North America Coring Market Trends and Forecast (2025-2032)

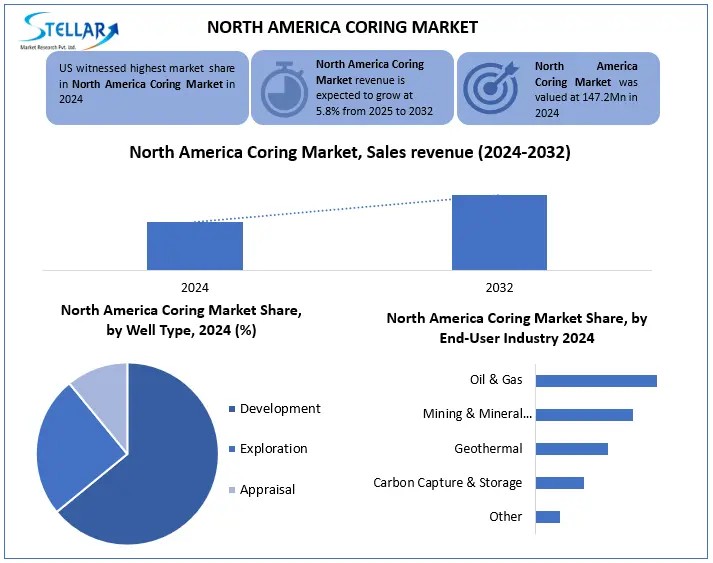

The North America Coring Market size was valued at 147.2 Mn in 2024 and the total Coring Market revenue is expected to grow at a CAGR of 5.8% from 2025 to 2032, reaching nearly USD 231.1 Mn by 2032.

Format : PDF | Report ID : SMR_2882

North America Coring Market Overview

Coring is a drilling technique used to extract cylindrical samples (called "cores") of subsurface materials, such as rock, soil, concrete, ice, or sediment. These samples provide valuable geological, engineering, and environmental data for analysis. North America Coring Market has been consistently experiencing development, inspired by progress in core drilling technologies as well as increasing construction and mining activities.

Coring industry growth is due to the development of infrastructure, while the supply remains competitive with high quality equipment and focus on efficient labour. Leading players in the Coring Market include Boart Longyear, Schlumberger and Baker Hughes, which dominate with innovative solutions and comprehensive service networks. The United States is a major country in coring market, due to its large manufacturing projects and strong mining sector. The end-user contribution is led by the construction industry, followed by oil & gas and mining, collectively increases the demand for core drilling services in the region.

To get more Insights: Request Free Sample Report

North America Coring Market Dynamics:

Offshore Wind Expansion to Boost the North America Coring Market Growth

Offshore wind development is dramatically increasing coring trends across North America, with the U.S. requiring 5,000-7,000 seabed cores per major wind project 3x more than conventional offshore oil/gas sites. Vineyard Wind alone collected 8,500+ cores for turbine foundation analysis, while BOEM's 41 new lease areas will each need 2,000-3,000 cores for geotechnical surveys. The Eastern Seaboard now sees 35% of all marine coring activity dedicated to wind farms, up from 5% in 2020. Operators are deploying vibra coring trends that process 50% more samples daily, with Fugro and Schlumberger operating 25+ specialized vessels to meet demand. This surge has made wind-related coring the fastest-growing segment of marine site investigations, supported by $3.5B in federal port infrastructure funding to accelerate projects.

Regulatory Hurdles to Restrain the North America Coring Market

North America's Coring market faces significant regulatory barriers that disrupt growth and operational efficiency. Strict environmental rules, such as the US Environmental Protection Agency (EPA) implement guidelines, compliance costs and delays on drilling waste disposal and emissions. Additionally, business safety standards set by OSA require expensive equipment upgradation, leading to an increase in project expenses by 15–20%. Cross -border trade restrictions between the US, Canada and Mexico further complicated supply chains, growing up to 12% under recent trade policies with tariffs on imported coring machinery. These regulatory challenges prevent new entry and slow down the deadline of the coring worth, limiting the market expansion.

Strategic Partnerships & Government Funding to Create Opportunity in the North America Coring Market

North America is unlocking important opportunities in the North America Coring industry by promoting strategic participation and government funding innovation and expanding project pipelines. The US Department of Energy (DOE) has allocated $ 7 billion for important mineral supply chains, with corresponds to acquire contracts for the discovery of lithium and rare earth. Additionally, the Bipartisan infrastructure law includes $ 8 billion for the clean hydrogen hub, which requires a wide sub -hinge coring for site assessment. Public-private cooperation, such as DOE's Frontier Observatory for Research in Geothermal Energy (FORGE) initiative, has attracted more than $ 220 million in investment demand for advanced coring technologies.

North America Coring Market Segment Analysis

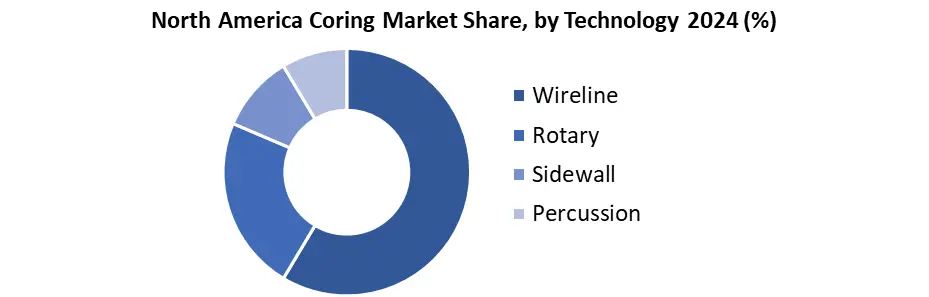

Based on Technology, the North America Coring industry is segmented into rotary, wireline, sidewall and percussion. Wireline coring technology led with highest market share due to its superior efficiency recovering 97% of samples versus rotary's 82%, while reducing rig downtime by 60%. Its adoption in 90% of offshore oil projects and ability to handle extreme depths (5000m+) cement its dominance, processing 3x more daily samples than sidewall methods.

Based on End-Use Industry, the North America Coring industry is segmented into Oil & Gas, Mining & Mineral exploration, geothermal, carbon capture & Storage, etc. The oil & gas coring sector dominated North America's coring market, accounting for over 42% of demand in 2024, driven by shale resurgence and offshore drilling. The Permian Basin alone saw 4,500+ new wells drilled in 2022 (EIA), requiring extensive coring growth for reservoir analysis. Rising crude prices and LNG export growth further sustain this dominance.

North America Coring Market Country Analysis

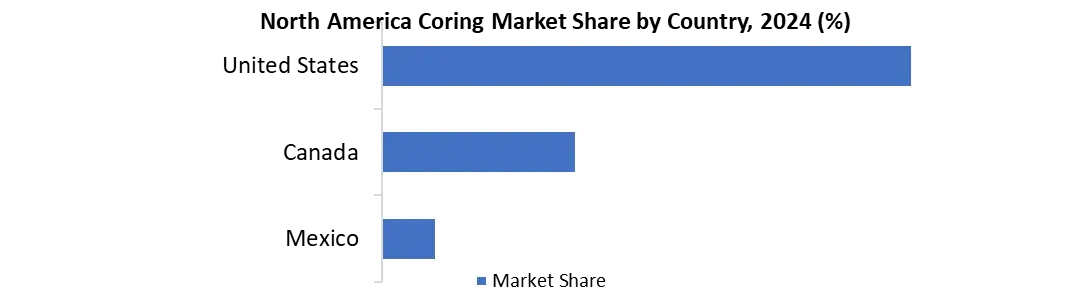

The United States commands the North American coring market through unparalleled energy activity and technological innovation. Permian Basin alone drilled over 4,500 new wells, each requiring extensive core sampling, while US geothermal drilling permits had an increase in 32% YoY in 2024 (DOE). American firms held 78% of the continent's active Coring Patent (by 2024), including 92% automatic Coring trends. Federal initiatives like the $ 7 billion Critical Minerals Program directly fund exploration Coring, and the US-based service companies completes 83% of the North American offshore Coring Projects (BSEE). This combination of intensive resource development, cutting-edge technology, and government support creates an insurmountable competitive advantage over Canada (25% market share) and Mexico (7%).

North America Coring Market Competitive Landscape

Schlumberger dominated the North American Coring market with a 22% revenue stake, operated by advanced coring technologies such as the PowerDrive Orbit rotary steerable system and the geosphere reservoir mapping. The company's Oilfield Services Segment produced $ 7.1B i.e. 28%of global revenue) in North America in 2022, supported by shell resurgence and deepwater projects. Schlumberger's R&D investment ($ 1.2b annually) ensures leadership in automatic Coring market and real-time data analytics, leading to rivals such as Baker Hughes (18% market share) and Halliburton (15%). Its strategic partnership, such as carbon storage in Coring, further strengthens its competitive position.

North America Coring Market Key Developments

Major Drilling (Canada) — “Major Drilling USA Demonstrates New Robotic Rod Handler and Drill Analytics to Senior Miners” — 05 Dec 2024. Innovation demos in Salt Lake City showcasing robotic rod handling for surface & underground operations.

Foraco International (Canada) — Q2-2024 Results Press Release — 02 Aug 2024. Company reports best quarter ever in North America, highlighting strong coring/drilling activity in the region.

North America Coring Market Scope Table

|

North America Coring Market Scope |

||

|

Market Size in 2024 |

147.2 Mn. |

|

|

Market Size in 2032 |

231.1 Mn. |

|

|

CAGR (2025-2032) |

5.8% |

|

|

Historic Data |

2019-2024 |

|

|

Base Year |

2024 |

|

|

Forecast Period |

2025-2032 |

|

|

Segments Analysis |

By Technology Rotary Wireline Sidewall Percussion |

|

|

By Well Type Exploration Appraisal Development |

||

|

By Application Onshore Offshore |

||

|

By End-Use Industry Oil & Gas Mining & Mineral Exploration Geothermal Carbon Capture & Storage Others |

|

|

Key Players in the North America Coring Market

- Boart Longyear (US)

- Schlumberger (US)

- Baker Hughes (US)

- Eijkelkamp (US)

- Haukaas Manufacturing (US)

- Major Drilling (Canada)

- Foraco International (Canada)

- Dando Drilling International (Canada)

- Perforadora México (Mexico)

- Grupo R (Mexico)

Frequently Asked Questions

The segments covered in the North America Coring Market are by technology, well type, by application and by end-user industry.

US dominated the North America Coring Market in 2024.

The Regulatory Hurdles hinders the North America Coring Market.

1. North America Coring Market: Research Methodology

2. North America Coring Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global North America Coring Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarters

3.2.3. Service Segment

3.2.4. Application Segment

3.2.5. Revenue (2024)

3.2.6. Geographical Presence

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. North America Coring Market: Dynamics

4.1. North America Coring Market Trends

4.2. North America Coring Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Regulatory Landscape by Region

4.6. Key Opinion Leader Analysis for the Global Industry

4.7. Analysis of Government Schemes and Initiatives for Industry

5. North America Coring Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032)

5.1. North America Coring Market Size and Forecast, By Well Type (2024-2032)

5.1.1. Exploration

5.1.2. Appraisal

5.1.3. Development

5.2. North America Coring Market Size and Forecast, By Technology (2024-2032)

5.2.1. Rotary

5.2.2. Wireline

5.2.3. Sidewall

5.2.4. Percussion

5.3. North America Coring Market Size and Forecast, By Application (2024-2032)

5.3.1. Onshore

5.3.2. Offshore

5.4. North America Coring Market Size and Forecast, By End-User (2024-2032)

5.4.1. Oil & Gas

5.4.2. Mining & Mineral Exploration

5.4.3. Geothermal

5.4.4. Carbon Capture & Storage

5.4.5. Others

5.5. North America Coring Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Coring Market Size and Forecast, By Well Type (2024-2032)

5.5.1.1.1. Exploration

5.5.1.1.2. Appraisal

5.5.1.1.3. Development

5.5.1.2. United States Coring Market Size and Forecast, By Technology (2024-2032)

5.5.1.2.1. Rotary

5.5.1.2.2. Wireline

5.5.1.2.3. Sidewall

5.5.1.2.4. Percussion

5.5.1.3. United States Coring Market Size and Forecast, By Application (2024-2032)

5.5.1.3.1. Onshore

5.5.1.3.2. Offshore

5.5.1.4. United States Coring Market Size and Forecast, By End-User (2024-2032)

5.5.1.4.1. Oil & Gas

5.5.1.4.2. Mining & Mineral Exploration

5.5.1.4.3. Geothermal

5.5.1.4.4. Carbon Capture & Storage

5.5.1.4.5. Others

5.5.2. Canada

5.5.2.1. Canada Coring Market Size and Forecast, By Well Type (2024-2032)

5.5.2.1.1. Exploration

5.5.2.1.2. Appraisal

5.5.2.1.3. Development

5.5.2.2. Canada Coring Market Size and Forecast, By Technology (2024-2032)

5.5.2.2.1. Rotary

5.5.2.2.2. Wireline

5.5.2.2.3. Sidewall

5.5.2.2.4. Percussion

5.5.2.3. Canada Coring Market Size and Forecast, By Application (2024-2032)

5.5.2.3.1. Onshore

5.5.2.3.2. Offshore

5.5.2.4. Canada Coring Market Size and Forecast, By End-User (2024-2032)

5.5.2.4.1. Oil & Gas

5.5.2.4.2. Mining & Mineral Exploration

5.5.2.4.3. Geothermal

5.5.2.4.4. Carbon Capture & Storage

5.5.2.4.5. Others

5.5.3. Mexico

5.5.3.1. Mexico Coring Market Size and Forecast, By Well Type (2024-2032)

5.5.3.1.1. Exploration

5.5.3.1.2. Appraisal

5.5.3.1.3. Development

5.5.3.2. Mexico Coring Market Size and Forecast, By Technology (2024-2032)

5.5.3.2.1. Rotary

5.5.3.2.2. Wireline

5.5.3.2.3. Sidewall

5.5.3.2.4. Percussion

5.5.3.3. Mexico Coring Market Size and Forecast, By Application (2024-2032)

5.5.3.3.1. Onshore

5.5.3.3.2. Offshore

5.5.3.4. Mexico Coring Market Size and Forecast, By End-User (2024-2032)

5.5.3.4.1. Oil & Gas

5.5.3.4.2. Mining & Mineral Exploration

5.5.3.4.3. Geothermal

5.5.3.4.4. Carbon Capture & Storage

5.5.3.4.5. Others

6. Company Profile: Key Players

6.1. Boart Longyear

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Schlumberger

6.3. Baker Hughes

6.4. Eijkelkamp

6.5. Haukaas Manufacturing

6.6. Major Drilling

6.7. Foraco International

6.8. Dando Drilling International

6.9. Perforadora México

6.10. Grupo R

7. Key Findings

8. Industry Recommendations