Tissue paper market Industry Analysis and Forecast (2026-2032) Trends, Statistics, Dynamics

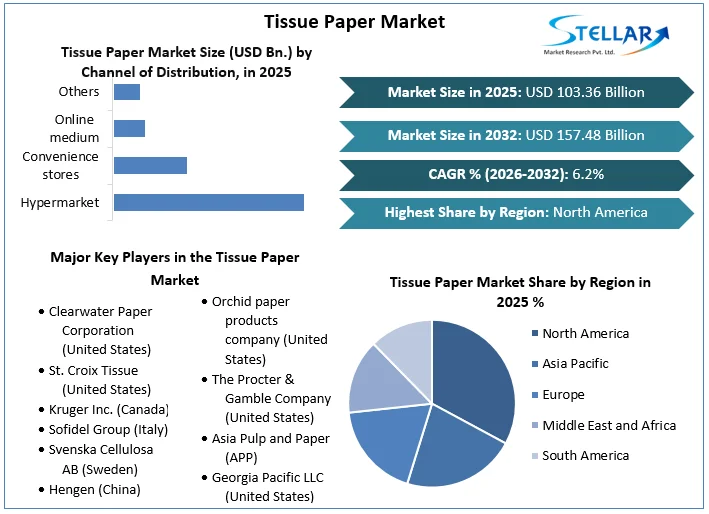

The Tissue Paper Market is expected to grow at a CAGR of 6.2 % during the forecast period. The Tissue paper market is expected to reach US$ 157.48 Bn in 2032 from US$ 103.36 Bn in 2025.

Format : PDF | Report ID : SMR_984

Tissue paper market Overview:

Hardwood and softwood tree pulp, water, and chemicals are used to make tissue papers. The main steps in making tissue paper include pulping and retting, adding colour or other ingredients to make it firmer or softer and increase its ability to hold water, and finally, pressing the finished product to shape it into the desired form. The main uses of tissue sheets are for sanitation and hygiene.

They are easy to use and ideal for drying and cleaning damp surfaces. They are commonly utilised for domestic and commercial uses in the form of toilet paper, paper towels, wet and pocket tissues, and napkins. Tissue papers are produced at a lower cost than plastics and textiles, and are readily accessible, biodegradable, and recyclable.

To get more Insights: Request Free Sample Report

Tissue paper market Dynamics:

The main driver fueling the growth of the tissue paper market is the expanding tourism and hospitality sectors. The growth of specialty tissues like glazed, premium ornamental, printed varieties, and others is also anticipated to propel the growth of the tissue paper market. These factors are projected to increase demand for tissue paper products in commercial spaces and complicated structures.

Additionally, the market for tissue paper is expected to witness plenty of chances due to increased consumer disposable income and government efforts to enhance public health. As they support the requirement for hygiene, tissues are regarded as one of the people's everyday lifestyle products in most industrialized nations. People have started choosing better lifestyles and becoming more health-conscious in recent decades, which is backed more and more by the improving standard of living. The factors behind the rising selling of face tissue sheets include their low cost and simplicity of availability.

However, the market for tissue paper is constrained by high raw material costs, and market growth is expected to be hampered by poor tissue paper quality and unsanitary conditions.

The increasing environmental concerns regarding deforestation and global warming due to the cutting of trees have led to a significant market growth restraint. Apart from this, with the advent of COVID-19, supply chain disruptions and issues in warehousing and storage caused problems in the growth of the tissue paper market.

Impact of COVID-19:

Full alterations brought in by the pandemic COVID-19 in the Tissue paper supply chain and adjustments in consumer behavior are forcing the business players to be more watchful and forward-looking to stay ahead of the competition.

In today's times, consumers have become more hygiene conscious and use tissue and sanitary products more to avoid the spread of COVID-19. During the initial period of COVID-19, consumers worldwide panic bought hygiene goods such as tissue papers, toilet papers, etc. to avoid shortage. These aspects have led to an increased growth in the demand for the tissue paper marker all around the world.

Tissue paper market Segmentation:

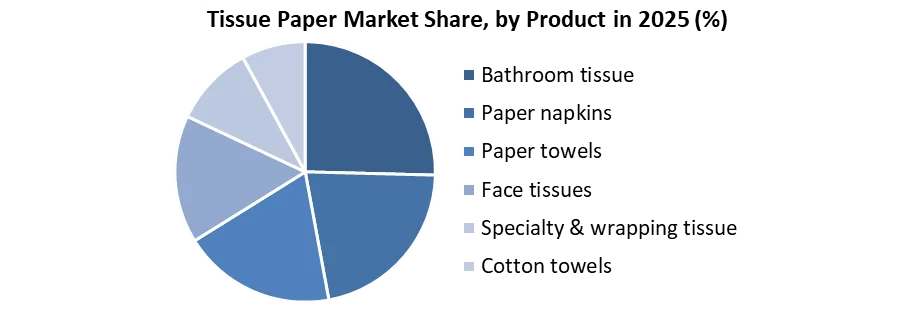

On the basis of Product, the Tissue paper market is segmented into bathroom tissue, paper napkins, paper towels, face tissues, and specialty & wrapping tissue, and cotton towels.

Over the next five years, it is anticipated that the bathroom tissue category is expected to continue to dominate the market, primarily due to the global modernization and westernization of toilet culture. The cotton towel segment is expected to witness an increase in the demand, as they are highly convenient and absorb in bathing times.

Face tissues hold approximately 20% of the share of the tissue paper market, as they are being utilized more now as a makeup remover. The specialty and wrapping tissue paper holds around 15% of the market share, these are increasingly used for gift wrapping purposes, and its sale has drastically increased concerning the paper packaging industry.

On the basis of Channel of Distribution, the Tissue paper market is segmented into Hypermarkets, Convenience stores, Online medium, and Others.

In supermarkets and hypermarkets consist of the major share in the grocery market, having all significant products necessary in a household. The supermarket segment holds the largest share in the market.

Convenience stores are easily accessible to consumers and are growing in market share. Since the advent of technology and the internet has taken over so many aspects of our lives, the internet can also be used to order and purchase grocery items. This mode of distribution offers convenience and discounts as well.

Hypermarkets hold the largest segment in the Tissue paper market in terms of channels of distribution. The online medium is growing steadily and is estimated to be the largest segment in the forecast period.

Tissue paper market Regional Analysis:

On the basis of Region, the Tissue paper market is segmented into North America, Latin America, Europe, Asia Pacific, Middle East, and Africa. In terms of region, North America, led primarily by the USA, is projected to retain its dominance in the market throughout the forecast period. The main reason for the region's supremacy is the higher penetration of tissue paper in various subsectors, particularly bathroom tissue, which has a 100 % user penetration rate in both residential and commercial settings. Due to expanding tourism and the hospitality industry, as well as increased public awareness of health and cleanliness, North America dominates the global tissue paper market.

The market in the region is relatively concentrated, with significant firms controlling the largest share. More than three times as much tissue paper is consumed in North America than in Europe.

Over the following five years, the market is expected to expand quickly in Asia-Pacific. In the next five years, the market in the area is predicted to have increased growth potential due to growing disposable income and improving living standards. The region's market is anticipated to continue primarily driven by China, Japan, and India.

This report aims to provide a comprehensive analysis of the Tissue paper market and highlight the significant trends and growth opportunities. The report offers Porter's Five Force Model for analysis of the Tissue paper market, which helps design the business strategies in the market.

The study aids in determining the number of rivals, who they are, and the performance of the products in the industry. The analysis also examines whether the Tissue paper market is open to new entrants, whether they enter and exit the market regularly, and whether a few players dominate it.

The report also includes PESTEL Analysis, which aids in developing company strategies. Numerous elements affect growth and profitability. A PESTEL study can assist in determining the significance and strength of these elements. It helps firms decide which characteristics are beneficial and which are not. PESTEL is a word that stands for Political, Economic, Socio-cultural, Technological, Environmental, and Legal. These variables take on added significance for organizations functioning in a global setting.

Tissue paper market Scope:

|

Tissue Paper Market |

|

|

Market Size in 2025 |

USD 103.36 Bn. |

|

Market Size in 2032 |

USD 157.48 Bn. |

|

CAGR (2026-2032) |

6.2% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

by Product

|

|

by Channel of Distribution

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Tissue paper market: Key players and their Insights:

The Tissue paper market has become competitive. Various industry players have adopted product launches and business growth as their development strategies to expand their market share, increase profitability, and remain stable in the market.

To grow their product range and acquire a competitive edge in the industry, key market players employ various business tactics such as business growth. To strengthen their market position, significant organizations in the industry are pursuing various business strategies such as mergers and acquisitions.

Some of the most prominent and loved players in the Tissue paper market from all over the world are:

- Clearwater Paper Corporation (United States)

- St. Croix Tissue (United States)

- Kruger Inc. (Canada)

- Sofidel Group (Italy)

- Svenska Cellulosa AB (Sweden)

- Hengen (China)

- Cascades Inc. (Canada)

- CPMC Tissue SA (Chile)

- Orchid paper products company (United States)

- The Procter & Gamble Company (United States)

- Asia Pulp and Paper (APP)

- Georgia Pacific LLC (United States)

- Kimberly-Clark Corporation (United States)

- Essity AB. (Sweden)

Frequently Asked Questions

Essity AB, Hengen, CPMC Tissue SA, Orchid paper products company, The proctor and gamble company are among the key players in the Tissue paper market.

The hypermarket segment holds the highest share in the distribution channel of the Tissue paper market. However, with the advent of technology and increasing use of the internet, the online medium of distribution in the Tissue paper market is expected to grow substantially in the next few years.

North America is expected to be the largest Tissue paper market during the forecast period 2026-2032.

The main driver fueling the growth of the tissue paper market is the expanding tourism and hospitality sectors. The growth of specialty tissues like glazed, premium ornamental, printed varieties, and others is also anticipated to propel the growth of the tissue paper market. These factors are projected to increase demand for tissue paper products in commercial spaces and complicated structures.

1. Tissue paper Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Research Assumptions

2. Tissue paper Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Tissue paper Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. Total Production (2025)

3.2.5. End-user Segment

3.2.6. Y-O-Y%

3.2.7. Revenue (2025)

3.2.8. Profit Margin

3.2.9. Market Share

3.2.10. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Tissue paper Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis and Supply Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Tissue paper Market Size and Forecast by Segments (by Value USD Million)

5.1. Tissue paper Market Size and Forecast, By Product (2025-2032)

5.1.1. Bathroom Tissue

5.1.2. Paper napkins

5.1.3. Paper towels

5.1.4. Face tissues

5.1.5. Specialty & wrapping tissue

5.1.6. Cotton towels

5.2. Tissue paper Market Size and Forecast, By Channel of Distribution (2025-2032)

5.2.1. Hypermarket

5.2.2. Convenience stores

5.2.3. Online medium

5.2.4. Others

5.3. Tissue paper Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Tissue paper Market Size and Forecast (by Value USD Million)

6.1. North America Tissue paper Market Size and Forecast, By Product (2025-2032)

6.1.1. Bathroom Tissue

6.1.2. Paper napkins

6.1.3. Paper towels

6.1.4. Face tissues

6.1.5. Specialty & wrapping tissue

6.1.6. Cotton towels

6.2. North America Tissue paper Market Size and Forecast, By Channel of Distribution (2025-2032)

6.2.1. Hypermarket

6.2.2. Convenience stores

6.2.3. Online medium

6.2.4. Others

6.3. North America Tissue paper Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Tissue paper Market Size and Forecast (by Value USD Million)

7.1. Europe Tissue paper Market Size and Forecast, By Product (2025-2032)

7.2. Europe Tissue paper Market Size and Forecast, By Channel of Distribution (2025-2032)

7.3. Europe Tissue paper Market Size and Forecast, by Country (2025-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Tissue paper Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Tissue paper Market Size and Forecast, By Product (2025-2032)

8.2. Asia Pacific Tissue paper Market Size and Forecast, By Channel of Distribution (2025-2032)

8.3. Asia Pacific Tissue paper Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Tissue paper Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Tissue paper Market Size and Forecast, By Product (2025-2032)

9.2. Middle East and Africa Tissue paper Market Size and Forecast, By Channel of Distribution (2025-2032)

9.3. Middle East and Africa Tissue paper Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Tissue paper Market Size and Forecast (by Value USD Million)

10.1. South America Tissue paper Market Size and Forecast, By Product (2025-2032)

10.2. South America Tissue paper Market Size and Forecast, By Channel of Distribution (2025-2032)

10.3. South America Tissue paper Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Clearwater Paper Corporation (United States)

11.1.1. Overview

11.1.2. Product Segment

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. St. Croix Tissue (United States)

11.3. Kruger Inc. (Canada)

11.4. Sofidel Group (Italy)

11.5. Svenska Cellulosa AB (Sweden)

11.6. Hengen (China)

11.7. Cascades Inc. (Canada)

11.8. CPMC Tissue SA (Chile)

11.9. Orchid paper products company (United States)

11.10. The Procter & Gamble Company (United States)

11.11. Asia Pulp and Paper (APP)

11.12. Georgia Pacific LLC (United States)

11.13. Kimberly-Clark Corporation (United States)

11.14. Essity AB. (Sweden)

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook