HVAC Maintenance Service Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

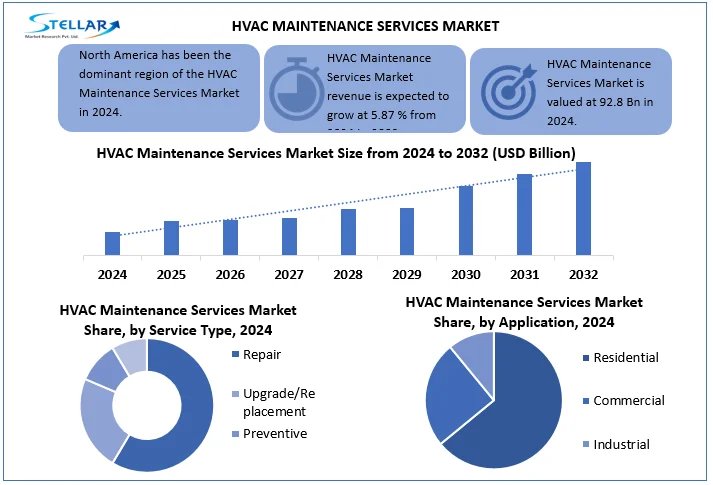

HVAC Maintenance Service Market Size was estimated at USD 92.8 billion in 2024 and is expected to reach USD 146.46 billion by 2032. The Market CAGR is expected to be around 5.87% during the forecast period (2025 - 2032)

Format : PDF | Report ID : SMR_2780

HVAC Maintenance Service Market Overview

HVAC maintenance service refers to the routine inspection, cleaning, repair, and optimization of Heating, Ventilation, and Air Conditioning (HVAC) systems to ensure their efficient, safe, and reliable operation. Professionals or specialized companies provide these services and are essential for extending the life of HVAC equipment, improving energy efficiency, and preventing unexpected system failures.

The market of global HVAC maintenance services is undergoing accelerated growth, increasing awareness regarding energy efficiency, increased equipment longevity, and change towards predictive and preventive maintenance solutions. In 2024, the global market value exceeded US $ 90 billion, indicating continuous growth through 2032 with estimates, driven by regulatory compliance for modernization of commercial infrastructure and formation of energy standards. Rapid urbanization and increasing deployment of HVAC systems in residential, commercial and industrial areas have increased the demand for long -term maintenance contracts.

North America and Europe, are the regions where the building owners are highly adopting the IOT-enabled predictive maintenance, which proves to reduce the system failure rates by 30%. Integration of AI-based fault detection, digital twins and mobile diagnostics is changing HVAC servicing into data-operated, proactive functions. In 2024, Carrier Global launched its real-time diagnostics platform for HVAC maintenance in the U.S., while Daikin Industries expanded its remote predictive service offerings in Southeast Asia, targeting commercial customers.

Governments of Asia Pacific and Middle East have also started subsidy and green building incentives, promoting the installation and maintenance of energy-efficient HVAC systems. However, global trade tensions and fluctuating tariff structures on HVAC components—notably between the U.S. and China have disrupted the spare parts supply chain, leading to delayed maintenance in certain regions. Additionally, skill deficiency in HVAC technicians obstruct service distribution and quality stability, especially in developing economies. Overall, the HVAC maintenance service market is developing from a reactive model to a strategic, performance-based service structure. With the increasing demand for sustainable and cost-effective climate control, industry players are preferring technology integration, membership-based service model and price-added contracts to get competitive benefits.

To get more Insights: Request Free Sample Report

Maintenance Services Market Dynamics

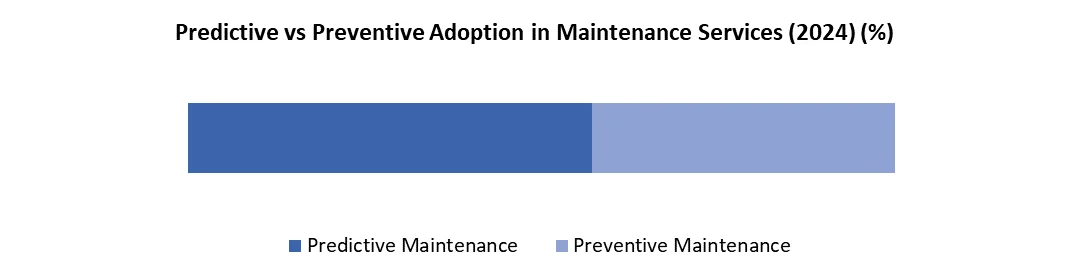

Shift Toward Predictive and Preventive Maintenance to Drive Maintenance Services Market Growth

The market is experiencing substantial growth due to the increasing demand for predictive and preventive maintenance services. In 2024, More than 60% of commercial buildings across the implement IoT-enabled predictive HVAC maintenance systems to reduce unexpected equipment failures. This change is influenced by energy savings, low repair costs and the need for compliance with carbon emission regulations. Predictive maintenance reduces the average system failures by 30%, making it an increasingly favored approach among property owners and convenience managers. Development in consumer preferences and technology trends gives fuel to this market driver.

Growing Commercial Infrastructure to Drive HVAC Maintenance Services Market Growth

The rapid expansion of commercial infrastructure in Asia-Pacific and North America is promoting market development. In 2023, India and China collectively replaced more than 120 million square feet of new commercial space, increasing the demand for HVAC servicing. Annual HVAC maintenance contract is required to ensure frequent operations for malls, office complexes, hospitals, and co-working spaces. Market forces and economic indicators in these areas support this expansion.

Shortage of Skilled Technicians to Restrain the HVAC Maintenance Services Market

Lack of adequately trained HVAC service technicians remains an important challenge. In 2023, North America and Europe reported a 22% decrease in certified maintenance professionals. It leads to delay in service and poor customer satisfaction, especially during extreme seasons. This issue is extended by rapid technological upgradation, which makes continuous upskilling necessary. This barrier affects the development and service distribution models of the industry.

Rise in Green Building Certifications to Present an Opportunity in the HVAC Maintenance Services Market

The growing emphasis on energy-efficient buildings certified by LEED and BREEAM is creating attractive opportunities. HVAC maintenance services play an important role to maintain high energy performance levels of these buildings. In 2024, more than 35% of newly constructed green buildings in Europe included compulsory service contracts with predictive maintenance segments. Innovation in industry and regulatory influences is expanding the scope of this market.

HVAC Maintenance Services Market Segmentation

Based on Service Type, the service segment includes repair, upgrade/replacement, preventive maintenance and predictive maintenance. In 2024, preventive maintenance dominated the market with 38% shares, inspired by increasing service contracts in commercial buildings. This segment represents traction as business demand to reduce unplanned outages and expand the equipment life, especially in the healthcare and IT sectors. Market segment dynamics indicate that predictive maintenance is the fastest-growing subsegment due to integration with IOT and AI systems.

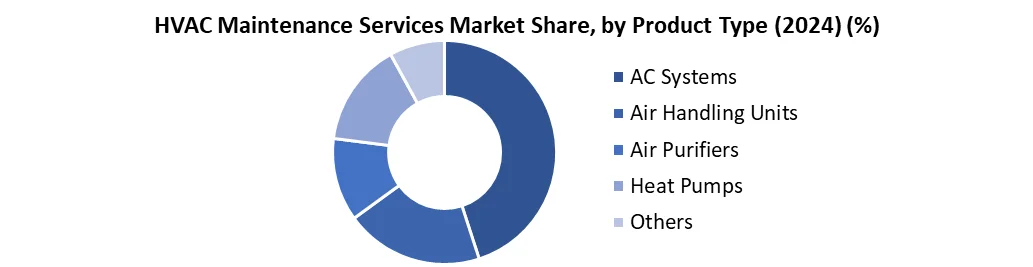

Based on Product Type, the product segment includes air handling units, AC systems, air purifiers, heat pumps and others. The AC system is the leading market share in 2024, accounting for more than 45% of the total service demand. The dominance is attributed to comprehensive AC use in residential and commercial spaces, combined with frequent maintenance needs due to refrigerant leakage, compressor defects and airflow issues. Segment growth analysis reveals high service frequency during summer months and urban heatwaves, which boost revenues.

Based on the Application, the application includes residential, commercial and industrial. In 2024, commercial applications dominate the market, which contributes about 52% of the market share. This is due to increased dependence on HVAC systems in malls, office parks, data centers and hospitals where the system uptime is important. Segment-specific trends indicate long-term AMCs and a digital maintenance dashboard in this segment. Market niche exploration reflects increasing investment in the HVAC-as-a-Service model in large commercial buildings.

HVAC Maintenance Services Market Regional Analysis

North America Dominated the HVAC Maintenance Services Market in 2024

The global HVAC maintenance service market is led by North America, holding a prominent position in 2024, mainly due to its advanced infrastructure, stringent energy efficiency rules and high adoption of smart HVAC technologies. The US region accounts largest market share, driven by the mature commercial real estate sector and the widespread implementation of predictive maintenance systems across office complexes, hospitals and retail facilities. Europe follows closely supported by the aggressive sustainability goals and the increasing number of green-certified buildings of the European Union, which require energy-efficient HVAC systems. The region has also seen an increase in HVAC-as-a-Service models, especially in Germany and the UK. Asia-Pacific is emerging as the fastest growing market, with rapid urbanization, growing middle-class income and fuel from extensive construction activities in countries such as India, China and Southeast Asia. The increasing number of commercial and residential units has created strong demand for preventive and contract-based maintenance services.

HVAC Maintenance Services Market Competitive Landscape

The HVAC Maintenance Service Market features a moderately fragmented competitive landscape, with a mix of global OEMs and regional service providers. Prominent players include Career Global Corporation, Daikin Industries Limited, Johnson Controls International, Trane Technologies, and Lennox International Inc. In 2024, Daikin expanded its predictive maintenance service portfolio in Southeast Asia, while Carrier Global Corporation launched a mobile-based diagnostic platform for real-time service updates in the U.S. Trane Technologies invested in AI-powered fault detection systems to increase operational uptime for large industrial clients. These players are competing on technology integration, service reliability, and pricing flexibility. Competitive landscape strategies include bundling installation with long-term maintenance plans, use of digital twins, and subscription-based HVAC-as-a-service models.

HVAC Maintenance Services Market Recent Developments

|

Date |

Recent Development |

Region |

|

Jan 16, 2024 |

Arizton reported the global HVAC maintenance & services market to grow from $78.5 billion in 2023 to $110.1 billion by 2029, at a CAGR of 5.79%. |

Global |

|

May 23, 2024 |

Analysts projected 15–25% global price increases on A2L refrigerants due to ongoing HFC phase-down regulations, affecting HVAC maintenance economics. |

Global |

|

Nov 29, 2024 |

A newly developed HVAC-DPT transformer model achieved 45% energy savings in variable-occupancy buildings across international test sites. |

Global |

|

May 1, 2024 |

Researchers introduced CLUE, a model-based reinforcement learning system reducing HVAC training data needs from months to just 7 days. |

Global |

|

HVAC Maintenance Services Market Scope |

|

|

Market Size in 2024 |

USD 92.8 Bn. |

|

Market Size in 2032 |

USD 146.46 Bn. |

|

CAGR (2024-2032) |

5.87% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

by Service Type Repair Upgrade/Replacement Preventive Predictive |

|

by Product Type Air Handling Units AC System Air purifier Heat Pump Others |

|

|

by Application Type Residential Commercial Industrial |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

HVAC Maintenance Services Market Key Players

North America

- Carrier Global Corporation – USA

- Trane Technologies plc – USA

- Johnson Controls International – USA

- Lennox International Inc. – USA

- Honeywell International Inc. – USA

- ABM Industries Inc. – USA

- Comfort Systems USA, Inc. – USA

- EMCOR Group, Inc. – USA

- Climate Pros, LLC – USA

- Southland Industries – USA

Europe

- Daikin Europe N.V. – Belgium

- Bosch Thermotechnology GmbH – Germany

- Vaillant Group – Germany

- BDR Thermea Group – Netherlands

- Swegon Group AB – Sweden

- Johnson Controls-Hitachi Air Conditioning Europe SAS – France

- FläktGroup – Germany

- Caverion Corporation – Finland

Asia Pacific

- Daikin Industries Ltd. – Japan

- Mitsubishi Electric Corporation – Japan

- LG Electronics Inc. – South Korea

- Blue Star Limited – India

- Voltas Limited – India

- Hitachi-Johnson Controls Air Conditioning Inc. – Japan

- Toshiba Carrier Corporation – Japan

- Samsung Electronics Co., Ltd. – South Korea

South America

- Midea Carrier Latin America – Brazil

- Springer Climatizações (a Midea Group Company) – Brazil

Frequently Asked Questions

North America dominates the HVAC Maintenance Services Market.

Preventive maintenance dominates the market with 38% shares HVAC Maintenance Services Market in 2024.

The Global HVAC Maintenance Services Market Size was estimated at USD 92.8 Bn in 2024, and it is expected to reach USD 146.46 Bn in 2032.

Shortage of Skilled Technicians, High Cost of Technology Integration are the main challenges in the HVAC Maintenance Services Market

1. HVAC Maintenance Services Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global HVAC Maintenance Services Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. HVAC Maintenance Services Market: Dynamics

3.1. HVAC Maintenance Services Market Trends by Region

3.1.1. North America HVAC Maintenance Services Market Trends

3.1.2. Europe HVAC Maintenance Services Market Trends

3.1.3. Asia Pacific HVAC Maintenance Services Market Trends

3.1.4. Middle East and Africa HVAC Maintenance Services Market Trends

3.1.5. South America HVAC Maintenance Services Market Trends

3.2. HVAC Maintenance Services Market Dynamics

3.2.1. HVAC Maintenance Services Market Drivers

3.2.2. HVAC Maintenance Services Market Restraints

3.2.3. HVAC Maintenance Services Market Opportunities

3.2.4. HVAC Maintenance Services Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for HVAC Maintenance Services Industry

4. HVAC Maintenance Services Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

4.1. HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

4.1.1. Repair

4.1.2. Upgrade/Replacement

4.1.3. Preventive

4.1.4. Predictive

4.2. HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

4.2.1. Air Handling Units

4.2.2. AC System

4.2.3. Air purifier

4.2.4. Heat Pump

4.2.5. Others

4.3. HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.4. HVAC Maintenance Services Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America HVAC Maintenance Services Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

5.1. North America HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

5.1.1. Repair

5.1.2. Upgrade/Replacement

5.1.3. Preventive

5.1.4. Predictive

5.2. North America HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

5.2.1. Air Handling Units

5.2.2. AC System

5.2.3. Air purifier

5.2.4. Heat Pump

5.2.5. Others

5.3. North America HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

5.3.1. Residential

5.3.2. Commercial

5.3.3. Industrial

5.4. North America HVAC Maintenance Services Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

5.4.1.1.1. Repair

5.4.1.1.2. Upgrade/Replacement

5.4.1.1.3. Preventive

5.4.1.1.4. Predictive

5.4.1.2. United States HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

5.4.1.2.1. Air Handling Units

5.4.1.2.2. AC System

5.4.1.2.3. Air purifier

5.4.1.2.4. Heat Pump

5.4.1.2.5. Others

5.4.1.3. United States HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

5.4.1.3.1. Residential

5.4.1.3.2. Commercial

5.4.1.3.3. Industrial

5.4.2. Canada

5.4.2.1. Canada HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

5.4.2.1.1. Repair

5.4.2.1.2. Upgrade/Replacement

5.4.2.1.3. Preventive

5.4.2.1.4. Predictive

5.4.2.2. Canada HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

5.4.2.2.1. Air Handling Units

5.4.2.2.2. AC System

5.4.2.2.3. Air purifier

5.4.2.2.4. Heat Pump

5.4.2.2.5. Others

5.4.3. Canada HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

5.4.3.1.1. Residential

5.4.3.1.2. Commercial

5.4.3.1.3. Industrial

5.4.4. Mexico

5.4.4.1. Mexico HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

5.4.4.1.1. Repair

5.4.4.1.2. Upgrade/Replacement

5.4.4.1.3. Preventive

5.4.4.1.4. Predictive

5.4.4.2. Mexico HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

5.4.4.2.1. Air Handling Units

5.4.4.2.2. AC System

5.4.4.2.3. Air purifier

5.4.4.2.4. Heat Pump

5.4.4.2.5. Others

5.4.4.3. Mexico HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

5.4.4.3.1. Residential

5.4.4.3.2. Commercial

5.4.4.3.3. Industrial

6. Europe HVAC Maintenance Services Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

6.1. Europe HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

6.2. Europe HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

6.3. Europe HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

6.4. Europe HVAC Maintenance Services Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

6.4.1.2. United Kingdom HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

6.4.1.3. United Kingdom HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

6.4.2. France

6.4.2.1. France HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

6.4.2.2. France HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

6.4.2.3. France HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

6.4.3. Germany

6.4.3.1. Germany HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

6.4.3.2. Germany HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

6.4.3.3. Germany HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

6.4.4. Italy

6.4.4.1. Italy HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

6.4.4.2. Italy HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

6.4.4.3. Italy HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

6.4.5. Spain

6.4.5.1. Spain HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

6.4.5.2. Spain HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

6.4.5.3. Spain HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

6.4.6.2. Sweden HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

6.4.6.3. Sweden HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

6.4.7. Austria

6.4.7.1. Austria HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

6.4.7.2. Austria HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

6.4.7.3. Austria HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

6.4.8.2. Rest of Europe HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

6.4.8.3. Rest of Europe HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7. Asia Pacific HVAC Maintenance Services Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

7.1. Asia Pacific HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.2. Asia Pacific HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.3. Asia Pacific HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4. Asia Pacific HVAC Maintenance Services Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.1.2. China HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.1.3. China HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.2.2. S Korea HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.2.3. S Korea HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.3. Japan

7.4.3.1. Japan HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.3.2. Japan HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.3.3. Japan HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.4. India

7.4.4.1. India HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.4.2. India HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.4.3. India HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.5. Australia

7.4.5.1. Australia HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.5.2. Australia HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.5.3. Australia HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.6.2. Indonesia HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.6.3. Indonesia HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.7.2. Philippines HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.7.3. Philippines HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.8.2. Malaysia HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.8.3. Malaysia HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.9.2. Vietnam HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.9.3. Vietnam HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.10.2. Thailand HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.10.3. Thailand HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

7.4.11.2. Rest of Asia Pacific HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

7.4.11.3. Rest of Asia Pacific HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

8. Middle East and Africa HVAC Maintenance Services Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

8.1. Middle East and Africa HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

8.2. Middle East and Africa HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

8.3. Middle East and Africa HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

8.4. Middle East and Africa HVAC Maintenance Services Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

8.4.1.2. South Africa HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

8.4.1.3. South Africa HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

8.4.2. GCC

8.4.2.1. GCC HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

8.4.2.2. GCC HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

8.4.2.3. GCC HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

8.4.3.2. Nigeria HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

8.4.3.3. Nigeria HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

8.4.4.2. Rest of ME&A HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

8.4.4.3. Rest of ME&A HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

9. South America HVAC Maintenance Services Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

9.1. South America HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

9.2. South America HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

9.3. South America HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

9.4. South America HVAC Maintenance Services Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

9.4.1.2. Brazil HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

9.4.1.3. Brazil HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

9.4.2.2. Argentina HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

9.4.2.3. Argentina HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

9.4.3.2. Rest Of South America HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

9.4.3.3. Rest Of South America HVAC Maintenance Services Market Size and Forecast, By Application Type (2024-2032)

10. Company Profile: Key Players

10.1. Carrier Global Corporation – USA

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Trane Technologies plc – USA

10.3. Johnson Controls International – USA

10.4. Lennox International Inc. – USA

10.5. Honeywell International Inc. – USA

10.6. ABM Industries Inc. – USA

10.7. Comfort Systems USA, Inc. – USA

10.8. EMCOR Group, Inc. – USA

10.9. Climate Pros, LLC – USA

10.10. Southland Industries – USA

10.11. Daikin Europe N.V. – Belgium

10.12. Bosch Thermotechnology GmbH – Germany

10.13. Vaillant Group – Germany

10.14. BDR Thermea Group – Netherlands

10.15. Swegon Group AB – Sweden

10.16. Johnson Controls-Hitachi Air Conditioning Europe SAS – France

10.17. FläktGroup – Germany

10.18. Caverion Corporation – Finland

10.19. Daikin Industries Ltd. – Japan

10.20. Mitsubishi Electric Corporation – Japan

10.21. LG Electronics Inc. – South Korea

10.22. Blue Star Limited – India

10.23. Voltas Limited – India

10.24. Hitachi-Johnson Controls Air Conditioning Inc. – Japan

10.25. Toshiba Carrier Corporation – Japan

10.26. Samsung Electronics Co., Ltd. – South Korea

10.27. Midea Carrier Latin America – Brazil

10.28. Springer Climatizações (a Midea Group Company) – Brazil

10.29. Engie Cofely Energy Services – United Arab Emirates

11. Key Findings

12. Analyst Recommendations

13. HVAC Maintenance Services Market: Research Methodology