Biosimilar Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

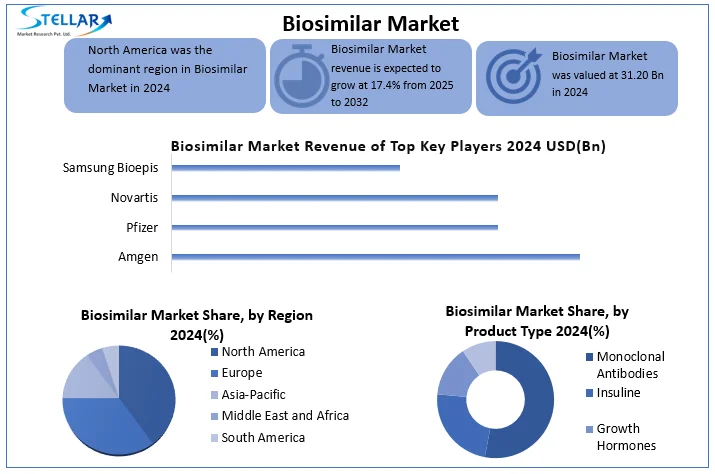

Biosimilar Market was estimated at USD 31.20 Bn in 2024 and is expected to grow at a CAGR of 17.4% from 2025 to 2032, reaching nearly USD 112.59 Bn by 2032.

Format : PDF | Report ID : SMR_2759

Biosimilar Market Overview:

A biosimilar is a biological medicine that is highly similar to another biological medicine already approved, called the reference medicine. The biosimilar market is growing fast. One big reason is that people want cheaper options instead of expensive biologic drugs. Many of the original drugs are losing their patents, and rules are becoming more supportive, so it’s easier for biosimilars to enter the market. Biosimilars usually cost 15–30% less than the original drugs. This helps save money and makes treatment more available to more people. In that market top key players are Amgen, Pfizer, Novartis which have invested heavy in biology manufacturing and regulatory expertise. Regionally, North America dominated the market, and this trend is expected to continue during the forecast period. The global biosimilar manufacturing exports in India and South Korea was more than 25% of manufacturing exports. Disruption caused by business restrictions or tariff growth limits the delay launch and eventually the patient's access to life-saving biology.

To get more Insights: Request Free Sample Report

Biosimilar Market Dynamics

Patent Expiration to Fuel the Biosimilar Market Growth

As biologic patents are finished, they create large-scale opportunities for biosimilar manufacturers to enter the market with low-cost options. Biologics of more than USD 100 billion in annual global sales are expected to lose uniqueness. It contains drugs such as Ustekinumab, Pembrolizumab, and Adalimumab. As of April 2023, around 60–70 biosimilar pipeline studies are expected to be half-launched in the next three to four years, which is expanding the market. These expiration price opens the door for competition, rapid market entry by biosimilar developers, and significant cost saving for healthcare systems. For example, the European market saw up to 80% price reductions in some therapeutic categories following biosimilar entry.

The Market Faces Restraints Related to Complexity in Manufacturing

One of the most important restrictions in the biosimilar market is the underlying complexity of manufacturing. Unlike generic drugs, which are chemically synthesized and are relatively simple to repeat, biosimilars are large, live-molecular remedies that require complex biological processes to produce. The manufacturing process includes complex stages using the ownership cell lines and procedures owned by the original manufacturers. For new entry, the cost can be from USD 100–250 million, including the construction of large-scale production features. To install such facilities, it can take five to seven years with different costs depending on the location.

Expansion of Biosimilars into Emerging Markets to create opportunity for Biosimilar Market

Extension of biosimilar in emerging markets, where the demand for inexpensive biological remedies is increasing rapidly. Many low and moderate-income countries are face limited access to promoter biologics due to high costs, requiring adequate non-medical. These nations like Latin America, Southeast Asia, Middle East, and Africa are beginning to increase spending on healthcare. Most of his administrations are implementing universal health coverage, and this involves introducing low-cost biosimilars in their public health systems. Moreover, big pharma companies cooperate with local manufacturers closely. Such engagement assists in lowering the cost of production, making drugs of good quality, and facilitating more local supply control.

Biosimilar Market Segment Analysis:

Based on product type, the biosimilar market is segmented into monoclonal antibodies, insulin, growth hormones, and others. The monoclonal antibodies segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). Monoclonal antibodies show largest and most commercially attractive segments of in a global biosimilars market. Oncology, autoimmune diseases and inflammatory conditions continue to promote demand for their comprehensive application. This biologic therapy targets specific antigens, offer high efficacy, but their cost becomes a significant burden after the original patent ends. Creates strong incentives for biosimilar growth to improve access to and reduce a healthcare expenses. Prominent biosimilar monoclonal antibodies include Adalimumab, Trastuzumab, and Bevacizumab.

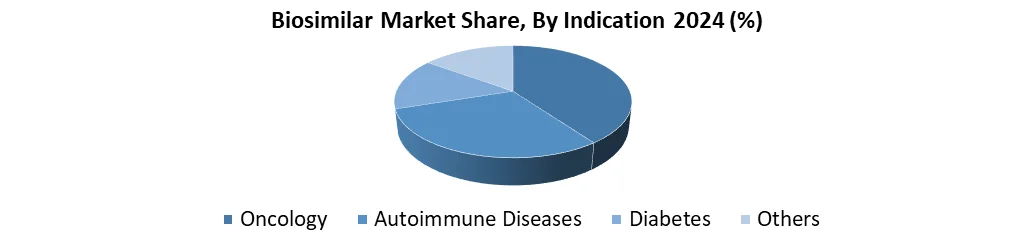

Based on Indication, the biosimilar market is segmented into oncology, autoimmune diseases, diabetes, and others. The oncology segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). by its availability of biosimilars at a lower price compared to new biologics, and a large number of cancer patients. Biologics are used in cancer treatment is a one of most expensive drugs on the market. Also, which creates an important strategy to reduce cost to maintain the access of biosimilar for life saving treatments by its high proliferation of cancer, healthcare system worldwide is focusing on reducing cancer burden by adopting cost effective treatment options worldwide. In this scenario, biosimilar drugs are widely adopted in major markets like US, Europe and Asia Pacific.

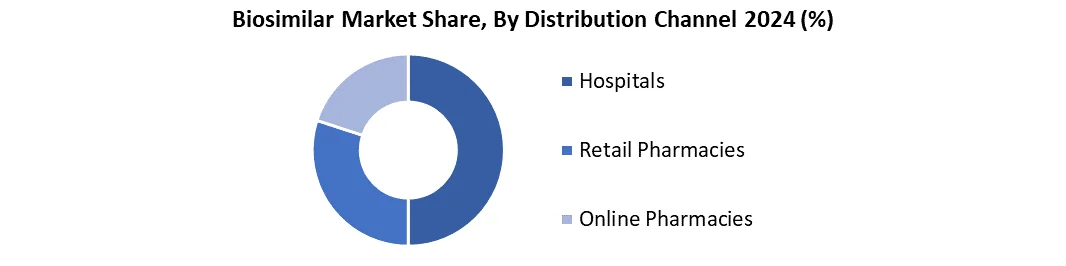

Based on distribution channel, the biosimilar market is segmented into hospitals, retail pharmacies, and online pharmacies. The hospitals segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2024-2032). It is largely caused by nature of most biosimilars, an injection or intravenous biology is used for complex conditions like a cancer, autoimmune diseases, and hematic disorders, mainly administered in inpatient or outpatient hospital settings. In many countries, especially in Europe and emerging markets, hospitals are the focal point of tender-based procurement systems, where the suppliers are provided with large-trunk biosimilar contracts to suppliers through centralized procurement by governments or health officials.

Biosimilar Market Regional Analysis:

The North America region dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032).

North America and especially the United States, are undergoing a transformative phase in the biosimilars market. Historically, the American market withdraws from Europe due to a combination of factors, including long-term patent cases, regulatory complications, and a cautious approach among prescribers. The oncology and immunology segments will run most of this development, with the growing biosimilar launch, it is planned for drugs such as Trastuzumab, Rituximab, and adalimumab. pharmacy and hospital infusion centers are the major distribution channels supporting this expansion.

Biosimilar Market Competitive Landscape

The biosimilar market is highly competitive and dominates a mixture of large pharmaceutical corporations and special biotech firms, which have invested heavy in biology manufacturing and regulatory expertise. Global Leaders, a division of Sandoze, Novartis, stands as a prominent player, including a large biosimilar portfolio, including Filgrastim, Epotin Alpha, Trastuzumab, and Rituximab Biosimilars. Sandoze has a strong presence in Europe and is rapidly expanding in North America and Asia-Pacific with partnerships and licensing deals to broaden its global access.

|

Biosimilar Market Scope |

|

|

Market Size in 2024 |

USD 31.20 Bn |

|

Market Size in 2032 |

USD 112.59 Bn |

|

CAGR (2025-2032) |

17.4% |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Segments |

By Product Type Monoclonal Antibodies Insulin Growth Hormones Others |

|

By Indication Oncology Autoimmune diseases Diabetes Others |

|

|

By Distribution Channel Hospitals Retail Pharmacies Online Pharmacies |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Biosimilar Market

North America

- Amgen (United States)

- Pfizer (United States)

- Biogen (United States)

- Coherus Biosciences (United States)

- Sorrento Therapeutics (United States)

- Momenta Pharmaceuticals (United States)

Europe

- Sandoz (Switzerland)

- STADA Arzneimittel (Germany)

- Fresenius Kabi (Germany)

- BioNTech (Germany)

- Novartis (Switzerland)

Asia-Pacific

- Celltrion (South Korea)

- Samsung Bioepis (South Korea)

- Biocon Biologics (India)

- Intas Pharmaceuticals (India)

- Lupin Biologics (India)

- Dr. Reddy's Laboratories (India)

- Zhejiang Hisun Pharmaceuticals (China)

- Innovent Biologics (China)

South America

- Libbs Farmacêutica (Brazil)

- EMS Pharma (Brazil)

- Biotoscana (Argentina)

- Hypera Pharma (Brazil)

- Laboratorios Bagó (Argentina)

Middle East & Africa

- Julphar (United Arab Emirates)

- Adcock Ingram (South Africa)

- Biovac Institute (South Africa)

- Pharco Pharmaceuticals (Egypt)

- Aspen Pharmacare (South Africa)

Frequently Asked Questions

Patent Expiration is the key factor driving the growth of the biosimilar market.

Sandoz, Pfizer, and Novartis are the key competitors of the biosimilar market.

Expansion of Biosimilars into Emerging Markets is an opportunity for the Biosimilar Market

The Monoclonal Antibodies segment dominated the biosimilar market.

1. Biosimilar Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Biosimilar Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. Distribution Channel Segment

2.3.4. Revenue (2024)

2.4. Leading Biosimilar Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Biosimilar Market: Dynamics

3.1. Biosimilar Market Trends by Region

3.1.1. North America Biosimilar Market Trends

3.1.2. Europe Biosimilar Market Trends

3.1.3. Asia Pacific Biosimilar Market Trends

3.1.4. Middle East & Africa Biosimilar Market Trends

3.1.5. South America Biosimilar Market Trends

3.2. Biosimilar Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

4. Biosimilar Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

4.1. Biosimilar Market Size and Forecast, By Product Type (2024-2032)

4.1.1. Monoclonal Antibodies

4.1.2. Insulin

4.1.3. Growth Hormones

4.1.4. Others

4.2. Biosimilar Market Size and Forecast, By Indication (2024-2032)

4.2.1. Oncology

4.2.2. Autoimmune Diseases

4.2.3. Diabetes

4.2.4. Others

4.3. Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

4.3.1. Hospitals

4.3.2. Retail Pharmacies

4.3.3. Online Pharmacies

4.4. Biosimilar Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Biosimilar Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

5.1. North America Biosimilar Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Monoclonal Antibodies

5.1.2. Insulin

5.1.3. Growth Hormones

5.1.4. Others

5.2. North America Biosimilar Market Size and Forecast, By Indication (2024-2032)

5.2.1. Oncology

5.2.2. Autoimmune Diseases

5.2.3. Diabetes

5.2.4. Others

5.3. North America Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Hospitals

5.3.2. Retail Pharmacies

5.3.3. Online Pharmacies

5.4. North America Biosimilar Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Biosimilar Market Size and Forecast, By Product Type (2024-2032)

5.4.1.1.1. Monoclonal Antibodies

5.4.1.1.2. Insulin

5.4.1.1.3. Growth Hormones

5.4.1.1.4. Others

5.4.1.2. United States Biosimilar Market Size and Forecast, By Indication (2024-2032)

5.4.1.2.1. Oncology

5.4.1.2.2. Autoimmune Diseases

5.4.1.2.3. Diabetes

5.4.1.2.4. Others

5.4.1.3. United States Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1.3.1. Hospitals

5.4.1.3.2. Retail Pharmacies

5.4.1.3.3. Online Pharmacies

5.4.2. Canada

5.4.2.1. Canada Biosimilar Market Size and Forecast, By Product Type (2024-2032)

5.4.2.1.1. Monoclonal Antibodies

5.4.2.1.2. Insulin

5.4.2.1.3. Growth Hormones

5.4.2.1.4. Others

5.4.2.2. Canada Biosimilar Market Size and Forecast, By Indication (2024-2032)

5.4.2.2.1. Oncology

5.4.2.2.2. Autoimmune Diseases

5.4.2.2.3. Diabetes

5.4.2.2.4. Others

5.4.2.3. Canada Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.2.3.1. Hospitals

5.4.2.3.2. Retail Pharmacies

5.4.2.3.3. Online Pharmacies

5.4.3. Mexico

5.4.3.1. Mexico Biosimilar Market Size and Forecast, By Product Type (2024-2032)

5.4.3.1.1. Monoclonal Antibodies

5.4.3.1.2. Insulin

5.4.3.1.3. Growth Hormones

5.4.3.1.4. Others

5.4.3.2. Mexico Biosimilar Market Size and Forecast, By Indication (2024-2032)

5.4.3.2.1. Oncology

5.4.3.2.2. Autoimmune Diseases

5.4.3.2.3. Diabetes

5.4.3.2.4. Others

5.4.3.3. Mexico Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.3.3.1. Hospitals

5.4.3.3.2. Retail Pharmacies

5.4.3.3.3. Online Pharmacies

6. Europe Biosimilar Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

6.1. Europe Biosimilar Market Size and Forecast, By Product Type (2024-2032)

6.2. Europe Biosimilar Market Size and Forecast, By Indication (2024-2032)

6.3. Europe Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

6.4. Europe Biosimilar Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Biosimilar Market Size and Forecast, By Product Type (2024-2032)

6.4.1.2. United Kingdom Biosimilar Market Size and Forecast, By Indication (2024-2032)

6.4.1.3. United Kingdom Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.2. France

6.4.2.1. France Biosimilar Market Size and Forecast, By Product Type (2024-2032)

6.4.2.2. France Biosimilar Market Size and Forecast, By Indication (2024-2032)

6.4.2.3. France Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Biosimilar Market Size and Forecast, By Product Type (2024-2032)

6.4.3.2. Germany Biosimilar Market Size and Forecast, By Indication (2024-2032)

6.4.3.3. Germany Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Biosimilar Market Size and Forecast, By Product Type (2024-2032)

6.4.4.2. Italy Biosimilar Market Size and Forecast, By Indication (2024-2032)

6.4.4.3. Italy Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Biosimilar Market Size and Forecast, By Product Type (2024-2032)

6.4.5.2. Spain Biosimilar Market Size and Forecast, By Indication (2024-2032)

6.4.5.3. Spain Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Biosimilar Market Size and Forecast, By Product Type (2024-2032)

6.4.6.2. Sweden Biosimilar Market Size and Forecast, By Indication (2024-2032)

6.4.6.3. Sweden Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Biosimilar Market Size and Forecast, By Product Type (2024-2032)

6.4.7.2. Austria Biosimilar Market Size and Forecast, By Indication (2024-2032)

6.4.7.3. Austria Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Biosimilar Market Size and Forecast, By Product Type (2024-2032)

6.4.8.2. Rest of Europe Biosimilar Market Size and Forecast, By Indication (2024-2032)

6.4.8.3. Rest of Europe Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7. Asia Pacific Biosimilar Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

7.1. Asia Pacific Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.2. Asia Pacific Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.3. Asia Pacific Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4. Asia Pacific Biosimilar Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.1.2. China Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.1.3. China Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.2.2. S Korea Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.2.3. S Korea Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.3.2. Japan Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.3.3. Japan Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.4. India

7.4.4.1. India Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.4.2. India Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.4.3. India Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.5.2. Australia Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.5.3. Australia Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.6.2. Indonesia Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.6.3. Indonesia Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.7.2. Philippines Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.7.3. Philippines Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.8.2. Malaysia Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.8.3. Malaysia Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.9.2. Vietnam Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.9.3. Vietnam Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.10.2. Thailand Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.10.3. Thailand Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.11. ASEAN

7.4.11.1. ASEAN Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.11.2. ASEAN Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.11.3. ASEAN Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

7.4.12. Rest of Asia Pacific

7.4.12.1. Rest of Asia Pacific Biosimilar Market Size and Forecast, By Product Type (2024-2032)

7.4.12.2. Rest of Asia Pacific Biosimilar Market Size and Forecast, By Indication (2024-2032)

7.4.12.3. Rest of Asia Pacific Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

8. Middle East and Africa Biosimilar Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

8.1. Middle East and Africa Biosimilar Market Size and Forecast, By Product Type (2024-2032)

8.2. Middle East and Africa Biosimilar Market Size and Forecast, By Indication Model (2024-2032)

8.3. Middle East and Africa Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

8.4. Middle East and Africa Biosimilar Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Biosimilar Market Size and Forecast, By Product Type (2024-2032)

8.4.1.2. South Africa Biosimilar Market Size and Forecast, By Indication Model (2024-2032)

8.4.1.3. South Africa Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Biosimilar Market Size and Forecast, By Product Type (2024-2032)

8.4.2.2. GCC Biosimilar Market Size and Forecast, By Indication Model (2024-2032)

8.4.2.3. GCC Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Biosimilar Market Size and Forecast, By Product Type (2024-2032)

8.4.3.2. Nigeria Biosimilar Market Size and Forecast, By Indication Model (2024-2032)

8.4.3.3. Nigeria Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Biosimilar Market Size and Forecast, By Product Type (2024-2032)

8.4.4.2. Rest of ME&A Biosimilar Market Size and Forecast, By Indication Model (2024-2032)

8.4.4.3. Rest of ME&A Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

9. South America Biosimilar Market Size and Forecast by Segmentation (by Value USD Bn.) (2024-2032)

9.1. South America Biosimilar Market Size and Forecast, By Product Type (2024-2032)

9.2. South America Biosimilar Market Size and Forecast, By Indication (2024-2032)

9.3. South America Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

9.4. South America Biosimilar Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Biosimilar Market Size and Forecast, By Product Type (2024-2032)

9.4.1.2. Brazil Biosimilar Market Size and Forecast, By Indication (2024-2032)

9.4.1.3. Brazil Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Biosimilar Market Size and Forecast, By Product Type (2024-2032)

9.4.2.2. Argentina Biosimilar Market Size and Forecast, By Indication (2024-2032)

9.4.2.3. Argentina Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Biosimilar Market Size and Forecast, By Product Type (2024-2032)

9.4.3.2. Rest Of South America Biosimilar Market Size and Forecast, By Indication (2024-2032)

9.4.3.3. Rest Of South America Biosimilar Market Size and Forecast, By Distribution Channel (2024-2032)

10. Company Profile: Key Players

10.1 Amgen (United States)

10.1.1 Company Overview

10.1.2 Business Portfolio

10.1.3 Financial Overview

10.1.4 SWOT Analysis

10.1.5 Strategic Analysis

10.1.6 Recent Development

10.2 Pfizer (United States)

10.3 Biogen (United States)

10.4 Coherus Biosciences (United States)

10.5 Sorrento Therapeutics (United States)

10.6 Momenta Pharmaceuticals (United States)

10.7 Sandoz (Switzerland)

10.8 STADA Arzneimittel (Germany)

10.9 Fresenius Kabi (Germany)

10.10 BioNTech (Germany)

10.11 Novartis (Switzerland)

10.12 Celltrion (South Korea)

10.13 Samsung Bioepis (South Korea)

10.14 Biocon Biologics (India)

10.15 Intas Pharmaceuticals (India)

10.16 Lupin Biologics (India)

10.17 Dr. Reddy's Laboratories (India)

10.18 Zhejiang Hisun Pharmaceuticals (China)

10.19 Innovent Biologics (China)

10.20 Libbs Farmacêutica (Brazil)

10.21 EMS Pharma (Brazil)

10.22 Biotoscana (Argentina)

10.23 Hypera Pharma (Brazil)

10.24 Laboratorios Bagó (Argentina)

10.25 Julphar (United Arab Emirates)

10.26 Adcock Ingram (South Africa)

10.27 Biovac Institute (South Africa)

10.28 Pharco Pharmaceuticals (Egypt)

10.29 Aspen Pharmacare (South Africa)

11. Key Findings & Analyst Recommendations

12. Biosimilar Markets: Research Methodology