Pet Food Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2026-2032)

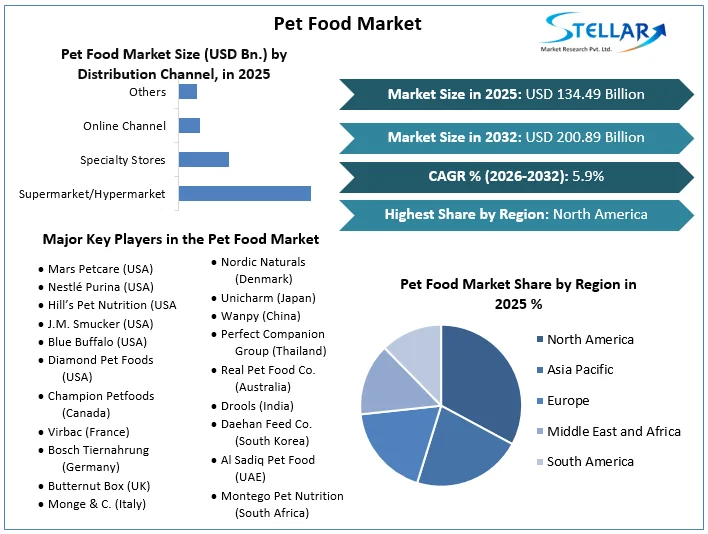

Pet Food Market was valued at USD 134.49 billion in 2025. Its total industry revenue is expected to grow by 5.9% from 2026 to 2032, reaching nearly USD 200.89 billion in 2032.

Format : PDF | Report ID : SMR_2713

Pet Food Market Overview

Pet food is animal feed intended for consumption by pets. Typically sold in pet stores and supermarkets, it is usually specific to the type of animal, such as dog food or cat food. Most meat used for animals is a byproduct of the human food industry, and is not regarded as "human grade.

Global pet food market is experiencing significant growth by evolving consumer preferences and innovative product developments. This expansion is promoted by a increasing humanization of pets, with owners prioritizing premium nutrition options like organic, grain-free, and high-protein formulations. Also, North America leads largest market share, by its high pet ownership and premium product adoption, while Asia Pacific shows most rapid growth potential. Major players like Mars, Nestlé Purina, and Hill's are driving innovation through acquisitions, sustainable solutions, and advanced veterinary nutrition offerings. Recent breakthroughs include AI powered personalized diets, FDA approved therapeutic foods, and alternative protein sources like insect based and lab grown options, signaling a dynamic future for pet nutrition.

The U.S. maintains 25% tariffs on Chinese pet food ingredients, raising production costs, while the EU's new carbon tax (2026) pressures non-sustainable imports. India's 30% duty on premium pet food and UK-EU tariffs (5-12%) are driving localization and price hikes. These trade barriers have increased pet food prices by 3-8%, accelerated regional manufacturing (e.g., Nestlé in Brazil), and boosted premiumization to offset costs.

To get more Insights: Request Free Sample Report

Pet Food Market Dynamics

Premium Pet Food Trends and Health-Conscious Demand to Drive the Pet Food Market

Pet food industry is undergoing a premiumization wave as health conscious consumers increasingly seek high-quality nutrition for their pets. This trend is a growing by demand for organic, natural, and grain-free formulations, along with a functional food offering specific health benefits like digestive support and joint care.

Fresh, human-grade pet food delivered through a subscription service has emerged as a fast growing segment, with brands offering restaurant quality meals for pets. Also, market saw strong interest in high protein diets featuring novel protein sources and meat-first formulations. This shift reflects pet owners growing willingness to invest in premium nutrition, mirroring human food trends toward clean labels and functional ingredients. Premium pet food movement continues to evolve as manufacturers innovate to meet consumers demands for transparency and specialized nutrition.

FDA Warnings on Grain-Free Diets and Canine Heart Disease to Restrain the Pet Food Market

Pet food industry faces significant regulatory and safety concerns, mainly in a grain-free diet linked to canine heart disease (DCM) by FDA investigations. Strict global regulations govern labeling, ingredient sourcing, and nutritional adequacy are enforced by bodies like AAFCO and FEDIAF. Also, recent recalls highlight ongoing risks of contamination from salmonella, heavy metals, and toxins in a pet food formulations.

FDA's ongoing scrutiny of legume rich diets has raised a consumer awareness despite no definitive bans being implemented. Manufacturers must comply with a varying international standards, like EU's ban on artificial additives or China's pre-market safety reviews. These challenges underscore need for a transparent labeling and rigorous quality control in pet food production. Consumers are advised to verify compliance certifications and consult veterinarians when selecting specialized diets.

Rise of Personalized Pet Food and Specialty Veterinary Diets to Create Opportunities in the Pet Food Market

Personalized and vet-recommended pet nutrition segment is rapidly expanding by pet owners and increasingly seek tailored dietary solutions for their pets unique needs. Customized meal plans, formulated based on factors like a breed, age, weight, and specific health conditions (e.g., diabetes, kidney disease, or allergies), are gaining traction through also pet food brands offering DNA based diets or online quizzes to create bespoke formulas.

Prescription diets, like Hill Science Diet and Royal Canin Veterinary is dominate this space and providing clinically proven nutrition for pets with a medical issues, often sold exclusively through veterinarians. Telehealth platforms and pet nutrition apps are further promoting growth by its connecting owners with veterinary nutritionists for a remote consultation. This trend reflects broader humanization of pets, with owners willing to pay a premium price for specialized, science backed food. High costs and regulatory hurdles for prescription diets remain challenges. In pet healthcare advances, this segment is poised for significant innovation, including AI-driven meal planning and functional ingredient enhancements.

Pet Food Market Segment Analysis

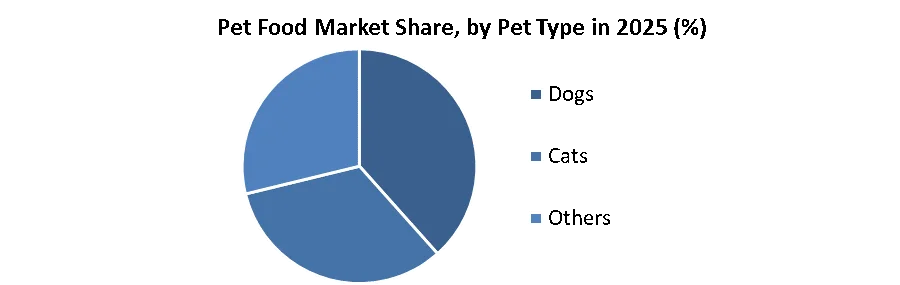

Based on pet type, Pet Food market is segmented in Dogs, Cats, Others. Dogs segment dominated the market in 2025 and is expected to hold the largest market share over the forecast period. Their leading position stems from higher global ownership rates compared to cats and other pets, mainly in Western households. Larger average size of dogs translates to greater food consumption per animal, side by side boosting a market volume. Dog owners demonstrate stronger willingness to purchase premium and specialized diets, including grain-free, high-protein, and functional nutrition options. Also, humanization trend is particularly pronounced with dogs and owners increasingly treating them like family members and investing in higher quality nutrition. While the cat food segment is growing steadily by its urban living trends. Dog food market continues to drive overall industry growth through its diverse product offerings and strong consumer spending habits.

Based on form, Pet Food market is segmented in Dry Pet Food, Wet Pet Food, Snacks & Treats, and others. Dry pet food segment dominated the market in 2025 and is expected to hold the largest market share over the forecast period. Its longer shelf life and lower cost make it most convenient and economical choice for pet owners. Crunchy texture helps in a maintaining dental health by reducing plaque buildup, which veterinarians often recommend. Dry kibble is easier to store and measure compared to wet alternatives, appealing to busy households. Also, manufacturers can incorporate a wider variety of functional ingredients into dry formulations, from probiotics to joint supplements. While wet food is growing in a popularity for its palatability and moisture content, and treats are expanding as an indulgence product, dry food remains the foundation of most pets diets. Segment dominance is further reinforced by its widespread availability across all retail channels and price points.

Pet Food Market Regional Analysis

North America Dominates Global Pet Food Market with Premium Trends & E-Commerce Surge

North America holds largest share of global pet food market, by several key factors. Mainly in U.S., where over 65% of households own pets. American consumers demonstrate a strong willingness to spend on premium pet nutrition, promoting growth in organic, grain-free, and functional food segments. Presence of major market players like Mars Petcare and Nestlé Purina strengthens the regions production and distribution capabilities. Also, North America's advanced retail infrastructure and booming e-commerce sector make pet food widely accessible. While Europe follows closely with growing demand for natural pet food, and Asia Pacific shows rapid growth, North America maintains its dominance through higher per-pet spending and earlier adoption of pet humanization trends.

Pet Food Market Competitive Landscape

Global pet food market is dominated by Mars Petcare (Royal Canin, Pedigree), Nestlé Purina (Purina ONE, Fancy Feast), Hill's Pet Nutrition (Science Diet), and J.M. Smucker (Rachel Ray Nutrish). Mars leads through premiumization (Royal Canin's breed-specific formulas) and veterinary channel dominance.

Nestlé Purina focuses on a mass market innovation with probiotic infused lines and sustainable packaging. Hill's leverages its science-backed prescription diets and veterinarian partnerships. Smucker capitalizes on celebrity-endorsed natural brands and affordable premium segments. These players are aggressively acquiring DTC startups (like Mars' investment in Nom Nom) while expanding into emerging markets and functional nutrition.

Recent Developments in the Pet Food Market

- In May 2025 Indian pet food startup Drools achieved unicorn status with a $1 billion valuation following a minority investment from Nestlé. Despite the investment, Drools will continue to operate independently

- In January 2024, Blue Buffalo’s General Mills brand released the first vet-prescribed food clinically proven to support dogs undergoing cancer treatment.

- In March 2024, Nestlé Purina opened a U.S. factory dedicated to plant-based and sustainable pet food, responding to demand for alternative proteins.

- In October 16, 2024, Hill’s Pet Nutrition, a division of Colgate-Palmolive, opened a new 365,000-square-foot smart manufacturing facility in Tonganoxie, Kansas. The plant features advanced automation and AI-driven food safety systems to produce over 170 wet pet food formulas

|

Pet Food Market Scope |

|

|

Market Size in 2025 |

USD 134.49 Bn. |

|

Market Size in 2032 |

USD 200.89 Bn. |

|

CAGR (2026-2032) |

5.9% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments

|

By Pet Type Dogs Cats Others |

|

By Form Dry Pet Food Wet Pet Food Snacks & Treats Others |

|

|

By Distribution Channel Supermarket/Hypermarket Specialty Stores Online Channel Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Pet Food Market

North America

- Mars Petcare (USA)

- Nestlé Purina (USA)

- Hill’s Pet Nutrition (USA)

- J.M. Smucker (USA)

- Blue Buffalo (USA)

- Diamond Pet Foods (USA)

- Champion Petfoods (Canada)

Europe

- Virbac (France)

- Bosch Tiernahrung (Germany)

- Butternut Box (UK)

- Monge & C. (Italy)

- Yarrah (Netherlands)

- Nordic Naturals (Denmark)

Asia-Pacific

- Unicharm (Japan)

- Wanpy (China)

- Perfect Companion Group (Thailand)

- Real Pet Food Co. (Australia)

- Drools (India)

- Daehan Feed Co. (South Korea)

Middle East & Africa

- Al Sadiq Pet Food (UAE)

- Montego Pet Nutrition (South Africa)

South America

- Total Alimentos (Brazil)

- Vitalcan (Argentina)

- PetFood Ltda. (Chile)

- Concentrados Bolívar (Colombia)

- Rinti (Peru)

Frequently Asked Questions

North America due to high pet ownership and premium product adoption.

Dogs due to higher ownership rates and food consumption.

Dry food (cost-effective, dental benefits), though wet food and treats are growing.

Mars, Nestlé Purina, Hill’s, J.M. Smucker, focusing on acquisitions, vet partnerships, and sustainability.

1. Pet Food Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Pet Food Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2025)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Pet Food Market: Dynamics

3.1. Pet Food Market Trends

3.2. Pet Food Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis For the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Pet Food Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

4.1. Pet Food Market Size and Forecast, By Pet Type (2025-2032)

4.1.1. Dogs

4.1.2. Cats

4.1.3. Others

4.2. Pet Food Market Size and Forecast, By Form (2025-2032)

4.2.1. Dry Pet Food

4.2.2. Wet Pet Food

4.2.3. Snacks & Treats

4.2.4. Others

4.3. Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

4.3.1. Supermarket/Hypermarket

4.3.2. Specialty Stores

4.3.3. Online Channel

4.3.4. Others

4.4. Pet Food Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Pet Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

5.1. North America Pet Food Market Size and Forecast, By Pet Type (2025-2032)

5.1.1. Dogs

5.1.2. Cats

5.1.3. Others

5.2. North America Pet Food Market Size and Forecast, By Form (2025-2032)

5.2.1. Dry Pet Food

5.2.2. Wet Pet Food

5.2.3. Snacks & Treats

5.2.4. Others

5.3. North America Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

5.3.1. Supermarket/Hypermarket

5.3.2. Specialty Stores

5.3.3. Online Channel

5.3.4. Others

5.4. North America Pet Food Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Pet Food Market Size and Forecast, By Pet Type (2025-2032)

5.4.1.1.1. Dogs

5.4.1.1.2. Cats

5.4.1.1.3. Others

5.4.1.2. United States Pet Food Market Size and Forecast, By Form (2025-2032)

5.4.1.2.1. Dry Pet Food

5.4.1.2.2. Wet Pet Food

5.4.1.2.3. Snacks & Treats

5.4.1.2.4. Others

5.4.1.3. United States Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.1.3.1. Supermarket/Hypermarket

5.4.1.3.2. Specialty Stores

5.4.1.3.3. Online Channel

5.4.1.3.4. Others

5.4.2. Canada

5.4.2.1. Canada Pet Food Market Size and Forecast, By Pet Type (2025-2032)

5.4.2.1.1. Dogs

5.4.2.1.2. Cats

5.4.2.1.3. Others

5.4.2.2. Canada Pet Food Market Size and Forecast, By Form (2025-2032)

5.4.2.2.1. Dry Pet Food

5.4.2.2.2. Wet Pet Food

5.4.2.2.3. Snacks & Treats

5.4.2.2.4. Others

5.4.2.3. Canada Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.2.3.1. Supermarket/Hypermarket

5.4.2.3.2. Specialty Stores

5.4.2.3.3. Online Channel

5.4.2.3.4. Others

5.4.3. Mexico

5.4.3.1. Mexico Pet Food Market Size and Forecast, By Pet Type (2025-2032)

5.4.3.1.1. Dogs

5.4.3.1.2. Cats

5.4.3.1.3. Others

5.4.3.2. Mexico Pet Food Market Size and Forecast, By Form (2025-2032)

5.4.3.2.1. Dry Pet Food

5.4.3.2.2. Wet Pet Food

5.4.3.2.3. Snacks & Treats

5.4.3.2.4. Others

5.4.3.3. Mexico Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.3.3.1. Supermarket/Hypermarket

5.4.3.3.2. Specialty Stores

5.4.3.3.3. Online Channel

5.4.3.3.4. Others

6. Europe Pet Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

6.1. Europe Pet Food Market Size and Forecast, By Pet Type (2025-2032)

6.2. Europe Pet Food Market Size and Forecast, By Form (2025-2032)

6.3. Europe Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

6.4. Europe Pet Food Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Pet Food Market Size and Forecast, By Pet Type (2025-2032)

6.4.1.2. United Kingdom Pet Food Market Size and Forecast, By Form (2025-2032)

6.4.1.3. United Kingdom Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.2. France

6.4.2.1. France Pet Food Market Size and Forecast, By Pet Type (2025-2032)

6.4.2.2. France Pet Food Market Size and Forecast, By Form (2025-2032)

6.4.2.3. France Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Pet Food Market Size and Forecast, By Pet Type (2025-2032)

6.4.3.2. Germany Pet Food Market Size and Forecast, By Form (2025-2032)

6.4.3.3. Germany Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Pet Food Market Size and Forecast, By Pet Type (2025-2032)

6.4.4.2. Italy Pet Food Market Size and Forecast, By Form (2025-2032)

6.4.4.3. Italy Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Pet Food Market Size and Forecast, By Pet Type (2025-2032)

6.4.5.2. Spain Pet Food Market Size and Forecast, By Form (2025-2032)

6.4.5.3. Spain Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Pet Food Market Size and Forecast, By Pet Type (2025-2032)

6.4.6.2. Sweden Pet Food Market Size and Forecast, By Form (2025-2032)

6.4.6.3. Sweden Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.7. Russia

6.4.7.1. Russia Pet Food Market Size and Forecast, By Pet Type (2025-2032)

6.4.7.2. Russia Pet Food Market Size and Forecast, By Form (2025-2032)

6.4.7.3. Russia Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Pet Food Market Size and Forecast, By Pet Type (2025-2032)

6.4.8.2. Rest of Europe Pet Food Market Size and Forecast, By Form (2025-2032)

6.4.8.3. Rest of Europe Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7. Asia Pacific Pet Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032)

7.1. Asia Pacific Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.2. Asia Pacific Pet Food Market Size and Forecast, By Form (2025-2032)

7.3. Asia Pacific Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4. Asia Pacific Pet Food Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.1.2. China Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.1.3. China Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.2.2. S Korea Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.2.3. S Korea Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.3.2. Japan Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.3.3. Japan Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.4. India

7.4.4.1. India Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.4.2. India Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.4.3. India Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.5.2. Australia Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.5.3. Australia Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.6.2. Indonesia Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.6.3. Indonesia Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.7.2. Malaysia Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.7.3. Malaysia Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.8. Philippines

7.4.8.1. Philippines Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.8.2. Philippines Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.8.3. Philippines Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.9. Thailand

7.4.9.1. Thailand Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.9.2. Thailand Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.9.3. Thailand Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.10.2. Vietnam Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.10.3. Vietnam Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Pet Food Market Size and Forecast, By Pet Type (2025-2032)

7.4.11.2. Rest of Asia Pacific Pet Food Market Size and Forecast, By Form (2025-2032)

7.4.11.3. Rest of Asia Pacific Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

8. Middle East and Africa Pet Food Market Size and Forecast (by Value in USD Billion) (2025-2032

8.1. Middle East and Africa Pet Food Market Size and Forecast, By Pet Type (2025-2032)

8.2. Middle East and Africa Pet Food Market Size and Forecast, By Form (2025-2032)

8.3. Middle East and Africa Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

8.4. Middle East and Africa Pet Food Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Pet Food Market Size and Forecast, By Pet Type (2025-2032)

8.4.1.2. South Africa Pet Food Market Size and Forecast, By Form (2025-2032)

8.4.1.3. South Africa Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Pet Food Market Size and Forecast, By Pet Type (2025-2032)

8.4.2.2. GCC Pet Food Market Size and Forecast, By Form (2025-2032)

8.4.2.3. GCC Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.3. Egypt

8.4.3.1. Egypt Pet Food Market Size and Forecast, By Pet Type (2025-2032)

8.4.3.2. Egypt Pet Food Market Size and Forecast, By Form (2025-2032)

8.4.3.3. Egypt Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Pet Food Market Size and Forecast, By Pet Type (2025-2032)

8.4.4.2. Nigeria Pet Food Market Size and Forecast, By Form (2025-2032)

8.4.4.3. Nigeria Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Pet Food Market Size and Forecast, By Pet Type (2025-2032)

8.4.5.2. Rest of ME&A Pet Food Market Size and Forecast, By Form (2025-2032)

8.4.5.3. Rest of ME&A Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

9. South America Pet Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032

9.1. South America Pet Food Market Size and Forecast, By Pet Type (2025-2032)

9.2. South America Pet Food Market Size and Forecast, By Form (2025-2032)

9.3. South America Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

9.4. South America Pet Food Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Pet Food Market Size and Forecast, By Pet Type (2025-2032)

9.4.1.2. Brazil Pet Food Market Size and Forecast, By Form (2025-2032)

9.4.1.3. Brazil Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Pet Food Market Size and Forecast, By Pet Type (2025-2032)

9.4.2.2. Argentina Pet Food Market Size and Forecast, By Form (2025-2032)

9.4.2.3. Argentina Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

9.4.3. Colombia

9.4.3.1. Colombia Pet Food Market Size and Forecast, By Pet Type (2025-2032)

9.4.3.2. Colombia Pet Food Market Size and Forecast, By Form (2025-2032)

9.4.3.3. Colombia Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

9.4.4. Chile

9.4.4.1. Chile Pet Food Market Size and Forecast, By Pet Type (2025-2032)

9.4.4.2. Chile Pet Food Market Size and Forecast, By Form (2025-2032)

9.4.4.3. Chile Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Pet Food Market Size and Forecast, By Pet Type (2025-2032)

9.4.5.2. Rest Of South America Pet Food Market Size and Forecast, By Form (2025-2032)

9.4.5.3. Rest Of South America Pet Food Market Size and Forecast, By Distribution Channel (2025-2032)

10. Company Profile: Key Players

10.1. Mars Petcare (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Nestlé Purina (USA)

10.3. Hill’s Pet Nutrition (USA)

10.4. J.M. Smucker (USA)

10.5. Blue Buffalo (USA)

10.6. Diamond Pet Foods (USA)

10.7. Champion Petfoods (Canada)

10.8. Virbac (France)

10.9. Bosch Tiernahrung (Germany)

10.10. Butternut Box (UK)

10.11. Monge & C. (Italy)

10.12. Yarrah (Netherlands)

10.13. Nordic Naturals (Denmark)

10.14. Unicharm (Japan)

10.15. Wanpy (China)

10.16. Perfect Companion Group (Thailand)

10.17. Real Pet Food Co. (Australia)

10.18. Drools (India)

10.19. Daehan Feed Co. (South Korea)

10.20. Al Sadiq Pet Food (UAE)

10.21. Montego Pet Nutrition (South Africa)

10.22. Total Alimentos (Brazil)

10.23. Vitalcan (Argentina)

10.24. PetFood Ltda. (Chile)

10.25. Concentrados Bolívar (Colombia)

10.26. Rinti (Peru)

11. Key Findings

12. Industry Recommendations

13. Pet Food Market: Research Methodology