Postpartum Depression drug market Global Industry Analysis and Forecast (2026-2032)

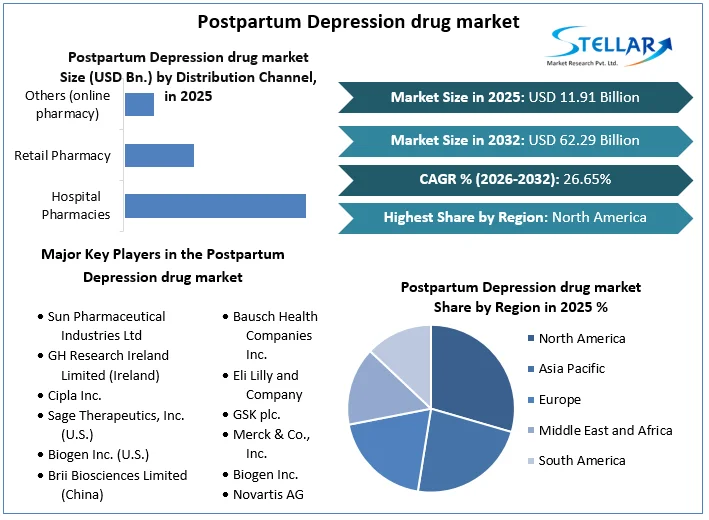

The global Postpartum Depression drug market size was valued at USD 11.91 Billion in 2025. The market is expected to grow at a CAGR of 26.65 % during the forecast period from 2026-2032, reaching nearly USD 62.29 Billion by 2032.

Format : PDF | Report ID : SMR_2462

Postpartum Depression drug market Overview

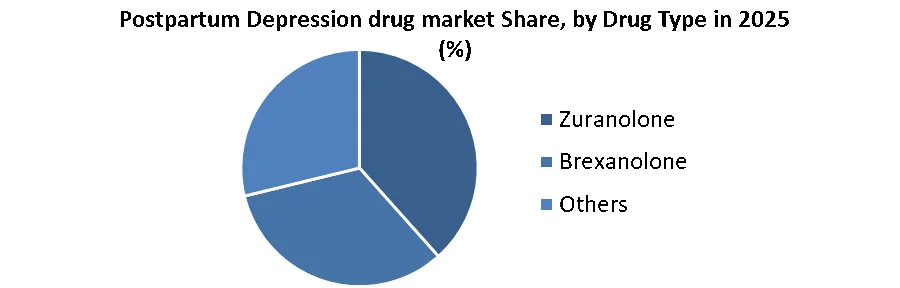

Postpartum depression also known as PPD is a medical condition that many women get after having a baby. Its strong feelings of sadness, anxiety (worry), and tiredness last for a long time after giving birth. PPD is a kind of perinatal depression that happens during pregnancy or in the first year after giving birth. Brexanolone and zuranolone are the two medications approved by the FDA for the treatment of postpartum depression.

Postpartum depression drug market is expected to grow during the forecasting period of 2025-2032, driven by the factors like increasing adoption of emerging drugs in hospitals and other medical centers. Some of the other significant factors that are responsible for the market growth include the advancements in neuroscience research and an increasing focus on maternal mental healthcare programs for postpartum depression. The increasing awareness regarding the disease symptoms and postpartum depression treatment is also anticipated to drive the market growth in the near future.

The postpartum depression drug market is divided into the region like North America, Europe, Asia Pacific, Middle East and Africa and South America. North America dominated the market of PPD in 2025, driven by the increasing prevalence of postpartum depression in the U.S., and the presence of advanced healthcare infrastructure in the region.

Sun Pharmaceutical, Industries Ltd, GH Research Ireland Limited, Cipla Inc., Sage Therapeutics, Inc., Biogen Inc., Brii Biosciences Limited, Pfizer Inc., and others are the key players in the Postpartum Depression drug market. There are a number of therapeutic interventions for postpartum depression including pharmacotherapy, psychotherapy, neuromodulation and hormonal therapy among others, helps to grow the PPD market.

To get more Insights: Request Free Sample Report

Postpartum Depression drug market Dynamics

Drivers

The rising prevalence of postpartum depression

The rising prevalence of postpartum depression is a significant driver of demand for effective treatment options. This increase can be attributed to enhanced awareness and improved diagnostic practices, which have led to better recognition and reporting of PPD cases. As healthcare professionals become more expert at identifying the symptoms of postpartum depression, and as societal stigma surrounding mental health issues decreases, more women are seeking and receiving diagnoses. This increased recognition has highlighted the widespread nature of PPD, underscoring the urgent need for effective therapeutic involvement. Additionally, growing public awareness and educational campaigns have played a crucial role in encouraging women to report symptoms and seek treatment. As a result, the demand for effective and accessible PPD treatments has surged, driving the development and adoption of new drugs and therapeutic options to address this pressing health concern.

Advancements like brexanolone and zuranolone are transforming PPD treatment with rapid relief and convenience

Advancements in drug development are significantly impacting the postpartum depression market by introducing innovative therapies that enhance treatment options. The approval and introduction of novel drugs like brexanolone and zuranolone mark a substantial shift in how PPD is managed. Brexanolone, the first FDA-approved drug specifically for PPD, offers rapid relief through intravenous infusion, targeting the neurochemical imbalances associated with the condition. Similarly, zuranolone, an oral neuroactive steroid, provides a convenient treatment option with sustained relief after the treatment period. These advancements not only address the urgent need for effective treatments but also cater to varying patient preferences and conditions. The ongoing research and development efforts are focused on creating drugs with faster onset, fewer side effects, and broader s, driving market growth. The continuous evolution of drug formulations and delivery methods reflects a commitment to improving patient outcomes and expanding the therapeutic landscape for postpartum depression.

Opportunities

Expanding post-partum depression drug treatments with combination therapies, personalized medicine, and adjunctive options enhances efficacy, caters to diverse needs, and boosts market demand.

Expanding treatment options for postpartum depression presents a significant opportunity for market growth, as it allows for more tailored and effective approaches to managing the condition. This expansion includes the development and integration of combination therapies, which can address multiple aspects of postpartum depression simultaneously. For example, combining antidepressants with psychotherapy or other therapeutic modalities could enhance treatment efficacy and offer comprehensive care. Additionally, personalized medicine approaches such as tailoring treatments based on genetic, environmental, and individual factors can lead to more targeted and effective involvements, improving patient outcomes and satisfaction. Furthermore, exploring adjunctive therapies, such as mood stabilizers or hormonal treatments that can be used in conjunction with existing medications can provide additional relief for patients who may not fully respond to monotherapy. This holistic approach to treatment not only broadens the range of available options but also caters to specific symptoms and patient needs, thus addressing a wider spectrum of PPD experiences and potentially increasing overall market demand for these therapies.

Challenges

Access to healthcare for postpartum depression is limited in low-income areas due to infrastructure shortages, financial barriers, and high treatment costs.

Access to healthcare presents a significant challenge in the postpartum depression drug market, particularly in regions with limited healthcare infrastructure or in low-income settings. In these areas, specialized mental health care, including the treatment of PPD, is often constrained by a shortage of trained professionals, inadequate facilities, and limited availability of medications. This disparity is exacerbated by financial constraints, which can restrict access to both preventive and therapeutic services. For many women in these regions, the lack of access to mental health resources means that postpartum depression remains undiagnosed and untreated, leading to poorer health outcomes. Furthermore, the high cost of novel PPD treatments, such as brexanolone and Zurzuvae, poses an additional barrier for patients who may already be struggling with financial challenges. Improving access to healthcare involves not only enhancing infrastructure and increasing the availability of mental health professionals but also addressing economic barriers and ensuring that treatments are affordable and accessible to all patients, regardless of their economic status.

Postpartum Depression drug Market Segment Analysis

By Drug Type

Brexanolone dominated the postpartum depression drug market in 2025 and Brexanolone is the first-ever drug approved by the FDA specifically for the treatment of postpartum depression. Brexanolone is a neuroactive steroid that must be administered intravenously (via IV infusion), notable for its rapid onset of action, quickly alleviating symptoms of postpartum depression. The approval of brexanolone represents a significant advancement in the treatment options available for postpartum depression, particularly for those in need of immediate relief from severe symptoms, driving the market growth.

Zuranolone another neuroactive steroid is expected to show rapid market growth during the forecasting period of 2026-2032. Clinical trials have demonstrated that Zurzuvae continues to provide relief from postpartum depression symptoms for over a month after the last dose, making it a convenient and effective option for many patients. The approval of Zurzuvae further expands the therapeutic landscape for postpartum depression, offering a more accessible treatment option for patients.

By Treatment

Based on treatments, the market is segregated into medication, psychotherapy, electroconvulsive therapy (ECT), supplements, and others. The medication segment has dominated the market in 2025, due to the increasing awareness and diagnosis of postpartum depression drugamong new mothers. This segment primarily includes antidepressants, such as selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs), which are widely prescribed for managing PPD symptoms. The introduction of novel therapies like brexanolone, the first FDA-approved medication specifically for postpartum depression drugs, has further boosted market growth.

The pharmacotherapy segment in the postpartum depression drug market is expected to show growth during the forecasting period of 2026-2032, driven by the growing awareness and diagnosis of PPD, alongside advancements in drug development. Recent innovations, such as the development of novel antidepressants like brexanolone, specifically approved for PPD, have further expanded the therapeutic options within this segment. The increasing emphasis on mental health, coupled with the ongoing research to develop faster-acting and more effective drugs, is expected to propel growth in the pharmacotherapy segment.

Postpartum Depression drug market Regional Insights

North America dominated the postpartum depression drug market in 2025, driven by strong healthcare infrastructure, high awareness of postpartum depression, and significant investment in research and development. The United States, in particular, benefits from the presence of key pharmaceutical companies and the early adoption of novel therapies, such as brexanolone (Zulresso), which has been a major factor in the region's market leadership. The region's focus on mental health, combined with favorable reimbursement policies, further supports market growth, making North America a key driver in the global PPD drugs market.

Asia-Pacific region is expected to show the postpartum depression drug market, due to increasing awareness, improving healthcare infrastructure, and rising healthcare expenditures in countries like China, Japan, and India. The large population base, coupled with a growing focus on mental health, provides significant market potential. However, the market faces challenges related to stigma and underreporting of postpartum depression, which could slow the adoption of these drugs. Addressing these challenges will be crucial for realizing the full potential of the PPD drugs market in the Asia-Pacific region.

- In January 2024, Sun Pharmaceuticals and Bayer inked a deal to market and distribute in India a second brand of Finerenone, a patented medicine that aims to reduce the risk of various complications in adult patients with chronic kidney disease linked to type 2 diabetes mellitus.

Postpartum Depression drug market Competitive Landscape

The key players in the Postpartum Depression drug market are Sun Pharmaceutical, Industries Ltd, GH Research Ireland Limited, Cipla Inc., Sage Therapeutics, Inc., Biogen Inc., Brii Biosciences Limited, Pfizer Inc., and others.

Sun Pharmaceuticals is the largest pharmaceutical company in India and the fifth-largest specialty generic company in the world. In several countries, Sun Pharma ranks among the leading companies in therapy areas. It has capabilities across dosage forms like injectables, sprays, ointments, creams, liquids, tablets, and capsules. Company producing generics, branded generics, specialty, over-the-counter (OTC) products, antiretrovirals (ARVs), active pharmaceutical ingredients (APIs), and intermediates in the full range of dosage forms.

- In 2024, Sun Pharmaceutical Industries Limited announced that the Australian Therapeutic Goods Administration (TGA) had granted regulatory approval for Winlevi. Winlevi is indicated for the topical treatment of acne vulgaris in patients 12 years of age and older.

Cipla Limited is an Indian multinational pharmaceutical company primarily focuses on developing medication to treat respiratory disease, cardiovascular disease, arthritis, diabetes, depression, and various other medical conditions. Cipla offers several medications like sertraline, Fluoxetine, and Citalopram that used to treat postpartum depression.

|

Postpartum Depression Drug market Scope |

|

|

Market Size in 2025 |

USD 11.91 Billion |

|

Market Size in 2032 |

USD 62.29 Billion |

|

CAGR (2026-2032) |

26.65 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Drug Type

|

|

By Treatment

|

|

|

By Route Administration

|

|

|

By Distribution Channel

|

|

Key Regions

- North America (United States, Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Rest of Europe)

- Asia Pacific (China, S Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, Rest of Asia Pacific)

- Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)

- South America (Brazil, Mexico, Rest of South America)

Postpartum Depression drug market Key Players

- Sun Pharmaceutical Industries Ltd

- GH Research Ireland Limited (Ireland)

- Cipla Inc.

- Sage Therapeutics, Inc. (U.S.)

- Biogen Inc. (U.S.)

- Brii Biosciences Limited (China)

- Pfizer Inc.

- Bausch Health Companies Inc.

- Eli Lilly and Company

- GSK plc.

- Merck & Co., Inc.

- Biogen Inc.

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Lupin

- SHIONOGI & Co., Ltd.

- Aurobindo Pharma

- Allergan, Inc

- Mylan N. V

- Johnson & Johnson Private Limited

- Sanofi S. A

Frequently Asked Questions

North America and Asia Pacific are regions key regions in the Postpartum Depression drug market in 2025.

SZ DJI Technology Co. Ltd (DJI), 3D Robotics, Inc., Aeronavics Ltd., AeroVironment Inc., Yuneec Holding Ltd (China), Skydio, Inc., and others are the key market players in the Postpartum Depression drug market.

The Postpartum Depression drug market size is USD 11.91 Billion in 2025.

1. Postpartum Depression drug market: Research Methodology

2. Postpartum Depression drug market: Competitive Landscape

2.1. Stellar Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Consolidation of the Market

3. Postpartum Depression drug market: Executive Summary

4. Postpartum Depression drug market: Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Market Opportunities

4.4. Market Challenges

4.5. Regulatory Landscape by Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. Postpartum Depression drug market Size and Forecast by Segments (by Value USD Billion)

5.1. Postpartum Depression drug market Size and Forecast, by Drug Type (2025-2032)

5.1.1. Zuranolone

5.1.2. Brexanolone

5.1.3. Others

5.2. Postpartum Depression drug market Size and Forecast, by Treatment (2025-2032)

5.2.1. Medication

5.2.2. Pharmacotherapy

5.2.3. Hormonal Therapy

5.2.4. Supplements

5.2.5. Electroconvulsive Therapy (ECT)

5.2.6. Others

5.3. Postpartum Depression drug market Size and Forecast, by Route Administration (2025-2032)

5.3.1. Oral

5.3.2. Parenteral

5.3.3. Others

5.4. Postpartum Depression drug market Size and Forecast, by Distribution Channel (2025-2032)

5.4.1. Hospital Pharmacies

5.4.2. Retail Pharmacy

5.4.3. Others (online pharmacy)

5.5. Postpartum Depression drug market Size and Forecast, by Region (2025-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Postpartum Depression drug market Size and Forecast (by Value USD Billion)

6.1. North America Postpartum Depression drug market Size and Forecast, by Drug Type (2025-2032)

6.1.1. Zuranolone

6.1.2. Brexanolone

6.1.3. Others

6.2. North America Postpartum Depression drug market Size and Forecast, by Treatment (2025-2032)

6.2.1. Medication

6.2.2. Pharmacotherapy

6.2.3. Hormonal Therapy

6.2.4. Supplements

6.2.5. Electroconvulsive Therapy (ECT)

6.2.6. Others

6.3. North America Postpartum Depression drug market Size and Forecast, by Route Administration (2025-2032)

6.3.1. Oral

6.3.2. Parenteral

6.3.3. Others

6.4. North America Postpartum Depression drug market Size and Forecast, by Distribution Channel (2025-2032)

6.4.1. Hospital Pharmacies

6.4.2. Retail Pharmacy

6.4.3. Others (online pharmacy)

6.5. North America Postpartum Depression drug market Size and Forecast, by Country (2025-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Postpartum Depression drug market Size and Forecast (by Value USD Billion)

7.1. Europe Postpartum Depression drug market Size and Forecast, by Drug Type (2025-2032)

7.1.1. Zuranolone

7.1.2. Brexanolone

7.1.3. Others

7.2. Europe Postpartum Depression drug market Size and Forecast, by Treatment (2025-2032)

7.2.1. Medication

7.2.2. Pharmacotherapy

7.2.3. Hormonal Therapy

7.2.4. Supplements

7.2.5. Electroconvulsive Therapy (ECT)

7.2.6. Others

7.3. Europe Postpartum Depression drug market Size and Forecast, by Route Administration (2025-2032)

7.3.1. Oral

7.3.2. Parenteral

7.3.3. Others

7.4. Europe Postpartum Depression drug market Size and Forecast, by Distribution Channel (2025-2032)

7.4.1. Hospital Pharmacies

7.4.2. Retail Pharmacy

7.4.3. Others (online pharmacy)

7.5. Europe Postpartum Depression drug market Size and Forecast, by Country (2025-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Postpartum Depression drug market Size and Forecast (by Value USD Billion)

8.1. Asia Pacific Postpartum Depression drug market Size and Forecast, by Drug Type (2025-2032)

8.1.1. Zuranolone

8.1.2. Brexanolone

8.1.3. Others

8.2. Asia Pacific Postpartum Depression drug market Size and Forecast, by Treatment (2025-2032)

8.2.1. Medication

8.2.2. Pharmacotherapy

8.2.3. Hormonal Therapy

8.2.4. Supplements

8.2.5. Electroconvulsive Therapy (ECT)

8.2.6. Others

8.3. Asia Pacific Postpartum Depression drug market Size and Forecast, by Route Administration (2025-2032)

8.3.1. Oral

8.3.2. Parenteral

8.3.3. Others

8.4. Asia Pacific Postpartum Depression drug market Size and Forecast, by Distribution Channel (2025-2032)

8.4.1. Hospital Pharmacies

8.4.2. Retail Pharmacy

8.4.3. Others (online pharmacy)

8.5. Asia Pacific Postpartum Depression drug market Size and Forecast, by Country (2025-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Postpartum Depression drug market Size and Forecast (by Value USD Billion)

9.1. Middle East and Africa Postpartum Depression drug market Size and Forecast, by Drug Type (2025-2032)

9.1.1. Zuranolone

9.1.2. Brexanolone

9.1.3. Others

9.2. Middle East and Africa Postpartum Depression drug market Size and Forecast, by Treatment (2025-2032)

9.2.1. Medication

9.2.2. Pharmacotherapy

9.2.3. Hormonal Therapy

9.2.4. Supplements

9.2.5. Electroconvulsive Therapy (ECT)

9.2.6. Others

9.3. Middle East and Africa Postpartum Depression drug market Size and Forecast, by Route Administration (2025-2032)

9.3.1. Oral

9.3.2. Parenteral

9.3.3. Others

9.4. Middle East and Africa Postpartum Depression drug market Size and Forecast, by Distribution Channel (2025-2032)

9.4.1. Hospital Pharmacies

9.4.2. Retail Pharmacy

9.4.3. Others (online pharmacy)

9.5. Middle East and Africa Postpartum Depression drug market Size and Forecast, by Country (2025-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of MEA

10. South America Postpartum Depression drug market Size and Forecast (by Value USD Billion)

10.1. South Postpartum Depression drug market Size and Forecast, by Drug Type (2025-2032)

10.1.1. Zuranolone

10.1.2. Brexanolone

10.1.3. Others

10.2. South America Postpartum Depression drug market Size and Forecast, by Treatment (2025-2032)

10.2.1. Medication

10.2.2. Pharmacotherapy

10.2.3. Hormonal Therapy

10.2.4. Supplements

10.2.5. Electroconvulsive Therapy (ECT)

10.2.6. Others

10.3. South America Postpartum Depression drug market Size and Forecast, by Route Administration (2025-2032)

10.3.1. Oral

10.3.2. Parenteral

10.3.3. Others

10.4. South America Postpartum Depression drug market Size and Forecast, by Distribution Channel (2025-2032)

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacy

10.4.3. Others (online pharmacy)

10.5. South America Postpartum Depression drug market Size and Forecast, by Country (2025-2032)

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. Sun Pharmaceutical Industries Ltd

11.1.1. Financial Overview

11.1.2. Business Portfolio

11.1.3. SWOT Analysis

11.1.4. Business Strategy

11.1.5. Recent Developments

11.2. GH Research Ireland Limited (Ireland)

11.3. Cipla Inc.

11.4. Sage Therapeutics, Inc. (U.S.)

11.5. Biogen Inc. (U.S.)

11.6. Brii Biosciences Limited (China)

11.7. Pfizer Inc.

11.8. Bausch Health Companies Inc.

11.9. Eli Lilly and Company

11.10. GSK plc.

11.11. Merck & Co., Inc.

11.12. Biogen Inc.

11.13. Novartis AG

11.14. Teva Pharmaceutical Industries Ltd.

11.15. Lupin

11.16. SHIONOGI & Co., Ltd.

11.17. Aurobindo Pharma

11.18. Allergan, Inc

11.19. Mylan N. V

11.20. Johnson & Johnson Private Limited

11.21. Sanofi S. A

11.22. Others

12. Key Findings

13. Industry Recommendations