Global Coring Market Analysis 2025-2032: Growth Trends, Key Players, and Future Opportunities

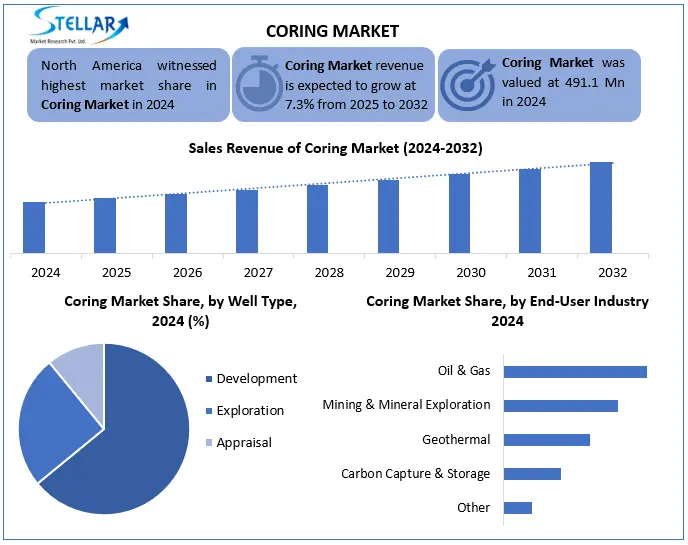

The Coring Market size was valued at 491.1 Mn in 2024 and the total Coring Market revenue is expected to grow at a CAGR of 7.3% from 2025 to 2032, reaching nearly USD 862.91 Mn by 2032.

Format : PDF | Report ID : SMR_2857

Coring Market Overview

Coring is a drilling technique used to extract cylindrical samples of subsurface materials, such as rock, soil, concrete, ice, or sediment. These samples provide valuable geological, engineering, and environmental data for analysis. Increased mineral exploration and energy demands are expanding the global Coring market, which enhances the efficiency of advanced techniques such as AI-operated coring rigs.

The supply struggles to meet the increasing demand, especially for the lithium and hydrocarbon core, an increase in 20% for accurate coring services in 2024. North America led with 30% of global activity, inspired by shell oil and technical adoption. Boart Longyear and Schlumberger dominate, holding 40% combined market share through automated coring innovations. Oil/gas coring technology accounts for 55% of demand, while mining contributes 30%, fuelled by EV battery minerals.

To get more Insights: Request Free Sample Report

Coring Market Dynamics

Surging Demand in Mining, Oil & Gas Exploration to Boost the Coring Market

The global Coring market growth is experiencing significant surge motivated by mining and increasing demand from oil and gas exploration areas, requiring 40% more main samples than five years ago to meet important mineral demands for clean energy technologies with mineral exploration. Increasing coring market mineral demand is running record, requiring 3x more core samples than 2020 with lithium exploration. Oil and gas operators now analyse 40% more reservoir core annually to customize fracking, while copper explorers drill 25% deep core to meet the needs of electrification. Automatic Coring Rigs productivity increased by 35%, making them necessary for tight-margin projects. The increase of this demand has increased the Coring service contracts by 50% since 2021.

Skilled Labor Shortage to Restrain the Coring Market Growth

According to the International Association of Drilling Contractors (IADC), serious shortage of efficient labour, with 40% deficit in certified drill operators and geologists, stop the Coring market considerably. This reduction leads to a 15–20% project delay and 25% high labour costs, as experienced workers demand premium wages. Complex diamond-coring and wireline operation require special training, yet 60% of the workforce is close to retirement, with only 1 new entry for each 3 retired people. The lack of training programs enhances the gap, causing companies to decline in 30% of potential contracts due to lack of manpower, limiting the market growth directly despite increasing demand.

AI-Powered Predictive Coring to Create Opportunity in the Coring Market

The AI-powered predictive coring trend is bringing revolution in the market by cutting up to 40% exploration waste through machine learning analysis of historical core samples. Algorithms now predict optimal drill sites with 92% accuracy, saving miners in unnecessary drilling $ 700m annually. This technique reduces the project deadline by 30%, increasing the mineral search rates, making it indispensable to lithium/copper explorers facing tight margin. According to Globaldata, adoption at 58% YoY is increasing, constructing $ 1.2B AI-coring area by 2026.

Coring Market Segment Analysis

Based on Technology, the Coring industry is segmented into rotary, wireline, sidewall and percussion. Wireline coring market led with highest market share due to its superior efficiency recovering 97% of samples versus rotary's 82%, while reducing rig downtime by 60%. Its adoption in 90% of offshore oil projects and ability to handle extreme depths (5000m+) cement its dominance, processing 3x more daily samples than sidewall methods.

Based on Well Type, the Coring industry is segmented into exploration, appraisal and development. Development wells dominated coring activity, representing 55% of total cores extracted, as they require intensive sampling for reservoir management and enhanced recovery. Operators collect 12-18 cores per well for precise porosity/permeability analysis with advanced LWD-coring systems achieving 96% data accuracy (SPE), making it critical for production optimization.

Based on Application, the Coring industry is segmented into onshore and offshore. Onshore coring dominated the market, accounting for highest segment of total coring operations, primarily due to its lower operational costs (60-70% cheaper than offshore) and higher accessibility. The demand for the mining sector benefits this section, where lithium and copper projects require 50–80 core per site for resource assessment, while 10–15 core per offshore well. Additionally, onshore projects have rapid deployment time and low regulatory barriers, making them more attractive to exploration and development.

Coring Market Regional Analysis

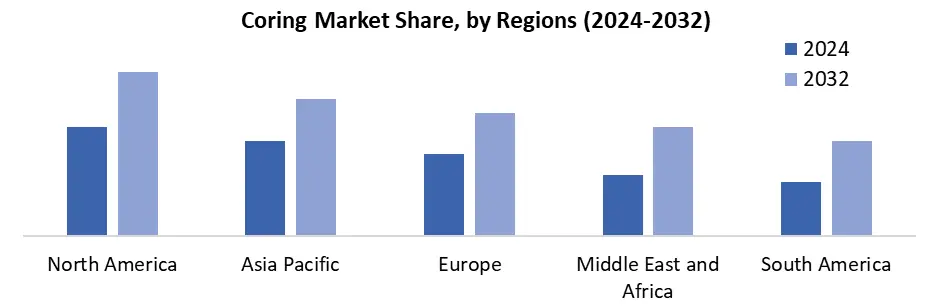

North America dominated the Coring Market in 2024 and is expected to dominate during the forecast period (2025-2032)

North America dominated the coring market in 2024, due to its technological edge and resource intensity. The region conducts 35% of global hydrocarbon coring analysis, with shale plays requiring 20+ cores per well (vs. 5-10 internationally) to optimize fracking. The U.S. and Canada also lead in automated coring, deploying 50% of the world's AI-driven rigs, while mining projects in Nevada and Quebec process 40% more cores daily than EU counterparts. Strict ESG standards further drive demand for high-precision cores, with 90% sample accuracy mandates (EPA) versus 70% in emerging markets.

Coring Market Competitive Landscape

In 2025, Boart Longyear solidifies its market leadership with breakthrough innovations and expanded capabilities. The company's AutoCore X9 system achieves 40% faster core drilling speeds while maintaining 99% sample integrity, capturing 30% of the global mineral coring market. Strategic partnerships with major lithium producers secure 50+ new contracts, and their AI-powered core analysis platform reduces interpretation time by 60%. Expansion into Arctic-ready rigs opens untapped markets, while zero-emission electric coring systems position Boart as the sustainability leader. With 20% YOY revenue growth, they outpace competitors in mining-sector technology adoption.

Coring Market Key Developments

- Boart Longyear-Launched "AutoCore X9" AI-driven coring rig (March 2024) reducing sample contamination by 40% in hard rock mining.

- Schlumberger-Introduced "CoreVault 2.0" (May 2024) with real-time fluid analysis during offshore wireline coring.

- Eijkelkamp-Developed "SonicSlim" (July 2024), a portable sonic coring system for contaminated site investigations.

- Geoprobe Systems®-Released "DirectCore 3240" (September 2024) enabling 30m continuous sampling in geotechnical projects.

- Foremost Industries-Unveiled "ArcticCore" (January 2025), a -50°C rated rig for permafrost mineral exploration.

|

Coring Market Scope |

||

|

Market Size in 2024 |

491.1 Mn. |

|

|

Market Size in 2032 |

862.91 Mn. |

|

|

CAGR (2025-2032) |

7.3% |

|

|

Historic Data |

2019-2024 |

|

|

Base Year |

2024 |

|

|

Forecast Period |

2025-2032 |

|

|

Segments Analysis |

By Technology Rotary Wireline Sidewall Percussion |

|

|

By Well Type Exploration Appraisal Development |

||

|

By Application Onshore Offshore |

||

|

By End-Use Industry Oil & Gas Mining & Mineral Exploration Geothermal Carbon Capture & Storage Others |

|

|

|

Regional Scope |

North America: United States, Canada, Mexico Europe: United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe Asia Pacific (APAC): China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC Middle East & Africa (MEA): South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA South America: Brazil, Argentina, Colombia, Chile, Peru, Rest of South America |

|

Key Players in the Coring Market

North America

- Boart Longyear (USA)

- Schlumberger – Well Services Division (USA)

- Eijkelkamp (USA)

- Geoprobe Systems® (USA)

- Foremost Industries (Canada)

- Perforadora México (Mexico)

Europe

- Sandvik Mining and Rock Solutions (Sweden)

- Atlas Copco (Sweden)

- Fraste S.p.A. (Italy)

- Bauer Maschinen GmbH (Germany)

- Rosgeologia (Russia)

Asia Pacific

- SANY Heavy Industry (China)

- Komatsu Mining Corp. (Japan)

- Imdex Limited (Australia)

- Tata Hitachi Construction Machinery (India)

- Hyundai Construction Equipment (South Korea)

- Schlumberger Asia Services (Malaysia)

Middle East and Africa

- Saudi Drill Manufacturing Co. (GCC)

- Elsewedy Electric (Egypt)

- Dando Drilling International (Turkey)

- Geodrill (Nigeria)

South America

- Sondotecnica (Brazil)

- Geotec Boyles Bros. (Chile)

- Imdex Latam (Peru)

- Tecno Drilling (Argentina)

Frequently Asked Questions

The expected CAGR of Coring Market is 7.3%.

The segments of Coring Market are by well type, by technology, by application and by end-use.

The application segments of Coring Market are onshore and offshore coring.

The major key players of Coring Market are Boart Longyear, Schlumberger –Well Services Division, Eijkelkamp, Geoprobe Systems® and Foremost Industries.

1. Coring Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Coring Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarters

2.2.3. Service Segment

2.2.4. End-User Segment

2.2.5. Revenue (2024)

2.2.6. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Coring Market: Dynamics

3.1. Coring Market Trends

3.2. Coring Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Coring Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032)

4.1. Coring Market Size and Forecast, By Well Type (2024-2032)

4.1.1. Exploration

4.1.2. Appraisal

4.1.3. Development

4.2. Coring Market Size and Forecast, By Technology (2024-2032)

4.2.1. Rotary

4.2.2. Wireline

4.2.3. Sidewall

4.2.4. Percussion

4.3. Coring Market Size and Forecast, By Application (2024-2032)

4.3.1. Onshore

4.3.2. Offshore

4.4. Coring Market Size and Forecast, By End-User (2024-2032)

4.4.1. Oil & Gas

4.4.2. Mining & Mineral Exploration

4.4.3. Geothermal

4.4.4. Carbon Capture & Storage

4.4.5. Others

4.5. Coring Market Size and Forecast, By Region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Coring Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032)

5.1. North America Coring Market Size and Forecast, By Well Type (2024-2032)

5.1.1. Exploration

5.1.2. Appraisal

5.1.3. Development

5.2. North America Coring Market Size and Forecast, By Technology (2024-2032)

5.2.1. Rotary

5.2.2. Wireline

5.2.3. Sidewall

5.2.4. Percussion

5.3. North America Coring Market Size and Forecast, By Application (2024-2032)

5.3.1. Onshore

5.3.2. Offshore

5.4. North America Coring Market Size and Forecast, By End-User (2024-2032)

5.4.1. Oil & Gas

5.4.2. Mining & Mineral Exploration

5.4.3. Geothermal

5.4.4. Carbon Capture & Storage

5.4.5. Others

5.5. North America Coring Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Coring Market Size and Forecast, By Well Type (2024-2032)

5.5.1.1.1. Exploration

5.5.1.1.2. Appraisal

5.5.1.1.3. Development

5.5.1.2. United States Coring Market Size and Forecast, By Technology (2024-2032)

5.5.1.2.1. Rotary

5.5.1.2.2. Wireline

5.5.1.2.3. Sidewall

5.5.1.2.4. Percussion

5.5.1.3. United States Coring Market Size and Forecast, By Application (2024-2032)

5.5.1.3.1. Onshore

5.5.1.3.2. Offshore

5.5.1.4. United States Coring Market Size and Forecast, By End-User (2024-2032)

5.5.1.4.1. Oil & Gas

5.5.1.4.2. Mining & Mineral Exploration

5.5.1.4.3. Geothermal

5.5.1.4.4. Carbon Capture & Storage

5.5.1.4.5. Others

5.5.2. Canada

5.5.2.1. Canada Coring Market Size and Forecast, By Well Type (2024-2032)

5.5.2.1.1. Exploration

5.5.2.1.2. Appraisal

5.5.2.1.3. Development

5.5.2.2. Canada Coring Market Size and Forecast, By Technology (2024-2032)

5.5.2.2.1. Rotary

5.5.2.2.2. Wireline

5.5.2.2.3. Sidewall

5.5.2.2.4. Percussion

5.5.2.3. Canada Coring Market Size and Forecast, By Application (2024-2032)

5.5.2.3.1. Onshore

5.5.2.3.2. Offshore

5.5.2.4. Canada Coring Market Size and Forecast, By End-User (2024-2032)

5.5.2.4.1. Oil & Gas

5.5.2.4.2. Mining & Mineral Exploration

5.5.2.4.3. Geothermal

5.5.2.4.4. Carbon Capture & Storage

5.5.2.4.5. Others

5.5.3. Mexico

5.5.3.1. Mexico Coring Market Size and Forecast, By Well Type (2024-2032)

5.5.3.1.1. Exploration

5.5.3.1.2. Appraisal

5.5.3.1.3. Development

5.5.3.2. Mexico Coring Market Size and Forecast, By Technology (2024-2032)

5.5.3.2.1. Rotary

5.5.3.2.2. Wireline

5.5.3.2.3. Sidewall

5.5.3.2.4. Percussion

5.5.3.3. Mexico Coring Market Size and Forecast, By Application (2024-2032)

5.5.3.3.1. Onshore

5.5.3.3.2. Offshore

5.5.3.4. Mexico Coring Market Size and Forecast, By End-User (2024-2032)

5.5.3.4.1. Oil & Gas

5.5.3.4.2. Mining & Mineral Exploration

5.5.3.4.3. Geothermal

5.5.3.4.4. Carbon Capture & Storage

5.5.3.4.5. Others

6. Europe Coring Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032)

6.1. Europe Coring Market Size and Forecast, By Well Type (2024-2032)

6.2. Europe Coring Market Size and Forecast, By Technology (2024-2032)

6.3. Europe Coring Market Size and Forecast, By Application (2024-2032)

6.4. Europe Coring Market Size and Forecast, By End-User (2024-2032)

6.5. Europe Coring Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Coring Market Size and Forecast, By Well Type (2024-2032)

6.5.1.2. United Kingdom Coring Market Size and Forecast, By Technology (2024-2032)

6.5.1.3. United Kingdom Coring Market Size and Forecast, By Application (2024-2032)

6.5.1.4. United Kingdom Coring Market Size and Forecast, By End-User (2024-2032)

6.5.2. France

6.5.2.1. France Coring Market Size and Forecast, By Well Type (2024-2032)

6.5.2.2. France Coring Market Size and Forecast, By Technology (2024-2032)

6.5.2.3. France Coring Market Size and Forecast, By Application (2024-2032)

6.5.2.4. France Coring Market Size and Forecast, By End-User (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Coring Market Size and Forecast, By Well Type (2024-2032)

6.5.3.2. Germany Coring Market Size and Forecast, By Technology (2024-2032)

6.5.3.3. Germany Coring Market Size and Forecast, By Application (2024-2032)

6.5.3.4. Germany Coring Market Size and Forecast, By End-User (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Coring Market Size and Forecast, By Well Type (2024-2032)

6.5.4.2. Italy Coring Market Size and Forecast, By Technology (2024-2032)

6.5.4.3. Italy Coring Market Size and Forecast, By Application (2024-2032)

6.5.4.4. Italy Coring Market Size and Forecast, By End-User (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Coring Market Size and Forecast, By Well Type (2024-2032)

6.5.5.2. Spain Coring Market Size and Forecast, By Technology (2024-2032)

6.5.5.3. Spain Coring Market Size and Forecast, By Application (2024-2032)

6.5.5.4. Spain Coring Market Size and Forecast, By End-User (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Coring Market Size and Forecast, By Well Type (2024-2032)

6.5.6.2. Sweden Coring Market Size and Forecast, By Technology (2024-2032)

6.5.6.3. Sweden Coring Market Size and Forecast, By Application (2024-2032)

6.5.6.4. Sweden Coring Market Size and Forecast, By End-User (2024-2032)

6.5.7. Russia

6.5.7.1. Russia Coring Market Size and Forecast, By Well Type (2024-2032)

6.5.7.2. Russia Coring Market Size and Forecast, By Technology (2024-2032)

6.5.7.3. Russia Coring Market Size and Forecast, By Application (2024-2032)

6.5.7.4. Russia Coring Market Size and Forecast, By End-User (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Coring Market Size and Forecast, By Well Type (2024-2032)

6.5.8.2. Rest of Europe Coring Market Size and Forecast, By Technology (2024-2032)

6.5.8.3. Rest of Europe Coring Market Size and Forecast, By Application (2024-2032)

6.5.8.4. Rest of Europe Coring Market Size and Forecast, By End-User (2024-2032)

7. Asia Pacific Coring Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032)

7.1. Asia Pacific Coring Market Size and Forecast, By Well Type (2024-2032)

7.2. Asia Pacific Coring Market Size and Forecast, By Technology (2024-2032)

7.3. Asia Pacific Coring Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific Coring Market Size and Forecast, By End-User (2024-2032)

7.5. Asia Pacific Coring Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.1.2. China Coring Market Size and Forecast, By Technology (2024-2032)

7.5.1.3. China Coring Market Size and Forecast, By Application (2024-2032)

7.5.1.4. China Coring Market Size and Forecast, By End-User (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.2.2. S Korea Coring Market Size and Forecast, By Technology (2024-2032)

7.5.2.3. S Korea Coring Market Size and Forecast, By Application (2024-2032)

7.5.2.4. S Korea Coring Market Size and Forecast, By End-User (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.3.2. Japan Coring Market Size and Forecast, By Technology (2024-2032)

7.5.3.3. Japan Coring Market Size and Forecast, By Application (2024-2032)

7.5.3.4. Japan Coring Market Size and Forecast, By End-User (2024-2032)

7.5.4. India

7.5.4.1. India Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.4.2. India Coring Market Size and Forecast, By Technology (2024-2032)

7.5.4.3. India Coring Market Size and Forecast, By Application (2024-2032)

7.5.4.4. India Coring Market Size and Forecast, By End-User (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.5.2. Australia Coring Market Size and Forecast, By Technology (2024-2032)

7.5.5.3. Australia Coring Market Size and Forecast, By Application (2024-2032)

7.5.5.4. Australia Coring Market Size and Forecast, By End-User (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.6.2. Indonesia Coring Market Size and Forecast, By Technology (2024-2032)

7.5.6.3. Indonesia Coring Market Size and Forecast, By Application (2024-2032)

7.5.6.4. Indonesia Coring Market Size and Forecast, By End-User (2024-2032)

7.5.7. Malaysia

7.5.7.1. Malaysia Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.7.2. Malaysia Coring Market Size and Forecast, By Technology (2024-2032)

7.5.7.3. Malaysia Coring Market Size and Forecast, By Application (2024-2032)

7.5.7.4. Malaysia Coring Market Size and Forecast, By End-User (2024-2032)

7.5.8. Philippines

7.5.8.1. Philippines Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.8.2. Philippines Coring Market Size and Forecast, By Technology (2024-2032)

7.5.8.3. Philippines Coring Market Size and Forecast, By Application (2024-2032)

7.5.8.4. Philippines Coring Market Size and Forecast, By End-User (2024-2032)

7.5.9. Thailand

7.5.9.1. Thailand Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.9.2. Thailand Coring Market Size and Forecast, By Technology (2024-2032)

7.5.9.3. Thailand Coring Market Size and Forecast, By Application (2024-2032)

7.5.9.4. Thailand Coring Market Size and Forecast, By End-User (2024-2032)

7.5.10. Vietnam

7.5.10.1. Vietnam Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.10.2. Vietnam Coring Market Size and Forecast, By Technology (2024-2032)

7.5.10.3. Vietnam Coring Market Size and Forecast, By Application (2024-2032)

7.5.10.4. Vietnam Coring Market Size and Forecast, By End-User (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Coring Market Size and Forecast, By Well Type (2024-2032)

7.5.11.2. Rest of Asia Pacific Coring Market Size and Forecast, By Technology (2024-2032)

7.5.11.3. Rest of Asia Pacific Coring Market Size and Forecast, By Application (2024-2032)

7.5.11.4. Rest of Asia Pacific Coring Market Size and Forecast, By End-User (2024-2032)

8. Middle East and Africa Coring Market Size and Forecast (by Value in USD Mn) (2024-2032)

8.1. Middle East and Africa Coring Market Size and Forecast, By Well Type (2024-2032)

8.2. Middle East and Africa Coring Market Size and Forecast, By Technology (2024-2032)

8.3. Middle East and Africa Coring Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa Coring Market Size and Forecast, By End-User (2024-2032)

8.5. Middle East and Africa Coring Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Coring Market Size and Forecast, By Well Type (2024-2032)

8.5.1.2. South Africa Coring Market Size and Forecast, By Technology (2024-2032)

8.5.1.3. South Africa Coring Market Size and Forecast, By Application (2024-2032)

8.5.1.4. South Africa Coring Market Size and Forecast, By End-User (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Coring Market Size and Forecast, By Well Type (2024-2032)

8.5.2.2. GCC Coring Market Size and Forecast, By Technology (2024-2032)

8.5.2.3. GCC Coring Market Size and Forecast, By Application (2024-2032)

8.5.2.4. GCC Coring Market Size and Forecast, By End-User (2024-2032)

8.5.3. Egypt

8.5.3.1. Egypt Coring Market Size and Forecast, By Well Type (2024-2032)

8.5.3.2. Egypt Coring Market Size and Forecast, By Technology (2024-2032)

8.5.3.3. Egypt Coring Market Size and Forecast, By Application (2024-2032)

8.5.3.4. Egypt Coring Market Size and Forecast, By End-User (2024-2032)

8.5.4. Nigeria

8.5.4.1. Nigeria Coring Market Size and Forecast, By Well Type (2024-2032)

8.5.4.2. Nigeria Coring Market Size and Forecast, By Technology (2024-2032)

8.5.4.3. Nigeria Coring Market Size and Forecast, By Application (2024-2032)

8.5.4.4. Nigeria Coring Market Size and Forecast, By End-User (2024-2032)

8.5.5. Rest of ME&A

8.5.5.1. Rest of ME&A Coring Market Size and Forecast, By Well Type (2024-2032)

8.5.5.2. Rest of ME&A Coring Market Size and Forecast, By Technology (2024-2032)

8.5.5.3. Rest of ME&A Coring Market Size and Forecast, By Application (2024-2032)

8.5.5.4. Rest of ME&A Coring Market Size and Forecast, By End-User (2024-2032)

9. South America Coring Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032)

9.1. South America Coring Market Size and Forecast, By Well Type (2024-2032)

9.2. South America Coring Market Size and Forecast, By Technology (2024-2032)

9.3. South America Coring Market Size and Forecast, By Application (2024-2032)

9.4. South America Coring Market Size and Forecast, By End-User (2024-2032)

9.5. South America Coring Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Coring Market Size and Forecast, By Well Type (2024-2032)

9.5.1.2. Brazil Coring Market Size and Forecast, By Technology (2024-2032)

9.5.1.3. Brazil Coring Market Size and Forecast, By Application (2024-2032)

9.5.1.4. Brazil Coring Market Size and Forecast, By End-User (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Coring Market Size and Forecast, By Well Type (2024-2032)

9.5.2.2. Argentina Coring Market Size and Forecast, By Technology (2024-2032)

9.5.2.3. Argentina Coring Market Size and Forecast, By Application (2024-2032)

9.5.2.4. Argentina Coring Market Size and Forecast, By End-User (2024-2032)

9.5.3. Colombia

9.5.3.1. Colombia Coring Market Size and Forecast, By Well Type (2024-2032)

9.5.3.2. Colombia Coring Market Size and Forecast, By Technology (2024-2032)

9.5.3.3. Colombia Coring Market Size and Forecast, By Application (2024-2032)

9.5.3.4. Colombia Coring Market Size and Forecast, By End-User (2024-2032)

9.5.4. Chile

9.5.4.1. Chile Coring Market Size and Forecast, By Well Type (2024-2032)

9.5.4.2. Chile Coring Market Size and Forecast, By Technology (2024-2032)

9.5.4.3. Chile Coring Market Size and Forecast, By Application (2024-2032)

9.5.4.4. Chile Coring Market Size and Forecast, By End-User (2024-2032)

9.5.5. Rest Of South America

9.5.5.1. Rest Of South America Coring Market Size and Forecast, By Well Type (2024-2032)

9.5.5.2. Rest Of South America Coring Market Size and Forecast, By Technology (2024-2032)

9.5.5.3. Rest Of South America Coring Market Size and Forecast, By Application (2024-2032)

9.5.5.4. Rest Of South America Coring Market Size and Forecast, By End-User (2024-2032)

10. Company Profile: Key Players

10.1. Boart Longyear

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Schlumberger – Well Services Division

10.3. Eijkelkamp

10.4. Geoprobe Systems®

10.5. Foremost Industries

10.6. Perforadora México

10.7. Sandvik Mining and Rock Solutions

10.8. Atlas Copco

10.9. Fraste S.p.A.

10.10. Bauer Maschinen GmbH

10.11. Rosgeologia

10.12. SANY Heavy Industry

10.13. Komatsu Mining Corp.

10.14. Imdex Limited

10.15. Tata Hitachi Construction Machinery

10.16. Hyundai Construction Equipment

10.17. Schlumberger Asia Services

10.18. Saudi Drill Manufacturing Co.

10.19. Elsewedy Electric

10.20. Dando Drilling International

10.21. Geodrill

10.22. Sondotecnica

10.23. Geotec Boyles Bros.

10.24. Imdex Latam

10.25. Tecno Drilling

11. Key Findings

12. Industry Recommendations

13. Coring Market: Research Methodology