North America HVAC Maintenance Service Market Size, Share and Forecast (2025-2032)

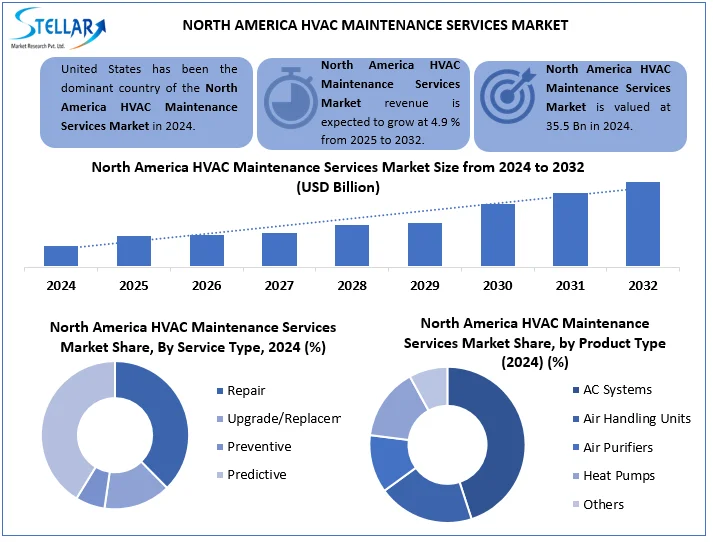

North America HVAC Maintenance Service Market Size was estimated at USD 35.5 Bn in 2024, and it is expected to reach USD 52.05 Bn in 2032. The Market CAGR is expected to be around 4.9% during the forecast period (2025 - 2032)

Format : PDF | Report ID : SMR_2871

HVAC Maintenance Service Market Overview

The North America HVAC maintenance service markets are rapidly converting, which is inspired by the growing demand of predictive and preventive maintenance solutions. As the HVAC system gets more digitally integrated, business systems are adopting IoT-enabled sensors, AI diagnostics, and real-time monitoring devices to reduce failures and energy consumption. In 2024, more than 60% of American commercial buildings had shifted towards predictive maintenance, reflecting a strong tendency towards intelligent servicing. Consumer behavior is rapidly in favor of subscription-based service model, presents an big opportunity in the HVAC maintenance service market.

The US dominated the market due to its strong industrial base, comprehensive commercial infrastructure, stringent energy regulations and high entry of smart building technologies. The Canada is moving through government-led initiatives, while Mexico is rapidly expanding industrial HVAC services in manufacturing sectors.

The market is moderately fragmented, with strong competition between global OEMs and regional service providers, the market is moderately fragmented. Prominent players such as Carrier, Trane Technologies, Johnson Controls, and Daikin are competing on technology innovation, service reliability and pricing models. Many are now offering long-term contracts to strengthen subscription-based HVAC-as-a-Service Plan, Digital twins, and customer retention.

North America HVAC Maintenance Services Market Recent Developments

|

Date |

Recent Development |

Country |

|

Feb 11, 2025 |

Carrier Global reported 11% organic growth in its Americas HVAC segment in Q4 2024 earnings call. |

United States |

|

May 1, 2025 |

Carrier raised its 2025 EPS forecast to $3.00–3.10 citing continued strength in HVAC services. |

|

|

Jan 16, 2025 |

New EPA refrigerant regulations led to 30–50% HVAC price increases, driving more maintenance demand. |

|

|

Nov 11, 2024 |

Sila Services, a major HVAC provider, was put up for sale by Morgan Stanley (valued at ~$1.5Bn). |

To get more Insights: Request Free Sample Report

North America HVAC Maintenance Services Market Dynamics

Rising Demand for Predictive Maintenance to Drive the North America HVAC Maintenance Services

North America is witnessing an adequate change towards predictive HVAC maintenance, driven by rapid advancement in IoT, Artificial Intelligence, and sensor-based diagnostics. In 2024, more than 60% of American commercial buildings adopted predictive maintenance models, reducing system failures by 30%. Businesses are investing in active servicing to reduce energy costs, avoid unplanned breakdowns, and comply with green building standards. Prominent firms such as Carrier and Daikin are launching mobile diagnostic platforms and cloud-based solutions, reflecting the growing market for intelligent maintenance services.

Skilled Labor Shortage to Hinder North America HVAC Maintenance Services Market Growth

The skilled labor shortage is a major hurdle in North America’s HVAC Maintenance Service Market. In 2024, over 45% of service providers in the US reported a workforce gap, which directly impacts service delivery times and customer satisfaction. As the HVAC system gets more complex, the required skills are growing faster than the available labor pool. This is more pronounced in rural and Tier 2 cities, where limited training access hinders the scalability of high-tech service solutions.

Subscription-Based Service Models to Present Opportunity in the HVAC Maintenance Services Market

The growing popularity of HVAC-as-a-Service (HaaS) is a big opportunity in North America. With capital budgets tightening, businesses are opting for flexible, operational expenditure models that bundle installation, maintenance and upgrades. Johnson Controls and Trane Technologies have launched HaaS in key cities like New York, Toronto and Chicago. This model is attractive to SMBs and public institutions looking for predictable costs and guaranteed uptime, so it’s a key segment to watch in the next few years.

North America HVAC Maintenance Services Market Segmentation

Based on Service Type, the service segment includes repair, upgrade/replacement, preventive maintenance and predictive maintenance. Predictive maintenance was the top trend in 2024 because it reduces unplanned system failures and increases energy efficiency. Companies are investing in real-time monitoring and AI-powered platforms for remote diagnostics. As a result, predictive is now preferred by over 60% of large commercial clients, especially in urban areas like New York and LA.

Based on Product Type, the product segment includes air handling units, AC systems, air purifiers, heat pumps and others. Air conditioning systems led the product segment because they are used in both residential and commercial buildings across North America. In 2024, the US had a long, hot summer and air conditioning units were used more than ever, and their maintenance needs increased. Smart and energy-efficient air conditioners also drive the demand for ongoing service plans.

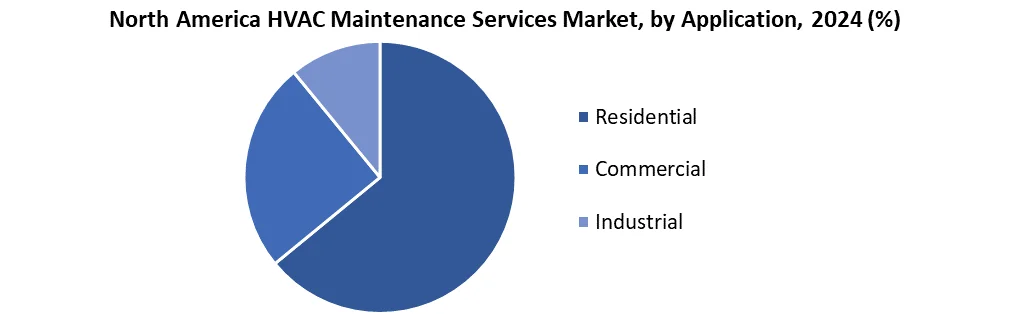

Based on the Application, the application includes residential, commercial, and industrial. Commercial was the largest application segment in 2024 driven by office buildings, hospitals, retail spaces and educational institutions. Compliance with building energy codes and ESG commitments has made routine HVAC maintenance a top priority. Facilities management companies are now looking for long-term service contracts with predictive and emergency

North America HVAC Maintenance Services Market Country Analysis

The United States led the HVAC maintenance service market in North America, accounting for more than 70% of regional revenue in 2024. This dominance is responsible for adopting the country's forecasting maintenance technologies, stringent energy efficiency regulations and early commercial infrastructure. Prominent players such as carriers, Johnson Control and Trane Technologies have accelerated investments in AI and IoT-enabled Services Models in urban centers such as New York, Chicago and Los Angeles. The growing demand for Green buildings and government incentives are also driving the HVAC maintenance service market.

North America HVAC Maintenance Services Market Competitive Landscape

The North American HVAC maintenance services market is moderately consolidated, with prominent key players offering technology-driven services and flexible pricing models. Carrier Global Corporation, Daikin North America, Trane Technologies, Johnson Controls, and Lennox International dominate the region.

- In 2024, Carrier launched a mobile based diagnostic platform, Trane introduced AI based fault detection systems for industrial clients and Johnson Controls expanded its HVAC-as-a-Service (HaaS) model in multiple US cities.

Competition is around bundling of services, remote monitoring and SLA based pricing. Regional players like Service Experts LLC (Canada) and Goettl Air Conditioning and Plumbing (U.S.) compete on local presence and quick response time. Emerging players are adopting cloud integration, smart thermostat linkage and digital twin models to stay competitive.

|

North America HVAC Maintenance Services Market Scope |

|

|

Market Size in 2024 |

USD 35.5 Bn. |

|

Market Size in 2032 |

USD 52.05 Bn. |

|

CAGR (2024-2032) |

4.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Service Type Repair Upgrade/Replacement Preventive Predictive |

|

By Product Type Air Handling Units AC System Air purifier Heat Pump Others |

|

|

By Application Type Residential Commercial Industrial |

|

North America HVAC Maintenance Services Key Players

- Carrier Global Corporation – USA

- Trane Technologies plc – USA

- Johnson Controls International plc – USA

- Lennox International Inc. – USA

- Daikin Applied Americas Inc. – USA

- Honeywell International Inc. – USA

- EMCOR Group, Inc. – USA

- ABM Industries Inc. – USA

- Comfort Systems USA, Inc. – USA

- Siemens Industry, Inc. – USA

- Mitsubishi Electric US, Inc. – USA

- Climate Control Group – USA

- TD Industries, Inc. – USAFranklin Electric Co., Inc. – USA

Frequently Asked Questions

Predictive maintenance led the market, adopted by over 60% of large commercial buildings due to its energy and failure reduction benefits.

IoT-enabled devices, AI diagnostics, real-time monitoring, and growing demand for tech-integrated predictive servicing are major growth drivers.

The United States led, accounting for over 70% of the regional market revenue in 2024.

1. North America HVAC Maintenance Services Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. North America HVAC Maintenance Services Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. North America HVAC Maintenance Services Market: Dynamics

3.1. North America HVAC Maintenance Services Market Trends

3.2. North America HVAC Maintenance Services Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. North America HVAC Maintenance Services Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. North America HVAC Maintenance Services Market Size and Forecast, By Service Type (2024-2032)

4.1.1. Repair

4.1.2. Upgrade/Replacement

4.1.3. Preventive

4.1.4. Predictive

4.2. North America HVAC Maintenance Services Market Size and Forecast, By Product Type (2024-2032)

4.2.1. Air Handling Units

4.2.2. AC System

4.2.3. Air purifier

4.2.4. Heat Pump

4.2.5. Others

4.3. North America HVAC Maintenance Services Market Size and Forecast, By Application (2024-2032)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.4. North America HVAC Maintenance Services Market Size and Forecast, By Country (2024-2032)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

5. Company Profile: Key Players

5.1. Carrier Global Corporation – USA

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2. Trane Technologies plc – USA

5.3. Johnson Controls International plc – USA

5.4. Lennox International Inc. – USA

5.5. Daikin Applied Americas Inc. – USA

5.6. Honeywell International Inc. – USA

5.7. EMCOR Group, Inc. – USA

5.8. ABM Industries Inc. – USA

5.9. Comfort Systems USA, Inc. – USA

5.10. Siemens Industry, Inc. – USA

5.11. Mitsubishi Electric US, Inc. – USA

5.12. Climate Control Group – USA

5.13. TD Industries, Inc. – USA

5.14. Franklin Electric Co., Inc. – USA

6. Key Findings

7. Industry Recommendations