Synchronous Generator Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

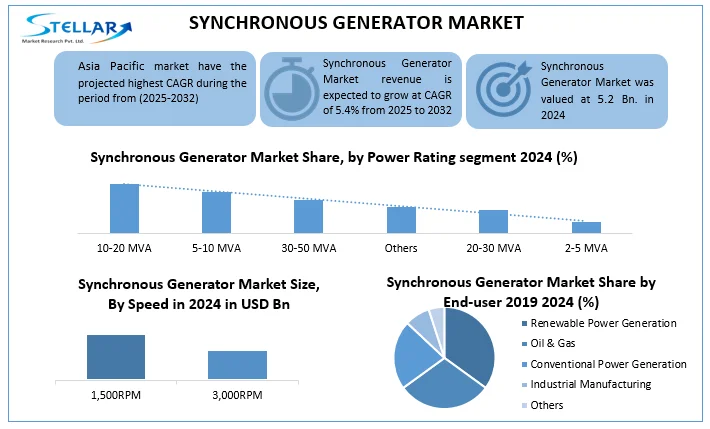

Synchronous Generator Market size was valued at USD 5.2 Bn. in 2024, and the total Synchronous Generator Market revenue is expected to grow at a CAGR of 5.4% from 2025 to 2032, reaching nearly USD 7.92 Bn.

Format : PDF | Report ID : SMR_2758

Synchronous Generator Market Overview:

A synchronous generator, also known as the alternator, is an electrical machine that converts mechanical energy into electrical energy in the form of alternating current (AC). They are widely useful in power stations, industrial services, marine environments, and renewable energy systems. The current trend in the synchronous generator market is the rising integration of synchronous generators in renewable energy projects, like wind and hydropower. The rising Global Electricity Demand to Drive the Synchronous Generator Market.

Asia-Pacific is the most dominant synchronous generator market, because of its industrialisation, urbanisation, and higher energy demand. Siemens AG and ABB Ltd. are the two leading players in the global synchronous generator market.

The tariffs on imported components increase production prices for synchronous generators, making them more expensive for power producers. Particularly in renewable energy projects. They slow the adoption of synchronous generators, where cost-efficiency is vital. Also, trade restrictions disrupt supply chains, causing delays in production and delivery that affect project timelines and grid stability.

To get more Insights: Request Free Sample Report

Synchronous Generator Market Dynamics

Increasing Global Electricity Demand to Drive the Synchronous Generator Market

This rising demand is mainly due to rapid urbanization, industrialization, and growing living standards, mostly in developing economies, it drives the synchronous generator market. Also, Individuals' access to electricity and industries rising their operations, then a further increase in demand for stable and high-capacity power generation. In 2024, world electricity consumption increased by around 4.3%, encouraged by drivers such as economic growth, high use of air conditioning during intense heatwaves, and the spread of data centres and electric vehicles (EVs). For instance, the key hydroelectric generating station in the world, the Three Gorges Dam, uses the 32 massive synchronous generators to generate tremendous amounts of electricity, around 100+ terawatt-hours per annum, and distributes it throughout China's enormous grid, providing stable power to businesses and residences.

Expansion of Renewable Energy Projects to Drive the Growth of the Synchronous Generator Market

In renewable energy systems, to ensure grid stability and power quality, Synchronous generators are very significant. Renewable sources such as wind and hydro generate mechanical energy is efficiently converted into electrical energy with constant voltage and frequency. Synchronous generators offer this conversion by synchronizing, helping to control frequency fluctuations caused by the variable nature of renewable energy production. Also, they supply reactive power, supporting voltage stability across the power network. As renewable installations rise in scale and complexity, the need for reliable synchronous generators to integrate intermittent energy into the grid increases significantly in synchronous generator market.

Cooling Requirements in Large-Capacity Industrial to Restrain the Synchronous Generator Market

In large capacity industrial applications, the synchronous generators generate sufficient heat due to their high electrical and mechanical loads, requiring advanced cooling systems such as hydrogen or water cooling. These systems are expensive to install and maintain, especially in distant or rigid environments such as offshore platforms or hydroelectric plants. The additional complexity of these cooling requirements and the operational costs make the synchronous generator less attractive than options with simple thermal management, preventing their adoption in cost-sensitive and logically challenging projects.

Synchronous Generator Market Segmentation

Based on speed, the Synchronous Generator Market is divided into 1,500 and 3,000 RPM. 1,500 RPM is the most dominant segment in the synchronous generator market. because of widespread use, mostly in areas that use 50 Hz power systems, like Europe, Asia, and Africa. Working at 1,500 RPM, a 4-pole synchronous generator accurately matches the 50 Hz grid frequency, and therefore, it is the business standard for grid-connected power generation. The increasing need for distributed and renewable energy systems is a vital opportunity in the Synchronous Generator Market.

Based on Power Rating, the synchronous generator market is divided into 2-5 MVA, 5-10 MVA, 10-20 MVA, 20-30 MVA and 30-50 MVA. Globally, the 10–20 MVA power rating segment holds a high market share in the synchronous generators. Due to its accurate balance between power capacity and operating flexibility, it suits an extensive scope of applications for both industrial and commercial purposes. In synchronous generators, this range is usually employed in medium-scale industrial applications, regional power plants, and commercial infrastructure development, and is a reliable and useful for the generation of electricity.

Based on end users, the synchronous generator market is divided into the Renewable Power Generation, Oil & Gas, Conventional Power Generation, Industrial sector and Others. The industrial segment has the highest market share of the synchronous generator market. because the industry's necessity is a reliable and constant power supply to avoid delayed operations and keep productivity profitable. Also, industries operate heavy machinery and complex systems that need a stable voltage and frequency, which synchronous generators effectively provide. The rising automation and electrification of industrial processes further boost demand for consistent power solutions, reinforcing the segment’s dominance.

Synchronous Generator Market Regional analysis:

The Asia-Pacific is the most dominant synchronous generator market due to its industrialisation, urbanisation, and high energy demand. China, India, and Japan are the key drivers for this growth, with continuous huge investments in thermal and nuclear power facilities to satisfy their growing electricity needs. The world's biggest energy user, China, is increasing synchronous generator application in coal-fired, nuclear, and hydropower plants, validating grid stability and frequency control. Even India is heavily investing in nuclear and thermal power plants to supply baseload energy to its burgeoning population and industry.

Synchronous Generator Market Competitive Landscape:

Siemens AG and ABB Ltd. are the two leading players in the global synchronous generator market. Siemens holds a slightly larger market share and is known for its advanced modular generator designs with high efficiency and digital integration, serving both conventional and renewable power sectors. ABB, while close behind, focuses heavily on energy efficiency and grid stability, offering reliable solutions tailored for industrial and utility-scale applications.

The joint venture between Siemens Energy and Orsted is the largest in the synchronous generator industry with the coming together of Siemens Energy's experience and management in offshore wind power. This partnership aims to contribute further to the development of offshore wind farms by offering efficient, reliable, and synchronized synchronous generators to produce electricity and management on the grid.

Synchronous Generator Market Recent Developments:

- In 2023, Siemens Energy and ABB established their investments in smart grid technologies. And they have real-time monitoring and predictive maintenance, are enhances the performance and operating efficiency of synchronous generators, particularly in North American and European power grids.

- In 2022, ABB introduced a new 20 MW modular synchronous generator through flywheel technology to enhance grid stability. This development is mainly useful for countries with high levels of renewable energy production, like Germany and Denmark, as it offers extra inertia to assist in the handling of variable power supplies.

|

The Synchronous Generator Market Scope |

|

|

Market Size in 2024 |

USD 5.2 Bn. |

|

Market Size in 2032 |

USD 7.92 Bn. |

|

CAGR (2025-2032) |

5.4% |

|

Historic Data |

2020-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Speed 1,500 RPM 3,000 RPM |

|

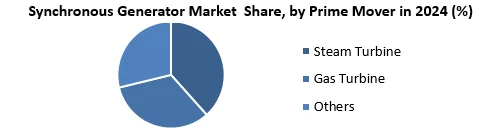

By Prime Mover Steam Turbine Gas Turbine Others |

|

|

By Power Rating 2-5 MVA 5-10 MVA 10-20 MVA 20-30 MVA 30-50 MVA |

|

|

By End user Renewable Power Generation Oil & Gas Conventional Power Generation Industrial Manufacturing Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Synchronous Generator Market Key Players:

North America

- IQVIA (USA)

- Caterpillar Inc. (USA)

- Cummins Inc. (USA)

- Powertec Generator System Inc. (USA)

- GE Power Conversion (USA)

- Baldor Electric Company (USA)

- Marathon Electric (USA)

Europe

- Flatiron Health (London, UK)

- Siemens Energy (Germany)

- Andritz AG (Austria)

- Leroy-Somer (France)

- Mecc Alte SpA (Italy)

- Ansaldo Energia (Italy)

- Elin Motoren GmbH (Austria)

- Ingeteam S.A. (Spain)

- Jeumont Electric (France)

- Marelli Motori (Italy)

Asia-Pacific

- ABB Ltd. (Switzerland)

- Meidensha Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- TMEIC (Japan)

- Nidec Corporation (Japan)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Toshiba Corporation (Japan)

- Hitachi Energy Ltd. (Japan/APAC HQ)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- Wolong Electric Group Co., Ltd. (China)

Middle East & Africa

- Actom (Pty) Ltd. (South Africa)

- Zest WEG Group Africa (South Africa)

South America

- WEG S.A. (Brazil)

- Motores WEG Argentina S.A. (Argentina)

Frequently Asked Questions

ABB, WEG, Siemens Energy, Meidensha Corporation and Andritz are the top 5 players in the Synchronous generator market.

The Asia-Pacific market is the most dominant synchronous generator market.

Due to their efficiency and capacity to continually produce huge quantities of power.

Increasing global electricity demand is the driver of the Synchronous generator market.

1. Synchronous Generator Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Synchronous Generator Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Synchronous Generator Market: Dynamics

3.1. Synchronous Generator Market Trends

3.2. Synchronous Generator Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Synchronous Generator Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

4.1. Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

4.1.1. 1,500RPM

4.1.2. 3,000RPM

4.2. Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

4.2.1. Steam Turbine

4.2.2. Gas Turbine

4.2.3. Others

4.3. Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

4.3.1. 2-5 MVA

4.3.2. 5-10 MVA

4.3.3. 10-20 MVA

4.3.4. 20-30 MVA

4.3.5. 30-50 MVA

4.4. Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

4.4.1. Renewable Power Generation

4.4.2. Oil & Gas

4.4.3. Conventional Power Generation

4.4.4. Industrial Manufacturing

4.4.5. Others

4.5. Synchronous Generator Market Size and Forecast, By Region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Synchronous Generator Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

5.1. North America Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

5.1.1. 1,500RPM

5.1.2. 3,000RPM

5.2. North America Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

5.2.1. Steam Turbine

5.2.2. Gas Turbine

5.2.3. Others

5.3. North America Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

5.3.1. 2-5 MVA

5.3.2. 5-10 MVA

5.3.3. 10-20 MVA

5.3.4. 20-30 MVA

5.3.5. 30-50 MVA

5.4. North America Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

5.4.1. Renewable Power Generation

5.4.2. Oil & Gas

5.4.3. Conventional Power Generation

5.4.4. Industrial Manufacturing

5.4.5. Others

5.5. North America Synchronous Generator Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

5.5.1.1.1. 1,500RPM

5.5.1.1.2. 3,000RPM

5.5.1.2. United States Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

5.5.1.2.1. Steam Turbine

5.5.1.2.2. Gas Turbine

5.5.1.2.3. Others

5.5.1.3. United States Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

5.5.1.3.1. 2-5 MVA

5.5.1.3.2. 5-10 MVA

5.5.1.3.3. 10-20 MVA

5.5.1.3.4. 20-30 MVA

5.5.1.3.5. 30-50MVA

5.5.1.4. United States Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

5.5.1.4.1. Renewable Power Generation

5.5.1.4.2. Oil & Gas

5.5.1.4.3. Conventional Power Generation

5.5.1.4.4. Industrial Manufacturing

5.5.1.4.5. Others

5.5.1.5. Canada Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

5.5.1.5.1. 1,500RPM

5.5.1.5.2. 3,000RPM

5.5.1.6. Canada Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

5.5.1.6.1. Steam Turbine

5.5.1.6.2. Gas Turbine

5.5.1.6.3. Others

5.5.1.7. Canada Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

5.5.1.7.1. Oncology

5.5.1.7.2. Cardiology

5.5.1.7.3. Neurology

5.5.1.7.4. Diabetes

5.5.1.7.5. Respiratory

5.5.1.7.6. Others

5.5.1.8. Canada Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

5.5.1.8.1. Renewable Power Generation

5.5.1.8.2. Oil & Gas

5.5.1.8.3. Conventional Power Generation

5.5.1.8.4. Industrial Manufacturing

5.5.1.8.5. Others

5.5.2. Mexico

5.5.2.1. Mexico Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

5.5.2.1.1. 1,500RPM

5.5.2.1.2. 3,000RPM

5.5.2.2. Mexico Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

5.5.2.2.1. Steam Turbine

5.5.2.2.2. Gas Turbine

5.5.2.2.3. Others

5.5.2.3. Mexico Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

5.5.2.3.1. 2-5 MVA

5.5.2.3.2. 5-10 MVA

5.5.2.3.3. 10-20 MVA

5.5.2.3.4. 20-30 MVA

5.5.2.3.5. 30-50 MVA

5.5.2.4. Mexico Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

5.5.2.4.1. Renewable Power Generation

5.5.2.4.2. Oil & Gas

5.5.2.4.3. Conventional Power Generation

5.5.2.4.4. Industrial Manufacturing

5.5.2.4.5. Others

6. Europe Synchronous Generator Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

6.1. Europe Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

6.2. Europe Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

6.3. Europe Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

6.4. Europe Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

6.5. Europe Synchronous Generator Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

6.5.1.2. United Kingdom Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

6.5.1.3. United Kingdom Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

6.5.1.4. United Kingdom Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

6.5.2. France

6.5.2.1. France Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

6.5.2.2. France Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

6.5.2.3. France Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

6.5.2.4. France Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

6.5.3.2. Germany Synchronous Generator Market Size and Forecast, By Prime Mover 2025-2032)

6.5.3.3. Germany Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

6.5.3.4. Germany Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

6.5.4.2. Italy Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

6.5.4.3. Italy Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

6.5.4.4. Italy Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

6.5.5.2. Spain Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

6.5.5.3. Spain Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

6.5.5.4. Spain Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

6.5.6.2. Sweden Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

6.5.6.3. Sweden Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

6.5.6.4. Sweden Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

6.5.7. Russia

6.5.7.1. Russia Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

6.5.7.2. Russia Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

6.5.7.3. Russia Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

6.5.7.4. Russia Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

6.5.8.2. Rest of Europe Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

6.5.8.3. Rest of Europe Synchronous Generator Market Size and Forecast By Power Rating (2024-2032)

6.5.8.4. Rest of Europe Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7. Asia Pacific Synchronous Generator Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

7.1. Asia Pacific Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.2. Asia Pacific Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.3. Asia Pacific Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.4. Asia Pacific Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5. Asia Pacific Synchronous Generator Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.1.2. China Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.1.3. China Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.1.4. China Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.2. S Korea

7.5.2.1. South Korea Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.2.2. South Korea Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.2.3. South Korea Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.2.4. South Korea Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.3.2. Japan Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.3.3. Japan Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.3.4. Japan Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.4. India

7.5.4.1. India Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.4.2. India Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.4.3. India Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.4.4. India Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.5.2. Australia Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.5.3. Australia Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.5.4. Australia Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.6.2. Indonesia Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.6.3. Indonesia Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.6.4. Indonesia Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.7. Malaysia

7.5.7.1. Malaysia Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.7.2. Malaysia Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.7.3. Malaysia Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.7.4. Malaysia Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.8. Philippines

7.5.8.1. Philippines Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.8.2. Philippines Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.8.3. Philippines Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.8.4. Philippines Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.9. Thailand

7.5.9.1. Thailand Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.9.2. Thailand Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.9.3. Thailand Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.9.4. Thailand Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.10. Vietnam

7.5.10.1. Vietnam Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.10.2. Vietnam Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.10.3. Vietnam Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.10.4. Vietnam Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

7.5.11.2. Rest of Asia Pacific Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

7.5.11.3. Rest of Asia Pacific Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

7.5.11.4. Rest of Asia Pacific Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

8. Middle East and Africa Synchronous Generator Market Size and Forecast (by Value in USD Bn.) (2024-2032)

8.1. Middle East and Africa Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

8.2. Middle East and Africa Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

8.3. Middle East and Africa Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

8.4. Middle East and Africa Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

8.5. Middle East and Africa Synchronous Generator Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

8.5.1.2. South Africa Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

8.5.1.3. South Africa Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

8.5.1.4. South Africa Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

8.5.2.2. GCC Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

8.5.2.3. GCC Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

8.5.2.4. GCC Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

8.5.3. Egypt

8.5.3.1. Egypt Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

8.5.3.2. Egypt Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

8.5.3.3. Egypt Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

8.5.3.4. Egypt Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

8.5.4. Nigeria

8.5.4.1. Nigeria Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

8.5.4.2. Nigeria Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

8.5.4.3. Nigeria Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

8.5.4.4. Nigeria Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

8.5.5. Rest of ME&A

8.5.5.1. Rest of ME&A Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

8.5.5.2. Rest of ME&A Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

8.5.5.3. Rest of ME&A Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

8.5.5.4. Rest of ME&A Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

9. South America Synchronous Generator Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

9.1. South America Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

9.2. South America Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

9.3. South America Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

9.4. South America Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

9.5. South America Synchronous Generator Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

9.5.1.2. Brazil Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

9.5.1.3. Brazil Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

9.5.1.4. Brazil Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

9.5.2.2. Argentina Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

9.5.2.3. Argentina Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

9.5.2.4. Argentina Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

9.5.3. Colombia

9.5.3.1. Colombia Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

9.5.3.2. Colombia Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

9.5.3.3. Colombia Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

9.5.3.4. Colombia Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

9.5.4. Chile

9.5.4.1. Chile Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

9.5.4.2. Chile Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

9.5.4.3. Chile Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

9.5.4.4. Chile Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

9.5.5. Rest Of South America

9.5.5.1. Rest of South America Synchronous Generator Market Size and Forecast, By Speed (2024-2032)

9.5.5.2. Rest of South America Synchronous Generator Market Size and Forecast, By Prime Mover (2024-2032)

9.5.5.3. Rest of South America Synchronous Generator Market Size and Forecast, By Power Rating (2024-2032)

9.5.5.4. Rest of South America Synchronous Generator Market Size and Forecast, By End-User (2024-2032)

10. Company Profile: Key Players

10.1. ABB Ltd. (Switzerland)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Meidensha Corporation (Japan)

10.3. Mitsubishi Electric Corporation (Japan)

10.4. TMEIC (Japan)

10.5. Nidec Corporation (Japan)

10.6. Mitsubishi Heavy Industries, Ltd. (Japan)

10.7. Toshiba Corporation (Japan)

10.8. Hitachi Energy Ltd. (Japan/APAC HQ)

10.9. Hyundai Heavy Industries Co., Ltd. (South Korea)

10.10. Wolong Electric Group Co., Ltd. (China)

10.11. General Electric Company (USA)

10.12. Caterpillar Inc. (USA)

10.13. Cummins Inc. (USA)

10.14. Powertec Generator System Inc. (USA)

10.15. GE Power Conversion (USA)

10.16. Baldor Electric Company (USA)

10.17. Marathon Electric (USA)

10.18. Siemens Energy (Germany)

10.19. Andritz AG (Austria)

10.20. Leroy-Somer (France)

10.21. Mecc Alte SpA (Italy)

10.22. Ansaldo Energia (Italy)

10.23. Elin Motoren GmbH (Austria)

10.24. Ingeteam S.A. (Spain)

10.25. Jeumont Electric (France)

10.26. Marelli Motori (Italy)

10.27. MENZEL Elektromotoren GmbH (Germany)

10.28. Motores WEG Argentina S.A. (Argentina)

10.29. Actom (Pty) Ltd. (South Africa)

10.30. Zest WEG Group Africa (South Africa)

11. Key Findings & Analyst Recommendations

12. Synchronous Generator Market: Research Methodology