Skin Care Devices Market Industry Analysis and Forecast (2025-2032)

The Skin Care Devices Market size was valued at USD 21.97 Bn. in 2024. Global Skin Care Devices revenue is expected to grow at a CAGR of 12.7 % from 2025 to 2032, reaching nearly USD 57.19 Bn. by 2032.

Format : PDF | Report ID : SMR_2170

Skin Care Devices Market Overview

The skin care devices market has been driven by a combination of technological advancements and increasing consumer awareness about skin health. A sector report on this market highlights the expanding product range, from cleansing devices and anti-aging solutions to sophisticated laser and LED therapy devices. These innovations have made skin care more accessible and effective, catering to diverse consumer needs. The market research report indicates that the rising prevalence of skin conditions and the growing emphasis on personal grooming are pivotal factors driving this market's growth.

Market trends reveal a strong inclination towards at-home skincare devices, which offer consumers the convenience of professional-grade treatments in the comfort of their homes. Consumers are increasingly investing in devices that offer effective solutions for various skin concerns, such as microdermabrasion and ultrasonic devices. Industry trends also show a surge in the adoption of smart skincare devices equipped with advanced features like AI and IoT, which provide personalized skin care regimens and real-time feedback, enhancing user experience and satisfaction.

Consumer insights gathered from various market research reports underscore a growing preference for non-invasive and minimally invasive skincare solutions. This shift is driven by the desire for safer, more affordable, and less painful alternatives to traditional skin treatments. The market has witnessed a rise in demand for organic and natural products, reflecting a broader trend towards health and wellness. As these industry trends continue to evolve, companies in the skincare devices sector are focusing on innovation, quality, and customer-centric approaches to capture and retain market share.

The Asia-Pacific region is the fastest-growing market for skincare devices, driven by rising consumer awareness, increasing disposable income, and the rapid adoption of advanced skincare technologies. Countries like China and South Korea are at the forefront of this growth, with significant investments in research and development and expanding healthcare infrastructure.

To get more Insights: Request Free Sample Report

Skin Care Devices Market Dynamics

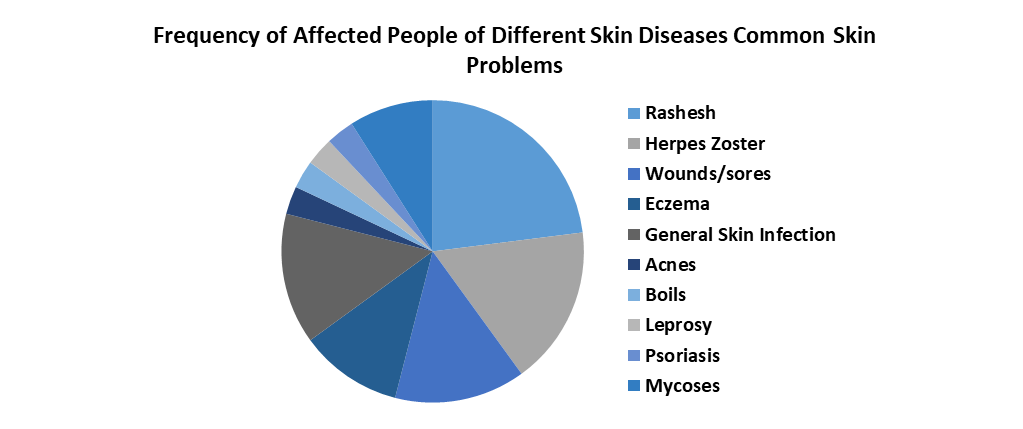

Rising Prevalence of Skin Conditions

The rising prevalence of skin conditions such as acne, hyperpigmentation, and signs of aging has significantly driven the demand for skin care devices, leading to substantial profit opportunities for manufacturers. As more consumers seek effective solutions for their skin concerns, there is a growing preference for advanced, at-home devices that offer professional-grade results. This trend has prompted manufacturers to innovate and develop a diverse range of products, from acne treatment devices to anti-aging lasers and LED therapy tools.

These devices not only cater to a wide spectrum of skin issues but also provide a convenient and non-invasive alternative to traditional dermatological treatments. With the increasing need for personalized and effective skincare solutions, manufacturers are capitalizing on this expanding market, thereby boosting their profitability and market share.

- For instance, on June 15, 2024, a leading manufacturer, NuFace, reported a significant increase in quarterly profits due to the successful launch of their new microcurrent device designed for at-home anti-aging treatments. As the awareness and incidence of skin conditions continue to rise, the demand for innovative skincare devices is expected to grow, further driving market growth.

- According to the American Cancer Society, melanoma skin cancer accounts for only 1% of total skin cancer cases, however, it is responsible for the highest number of cancer deaths.

Challenges in Accessing Advanced Skincare Technologies

The high cost associated with advanced technologies and devices, limits accessibility for a broader consumer base. According to a report by the the expense of research and development for innovative skincare solutions creates a financial barrier to entry for new companies, leading to market consolidation among established players. Market volatility due to economic fluctuations and changing consumer preferences deter investment and slow market growth. These financial constraints and market dynamics pose challenges for both new entrants and existing manufacturers.

- Skin disease costs the US health care system $75 billion in medical, preventative, and prescription and non-prescription drug costs.

Growing Demand for Organic and Natural Skin Care Devices

The increasing consumer preference for organic and natural skin care products presents a significant opportunity for the skin care devices market. By effectively product positioning and emphasizing the benefits of natural ingredients, manufacturers enhance brand awareness and attract health-conscious consumers. Integrating eco-friendly materials and sustainable practices into their supply chain further strengthens their market position.

- For instance, on May 20, 2024, Foreo, a leading skin care device company, launched a new line of eco-friendly devices made with biodegradable materials.

This move not only caters to the growing demand for sustainable products but also differentiates the brand in a competitive market. As consumers become more discerning, companies that prioritize transparency and natural product offerings are likely to see increased demand and customer loyalty.

Skin Care Devices Market Trends

Emerging Trends in the Skin Care Devices Market

Technological Advancements and shifting consumer preferences are emerging trends in the skincare devices market. Recent developments include the integration of AI and IoT technologies into devices, allowing for personalized skincare solutions that cater to individual needs.

- For example, in 2023, L'Oreal introduced an AI-powered anti-aging device that analyzes skin conditions and adapts treatments accordingly, reflecting a growing demand for smart beauty solutions

There is a rising preference for non-invasive treatments such as LED therapy and microcurrent devices, which offer effective results with minimal downtime. These trends underscore a broader shift towards convenience, efficacy, and customization in skincare technology, shaping the market's future trajectory.

Skin Care Devices Market Segment Analysis

According to SMR analysis, the anti-aging devices segment stands out as the leading segment in 2024 and is expected to dominate in the forecast period (2025-2032), driven by technological advancements and increasing consumer demand for non-invasive cosmetic treatments. According to a report by the American Academy of Dermatology (AAD), the market for anti-aging devices is projected to grow significantly due to innovations in laser and light-based therapies, which are favored for their efficacy and minimal downtime compared to traditional procedures.

- For instance, in 2023, the FDA approved several new anti-aging devices that utilize advanced technologies to reduce wrinkles and improve skin texture.

Companies like Lumenis and Cutera have reported substantial growth, citing robust sales in international markets and strategic investments in research and development. This growth is also reflected in import-export data, showing a steady increase in the global trade of skincare devices, further bolstering profit margins for leading manufacturers.

Skin Care Devices Market Regional Analysis

North America is at the forefront of the skincare devices market in 2024 and is expected to dominate in the forecast period (2025-2032), driven by strong demand and robust supply chains. According to the U.S. Food and Drug Administration (FDA), the U.S. skincare device industry has seen significant advancements, particularly in non-invasive anti-aging technologies.

- In 2024, the American Academy of Dermatology (AAD) emphasized a surge in the adoption of laser and light-based devices, with companies like Johnson & Johnson and Lumenis securing leading market positions.

Canada also contributes to the regional dominance, with Health Canada reporting increased imports and exports of skincare devices, fueling market growth. Leading companies, such as Cutera and Syneron Candela, reveal strategic expansions and high profit margins owing to increased consumer demand and successful product innovations. The robust supply and demand dynamics in North America solidify its leadership in the global skincare devices market.

Skin Care Devices Market Competitive Landscape

The skincare devices market is fiercely competitive, characterized by a diverse landscape of established players and innovative startups. Leading companies such as L'Oreal, Johnson & Johnson, and Nu Skin Enterprises maintain market dominance through extensive product portfolios and global distribution networks. These industry giants leverage substantial R&D investments to introduce advanced technologies, driving market growth and consumer adoption.

Startups and niche players, such as Foreo and Silk'n, contribute to the competitive intensity by focusing on specialized devices like cleansing brushes and IPL hair removal systems, catering to specific consumer needs with agile marketing strategies and online presence. The market's competitive dynamics are further shaped by regulatory frameworks that influence product innovation and market entry barriers. This environment fosters continuous innovation and strategic partnerships, ensuring a dynamic marketplace where companies vie for market share based on product efficacy, brand reputation, and technological advancements.

- On May 15th, 2023 L'Oreal declared the launch of their latest anti-aging device, integrating artificial intelligence for personalized skincare solutions. The device aims to revolutionize at-home beauty routines with advanced technology.

- On February 28th, 2023, Johnson & Johnson showcased their latest dermatological devices at the American Academy of Dermatology conference, emphasizing innovation in skincare technology and clinical efficacy.

- On September 10th, 2023, Nu Skin launched a new Galvanic Spa System, offering consumers professional-grade skin rejuvenation treatments at home. The device combines galvanic currents with proprietary skincare formulations for enhanced results.

- On June 5th, 2023, Foreo expanded its popular LUNA series with advanced facial cleansing devices, featuring upgraded sonic technology and ergonomic design for improved skincare routines.

- On October 20th, 2023, Silk'n launched a new home hair removal device utilizing IPL (Intense Pulsed Light) technology, promising safe and effective hair removal results for various skin tones.

Skin Care Devices Market Scope

|

Skin Care Devices Market |

|

|

Market Size in 2024 |

USD 21.97 Bn. |

|

Market Size in 2032 |

USD 57.19 Bn. |

|

CAGR (2025-2032) |

12.7 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Cleansing Devices Anti-Aging Devices Acne Treatment Devices Hair Removal Devices Dermal Rollers Others |

|

By Application Acne, Psoriasis, and Tattoo Removal Hair Removal Cellulite Reduction Skin Tightening and Body Contouring Skin Rejuvenation and Resurfacing Damage Repair |

|

|

By End User Homecare settings Dermatology clinics Beauty clinics Others |

|

|

By Distribution Channel Online Specialty Stores Supermarkets/Hypermarkets Others |

|

|

Regional Scope |

North America(United States), Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Skin Care Devices Market

- Lumenis - Israel

- Cutera, Inc. - USA

- Syneron Candela - USA

- Johnson & Johnson - USA

- L’Oréal S.A. - France

- Procter & Gamble Co. - USA

- Philips N.V. - Netherlands

- Panasonic Corporation - Japan

- Nu Skin Enterprises, Inc. - USA

- TRIA Beauty, Inc. - USA

- Silk'n (Home Skinovations Ltd.) - Israel

- Conair Corporation - USA

- Spectrum Brands Holdings, Inc. (Remington) - USA

- FOREO - Sweden

- Beurer GmbH - Germany

- SHISEIDO Company, Limited - Japan

- The Proactiv Company LLC - USA

- Pure Daily Care - USA

- Shenzhen Mareal Technology Co. Ltd. - China

- MTG Co. Ltd. - Japan

- PhotoMedex Inc. - USA

- Carol Cole Company, Inc. (NuFACE) - USA

- DD Karma LLC – USA

- XXX.Inc.

Frequently Asked Questions

North America is expected to hold the highest share of the Skin Care Devices Market.

The Skin Care Devices Market size was valued at USD 21.97 Billion in 2024 reaching nearly USD 57.19 Billion in 2032.

The anti-aging segment growing in the Global Skin Care Devices Market.

The segments covered in the Skin Care Devices Market report are based on Product Type, Application, End-User, and Distribution Channel.

1. Skin Care Devices Market: Research Methodology

2. Skin Care Devices Market: Executive Summary

3. Skin Care Devices Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

3.6. Global Import-Export Analysis

4. Skin Care Devices Market: Dynamics

4.1. Market Driver

4.2. Market Trends

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Strategies for New Entrants to Penetrate the Market

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Skin Care Devices Market Size and Forecast by Segments (by Value in USD Billion)

5.1. Skin Care Devices Market Size and Forecast, by Product Type (2024-2032)

5.1.1. Cleansing Devices

5.1.2. Anti-Aging Devices

5.1.3. Acne Treatment Devices

5.1.4. Hair Removal Devices

5.1.5. Dermal Rollers

5.1.6. Others

5.2. Skin Care Devices Market Size and Forecast, by Application (2024-2032)

5.2.1. Acne, Psoriasis, and Tattoo Removal

5.2.2. Hair Removal

5.2.3. Cellulite Reduction

5.2.4. Skin Tightening and Body Contouring

5.2.5. Skin Rejuvenation and Resurfacing

5.2.6. Damage Repair

5.3. Skin Care Devices Market Size and Forecast, by End User (2024-2032)

5.3.1. Homecare settings

5.3.2. Dermatology clinics

5.3.3. Beauty clinics

5.3.4. Others

5.4. Skin Care Devices Market Size and Forecast, by Distribution Channel (2024-2032)

5.4.1. Online

5.4.2. Specialty Stores

5.4.3. Supermarkets/Hypermarkets

5.4.4. Others

5.5. Skin Care Devices Market Size and Forecast, by Region (2024-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Skin Care Devices Market Size and Forecast (by Value in USD Billion)

6.1. North America Skin Care Devices Market Size and Forecast, by Product Type (2024-2032)

6.1.1. Cleansing Devices

6.1.2. Anti-Aging Devices

6.1.3. Acne Treatment Devices

6.1.4. Hair Removal Devices

6.1.5. Dermal Rollers

6.2. North America Skin Care Devices Market Size and Forecast, by Application (2024-2032)

6.2.1. Acne, Psoriasis, and Tattoo Removal

6.2.2. Hair Removal

6.2.3. Cellulite Reduction

6.2.4. Skin Tightening and Body Contouring

6.2.5. Skin Rejuvenation and Resurfacing

6.2.6. Damage Repair

6.3. North America Skin Care Devices Market Size and Forecast, by End User (2024-2032)

6.3.1. Homecare settings

6.3.2. Dermatology clinics

6.3.3. Beauty clinics

6.3.4. Others

6.4. North America Skin Care Devices Market Size and Forecast, by Distribution Channel (2024-2032)

6.4.1. Online Retail

6.4.2. Specialty Stores

6.4.3. Supermarkets/Hypermarkets

6.4.4. Others

6.5. North America Skin Care Devices Market Size and Forecast, by Country (2024-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Skin Care Devices Market Size and Forecast (by Value in USD Billion )

7.1. Europe Skin Care Devices Market Size and Forecast, by Product Type (2024-2032)

7.1.1. Cleansing Devices

7.1.2. Anti-Aging Devices

7.1.3. Acne Treatment Devices

7.1.4. Hair Removal Devices

7.1.5. Dermal Rollers

7.2. Europe Skin Care Devices Market Size and Forecast, by Application (2024-2032)

7.2.1. Acne, Psoriasis, and Tattoo Removal

7.2.2. Hair Removal

7.2.3. Cellulite Reduction

7.2.4. Skin Tightening and Body Contouring

7.2.5. Skin Rejuvenation and Resurfacing

7.2.6. Damage Repair

7.3. Europe Skin Care Devices Market Size and Forecast, by End User (2024-2032)

7.3.1. Homecare settings

7.3.2. Dermatology clinics

7.3.3. Beauty clinics

7.3.4. Others

7.4. Europe Skin Care Devices Market Size and Forecast, by Distribution Channel (2024-2032)

7.4.1. Online

7.4.2. Specialty Stores

7.4.3. Supermarkets/Hypermarkets

7.4.4. Others

7.5. Europe Skin Care Devices Market Size and Forecast, by Country (2024-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Skin Care Devices Market Size and Forecast (by Value in USD Billion )

8.1. Asia Pacific Skin Care Devices Market Size and Forecast, by Product Type (2024-2032)

8.1.1. Cleansing Devices

8.1.2. Anti-Aging Devices

8.1.3. Acne Treatment Devices

8.1.4. Hair Removal Devices

8.1.5. Dermal Rollers

8.2. Asia Pacific Skin Care Devices Market Size and Forecast, by Application (2024-2032)

8.2.1. Acne, Psoriasis, and Tattoo Removal

8.2.2. Hair Removal

8.2.3. Cellulite Reduction

8.2.4. Skin Tightening and Body Contouring

8.2.5. Skin Rejuvenation and Resurfacing

8.2.6. Damage Repair

8.3. Asia Pacific Skin Care Devices Market Size and Forecast, by End User (2024-2032)

8.3.1. Homecare settings

8.3.2. Dermatology clinics

8.3.3. Beauty clinics

8.3.4. Others

8.4. Asia Pacific Skin Care Devices Market Size and Forecast, by Distribution Channel (2024-2032)

8.4.1. Online Retail

8.4.2. Specialty Stores

8.4.3. Supermarkets/Hypermarkets

8.4.4. Others

8.5. Asia Pacific Skin Care Devices Market Size and Forecast, by Country (2024-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Skin Care Devices Market Size and Forecast (by Value in USD Billion )

9.1. Middle East and Africa Skin Care Devices Market Size and Forecast, by Product Type (2024-2032)

9.1.1. Cleansing Devices

9.1.2. Anti-Aging Devices

9.1.3. Acne Treatment Devices

9.1.4. Hair Removal Devices

9.1.5. Dermal Rollers

9.2. Middle East and Africa Skin Care Devices Market Size and Forecast, by Application (2024-2032)

9.2.1. Acne, Psoriasis, and Tattoo Removal

9.2.2. Hair Removal

9.2.3. Cellulite Reduction

9.2.4. Skin Tightening and Body Contouring

9.2.5. Skin Rejuvenation and Resurfacing

9.2.6. Damage Repair

9.3. Middle East and Africa Skin Care Devices Market Size and Forecast, by End User (2024-2032)

9.3.1. Homecare settings

9.3.2. Dermatology clinics

9.3.3. Beauty clinics

9.3.4. Others

9.4. Middle East and Africa Skin Care Devices Market Size and Forecast, by Distribution Channel (2024-2032)

9.4.1. Online Retail

9.4.2. Specialty Stores

9.4.3. Supermarkets/Hypermarkets

9.4.4. Others

9.5. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2024-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Skin Care Devices Market Size and Forecast (by Value in USD Billion )

10.1. South America Skin Care Devices Market Size and Forecast, by Product Type (2024-2032)

10.1.1. Cleansing Devices

10.1.2. Anti-Aging Devices

10.1.3. Acne Treatment Devices

10.1.4. Hair Removal Devices

10.1.5. Dermal Rollers

10.2. South America Skin Care Devices Market Size and Forecast, by Application (2024-2032)

10.2.1. Acne, Psoriasis, and Tattoo Removal

10.2.2. Hair Removal

10.2.3. Cellulite Reduction

10.2.4. Skin Tightening and Body Contouring

10.2.5. Skin Rejuvenation and Resurfacing

10.2.6. Damage Repair

10.3. South America Skin Care Devices Market Size and Forecast, by End User (2024-2032)

10.3.1. Homecare settings

10.3.2. Dermatology clinics

10.3.3. Beauty clinics

10.3.4. Others

10.4. South America Skin Care Devices Market Size and Forecast, by Distribution Channel (2024-2032)

10.4.1. Online Retail

10.4.2. Specialty Stores

10.4.3. Supermarkets/Hypermarkets

10.4.4. Others

10.5. South America Skin Care Devices Market Size and Forecast, by Country (2024-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. Cutera, Inc. - USA

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Lumenis - Israel

11.3. Syneron Candela - USA

11.4. Johnson & Johnson - USA

11.5. L’Oréal S.A. - France

11.6. Procter & Gamble Co. - USA

11.7. Philips N.V. - Netherlands

11.8. Panasonic Corporation - Japan

11.9. Nu Skin Enterprises, Inc. - USA

11.10. TRIA Beauty, Inc. - USA

11.11. Silk'n (Home Skinovations Ltd.) - Israel

11.12. Conair Corporation - USA

11.13. Spectrum Brands Holdings, Inc. (Remington) - USA

11.14. FOREO - Sweden

11.15. Beurer GmbH - Germany

11.16. SHISEIDO Company, Limited - Japan

11.17. The Proactiv Company LLC - USA

11.18. Pure Daily Care - USA

11.19. Shenzhen Mareal Technology Co. Ltd. - China

11.20. MTG Co. Ltd. - Japan

11.21. PhotoMedex Inc. - USA

11.22. Carol Cole Company, Inc. (NuFACE) - USA

11.23. DD Karma LLC – USA

11.24. XXX.Inc

12. Key Findings

13. Industry Recommendations