Asia Pacific Membrane Market Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

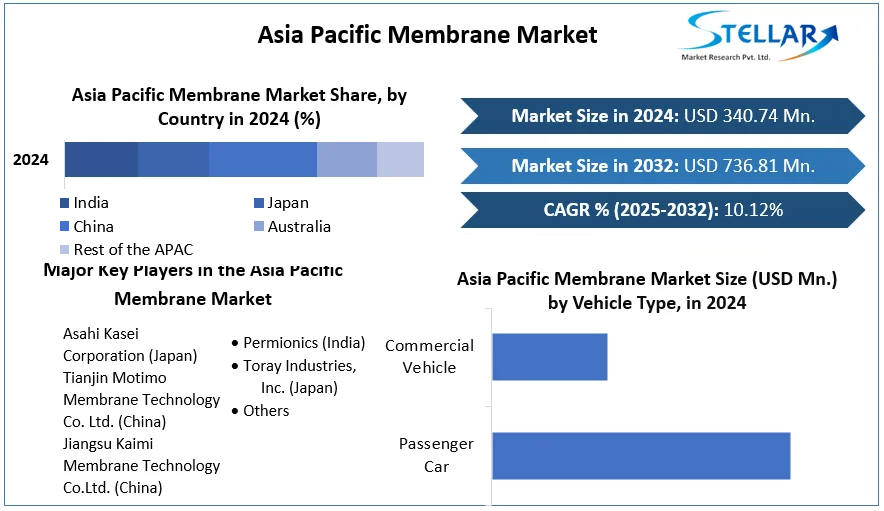

Asia Pacific Membrane market size was valued at US$ 340.74 Million in 2024 and the Asia Pacific Membrane Market revenue is expected to grow at 10.12% through 2025 to 2032, reaching nearly US$ 736.81 Million.

Format : PDF | Report ID : SMR_186

Asia Pacific Membrane Market Overview:

Membranes are thin films that, depending on their size, allow specific chemicals and particles to flow through. They're semi-permeable, to put it another way. For a range of applications, procedures such as MF (microfiltration), UF (ultrafiltration), NF (nanofiltration), and others are used, depending on the size of the substrates to be separated. Microfiltration and Ultrafiltration were two of the first large-scale applications of these barrier films, and they are still in use in many waters treatment plants throughout the world. These barrier films are made from natural or synthetic polymers, as well as metallic powders, ceramics, and zeolites. Asia Pacific Membrane Market report is analysied and well formated in the statestic data for the segment analysis on the basis of technology, end use industry and region.

To get more Insights: Request Free Sample Report

Asia Pacific Membrane Market Dynamics:

Need for water purification thanks to water scarcity:

According to the Asia-Pacific Water Forum, more than 90% of people in Asia and the Pacific do not have access to safe drinking water. While an estimated 1.7 billion people still lack access to clean water, agriculture requires significantly more water in the future to produce more food, despite the region's restricted availability. East Asia has made progress in terms of urban water security, whereas South and Southeast Asia, particularly Myanmar, Pakistan, and the Philippines, still have a long way to go.

Although nearly half of the economies have piped water supplies of more than 85%, fewer than half of the urban population has access to modern sanitation. Wastewater is dumped into the environment with little or no treatment in many regions. The Pacific island countries fared well in the fourth dimension of river basin management. Bangladesh, the lower Yangtze River Basin, Nepal, and the Mekong Delta in Vietnam all have declining river health, according to the research. The water purification need is helping the Asia Pacific Membrane Market in growth.

Continuously rising water pollution:

In Asia, rivers are heavily polluted by domestic trash. Many of the region's waterways have up to three times the global average of germs produced from human waste (measured in fecal coliforms, or FC). Inadequate access to sanitation infrastructure (such as connections to public sewers and septic systems) is already an issue; but, as cities grow, so will the demand for more of this infrastructure. According to present trends, demand may continue to exceed supply, resulting in increased pollution. While there are significant attempts to equip rapidly rising cities, a large number of rapidly growing Asian towns remain unserved. The icreasing water polution with population growth is also expected to propel Asia Pacific Membrane Market in coming years.

Asia's old agricultural economies are giving way to industrialized ones. This transition is having major negative consequences for the environment, particularly in terms of pollution. Although efforts have been made to tighten regulation, the lack of efficient governance makes enforcement extremely difficult in most circumstances. In Pakistan, for example, barely 5% of national companies have completed environmental studies.

Fouling causes frequent membrane replacements:

Membrane fouling is a significant problem that has an adverse impact on its performance and hampers in the Asia Pacific Membrane Market growth. It reduces both efficiency and flow, resulting in higher energy consumption and deterioration of water or stream quality. Chemical cleaning or replacement are the two choices for getting rid of tainted products (both of which come at a high cost). When these costs are factored in, applications and acceptance are restricted to specific industries, limiting the market growth. Membrane fouling is a process in which a solution or particle is deposited on a membrane surface or in membrane pores, causing the membrane to perform poorly.

It is a significant impediment to the general adoption of this technology. Membrane fouling can result in a significant drop in flux and have an impact on the quality of the water generated. Fouling that is severe may demand extensive chemical cleaning or membrane replacement. This raises a treatment plant's operational expenses. Foulants can be colloidal (clays, flocs), biological (bacteria, fungi), organic (oils, polyelectrolytes, humic), or scaling in nature (mineral precipitates).

Asia Pacific Membrane Market Segment Analysis:

Based on Technology RO membrane technology is expected to remain dominant in the Asia Pacific membrane market. Because of its widespread usage in water and wastewater treatment, RO/FO Asia Pacific Membrane technology is the most widely adopted. Also, it has a high rate of adoption in industrial applications, ensuring its long-term success in the sector. As Asia Pacific's water crises worsen, RO technology is expected to grow at the fastest rate.

Detailed analysis of each segment mentioned in the scope table is covered in the SMR’s report.

Key Market Trends Reverse Osmosis to dominate the Asia Pacific Membrane Market.Reverse Osmosis (RO) is a process that uses pressure to demineralize or deionize water. Contaminants are rejected by a RO membrane based on their size and charge. Any contaminant with a molecular weight larger than 200 or anionic charge greater will be filtered. Reverse osmosis can remove particles, 99% or more of dissolved salts (ions), colloids, organics, microorganisms, pyrogens, monovalent and multivalent ions, and monovalent and multivalent ions from the feed water.

Reverse osmosis is the most used method of water purification in both commercial and household settings. Reverse osmosis filters away organic pollutants, metals, and pathogens as well as lowers the salt content in water. Reverse osmosis is also used to filter liquids that include undesired impurities in the water.

The Asia-Pacific region's growing population, and thus the demand for fresh drinking water, is expected to drive demand for reverse osmosis treatment in the Asia Pacific Membrane Market.

Asia Pacific Membrane Market Regional Insights:

Membrane water and wastewater treatment are necessary for China primarily thanks to effluents produced in a variety of businesses, including power generation, chemicals, food and beverage, mineral processing, and pulp and paper, among others, all of which require freshwater for day-to-day operations. North China accounts for around 90% of the country's coal-based industry. Also, because North China has fewer freshwater sources, demand for wastewater technology is rising, which is creating opportunities in the Asia Pacific membrane market.

Since the last few years, China's demand for processed foods has been increasing at a rapid pace. The demand for protein, dairy, and meat products is skyrocketing; the supply is far outstripping the demand. The need for membranes for water treatment in the food processing industry is expected to increase as a result of the scenario. China is also a key center for chemical processing, producing a significant portion of the world's chemicals. The need for membrane water and wastewater treatment from this sector is expected to rise over the forecast period, owing to increased global demand for various chemicals.

The objective of the report is to present a comprehensive analysis of the Asia Pacific Membrane Market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific Membrane Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific Membrane Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific Membrane Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific Membrane Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific Membrane Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Asia Pacific Membrane Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific Membrane Market is aided by legal factors.

Asia Pacific Membrane Market Scope:

|

Asia Pacific Membrane Market |

|

|

Market Size in 2024 |

USD 340.74 Mn. |

|

Market Size in 2032 |

USD 736.81 Mn. |

|

CAGR (2025-2032) |

10.12% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Technology

|

|

By End-Use Industry

|

|

|

|

By Vehicle Type

|

|

|

By Geography

|

Asia Pacific Membrane Market Players

• Asahi Kasei Corporation (Japan)

• Tianjin Motimo Membrane Technology Co. Ltd. (China)

• Jiangsu Kaimi Membrane Technology Co.Ltd. (China)

• Permionics (India)

• Toray Industries, Inc. (Japan)

• Others

Frequently Asked Questions

China has the highest growth rate in the Asia Pacific Membrane market.

Asahi Kasei Corporation (Japan), Tianjin Motimo Membrane Technology Co. Ltd. (China), Jiangsu Kaimi Membrane Technology Co.Ltd. (China), Permionics (India), Toray Industries, Inc. (Japan), and Others are the top players in Asia Pacific Membrane market.

China held almost 45% of the overall Asia Pacific Membrane market share.

- Chapter 1 Scope of the Report

- Chapter 2 Research Methodology

- 2.1. Research Process

2.2. Asia Pacific Membrane Market: Target Audience

2.3. Asia Pacific Membrane Market: Primary Research (As per Client Requirement)

2.4. Asia Pacific Membrane Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Value, 2024-2032

4.1.1.Asia Pacific Market Share Analysis, By Technology, By Value, 2024-2032 (In %)

4.1.1.1.China Market Share Analysis, By Technology, By Value, 2024-2032 (In %)

4.1.1.2.India Market Share Analysis, By Technology, By Value, 2024-2032 (In %)

4.1.1.3.Japan Market Share Analysis, By Technology, By Value, 2024-2032 (In %)

4.1.1.4.South Korea Market Share Analysis, By Technology, By Value, 2024-2032 (In %)

4.1.1.5.Australia Market Share Analysis, By Technology, By Value, 2024-2032 (In %)

4.1.1.6.ASEAN Market Share Analysis, By Technology, By Value, 2024-2032 (In %)

4.1.1.7.Rest of APAC Market Share Analysis, By Technology, By Value, 2024-2032 (In %)

4.1.2.Asia Pacific Market Share Analysis, By End-Use Industry, By Value, 2024-2032 (In %)

4.1.2.1.China Market Share Analysis, By End-Use Industry, By Value, 2024-2032 (In %)

4.1.2.2.India Market Share Analysis, By End-Use Industry, By Value, 2024-2032 (In %)

4.1.2.3.Japan Market Share Analysis, By End-Use Industry, By Value, 2024-2032 (In %)

4.1.2.4.South Korea Market Share Analysis, By End-Use Industry, By Value, 2024-2032 (In %)

4.1.2.5.Australia Market Share Analysis, By End-Use Industry, By Value, 2024-2032 (In %)

4.1.2.6.ASEAN Market Share Analysis, By End-Use Industry, By Value, 2024-2032 (In %)

4.1.2.7.Rest of APAC Market Share Analysis, By End-Use Industry, By Value, 2024-2032 (In %)

4.2. Stellar Competition matrix

4.2.1.Asia Pacific Stellar Competition Matrix

4.3.Key Players Benchmarking

4.3.1.Key Players Benchmarking by Technology, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

4.4. Mergers and Acquisitions in Industry

4.4.1.M&A by Region, Value and Strategic Intent

4.5. Market Dynamics

4.5.1.Market Drivers

4.5.2.Market Restraints

4.5.3.Market Opportunities

4.5.4.Market Challenges

4.5.5.PESTLE Analysis

4.5.6.PORTERS Five Force Analysis

4.5.7.Value Chain Analysis

Chapter 5 Asia Pacific Membrane Market Segmentation: By Technology

5.1. Asia Pacific Membrane Market, By Technology, Overview/Analysis, 2024-2032

5.2. Asia Pacific Membrane Market, By Technology, By Value, Market Share (%), 2024-2032 (USD Billion)

5.3. Asia Pacific Membrane Market, By Technology, By Value, -

5.3.1.Microfiltration (MF)

5.3.2.Ultrafiltration (UVF)

5.3.3.Nanofiltration (NF)

5.3.4.Reverse Osmosis (RO)

Chapter 6 Asia Pacific Membrane Market Segmentation: By End-Use Industry

6.1. Asia Pacific Membrane Market, By End-Use Industry, Overview/Analysis, 2024-2032

6.2. Asia Pacific Membrane Market Size, By End-Use Industry, By Value, Market Share (%), 2024-2032 (USD Billion)

6.3. Asia Pacific Membrane Market, By End-Use Industry, By Value, -

6.3.1.Municipal

6.3.2.Pulp & Paper

6.3.3.Chemical

6.3.4.Food & Beverage

6.3.5.Healthcare

6.3.6.Power

6.3.7.Other

Chapter 7 Asia Pacific Membrane Market Size, By Value, 2024-2032 (USD Billion)

7.1.1.China

7.1.2.India

7.1.3.Japan

7.1.4.South Korea

7.1.5.Australia

7.1.6.ASEAN

7.1.7.Rest of APAC

Chapter 8 Company Profiles

8.1. Key Players

8.1.1.Asahi Kasei Corporation (Japan)

8.1.1.1. Company Overview

8.1.1.2. Technology Portfolio

8.1.1.3. Financial Overview

8.1.1.4. Business Strategy

8.1.1.5. Key Developments

8.1.2.Tianjin Motimo Membrane Technology Co. Ltd. (China)

8.1.3.Jiangsu Kaimi Membrane Technology Co.Ltd. (China)

8.1.4.Permionics (India)

8.1.5.Toray Industries, Inc. (Japan)

8.1.6.Others

8.2. Key Findings

8.3. Recommendations