Single-use Filtration Assemblies Market - Global Industry Analysis and Forecast (2025-2032)

The Single-use Filtration Assemblies Market size was valued at USD 4.51 Bn. in 2024 and the total Global Single-use Filtration Assemblies revenue is expected to grow at a CAGR of 18.8% from 2025 to 2032, reaching nearly USD 17.91 Bn. by 2032.

Format : PDF | Report ID : SMR_1739

Single-use Filtration Assemblies Market Overview

A single-use assembly is a ready-to-use custom-made all-in-one solution made from different plastic components that are assembled into one whole

The Single-Use Filtration Assemblies Market report offers a comprehensive analysis of the sector, providing in-depth insights into market divisions based on type, product, application, and geographical region. Through meticulous research, the report reveals crucial information such as market size, share, growth trajectory, competitive framework, and key factors that drive or hinder market growth. This complete perspective of the Global Single-Use Filtration Assemblies Market assists stakeholders in identifying growth opportunities within the industry and making well-informed decisions. By thoroughly scrutinizing market dimensions, growth patterns, and key drivers and barriers, the report serves as a reliable guide in navigating the complexities of the market landscape.

The Single-Use Filtration Assemblies market is poised for significant growth between 2025 and 2032 driven by a mix of factors that offer promising opportunities. Technological advancements, growing demand, and supportive government policies are the pillars of this anticipated expansion. Additionally, the increasing consumer awareness and a shift towards sustainability and eco-friendly products contribute to the market's upward trajectory. As consumers prioritize products that resonate with their values and lifestyle choices, the market is expected to thrive. This scenario provides a fertile ground for established companies and new entrants to capitalize on emerging trends and favorable market dynamics.

Based on the analysis conducted by Stellar Market Research, the Single-Use Filtration Assemblies Market is poised for growth, with a focus on critical metrics such as CAGR, revenue, and market share. The utilization of cutting-edge primary and secondary research techniques ensures the precision and dependability of the findings. Detailed evaluations of regional markets in North America, Europe, Asia Pacific, South America, and MEA offer thorough insights into market dynamics across various geographical regions. Additionally, the profiles of key industry players provide valuable information on market presence, production, revenue, and recent advancements, assisting stakeholders in making informed strategic decisions.

This all-encompassing report on the Single-Use Filtration Assemblies Market equips stakeholders with crucial insights into current trends, major players, obstacles, and prospects that influence the industry landscape. From market segmentation to competitive analysis, this report acts as an essential tool for businesses navigating the details of the Single-Use Filtration Assemblies market.

To get more Insights: Request Free Sample Report

Single-use Filtration Assemblies Market Dynamics

Sterility Focus and Technological Advances Reshape Single-Use Filtration Market

The single-use filtration assembly market is currently undergoing a significant transformation owing to a heightened focus on sterility and rapid technological advancements. This shift is fundamentally reshaping the analysis of the industry's entire value chain. Regulatory requirements in sectors such as biopharmaceuticals necessitate strict sterility standards, leading to the implementation of aggressive market penetration strategies for single-use filtration assemblies. This strategic change presents manufacturers with lucrative profit margin prospects as the adoption of these assemblies eliminates the need for expensive cleaning and validation processes associated with traditional stainless-steel systems. After conducting an extensive feasibility study that examined the financial metrics of the company, it was concluded that investing in research and development for such assemblies has been an extremely appealing choice, offering the potential for substantial returns.

The market has been revolutionized by technological advancements that effectively address critical requirements in bioprocessing and have triggered a series of positive economic consequences. The growing adoption of single-use filtration assemblies leads to a more efficient production process, reduced downtime, and minimized risks of contamination, all of which result in significant cost savings and faster time-to-market for biopharmaceuticals. This economic flow effect goes beyond individual companies and benefits the wider healthcare sector by ensuring the production of safe and effective medications. Market opportunities flourish for manufacturers who are savvy enough to capitalize on the trend. By taking a data-driven approach, including comprehensive value chain analysis and company financial matrix evaluation, manufacturers identify the path to profitability. By leveraging nascent market opportunities and optimizing distribution channels, manufacturers are able to employ significant influence in shaping the future of biopharmaceutical manufacturing.

High Costs and Waste Disposal Hurdles

The Single-Use Filtration Market at the global level encounters major limitations due to the high costs involved initially and the concerns related to waste disposal. These limitations create market barriers to entry. As the market becomes saturated, the leading players have established their dominance, making it increasingly challenging for new companies to enter the market. The market consolidation further intensifies the barriers to entry as established companies use their resources and market presence to maintain their position in the market.

The high initial costs associated with the single-use filtration systems acts restraining for smaller players, who need substantial investment in equipment and infrastructure. Additionally, waste disposal concerns, especially in industries like healthcare, where environmental sustainability is crucial, pose significant challenges. As the healthcare industry moves towards more eco-friendly practices, the importance of addressing waste disposal concerns increases. All these factors collectively contribute to the market's complexity and discourage potential new entrants. Despite the growing demand for single-use filtration solutions, it is crucial to overcome these obstacles for sustained growth and competitiveness in the single-use filtration assembly market.

Single-use Filtration Assemblies Market Segment Analysis

By Type, According to SMR research, the Membrane Filtration segment is dominant in 2024. It holds about XX% of the market share and dominates the Single-use Filtration Assemblies market. The dominance is supported by its considerable market share and ongoing innovation trends. Membrane filtration, which utilizes semipermeable membranes for precise separations, is highly effective in removing particles, microorganisms, and impurities from liquids or gases in various industries, especially pharmaceuticals and bioprocessing. The ability to improve product quality, lower maintenance costs, and meet the growing demand for filtration systems in different sectors raises the demand for membrane filtration in the single-use filtration market. Among membrane filtration techniques, Tangential Flow Filtration (TFF) holds the largest market share owing to its crucial role in separating and purifying biomolecules.

Membrane filtration's prevalence in the single-use filtration market is attributed to its versatility, which makes it applicable in various stages such as process development, large-scale GMP manufacturing, and R&D. This adaptability allows it to overcome the limitations associated with traditional methods. Additionally, the dominance of membrane filtration is further strengthened by significant investments made by key industry players in membrane filtration assembly.

These investments aim to enhance downstream bioprocessing and address capacity constraints. With the increasing demand for membrane filtration in the market, driven by the need to overcome the limitations of single-use centrifugation methods, the dominance of this segment is expected to continue. By embracing innovative trends and leveraging efficient distribution channels, membrane filtration continues to establish itself as the foundation of single-use filtration assemblies. It navigates through market volatility while maintaining a strong position owing to its unmatched production volume and cost-effectiveness in manufacturing.

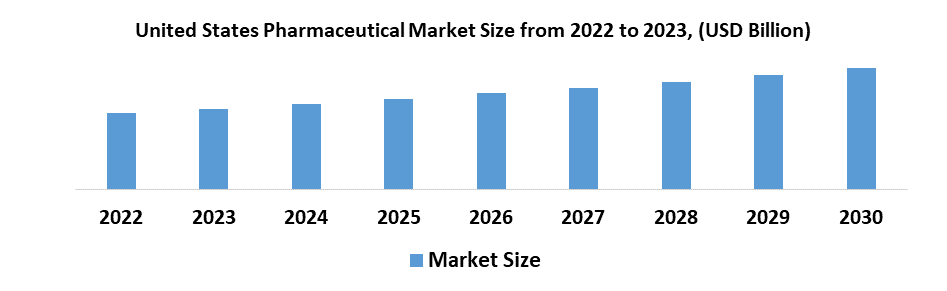

- The pharmaceutical industry contributes an estimated $1.4 trillion to the U.S. economy.

Single-use Filtration Assemblies Market Regional Analysis

North America holds a dominant position in the Single-use Filtration Assemblies Market in 2024 with a market share of about XX%. The strong market penetration for single-use filtration assemblies in North America is closely tied to the region's thriving biopharmaceutical industry, which plays a key role in driving demand for the single-use filtration assembly market. Leading biopharmaceutical companies in the United States and Canada have a well-established presence, prioritizing efficiency, regulatory compliance, and contamination risk reduction, which aligns perfectly with the advantages provided by single-use systems.

North American manufacturers maintain their dominance in the single-use filtration Market thanks to their strong production capacity. Leading companies such as Danaher Corporation and Thermo Fisher Scientific, based in the US, leverage economies of scale and well-established supply chains within the region. This enables them to efficiently produce and distribute single-use assemblies, meeting the demands of the market seamlessly. Additionally, the robust supply chains within North America reduce dependence on external sources for raw materials and components, mitigating potential disruptions and delays further solidifying the region's dominance in the Single Use Filtration Market.

The market leadership in the industry has a clear economic influence. The cost of manufacturing associated with producing single-use assemblies in contrast to conventional systems results in considerable profits for manufacturers. Also, the employment opportunities in manufacturing and related sectors contribute to the growth of the local economy, establishing the region as a key player in the Single Use Filtration Market.

Single-use Filtration Assemblies Market Competitive Landscape

The Global Single-use Filtration Assemblies Market industry is competitive among companies owing to the presence of numerous players across the industry. The major players in the market include etc. These companies are pushing boundaries, investing in research and development to expand their product lines, and undertaking strategic activities including new product launches, contractual agreements, mergers and acquisitions, and collaborations with other organizations. The future of the Single-use Filtration Assemblies Market promises to be vibrant and dynamic, driven by the increased focus on contamination control, growing demand for biopharmaceuticals, and advancements in technology.

- In 2022, Merck invested over Euro 130 million in Molsheim, France to improve its manufacturing capabilities for single-use filtration assemblies, which is a novel technology used in producing COVID-19 vaccines and other life-saving therapies.

- In 2022, Thermo Fisher launched the largest single-use technology manufacturing facility in Greater Nashville, to accelerate the production of its single-use technologies product, while also enabling pharmaceutical companies to deliver medicines to patients more quickly.

- In 2022, Sartorius Stedim Biotech, a subgroup of Sartorius, completed the acquisition of the chromatography division of Novasep, a leading supplier of services in the field of purification and molecule production. The acquisition of a chromatography suite consists of chromatography systems suitable for smaller biomolecules and advanced systems for the continuous production of biologics.

|

Single-use Filtration Assemblies Market Scope |

|

|

Market Size in 2024 |

USD 4.51 Bn. |

|

Market Size in 2032 |

USD 17.91 Bn. |

|

CAGR (2025-2032) |

18.8 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

|

By Type Membrane Filtration Depth Filtration Others |

|

|

By Product Cartridges Membranes Manifold Cassettes Syringes Others |

|

|

By Application Pharmaceuticals Bioprocessing/Biopharmaceuticals Laboratory Use Others |

|

Regional Scope |

North America (United States), Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Single-use Filtration Assemblies Market

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Saint-Gobain Performance Plastics (France)

- GE Healthcare (United States)

- Thermo Fisher Scientific (United States)

- 3M Company (United States)

- EMD Millipore (United States)

- Pall Corporation - United State

- Parker Hannifin Corporation (United States)

- Meissner Filtration Products (United States)

- Porvair plc - United Kingdom

- Entegris, Inc. (United States)

- Sterlitech Corporation (United States)

- Eaton Corporation (Ireland)

- Repligen Corporation (United States)

- Alfa Laval AB (Sweden)

- Danaher Corporation (United States)

- Finesse Solutions, LLC (United States)

- Amazon Filters Ltd. (United Kingdom)

- Cytiva (formerly GE Healthcare Life Sciences) (United States)

- TSI Incorporated (United States)

- Polypore International, Inc. (United States)

- Filtration Group Corporation (United States)

- Filtros Cartés (Mexico)

- Hepworth (United Arab Emirates)

Frequently Asked Questions

Growing biopharmaceutical industries and sustainable solutions are the opportunities in the Single-use Filtration Assemblies market.

The North American region is expected to dominate the market share throughout the forecasted period, fuelled by stringent regulations on product quality and high adoption of biopharmaceutical manufacturing.

The Market size was valued at USD 4.51 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 18.8 % from 2025 to 2032, reaching nearly USD 17.91 billion.

The segments covered in the market report are type, product, application, and region.

1. Single-Use Filtration Assembly Market: Research Methodology

2. Single-Use Filtration Assembly Market: Executive Summary

3. Single-Use Filtration Assembly Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

4.6. Global Import-Export Analysis

5. Single-Use Filtration Assembly Market: Dynamics

5.1. Market Driver

5.1.1. Increased Focus on Sterility

5.1.2. Technological Advancements in single-use filters

5.1.3. Regulatory Requirements on Product Quality & Safety

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Single-Use Filtration Assembly Market Size and Forecast by Segments (by Value Units)

6.1. Single-Use Filtration Assembly Market Size and Forecast, by Type (2024-2032)

6.1.1. Membrane Filtration

6.1.2. Depth Filtration

6.1.3. Others

6.2. Single-Use Filtration Assembly Market Size and Forecast, by Product (2024-2032)

6.2.1. Cartridges

6.2.2. Membranes

6.2.3. Manifold

6.2.4. Cassettes

6.2.5. Syringes

6.2.6. Others

6.3. Single-Use Filtration Assembly Market Size and Forecast, by Application (2024-2032)

6.3.1. Pharmaceuticals

6.3.2. Bioprocessing/Biopharmaceuticals

6.3.3. Laboratory Use

6.3.4. Others

6.4. Single-Use Filtration Assembly Market Size and Forecast, by Region (2024-2032)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Single-Use Filtration Assembly Market Size and Forecast (by Value Units)

7.1. North America Single-Use Filtration Assembly Market Size and Forecast, by Type (2024-2032)

7.1.1. Membrane Filtration

7.1.2. Depth Filtration

7.1.3. Others

7.2. North America Single-Use Filtration Assembly Market Size and Forecast, by Product (2024-2032)

7.2.1. Cartridges

7.2.2. Membranes

7.2.3. Manifold

7.2.4. Cassettes

7.2.5. Syringes

7.2.6. Others

7.3. North America Single-Use Filtration Assembly Market Size and Forecast, by Application (2024-2032)

7.3.1. Pharmaceuticals

7.3.2. Bioprocessing/Biopharmaceuticals

7.3.3. Laboratory Use

7.3.4. Others

7.4. North America Single-Use Filtration Assembly Market Size and Forecast, by Country (2024-2032)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Single-Use Filtration Assembly Market Size and Forecast (by Value Units)

8.1. Europe Single-Use Filtration Assembly Market Size and Forecast, by Type (2024-2032)

8.1.1. Membrane Filtration

8.1.2. Depth Filtration

8.1.3. Others

8.2. Europe Single-Use Filtration Assembly Market Size and Forecast, by Product (2024-2032)

8.2.1. Cartridges

8.2.2. Membranes

8.2.3. Manifold

8.2.4. Cassettes

8.2.5. Syringes

8.2.6. Others

8.3. Europe Single-Use Filtration Assembly Market Size and Forecast, by Application (2024-2032)

8.3.1. Pharmaceuticals

8.3.2. Bioprocessing/Biopharmaceuticals

8.3.3. Laboratory Use

8.3.4. Others

8.4. Europe Single-Use Filtration Assembly Market Size and Forecast, by Country (2024-2032)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Single-Use Filtration Assembly Market Size and Forecast (by Value Units)

9.1. Asia Pacific Single-Use Filtration Assembly Market Size and Forecast, by Type (2024-2032)

9.1.1. Membrane Filtration

9.1.2. Depth Filtration

9.1.3. Others

9.2. Asia Pacific Single-Use Filtration Assembly Market Size and Forecast, by Product (2024-2032)

9.2.1. Cartridges

9.2.2. Membranes

9.2.3. Manifold

9.2.4. Cassettes

9.2.5. Syringes

9.2.6. Others

9.3. Asia Pacific Single-Use Filtration Assembly Market Size and Forecast, by Application (2024-2032)

9.3.1. Pharmaceuticals

9.3.2. Bioprocessing/Biopharmaceuticals

9.3.3. Laboratory Use

9.3.4. Others

9.4. Asia Pacific Single-Use Filtration Assembly Market Size and Forecast, by Country (2024-2032)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Type (2024-2032)

10.1.1. Membrane Filtration

10.1.2. Depth Filtration

10.1.3. Others

10.2. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Product (2024-2032)

10.2.1. Cartridges

10.2.2. Membranes

10.2.3. Manifold

10.2.4. Cassettes

10.2.5. Syringes

10.2.6. Others

10.3. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Application (2024-2032)

10.3.1. Pharmaceuticals

10.3.2. Bioprocessing/Biopharmaceuticals

10.3.3. Laboratory Use

10.3.4. Others

10.4. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2024-2032)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Single-Use Filtration Assembly Market Size and Forecast (by Value Units)

11.1. South America Single-Use Filtration Assembly Market Size and Forecast, by Type (2024-2032)

11.1.1. Membrane Filtration

11.1.2. Depth Filtration

11.1.3. Others

11.2. South America Single-Use Filtration Assembly Market Size and Forecast, by Product (2024-2032)

11.2.1. Cartridges

11.2.2. Membranes

11.2.3. Manifold

11.2.4. Cassettes

11.2.5. Syringes

11.2.6. Others

11.3. South America Single-Use Filtration Assembly Market Size and Forecast, by Application (2024-2032)

11.3.1. Pharmaceuticals

11.3.2. Bioprocessing/Biopharmaceuticals

11.3.3. Laboratory Use

11.3.4. Others

11.4. South America Single-Use Filtration Assembly Market Size and Forecast, by Country (2024-2032)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Merck KGaA (Germany)

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Saint-Gobain Performance Plastics (France)

12.3. GE Healthcare (United States)

12.4. Thermo Fisher Scientific (United States)

12.5. 3M Company (United States)

12.6. EMD Millipore (United States)

12.7. Pall Corporation - United State

12.8. Parker Hannifin Corporation (United States)

12.9. Meissner Filtration Products (United States)

12.10. Porvair plc - United Kingdom

12.11. Entegris, Inc. (United States)

12.12. Sterlitech Corporation (United States)

12.13. Eaton Corporation (Ireland)

12.14. Repligen Corporation (United States)

12.15. Alfa Laval AB (Sweden)

12.16. Danaher Corporation (United States)

12.17. Finesse Solutions, LLC (United States)

12.18. Amazon Filters Ltd. (United Kingdom)

12.19. Cytiva (formerly GE Healthcare Life Sciences) (United States)

12.20. TSI Incorporated (United States)

12.21. Polypore International, Inc. (United States)

12.22. Filtration Group Corporation (United States)

12.23. Filtros Cartés (Mexico)

12.24. Hepworth (United Arab Emirates)

13. Key Findings

14. Industry Recommendations