Red Clover Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

Red Clover Market Size Was Valued at USD 2.3 Billion in 2024, and is Projected to Reach USD 5.45 Billion by 2032, Growing at a CAGR of 11.3% From 2024-2032.

Format : PDF | Report ID : SMR_2745

Red Clover Market Overview

The Red Clover is a perennial, vegetarian flowering plant of the family Legume, scientifically known as Trifolium pratense. It is usually used as a fodder crop for animals because it contains high protein and can increase soil fertility by fixing nitrogen. Red Clover is also given prized in herbal medicine for its potential health benefits, such as assisting women's health and increasing general well-being during menopause. The Red Clover market is experiencing significant growth, which is powered by its various applications in agriculture, animal feed, and nutraceuticals.

Red clover is valuable for its high isoflavone content, nitrogen-fixing properties, and role in durable cultivation. Increasing demand for natural health supplements, especially to support the welfare of women and menopause, has promoted their use in herbal treatment. Additionally, the change of organic livestock feed and environmentally friendly agricultural practices has carried forward the expansion of the market. Recent developments highlight strategic moves by major industry players.

In May 2024, the Kargil Incorporate acquired a prominent European red clover drawn manufacturer to strengthen its plant-based nutrition offerings to meet the increasing demand for natural supplements. Similarly, in February 2024, Archer-Daniel-Midland Company (ADM) participated with an American-based organic farming cooperative to expand the cultivation of red clover for permanent animal fodder, including them with increasing priority for non-GMO and organic feed solutions. Red Clover industry trends are in favor of rapidly permanent agricultural practices, attracting attention as a cover crop to increase soil health with red clris and reduce dependence on synthetic fertilizers.

Companies like Martin Bauer Group and NeutraGreen Biotechnology Company, Ltd. are increasing their investment in R&D to develop high-isoflavone red clover varieties, which increase global demand. Industry estimates indicate a strong growth for the red clover market with an estimated annual growth rate (CAGR) of 11.3% between 2024 and 2032. Major expansion opportunities in Asia-Pacific and South America are emerging, inspired by factors such as growing health awareness, permanent farming initiatives, and increasing popularity of plant-based supplements. To capitalize on this speed, businesses are liking innovation and creating strategic partnerships to strengthen their market status and align consumer preferences.

To get more Insights: Request Free Sample Report

Red Clover Market Dynamics

Growing demand for natural health supplements boosts the red clover market

Consumers are rapidly moving towards natural and plant-based health supplements, which promotes a strong growth in the global red clover market. Red Clover is well known for its medicinal benefits, especially in supporting women's health, heart health, and skin care. Its high isoflavone content helps in the management of symptoms of menopause, has made it a popular component in dietary doses, herbal tea, and skincare products. As awareness about these benefits increases, demand continues to increase. The global herbal supplementary market is rapidly expanding, in which the red clover extract is important due to its phytoestrogenic properties. The increasing prevalence of hormone-related health issues in collaboration with synthetic hormone replacement therapy (HRT) also intensified the market. Additionally, the rising popularity of organic and non-GMO herbal products in North America and Europe has led to high cultivation and commercialization of red clover. In addition, the agricultural sector contributes to the expansion of the market, as red clover is used as a cover crop in the form of improving soil fertility and feed for livestock.

Supply Chain and Regulatory Challenges: To Limit the Red Clover Market Despite Its Growing Demand

The Red Clover Market supply faces challenges related to chain discrepancies, regulatory probes, and quality control issues. Red Clover is highly dependent on climatic conditions, affecting stable production in yield due to the ups and downs of the weather. Areas such as Europe and North America, which are major producers, sometimes face limited availability due to adverse growing seasons, causing value instability. Additionally, lack of standardized rules for herbal supplements in some markets creates obstacles for Red Clover manufacturers. While the US. FDA and the European Food Safety Authority (EFSA) have strict guidelines for health claims, small markets may have incompatible rules, which may cause quality discrepancies and consumer doubts. Certified organic and non-GMO red clover products make the increasing demand production more complex, as farmers and processors follow strict certification processes, which results in rising costs.

Trade restrictions and export-income policies in major markets also affect supply chain efficiency. For example, Brexit-related trade adjustments have affected the UK's Herbal Supplementary Industry, causing delays and high costs for red clover to import and export. These challenges require market players to follow international standards to invest in permanent agricultural practices, strong supply chain management, and maintain competition in the developed herbal product sector. With the continuous increase in demand for natural health solutions and sustainable agriculture, the red clover is ready for market development, but must navigate production and regulatory challenges to ensure longer.

Red Clover Market Segmentation

Based on Product Type, the red clover market is divided into several product categories such as dietary dose, herbal tea, extracts and tinctures, and others. Diet dosage dominates the Red Clover market, more than 45% of global demand, which is mainly inspired by the increasing use of red clover in women's health for hormonal balance, menopause relief, and heart support. These supplements are mainly available in tablets, capsules, and soft gel forms, with strong demand in North America and Europe. Herbal tea represents the second largest segment, which is about 25% of the accounting for market, especially in Asia and Europe, for their detoxifying and antioxidant properties. The diversification of red clover weed in these product types expands its versatility and applications in health, welfare and agriculture.

Based on Form, the Red Clover Market is divided into powdered red clover, liquid extracts, capsules and tablets, fresh and dried leaves. The powder red clover holds the largest Red Clover market share at around 40%, which is in favor of its versatility in functional food fortifications due to dietary dose, herbal tea, and its easy mixing properties. Liquid extracts, which include about 30% of market, are widely used in tinctures, skincare serums, and beverages, which are prized for their focused bioactive compounds such as isoflavone.

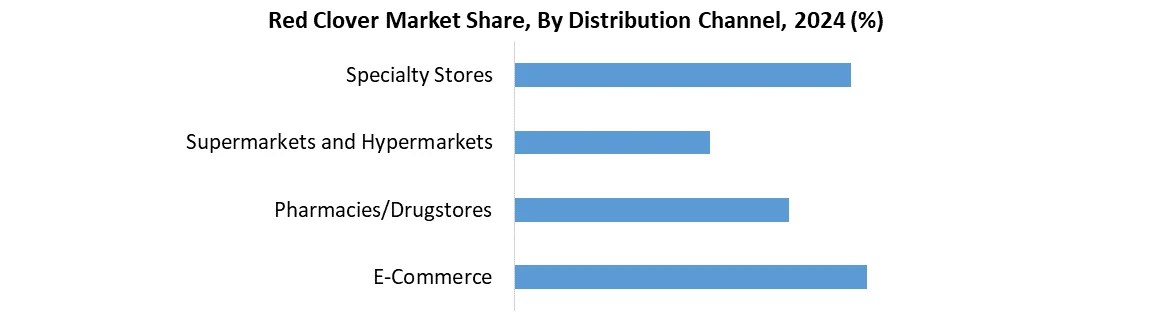

Based on Distribution Channel, the red clover market is distributed through several channels, like Supermarkets/Hypermarkets, E-Commerce, Pharmacies/Drugstores, and Specialty Stores. the fastest growing segment in online retail, occupies about 35% of sales due to a rapid expansion of e-commerce platforms and direct-to-consumer supplements brands. Pharmacies and Health Stocks remain a major traditional channel, which holds about 30% market share, especially in Europe and North America, where consumers prefer expert guidance when purchasing herbal supplements. Diversification of distribution channels indicates the development of consumer purchasing behavior, the online platform is gaining prominence, while traditional retail maintains its stronghold in specific demographics. This multi-channel approach ensures widespread access to red clover products in various consumer segments and geographical markets.

Red Clover Market Regional Analysis

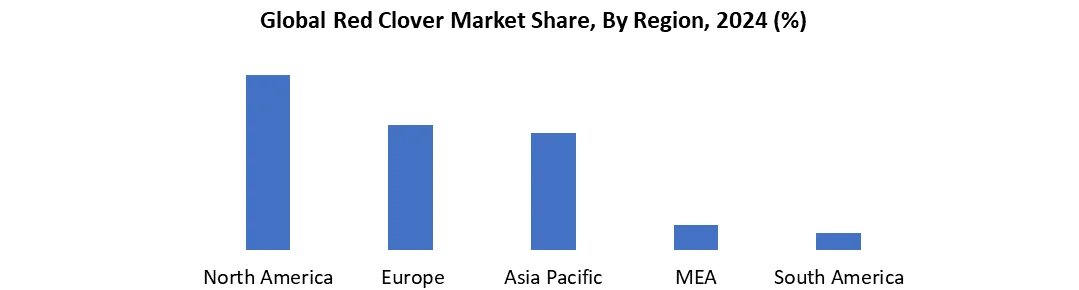

The Global Red Clover market reflects regional trends, North America is currently representing the largest consumer market. This dominance is inspired by strong demand for plant-based, hormone-free health solutions, especially among women seeking natural options for menopause support. The US dietary supplement market has seen significant growth in herbal extracts in the market, in which red clover products are gaining popularity under FDA and NCCIH oversight. Europe maintains leadership in red clover production and innovation, the region's well-established herbal medicine tradition, and a strict regulatory framework (EMA, EFSA) deployed red clover as a preferred natural alternative to synthetic hormone replacement therapy. Major European companies such as Martin Bauer Group and Bionorica SE supply high-quality extracts to global Red Clover market.

Asia-Pacific region is experiencing rapid growth in the red clover market, mainly due to rising awareness about herbal therapy and increasing disposable income. Countries like China, Japan, South Korea, and India are major contributors, including traditional medical systems such as Ayurveda and traditional Chinese medicine (TCM). China is the largest producer and consumer in the region, where the herbal supplementary industry is expanding. Meanwhile, India's growing nutraceutical sector is demanding red clover-based products, especially in women's health and skincare. The government initiative promoting herbal medicine and organic farming, which is making market expansion.

Competitive Landscape of Red Clover Market

The Red Clover Market is moderately fragmented, with a mixture of multinational nutraceutical giants, regional herbal manufacturers, and raw material suppliers for market share. Prominent players such as Martin Bauer Group, Frutarom, and Bionorica SE lead the market with standardized extracts, clinical backing, and strong global distribution. U.S. In, now companies such as NOW Foods, Gaia Herbs, and Traditional Medicinals are dominating through various product portfolios and natural health branding. Meanwhile, players such as Bioforce AG and Blackmores focus on evidence-based, clean-labeled products, targeting menopause and women's health.

China and South America's emerging companies, such as SanHerb BioTech and Ecuadorian Rainforest, are competing on the cost and bulk extract supply. In Asia, firms such as Himalaya Herbals and Organic India have included red clover in their Ayurvedic and Wellness Portfolio, responding to global trends. Red Clover market dynamics are rapidly taking shape due to an increase in plant-based measures, clean-labeled, and traceable sourcing. Strategic tricks such as acquisition, product innovation, and e-commerce expansion are running competitive discrimination, while regulatory compliance and scientific verification remain a significant success factor for continuous leadership in the Red Clover market.

|

Red Clover Market Scope |

|

|

Market Size in 2024 |

USD 2.3 billion. |

|

Market Size in 2032 |

USD 5.45 billion. |

|

CAGR (2025-2032) |

11.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Dietary supplements Herbal teas Extracts & tinctures Others |

|

By Form Powdered red clover Liquid extracts Capsules & tablets Fresh/dried leaves |

|

|

By Distribution Channel Supermarkets/Hypermarkets E-Commerce Pharmacies/Drugstores Specialty Stores |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Red Clover Market key players include:

North America

- Gaia Herbs (USA)

- Frontier Co-op (USA)

- NOW Foods (USA)

- Solaray (USA)

- Traditional Medicinals (USA)

- NutraGreen Biotechnology (USA)

- Herb Pharm (USA)

Europe

- Martin Bauer Group (Germany)

- Bionorica SE (Germany)

- Bioforce AG (Switzerland)

- Finzelberg (Germany)

- Herbapharm (Germany)

- Nature's Way (Germany)

- Salus Haus (Germany)

- Bristol Botanicals (UK)

- Arkopharma (France)

- Kräuterhaus Sanct Bernhard (Germany)

Asia-Pacific

- Himalaya Herbals (India)

- Organic India (India)

- Novotech Nutraceuticals (China)

- Tsumura & Co. (Japan)

- Kaneka Corporation (Japan)

- SanHerb BioTech (China)

- Blackmores (Australia)

- PharmaFungi (India)

Middle East & Africa

- Afriplex (South Africa)

- Glenmark Pharmaceuticals (India)

- Herbex (South Africa)

South America

- Natura Brasil (Brazil)

- Vitadiet (Brazil)

Frequently Asked Questions

Key companies include Martin Bauer Group (Germany), Bioforce AG (Switzerland), Gaia Herbs (USA), Himalaya Herbals (India), and NOW Foods (USA).

In countries like India and China, red clover demand is growing due to increasing disposable income, revival of traditional medicine (Ayurveda/TCM), and rising health consciousness.

Europe leads globally, driven by strong herbal medicine traditions and strict quality standards. However, Asia-Pacific is the fastest-growing region due to expanding nutraceutical industries.

Climate-dependent cultivation affecting supply, high costs of organic certification, varying international regulations, and competition from synthetic alternatives are the main market challenges.

1. Red Clover Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Red Clover Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Red Clover Market: Dynamics

3.1. Red Clover Market Trends by Region

3.1.1. North America Red Clover Market Trends

3.1.2. Europe Red Clover Market Trends

3.1.3. Asia Pacific Red Clover Market Trends

3.1.4. Middle East and Africa Red Clover Market Trends

3.1.5. South America Red Clover Market Trends

3.2. Red Clover Market Dynamics

3.2.1. Red Clover Market Drivers

3.2.2. Red Clover Market Restraints

3.2.3. Red Clover Market Opportunities

3.2.4. Red Clover Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Red Clover Industry

4. Red Clover Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Red Clover Market Size and Forecast, By Product Type (2024-2032)

4.1.1. Dietary supplements

4.1.2. Herbal teas

4.1.3. Extracts & tinctures

4.1.4. Others

4.2. Red Clover Market Size and Forecast, By Form (2024-2032)

4.2.1. Powdered red clover

4.2.2. Liquid extracts

4.2.3. Capsules & tablets

4.2.4. Fresh/dried leaves

4.3. Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

4.3.1. Supermarkets/Hypermarkets

4.3.2. E-Commerce

4.3.3. Pharmacies/Drugstores

4.3.4. Specialty Stores

4.4. Red Clover Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Red Clover Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Red Clover Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Dietary supplements

5.1.2. Herbal teas

5.1.3. Extracts & tinctures

5.1.4. Others

5.2. North America Red Clover Market Size and Forecast, By Form (2024-2032)

5.2.1. Powdered red clover

5.2.2. Liquid extracts

5.2.3. Capsules & tablets

5.2.4. Fresh/dried leaves

5.3. North America Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Supermarkets/Hypermarkets

5.3.2. E-Commerce

5.3.3. Pharmacies/Drugstores

5.3.4. Specialty Stores

5.4. North America Red Clover Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Red Clover Market Size and Forecast, By Product Type (2024-2032)

5.4.1.1.1. Dietary supplements

5.4.1.1.2. Herbal teas

5.4.1.1.3. Extracts & tinctures

5.4.1.1.4. Others

5.4.1.2. United States Red Clover Market Size and Forecast, By Form (2024-2032)

5.4.1.2.1. Powdered red clover

5.4.1.2.2. Liquid extracts

5.4.1.2.3. Capsules & tablets

5.4.1.2.4. Fresh/dried leaves

5.4.1.3. United States Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1.3.1. Supermarkets/Hypermarkets

5.4.1.3.2. E-Commerce

5.4.1.3.3. Pharmacies/Drugstores

5.4.1.3.4. Specialty Stores

5.4.2. Canada

5.4.2.1. Canada Red Clover Market Size and Forecast, By Product Type (2024-2032)

5.4.2.1.1. Dietary supplements

5.4.2.1.2. Herbal teas

5.4.2.1.3. Extracts & tinctures

5.4.2.1.4. Others

5.4.2.2. Canada Red Clover Market Size and Forecast, By Form (2024-2032)

5.4.2.2.1. Powdered red clover

5.4.2.2.2. Liquid extracts

5.4.2.2.3. Capsules & tablets

5.4.2.2.4. Fresh/dried leaves

5.4.3. Canada Red Clover Market Size and Forecast, By Distribution Channel Industry (2024-2032)

5.4.3.1.1. Supermarkets/Hypermarkets

5.4.3.1.2. E-Commerce

5.4.3.1.3. Pharmacies/Drugstores

5.4.3.1.4. Specialty Stores

5.4.4. Mexico

5.4.4.1. Mexico Red Clover Market Size and Forecast, By Product Type (2024-2032)

5.4.4.1.1. Dietary supplements

5.4.4.1.2. Herbal teas

5.4.4.1.3. Extracts & tinctures

5.4.4.1.4. Others

5.4.4.2. Mexico Red Clover Market Size and Forecast, By Form (2024-2032)

5.4.4.2.1. Powdered red clover

5.4.4.2.2. Liquid extracts

5.4.4.2.3. Capsules & tablets

5.4.4.2.4. Fresh/dried leaves

5.4.4.3. Mexico Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.4.3.1. Supermarkets/Hypermarkets

5.4.4.3.2. E-Commerce

5.4.4.3.3. Pharmacies/Drugstores

5.4.4.3.4. Specialty Stores

6. Europe Red Clover Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Red Clover Market Size and Forecast, By Product Type (2024-2032)

6.2. Europe Red Clover Market Size and Forecast, By Form (2024-2032)

6.3. Europe Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

6.4. Europe Red Clover Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Red Clover Market Size and Forecast, By Product Type (2024-2032)

6.4.1.2. United Kingdom Red Clover Market Size and Forecast, By Form (2024-2032)

6.4.1.3. United Kingdom Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.2. France

6.4.2.1. France Red Clover Market Size and Forecast, By Product Type (2024-2032)

6.4.2.2. France Red Clover Market Size and Forecast, By Form (2024-2032)

6.4.2.3. France Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Red Clover Market Size and Forecast, By Product Type (2024-2032)

6.4.3.2. Germany Red Clover Market Size and Forecast, By Form (2024-2032)

6.4.3.3. Germany Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Red Clover Market Size and Forecast, By Product Type (2024-2032)

6.4.4.2. Italy Red Clover Market Size and Forecast, By Form (2024-2032)

6.4.4.3. Italy Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Red Clover Market Size and Forecast, By Product Type (2024-2032)

6.4.5.2. Spain Red Clover Market Size and Forecast, By Form (2024-2032)

6.4.5.3. Spain Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Red Clover Market Size and Forecast, By Product Type (2024-2032)

6.4.6.2. Sweden Red Clover Market Size and Forecast, By Form (2024-2032)

6.4.6.3. Sweden Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Red Clover Market Size and Forecast, By Product Type (2024-2032)

6.4.7.2. Austria Red Clover Market Size and Forecast, By Form (2024-2032)

6.4.7.3. Austria Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Red Clover Market Size and Forecast, By Product Type (2024-2032)

6.4.8.2. Rest of Europe Red Clover Market Size and Forecast, By Form (2024-2032)

6.4.8.3. Rest of Europe Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7. Asia Pacific Red Clover Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.2. Asia Pacific Red Clover Market Size and Forecast, By Form (2024-2032)

7.3. Asia Pacific Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4. Asia Pacific Red Clover Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.1.2. China Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.1.3. China Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.2.2. S Korea Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.2.3. S Korea Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.3.2. Japan Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.3.3. Japan Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.4. India

7.4.4.1. India Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.4.2. India Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.4.3. India Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.5.2. Australia Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.5.3. Australia Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.6.2. Indonesia Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.6.3. Indonesia Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.7.2. Philippines Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.7.3. Philippines Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.8.2. Malaysia Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.8.3. Malaysia Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.9.2. Vietnam Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.9.3. Vietnam Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.10.2. Thailand Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.10.3. Thailand Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Red Clover Market Size and Forecast, By Product Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Red Clover Market Size and Forecast, By Form (2024-2032)

7.4.11.3. Rest of Asia Pacific Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

8. Middle East and Africa Red Clover Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Red Clover Market Size and Forecast, By Product Type (2024-2032)

8.2. Middle East and Africa Red Clover Market Size and Forecast, By Form (2024-2032)

8.3. Middle East and Africa Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

8.4. Middle East and Africa Red Clover Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Red Clover Market Size and Forecast, By Product Type (2024-2032)

8.4.1.2. South Africa Red Clover Market Size and Forecast, By Form (2024-2032)

8.4.1.3. South Africa Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Red Clover Market Size and Forecast, By Product Type (2024-2032)

8.4.2.2. GCC Red Clover Market Size and Forecast, By Form (2024-2032)

8.4.2.3. GCC Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Red Clover Market Size and Forecast, By Product Type (2024-2032)

8.4.3.2. Nigeria Red Clover Market Size and Forecast, By Form (2024-2032)

8.4.3.3. Nigeria Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Red Clover Market Size and Forecast, By Product Type (2024-2032)

8.4.4.2. Rest of ME&A Red Clover Market Size and Forecast, By Form (2024-2032)

8.4.4.3. Rest of ME&A Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

9. South America Red Clover Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Red Clover Market Size and Forecast, By Product Type (2024-2032)

9.2. South America Red Clover Market Size and Forecast, By Form (2024-2032)

9.3. South America Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

9.4. South America Red Clover Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Red Clover Market Size and Forecast, By Product Type (2024-2032)

9.4.1.2. Brazil Red Clover Market Size and Forecast, By Form (2024-2032)

9.4.1.3. Brazil Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Red Clover Market Size and Forecast, By Product Type (2024-2032)

9.4.2.2. Argentina Red Clover Market Size and Forecast, By Form (2024-2032)

9.4.2.3. Argentina Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Red Clover Market Size and Forecast, By Product Type (2024-2032)

9.4.3.2. Rest Of South America Red Clover Market Size and Forecast, By Form (2024-2032)

9.4.3.3. Rest Of South America Red Clover Market Size and Forecast, By Distribution Channel (2024-2032)

10. Company Profile: Key Players

10.1 Martin Bauer Group (Germany)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Bioforce AG (Switzerland)

10.3. Frutarom (IFF) (Switzerland)

10.4. Herbapharm (Germany)

10.5. Nature's Way (Germany)

10.6. Salus Haus (Germany)

10.7. Finzelberg (Germany)

10.8. Bionorica SE (Germany)

10.9. Gaia Herbs (USA)

10.10. Frontier Co-op (USA)

10.11. NOW Foods (USA)

10.12. NutraGreen (Canada)

10.13. Solaray (USA)

10.14. Traditional Medicinals (USA)

10.15. Pure Encapsulations (USA)

10.16. Novotech Nutraceuticals (China)

10.17. Himalaya Herbals (India)

10.18. SanHerb BioTech (China)

10.19. Shanghai TCM Herbals (China)

10.20. Organic India (India)

10.21. Aovca (Australia)

10.22. Blackmores (Australia)

10.23. Tsumura & Co. (Japan)

10.24. Kaneka Corporation (Japan)

10.25. Natura Brasil (Brazil)

10.26. Vitadiet (Brazil)

10.27. Ecuadorian Rainforest (Ecuador)

10.28. Afriplex (South Africa)

10.29. Glenmark Pharmaceuticals (South Africa)

10.30. Herbex (South Africa)

11. Key Findings

12. Analyst Recommendations

13. Red Clover Market: Research Methodology