Smoked Fish Market - Global Industry Analysis and Forecast (2025-2032)

The Smoked Fish Market size was valued at USD 8.61 Bn. in 2024 and the total Smoked Fish Market revenue is expected to grow at a CAGR of 5% from 2025 to 2032, reaching nearly USD 12.72 Bn. by 2032.

Format : PDF | Report ID : SMR_1770

Smoked Fish Market Overview

The smoked fish market is projected to grow during the forecast period thanks to rising consumer awareness of the health benefits of seafood and the increasing popularity of smoked fish in a variety of food styles. There are many different goods in the smoked fish category, such as smoked salmon, trout, herring, mackerel, and other fish varieties. Also, there is a growing need for smoked fish because of consumers' constantly changing tastes and their growing need for fast, healthful meals. The market of smoked fish is expanding more quickly because smoked fish is high in protein, omega-3 fatty acids, vitamins, and minerals.

Increased working-class population, rising per capita income, and growing demand for prepared seafood items are further factors expected to propel the expansion of the smoked fish industry. Fish that has been preserved and flavored from cooking is referred to as smoked fish. Seafood has long been preserved and flavored through smoked fish are subjected to smoked during the procedure from burning wood chips, herbs, or flavorings In addition, smoked gives the fish a distinct flavor, the smoked keeps it fresh longer by preventing the growth of microorganisms. On the other hand, during the forecast period, health hazards associated with preserved food and allergic reactions to fish pose an obstacle to market growth.

To get more Insights: Request Free Sample Report

Smoked Fish Market Dynamics:

Increasing consumer preference for healthy and nutritious food to accelerate market growth and growing consumer preference for wholesome, nutritious foods is one of the factors propelling the smoked fish industry. High-quality protein, omega-3 fatty acids, vitamins, and minerals are all thought to be present in good amounts in smoked fish. People are including a greater number of smoked fish in their diets as awareness about the health advantages of eating fish grows. The belief that smoked fish is a healthier substitute for processed meats contributes to an increase in demand for it.

The growing demand for cooked seafood, which includes Alaskan Pollock, crap, catfish, and snapper smoked salmon, is expected to drive market growth these things take little time to prepare and are quick to finish. Raising per capita income, an increase in the working class population, and growing demand for ready-to-eat (RTE) packaged seafood goods are other variables that are expected to have an important impact on the expansion of the globally smoked fish industry.

Smoked Fish Market Restraints:

The smoked fish industry has great potential, however, some industrial restrictions present challenges. Industry players need to be aware of these difficulties. High price points are one of the main barriers to the market. Certain customer segments are not able to afford smoked fish because of its higher price tag, particularly for quality and specialized types. Proneness to deterioration the shelf life of smoked fish is less than that of a few other preserved or processed foods since it is a perishable product that spoils quickly. Overfishing and environmental problems, Consumer perceptions of seafood items, particularly smoked fish, have been impacted by worries about overfishing and environmental sustainability.

Regulatory obstacles and strict laws controlling food safety and processing requirements make it difficult for small-scale manufacturers to enter new markets and create problems for their operations. Competition from other sources of protein customary seafood products, including smoked fish, are challenged by the increasing acceptance and availability of substitute protein sources, like plant-based diets. Events that Affect the Seafood Supply Chain the supply of products manufactured from smoked fish is impacted by issues with catching, processing, and shipping.

Smoked Fish Market Challenges:

The distribution challenges are going to be a significant barrier to the expansion of the global market share for smoked fish. Retail outlets like supermarkets, hypermarkets, convenience stores, and discount stores play a significant role in the distribution of smoked fish products for producers and suppliers. The retailers' increasing desire for small, frequent product delivery to cut warehousing costs, coupled with pressure on pricing and margins as retail locations run at low-profit margins, create challenges for producers. Another issue is the growing demand from retailers to implement innovative merchandising pieces like rolling shelves that are repositioned once they are completely loaded to lower the cost of store restocking.

Retailers view order fulfilment rate as a critical component in building a connection with manufacturers if a manufacturer cannot provide enough goods for marketing efforts and periods of high demand, they quickly switch to another supplier. In addition, the growing trend of consumers shopping at convenience stores puts pressure on manufacturers to control their categories by finding a healthy mix between volume and pricing. Such impediments essentially prevent the increase in market share.

Smoked Fish Market Segment Analysis:

Based on Method, Hot Smoked Fish items are made using the hot smoking method. Products that have been hot-smoked are thoroughly cooked and have reached temperatures as high as 82° C. Depending on the interior temperature of the product, hot smoking is quick because of the high temperatures. The hot smoke procedure varies depending on the type of fish, as different species have variable heat capabilities. The procedure was adjusted to the species, the equipment used for processing, the demands of the market, distribution factors, and legal requirements. When cooked to perfection hot-smoked fish is delicious and moist. They must therefore be refrigerated and have a rather short shelf life.

Cold Smoking Fish is uncooked, since the temperature rarely rises over 43° Celsius. It is customary to smoke cold below 30 degrees Celsius to avoid causing unwanted alterations to the texture of the muscle. It is essential to employ an indirect source of heat and smoke to maintain the right temperature, guarantee even drying, and preserve the ideal color. It usually takes less than 24 hours to smoke properly outside. During this time, the relative humidity should be kept at 90% at first to aid in the absorption of smoke, then lowered to roughly 70% to accomplish the necessary drying.

Salmon is the main product of the cold-smoking method. Black cod (sablefish), trout, eel, herring, haddock, and cod are some other classic cold-smoked fish. Microorganisms that cause food poisoning and food deterioration thrive in conditions and timings similar to those used in the production of cold-smoked salmon. Therefore, it's crucial to pay close attention to correct handling, brining, sanitation, process control, and refrigeration as soon as possible after smoking.

Smoked Fish Market Regional Insight:

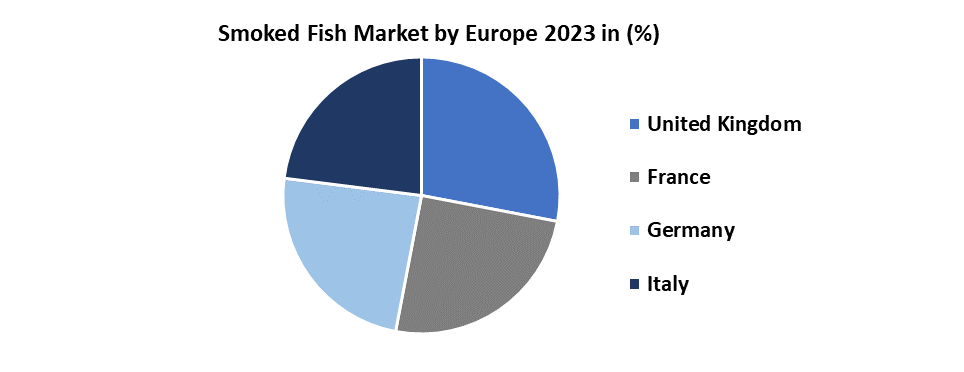

Europe the smoked fish market growth is expected to be 56% over the forecast period. Germany, France, the United Kingdom, and Italy are the biggest European markets for smoked fish. Throughout the projected period, the expansion of the smoked fish market in Europe is expected to be driven by the rising number of convenience stores, supermarkets, hypermarkets, and discount retailers carrying smoked fish products. The market research study contains comprehensive data on the marketing gaps, competition intelligence, and geographical prospects that await vendors.

This data is useful in developing effective business plans. Over the expected term, there is a greater market potential for smoked fish because of growing urbanization and rising user spending power. The primary factors impacting the consumption of smoked fish in Europe are shifts in consumer lifestyle, increased consumer knowledge of the health benefits of fish, and financial factors that affect purchasing capacity. The smoked fish industry would flourish more if a greater range of smoked fish were produced and more convenience stores and internet shops were available.

Smoked Fish Market Competitive Landscape:

The major players in the Smoked Fish Market are currently focusing on putting strategies into practice, such as embracing new technology, developing innovative products, mergers and acquisitions, joint ventures, alliances, and partnerships, to strengthen their market positions.

- On 5 September 2023, Leroy has now decided to invest NOK 158 million in the factory located in Kjollefjord. This buying station specializes in king crab, but the factory also handles high-quality white fish for filleting and salting. The products from Kjollefjord are sent to customers all over the world.

- November 7, 2023, for the fifth consecutive year, Mowi has been ranked the world’s most sustainable animal protein producer by the Coller FAIRR Protein Producer Index. The Coller FAIRR Protein Producer Index is the most detailed assessment of the largest meat.

- Feb. 29, 2024, High Liner Foods Incorporated a leading North American value-added frozen seafood company, today announced it has committed to make a US$5 million investment in Norcod AS a leader in responsible and sustainable cod aquaculture based in Trondheim, Norway, and listed on the Euronext Growth exchange on the Oslo Stock Exchange.

|

Smoked Fish Market Scope |

|

|

Market Size in 2024 |

USD 8.61 Bn. |

|

Market Size in 2032 |

USD 12.72 Bn. |

|

CAGR (2025-2032) |

5 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Method Hot Smoked Fish Cold Smoked Fish |

|

By Product Smoked salmon Smoked mackerel Smoked herring Smoked trout Other smoked fish |

|

|

By Application Food Service Sector Retail Sector |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Smoked Fish Market

Europe

- Leroy - Norway

- Maisadour - France

- 2Sisters Food Group - United Kingdom

- Foppen - Netherlands

- Der Friedrichs - Germany

- Guyader Gastronomie – France

North America

- High Liner Foods - Canada

- Acme Smoked Fish Corp. - United States

- MOWI– Canada

- The Hain Celestial Group - United States

- KraftHeinz.com - United States

Asia-Pacific

- Tassal Group Ltd. - Australia

- Epermarket – China

- Marine Harvest - Norway

- Thai Union Group - Thailand

Frequently Asked Questions

Europe is expected to lead the Smoked Fish Market during the forecast period.

An analysis of profit trends and projections for companies in the Smoked Fish Market is included, offering insights into factors driving profitability, cost management strategies, and financial performance metrics.

The Smoked Fish Market size was valued at USD 8.2 Billion in 2023 and the total Smoked Fish Market size is expected to grow at a CAGR of 5% from 2025 to 2032, reaching nearly USD 12.72 Billion by 2032.

The segments covered in the market report are by Method, by Product, and by Application.

1. Smoked Fish Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Assumptions

2. Smoked Fish Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025– 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Smoked Fish Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Smoked Fish Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. Smoked Fish Market Size and Forecast by Segments (by Value USD Million)

5.1. Smoked Fish Market Size and Forecast, By Method (2024-2032)

5.1.1. Hot Smoked Fish

5.1.2. Cold Smoked Fish

5.2. Smoked Fish Market Size and Forecast, By Product (2024-2032)

5.2.1. Smoked salmon

5.2.2. Smoked mackerel

5.2.3. Smoked herring

5.2.4. Smoked trout

5.2.5. Other smoked fish

5.3. Smoked Fish Market Size and Forecast, By Application (2024-2032)

5.3.1. Food Service Sector

5.3.2. Retail Sector

5.4. Smoked Fish Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Smoked Fish Market Size and Forecast (by Value USD Million)

6.1. North America Smoked Fish Market Size and Forecast, By Method (2024-2032)

6.1.1. Hot Smoked Fish

6.1.2. Cold Smoked Fish

6.2. North America Smoked Fish Market Size and Forecast, By Product (2024-2032)

6.2.1. Smoked salmon

6.2.2. Smoked mackerel

6.2.3. Smoked herring

6.2.4. Smoked trout

6.2.5. Other smoked fish

6.3. North America Smoked Fish Market Size and Forecast, By Application (2024-2032)

6.3.1. Food Service Sector

6.3.2. Retail Sector

6.4. North America Smoked Fish Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Smoked Fish Market Size and Forecast (by Value USD Million)

7.1. Europe Smoked Fish Market Size and Forecast, By Method (2024-2032)

7.2. Europe Smoked Fish Market Size and Forecast, By Product (2024-2032)

7.3. Europe Smoked Fish Market Size and Forecast, By Application (2024-2032)

7.4. Europe Smoked Fish Market Size and Forecast, by Country (2024-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Smoked Fish Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Smoked Fish Market Size and Forecast, By Method (2024-2032)

8.2. Asia Pacific Smoked Fish Market Size and Forecast, By Product (2024-2032)

8.3. Asia Pacific Smoked Fish Market Size and Forecast, By Application (2024-2032)

8.4. Asia Pacific Smoked Fish Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Smoked Fish Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Smoked Fish Market Size and Forecast, By Method (2024-2032)

9.2. Middle East and Africa Smoked Fish Market Size and Forecast, By Product (2024-2032)

9.3. Middle East and Africa Smoked Fish Market Size and Forecast, By Application (2024-2032)

9.4. Middle East and Africa Smoked Fish Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Smoked Fish Market Size and Forecast (by Value USD Million)

10.1. South America Smoked Fish Market Size and Forecast, By Method (2024-2032)

10.2. South America Smoked Fish Market Size and Forecast, By Product (2024-2032)

10.3. South America Smoked Fish Market Size and Forecast, By Application (2024-2032)

10.4. South America Smoked Fish Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Leroy - Norway

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Maisadour - France

11.3. 2Sisters Food Group - United Kingdom

11.4. Foppen - Netherlands

11.5. Der Friedrichs - Germany

11.6. Guyader Gastronomie – France

11.7. High Liner Foods - Canada

11.8. Acme Smoked Fish Corp. - United States

11.9. MOWI– Canada

11.10. The Hain Celestial Group - United States

11.11. KraftHeinz.com - United States

11.12. Tassal Group Ltd. - Australia

11.13. Epermarket – China

11.14. Marine Harvest - Norway

11.15. Thai Union Group - Thailand

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook