Europe Generic Drugs Market- Industry Analysis and Forecast (2025-2032)

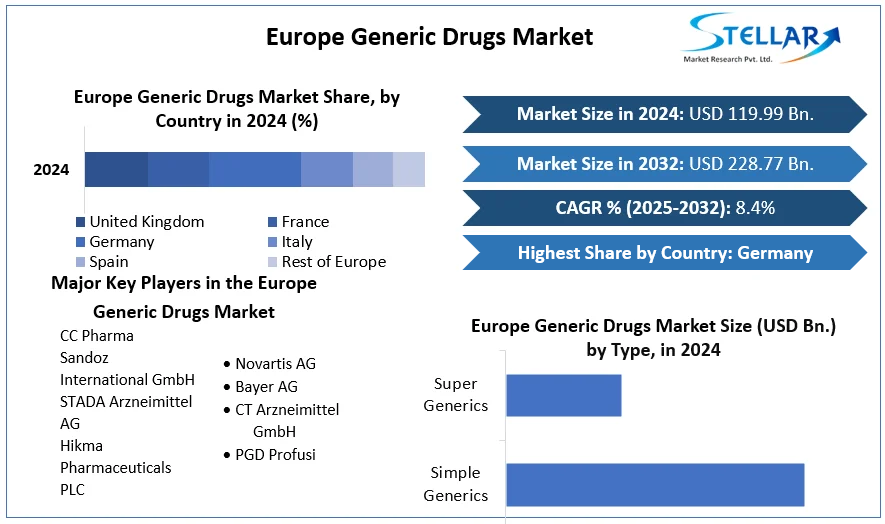

The Europe Generic Drugs Market size was valued at USD 119.99 Bn. in 2024 and the total Market size is expected to grow at a CAGR of 8.4 % from 2025 to 2032, reaching nearly USD 228.77 Bn.

Format : PDF | Report ID : SMR_1802

Europe Generic Drugs Market Overview

A generic drug is a medication created to be the same as an already marketed brand-name drug in dosage form, safety, strength, route of administration, quality, performance characteristics, and intended use. These similarities help to demonstrate bioequivalence, which means that a generic medicine works in the same way and provides the same clinical benefit as the brand-name medicine.

The report has highlighted the current market trends in Europe that have been boosting the European Generic Drugs Market. The comprehensive analysis of European Generic Drugs Market Dynamics such as growth drivers, opportunities, restraints, and challenges are analysed in the report. The market revenue is expected to grow from xx to xx during the forecast year with an increase in sales of Generic Drugs in Europe. The report consists of broad research on various Leading players strategies like collaboration, partnership, mergers, and acquisition which are adopted by the companies. The regional analysis focuses on the ongoing developments in European Countries with the market segment which are analysed in the report.

To get more Insights: Request Free Sample Report

Europe Generic Drugs Market Dynamics

Growth Trends in Europe's Generic Drugs Market

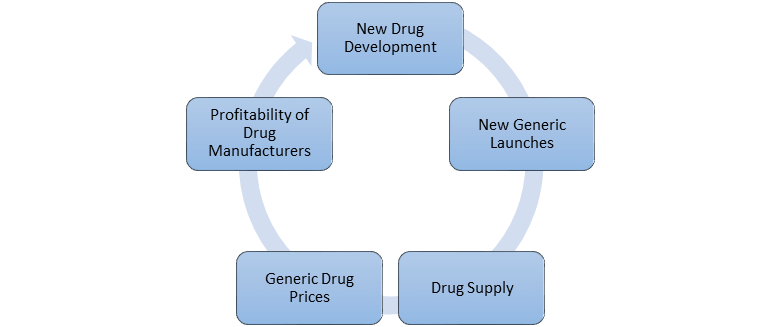

The rising awareness of chronic diseases and the increase in the demand for generic medicine have propelled the market growth in Europe. Rising healthcare costs continue to generate increasing demand for generic drugs, which has led to increased generic prices under normal market conditions resulting in a boost in the demand. The increasing number of Research and development and Investors in the European generic drugs market has experienced an increase in the supply of medicine and met the market's current needs.

The surge in the manufacturers of the generic drugs industry has driven the market owing to the rise in the approval of FDA in the Europe which has helped to accelerate the market growth. The region's aging population, combined with the increased prevalence of chronic conditions, drives demand for specialized generics. The demand is fueled by both the efficacy of these medications and their low cost in comparison to branded alternatives. Specialty generics are a long-term solution that provides high-quality care while lowering healthcare costs.

Navigating the European Generics Market

Many challenges have limited the competitiveness and sustainability of the European generics sector. Tendering systems introduced in Denmark, Germany, and The Netherlands, have caused financial impacts on the stability of some pharmacists and wholesalers, as well as problems with continuity of supply, while producing only short-term savings. Generic manufacturers have an opportunity to increase and grow in Europe, but identifying a winning formula for market entry poses challenges for many small and mid-size companies that have hindered market growth. The increase in Brand loyalty plays a crucial role in the pharmaceutical industry, as it impacts the generation of sales and revenue, as well as acts as an entry barrier to competitors once patent protection expires resulting in a barrier in the generic drugs market.

Europe Generic Drugs Market Segment Analysis

Based on Type, the Super Generic segment holds the largest share and is projected to grow during the forecast period. The factors driving the super generics market include patent expirations on branded drugs, advancements in drug delivery systems and formulations, and the growing global demand for cost-effective healthcare solutions. The rise of super generics has led to a new age of innovation and competition in the European pharmaceutical sector. Super generics combine advanced formulations and delivery methods, and improved bioavailability, compared to traditional generics.

The rising consumer awareness of super generic drugs, the prevalence of chronic diseases, and growing geriatric populations contribute to market growth. The digital revolution has brought about a significant shift, with online services leading the way. Online pharmacies provide affordability, accessibility, and convenience, becoming a vital healthcare ecosystem component. Additionally, super generics are positioned to take advantage of European online pharmacies' benefits. With surging investments in innovation and technology, Poland is becoming a super generic drug production hub.

Europe Generic Drugs Market Regional Analysis

Germany dominated the market with an increasing CAGR and is expected to maintain its dominance till 2032. In Europe, Germany is a densely populated country and it is also home to the largest generic drugs market. The German Generic Drugs market has high demand owing to the high biological use, prices, growth, and widespread acceptance of generics that makes Germany a very attractive market in Europe. Germany has a high number of generics manufacturers present in the market, making the generics segment of the pharmaceuticals market in Germany appear rather fragmented.

Germany is a relatively mature generic drug market with penetration at 75 percent by volume and 35 percent by value. From a regulatory and reimbursement perspective, the market is driven by tenders, with price and quality considered key criteria. The proliferation of generic companies in Germany contributes to fierce competition and pricing pressures.

- The generics industry supplies 76% of prescriptions at only 36.8% of the cost.

Poland is the fastest growing country and is estimated to rise with increasing demand for the generic drugs market. The rising healthcare costs in Poland have driven the demand for generic drugs. Generic medicines are extremely popular in Poland, accounting for 88% of the country’s drug market in terms of value and 66% of volume. The Polish government approves in principle the idea that changes in the EU pharmaceutical law must be adopted to increase the competitiveness of Europe's pharmaceutical industry. It also recognizes the challenges posed by the lack of availability of drugs and antibiotic resistance on the EU market. Poland is generally considered to be a mature market, with generics around for more than 10 years. Poland’s generics penetration is one of the highest in Europe, at 70 percent by volume and 55 percent by value. Additionally, local manufacturers hold nearly 70 percent market share in the country.

Europe Generic Drugs Market Competitive Landscape

- In 2022, Novartis announced its intention to separate Sandoz business to create a standalone company by way of a 100% spin-off. Sandoz strategic review concludes that a separation of Sandoz by way of a 100% spin-off is in the best interest of shareholders, creating the first European generics company and a global leader in biosimilars, and a more focused Novartis.

|

|

Europe Generic Drugs Market Scope |

|

Market Size in 2024 |

USD 119.99 Bn. |

|

Market Size in 2032 |

USD 228.77 Bn. |

|

CAGR (2025-2032) |

8.4 % |

|

Historic Data |

2019 - 2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Type

|

|

By Application

|

|

|

By Route of Administration

|

|

|

By End User

|

|

|

Country Scope |

|

Europe Generic Drugs Market Key Players

- CC Pharma

- Sandoz International GmbH

- STADA Arzneimittel AG

- Hikma Pharmaceuticals PLC

- Novartis AG

- Bayer AG

- CT Arzneimittel GmbH

- PGD Profusi

Frequently Asked Questions

High manufacturing costs are expected to be the major restraining factors for the market growth.

The Market size was valued at USD 119.99 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 8.4 % from 2025 to 2032, reaching nearly USD 228.77 Billion.

The segments covered in the market report are By Type, Application, Route of Administration and End User.

1. Europe Generic Drugs Market: Research Methodology

1.1. Research Data

1.1.1. Secondary Data

1.1.2. Primary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Europe Generic Drugs Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Europe Generic Drugs Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Europe Generic Drugs Market: Dynamics

4.1. Europe Generic Drugs Market Trends

4.2. Europe Generic Drugs Market Drivers

4.3. Europe Generic Drugs Market Restraints

4.4. Europe Generic Drugs Market Opportunities

4.5. Europe Generic Drugs Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

5. Europe Generic Drugs Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Europe Generic Drugs Market Size and Forecast, by Type (2024-2032)

5.1.1. Simple Generics

5.1.2. Super Generics

5.2. Europe Generic Drugs Market Size and Forecast, by Application (2024-2032)

5.2.1. Central Nervous System (CNS)

5.2.2. Cardiovascular

5.2.3. Dermatology

5.2.4. Oncology

5.2.5. Respiratory

5.2.6. Others

5.3. Europe Generic Drugs Market Size and Forecast, by Route of Administration (2024-2032)

5.3.1. Oral

5.3.2. Topical

5.3.3. Parenteral

5.3.4. Others

5.4. Europe Generic Drugs Market Size and Forecast, by End User (2024-2032)

5.4.1. Hospitals

5.4.2. Homecare

5.4.3. Specialty Clinics

5.4.4. Others

5.5. Europe Generic Drugs Market Size and Forecast, by Country (2024-2032)

5.5.1. Germany

5.5.2. United Kingdom

5.5.3. Spain

5.5.4. France

5.5.5. Italy

5.5.6. Belgium

5.5.7. Sweden

5.5.8. Poland

5.5.9. Russia

5.5.10. Rest of Europe

6. Company Profile: Key Players

6.1. CC Pharma

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Sandoz International GmbH

6.3. STADA Arzneimittel AG

6.4. Hikma Pharmaceuticals PLC

6.5. Novartis AG

6.6. Bayer AG

6.7. CT Arzneimittel GmbH

6.8. PGD Profusi

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook