Warehouse Automation Market Global Industry Analysis and Forecast (2026-2032) Trends, Statistics, Dynamics, Segmentation by Type, Technology, Application and Region

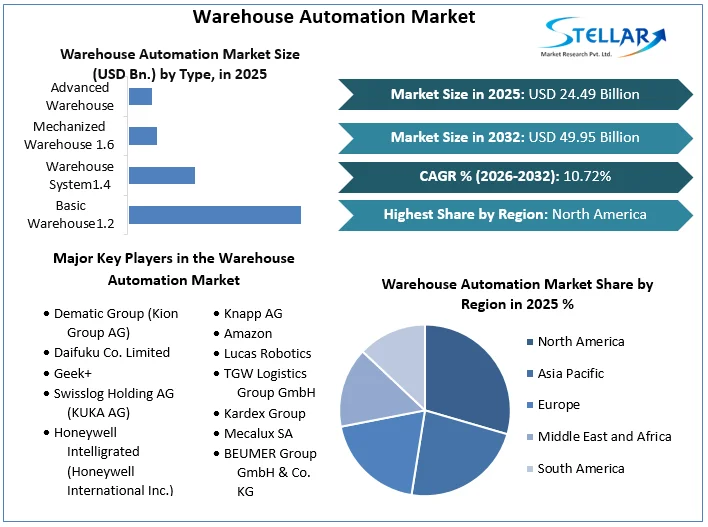

Global Warehouse Automation Market was valued nearly US$ 24.49 Bn. in 2025. Global Warehouse Automation Market size is estimated to grow at a CAGR of 10.72 % and is expected to reach at US$ 49.95 Bn. by 2032.

Format : PDF | Report ID : SMR_157

Warehouse Automation Market Overview & Dynamics:

In 2020, COVID-19 amplified both labour shortages and the pressure on global logistics networks, driving even more investment into Warehouse Automation Market. As per the study estimations that post-COVID-19, warehouse automation is projected to attract nearly 15% more investment in the next 4-5 years than previously foreseen.

To get more Insights: Request Free Sample Report

Warehouse automation is the process of restructuring business warehouse business operations with automated technology. Warehouse automation offers various growth opportunities to the companies as they reap benefits such as helpful fluctuating demand faster, bringing supply chain visibility, improving operation efficiency, and others.

Looking forward, the Warehouse Automation Market is projected to reach a value of US$ 30.05 Bn. by 2026, expanding at a CAGR of around 10.72% during 2021-2026. Warehouses are experiencing a continuous rise in investment, driven by growing levels of automation within the warehouse also the integration of supply chains. The new entrance is providing advanced solutions at best value thereby disrupting the well-known players. Nevertheless, the pandemic & the post-pandemic world has offered growth opportunities to the developing as well as established players.

Warehouse Automation Trends for 2022 and Beyond:

- Heightened Use of Robots- Robots have considerably taken up notable functions in warehouses across the globe. It’s expected that by the end of the year 2025, robotic warehouses should be nearby 50,000, and robot installations above 4 million.

- Demand for the Internet of Things (IoT) to Remain High- the IoT is fuelling current warehouse automation trends. It’s aiding transform the modern warehouse into a connected & coordinated unit. The improved IoT sensors and reduced costs are expected to increase the popularity of IoT in warehouses in 2023. The IoT permits you to connect & monitor your warehouse robots, pallets, drones, equipment, inventory and beacons. It also allows you to supervise your employees remotely in real-time.

- Rapid Growth of the Cloud Based Software: Cloud-based software has become progressively popular among logistics companies. To Modula.us proposals modern warehouse software solutions that have become gradually popular among logistics corporations.

E-Commerce Fulfilment Driving Up Demand for Warehouse Automation in Robotics:

The E-commerce application segment of the Warehouse Automation Market is expected to grow at the highest CAGR of 12.5% over 2024-2030 followed by Grocery. E-Commerce and Grocery will have the major demand for warehouse automation equipment, rising in high double digits over 2026. The growth of e-commerce is also driving the demand for automation solutions from major economies such as Central & Eastern Europe, India, Indonesia, and South America, where historically there is a very low penetration of such solutions. In developing economies, there is a high demand for modern warehouse space

Warehouse Automation Robot Companies in Picking Solutions:

|

Company |

Country |

Solution |

|

Function |

|

Amazon |

U.S. |

Kiva |

|

AGV |

|

Swisslog |

Germany |

AutoStore |

|

AS/RS |

|

Locus Robotics |

U.S. |

LocusBot |

|

AGV |

|

IAM Robotics |

U.S. |

Swift |

|

Picking / AGV |

Rapid Growth of the Autonomous Mobile Robots (AMRs) to Propel Market Growth:

Autonomous Mobile Robots (AMRs) offers new opportunities for inventory monitoring. When mutual with RFID-tagged products & equipment, these machines can now conduct their register sweeps autonomously at plans determined by the warehouse. The adoption of AMRs, technology that eliminates major non-productive walking time in warehouses, has advanced from early-stage pilots about 4 years ago to many at-scale deployments today. Such as, DHL rolled out 1000 Locus Robotics AMRs and will install up to 2,000 robots by 2022.

North America to Retain Lead through 2026:

North America region holds the largest XX% share in the Warehouse Automation Market across the world followed by APAC and Europe. The growth in e-commerce is the primary reason for growing robots in warehouses and distribution centres in the U.S. Furthermore, advancements in technology that have made robots better & smaller, lower costs, and a shortage of labour in some places further aiding the North American market to grow.

The key companies with various warehouses & distribution units are using acquisition strategies to reduce the labour cost and increase their profitability. Such as, in 2023, Amazon has installed above 200,000 mobile robots that work inside its warehouse network, beside hundreds of thousands of human workers in the U.S. This robot army has assisted the company fulfil its ever-increasing abilities of speedy deliveries to Amazon Prime customers.

Industry Developments:

Many start-ups have come up to develop solutions for robotic for warehousing & retail sectors and nowadays witnessing a huge explosion of different mobile robotic systems with many degrees of autonomy. The sector is still in its start, with competitors ranging from established players like Swisslog, a subsidiary of KUKA, Adept, also lately acquired by Omron of Japan, to a multitude of startups for instance Fetch Robotics in the US, MiR (Mobile Industrial Robots) in Denmark.

In recent years, major players in the Global Warehouse Automation Market have taken several strategic measures, for example facility expansions and partnerships:

- In 2021, Geek+ has launched a new solution for smart varied case palletizing. That promises to help warehouse operators systematically handle outbound orders in combination with autonomous mobile robots. The new process promises to streamline outbound distributions with a higher safety, efficiency, and flexibility.

- In 2021, Lucas Robotics announced that the company higher another US$150 Mn funding in series E, to take the valuation of the company near US$ 1 Bn. Its new investors contain Tiger Global Management, BOND, and its earlier investors include Prologis Ventures, and Scale Venture Partners.

The objective of the report is to present a comprehensive analysis of the Warehouse Automation Market to the stakeholders in the industry. The report provides trends that are most dominant in the Warehouse Automation Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Warehouse Automation Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Warehouse Automation Market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Warehouse Automation Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Warehouse Automation Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Market. The report also analyses if the Warehouse Automation Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Warehouse Automation Market is aided by legal factors.

Warehouse Automation Market Scope:

|

Warehouse Automation Market |

|

|

Market Size in 2025 |

USD 24.49 Bn. |

|

Market Size in 2032 |

USD 49.95 Bn. |

|

CAGR (2026-2032) |

10.72% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Type

|

|

by Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Major Players operating in the Global Warehouse Automation Market are:

- Dematic Group (Kion Group AG)

- Daifuku Co. Limited

- Geek+

- Swisslog Holding AG (KUKA AG)

- Honeywell Intelligrated (Honeywell International Inc.)

- Jungheinrich AG

- Murata Machinery Ltd

- Knapp AG

- Amazon

- Lucas Robotics

- TGW Logistics Group GmbH

- Kardex Group

- Mecalux SA

- BEUMER Group GmbH & Co. KG

- SSI Schaefer AG

- Vanderlande Industries BV

- WITRON Logistik + Informatik GmbH

- Oracle Corporation

- One Network Enterprises Inc.

- SAP SE

Frequently Asked Questions

Global Warehouse Automation Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Global Warehouse Automation Market: Target Audience

2.3. Global Warehouse Automation Market: Primary Research (As per Client Requirement)

2.4. Global Warehouse Automation Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2025-2032(In %)

4.1.1.1. North America Market Share Analysis, By Value, 2025-2032 (In %)

4.1.1.2. Europe Market Share Analysis, By Value, 2025-2032 (In %)

4.1.1.3. Asia Pacific Market Share Analysis, By Value, 2025-2032 (In %)

4.1.1.4. South America Market Share Analysis, By Value, 2025-2032 (In %)

4.1.1.5. Middle East and Africa Market Share Analysis, By Value, 2025-2032 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Global Warehouse Automation Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.3.1.1. Global Market Share Analysis, By Type, 2025-2032 (Value US$ MN)

4.3.1.1.1.Basic Warehouse

4.3.1.1.2.Warehouse System

4.3.1.1.3.Mechanized Warehouse

4.3.1.1.4.Advanced Warehouse

4.3.1.2. Global Market Share Analysis, By Technology, 2025-2032 (Value US$ MN)

4.3.1.2.1.Automated Storage and Retrieval Systems (AS/RS)

4.3.1.2.2.Automatic Guided Vehicles (AGVs)

4.3.1.2.3.Autonomous Mobile Robots (AMRs)

4.3.1.2.4.Voice Picking and Tasking

4.3.1.2.5.Automated Sortation Systems

4.3.1.2.6.Others

4.3.1.3. Global Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.3.1.3.1.E-commerce

4.3.1.3.2.Grocery

4.3.1.3.3.Apparel

4.3.1.3.4.Food & Beverage

4.3.1.3.5.Pharmaceutical

4.4. North America Warehouse Automation Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.4.1.1. North America Market Share Analysis, By Type, 2025-2032 (Value US$ MN)

4.4.1.1.1.Basic Warehouse

4.4.1.1.2.Warehouse System

4.4.1.1.3.Mechanized Warehouse

4.4.1.1.4.Advanced Warehouse

4.4.1.2. North America Market Share Analysis, By Technology, 2025-2032 (Value US$ MN)

4.4.1.2.1.Automated Storage and Retrieval Systems (AS/RS)

4.4.1.2.2.Automatic Guided Vehicles (AGVs)

4.4.1.2.3.Autonomous Mobile Robots (AMRs)

4.4.1.2.4.Voice Picking and Tasking

4.4.1.2.5.Automated Sortation Systems

4.4.1.2.6.Others

4.4.1.3. North America Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.4.1.3.1.E-commerce

4.4.1.3.2.Grocery

4.4.1.3.3.Apparel

4.4.1.3.4.Food & Beverage

4.4.1.3.5.Pharmaceutical

4.4.1.4. North America Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.4.1.4.1.US

4.4.1.4.2.Canada

4.4.1.4.3.Mexico

4.5. Europe Warehouse Automation Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.5.1.1. Europe Market Share Analysis, By Type, 2025-2032 (Value US$ MN)

4.5.1.2. Europe Market Share Analysis, By Technology, 2025-2032 (Value US$ MN)

4.5.1.3. Europe Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.5.1.4. Europe Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.5.1.4.1.UK

4.5.1.4.2.France

4.5.1.4.3.Germany

4.5.1.4.4.Italy

4.5.1.4.5.Spain

4.5.1.4.6.Sweden

4.5.1.4.7.Austria

4.5.1.4.8.Rest Of Europe

4.6. Asia Pacific Warehouse Automation Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.6.1.1. Asia Pacific Market Share Analysis, By Type, 2025-2032 (Value US$ MN)

4.6.1.2. Asia Pacific Market Share Analysis, By Technology, 2025-2032 (Value US$ MN)

4.6.1.3. Asia Pacific Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.6.1.4. Asia Pacific Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.6.1.4.1.China

4.6.1.4.2.India

4.6.1.4.3.Japan

4.6.1.4.4.South Korea

4.6.1.4.5.Australia

4.6.1.4.6.ASEAN

4.6.1.4.7.Rest Of APAC

4.7. South America Warehouse Automation Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.7.1.1. South America Market Share Analysis, By Type, 2025-2032 (Value US$ MN)

4.7.1.2. South America Market Share Analysis, By Technology, 2025-2032 (Value US$ MN)

4.7.1.3. South America Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.7.1.4. South America Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.7.1.4.1.Brazil

4.7.1.4.2.Argentina

4.7.1.4.3.Rest Of South America

4.8. Middle East and Africa Warehouse Automation Market Segmentation Analysis, 2025-2032 (Value US$ MN)

4.8.1.1. Middle East and Africa Market Share Analysis, By Type, 2025-2032 (Value US$ MN)

4.8.1.2. Middle East and Africa Market Share Analysis, By Technology, 2025-2032 (Value US$ MN)

4.8.1.3. Middle East and Africa Market Share Analysis, By Application, 2025-2032 (Value US$ MN)

4.8.1.4. Middle East and Africa Market Share Analysis, By Country, 2025-2032 (Value US$ MN)

4.8.1.4.1.South Africa

4.8.1.4.2.GCC

4.8.1.4.3.Egypt

4.8.1.4.4.Nigeria

4.8.1.4.5.Rest Of ME&A

Chapter 5 Stellar Competition Matrix

5.1.1. Global Stellar Competition Matrix

5.1.2. North America Stellar Competition Matrix

5.1.3. Europe Stellar Competition Matrix

5.1.4. Asia Pacific Stellar Competition Matrix

5.1.5. South America Stellar Competition Matrix

5.1.6. Middle East and Africa Stellar Competition Matrix

5.2. Key Players Benchmarking

5.2.1. Key Players Benchmarking By Type, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.3. Mergers and Acquisitions in Industry

5.3.1. M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. Dematic Group (Kion Group AG).

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. Daifuku Co. Limited

6.1.3. Geek+

6.1.4. Swisslog Holding AG (KUKA AG)

6.1.5. Honeywell Intelligrated (Honeywell International Inc.)

6.1.6. Jungheinrich AG

6.1.7. Murata Machinery Ltd

6.1.8. Knapp AG

6.1.9. Amazon

6.1.10. Lucas Robotics

6.1.11. TGW Logistics Group GmbH

6.1.12. Kardex Group

6.1.13. Mecalux SA

6.1.14. BEUMER Group GmbH & Co. KG

6.1.15. SSI Schaefer AG

6.1.16. Vanderlande Industries BV

6.1.17. WITRON Logistik + Informatik GmbH

6.1.18. Oracle Corporation

6.1.19. One Network Enterprises Inc.

6.1.20. SAP SE

6.2. Key Findings

6.3. Recommendations