.2.5.Australia Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.2.6.ASEAN Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.1.2.7.Rest of APAC Market Share Analysis, By Source, By Value, 2024-2032 (In %)

4.2. Stellar Competition matrix

4.2.1.Asia Pacific Stellar Competition Matrix

4.3. Key Players Benchmarking

4.3.1.Key Players Benchmarking By Distribution Channel, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

4.4. Mergers and Acquisitions in Industry

4.4.1.M&A by Region, Value and Strategic Intent

4.5. Market Dynamics

4.5.1.Market Drivers

4.5.2.Market Restraints

4.5.3.Market Opportunities

4.5.4.Market Challenges

4.5.5.PESTLE Analysis

4.5.6.PORTERS Five Force Analysis

4.5.7.Value Chain Analysis

Chapter 5 Asia Pacific Plant-based Beverages Market Segmentation: By Distribution Channel

5.1.Asia Pacific Plant-based Beverages Market, By Distribution Channel, Overview/Analysis, 2024-2032

5.2.Asia Pacific Plant-based Beverages Market, By Distribution Channel, By Value, Market Share (%), 2024-2032 (USD Million)

5.3.Asia Pacific Plant-based Beverages Market, By Distribution Channel, By Value, -

5.3.1.Hypermarket and Supermarket

5.3.2.Convenience Stores

5.3.3.Speciality Stores

5.3.4.Online

Chapter 6 Asia Pacific Plant-based Beverages Market Segmentation: By Source

6.1.Asia Pacific Plant-based Beverages Market, By Source, Overview/Analysis, 2024-2032

6.2.Asia Pacific Plant-based Beverages Market Size, By Source, By Value, Market Share (%), 2024-2032 (USD Million)

6.3.Asia Pacific Plant-based Beverages Market, By Source, By Value, -

6.3.1.Fruits

6.3.2.Nuts

6.3.3.Rice

6.3.4.Soy

6.3.5.Others

Chapter 7 Asia Pacific Plant-based Beverages Market Size, By Value, 2024-2032 (USD Million)

7.1.1.China

7.1.2.India

7.1.3.Japan

7.1.4.South Korea

7.1.5.Australia

7.1.6.ASEAN

7.1.7.Rest of APAC

Chapter 8 Company Profiles

8.1.Key Players

8.1.1.Kikkoman Corporation (Japan)

8.1.1.1.Company Overview

8.1.1.2.Source Portfolio

8.1.1.3.Financial Overview

8.1.1.4.Business Strategy

8.1.1.5.Key Developments

8.1.2.Vitasoy International Holdings Limited (Hong Kong)

8.1.3.The Sanitarium Health and Wellbeing Company (Australia)

8.1.4.Australia's Own (Australia)

8.1.5.Ahimsa Food (India)

8.1.6.Evo Foods (India)

8.1.7.Oatly Group AB (China)

8.1.8.Yoi (Japan)

8.2. Key Findings

8.3. Recommendation