Phosphate Rock Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

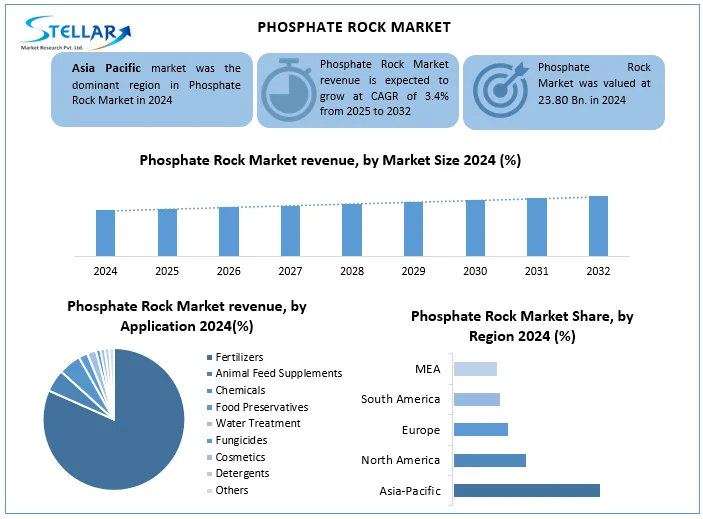

Phosphate Rock Market size was valued at USD 23.80 Bn. in 2024, and the total Phosphate Rock Market revenue is expected to grow at a CAGR of 3.4% from 2025 to 2032, reaching nearly USD 31.10 Bn.

Format : PDF | Report ID : SMR_2765

Phosphate Rock Market Overview

Phosphate rock also known as phosphorite, is a sedimentary rock containing higher concentrations of phosphate minerals, mainly calcium phosphate. Phosphate rock is a crucial natural source of phosphorus and a significant nutrient for plant growth. They are also, key ingredient in the manufacturing of fertilizers and animal food supplements.

In the phosphate rock industry, the key trend is the growing application of phosphate rock in the production of lithium iron phosphate (LFP) batteries and other products, because of the increasing demand for phosphate-based fertilizers. The rising Implementation of intensive farming practices to driving the phosphate rock market.

In 2024, the Asia-Pacific region is the most dominant in the phosphate rock market, due to its big agricultural area and increasing population. In the global phosphate rock market, the leading companies are Mosaic Company and OCP Group. Exports by major producer country like China reduce global availability and increase charges, while the U.S. For example, tariffs on imports in countries increase costs for users.

To get more Insights: Request Free Sample Report

Phosphate Rock Market Dynamics

Increasing Implementation of Intensive Farming Practices to Drive the Market Growth

The practices of intensive farming is characterized by high-input and high-output systems globally. They are adopted globally to meet the growing food demand. These practices are caused by quick nutrient exhaustion from the soil, mainly phosphorus, necessitating the use of phosphate fertilizers. Phosphate is a major raw material for the manufacture of rock in fertilizers. Farmers adopt intensive agriculture to satisfy the needs of increasing global food production, soils deplete more rapidly of phosphorus due to multiple rounds of cropping. Farmers are essential to apply phosphate fertilizers more frequently and in greater quantities if they are to sustain soil fertility and optimize yields.

Rising Use of Phosphates in Industrial Applications to Drive the Growth of Phosphate Rock Market

The increased phosphate use in industrial applications raises the growth of phosphate rock market. In the phosphoric acid and other phosphate derivatives production, phosphate rock is the primary raw material and the serves as a key component in the fertilizers, detergents, animal food supplements, food additives and water treatment chemicals. Industries like food processing, detergent, animal feed and water medicines expand the use of phosphate for conservation, hygiene, nutrition and chemical treatment. Also, the progress in industrial processing technologies and strict quality standards in food and water security have further intensified the consumption of refined phosphate products, thus, strengthening the dependence on expanding and stable phosphate rock supply.

Cadmium Contamination in Phosphate Rock to Restrain the Phosphate Rock Market

The cadmium contamination in phosphate rock significantly restrains the phosphate rock market due to its harmful and dangerous effects on the environment and human well-being. Cadmium naturally present in the sedimentary phosphate deposits, collects in soil and crops when phosphate fertilizers are used, they causing a risk of kidney damage and bone conditions. In addition, cadmium contamination degrades the soil and reduces agricultural productivity over time, which causes long -term stability for concerns.

Phosphate Rock Market Segment Analu

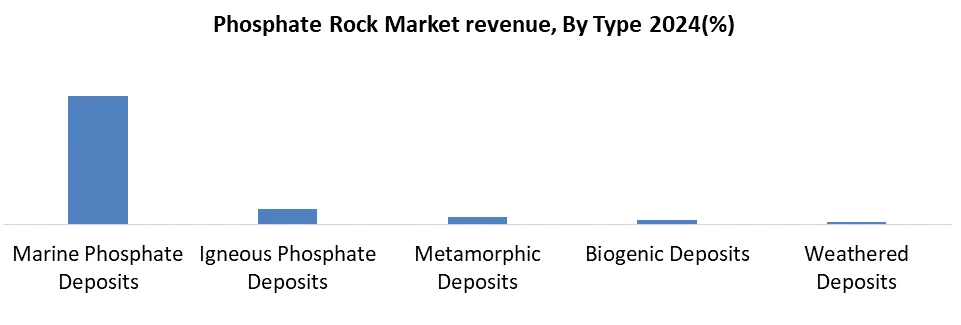

Based on Type, the phosphate rock market is segmented into marine phosphate deposits, igneous phosphate deposits, biogenic deposits, metamorphic deposits and Weathered deposits. Marine phosphate deposits are major segment type in the phosphate rock industry, as due to widespread access to Marine phosphate deposits. Marine phosphate deposits are generally rich in phosphorus due to their great value in phosphate-based fertilizers. They have high-grade quality with a relatively low price of extraction and processing. therefore, marine phosphate is more economical than some other deposits.

Based on application, the phosphate rock market is segmented into fertilizers, animal feed supplements, chemicals, water treatment, fungicides, food preservatives, cosmetics, detergents and others. Phosphate rock is the most dominant type is fertilizer in the market, is an important application for phosphate rock and it is important nutrient required for the growth and growing agricultural yield and healthy plants. Phosphate rock is the primary source of phosphate that is used in the production of phosphate-based fertilizers such as monoammonium phosphate (MAP) and also diammonium phosphate (DAM). Now a days, the global population is constantly increasing and the demand for food is increasing.

Phosphate Rock Market Regional analysis:

Asia Pacific, In 2024, the Asia-Pacific is the most dominant region in the phosphate rock market because of its huge agriculture industry and rising population. China and India are the major consumers of phosphate fertilizers, because they require to ensure the food products security and raise agricultural output to sustain their vast populations. China is the world's leading producer of phosphate rock, with huge reserves and established processing facilities. Fast industrial development and agriculture are the pillars of the advanced economies and these emerging economies are likely to boost the demand for phosphate rock in the Asia Pacific region.

Phosphate Rock Market Competitive Landscape

The top companies in the global phosphate rock industry are the Mosaic Company and OCP Group in 2024. United States-based Mosaic has advantages due to its vertical integration, controlling everything from phosphate rock production in North America to producing finished fertilizers and having a worldwide distribution system. This integration gives the Mosaic strong supply chain control and price efficiency. Morocco's OCP Group has a strategic advantage with access to the world's largest phosphate rock investments, having over 70% control of the global reserves. As a state-owned company, OCP usages its vast resource base to provide most of the world's phosphate, especially to developing markets in Africa, Asia, and South America.

|

The Phosphate Rock Market Scope |

|

|

Market Size in 2024 |

USD 23.80 Bn. |

|

Market Size in 2032 |

USD 31.10 Bn. |

|

CAGR (2025-2032) |

3.4% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Marine Phosphate Deposits Igneous Phosphate Deposits Metamorphic Deposits Biogenic Deposits Weathered Deposits |

|

By Application Fertilizers Animal Feed Supplements Chemicals Food Preservatives Water Treatment Fungicides Cosmetics Detergents Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Phosphate Rock Market Key Players:

North America

- The Mosaic Company (USA)

- Nutrien Ltd. (Canada)

- J.R. Simplot Company (USA)

- CF Industries Holdings, Inc. (USA)

- Agrium Inc. (Canada)

- Simplot Phosphates (USA)

Europe

- Yara International ASA (Norway)

- EuroChem Group AG (Switzerland)

- ICL Group Ltd. (Israel)

- PhosAgro (Russia)

- Grupa Azoty (Poland)

- Kemira Oyj (Finland)

Asia-Pacific

- China National Chemical Corporation (China)

- Gujarat State Fertilizers & Chemicals Ltd. (India)

- Indian Farmers Fertiliser Cooperative Limited (IFFCO) (India)

- Haifa Group (Israel)

- PT Pupuk Indonesia (Indonesia)

- Sinofert Holdings Limited (China)

Middle East & Africa

- OCP Group (Morocco)

- SABIC (Saudi Arabia)

- Jordan Phosphate Mines Company (Jordan)

- Abu Dhabi Fertilizer Industries (UAE)

- Ma’aden (Saudi Arabia)

- Kropz (South Africa)

South America

- Vale Fertilizantes (Brazil)

- Fosfertil (Brazil)

- Yara Brazil (Brazil)

- Empresa Química de Nitrogeno S.A. (Argentina)

- Fertilizantes Heringer (Brazil)

- Copebrás (Brazil)

Frequently Asked Questions

The top players in the global phosphate rock industry are the Mosaic Company and OCP Group.

The Asia-Pacific market is the most dominant in the Phosphate Rock Market.

Because they have generally higher phosphate content (P2O5), making them more effective for fertilizer manufacturing.

Rising Adoption of Intensive Farming Practices and Increasing Use of Phosphates in Industrial Applications are the drivers in the Phosphate Rock Market.

1. Phosphate Rock Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Phosphate Rock Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Phosphate Rock Market: Dynamics

3.1. Phosphate Rock Market Trends

3.2. Phosphate Rock Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Phosphate Rock Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

4.1. Phosphate Rock Market Size and Forecast, By Type (2024-2032)

4.1.1. Marine Phosphate Deposits

4.1.2. Igneous Phosphate Deposits

4.1.3. Metamorphic Deposits

4.1.4. Biogenic Deposits

4.1.5. Weathered Deposits

4.2. Phosphate Rock Market Size and Forecast, By Application (2024-2032)

4.2.1. Fertilizers

4.2.2. Animal Feed Supplements

4.2.3. Chemicals

4.2.4. Food Preservatives

4.2.5. Water Treatment

4.2.6. Fungicides

4.2.7. Cosmetics

4.2.8. Detergents

4.2.9. Others

4.3. Phosphate Rock Market Size and Forecast, By Region (2024-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Phosphate Rock Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

5.1. North America Phosphate Rock Market Size and Forecast, By Type (2024-2032)

5.1.1. Marine Phosphate Deposits

5.1.2. Igneous Phosphate Deposits

5.1.3. Metamorphic Deposits

5.1.4. Biogenic Deposits

5.1.5. Weathered Deposits

5.2. North America Phosphate Rock Market Size and Forecast, By Application (2024-2032)

5.2.1. Fertilizers

5.2.2. Animal Feed Supplements

5.2.3. Chemicals

5.2.4. Food Preservatives

5.2.5. Water Treatment

5.2.6. Fungicides

5.2.7. Cosmetics

5.2.8. Detergents

5.2.9. Others

5.3. North America Phosphate Rock Market Size and Forecast, by Country (2024-2032)

5.3.1. United States

5.3.1.1. United States Phosphate Rock Market Size and Forecast, By Type (2024-2032)

5.3.1.1.1. Marine Phosphate Deposits

5.3.1.1.2. Igneous Phosphate Deposits

5.3.1.1.3. Metamorphic Deposits

5.3.1.1.4. Biogenic Deposits

5.3.1.1.5. Weathered Deposits

5.3.1.2. United States Phosphate Rock Market Size and Forecast, By Application (2024-2032)

5.3.1.2.1. Fertilizers

5.3.1.2.2. Animal Feed Supplements

5.3.1.2.3. Chemicals

5.3.1.2.4. Food Preservatives

5.3.1.2.5. Water Treatment

5.3.1.2.6. Fungicides

5.3.1.2.7. Cosmetics

5.3.1.2.8. Detergents

5.3.1.2.9. Others

5.3.2. Canada

5.3.2.1. Canada Phosphate Rock Market Size and Forecast, By Type (2024-2032)

5.3.2.1.1. Marine Phosphate Deposits

5.3.2.1.2. Igneous Phosphate Deposits

5.3.2.1.3. Metamorphic Deposits

5.3.2.1.4. Biogenic Deposits

5.3.2.1.5. Weathered Deposits

5.3.2.2. Canada Phosphate Rock Market Size and Forecast, By Application (2024-2032)

5.3.2.2.1. Fertilizers

5.3.2.2.2. Animal Feed Supplements

5.3.2.2.3. Chemicals

5.3.2.2.4. Food Preservatives

5.3.2.2.5. Water Treatment

5.3.2.2.6. Fungicides

5.3.2.2.7. Cosmetics

5.3.2.2.8. Detergents

5.3.2.2.9. Others

5.3.3. Mexico

5.3.3.1. Mexico Phosphate Rock Market Size and Forecast, By Type (2024-2032)

5.3.3.1.1. Marine Phosphate Deposits

5.3.3.1.2. Igneous Phosphate Deposits

5.3.3.1.3. Metamorphic Deposits

5.3.3.1.4. Biogenic Deposits

5.3.3.1.5. Weathered Deposits

5.3.3.2. Mexico Phosphate Rock Market Size and Forecast, By Application (2024-2032)

5.3.3.2.1. Fertilizers

5.3.3.2.2. Animal Feed Supplements

5.3.3.2.3. Chemicals

5.3.3.2.4. Food Preservatives

5.3.3.2.5. Water Treatment

5.3.3.2.6. Fungicides

5.3.3.2.7. Cosmetics

5.3.3.2.8. Detergents

5.3.3.2.9. Others

6. Europe Phosphate Rock Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

6.1. Europe Phosphate Rock Market Size and Forecast, By Type (2024-2032)

6.2. Europe Phosphate Rock Market Size and Forecast, By Application (2024-2032)

6.3. Europe Phosphate Rock Market Size and Forecast, by Country (2024-2032)

6.3.1. United Kingdom

6.3.1.1. United Kingdom Phosphate Rock Market Size and Forecast, By Type (2024-2032)

6.3.1.2. United Kingdom Phosphate Rock Market Size and Forecast, By Application (2024-2032)

6.3.2. France

6.3.2.1. France Phosphate Rock Market Size and Forecast, By Type (2024-2032)

6.3.2.2. France Phosphate Rock Market Size and Forecast, By Application (2024-2032)

6.3.3. Germany

6.3.3.1. Germany Phosphate Rock Market Size and Forecast, By Type (2024-2032)

6.3.3.2. Germany Phosphate Rock Market Size and Forecast, By Application (2024-2032)

6.3.4. Italy

6.3.4.1. Italy Phosphate Rock Market Size and Forecast, By Type (2024-2032)

6.3.4.2. Italy Phosphate Rock Market Size and Forecast, By Application (2024-2032)

6.3.5. Spain

6.3.5.1. Spain Phosphate Rock Market Size and Forecast, By Type (2024-2032)

6.3.5.2. Spain Phosphate Rock Market Size and Forecast, By Application (2024-2032)

6.3.6. Sweden

6.3.6.1. Sweden Phosphate Rock Market Size and Forecast, By Type (2024-2032)

6.3.6.2. Sweden Phosphate Rock Market Size and Forecast, By Application (2024-2032)

6.3.7. Russia

6.3.7.1. Russia Phosphate Rock Market Size and Forecast, By Type (2024-2032)

6.3.7.2. Russia Phosphate Rock Market Size and Forecast, By Application (2024-2032)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe Phosphate Rock Market Size and Forecast, By Type (2024-2032)

6.3.8.2. Rest of Europe Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Phosphate Rock Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

7.1. Asia Pacific Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3. Asia Pacific Phosphate Rock Market Size and Forecast, by Country (2024-2032)

7.3.1. China

7.3.1.1. China Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.1.2. China Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.2. S Korea

7.3.2.1. S Korea Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.2.2. S Korea Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.2.3. S Japan

7.3.2.4. Japan Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.2.5. Japan Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.3. India

7.3.3.1. India Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.3.2. India Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.4. Australia

7.3.4.1. Australia Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.4.2. Australia Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.5. Indonesia

7.3.5.1. Indonesia Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.5.2. Indonesia Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.6. Malaysia

7.3.6.1. Malaysia Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.6.2. Malaysia Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.7. Philippines

7.3.7.1. Philippines Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.7.2. Philippines Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.8. Thailand

7.3.8.1. Thailand Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.8.2. Thailand Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.9. Vietnam

7.3.9.1. Vietnam Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.9.2. Vietnam Phosphate Rock Market Size and Forecast, By Application (2024-2032)

7.3.10. Rest of Asia Pacific

7.3.10.1. Rest of Asia Pacific Phosphate Rock Market Size and Forecast, By Type (2024-2032)

7.3.10.2. Rest of Asia Pacific Phosphate Rock Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Phosphate Rock Market Size and Forecast (by Value in USD Bn.) (2024-2032)

8.1. Middle East and Africa Phosphate Rock Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Phosphate Rock Market Size and Forecast, By Application (2024-2032)

8.3. Middle East and Africa Phosphate Rock Market Size and Forecast, by Country (2024-2032)

8.3.1. South Africa

8.3.1.1. South Africa Phosphate Rock Market Size and Forecast, By Type (2024-2032)

8.3.1.2. South Africa Phosphate Rock Market Size and Forecast, By Application (2024-2032)

8.3.2. GCC

8.3.2.1. GCC Phosphate Rock Market Size and Forecast, By Type (2024-2032)

8.3.2.2. GCC Phosphate Rock Market Size and Forecast, By Application (2024-2032)

8.3.3. Egypt

8.3.3.1. Egypt Phosphate Rock Market Size and Forecast, By Type (2024-2032)

8.3.3.2. Egypt Phosphate Rock Market Size and Forecast, By Application (2024-2032)

8.3.4. Nigeria

8.3.4.1. Nigeria Phosphate Rock Market Size and Forecast, By Type (2024-2032)

8.3.4.2. Nigeria Phosphate Rock Market Size and Forecast, By Application (2024-2032)

8.3.5. Rest of ME&A

8.3.5.1. Rest of ME&A Phosphate Rock Market Size and Forecast, By Type (2024-2032)

8.3.5.2. Rest of ME&A Phosphate Rock Market Size and Forecast, By Application (2024-2032)

9. South America Phosphate Rock Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

9.1. South America Phosphate Rock Market Size and Forecast, By Type (2024-2032)

9.2. South America Phosphate Rock Market Size and Forecast, By Application (2024-2032)

9.3. South America Phosphate Rock Market Size and Forecast, by Country (2024-2032)

9.3.1. Brazil

9.3.1.1. Brazil Phosphate Rock Market Size and Forecast, By Type (2024-2032)

9.3.1.2. Brazil Phosphate Rock Market Size and Forecast, By Application (2024-2032)

9.3.2. Argentina

9.3.2.1. Argentina Phosphate Rock Market Size and Forecast, By Type (2024-2032)

9.3.2.2. Argentina Phosphate Rock Market Size and Forecast, By Application (2024-2032)

9.3.3. Colombia

9.3.3.1. Colombia Phosphate Rock Market Size and Forecast, By Type (2024-2032)

9.3.3.2. Colombia Phosphate Rock Market Size and Forecast, By Application (2024-2032)

9.3.4. Chile

9.3.4.1. Chile Phosphate Rock Market Size and Forecast, By Type (2024-2032)

9.3.4.2. Chile Phosphate Rock Market Size and Forecast, By Application (2024-2032)

9.3.5. Rest Of South America

9.3.5.1. Rest Of South America Phosphate Rock Market Size and Forecast, By Type (2024-2032)

9.3.5.2. Rest Of South America Phosphate Rock Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1. OCP Group (Morocco)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. The Mosaic Company (USA)

10.3. Nutrien Ltd. (Canada)

10.4. J.R. Simplot Company (USA)

10.5. CF Industries Holdings, Inc. (USA)

10.6. Agrium Inc. (Canada)

10.7. Simplot Phosphates (USA)

10.8. Yara International ASA (Norway)

10.9. EuroChem Group AG (Switzerland)

10.10. ICL Group Ltd. (Israel)

10.11. PhosAgro (Russia)

10.12. Grupa Azoty (Poland)

10.13. Kemira Oyj (Finland)

10.14. China National Chemical Corporation (China)

10.15. Gujarat State Fertilizers & Chemicals Ltd. (India)

10.16. Indian Farmers Fertiliser Cooperative Limited (IFFCO) (India)

10.17. Haifa Group (Israel)

10.18. PT Pupuk Indonesia (Indonesia)

10.19. Sinofert Holdings Limited (China)

10.20. SABIC (Saudi Arabia)

10.21. Jordan Phosphate Mines Company (Jordan)

10.22. Abu Dhabi Fertilizer Industries (UAE)

10.23. Ma’aden (Saudi Arabia)

10.24. Kropz (South Africa)

10.25. Vale Fertilizantes (Brazil)

10.26. Fosfertil (Brazil)

10.27. Yara Brazil (Brazil)

10.28. Empresa Química de Nitrogeno S.A. (Argentina)

10.29. Fertilizantes Heringer (Brazil)

10.30. Copebrás (Brazil)

11. Key Findings

12. Analyst Recommendations

13. Phosphate Rock Market: Research Methodology