North America Vapor Recovery Unit Market: Trends, Growth Analysis

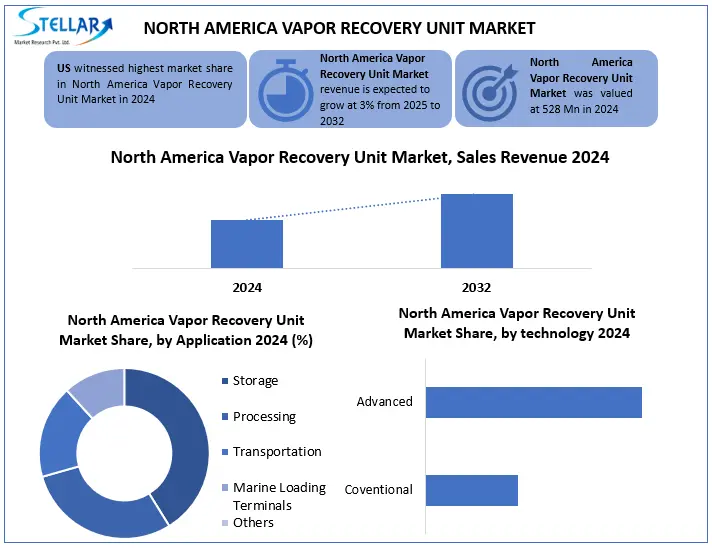

The North America Vapor Recovery Unit Market size was valued at USD 528 Mn in 2024 and the total North America Vapor Recovery Unit Market revenue is expected to grow at a CAGR of 3% from 2025 to 2032, reaching nearly USD 668.85 Mn by 2032.

Format : PDF | Report ID : SMR_2883

North America Vapor Recovery Unit Market

A Vapor Recovery Unit (VRU) is an environmental control system that captures and processes volatile organic compounds (VOCs) and hydrocarbon vapours emitted during industrial operations such as oil & gas production, fuel storage, refining, and chemical processing to prevent atmospheric pollution and recover valuable gases for reuse.

The North America Vapor Recovery Unit Market has been witnessing strong demand powered by strict EPA rules, in which the supply chain stability ensures 90%+ equipment availability. The U.S. dominates, led by Texas and California’s oil/gas and fuelling sectors. Prominent players include John Zink Hamworthy, Hy-Bon/EDI, and Cimarron Energy. The top end-user are oil refineries (45% demand) and gas stations (30%), followed by chemical plant and LNG terminals.

To get more Insights: Request Free Sample Report

North America Vapor Recovery Unit Market Dynamics

Rising Demand for Fuel Station Vapor Recovery to Boost the North America Vapor Recovery Unit Market

The North America Vapor Recovery Unit is observing the growth due to the increasing demand for fuel recovery station, which is powered by stringent EPA rules such as the Clean Air Act. And more than 500,000 gasoline stations in Canada require Stage II vapor recovery system with major adoption in California, Texas and New York. Increasing fuel retail infrastructure and emission norms in the North America Vapor Recovery Unit market benefits, which ensures continuous demand.

Maintenance & Technical Complexity to Restrain the North America Vapor Recovery Unit Market

Maintenance & technical complexity poses a key challenge for the North America vapor recovery unit market, with over 30% of operators citing high service costs as a barrier. Vapor Recovery Unit require quarterly inspections and specialized technicians, with 15-20% of systems experiencing downtime annually due to component failures. These operational hurdles limit adoption in the North America vapor recovery unit market, particularly among small-scale fuel stations.

LNG Bunkering & Marine Fuelling Stations to Present Opportunity in the North America Vapor Recovery Unit Market

LNG Bunkering and Marine Fuelling stations are creating strong opportunities in the North America Vapor Recovery Unit Market, with 32 active LNG bunkering projects run by U.S. and Canadians till 2024. EPA's clean ports initiatives adopt evaporative terminals on 85% new LNG terminals under vapor control. This maritime change is located in the North America Vapor Recovery Unit Market, especially in the hub, such as Houston and Vancouver for an increase of 40% in marine applications by 2027 creating opportunities.

North America Vapor Recovery Unit Market Segment Analysis

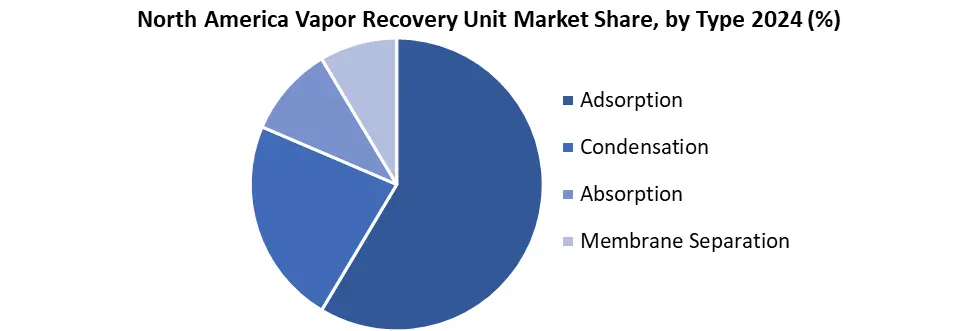

Based on Type, the North America Vapor Recovery Unit Market is segmented into adsorption, absorption, condensation and membrane separation. Adsorption-based vapor recovery units dominated the North America Vapor Recovery Unit market in 2024, occupying more than 40% stake in their cost-efficiency and high efficiency in processing of volatile organic compounds. Widely adopted in gas stations and oil terminals, these systems use active carbon beds, offering better reliability and compliance with stringent EPA emission standards.

Based on End-Use Industry, the North America Vapor Recovery Unit Market is segmented into Oil & Gas, Chemicals & Petrochemicals, Pharmaceuticals, Food & Beverage, etc. The oil and gas sector dominated the North America Vapor Recovery Unit Market, accounting for over 60% of demand. This leadership stems from stringent EPA rules on hydrocarbon emissions in upstream production, midstream pipelines, and downstream refineries, requiring phase I/II vapor collection system in collaboration with the area's broad fuel station network.

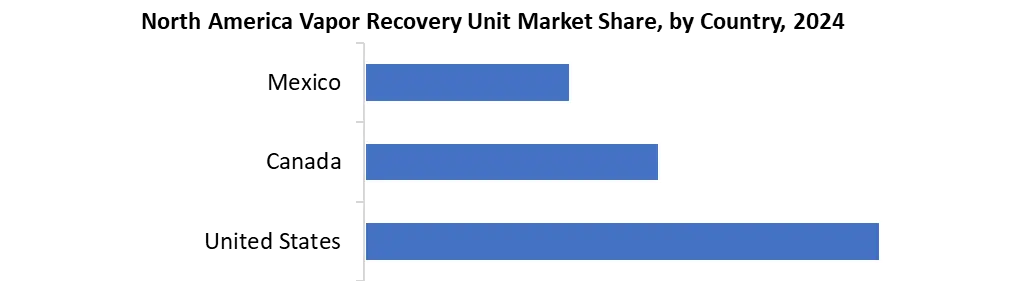

North America Vapor Recovery Unit Market Country Analysis

US dominated the North America Vapor Recovery Unit Market in 2024 and is expected to dominate during forecast period (2025-2032)

The U.S. dominated the North America Vapor Recovery Unit Market due to over 5,000 petroleum facilities operating under strict EPA regulations, including 1,300+ refineries and storage terminals requiring Vapor Recovery Unit compliance. California's CARB mandates alone cover 35,000+ gas stations, while Texas's Permian Basin has 2,400+ active drill sites needing emission controls. The country accounts for 78% of Vapor Recovery Unit patents filed in North America and hosts 90% of regional Vapor Recovery Unit manufacturers, supported by $3.2 billion annual R&D in clean air technologies.

North America Vapor Recovery Unit Market Competitive Landscape

John Zink Hamworthy Combustion (Baker Hughes) dominated the competitive landscape of the North America Vapor Recovery Unit market through technological leadership and regulatory expertise. The Tulsa-based firm holds 28% of the U.S. market share, with its patented KnitMesh™ vapor recovery technology deployed across 1,200+ oil/gas facilities. As a primary EPA-compliant supplier, it serves 90% of major refiners like Chevron and ExxonMobil, while its modular Vapor Recovery Unit systems lead in shale operations. The company invests $50M annually in R&D, focusing on carbon-neutral vapor recovery, and maintains a 92% customer retention rate through integrated IoT monitoring solutions.

Key developments in the North America Vapor Recovery Unit Market

- John Zink Hamworthy Combustion- June 2024: Launched AI-powered Vapor Recovery unit predictive maintenance software, reducing downtime by 30% for refinery clients. Partnered with Chevron for a zero-emission vapor recovery pilot in California.

- Hy-Bon/EDI- March 2024: Unveiled high-capacity Vapor Recovery units for Permian Basin shale ops, boosting efficiency by 25%. Won a $15M contract with Pioneer Natural Resources.

- Cimarron Energy- May 2024: Released next-gen Stage II Vapor recovery units with 40% lower energy use. Expanded EPA-certified units to 200+ new gas stations.

- AEREON-February 2025: Developed cryogenic Vapor Recovery Unit for LNG bunkering, adopted by Port of Houston. Secured CARB approval for low-VOC models.

- Polaris Energy Services-January 2025: Deployed modular, trailer-mounted Vapor Recovery Unit for remote well sites. Signed a multi-year deal with ConocoPhillips in the Eagle Ford shale.

North America Vapor Recovery Unit Market Scope Table

|

North America Vapor Recovery Unit Market Scope |

||

|

Market Size in 2024 |

528 Mn. |

|

|

Market Size in 2032 |

668.85 Mn. |

|

|

CAGR (2025-2032) |

3% |

|

|

Historic Data |

2019-2024 |

|

|

Base Year |

2024 |

|

|

Forecast Period |

2025-2032 |

|

|

Segments Analysis |

By Type Adsorption Absorption Condensation Membrane Separation |

|

|

By Technology Conventional Advanced |

||

|

By Application Processing Storage Transportation Marine Loading Terminals Others |

||

|

By End-Use Industry Oil & Gas Chemicals & Petrochemicals Pharmaceuticals Food & Beverage Others |

||

North America Vapor Recovery Unit Market Key Players

- John Zink Hamworthy Combustion (US)

- Hy-Bon/EDI (US)

- Cimarron Energy (US)

- AEREON (US)

- Polaris Energy Services (US)

- Cool Sorption (Canada)

- ClearPower Systems (Canada)

- Progin Mexicana (Mexico)

- Tecam Group México (Mexico)

- Sistemas de Control Ambiental (SCA) Mexico

Frequently Asked Questions

The key Competitors in the North America Vapor Recovery Units Market are John Zink Hamworthy Combustion, Hy-Bon/EDI, AEREON Inc. US, Cool Sorption and Patterson-Kelley.

The key factors driving the growth of the North America Vapor Recovery Units Market are Rising Demand for Fuel Station Vapor Recovery.

Maintenance & Technical Complexity is the major restrain in the North America Vapor Recovery Units Market.

1. North America Vapor Recovery Unit Market: Research Methodology

2. North America Vapor Recovery Unit Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global North America Vapor Recovery Unit Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarters

3.2.3. Service Segment

3.2.4. Application Segment

3.2.5. Revenue (2024)

3.2.6. Geographical Presence

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. North America Vapor Recovery Unit Market: Dynamics

4.1. North America Vapor Recovery Unit Market Trends

4.2. North America Vapor Recovery Unit Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Regulatory Landscape by Region

4.6. Key Opinion Leader Analysis for the Global Industry

4.7. Analysis of Government Schemes and Initiatives for Industry

5. North America Vapor Recovery Unit Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032)

5.1. North America Vapor Recovery Unit Market Size and Forecast, By Type (2024-2032)

5.1.1. Adsorption

5.1.2. Absorption

5.1.3. Condensation

5.1.4. Membrane Separation

5.2. North America Vapor Recovery Unit Market Size and Forecast, By Technology (2024-2032)

5.2.1. Conventional

5.2.2. Advanced

5.3. North America Vapor Recovery Unit Market Size and Forecast, By Application (2024-2032)

5.3.1. Processing

5.3.2. Storage

5.3.3. Transportation

5.3.4. Marine Loading Terminals

5.3.5. Others

5.4. North America Vapor Recovery Unit Market Size and Forecast, By End-User (2024-2032)

5.4.1. Oil & Gas

5.4.2. Chemicals & Petrochemicals

5.4.3. Pharmaceuticals

5.4.4. Food & Beverage

5.4.5. Others

5.5. North America Vapor Recovery Unit Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Vapor Recovery Unit Market Size and Forecast, By Type (2024-2032)

5.5.1.1.1. Adsorption

5.5.1.1.2. Absorption

5.5.1.1.3. Condensation

5.5.1.1.4. Membrane Separation

5.5.1.2. United States Vapor Recovery Unit Market Size and Forecast, By Technology (2024-2032)

5.5.1.2.1. Conventional

5.5.1.2.2. Advanced

5.5.1.3. United States Vapor Recovery Unit Market Size and Forecast, By Application (2024-2032)

5.5.1.3.1. Processing

5.5.1.3.2. Storage

5.5.1.3.3. Transportation

5.5.1.3.4. Marine Loading Terminals

5.5.1.3.5. Others

5.5.1.4. United States Vapor Recovery Unit Market Size and Forecast, By End-User (2024-2032)

5.5.1.4.1. Oil & Gas

5.5.1.4.2. Chemicals & Petrochemicals

5.5.1.4.3. Pharmaceuticals

5.5.1.4.4. Food & Beverage

5.5.1.4.5. Others

5.5.2. Canada

5.5.2.1. Canada Vapor Recovery Unit Market Size and Forecast, By Type (2024-2032)

5.5.2.1.1. Adsorption

5.5.2.1.2. Absorption

5.5.2.1.3. Condensation

5.5.2.1.4. Membrane Separation

5.5.2.2. Canada Vapor Recovery Unit Market Size and Forecast, By Technology (2024-2032)

5.5.2.2.1. Conventional

5.5.2.2.2. Advanced

5.5.2.3. Canada Vapor Recovery Unit Market Size and Forecast, By Application (2024-2032)

5.5.2.3.1. Processing

5.5.2.3.2. Storage

5.5.2.3.3. Transportation

5.5.2.3.4. Marine Loading Terminals

5.5.2.3.5. Others

5.5.2.4. Canada Vapor Recovery Unit Market Size and Forecast, By End-User (2024-2032)

5.5.2.4.1. Oil & Gas

5.5.2.4.2. Chemicals & Petrochemicals

5.5.2.4.3. Pharmaceuticals

5.5.2.4.4. Food & Beverage

5.5.2.4.5. Others

5.5.3. Mexico

5.5.3.1. Mexico Vapor Recovery Unit Market Size and Forecast, By Type (2024-2032)

5.5.3.1.1. Adsorption

5.5.3.1.2. Absorption

5.5.3.1.3. Condensation

5.5.3.1.4. Membrane Separation

5.5.3.2. Mexico Vapor Recovery Unit Market Size and Forecast, By Technology (2024-2032)

5.5.3.2.1. Conventional

5.5.3.2.2. Advanced

5.5.3.3. Mexico Vapor Recovery Unit Market Size and Forecast, By Application (2024-2032)

5.5.3.3.1. Processing

5.5.3.3.2. Storage

5.5.3.3.3. Transportation

5.5.3.3.4. Marine Loading Terminals

5.5.3.3.5. Others

5.5.3.4. Mexico Vapor Recovery Unit Market Size and Forecast, By End-User (2024-2032)

5.5.3.4.1. Oil & Gas

5.5.3.4.2. Chemicals & Petrochemicals

5.5.3.4.3. Pharmaceuticals

5.5.3.4.4. Food & Beverage

5.5.3.4.5. Others

6. Company Profile: Key Players

6.1. John Zink Hamworthy Combustion

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Hy-Bon/EDI

6.3. Cimarron Energy

6.4. AEREON

6.5. Polaris Energy Services

6.6. Cool Sorption

6.7. ClearPower Systems

6.8. Progin Mexicana

6.9. Tecam Group México

6.10. Sistemas de Control Ambiental (SCA)

7. Key Findings

8. Industry Recommendations